What Are Crypto Aggregators?

Crypto aggregators are decentralized finance (DeFi) and Web3 tools that connect to multiple decentralized applications (dApps) to help users find the best prices, deals, and relevant data across the Web3 ecosystem.

Aggregators pull data from multiple sources, offering users improved access to liquidity, enhanced price discovery, and a more seamless user experience. These tools allow crypto users to access various dApps from a single interface. For example, Jupiter is a popular decentralized exchange (DEX) aggregator connecting to multiple Solana DEXs, while 1inch is the largest DEX aggregator for the EVM ecosystem dominated by Ethereum.

In this article, we’ll explore the main types of crypto aggregators, including DEX, DeFi yield, and crypto data aggregators.

Key Takeaways

How Crypto Aggregators Work

Crypto aggregators’ main task is to pull data and liquidity from multiple sources and deliver it to the user in an accessible format.

Think of a hotel booking website and the hotels and resorts you find listed on them. Instead of researching prices and availability for each hotel separately, the aggregator pulls data from them to show you the best deals from a unified interface. This is similar to the function of crypto aggregators for dApps.

That said, crypto aggregators have unique abilities that make them essential to the DeFi market. For example, DEX aggregators don’t simply redirect you to a single DEX with the best rate but instead may use a “smart order routing.” It allows them to split trades across multiple DEXs to reduce slippage and maximize returns for users.

Whether you’re swapping tokens, searching for yield opportunities in DeFi, or analyzing market trends, crypto aggregators streamline your experience and make it more efficient.

Interacting with Crypto Aggregators

Here is how users typically interact with crypto aggregators:

- Step 1: Connect a wallet – Most aggregators are decentralized and only require users to connect a non-custodial wallet like MetaMask.

- Step 2: Input request or initiate process – Users initiate a desired action depending on the aggregator, such as swapping one token for another, starting a yield strategy, or exploring on-chain data.

- Step 3: Aggregator searches across protocols – Next, the aggregator scans all the supported protocols to find the best rates or relevant data.

- Step 4: Best route or offer is calculated – After checking all options, the aggregator analyzes the best deal. For example, DEX aggregators determine the best route for a trade, while yield aggregators calculate the best returns.

- Step 5: Aggregator returns results – The user can preview the optimized results.

- Step 6: Transaction is executed – Lastly, the user can proceed with the transaction if they are satisfied with the deal. Some aggregators, such as yield farming tools, involve ongoing automatic operations, such as auto-rebalancing and reinvesting earnings.

Aggregators save users time and help them improve their Web3 experiences, including trading, yield farming, and data analysis.

Examples of Crypto Data Aggregators

There are several types of crypto aggregators which can specialize in certain areas. Popular aggregator platforms include:

- DEX aggregators

- Yield aggregators

- Data aggregators

- Non-fungible token (NFT) aggregators

- Lending aggregators

- Bridge aggregators

- Launchpad aggregators

- Perpetual exchange aggregators

Let’s explore the three main categories of crypto aggregators and their advantages and potential drawbacks.

DEX Aggregators

DEX aggregators pool liquidity from various DEX protocols, helping users find the best price for a trade. As mentioned, these tools can split trades into smaller pieces to be processed across several DEXs for maximum efficiency.

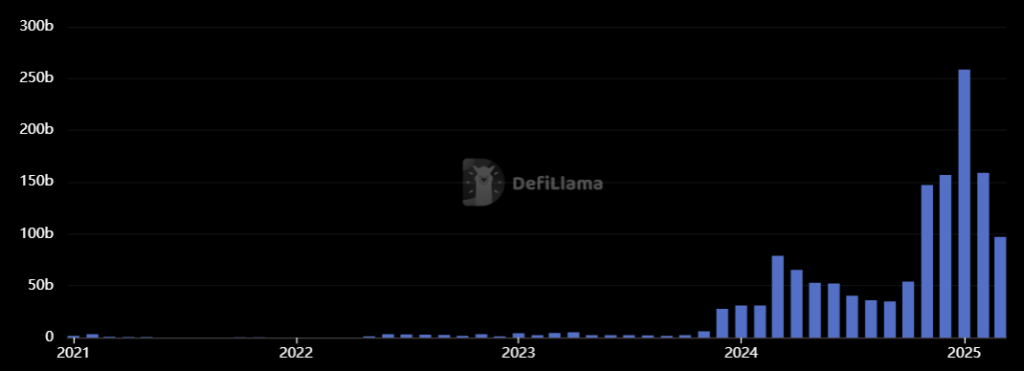

In January 2025, DEX aggregators processed over $250 billion in trading volume, which was nearly 50% of the total volume of all DEXs.

Pros Cons

DeFi Yield Aggregators

DeFi yield aggregators like Beefy and Yearn Finance automate the yield farming process by allocating user funds to the most profitable yield opportunities across DEXs, lending, staking, and liquidity protocols.

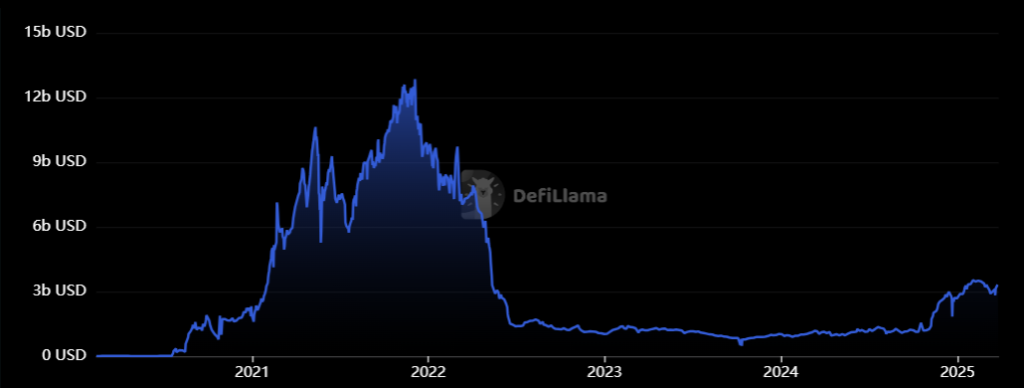

As of March 2025, the total value locked (TVL) in yield aggregators was $3.5 billion, which is about a third of the TVL on individual yield protocols.

Pros Cons

Crypto Data Aggregators

Crypto data aggregators collect and display real-time information across various DeFi protocols, crypto exchanges, blockchains, and wallets, helping users make informed decisions. One example of this are depth charts, which give a sense of short-term market sentiment by providing a visual representation of the limit buy and sell orders on a cryptocurrency trading platform.

Additionally, crypto portfolio trackers like Coinstats, Kubera, and Delta help crypto holders manage their funds across multiple exchanges and wallets from a single place.

Pros Cons

Key Features of a Cryptocurrency Aggregator

Most crypto aggregators aim to make life easier for crypto investors and researchers. This is why many of them greatly emphasize user experience, offering various features to streamline Web3 interaction.

One of the main features is the dashboard, which may serve as the gateway to the crypto market. It helps users perform operations smoothly.

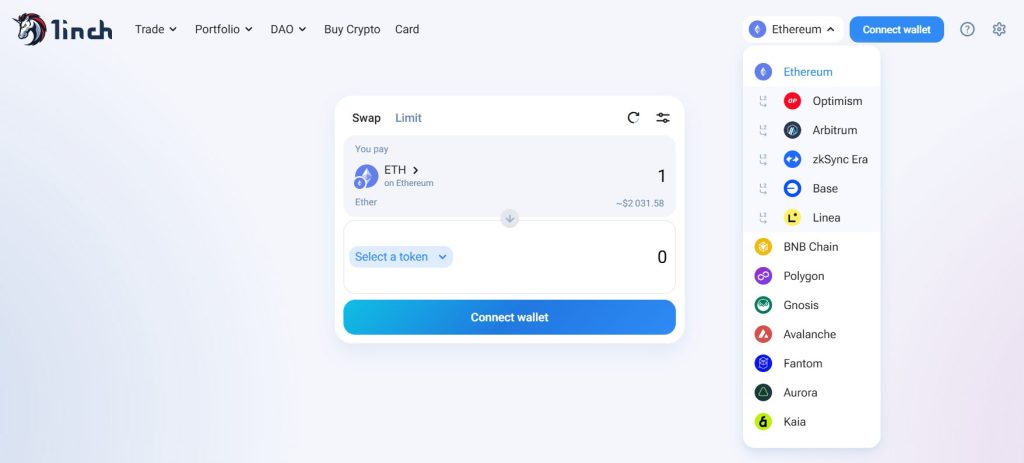

For example, 1inch, a leading DEX aggregator, offers a user experience similar to that of a regular DEX like Uniswap. Its dashboard allows users to swap tokens with no hassle.

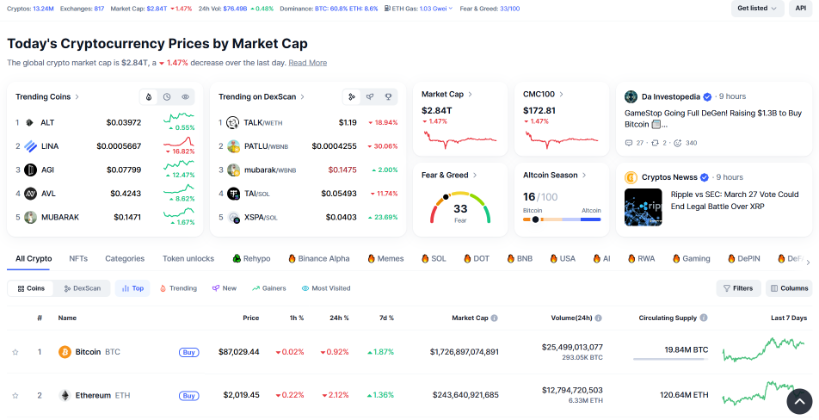

A good example of a clean data aggregator dashboard is CoinMarketCap. It uses a light theme by default and directly shows a lot of on-chain information on the homepage, including trending coins, market cap, the fear & greed index, the altcoin season index, and a long list of supported coins that multiple categories can filter.

Other key features of crypto aggregators include customization options, cross-chain support, saved preferences and watchlists, and automated processes.

Benefits of Crypto Aggregator for Users

Crypto aggregators simplify and streamline Web3 and DeFi interactions, helping users find the best deals or relevant data. Here are the main benefits of these tools:

Time Efficiency and Convenience

Crypto aggregators save users a lot of time by pulling data, liquidity, and prices from multiple DeFi protocols or data platforms. Without them, users would have to check each protocol separately, resulting in less efficient trading or yield farming.

Some crypto aggregators connect to hundreds of projects, saving countless hours for users.

Optimized Trading Outcomes

Thanks to smart order routing and real-time price comparison, DEX aggregators optimize trading outcomes by discovering the best prices, minimizing slippage, and improving execution.

DeFi traders benefit from higher value per transaction compared to swapping on individual DEXs.

Cost Efficiency

DeFi aggregators aim to find the best prices on the market, which translates into significant savings for users. The cost efficiency is significant even if gas fees on aggregators are often higher than on individual protocols due to order routing.

Many aggregators show real-time gas estimates, helping users anticipate transaction costs.

Improved Security

Crypto aggregators in DeFi are more secure than centralized exchanges and platforms, as they allow users to control their funds.

Also, by interacting with supported protocols from a single dashboard, crypto traders have fewer chances of becoming phishing victims by connecting to malicious apps. For example, at the end of 2024, crypto anti-scam solution provider Scam Sniffer reported that a PEPE holder lost $1.4 million worth of tokens due to a Uniswap phishing scam.

Some aggregators use security features like two-factor authentication.

Potential Challenges and How to Overcome Them

While crypto aggregators offer efficiency and convenience, they have much room for improvement. One of the main goals is to simplify the experience for beginners with intuitive dashboards and enhanced streamlined onboarding. Here are the main challenges that aggregators must overcome:

Complexity and User Error

While aggregators aim to simplify processes, beginners may not understand how they work behind the scenes, making it difficult to choose the best tool for their needs.

Also, some aggregators pack many features directly on the main dashboard, which may overwhelm newcomers.

Dependence on External Data

The main problem of all crypto aggregators is that they rely on other protocols and external data. If a supported DEX experiences an issue during the token swap process, the aggregator will fail to complete it and have to re-route the trade, which may result in additional costs.

Security Risks

DeFi aggregators may be safer than many centralized exchanges, but they also have security risks. If their smart contracts or APIs are compromised, they can become targets for hackers.

Sometimes the aggregator itself can be used to facilitate hacking attacks by hiding traces. In mid-March 2025, OKX was forced to temporarily suspend the activity of its DEX aggregator amid concerns that North Korean hacking group Lazarus had misused it.

Crypto users should deal with transparent audited aggregators.

Regulatory Uncertainty

DeFi aggregators depend on crypto regulations across many jurisdictions. Local or international restrictions could influence their operations in some regions. Some platforms may geo-fence users or implement KYC verification.

For example, DEX aggregator KyberSwap doesn’t operate in countries like Syria, Iran, Russia, or North Korea.

The Future of Crypto Aggregators

Crypto and Web3 adoption is expected to grow in the coming years, and as a result, the use of DeFi and data aggregators will also increase.

As mentioned earlier, DEX aggregators handle around half of all DEX trading volume, and their influence will likely grow.

Data aggregators already dominate the information space, with platforms like CoinMarketCap being the primary source for market updates.

As more platforms introduce innovative services and approaches, the crypto market may experience a more diverse range of aggregators.

Several crypto aggregators exist, including DEX, yield, and data aggregators. They make the Web3 experience more accessible to retail crypto holders and play an important role in crypto. For example, DEX aggregators handle half of all trading volume across DEXs. Despite their transformative potential, crypto aggregators must address security and user experience challenges. Their reliance on multiple external sources can also unexpectedly affect their performance. The use of crypto aggregators is likely to increase along with Web3, DeFi, and the broader crypto industry. With more innovation in DeFi and regulatory clarity, these tools may become the go-to apps for trading, earning passive income, and analyzing crypto data.Conclusion

Crypto aggregators help users navigate the Web3 and DeFi sector more conveniently by improving access to liquidity, better prices, and analytics. These tools pull data from multiple sources, boosting efficiency in various use cases.

FAQs

What is an aggregator in trading?

Are crypto aggregators safe to use?

How can I see all my crypto in one place?

What is the difference between a crypto aggregator and a traditional exchange?

Do I need a crypto wallet to use a crypto aggregator?

References

- DEX Aggregator Volume (DefiLlama)

- Yield Aggregators TVL (DefiLlama)

About Cryptonews

Our goal is to offer a comprehensive and objective perspective on the cryptocurrency market, enabling our readers to make informed decisions in this ever-changing landscape.

Our editorial team of more than 70 crypto professionals works to maintain the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re looking for breaking news, expert opinions, or market insights, Cryptonews has been your go-to destination for everything cryptocurrency since 2017.

Ryan Glenn

Ryan Glenn

Camila Karam

Camila Karam