Top Cryptocurrencies for a Diverse Portfolio in 2026

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships. However, this potential compensation never influences our analysis, opinions, or reviews. Our editorial content is created independently of our marketing partnerships, and our ratings are based solely on our established evaluation criteria. Read More

A diversified crypto portfolio allocates capital across different risk and utility categories to maximize returns while mitigating the risk of single-asset failure.

To maximize upside while staying diversified enough to withstand bearish cycles, exposure to presales and small caps (10x-100x potential) should be balanced by a mix of infrastructure and utility altcoins (5x-10x potential) as well as blue chips (2x-5x potential).

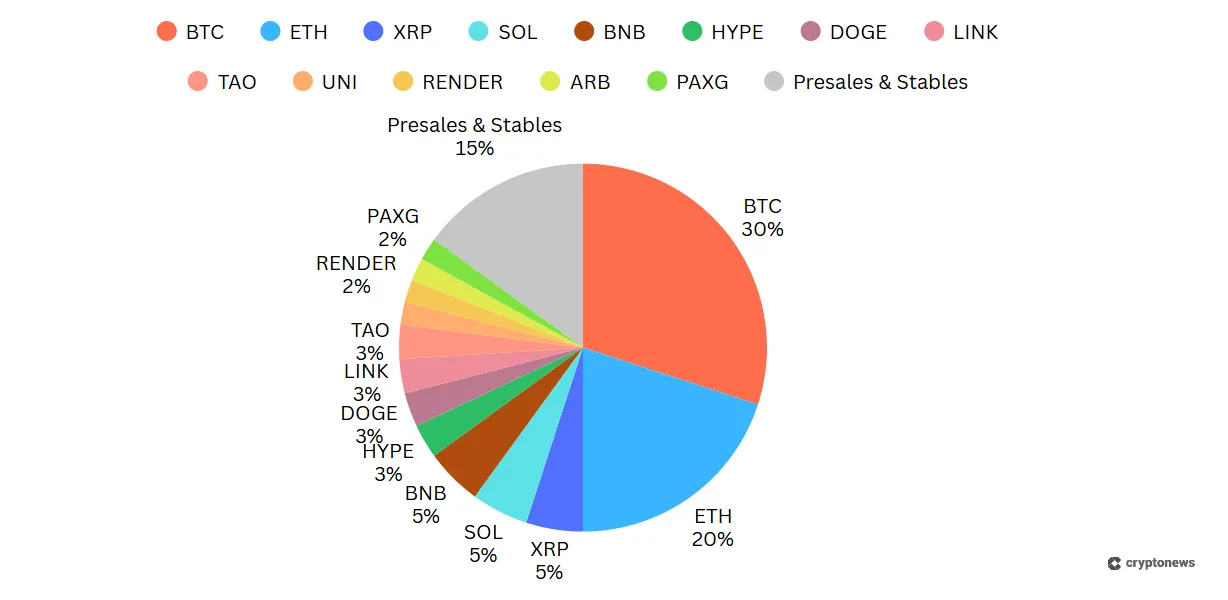

Therefore, a more aggressive diversified portfolio for investors with a higher risk appetite would include early-stage assets like Bitcoin Hyper (HYPER), Maxi Doge (MAXI), and PEPENODE (PEPENODE), alongside high-growth altcoins and blue chips like Bittensor (TAO), Hyperliquid (HYPE), Arbitrum (ARB), Solana (SOL), BNB Coin (BNB), XRP (XRP), Ethereum (ETH), and Bitcoin (BTC).

Assets like BTC and ETH are top choices for stability, offering some downside protection. On the other hand, HYPER and MAXI offer more room for significant upside, satisfying our needs for growth.

In this article, we will break down what a growth-oriented diversified portfolio may look like. Assets are categorized by weight or allocation, upside potential, price, market cap, and other factors.

- In This Article

- Show Full Guide

Top Crypto Presales to Watch in 2025

- Introducing the first Bitcoin L2 solution

- Allows users to trade BTC almost instantaneously

- Enhanced transaction security with ZK-proofs

- USDC

- ETH

- usdt

- Meme-powered Dogecoin derivative with the focus on 1,000x leverage trading

- Maxi Doge will feature community contests and partner events to engage with its audience

- The project offers high staking rewards to its early supporters

- ETH

- usdt

- USDC

- +2 more

- Infrastructure token built to withstand quantum-powered attacks

- BMIC is burned to create credits for quantum computing

- Extra holder utility through staking and governance

- ETH

- usdt

- USDC

- Next-gen platform merging live content, AI tools, staking, crypto payments and more

- SUBBD holders get access to AI-optimized content and experiences

- Loyalty is rewarded with staking bonuses, XP boosts, and daily creator drops

- Bank Card

- ETH

- bnb

- +1 more

- VFX Token powers the next-gen forex broker Vortex FX

- Offers daily rebates from trading volume

- Stake VFX tokens to earn APYs up to 67.7%

- ETH

- usdt

- bnb

Recommended 2025 Diversification Model

| Portfolio Segment | Allocation % | Key Asset Example | Investment Thesis | Risk Level |

| Bitcoin Core (Anchor) | 45% | Bitcoin (BTC) |

|

Low |

| Smart Contract Core | 20% | Ethereum (ETH) |

|

Medium |

| Bitcoin L2 Infrastructure | 10% | Bitcoin Hyper (HYPER) |

|

High |

| Utility Bridge (AI & RWAs) | 15% | Chainlink (LINK) |

|

Medium–High |

| Speculative Alpha (Meme) | 5% | Maxi Doge (MAXI) |

|

Very High |

| Stablecoins (Rebalancing Buffer) | 5% | USDC |

|

Very Low |

Top Cryptos for a Balanced Portfolio Compared

For investors, diversification is one of the most important rules for building long-term growth through mixed exposure. In crypto, diversification is especially relevant given the higher internal correlation compared to other asset classes.

You can use a balanced 70/30 rule for allocations, where roughly 70% of your portfolio is allocated to stability (e.g., blue chips) and 30% to growth (e.g., altcoins, presales, and small caps).

Building a diversified crypto portfolio that can serve as a volatility hedge and provide sustainable growth over the years requires skill, discipline, and a deep understanding of the blockchain space.

In January 2026, the best cryptos for a balanced crypto portfolio are:

| Cryptocurrency | Price | Market Cap | Type | Score | Weight |

|---|---|---|---|---|---|

HYPER +18.74% HYPER +18.74% |

$0.01365500 | $31.1M | Presale, Meme Coin | 5.5 | 2% |

MAXI +12.02% MAXI +12.02% |

$0.00028005 | $4.54M | Presale, Meme Coin | 5.0 | 2% |

| $0.0012161 | $2.49M | Presale, Meme Coin | 6.5 | 2% | |

| $33.34 | $33.34B | DeFi, DEX | 7.5 | 3% | |

| $0.12 | $18.61B | Meme Coin | 7.0 | 3% | |

| $11.85 | $11.85B | Oracle System | 7.6 | 3% | |

TAO +1.44% TAO +1.44% |

$238.76 | $5.01B | AI | 6.8 | 3% |

| $4.83 | $4.83B | DeFi, DEX | 7.2 | 2% | |

RNDR +3.96% RNDR +3.96% |

$1.94 | $1.04B | DePIN, AI | 6.5 | 2% |

| $0.17 | $1.71B | Layer 2 | 7.0 | 2% | |

PAXG +3.77% PAXG +3.77% |

$5,386.15 | $1.06B | RWA | 8.0 | 2% |

| $89,291.23 | $1.78T | Layer 1 | 9.0 | 30% | |

| $3,015.92 | $362.61B | Layer 1, DeFi | 8.8 | 20% | |

| $1.92 | $191.80B | Layer 1, Payments | 7.5 | 5% | |

| $125.84 | $74.08B | Layer 1, DeFi | 8.2 | 5% | |

| $903.85 | $125.80B | Layer 1, DeFi | 7.8 | 5% |

ℹ️ The data in this table was last updated on January 28, 2026.

Why Diversification Matters in Crypto Investing

Diversification is especially important in crypto because it’s the most volatile asset class, where double-digit daily swings are common. A diversified portfolio helps limit the impact of any single coin or sector crashing by spreading exposure across different assets.

Traditional diversification (holding only BTC and ETH) is no longer sufficient. As the ecosystem expanded to include DeFi, AI, and RWA, strong diversification needs exposure beyond those two.

Additionally, since Bitcoin often drives overall market cycles, many cryptocurrencies move in sync. Diversifying into multiple sectors can reduce this correlation, spreading risk while balancing potential returns.

A well-structured mix may even outperform Bitcoin alone by capturing growth in areas like DeFi, AI, meme coins, and more.

Finally, setting aside a small allocation for emerging projects, such as small caps or presales, can boost upside potential from new trends that established coins might miss.

How to Build a Diversified Portfolio

There are several ways to diversify crypto exposure, e.g., by sector, market volatility, dominance, or use case. For a balanced approach, we considered multiple factors to create a sustainable crypto investment strategy.

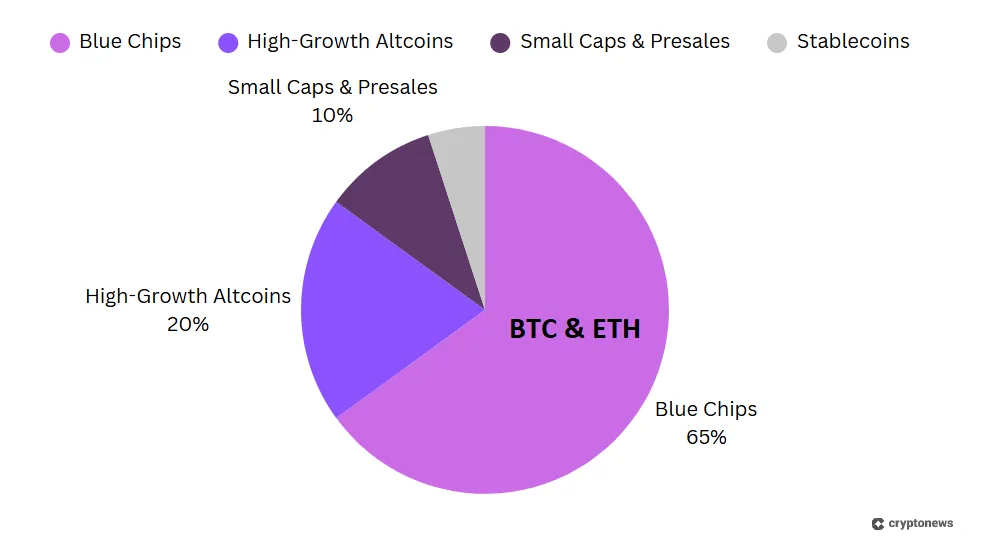

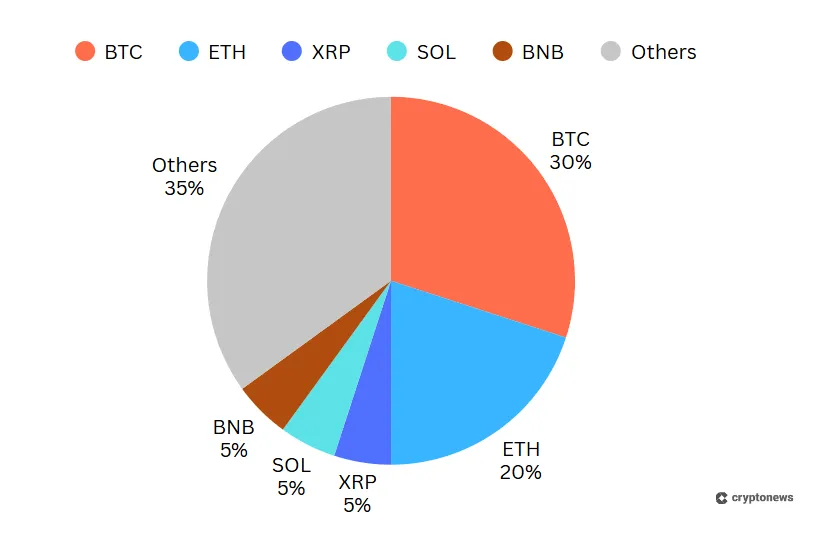

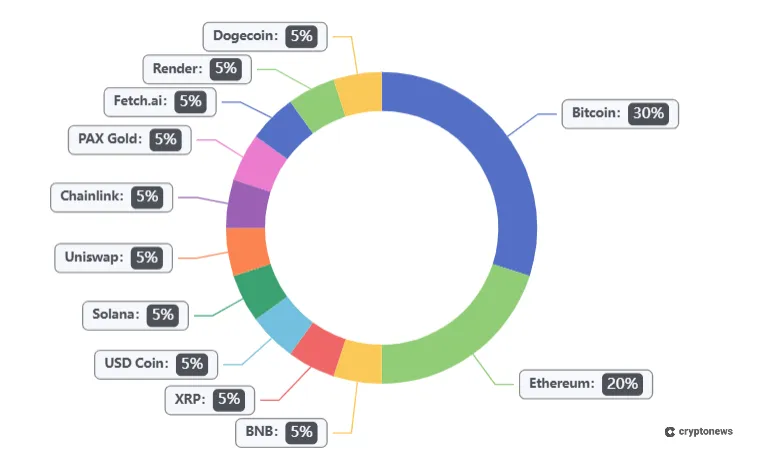

Our portfolio allocation would look like this:

- 10% Small Caps & Presales: These assets have the strongest upside potential, but they carry the highest risk as well, so their share is minimal.

- 20% High-Growth Altcoins: Medium-cap crypto assets can account for about a fifth of the portfolio. They are riskier than blue chips, but still provide some stability, and, more importantly, offer greater growth potential.

- 65% Blue Chips: Large-cap and dinosaur crypto coins should make up the largest share as they’re more stable thanks to deeper liquidity, lower volatility, and increased resilience during market downturns.

- 5% Stablecoins: For convenient rebalancing and quick position exits, we can allocate up to 5% to stablecoins like USDT and USDC.

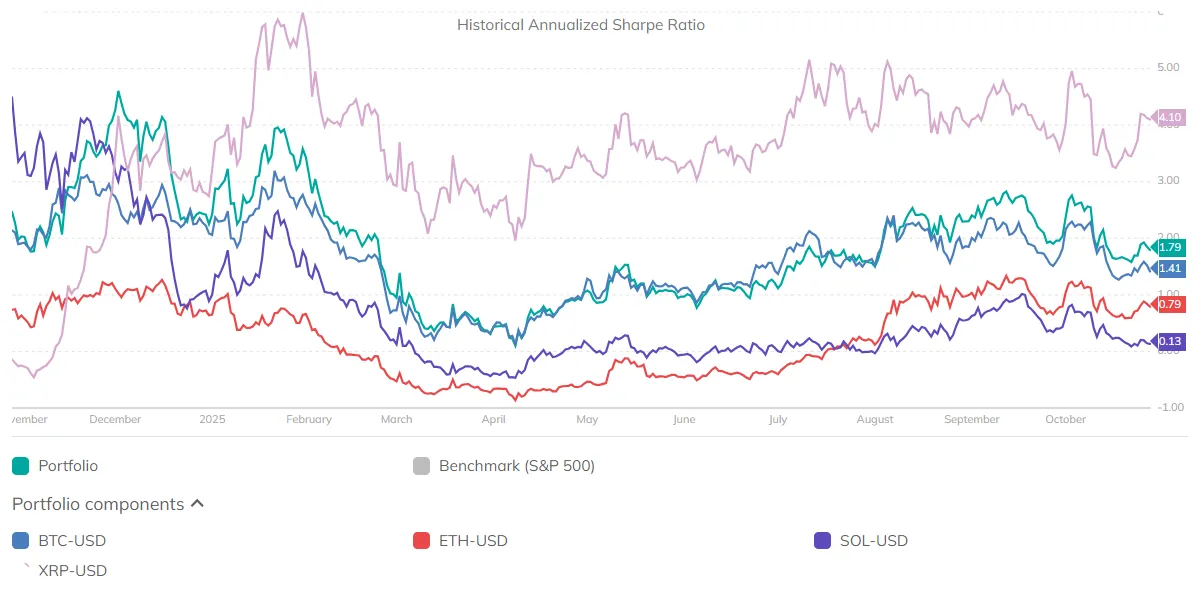

One of the main goals of our crypto portfolio is to maximize the Sharpe ratio, which measures the extra return earned for each unit of risk. We’re interested in keeping the ratio above 1, which is considered good. A ratio greater than 2.0 is rated as very good.

For example, the 1-year Sharpe ratio of a portfolio holding four blue chips – BTC, ETH, SOL, and XRP – is currently above 1, close to Bitcoin’s own ratio. While this is lower than XRP’s ratio of 4.10, it remains well above those of ETH and SOL.

We can see that the rolling Sharpe ratios of XRP and SOL have fluctuated significantly over the past year, while our portfolio has remained more stable.

This kind of approach ensures downside protection while improving risk-adjusted returns.

As Nobel laureate Harry Markowitz famously said: “The only free lunch in investing is diversification.”

Correlation and the Altcoin Season

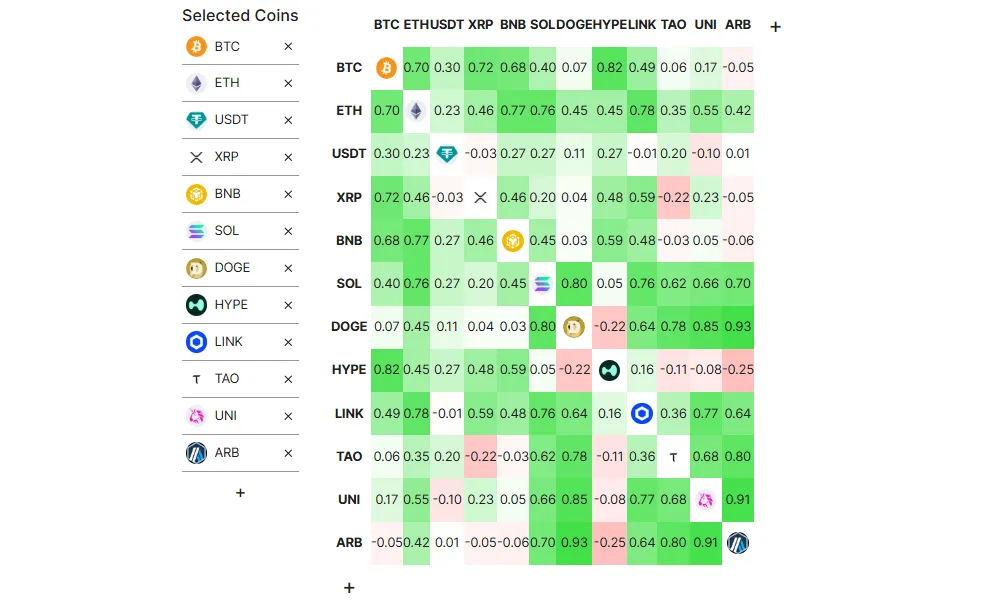

Allocating by market cap is the most intuitive way to diversify a portfolio, but the problem is that the crypto market is known for high internal correlation. Therefore, we should also allocate by token type and sector, adding assets with low correlation coefficients.

For those unfamiliar, a correlation coefficient ranges from -1.0 to 1.0, where:

- 1 shows perfect positive correlation, suggesting that the two compared assets always move together.

- 0 indicates no correlation, with movements being unrelated.

- -1.0 means perfect negative correlation, where assets always move in opposite directions.

This chart shows the correlation between major coins during the past year:

Interestingly, Arbitrum(ARB) and Bittensor (TAO) have shown the lowest correlation to Bitcoin and most other assets, making them great additions to a diversified portfolio. Meanwhile, presales can show even lower correlation due to their project-specific catalysts.

Most often, altcoins tend to follow the BTC price, but there are periods when they move independently of it. We call such a phase an Altcoin Season, which is confirmed when 75% of the top altcoins by market cap outperform Bitcoin over a three-month period.

As of Q4 2025, the Altcoin Season Index from CoinMarketCap stands at 31, suggesting that close to half of the top 100 non-stablecoin, non-wrapped tokens could underperform BTC over the past three months.

During an altcoin season, many cryptos show lower correlation to Bitcoin, making it an opportune time to rebalance the portfolio and seek growth opportunities.

How We Allocated These Top Cryptos

For our balanced crypto portfolio example, we allocated the selected cryptos based on several factors and key metrics, including market cap, use case, sector relevance, on-chain activity, tokenomics, and developer activity.

This table shows the weighting and significance of each factor:

| Weighting | What It Shows | Why It Matters | |

|---|---|---|---|

| Market Cap & Liquidity | 25% | Market size, stability, and liquidity | Higher market cap means lower risk of collapse; liquidity ensures investors can buy and sell easily. |

| Sector Relevance | 20% | Role in major blockchain narratives (L1s, DeFi, AI) | It reflects exposure to the most important crypto sectors. |

| On-Chain Activity | 20% | Usage metrics (daily active users, transactions, fees, TVL, etc.) | Indicates whether a coin or token is used beyond speculation. |

| Tokenomics | 15% | Supply cap, inflation, staking design, incentives, vesting schedule | Strong tokenomics ensure long-term sustainability. |

| Developer Engagement | 5% | Ecosystem contributions | Active developers are often associated with more upgrades and better security. |

| Price Momentum | 5% | Relative strength versus the broader market | Short-term indicator of investor sentiment. |

| Other Factors (Narrative, Partnerships, Regulation) | 10% | Fundamentals like high-profile partnerships, potential for ETFs, and regulatory clarity | Can influence short-term and medium-term price action. |

That being said, a balanced crypto portfolio must include three main types of coins: small-cap coins, high-growth altcoins, and blue chips.

The Multiplier (High-Risk/High-Reward)

This bucket is where you chase asymmetric upside–the kind of tokens that can move fast in a bull cycle, but can drop hard when sentiment shifts.

Keep your allocation in these high-risk, high-reward tokens small and only invest what you can afford to lose.

- Type: Bitcoin Layer 2

- Raised: $31.1M

- Price: $0.01365500

- Risk Level: High

- Powers a Bitcoin-oriented DeFi ecosystem

- Token price doesn’t follow Bitcoin performance

HYPER is the first Solana-based Layer 2 solution designed for Bitcoin-native DeFi, enabling BTC liquidity and unlocking the potential of a $2 trillion market by offering smart contracts and secure transactions without relying on Ethereum’s increasingly fragmented L2 ecosystem.

Investors can stake the token to earn an APY of 38%, adding an extra yield component to enhance their crypto portfolio.

🎖️ Bitcoin Hyper Score: 6.5

- Type: Meme Coin

- Market cap: $4.54M

- Price: $0.00028005

- Risk Level: High

- Provides leveraged trading

- Allocates 40% of the supply to marketing

MAXI is a Doge-inspired meme token that includes margin trading up to 1000x. The project plans community contests and partner events to keep traders engaged.

🎖️ Maxi Doge Score: 5.0

- Type: Meme Coin, Utility

- Market cap: $2.49M

- Price: $0.0012161

- Risk Level: High

- Powers virtual mining rig system

- Complex mine-to-earn mechanism may deter beginners

PEPENODE is a meme coin that powers a virtual mining rig system where users can experiment with the concept of crypto mining. The gamified mining platform allows users to earn established meme coins like PEPE.

🎖️ PEPENODE Score: 6.0

- Type: Meme Coin

- Market cap: $18.61B

- Price: $0.12

- High liquidity

- Leads the meme coin narrative

- No utility

Originally started as a joke, Dogecoin has now grown enough to benefit from deep liquidity and a strong community that keeps it relevant. Even though it has limited functionality, DOGE represents the true meme narrative, outperforming the broader market even during speculative bull runs.

🎖️ Dogecoin Score: 7.0

The Utility Bridge (AI, RWAs, and Real Usage)

Next, we can allocate a fifth of the portfolio to high-growth altcoins backed by robust fundamentals and solving real problems.

These altcoins derive value from real usage rather than relying on hype and speculation. They sit between growth and stability, which offers investors growth, stability, and exposure to long-term narratives, like AI infrastructure, decentralized data, and tokenized real-world assets. But, they still bring higher risks compared to blue chips.

- Type: Layer 1, Decentralized Exchange (DEX), DeFi

- Market cap: $33.34B

- Price: $33.34

- High on-chain activity and trading volume

- Low correlation to major coins

Hyperliquid has been one of the fastest-growing coins in 2025 due to its innovative DEX and derivative trading platform built on its native chain. Since the end of 2024, it has been the largest perpetual futures platform by trading volume.

Its strong fundamentals and low correlation to BTC make it a top candidate for growth allocation.

🎖️ Hyperliquid Score: 7.5

- Type: Oracle Infrastructure

- Market cap: $11.85B

- Price: $11.85

- Essential role in crypto thanks to its oracle infrastructure

- Steady liquidity and usage

- Price often underperforms other altcoins

Chainlink is the leading decentralized network for oracles, which feed smart contracts with accurate real-world and on-chain data. In DeFi, it accounts for nearly two-thirds of total value secured (TVS). Its unique role in crypto makes LINK one of the most critical altcoins.

🎖️ Chainlink Score: 7.6

- Type: AI, DePIN

- Market cap: $5.01B

- Price: $238.76

- Leading crypto AI coin

- Promising, but low liquidity and adoption

Buying Bittensor can represent holding part of the crypto-AI narrative, offering a proprietary Layer 1 chain for machine learning models called subnets, which perform different AI tasks.

Its tokenomics design is inspired by Bitcoin. Overall, TAO is one of the best coins for AI exposure.

🎖️ Bittensor Score: 6.8

- Type: DEX, DeFi

- Market cap: $4.83B

- Price: $4.83

- Powers the largest DEX by TVL

- Strong development base

- Little utility outside of governance

Uniswap is the largest DEX by total value locked (TVL) and daily trading volume, processing billions in daily swaps. Its governance token, UNI, benefits from decent tokenomics and robust developer engagement.

🎖️ Uniswap Score: 7.2

- Type: DePIN, AI

- Market cap: $1.04B

- Price: $1.94

- Leading DePIN/AI coin

- Limited real usage

Render is a decentralized global marketplace for GPUs, connecting GPU providers with users who need computer power for rendering and AI tasks. It remains one of the largest Decentralized Physical Infrastructure Networks (DePINs). The RENDER token migrated from Ethereum to Solana in 2024.

🎖️ Render Score 6.5

- Type: Layer 2

- Market cap: $1.71B

- Price: $0.17

- Largest Ethereum L2 by TVL

- Growing developer activity and active usage

- Token has little utility outside of governance

Arbitrum and Base are Ethereum’s two largest Layer 2 scaling solutions, but the latter doesn’t have a native token. Arbitrum’s leading position among crypto rollups makes ARB a standout among altcoins.

🎖️ Arbitrum Score: 7.0

- Type: RWA

- Market cap: $1.06B

- Price: $5,386.15

- Pegged to the price of gold

- Limited utility

PAX Gold is a real-world asset (RWA) tied to the price of gold, which reached new record highs in 2025 amid rising inflation and geopolitical tensions. Adding PAXG to your crypto portfolio provides exposure to traditional markets, with gold being regarded as a top safe-haven asset favored by many institutions.

🎖️ PAX Gold Score: 8.0

- Type: Layer 2, Scaling Solution, DeFi Infrastructure

- Market cap: $5.27B

- Price: $0.65

- High dApp activity and growing DeFi/NFT ecosystem

- Competes with several other Ethereum Layer 2 solutions

Polygon (POL) is a leading Ethereum Layer 2 network offering fast, low-fee transactions and strong DeFi and NFT activity. Its growing ecosystem, major brand partnerships, and key role in Ethereum scaling make it a solid option for growth-focused, diversified crypto portfolios in the current market.

🎖️ Polygon Score: 7.5

- Type: Real-World Assets (RWA), DeFi, Layer 1

- Market cap: $3.41B

- Price: $0.34

- Backed by tokenized U.S. Treasuries and strong institutional partnerships

- Sensitive to regulation and interest-rate changes

Ondo turns short-term U.S. Treasuries into on-chain tokens that pay yield, giving crypto users access to dollar-based returns. It runs on its own PoS chain and connects with networks like Ethereum and Solana, offering income-focused products with typically lower volatility than many speculative DeFi strategies.

🎖️ Ondo Score: 8.3

The Anchor (Core Stability Layer)

The largest chunk of a balanced crypto portfolio should consist of blue chip cryptocurrencies. Ideally, they should account for more than half of it, with Bitcoin and Ethereum holding the largest share.

Blue chips maintain stability and ensure resilience during major corrections, which have happened every few years.

Crypto coins in this category are typically Layer 1 networks with a market cap of around $100 billion or more, supporting large ecosystems. Here they are:

- Type: Layer 1

- Market cap: $1.78T

- Price: $89,291.23

- TVL: $6.8 billion

- Daily active addresses: 569K+

- Largest market cap and liquidity

- Robust tokenomics

- The most secure infrastructure

- Moderate but strong developer activity

- Sometimes correlates with equities

The oldest, arguably the most secure, and the largest cryptocurrency by market cap. For many, BTC is the epitome of cryptocurrency.

With a limited total supply of 21 million coins, BTC has consolidated its store of value (SOV) status, being adopted by institutional and retail investors who want to hedge against inflation.

🎖️ Score: 9.0/10

- Type: Layer 1, DeFi

- Market cap: $362.61B

- Price: $3,015.92

- TVL: $68.1 billion

- Daily active addresses: 521K+

- Largest DeFi & Web3 ecosystem

- High liquidity

- High usage

- Largest staking ecosystem

- Often underperforms other altcoins

Ethereum is the largest blockchain supporting decentralized applications (dApps) and has dominated the narratives around decentralized finance (DeFi), Web3, and non-fungible tokens (NFTs).

It attracts investors thanks to token utility and ETH staking yield.

🎖️ Score: 8.8/10

- Type: Layer 1, Payments

- Market cap: $191.80B

- Price: $1.92

- TVL: $100 million

- Daily active addresses: 16.5K+

- High cap and liquidity

- Strong utility

- Limited on-chain usage

- Less transparent tokenomics

- Ongoing legal issues

XRP is a high-cap token powering a fast, low-cost cross-border payments infrastructure. It has experienced significant institutional backing and adoption, and the settlement of legal uncertainties has boosted its value in 2025, opening the door to more adoption.

XRP changed by +3.55% in the past 30 days, and is currently trading at around $1.92. It’s expected to enter Q1 2026 with bullish momentum, rising adoption, and breakout potential.

🎖️ Score: 7.5/10

- Type: Layer 1, DeFi

- Market cap: $74.08B

- Price: $125.84

- TVL: $8.3 billion

- Daily active addresses: 18 million

- High user growth

- High network activity

- Strong DeFi and NFT ecosystem

- Moderate but strong developer activity

- Occasional outages in the past

Solana has been the fastest-growing proof-of-stake (PoS) chain since 2023, occasionally challenging Ethereum on several fronts.

Its high speed and low fees have attracted millions of daily users, while institutional capital has increased in 2025.

🎖️ Score: 8.2/10

- Type: Layer 1, DeFi

- Market cap: $125.80B

- Price: $903.85

- TVL: $6.4 billion

- Daily active addresses: 2.5 million

- Deep liquidity

- Exchange utility

- Large DeFi and Web3 ecosystem

- Centralization concerns

- Regulatory risks

BNB was launched by the Binance exchange but eventually detached and became an independent, decentralized chain.

It has consistently been ranked among the top ten coins by market capitalization and has one of the largest ecosystems in DeFi. Still, its close ties to Binance remain an issue, exposing it to regulatory scrutiny.

🎖️ Score: 7.8/10

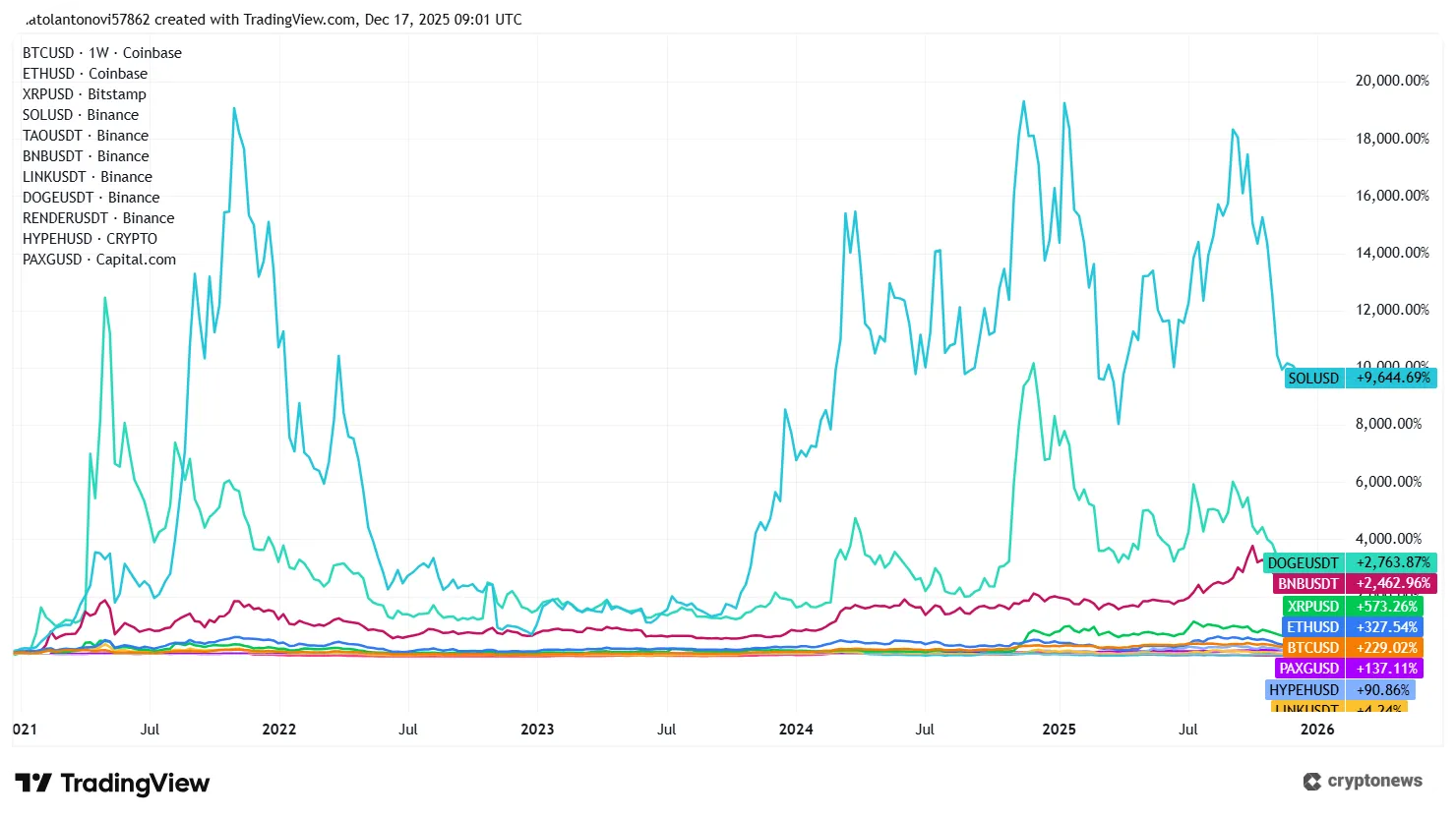

All of these coins have delivered impressive returns during the past five years. Here is how their performance compares to traditional markets, including gold and the S&P 500 index, which tracks leading U.S. public companies.

Blue-chip Assets vs. Traditional Markets’ Performance

In this table, you can see how our stable blue-chip portfolio picks perform compared to traditionally stable assets like the S&P500 and gold.

| 1-year ROI | 5-year ROI | 30-day volatility | |

|---|---|---|---|

| BTC | -12.86% | 873% | 2.5% |

| ETH | -3.64% | 946% | 5.8% |

| XRP | -37.65% | 916% | 6.4% |

| SOL | -45.15% | 5,882% | 6.7% |

| BNB | +34.98% | 3,621% | 4.7% |

| S&P 500 | 14.55% | 88.73% | 1% |

| Gold | 34.51% | 72.67% | 1.3% |

Sources: Cryptonews.com, CoinGecko, MarketMilk

Here is the allocation scheme for blue chips:

Blue-chip cryptocurrencies that provide stability can also include yield-bearing assets that provide stable returns. For example, if inflation is 3% and you hold a stablecoin that yields 4%, then your portfolio will not only hold its value but will also grow at a stable rate.

To conclude, our growth-oriented diversified portfolio holds 18 cryptocurrencies other than stablecoins.

Here is how they performed over the past five years (except for presales, which don’t have a track record):

[/su_note]

Sector Allocation for a Balanced Crypto Portfolio

In addition to taking into account market cap and liquidity, crypto investors can diversify by balancing exposure across blockchain sectors. Again, we aim to have a broad set of high-quality assets with low internal correlation.

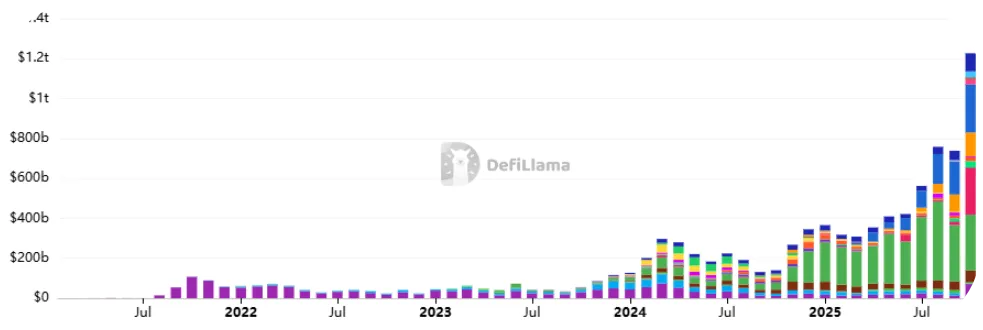

Some sectors outperform the broader crypto market due to strong narratives.

- For example, non-fungible tokens (NFTs), along with gaming and metaverse coins made waves in 2021.

- Shortly after OpenAI unveiled its ChatGPT app, the AI crypto sector emerged and exploded to record highs in 2023-2024.

- In 2025, RWAs have taken center stage.

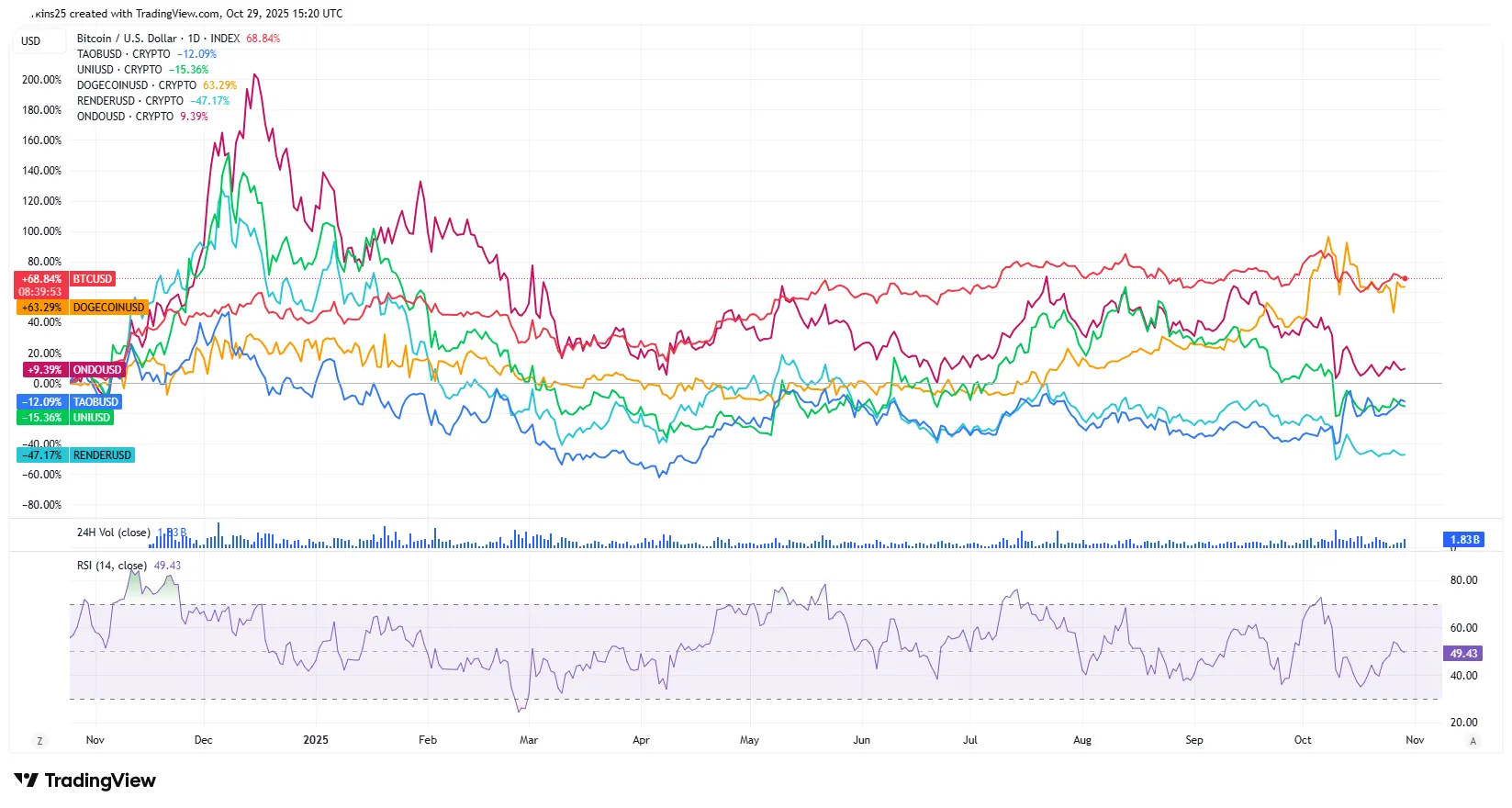

This chart shows the 18-month performance of several coins dominating their sectors. We can see that TAO and RENDER, some of the best DePIN and AI crypto coins, had two bullish cycles in 2024, but found resistance at the same levels.

Elsewhere, DOGE and ONDO, which dominate the meme coin and RWA sectors, reached higher highs at the end of 2024, outperforming the broader crypto market.

Investors looking to take a more aggressive stance can allocate by sector as follows:

- 50% Layer 1s (BTC, ETH, SOL)

- 10% DeFi (UNI, HYPE)

- 10% AI & DePIN (TAO, RENDER)

- 10% Meme Coins (DOGE, PEPE)

- 10% RWAs and Stablecoins (PAXG, ONDO, USDC)

- 10% Presales (HYPER, MAXI, PEPENODE)

Historical Performance of Diversified Portfolios in Crypto

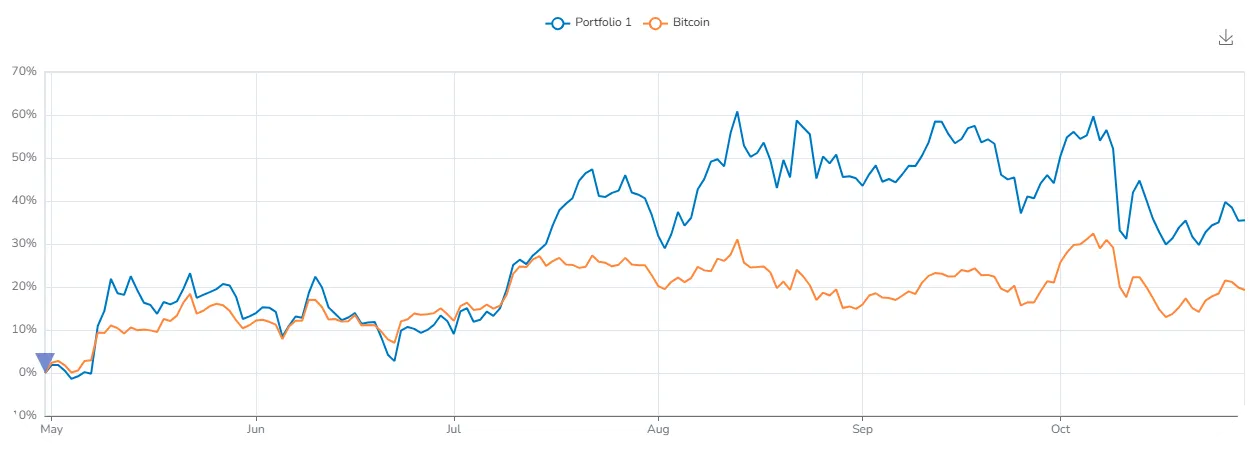

A diversified crypto portfolio can outperform Bitcoin over the long term when driven by altcoin bull runs.

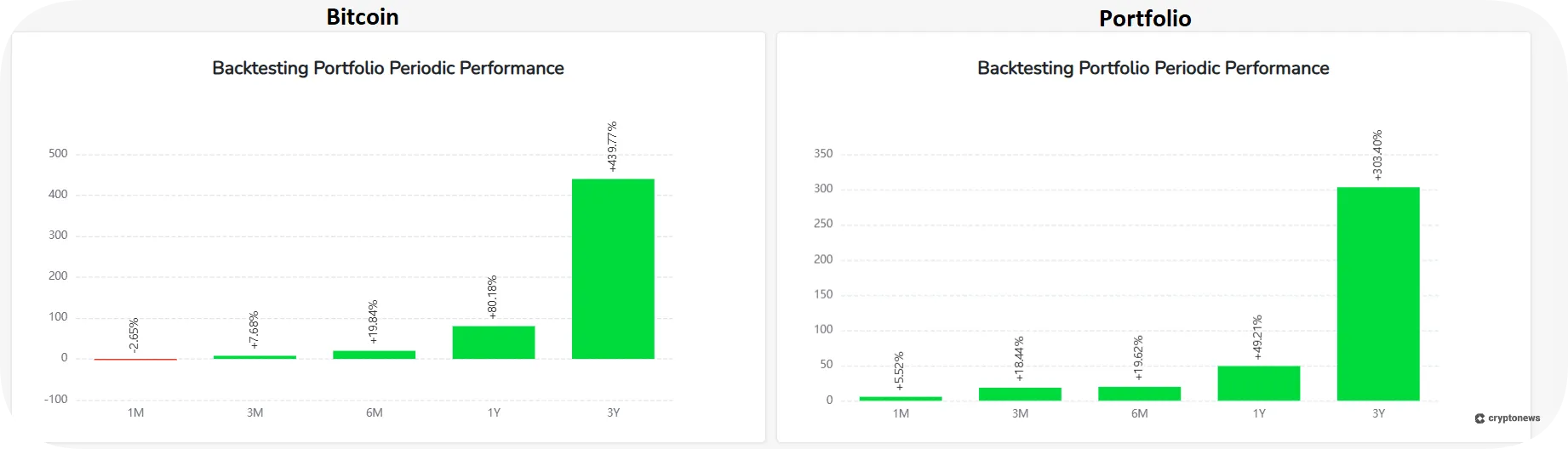

Let’s explore past data to see how a diversified portfolio compares to holding BTC alone.

For this example, we used Final Crypto Tool to simulate a crypto portfolio that allocates 30% to Bitcoin, 20% to Ethereum, and 50% to altcoins representing different blockchain sectors, including AI, meme coins, RWAs, and infrastructure.

This portfolio takes a more aggressive stance than our recommended picks and excludes presales, as we can’t backtest them.

The historical data show that Bitcoin has experienced a tenfold increase during the past five years, while the diversified portfolio has delivered +1,500% returns, outperforming BTC by about 60%.

Still, Bitcoin can be more stable and may outperform during certain periods. For example, over the past 1-year and 3-year timeframes, Bitcoin delivered stronger returns than the diversified portfolio.

Over the past year alone, Bitcoin performed slightly better than this specific portfolio example. However, adding presales and rebalancing into newer tokens, such as Hyperliquid, could have boosted the diversified strategy.

It’s worth noting that Bitcoin is more stable, which is why it should be allocated the lion’s share.

Since 2020, the oldest coin has shown a slightly smaller maximum drawdown, falling -76% compared with -80% for the diversified portfolio. Still, in the past, Bitcoin has experienced drawdowns of more than 80%.

A volatility comparison shows that the portfolio’s annualized volatility is often higher than Bitcoin’s. Currently, it’s 77% versus 45%, respectively.

Historical data on the performance of a diversified portfolio vs. a Bitcoin-only strategy shows that crypto investors risk missing growth opportunities if they focus solely on Bitcoin.

Risks and How to Mitigate Them

With a maximum drawdown of 70% or more, even the most carefully balanced portfolios carry high risks, as cryptos remain the most volatile asset class.

In addition, investors must be aware of technical risks such as smart contract exploits, hacking attacks, rug pulls (in the case of presales and early-stage tokens), and regulatory uncertainty.

Here are some basic tips to mitigate these major risks:

🤔 Decide Your Risk Tolerance

- Consider basic risk management principles (e.g., do not risk $100 for $10 in profit).

- Never invest more than you can afford to lose.

- Use stop-loss orders to limit potential losses caused by volatility spikes.

- Avoid overexposure to small caps and presales.

⛔ Avoid Regulatory Uncertainty

- Prefer jurisdictions with clear crypto rules and investor protections.

- Avoid projects with unclear legal status or pseudolegal fundraising schemes.

🫷 Stay Away From Rug Pulls

- Don’t invest in projects that have invisible teams behind them, especially if they control a majority of tokens, or demand payment before a live, minimally viable product (MVP) is revealed.

- Always do your own research on the team’s background, make sure that the tokenomics are logical, and that the roadmap is easy to achieve.

🤓 Smart Contract Exploits

- Prioritize investing in projects with audits.

- Look for a project that has anonymous KYC, audits, or a proof of reserves, if applicable.

♥️ Emotional Decision-Making

- Stick to predetermined strategy rules; don’t let the FUD and FOMO break the balance. Use stop-loss strategies, stablecoin hedge, and regular rebalancing.

- Use a crypto portfolio tracker to avoid complexity. To stay organized, choose from these best crypto portfolio trackers.

To maintain your diversified portfolio in good shape, rebalance quarterly based on performance. You should also consider rebalancing when a coin exceeds its target allocation by 20% or more.

Final Thoughts – A Mixed Crypto Portfolio for Better Risk-Adjusted Returns

A well-diversified crypto portfolio offers a balance between growth and risk-adjusted returns by combining early-stage projects with high-growth altcoins and large-cap blue chips. This approach helps investors address volatility risks while benefiting from strong returns.

The key is to spread exposure across multiple sectors and token types while monitoring markets on a regular basis. When picking crypto assets to allocate to, it’s imperative to analyze the broader narrative, on-chain usage, tokenomics, and momentum.

To ensure the portfolio’s long-term sustainability, make sure to rebalance every quarter or during major swings, hedge with stablecoins, and keep exposure to speculative presales within a predefined range.

👉 For more high-quality early-stage tokens, check our Best Crypto Presales page.

FAQs

What is the safest cryptocurrency to hold?

How many coins should be in a diversified crypto portfolio?

How much does a beginner need to start investing in crypto?

Are presales worth the risk?

How much of my portfolio should be in Bitcoin?

How much should my portfolio change during altcoin season?

References

- Rolling 12-Month Sharpe Ratio (Portfolio Labs)

- Crypto Correlations (DefiLlama)

- CMC Altcoin Season Index (CoinMarketCap)

- Perp Trading Volume (DefiLlama)

- Oracles TVS (DefiLlama)

- TradingView Chart 1 (TradingView)

- TradingView Chart 2 (TradingView)

- Crypto Portfolio Simulator (Final Crypto Tool)

About Cryptonews

Our goal is to offer a comprehensive and objective perspective on the cryptocurrency market, enabling our readers to make informed decisions in this ever-changing landscape.

Our editorial team of more than 70 crypto professionals works to maintain the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re looking for breaking news, expert opinions, or market insights, Cryptonews has been your go-to destination for everything cryptocurrency since 2017.