5 Best Polymarket Alternatives in January 2026

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships. However, this potential compensation never influences our analysis, opinions, or reviews. Our editorial content is created independently of our marketing partnerships, and our ratings are based solely on our established evaluation criteria. Read More

We tested a wide range of Polymarket competitors and found that overall, Kalshi, Myriad, and OPINION are the best alternatives for 2026. These platforms suit various profiles, such as those seeking a regulated environment, social-driven features, or political-focused markets.

Traders search for Polymarket alternatives for several reasons. Whether you favor platforms with deeper liquidity, lower fee structures, or a broader range of markets, this guide ranks and reviews the best Polymarket rivals for each trading preference.

Read on to compare the top prediction exchanges, discover which platforms suit U.S. clients, and what factors to consider when selecting a provider.

- In This Article

- In This Article

- Show Full Guide

Sites Like Polymarket Compared

Here is a summary of the best Polymarket alternatives, compared by volume, betting markets, and other core factors:

| Name | 30-Day Volume | Market Categories | Currency | Fees | Availability |

|---|---|---|---|---|---|

| Polymarket | $2.7 billion | Politics, sports, cryptocurrency, finance, geopolitics, earnings, technology, culture, real-world events, economy, climate & science, elections, mentions | Cryptocurrency | No fees | Non-custodial access, but restricts IP addresses from 30+ countries, including the U.S., the UK, and Australia |

| Kalshi | $8.5 billion | Politics, sports, culture, cryptocurrency, climate, economics, mentions, companies, financial, technology & science | Fiat and cryptocurrency | Maker and taker commissions vary by market and are charged per contract | U.S. and 140+ additional countries |

| Myriad | $13.8 million | Cryptocurrency, sports, politics, economy, gaming, culture, sentiment | Cryptocurrency | Approximately 3% on buy and sell orders | Global (non-custodial) |

| OPINION | $3.1 billion | Macroeconomic | Cryptocurrency | Takers pay 0–2% depending on the market | Non-custodial access, but restricts IP addresses from 10+ countries, including the U.S., the UK, and France |

| PredictIt | Not publicly reported | Politics | Fiat | 5% deposit fee and a 10% commission on trading profits | U.S. clients only |

| Predict.fun | $267 million | Politics, cryptocurrency, sports, economy, culture, games, finance, technology | Cryptocurrency | Makers pay no fee. Takers pay from 0.018% to 2% (discounts often available). | Global (non-custodial) |

Best Alternatives to Polymarket Reviewed

Some traders ask the question: Is Polymarket legit? While Polymarket is a legitimate prediction exchange, you might want to seek alternatives that better fit your priorities.

The following reviews discuss prediction market platforms that offer certain benefits over Polymarket, based on personal testing experiences. Our findings help traders choose a safe alternative to Polymarket in 2026.

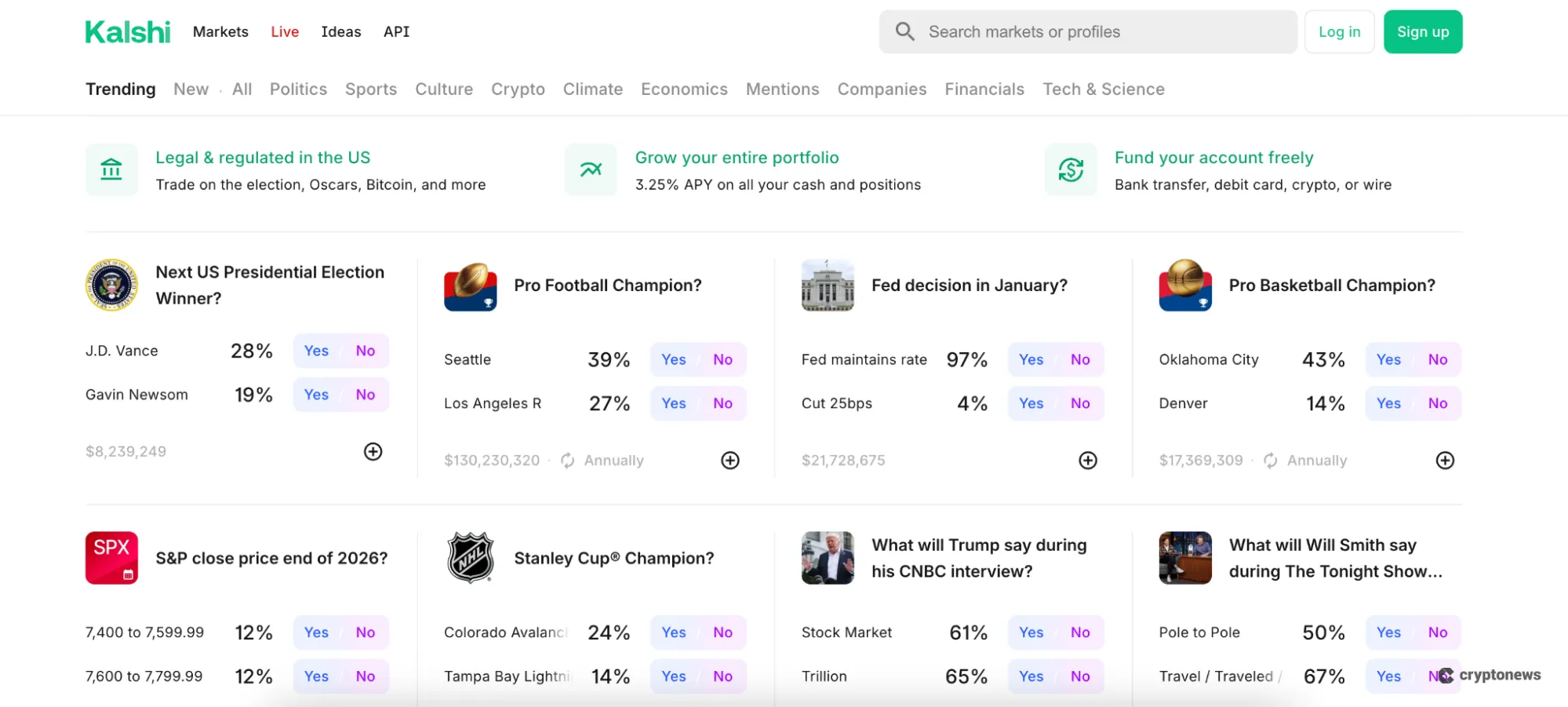

1. Kalshi – Best Alternative for U.S. Users

With a daily notional volume of several hundred million dollars, Kalshi is Polymarket’s closest competitor, though a crucial difference is that while Polymarket operates a non-custodial model that relies on cryptocurrency payments and smart contract execution, Kalshi offers a more traditional platform experience.

As a Commodity Futures Trading Commission (CFTC)-regulated platform, Kalshi is a licensed prediction exchange that legally accepts U.S. clients. Users must complete standard know-your-customer (KYC) requirements before trading, so unlike Polymarket, Kalshi traders must provide personal information and a government-issued ID.

Kalshi’s licensing framework enables it to accept USD payment methods like ACH, Apple Pay, Google Pay, and debit cards. The payment experience will appeal to beginners who don’t feel comfortable using cryptocurrency wallets.

In terms of markets, Kalshi supports a similar range of betting niches. It covers political events, sports betting, cryptocurrency markets, earnings reports, mentions, and culture. The main drawback is fees. While Polymarket charges no fees, Kalshi applies maker and taker commissions that vary by market.

| Polymarket Alternative | Kalshi |

| Custody Model | Centralized |

| Chains | N/A |

| KYC? | Yes |

| Fees | Charges maker and taker fees per contract. Commission rates vary by prediction market. |

| Payment Methods | ACH, Apple/Google Pay, debit cards, and cryptocurrencies |

| U.S. Friendly? | Yes |

| 30-Day Volume | $8.5 billion |

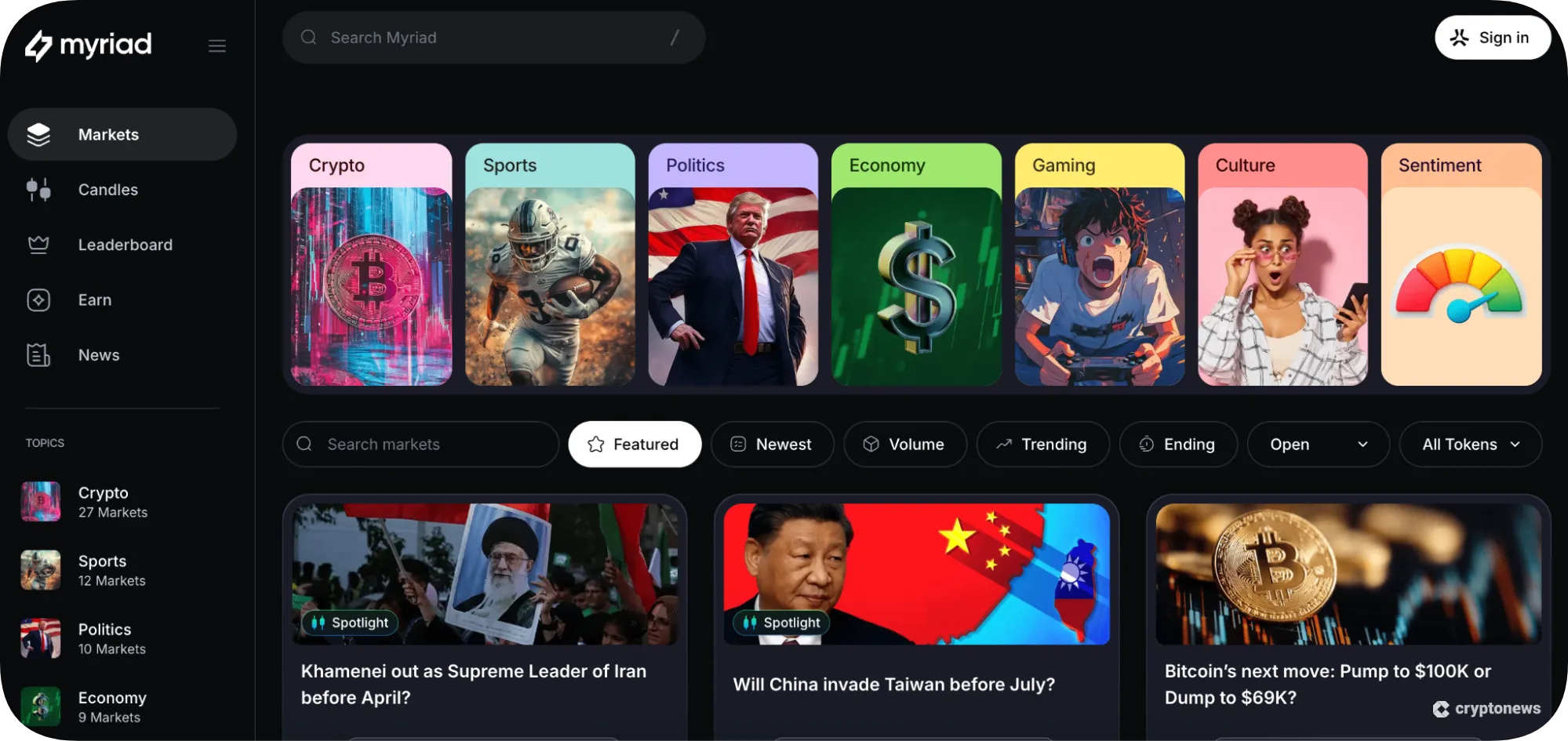

2. Myriad – Closest Like-for-Like Polymarket Competitor

Myriad is an up-and-coming prediction exchange that operates on three networks: BNB Chain, Linea, and Abstract. The decentralized marketplace offers a social-driven dashboard with well-optimized categories, filters, and market summaries.

Similar to Polymarket, platform users can bet stablecoins on politics, sports, culture, and other popular markets. It uses the same YES/NO mechanism, and smart contracts settle winning bets automatically for a non-custodial experience.

We found that Myriad is one of the best Polymarket alternatives for beginners, since it also lets users place bets with virtual points. This feature helps inexperienced prediction market traders learn how markets work without risking funds. Myriad users earn points by completing tasks, participating in markets, and using the Myriad browser extension.

Although Myriad has processed millions of prediction wagers since its inception, trading volumes remain low. On-chain data shows that across its three supported ecosystems, 30-day volumes sit below $14 million. This downside discourages serious traders, as limited liquidity causes wide spreads and high slippage.

| Polymarket Alternative | Myriad |

| Custody Model | Decentralized |

| Chains | BNB Chain, Linea, and Abstract |

| KYC? | No |

| Fees | Approximately 3% on buy and sell orders |

| Payment Methods | USDT |

| U.S. Friendly? | Yes, non-custodial access without restrictions |

| 30-Day Volume | $13.8 million |

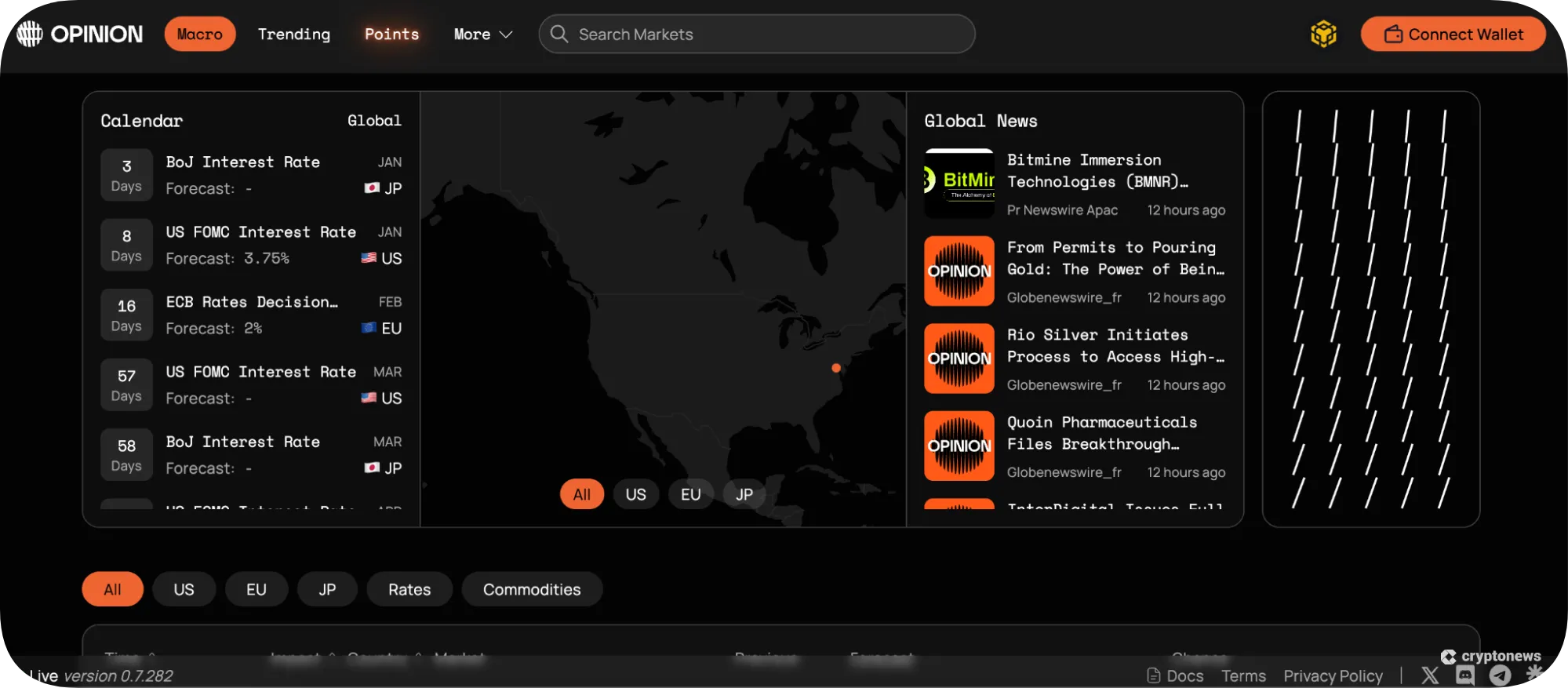

3. OPINION – Best for Macroeconomic and Sophisticated Data Markets

OPINION is a high-level prediction exchange that specifically specializes in real-world macroeconomic events. Markets include U.S., European, and Japanese interest rate decisions, and users cannot trade in other prediction areas, such as culture or mentions.

The platform focuses on serious traders who demand clarity and strong liquidity, and (compared with Polymarket) OPINION handles larger trading volumes. We like that each market comes with objective resolution rules without any vague terms. Advanced trading tools include bid and ask order book data, market and limit orders, and the option to set expiration terms on unmatched positions.

OPINION is built on the BNB Chain and only charges trading commissions to market takers, who pay between 0% and 2% depending on the market. The dynamic system increases fees as the resolution probability approaches 50%. Since takers pay a minimum commission of $0.50, the Polymarket alternative might not suit casual traders with low-margin strategies, but outside of that, it is still one of the best decentralized platforms.

Similar to Myriad, OPINION runs a rewards framework that enables users to earn platform points. Users collect points by providing liquidity, achieving volume milestones, and holding conditional tokens. According to some sources, OPINION point holders could be eligible for future token airdrops.

| Polymarket Alternative | OPINION |

| Custody Model | Decentralized |

| Chains | BNB Chain |

| KYC? | No |

| Fees | Takers pay 0–2% depending on the market ($0.50 minimum) |

| Payment Methods | USDT |

| U.S. Friendly? | Non-custodial access, but it restricts U.S. IP addresses |

| 30-Day Volume | $3.1 billion |

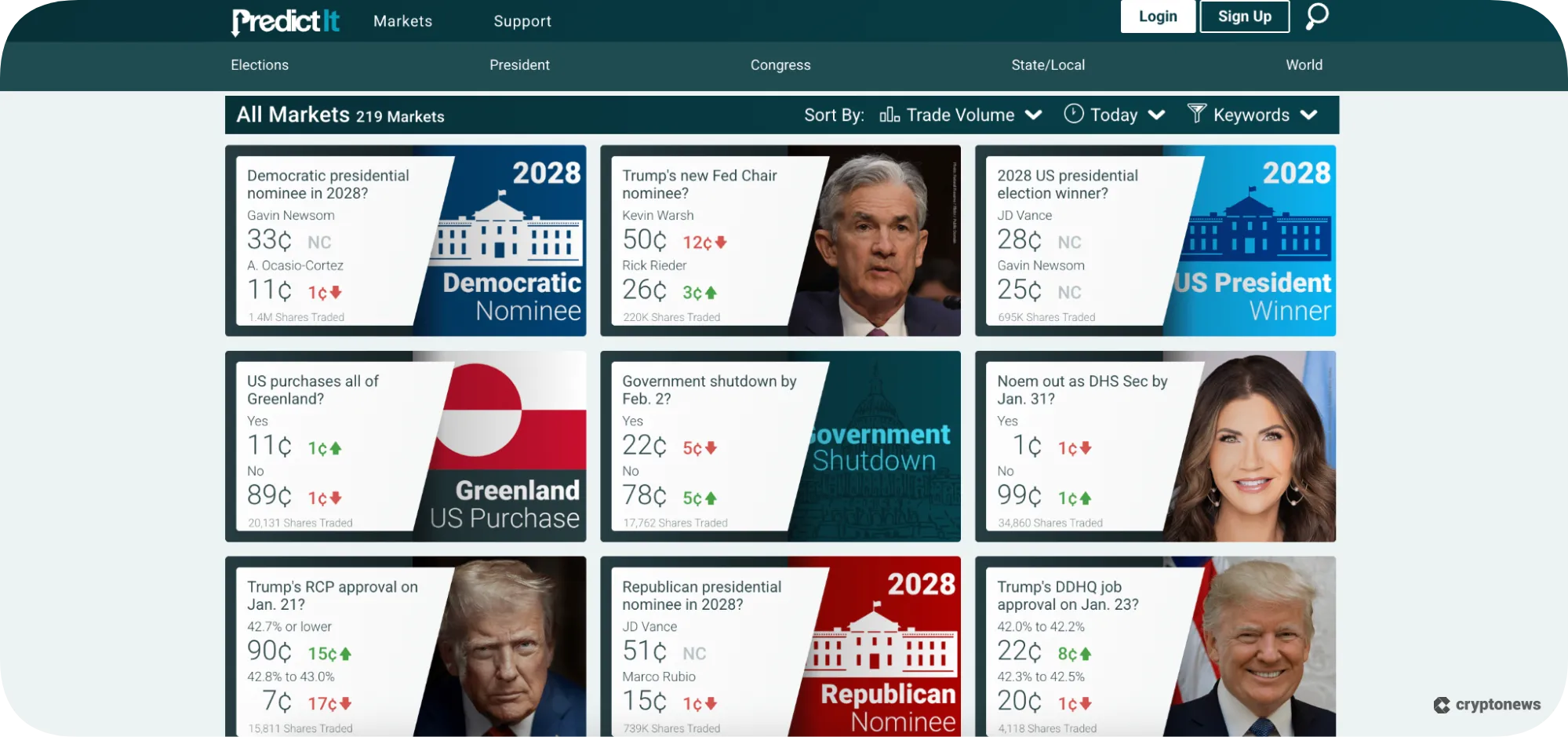

4. PredictIt – Best for U.S. Political Prediction Markets

PredictIt is a New Zealand-based (but U.S.-focused) platform that supports political markets exclusively. More than 200 prediction markets cover presidential, state, and local elections, as well as major geopolitical events. Since PredictIt runs a custodial model, we are unable to confirm average trading volumes.

Backed by the Prediction Market Research Consortium, academics from around the world use PredictIt for deep analytical research. Partners include academics from dozens of globally recognized institutions, including Yale, Harvard, Oxford, and Cambridge.

The prediction market dashboard offers charting data with candlesticks and lines across multiple timeframes, and users can download charts via CSV files to explore trends. The dashboard also supports social tools, where registered users discuss strategies, community forecasts, and potential market movements.

PredictIt’s terms and conditions confirm that the platform restricts account access to U.S. citizens. It allows a maximum bet size of $3,500 per contract, which limits significant wagers. We also found that PredictIt charges much higher fees than most Polymarket alternatives. Users pay a 5% deposit fee and a 10% settlement commission on winning bets (profit only).

| Polymarket Alternative | PredictIt |

| Custody Model | Centralized |

| Chains | N/A |

| KYC? | Yes |

| Fees | 5% deposit fee and a 10% commission on trading profits |

| Payment Methods | ACH |

| U.S. Friendly? | Yes, U.S. clients only |

| 30-Day Volume | Not publicly reported |

5. Predict.fun – Best for Casual, Sports, and Entertainment Predictions

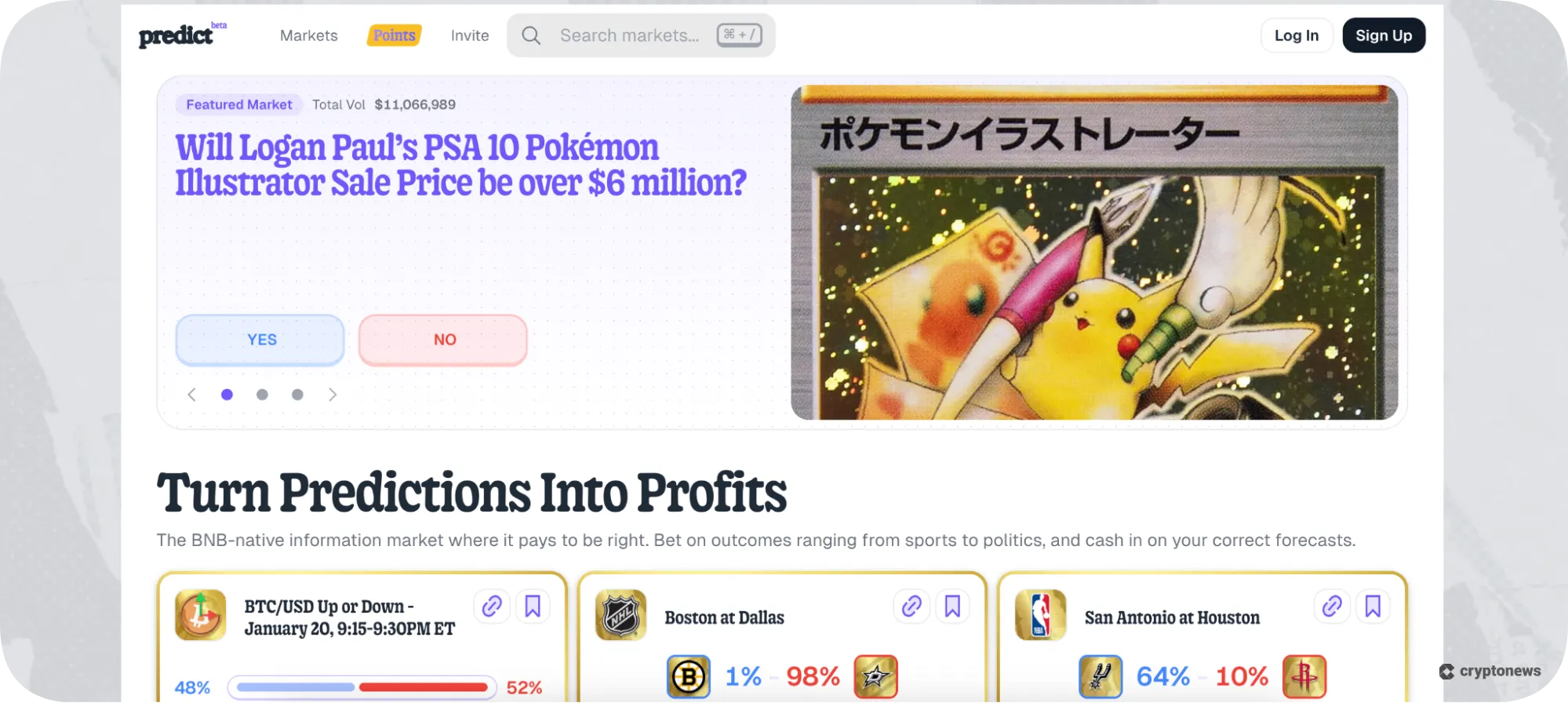

Predict.fun offers decentralized markets on the BNB Chain and Blast networks. Its most liquid prediction events include politics, cryptocurrency price movements, and sports like the NBA, NFL, NHL, and boxing.

Rising activity in other niches includes culture, economics, and games. According to DeFi Llama, 30-day volumes recently passed $267 million, and the platform generates approximately $613,000 in monthly fee revenue.

The prediction exchange’s simple interface suits casual traders, since it simplifies stakes, odds, and potential payouts. Predict.fun also performs well on mobile devices. The optimized dashboard offers a browser-based experience with clear betting buttons to eliminate errors.

One of the key features is Predict.fun’s yield program. While Polymarket locks user rewards in smart contracts, Predict.fun lets you allocate those funds to other prediction markets. This mechanism ensures capital efficiency, as idle funds generate income while simultaneously enabling exposure to new betting opportunities.

| Polymarket Alternative | Predict.fun |

| Custody Model | Decentralized |

| Chains | BNB Chain and Blast |

| KYC? | No |

| Fees | Makers pay no fee. Takers pay from 0.018% to 2%, with discounts often available. |

| Payment Methods | USDT |

| U.S. Friendly? | Yes, non-custodial access without restrictions |

| 30-Day Volume | $267 million |

Who Is Polymarket’s Biggest Competitor?

Polymarket’s biggest competitors depend on several metrics.

Kalshi remains the largest market for U.S. clients who prefer traditional, regulated environments. It supports familiar USD payment methods, so experienced traders can access prediction markets without relying on non-custodial wallets.

On-chain data also shows that Kalshi ($8.5 billion) processed over three times more trading volume than Polymarket ($2.7 billion) in the past 30 days. These figures confirm Kalshi as the largest prediction market by betting activity.

Research suggests that Myriad is a rising Polymarket competitor for those who prefer cryptocurrency-native platforms. It operates on the BNB Chain, Linea, and Abstract networks and supports non-custodial USDT wagers across similar prediction markets.

In terms of the biggest Polymarket alternative for trader growth, Kalshi does not publish monthly active user (MAU) numbers, yet some sources suggest that over two million people used the platform in 2025. In contrast, Polymarket has over 547,000 MAUs, and another 200,000 people have joined its U.S.-compliant waitlist.

How to Choose the Right Polymarket Alternative for You

Consider how much you value the following criteria when considering the top Polymarket alternatives:

U.S. vs. Non-U.S. User

Evaluate eligibility as the first factor, especially when exploring the question: Is Polymarket legal? Although U.S. clients use the global Polymarket exchange, the terms of service explicitly prohibit Americans from using the platform. Polymarket has launched a CFTC-approved U.S. platform, but the full rollout is not expected to happen until later in 2026.

U.S. traders who seek existing regulatory-compliant markets use Kalshi. The CFTC regulates Kalshi as a Designated Contract Market (DCM), which ensures integrity and fair prediction markets.

PredictIt is another Polymarket alternative in the USA, since the platform offers accounts exclusively to U.S. citizens.

Non-U.S. traders have access to a much wider range of Polymarket alternatives. Besides Kalshi, which supports over 140 additional countries, global users can trade prediction markets on Myriad and OPINION. While OPINION restricts IP addresses from some countries, its non-custodial model means that it cannot realistically enforce geographic restrictions.

Crypto vs. Fiat Preference

Your payment methods and preferences also matter when exploring sites like Polymarket.

Kalshi has integrated traditional payment methods like debit cards, bank transfers, and e-wallets, which means users can deposit and withdraw funds without cryptocurrency knowledge. PredictIt also supports U.S. dollar transfers via ACH.

Some traders prefer digital asset payments and transferring funds without relying on centralized institutions. Myriad and Predict.fun allow users to place prediction bets with USDT on the BNB Chain network. They feature crypto on-ramps to smart contracts rather than centrally controlled accounts, so they eliminate counterparty risks.

Casual vs. Professional Trader

We found that some Polymarket alternatives suit casual traders, while others target professionals with more advanced requirements.

Predict.fun offers a user-friendly desktop and mobile dashboard, and novelty markets include the GTA 6 launch dates, Logan Paul’s Pokémon sale, and Oscar award winners.

Conversely, serious traders use OPINION to trade macroeconomic future events, such as central bank policy decisions.

Entertainment vs. Serious Forecasting

If you use prediction markets for fun, Kalshi offers the widest selection of entertainment events. It especially excels in mention markets, where users bet U.S. dollars on Trump speeches, earnings calls, and even congressional hearings.

PredictIt caters to professional political analysts who engage in serious forecasting. Research partnerships include academics from Yale, Oxford, Harvard, and other leading institutions. However, PredictIt limits bet sizes to $3,500 per contract, so many analysts use the platform for research only.

Final Verdict: Are Polymarket Alternatives Better?

Kalshi is the leading Polymarket alternative in several key areas. The CFTC-regulated platform legally accepts U.S. clients and USD payment methods like ACH and debit cards. It attracts higher trading volumes than Polymarket, but as a U.S.-compliant platform, users must complete traditional KYC processes.

OPINION and PredictIt also merit mention for their professional-grade prediction platforms in the macroeconomic and political spaces.

However, Polymarket remains the best choice for non-custodial prediction markets, where traders use USDC to eliminate counterparty risks and KYC requirements. While Myriad and Predict.fun also offer cryptocurrency-native platforms, trading volumes are minute compared with Polymarket.

FAQs

Which Polymarket competitors offer mobile apps?

Which is bigger, Kalshi or Polymarket?

Is Polymarket legal in the US?

Is there a U.S. version of Polymarket?

Do Polymarket alternatives require KYC or identity verification?

References

About Cryptonews

Our goal is to offer a comprehensive and objective perspective on the cryptocurrency market, enabling our readers to make informed decisions in this ever-changing landscape.

Our editorial team of more than 70 crypto professionals works to maintain the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re looking for breaking news, expert opinions, or market insights, Cryptonews has been your go-to destination for everything cryptocurrency since 2017.