10 Best Cryptos to Buy During the Bear Market of 2026

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships. However, this potential compensation never influences our analysis, opinions, or reviews. Our editorial content is created independently of our marketing partnerships, and our ratings are based solely on our established evaluation criteria. Read More

Crypto investors are arguing about whether this is just a sharp correction or a full bear market, but most market commentators now see Q4 2025 as firmly bearish. Bitcoin has given back much of its earlier gains, Ethereum is even further from its peak, and forced selling plus softer ETF inflows have dragged sentiment down.

In this kind of environment, the strongest options usually combine resilience and real utility. That often means established networks like Bitcoin (BTC) and Ethereum (ETH), together with technically solid projects, focused on real use cases, such as Solana (SOL), Monero (XMR), and Bitcoin Hyper (HYPER).

The Best Crypto to Buy During the Bear Market

Finding the cryptos with the most potential in a bear phase isn’t easy. Most coins have seen steep drawdowns, but that also means a rare chance to buy quality assets at marked-down prices. Alongside established names, we’ve also included upcoming tokens, which can offer higher upside if the next cycle starts from today’s lower valuations.

With that in mind, a list of the best cryptocurrencies to buy during the dip is presented below. They all have potential for the year ahead:

- Bitcoin (BTC) – Original cryptocurrency with the largest market cap and the main driver of crypto market cycles.

- Ethereum (ETH) – Leading smart contract platform powering DeFi, NFTs, and thousands of decentralized applications.

- Solana (SOL) – High-speed blockchain built for low-fee trading, gaming, and other high-throughput applications.

- Monero (XMR) – Privacy-focused coin offering confidential, untraceable payments through advanced on-chain encryption.

- Bitcoin Hyper (HYPER) – Upcoming Bitcoin Layer 2 bringing faster BTC transactions and DeFi-style staking opportunities.

- Chainlink (LINK) – Decentralized oracle network that feeds real-world data into smart contracts across multiple blockchains.

- Binance Coin (BNB) – Native token of the Binance ecosystem, $85.41B market cap.

- Cardano (ADA) – Research-driven proof-of-stake blockchain focused on security, sustainability, and gradual ecosystem growth.

- SUBBD (SUBBD) – Web3 creator token for an AI-powered subscription and content platform with staking rewards.

- Polygon (POL) – Scaling token for Ethereum-based networks, enabling faster and cheaper transactions for dApps and DeFi.

Is Crypto in a Bear Market Right Now?

Crypto prices are in a clear downturn at the moment, facing a bear market. After Bitcoin briefly traded above $126,000 in early October, it has since fallen by roughly 25%, while Ethereum is down more than 35%. Most major coins have surrendered much of their 2025 gains, and a wave of liquidations has hurt overall market confidence.

On top of that, money flowing in from ETFs has slowed, and higher interest rates are still a worry. With fewer traders active, markets feel thin and jumpy. Many see this as a typical crypto shakeout that will likely need time and sideways action before a stronger recovery can start.

Reviewing the Best Cryptos to Invest in During the Bear Market

Now, let’s take a closer look at the best crypto to consider during this bear market. The sections below cover use cases, roadmaps, and price potential for each project, from established names like Bitcoin, Ethereum, and Solana to newer plays such as Bitcoin Hyper, and SUBBD.

1. Bitcoin (BTC) – Flagship Crypto and Main Market Benchmark

Bitcoin is still the main reference point for the crypto market and the first asset many people look at in a downturn. With a hard cap of 21 million coins, deep liquidity, and the biggest market value in the sector, it’s often treated as digital gold rather than a niche token.

During a bear phase, many investors use Bitcoin as their core position while they wait for clearer signals. It has a long track record, growing institutional demand through Bitcoin ETFs and balance sheets, and a history of strong fourth quarters, so some buyers gradually add on dips instead of chasing short-term trends.

Even after dropping about a quarter from its peak, Bitcoin still leads the market in volume and attention. If you’re thinking about buying, keep its sharp swings in mind, decide in advance how much you can risk, and consider building a position slowly instead of going all in.

| Launch Date | January 2009 |

| Chain | Bitcoin |

| Current Price | $68,722.62 |

| Price Change | -2.46% |

2. Ethereum (ETH) – DeFi Backbone With Deep Liquidity and Staking Yield

Ethereum needs no introduction, as this cryptocurrency remains the second largest behind Bitcoin and the backbone of the DeFi and NFT ecosystems. Ethereum is a project with long-term potential, especially when the market is uncertain.

Ethereum’s success is primarily contingent on the NFT and DeFi sectors. Even in a bear market, Ethereum’s broad adoption and developer activity help maintain its relevance when many other projects slow down.

Ethereum’s transition to a proof-of-stake (PoS) consensus protocol was vital in the blockchain regaining its stature. Ethereum now requires over 99% less energy than before, making it one of the most eco-friendly crypto projects.

| Launch Date | July 2015 |

| Chain | Ethereum |

| Current Price | $1,972.57 |

| Price Change | -4.69% |

3. Solana (SOL) – High-Speed Layer 1 Built for the Next Market Recovery

Solana stands out as a candidate to watch in a bear market. It is a high-performance Layer 1 chain that combines Proof of History with Proof of Stake to reach very fast confirmation times and low fees, making it a natural home for trading platforms, DeFi apps, NFTs, and on-chain games.

During a downturn, Solana’s fast and low-cost transactions let people keep using the network without wasting money on fees. SOL holders can also stake their coins, helping to secure the chain while earning steady rewards as they wait for a potential market recovery.

After sharp rallies earlier in the cycle, Solana now trades well below its previous highs, drawing interest from investors looking for large caps at marked-down prices. Whether the bear market deepens or stabilizes, many see SOL as a core bet on high-throughput infrastructure that could benefit when risk appetite returns.

| Launch Date | March 2020 |

| Chain | Solana |

| Current Price | $85.35 |

| Price Change | -5.30% |

4. Monero (XMR) – Privacy-First Coin for Confidential Payments in Bear Markets

Monero is one of the main coins people look at when markets turn red. Launched in 2014 as a Bytecoin fork, it focuses on private, fungible payments. Ring signatures, stealth addresses, and RingCT hide sender, receiver, and amount, keeping every transaction confidential on a public, decentralized network.

In a bear market, Monero allows people to move and store money without exposing their finances. Holders often use XMR for everyday payments and peer-to-peer transfers, while keeping balances and transaction details private, which appeals to anyone who values privacy and financial independence.

Monero had no premine or presale, so every coin in circulation comes from mining on the open network. After more than a decade online, it has kept a loyal community, steady development, and daily usage. Bear markets often push prices down, giving privacy-minded investors chances to accumulate XMR at lower levels.

| Launch Date | April 2014 |

| Chain | Monero |

| Current Price | $319.97 |

| Price Change | -7.74% |

5. Bitcoin Hyper (HYPER) – Bitcoin L2 Project Unlocking Fast Transactions and DeFi for BTC

Bitcoin Hyper is one of the top tokens to consider during a bear market. It’s the very first Layer 2 network for Bitcoin that supports smart contracts. Built using the Solana Virtual Machine (SVM) protocol, this new Web3 project will allow users to deposit their native BTC holdings and receive a digital asset equivalent in the L2 chain. Aside from making Bitcoin transactions more efficient and scalable, Bitcoin Hyper enables BTC to be used for DeFi activities, such as staking and yield farming.

In bearish conditions, Bitcoin Hyper provides a low-cost solution for managing Bitcoin and helps BTC holders prepare for the next bull cycle. Additionally, users can stake the native utility token, HYPER, to earn staking rewards even during the presale. Currently, HYPER holders can earn 37% APY returns when staking the token during presale.

The Bitcoin Hyper presale has already raised 37%, signalling decent investment activity for the L2 project. Whether or not a market selloff occurs, HYPER will be sold at a discounted rate in its presale phase.

| Presale Started | May 2025 |

| Purchase Methods | USDT, ETH, BNB, and Card |

| Chain | Ethereum |

| Current Price | $0.01367570 |

| Price Change | +18.92% |

6. Chainlink (LINK) – Decentralized Oracle Network Connecting Blockchains to Data

Chainlink stands out in rough markets because it sits behind many major crypto apps. The network delivers price feeds and other real-world data to smart contracts, helping DeFi, gaming, and tokenization platforms function reliably. That core role keeps Chainlink relevant even when speculation cools across the wider market.

During bear markets, Chainlink still sits at the center of on-chain activity. Protocols continue paying for reliable oracles and cross-chain messaging, which supports steady LINK demand. Holders can also stake LINK to help secure services and earn rewards, turning a quiet market phase into a time to accumulate.

Launched in 2019 after its early whitepaper work and fundraising, Chainlink has grown into core infrastructure for thousands of projects. That history, plus ongoing upgrades and new partnerships, means many investors see LINK as a long-term play on Web3 plumbing rather than a short-lived speculative token.

| Launch Date | June 2019 |

| Chain | Chainlink |

| Current Price | $8.80 |

| Price Change | -3.57% |

7. Binance Coin (BNB) – Exchange-Backed Token With Real-World Demand Stability

Binance Coin has also emerged as one of the top coins to buy during the bear market. Following the collapse of FTX, Binance solidified its position as the dominant crypto exchange.

With daily trading volumes often exceeding $2.2 billion, Binance continues to attract retail and institutional users, creating steady demand for BNB, which is used to pay trading fees at a discount.

Moreover, BNB is tied to and backed by the Binance exchange. The token offers investors the opportunity to capitalize on Binance’s growth. BNB holders can even deposit their tokens in the “BNB Vault” to generate a yield, adding another valuable long-term use case for investors.

| Launch Date | July 2017 |

| Chain | Binance Smart Chain |

| Current Price | $613.67 |

| Price Change | -2.71% |

8. Cardano (ADA) – Resilient L1 With Steady Development and Staking

Cardano is a smart contract platform known for taking a slow and steady approach. It’s built using peer-reviewed research and aims to be scalable, secure, and eco-friendly.

In a bear market, that steady progress can be a good thing. ADA has survived past crashes and keeps building upgrades like Hydra, which aim to make it faster. You can stake ADA to earn rewards in the meantime.

It might not move fast like other projects, but Cardano’s long-term focus and strong community make it worth keeping an eye on while prices are low.

| Launch Date | September 2017 |

| Chain | Cardano |

| Current Price | $0.28 |

| Price Change | -4.77% |

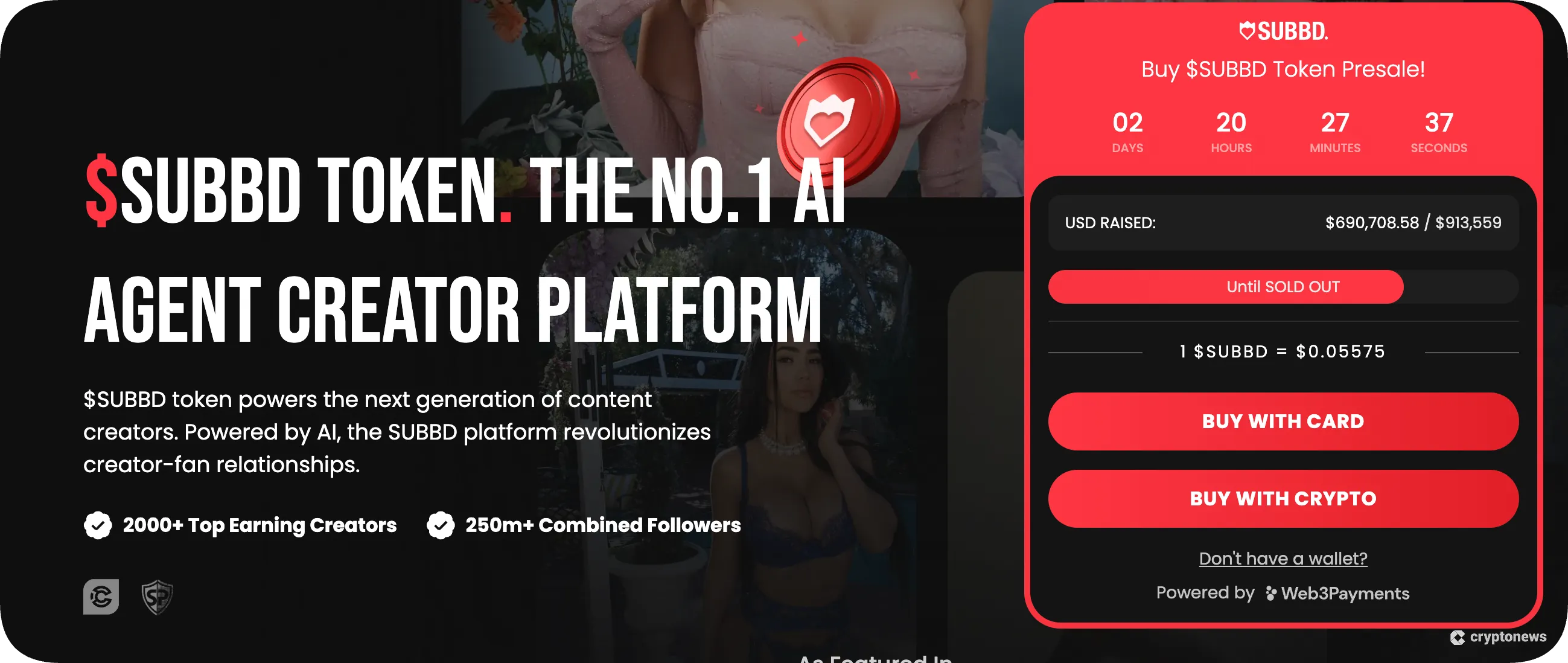

9. SUBBD (SUBBD) – An All-in-One AI-Powered Creator/Fan Connection Platform

SUBBD is a new content creation and subscription platform that’s powered by both AI and Web3, and has a new utility token moving through its presale phase. Because the SUBBD token hasn’t launched on exchanges yet, it’s still insulated from the day-to-day price swings affecting the majority of traded assets. The SUBBD token presale has already raised $1.49M from early supporters.

What makes SUBBD stand out is its plan to remove content subscription industry intermediaries and give both fans and creators more flexibility and control. To enable this, the platform will launch an AI personal assistant to handle 24/7 fan interactions.

SUBBD also aims to provide frictionless crypto payments, advanced AI creation tools, and community rewards all under one roof. In practical terms, fans will get direct access to creators, while creators can keep more of their revenue. The platform currently has a combined network of over 250 million followers across its platform and ambassador networks, which has already helped this presale start going viral.

| Presale Started | April 2025 |

| Purchase Methods | USDT, ETH, BNB, and Card |

| Chain | Ethereum |

| Current Price | $0.05747500 |

| Price Change | +4.50% |

10. Polygon (POL) – Useful Token with Rebound Potential During the Bear Market

Polygon is rounding off our discussion of the best crypto to buy during the dip. It’s a Layer 2 blockchain designed to work alongside the Ethereum network, making it faster and cheaper for developers.

Due to Polygon’s critical use case, the project has been able to partner with various companies, including Meta Platforms, Starbucks, and JPMorgan Chase. Meta and Starbucks even chose Polygon to power their ventures into the NFT space.

Many investors and developers believe that Polygon may not be required. That’s because Ethereum is expected to continue improving its scalability. However, this has yet to prove to be the case, and Polygon still has exceptional backing.

| Launch Date | October 2017 |

| Chain | Ethereum |

| Current Price | $0.65 |

| Price Change | +0.15% |

What Causes a Crypto Bear Market?

Before deciding what crypto to buy during the bear market, it’s essential to understand the forces that cause the bearish momentum. Here’s what can contribute to a pricing downturn:

- Geopolitical crises (e.g., the war in Ukraine)

- Rising interest rates

- A slowdown in economic growth

- Sudden adverse events (e.g., the collapse of FTX)

- Public health issues (e.g., the COVID-19 pandemic)

- Major security breaches or large-scale hacks (e.g., the $1.5 billion Bybit exchange hack)

- Regulatory crackdowns or unclear government policies

Unfortunately, these factors have created the perfect environment for a bear market. When they’re present, they create a ‘risk-off’ atmosphere for investors, leading them to shy away from crypto.

It may also prompt investors to liquidate their crypto holdings, which causes downward price pressure. But despite all the negativity, there are still some cryptos to buy during the crash that offer potential.

When Will the Bear Market End?

Many market models suggest this crypto bear phase is almost over, with more than 99% of the current cycle already behind us. One tool traders watch is the Pi Cycle Top Indicator. Because it tends to mark major tops, its last signal and the sharp cooling since then point to a late-stage bear.

The Pi Cycle Top looks at two moving averages of Bitcoin’s price, a faster 111-day line and a slower 350-day line (multiplied by two). When the fast line crosses above the slow one, it often flags a peak. Once that signal is in the rearview and prices reset, many see room for the next cycle to form.

Since Bitcoin briefly traded above $126,000 and then dropped about 25%, many see this move as a late-cycle shakeout. ETF inflows have slowed or turned into outflows, retail interest has faded, and liquidity is thinner. These are common features when a bear phase is close to finding a floor.

Macro conditions could also help the turn. Expected interest rate cuts from the Federal Reserve and easier global liquidity may support risk assets again. Still, many traders want to see Bitcoin hold key support levels, such as the $90,000 area, before calling a clear bottom. Patience remains important.

Risk Warning: Should You Invest During a Bear Market?

Investing during a bear market can be tempting because prices look cheap, but the risk is very high. Crypto can fall for months or even years, and big drops often happen without warning. Liquidity also dries up, so exiting a position quickly at a fair price can be difficult.

If you still want to invest, treat it as high-risk capital only:

- Use small position sizes and keep cash aside

- Spread funds across several projects, not just one coin

- Avoid leverage and be ready for sharp swings

- Decide in advance when you will sell or cut losses

All cryptocurrencies are volatile, speculative assets, and you could lose your entire investment. Macro news, regulation, or project failures can make prices fall further. Only invest money you can afford to lose, keep a long-term view, and make sure your overall finances do not depend on crypto recovery.

Risk Management Strategies for Investing During a Crypto Bear Market

Volatile bear markets can punish even experienced crypto investors, so surviving the downturn means having a clear plan. The strategies below focus on protecting capital, controlling emotions, and positioning your portfolio for the next recovery.

1. Focus on Quality and Utility

When markets run cold, one way to stay grounded is to focus on coins that actually do something. Look for networks with real use cases, active builders, and clear plans, instead of meme tokens whose price depends mainly on jokes and viral posts.

By concentrating on useful networks, you naturally avoid many low-cap gambles and FOMO trades. This helps smooth portfolio swings, limits damage when sentiment flips, and increases the chance that gains made in the bear market survive the next price change.

2. Avoid Timing the Market; Use Dollar-Cost Averaging (DCA) Instead

Trying to guess exact tops and bottoms in a crypto bear market usually backfires. Prices move fast, news changes suddenly, and emotions creep in. Instead of throwing in a big lump sum at once, you spread your entries over time.

With dollar-cost averaging, you invest a fixed amount on a regular schedule, no matter what the chart looks like that day. Sometimes you buy high, sometimes low, but your average entry evens out. This reduces the risk of buying only near the peak and keeps your plan steady when markets get noisy.

3. Diversify Your Crypto Portfolio

Diversifying in a crypto bear market means not betting everything on one narrative or token. Spread your capital across blue-chip assets like Bitcoin and Ethereum, strong altcoins such as Solana, and a smaller slice in higher-risk, meme, or presale coins. Different assets will move differently as the cycle unfolds.

Go wider than just coin names. Mix several blockchains (Ethereum, Solana, BNB Chain), various market caps, and use cases like DeFi, NFTs, privacy, and oracles—rebalance from big winners into overlooked projects to lock in profits and keep risk under control.

4. Always Do Your Own Research (DYOR)

Doing your own research (DYOR) in a bear market means checking projects yourself instead of trusting hype. Read the whitepaper, understand tokenomics, look into the team, roadmap, partnerships, and community activity. This makes it easier to spot weak projects, red flags, or outright scams.

DYOR is ongoing, not a one-time task. Keep up with news, audits, listings, and regulatory updates, then adjust positions when something changes. Research also supports better entry and exit plans, position sizing, and diversification, so gains are protected if the market suddenly changes.

How to Find Cryptos to Buy in the Bear Market

Those who do decide to invest during a bear market must educate themselves. That’s why we’d like to explain three ways investors can evaluate crypto tokens during a downturn:

Use Technical Analysis to Identify Support

A popular approach for finding the best long-term crypto projects is to employ technical analysis. You’ll analyze an asset’s historical price movements to identify where the price could go.

Another common tactic is to determine a coin or token’s support level, which is a specific price point that has historically supported the price.

When an asset has a support level, it indicates a lot of buying pressure around that price point. Ultimately, we consider this to be a high-probability rebound area.

Be Aware of Trending Cryptos on Social Media

Many of the best cryptos to buy on X are ideal for bear markets since they have the most extensive community backing. Although this may not mean they can provide market-beating returns, these cryptos can often more effectively withstand adverse conditions.

Look for Projects with a Unique Selling Point (USP)

Looking for projects with a clear, unique selling point means backing coins that actually solve a problem or offer something different. In a bear market, these tokens are more likely to keep users, stay relevant, and avoid fading into obscurity like many copy-paste projects.

A strong USP also makes research easier: you can see who the project is for, what it improves, and how it plans to grow. That clarity helps you invest with more confidence, focus less on hype, and position yourself for the next market recovery.

Methodology: How We Chose These Cryptocurrencies

We used a balanced scoring system to build this list based on factors that matter most in a downtrend. Each coin was evaluated using the following criteria:

Project Fundamentals (25%)

We looked at whether each project solves a real problem or brings something new to the table. Tokens with strong use cases, clear roadmaps, and sustainable tokenomics scored highest here.

Market Position & Liquidity (25%)

Bear markets require assets that can hold their ground. We prioritized coins with high trading volumes, strong exchange listings, and consistent market cap rankings, plus those with healthy liquidity for smoother entries and exits.

Bear Market Suitability (20%)

Some tokens are better equipped to survive downturns. We factored in things like staking rewards, presale status (which protects against immediate downside), and overall stability during previous corrections.

Development & Community Activity (20%)

Ongoing development and an active community can be signs of long-term strength. We focused on tokens with engaged user bases, consistent updates, and transparent teams.

Narrative Potential (10%)

Lastly, we considered whether the token fits into a trending narrative, like AI, meme coins, or Layer-2 scaling, that could catch fire when the market flips bullish again.

Final Thoughts

Investing in crypto during a bear market is rarely comfortable, but it can be one of the best times to build positions. The presale tokens and already launched projects covered here were picked for their utility, active development, and solid ecosystems, giving them a better chance to rebound when conditions improve.

Bear markets are risky. Some coins will fail, and prices can keep lurching up and down for a long time. Look into every project yourself, keep position sizes small enough that a big drop won’t break your budget, and don’t chase sudden spikes. Stick with strong use cases and a long-term plan.

FAQs

Can you make money in a crypto bear market?

How do you spot a crypto bear market?

How long is a crypto bear market?

Are we still in a bear market?

References

About Cryptonews

Our goal is to offer a comprehensive and objective perspective on the cryptocurrency market, enabling our readers to make informed decisions in this ever-changing landscape.

Our editorial team of more than 70 crypto professionals works to maintain the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re looking for breaking news, expert opinions, or market insights, Cryptonews has been your go-to destination for everything cryptocurrency since 2017.