Is Bitcoin Hyper Legit or a Scam? A Detailed Review

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships. However, this potential compensation never influences our analysis, opinions, or reviews. Our editorial content is created independently of our marketing partnerships, and our ratings are based solely on our established evaluation criteria. Read More

According to our research, Bitcoin Hyper is attempting to address real problems with Bitcoin and has a tokenomics model for its presale that aligns with fair launches; however, the project does show risks that potential investors should keep in mind.

So far, the project has secured over $31.21M in presale funding, passed security audits, and operates with no regulatory warnings.

We’ll explain how Bitcoin Hyper’s tech could solve Bitcoin’s speed and cost issues. You’ll also see verified audit results, token distribution details, team credentials, and how the presale works. This gives you the facts to decide if HYPER fits your investment strategy.

- Introducing the first Bitcoin L2 solution

- Allows users to trade BTC almost instantaneously

- Enhanced transaction security with ZK-proofs

- USDC

- ETH

- usdt

Key Takeaways: Our Verdict

Our Verdict at a Glance (4 Key Factors):

- Risk Profile: EXTREMELY HIGH (Early-stage presale, no mainnet MVP).

- Audit Status: VERIFIED (Coinsult/SpyWolf audits completed).

- Team Transparency: LOW (Anonymous/Faceless Team).

- Trust Score: 7.5/10

Verified Token: Smart Contract Audited by Coinsult & SpyWolf

- Check Coinsult’s HYPER audit

- Check SpyWolf’s Hyper audit

What Should I Look at When Deciding Whether Bitcoin Hyper is Legit?

You can use the following checklist to review Bitcoin Hyper’s legitimacy. Read on to make an informed decision through independent due diligence.

1. Team Transparency

The whitepaper says the project is run by experienced cryptographers, developers, and blockchain engineers, with founders skilled in smart contracts and zero-knowledge systems—important for any advanced Layer 2. The main issue is that no individual is named, leaving presale buyers to trust an anonymous team and accept claims they cannot independently verify.

Bitcoin Hyper’s privacy-focused structure does not automatically make it illegitimate. Bitcoin itself was launched by the unknown creator Satoshi Nakamoto, who still controls close to 5% of the BTC supply while remaining unidentified. The comparison shows that anonymity is a risk factor, but not, on its own, proof of bad intent.

However, this privacy choice comes with a trade-off. An anonymous team provides no legal or reputational protection if the project fails to deliver on its goals and roadmap by the set deadline of Q1 2026.

- There are no public team identities, and investors cannot independently verify the whitepaper’s claims

- However, anonymity doesn’t automatically mean scam or illegitimacy

- The team cites strong cryptography and blockchain engineering

- Founders are experienced with smart contracts and zero-knowledge proofs

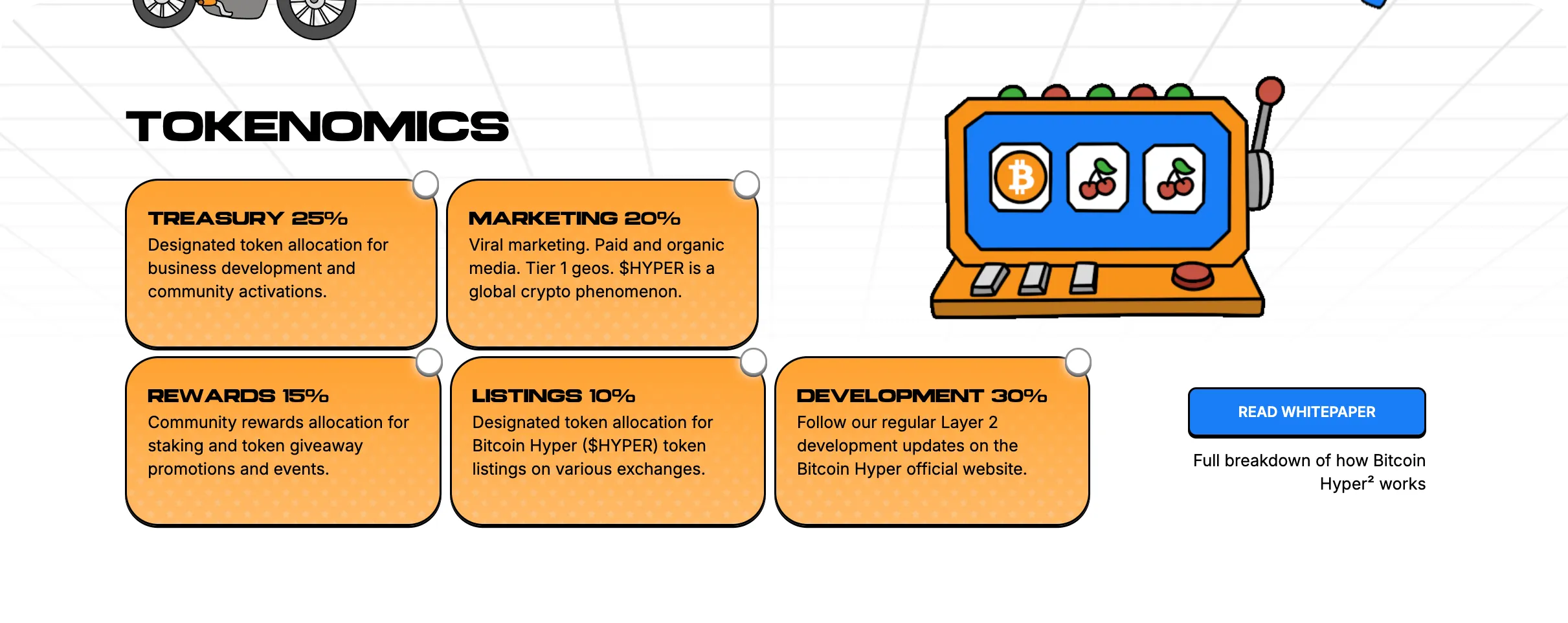

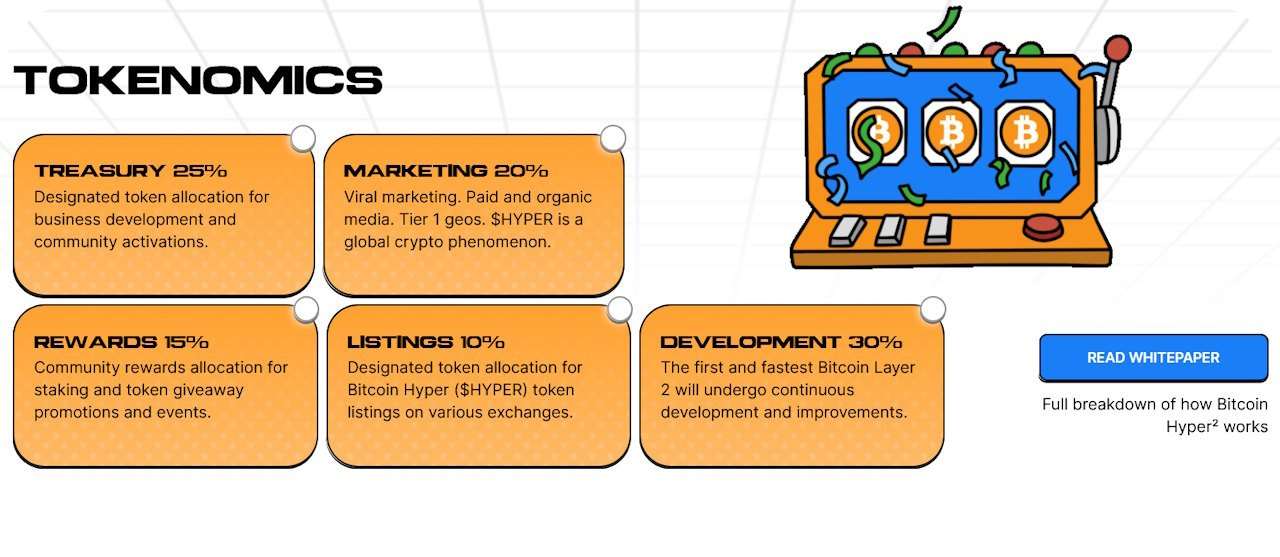

2. Tokenomics

After reviewing HYPER tokenomics, the supply and allocation look clear and balanced. The project fixed the total supply at 21 billion HYPER, so no extra coins can be minted later. This hard cap removes ongoing inflation pressure and makes it easier to track who owns what across different allocation buckets.

HYPER uses a proof-of-stake model rather than Bitcoin’s proof-of-work mining. All tokens were pre-minted, with the team holding everything not sold during the presale. This setup removes energy-heavy mining, but also means early control stays concentrated until tokens spread more widely through sales and staking.

- Fixed 21 billion supply removes ongoing inflation

- Proof-of-stake model avoids energy-heavy, wasteful mining operations

- Early supply concentration heightens centralization risk significantly

- Team controls all pre-minted tokens initially held

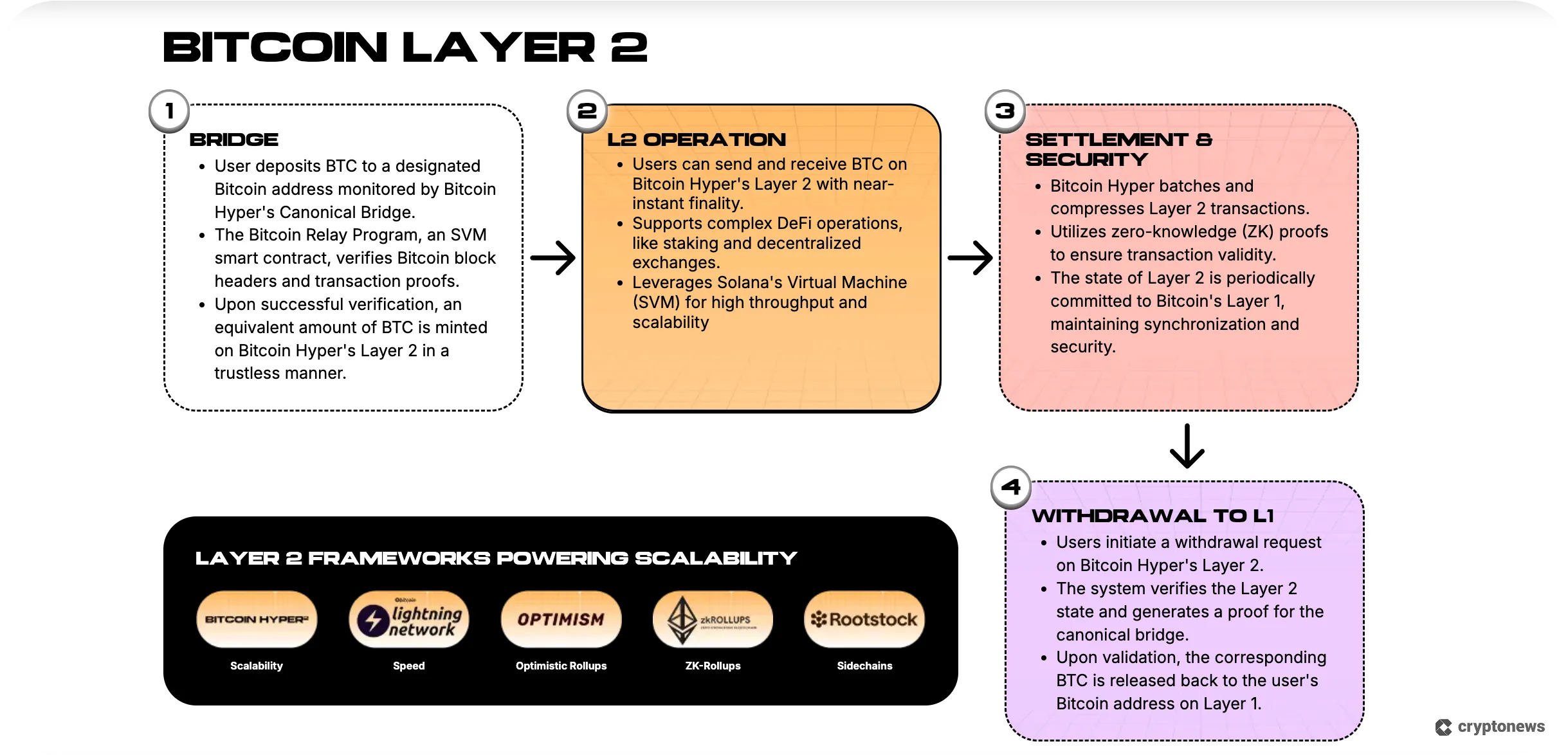

3. Bitcoin Layer 2 Utility

HYPER is the utility and governance token for a Bitcoin Layer 2 ecosystem built to tackle real pain points for BTC users. It focuses first on transaction efficiency, turning Bitcoin into a practical medium of exchange for remittances. Instead of 10-minute confirmations, Bitcoin Hyper aims to cut settlement times down to seconds.

Bitcoin’s base layer handles roughly seven transactions per second, which limits everyday use at scale. Bitcoin Hyper documents suggest its Layer 2 can increase throughput by hundreds of times. On top of faster transfers, it adds dApp access for BTC holders, including DeFi lending and staking, metaverse and gaming, and non-custodial trading.

However, the system still depends on Bitcoin. Base-layer confirmations anchor security and final settlement, so performance and reliability stay tied to the main BTC network. Bitcoin Hyper can ease congestion and speed up transactions, but it does not completely remove the structural limits of Bitcoin itself.

- HYPER speeds up Bitcoin transactions from minutes to seconds

- It also adds DeFi, gaming, and dApp opportunities for BTC holders

- However, it still relies on Bitcoin’s base-layer confirmations

- It cannot fully bypass Bitcoin’s structural throughput limits

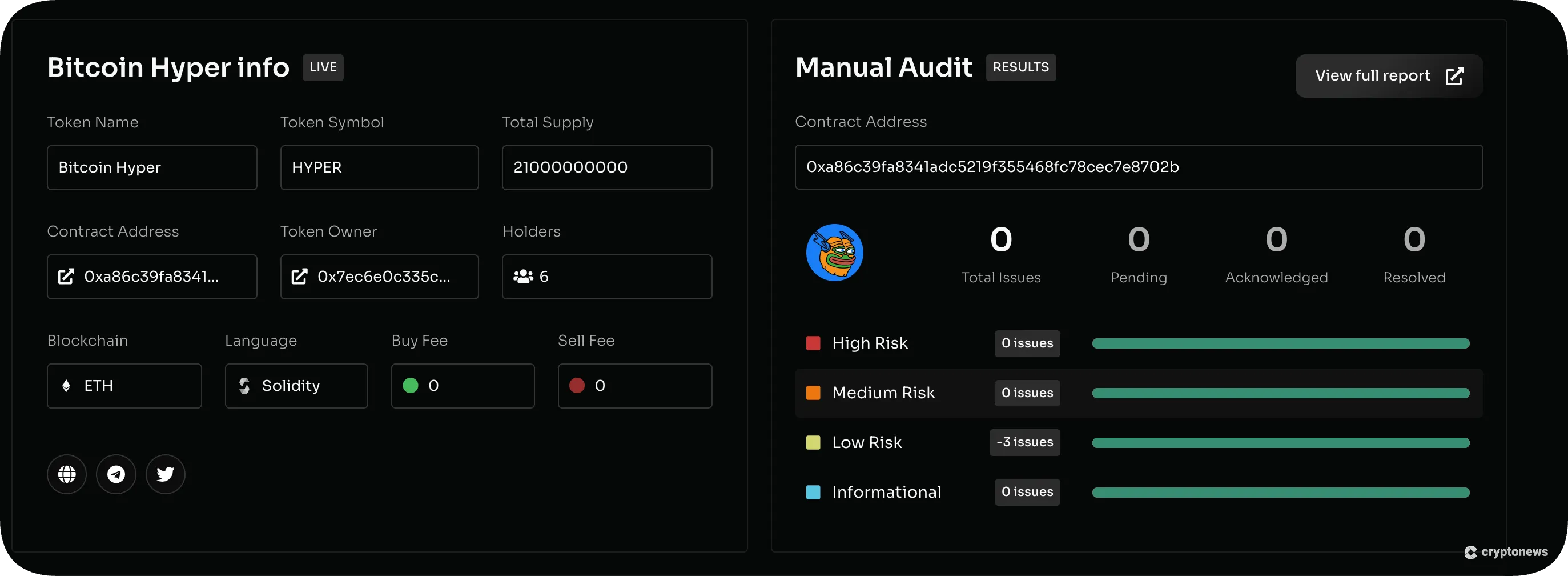

4. Audits and Security

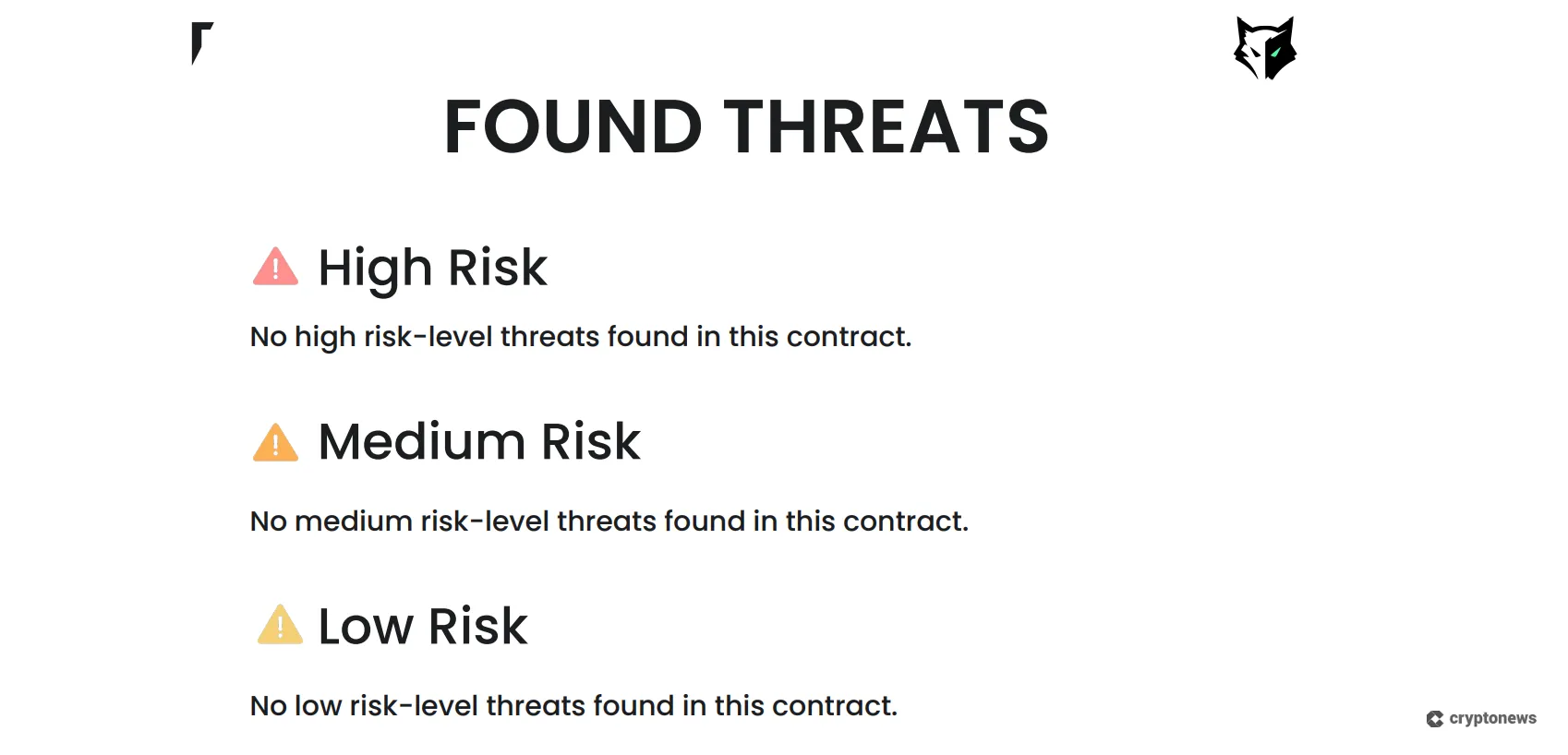

Bitcoin Hyper’s anonymous team structure is a clear risk, but some trust is earned through external audits. The project is not claiming to be safe without proof. Two well-known blockchain security firms, Coinsult and SpyWolf, have reviewed the HYPER smart contract. Both firms provide publicly accessible reports.

Their involvement shows the project was willing to open its code to independent scrutiny before scaling up its ecosystem. These audits have checked for high-risk vectors like backdoors, owner minting privileges, and honeypot logic.

Both audits report that key safeguards are in place, stopping extra tokens from being minted, wallets from being frozen, or hidden limits on DEX sales. They also confirm the fixed 21 billion HYPER supply and the correct contract address, helping buyers check they are dealing with the real token.

- HYPER’s external audits by Coinsult and SpyWolf are completed

- Safeguards prevent minting, freezing, or hidden restrictions

- However, anonymous team structure reduces accountability and trust

An important consideration that readers should keep in mind is that the audit only covers the smart contract for the HYPER token. This is an important nuance because the actual Bitcoin Hyper project is the ZK rollup — not the token.

To put it simply, the project is requesting funding based on the promise of delivering its Bitcoin Layer 2 (L2). Which means that the rollup must not only be operational, but secure as well. So far, there is no publicly available code or proof of concept for a Bitcoin Hyper L2.

To ensure due diligence, the Bitcoin Hyper team should, at the very least, release a proof of concept for its L2. It could also benefit from securing an audit of its zero-knowledge proof system or releasing a testnet.

5. Community: Hype vs. Reality

Bitcoin Hyper is also discussed in a number of crypto news outlets and YouTube channels during its presale. This coverage assists the project in coming out prominently in a market with new cryptocurrencies. It also attracts traders that may not even notice the presale by simply scanning the listings or some random social post.

On official channels, Bitcoin Hyper has over 18,300 followers on X, with most posts drawing 2,000–3,000 impressions, which fits that audience size. The HYPER’s Telegram group holds more than 8,800 members and is expected to grow as the presale continues. Some YouTube videos are likely sponsored, a standard promotion tactic for new crypto launches.

- HYPER is widely covered on news sites and YouTube

- It has over 18,300 X followers with consistent engagement and over 8,200 Telegram members

- Still, organic interest versus paid marketing remains unclear

- Also, some reach depends on sponsored YouTube reviews

6. Risks vs. Milestones

As a presale project, Bitcoin Hyper can reduce some risks if it delivers on its roadmap. The whitepaper sets a mainnet launch for Q1 2026, which would act as a proof of concept for sceptical buyers. In the same phase, the team plans its Web3 ecosystem, including the first smart contract and dApp.

Further confidence is expected at the token generation event, when HYPER lists on Uniswap. At that stage, the team needs to lock liquidity to lower rug pull risk and show long-term commitment. This step can only happen after the presale finishes, once the final token and liquidity allocations are clear.

- HYPER’s mainnet launch can prove real working product

- Uniswap listing plus liquidity lock boosts trust

- Roadmap milestones are still unproven until fully delivered

- Presale investors carry higher early-stage risk levels

Is Bitcoin Hyper Technology Legit or Just Hype?

Bitcoin Hyper hasn’t released an early demo or minimum viable product (MVP) yet. It plans to release these by Q1 2026. Investing in its presale now carries significant risk, similar to gaining exposure to a brand-new tech startup.

As you know, venture capitalists are willing to take on enhanced risk by investing in projects at the lowest valuations early, being well aware that the project might never reach mass adoption.

Early HYPER backers prefer to gain access at a micro-cap valuation ahead of the mainnet launch. More risk-averse investors may choose to wait for the MVP, although this likely means entering the market at a much higher market capitalization. This illustrates the classic high-risk/higher-potential-reward dynamic.

While the Layer 2 network remains under development, its whitepaper outlines legitimate goals grounded in real technological principles. The core technology includes:

- Solana Virtual Machine (SVM) integration

- A canonical bridge for secure BTC movement

- Real-time scaling solutions for the Bitcoin blockchain

Bitcoin Hyper’s goal is to bring Web 3.0 to Bitcoin; by introducing smart contract capabilities, it will allow BTC holders to access DeFi services (e.g., loans, swaps, and staking rewards). However, its success will depend on developer adoption.

Consequently, the HYPER team supports this initiative by providing grants to Web 3.0 builders. This will create an incentive for them to develop applications on its blockchain.

Next Price Increase In:

Who is Behind Bitcoin Hyper? Team, Company, and Background Check

The team behind Bitcoin Hyper is anonymous, a trend that has become increasingly common among many meme coin projects. What we know for sure is that Sentinum Ltd issued the whitepaper. However, we can’t research the firm, as it’s still not yet formally incorporated. This status doesn’t allow access to key corporate data like share count, list of shareholders, financial statements, and liabilities.

The project documents only provide the name of the issuer’s Managing Director, Agus Prabowo Saputra. When we searched the public domain, we couldn’t find additional information about Saputra.

The company’s registered address is Quijano Chambers, P.O. Box 3159, Road Town, Virgin Islands (British), 3159. Research shows that several unrelated companies use this address, so it provides little to no accountability.

The key takeaway is that Bitcoin Hyper is protected by privacy laws and the blockchain’s anonymous nature. Although many large-cap cryptocurrencies with real use cases have similar setup structures, HYPER’s lack of transparency raises red flags.

Bitcoin Hyper Tokenomics Explained: Is the Token Structure Fair?

The best utility tokens don’t just have viable products with real use cases, but also fair and sustainable tokenomics. Regardless of the asset’s utility, ill-structured token dynamics likely hinder the long-term Bitcoin Hyper’s price prediction potential.

The first aspect to explore is the token supply. As confirmed by Coinsult and SpyWolf, Bitcoin Hyper issued 21 billion HYPER tokens. Most importantly, the stated supply is capped, protecting holders from excessive inflationary pressures. The audited smart contract does not allow new issuances, so the founders cannot create additional tokens even if they wanted to.

Bitcoin Hyper has not disclosed the presale token allocation, though. This shortfall prevents analysts from evaluating the initial circulating supply of presale tokens and TGE market capitalization.

The tokenomics are transparent, including a full breakdown of how the team allocates the operational supply. 30% is reserved for product development, helping to fund the Layer 2 ecosystem, canonical bridge, and robust security mechanisms.

The next most significant allocation is the company treasury. At 25%, these tokens support business development, strategic partnerships, and community engagement initiatives.

The project plans to raise global awareness, using 20% of the HYPER supply for marketing campaigns. Target areas include paid and organic media, dApp onboarding, and user adoption growth, particularly in the Bitcoin community.

The remaining 25% is split between rewards (staking and promotional giveaways) and exchange liquidity.

While the high APY of 38% – which will decline over time – might appear aggressive at first, the fact that it’s an early presale project makes it less suspicious. This is mainly because the APY is funded by the tokenomics allocation rather than being paid from new investor deposits. This matters as it separates the projects from Ponzi-style mechanics.

Bitcoin Hyper Marketing Tactics: Community-Driven or Pure Hype?

No project documents promise profit returns or use hyperbolic language, unlike the top shitcoins. Bitcoin Hyper’s whitepaper is utility-focused, so the narrative concentrates on how its Layer 2 network solves existing problems.

As a new technical concept, Bitcoin Hyper relies on social media and other marketing avenues to increase product awareness. On the developer front, it plans to attract experienced blockchain programmers, which ensures an active dApp ecosystem for Bitcoin holders, including DeFi, real-world asset (RWA) tokenization, and Web 3.0 gaming.

Marketing also focuses on driving user adoption. Most Bitcoin investors are unaware of Bitcoin Hyper, let alone how its Layer 2 solutions work. HYPER’s success is determined by user growth and network activity, as these metrics drive demand and price appreciation.

Just like the roadmap journey, HYPER’s community is still in the early stages, with more than 18,300 followers across Telegram and X. These followers are organic. They will likely grow as the marketing campaign accelerates.

Bitcoin Hyper User Reviews: Real Investor Feedback and Complaints

Investors appreciate Bitcoin Hyper’s Layer 2 solution, which uses Solana VM and ZKPs to fix Bitcoin’s speed and scalability. The presale success and great staking rewards show strong confidence.

It is not a scam, it’s pre sale. Looking good for me.

— Common_Fill5075 on Reddit

Audits confirm secure contracts, and the team’s transparency fosters trust. Many see potential in its DeFi/NFT ecosystem and active community growth.

Bitcoin hyper has been audited by two highly reputable companies.

— Tennebelievin on Reddit

Some note significant risks: Bitcoin Hyper has regulatory and execution uncertainties. New users find Layer 2 mechanics and staking complex. Skeptics stress the need for real-world performance data before trusting its long-term viability as a project.

On TrustPilot, there are some negative reviews stating that issues with withdrawals and payment approvals occurred on the official presale website.

Most investors are optimistic about Bitcoin Hyper’s tech and market potential. A Reddit user stated that he used a block explorer to confirm that Bitcoin Hyper is not a scam:

When I purchased my HYPER, I did a screen recording, and I went into the block and [saw] my purchase.

— Silver_Base_7072 on Reddit

Audits and clear communication help, yet caution is urged, like any early-stage crypto. Balance excitement with realistic expectations about adoption timelines.

Where to Buy Bitcoin Hyper Crypto?

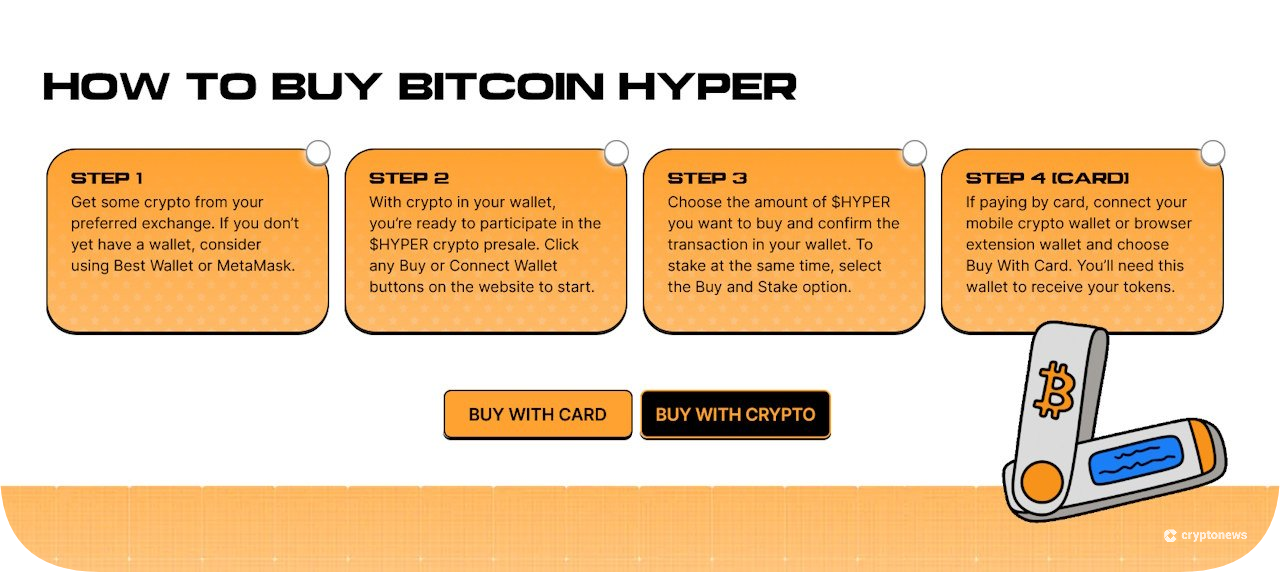

You can buy HYPER directly through Bitcoin Hyper’s ongoing presale. To do this, visit the official website, connect your non-custodial crypto wallet (such as Best Wallet or MetaMask), and pay with one of the supported assets (ETH, USDT, or BNB). Credit cards are accepted but require KYC checks and come with higher fees. Buying early secures a lower token price before stage increases.

Initially, HYPER will use the ERC-20 standard, which means you’ll need an Ethereum-compatible wallet like Best Wallet. To participate, simply connect your wallet to the presale dashboard and approve payments directly within your wallet app. The smart contract automatically records transfers on-chain. This temporary setup mirrors early BNB or Polygon.

After the presale (which is expected to end by the first quarter of 2026), HYPER will trade first on Uniswap. Centralized exchanges (CEXs) may list it later. Presale participants will receive their tokens directly in their connected wallets.

Next Price Increase In:

👉 Check our full guide on how to buy Bitcoin Hyper

Is Buying Bitcoin Hyper Safe?

Bitcoin Hyper has passed audits by Coinsult and SpyWolf, confirming that there are no backdoors or hidden risks in its contracts. The presale is non-custodial—you keep wallet control—and uses verifiable on-chain security. With $31.21M raised and a live staking platform (38% APY), its tech shows strong early trust signals from investors.

The anonymous team and the pre-mainnet stage mean high volatility and execution risk. Regulatory uncertainty also persists. While audits and transparency boost credibility, treat HYPER as high-risk. Only invest what you can afford to lose via official channels, and track roadmap progress closely.

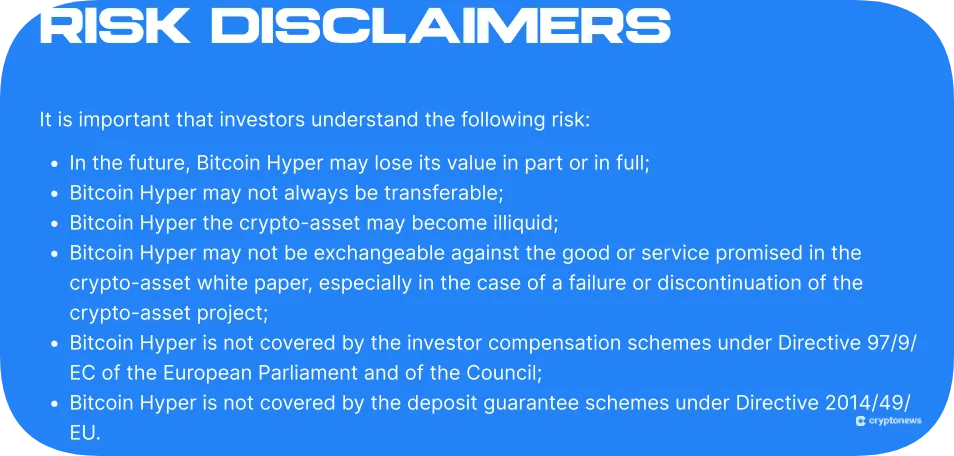

Is Bitcoin Hyper Legal? Regulatory Risks and Warnings

So far, Bitcoin Hyper is operating in a somewhat legal gray zone. To stay safe, the fundraising event only accepts digital asset payments.

If you use a credit card, the site will redirect you through a third-party gateway that processes fiat payments and conducts KYC checks. The buyer will receive ETH instead of HYPER. This creates a buffer that may offer legal protection to the project. Therefore, the responsibility to know if investing in HYPER is legal in their jurisdiction is mostly on the buyer.

The whitepaper also includes a long list of risk warnings, including potential financial losses and liquidity inaccessibility.

To comply with EU rules, Bitcoin Hyper gives users a two-week window to change their minds. This means you can back out of your presale purchase with no questions asked during this period. But once HYPER is listed on exchanges, you won’t be able to reverse your transaction.

Bitcoin Hyper: Is the Project Delivering on Promises?

Bitcoin Hyper’s roadmap provides a summarized list of objectives and quarterly due dates. This structure enables stakeholders to monitor the team’s progress.

Bitcoin Hyper is currently a presale token, not a working Bitcoin Layer 2. As of early 2026, there is no public mainnet, testnet, or open-source code showing a live L2 network, BTC bridge, or the Solana VM and ZK-rollup stack it promotes. Most of the pitch rests on marketing claims and a vague whitepaper rather than demonstrable infrastructure.

Only the basic ERC-20 HYPER contract has been audited, which helps reduce direct contract-rug risk but says nothing about staking, bridging, or any future Layer 2 mechanics. The team is fully anonymous, technical repos are closed, fundraising figures vary between promotions, and coverage leans heavily on paid PR, countdowns, and bold, unverified promises.

The roadmap talks about a mainnet, BTC bridge, and dApps rolling out in 2026, but these remain plans, not delivered milestones. According to its roadmap, HYPER is behind schedule with its TGE, as the presale was expected to end in Q1 2026.

So far, Bitcoin Hyper has delivered on different aspects, including:

- Presale success: The project has raised over $31.21M.

- Security audits: The project has successfully passed two smart contract security audits from Coinsult and SpyWolf.

- Developer network: The project’s devnet is already live, demonstrating stable performance in alpha testing.

How Does Bitcoin Hyper Compare to Other Crypto Projects?

If you’re considering other upcoming ICOs to invest in, here’s how they compare with Bitcoin Hyper:

| Project | Token | Current Price | Amount Raised (Presale) | Utility Highlights |

|---|---|---|---|---|

| Bitcoin Hyper |  HYPER +18.91% HYPER +18.91% |

$0.01367500 | $31.21M | Layer 2 for Bitcoin |

| Maxi Doge |  MAXI +12.06% MAXI +12.06% |

$0.00028015 | $4.57M | Meme coin focused on trader culture |

| LiquidChain |  LIQUID +22.27% LIQUID +22.27% |

$0.01345 | $517K | Layer 3 solution for unifying Bitcoin, Ethereum, and Solana ecosystems |

| SUBBD |  SUBBD +4.50% SUBBD +4.50% |

$0.05747500 | $1.47M | AI content subscription platform |

The above presale campaigns provide exposure to high-growth crypto narratives like AI integration, non-custodial storage, and some of the best meme coins. Each offers varying risks and rewards.

Among these projects, LiquidChain may share more common elements with HYPER than others because it’s also building a scaling solution on top of Bitcoin, although it additionally interacts with Ethereum and Solana and focuses on cross-chain liquidity.

Meanwhile, Maxi Doge is treated as a meme coin rather than an infrastructure project.

However, investing in any of these presales carries high risk, so conducting independent research is a must.

What Makes Bitcoin Hyper Stand Out?

Bitcoin Hyper is building the first Layer 2 solution for Bitcoin that utilizes the SVM, which is a pretty big deal. It uses Solana’s virtual machine to finally bring smart contracts and faster transactions to Bitcoin, directly tackling its longtime scalability problems in a very practical way.

Unlike many presales, you can choose to stake your tokens after you complete the purchase. So far, the project has already raised over $31.21M from investors. This shows serious confidence in its technical goals and the team’s ability to deliver.

The team’s roadmap includes a mainnet launch late in Q1 2026 and hopes for future listings on major exchanges. This approach provides a realistic plan that, if followed, could offer Bitcoin Hyper growth and wider accessibility.

Is Bitcoin Hyper Crypto a Scam or Legit? Final Verdict

Bitcoin Hyper is a legitimate project. It aims to solve some of Bitcoin’s major issues, like poor scaling, slow speed, relatively high costs, and delayed confirmation times. However, as with any presale, Bitcoin Hyper is a high-risk investment. It is still in its early development stages, and it hasn’t released any MVP or demo yet. According to its whitepaper, the mainnet launch is expected to occur in Q1 2026.

Next Price Increase In:

Frequently Asked Questions

What is Bitcoin Hyper crypto used for?

Is Bitcoin Hyper listed on any major crypto exchanges?

Has Bitcoin Hyper been flagged by any regulators?

When will Bitcoin Hyper launch?

What are the risks involved when buying Bitcoin Hyper?

Is Bitcoin Hyper built on Bitcoin?

How do I invest in the Bitcoin Hyper presale?

Am I safe to invest if Bitcoin Hyper’s team is anonymous?

How does Bitcoin Hyper utilize the Solana Virtual Machine (SVM)?

Who is behind Bitcoin Hyper?

Can you withdraw from the Bitcoin Hyper presale?

Is Bitcoin Hyper a Ponzi scheme?

References

- Bitcoin Hyper Official Website

- Bitcoin Hyper Whitepaper

- Bitcoin Hyper Report (Coinsult)

- Bitcoin Hyper Report (SpyWolf)

- What To Know About Cryptocurrency and Scams (Federal Trade Commission)

- Regulation (EU) 2023/1114 of the European Parliament and of the Council (EUR-Lex)

About Cryptonews

Our goal is to offer a comprehensive and objective perspective on the cryptocurrency market, enabling our readers to make informed decisions in this ever-changing landscape.

Our editorial team of more than 70 crypto professionals works to maintain the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re looking for breaking news, expert opinions, or market insights, Cryptonews has been your go-to destination for everything cryptocurrency since 2017.