Launched in 2017

Launched in 2017- 0.1% base spot fees with BNB discounts

- 500+ cryptocurrencies and deep markets

- Web3 wallet and copy trading in‑app

New‑user voucher bundles

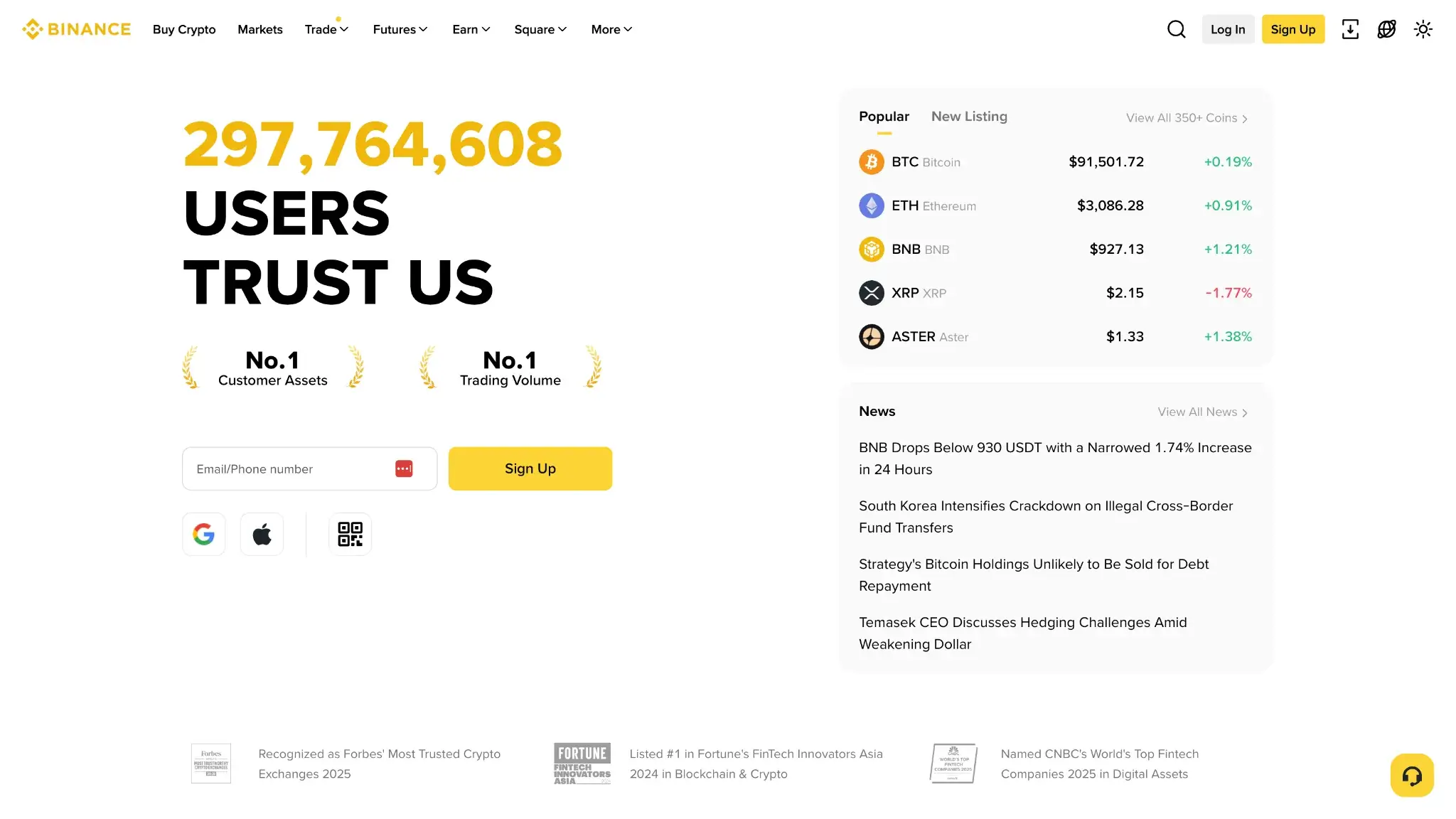

Binance Overview

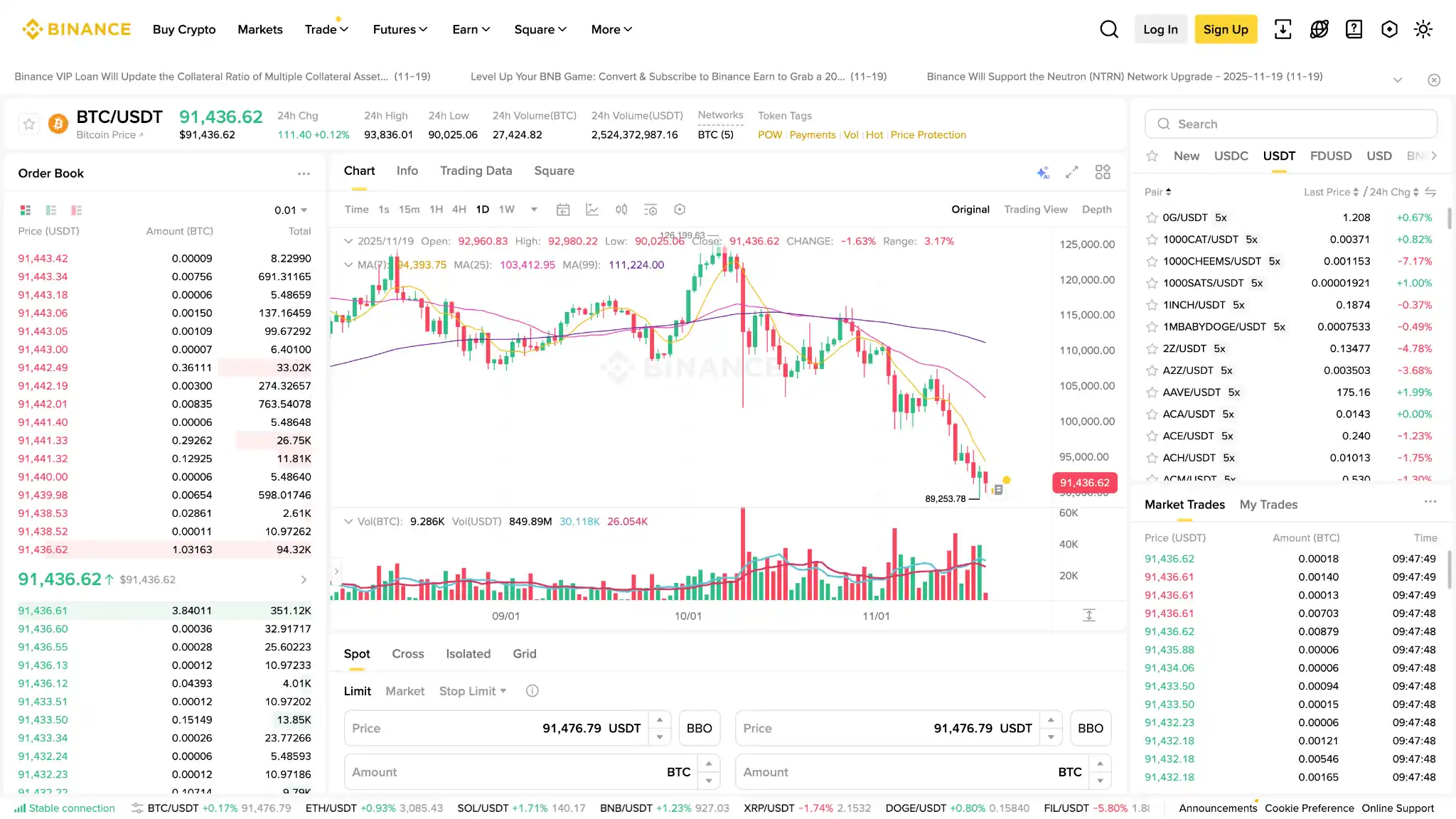

Binance Screenshots

Binance Pros and Cons

Pros

- 0.1% base spot fees with a 25% BNB discount and volume tiering

- Deep liquidity across majors and mid caps with tight spreads

- 500+ assets and hundreds of pairs for portfolio building

- Robust mobile and web apps with Lite and Pro modes

- Copy trading, staking, and automation tools in one place

Cons

- Instant buys and card purchases include a spread over spot

- Busy interface can overwhelm first‑time users

- Proof of reserves is not a full financial audit

- Availability and card support vary by country

What is Binance? Background and Oversight

Binance launched in 2017 as a centralized, custodial exchange operated by Binance Holdings Ltd. It grew rapidly on low fees, fast listings, and a global app that serves retail and professional traders. The company remains private and continues to expand its product set under a single consumer brand.

Today it reports more than 275 million registered users and lists over 500 cryptocurrencies across spot and derivatives. The platform integrates staking, copy trading, and a Web3 wallet, which keeps many user flows inside one app.

Recent context includes a leadership transition to Richard Teng in late 2023 and an ongoing transparency push via a proof‑of‑reserves dashboard. The approach improves visibility into asset coverage while stopping short of a full financial audit.

Features and Services

Trading Options

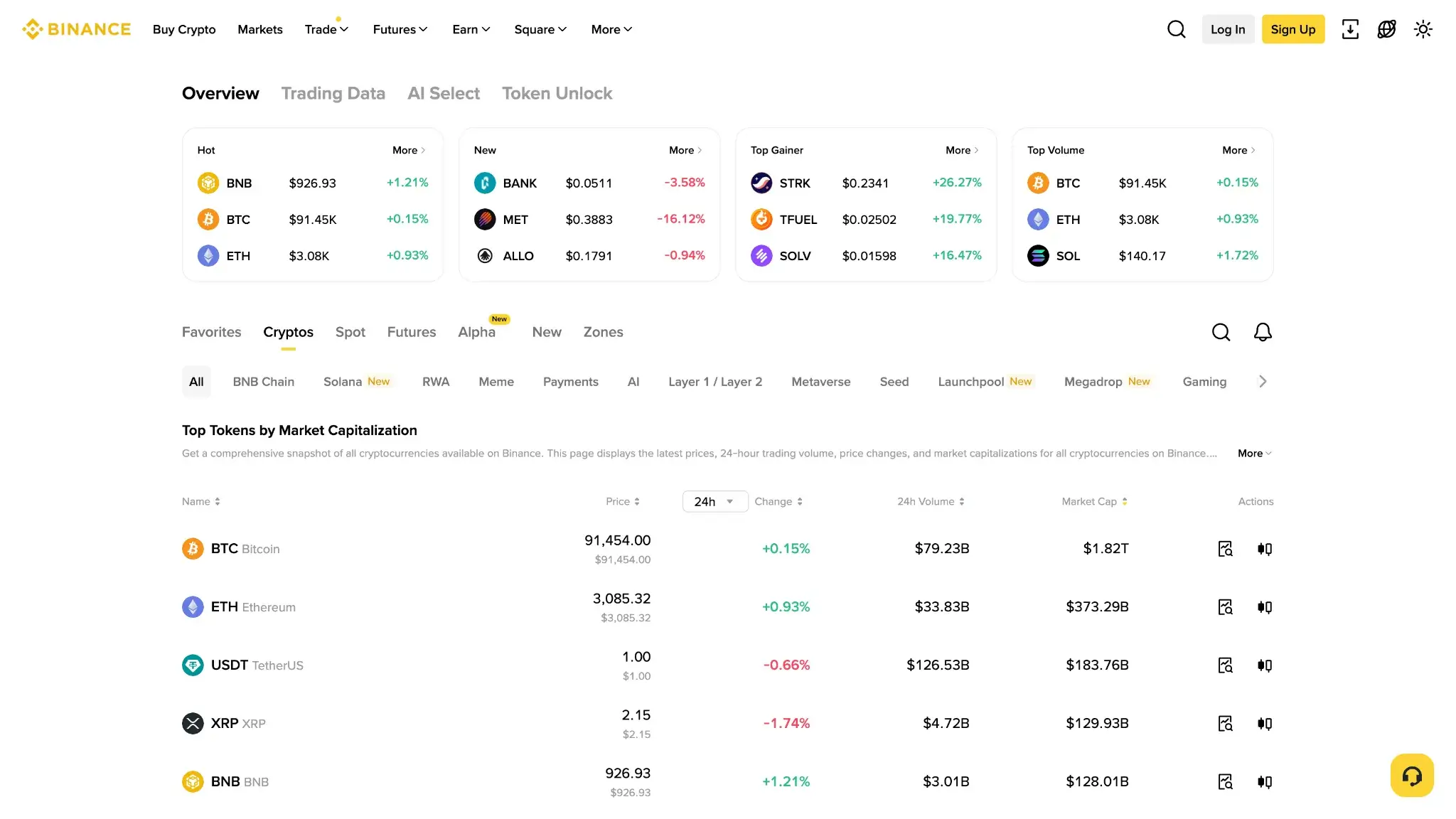

Markets offered. Live markets include Spot, Margin (cross and isolated), USD‑margined perpetuals, COIN‑margined perpetuals, European‑style options, and OTC/P2P. Availability of margin and derivatives depends on your verification level and local rules. The advanced suite is visible only after identity checks.

Interface modes. A simple Convert flow handles one‑click swaps, while the Advanced terminal exposes TradingView charts, depth, and a full ticket. Order types include market, limit, stop‑limit, stop‑market, and OCO. Derivatives add post‑only and reduce‑only controls. Mobile mirrors web with Lite for quick buys and Pro for full tools, including charting, order book, and stops.

Pairs and assets. Spot offers hundreds of trading pairs quoted in USDT, USDC, FDUSD, BNB, and BTC, plus selected fiat pairs such as EUR and GBP on key assets. Margin draws from the same spot books for eligible pairs. Perpetuals cover a broad roster of majors and liquid mid‑caps in both USD‑margined and coin‑margined formats.

Liquidity note. As of Jul. 2, 2025, Kaiko data shows Binance with the largest share of global spot volume, with consistently deep books and tight spreads on major pairs.

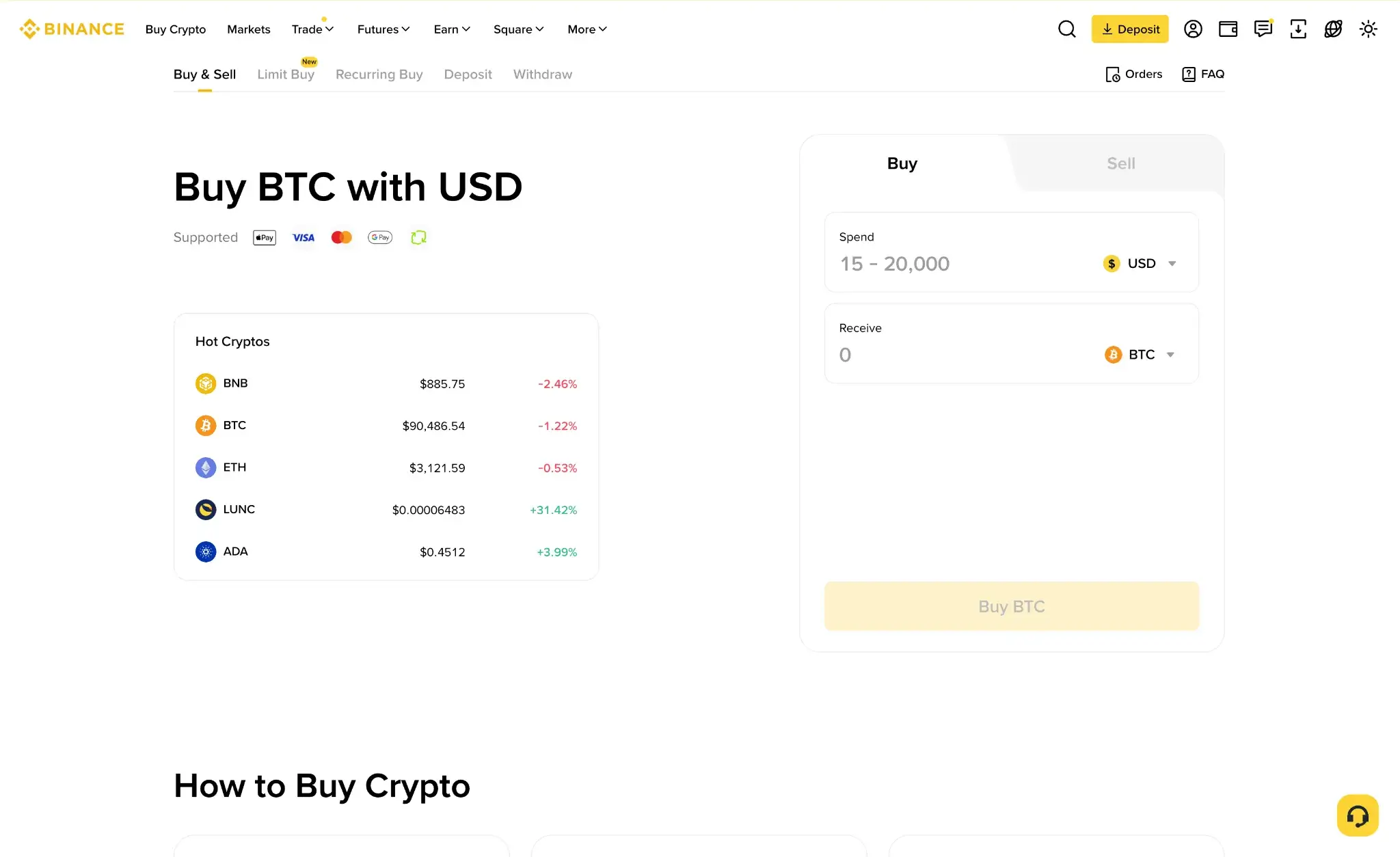

Brokerage and Simple-buy Experience

Binance offers a Convert and Buy Crypto flow for users who never touch the advanced order book. You choose a coin, select a fiat amount such as $100, and pay by card, bank transfer, or account balance where supported. The flow is available on web and in the mobile app. It takes only a few taps from funding to completed purchase once your account is verified.

Simple buys use an all in spread instead of a separate fee line. In tests on BTC and ETH against USD and EUR, at the time of this Binance review the quotes were around 0.1% to 0.5% above mid market in normal conditions. Minimum tickets are low for major coins and the app shows the final rate and total cost before you confirm. Some smaller assets are only available through the advanced interface and do not appear in Convert.

Daily and rolling limits depend on your verification level, payment method, and region. Simple buys may be disabled in some countries or routed through local partners. Costs are higher than placing limit orders on the advanced screen but the UX is faster and easier for first time buyers. For the lowest cost, fund with bank transfer, switch to the pro view, and use maker orders where possible.

Derivatives and Leverage Controls

Availability. Binance lists USDⓈ‑M perpetuals (margined and settled in stablecoins) and COIN‑M perpetuals (margined in the underlying asset), plus European‑style vanilla options on leading coins. Contract specs show tick sizes, maintenance margin tiers, funding cadence, and risk rules in‑app. Copy trading for futures is available in supported regions.

Leverage and margin modes. Perpetuals support headline leverage up to 125× on selected symbols. Maximum leverage scales down at higher notionals via tiered initial and maintenance margin. Funding typically accrues every eight hours, with schedule adjustments during stress. Margin trading supports cross and isolated modes with per‑asset borrow limits and collateral ratios displayed on the ticket.

Regions and eligibility. Access to derivatives requires completed identity verification and may be limited by country rules and suitability checks. Portfolio margin and higher leverage tiers are restricted to users that meet platform criteria. Notional caps, leverage ceilings, and product menus can differ by location.

Risk disclosure. Leverage can amplify gains and losses. Positions liquidate on mark price using maintenance tiers, and extreme events may trigger Insurance Fund coverage or Auto‑Deleveraging. Understand funding, liquidation logic, and ADL queues before opening leveraged trades.

Supported Assets

Asset coverage. Binance lists 500+ cryptocurrencies across majors, stablecoins, and sector plays. Trading bases include USDT, USDC, FDUSD, BNB, and BTC, with selected fiat pairs on top assets. Counts fluctuate depending on market conditions.

Stablecoins and networks. Core stablecoins such as USDT and USDC support multiple networks for deposits and withdrawals, typically ERC‑20, TRC‑20, and BEP‑20. Trading routes are centralized on spot books regardless of deposit network. The lowest withdrawal cost can differ from the quote asset.

Listing cadence and policy. New listings and pair additions are posted on the Announcements page, while delistings follow periodic reviews of liquidity, compliance, and project progress. Notices include effective dates and impact to deposits, trading, and withdrawals.

Native token impact. BNB is the ecosystem token. Paying trading fees in BNB reduces spot fees and contributes to VIP eligibility. BNB also powers Launchpad allocations and gas on BNB Chain, but holding it is optional for using the exchange.

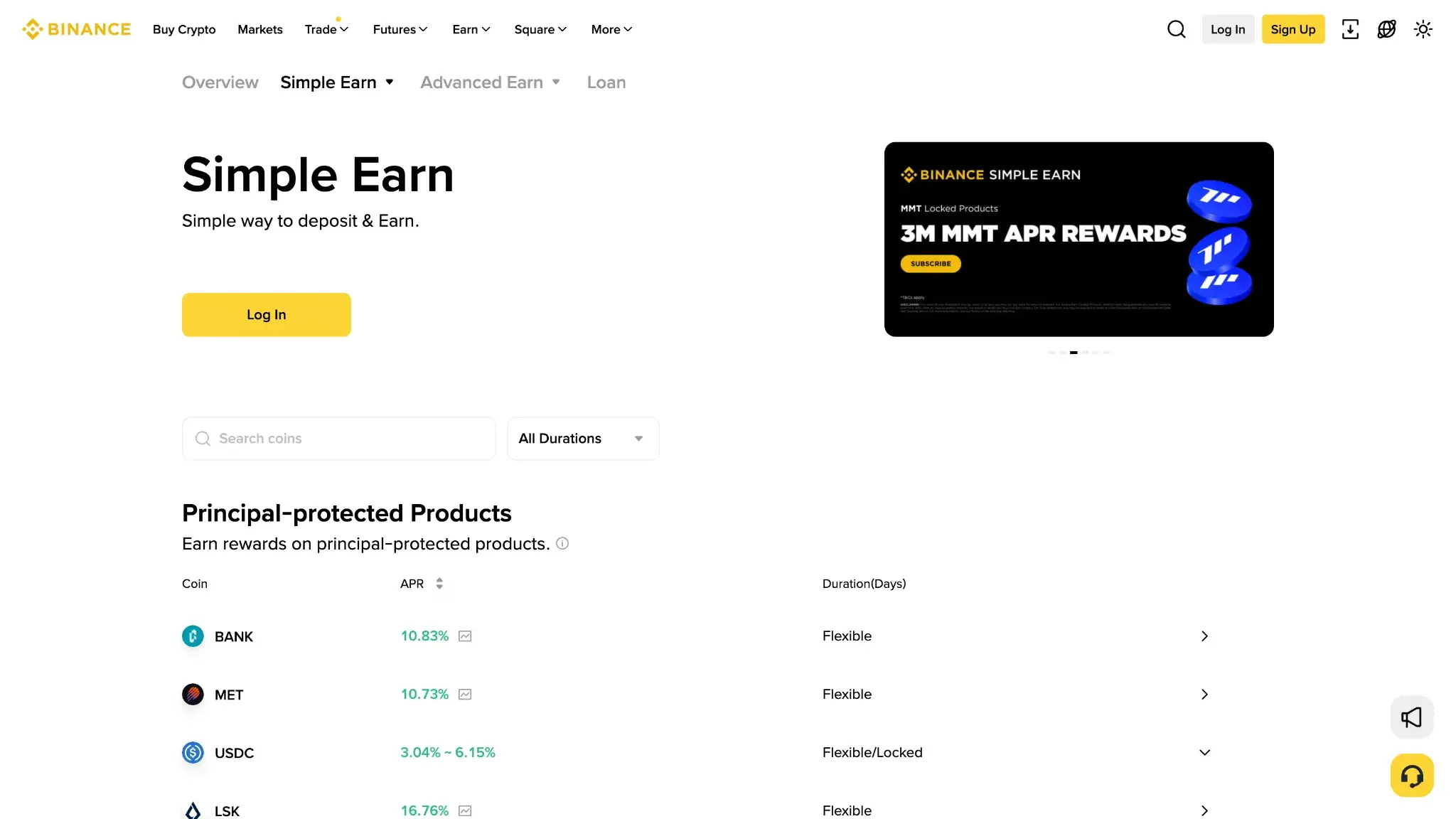

Staking and Rewards

Binance’s Simple Earn suite covers Flexible and Locked products plus on‑chain options such as ETH liquid staking via WBETH. Flexible balances earn variable real‑time APRs, while Locked terms pay higher, time‑bound yields. At the moment, large‑cap flexible rates sit in the low single digits and promotional locked offers can run higher. All yields are variable and not guaranteed.

ETH staking carries a 10% commission on rewards before distribution, with returns reflected in the WBETH:ETH ratio. Flexible rewards credit to your Earn wallet and Locked products pay daily until maturity. Early redemption on Locked typically returns principal but forfeits rewards and may take up to 72 hours to settle. Earn products require KYC and can be restricted or capped by asset, region, and product.

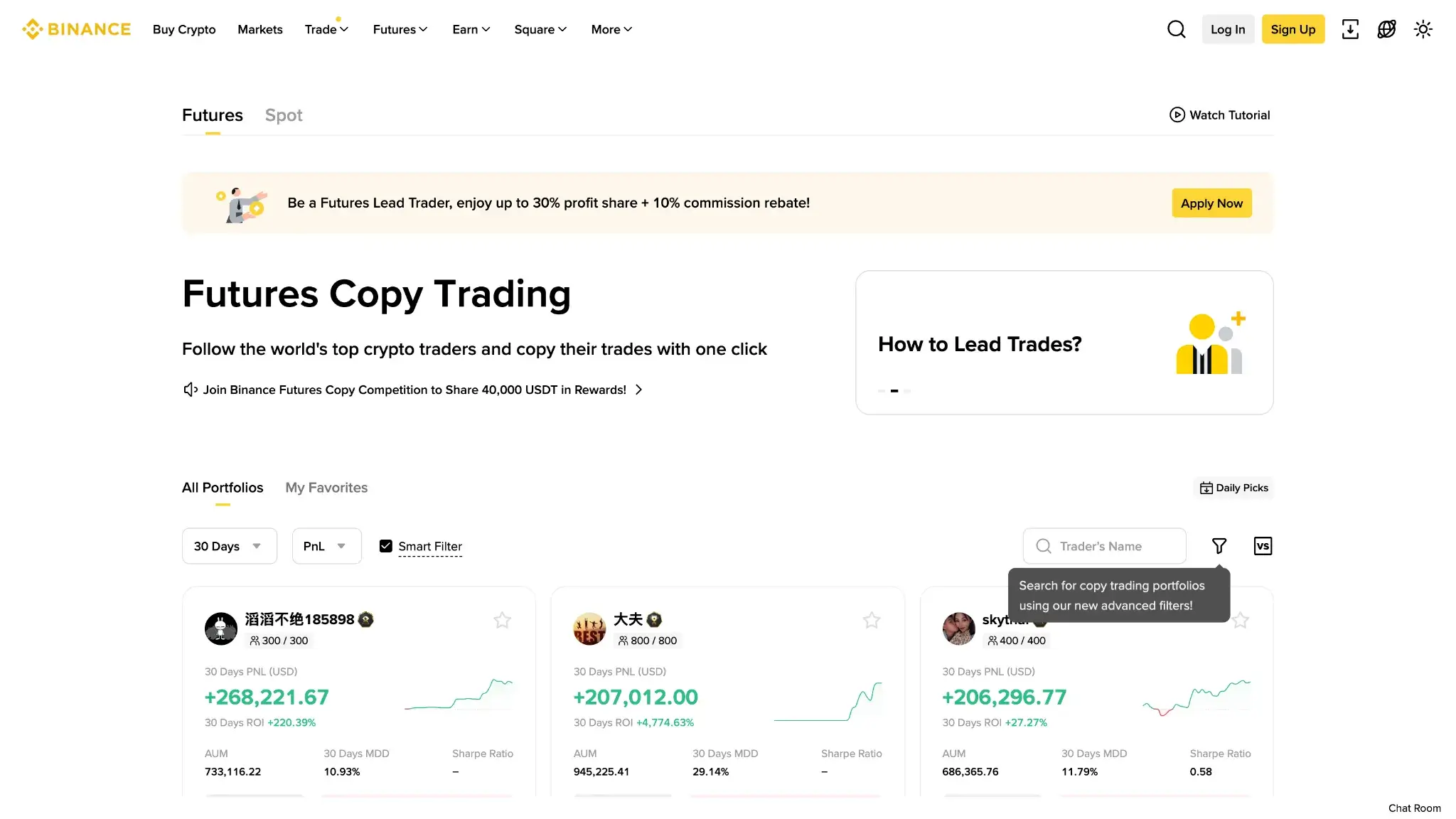

Copy Trading and Bots

Binance offers Spot Copy Trading and Futures Copy Trading for verified users in eligible regions, accessible under Trade then Copy Trading. Followers choose simple allocation modes and minimums start around 10–100 USDT depending on product. Leaders must meet higher balance thresholds and pass checks before opening portfolios or strategies.

Copy trading uses a profit‑share model on realised gains, typically up to around 10–30% for leaders on top of standard trading fees. Orders mirror leader activity in real time, but slippage, latency, and leverage limits can cause differences in performance. Strategy bots such as Spot Grid and Futures Grid are available in the Trading Bots hub and execute at the prevailing fee schedule. Copying and automation add strategy and execution risk, so set conservative allocation caps and stop‑loss levels.

Launchpad, Launchpool and Airdrops

Binance runs three main token‑distribution programs: Launchpad token sales, Launchpool yield‑style distributions, and Megadrop campaigns that combine BNB lock‑ups with Web3 quests. All require KYC, are unavailable in restricted regions, and allocate tokens based on users’ BNB or other eligible balances during defined snapshot or subscription periods.

Launchpad and Launchpool rewards usually settle to your Spot wallet around listing, while Megadrop allocations follow each project’s schedule. Lock‑up rules, per‑user caps, and tax or jurisdiction notes are detailed in individual announcements. Token launches are volatile and project due diligence is limited, so review each sale page and the Announcements hub before committing assets.

Binance Wallet & Web3 Wallet

Custody model. The default Binance wallet in your exchange account is custodial: Binance controls the keys while you trade and store funds. The separate Binance Web3 Wallet is a self‑custodial wallet inside the app and browser extension. You move assets between them via internal transfers or standard on‑chain deposits and withdrawals.

Keys and recovery. The Web3 Wallet uses MPC (multi‑party computation) with three key‑shares (device, encrypted cloud backup, and a Binance share) instead of a single seed phrase. Recovery relies on your cloud backup plus device authentication or a recovery password/biometric step, and you can revoke or rotate devices from the app.

Networks and asset support. Web3 Wallet supports multiple networks, including BNB Smart Chain, Ethereum, Polygon, and other EVM chains, and holds native assets and common token standards. For many users it functions as a Binance Smart Chain and general Web3 hub, with supported networks, swaps, and bridges shown in the wallet’s network selector.

External wallets and Trust Wallet. You can withdraw from Binance to external wallets, including hardware wallets and apps like Trust Wallet, by copying an address or scanning a QR code. Always match the asset and network (for example ERC‑20, TRC‑20, or BEP‑20) and start with a small test transfer.

Is the Binance wallet safe? The custodial Binance wallet is only as safe as Binance’s own security and your account hygiene, so it carries counterparty risk compared with holding coins on a hardware wallet. The self‑custodial Web3 Wallet removes exchange custody risk for those balances but shifts responsibility to your devices, cloud account, and signing practices. Many users keep a smaller trading balance on Binance and hold larger, long‑term positions on separate hardware wallets.

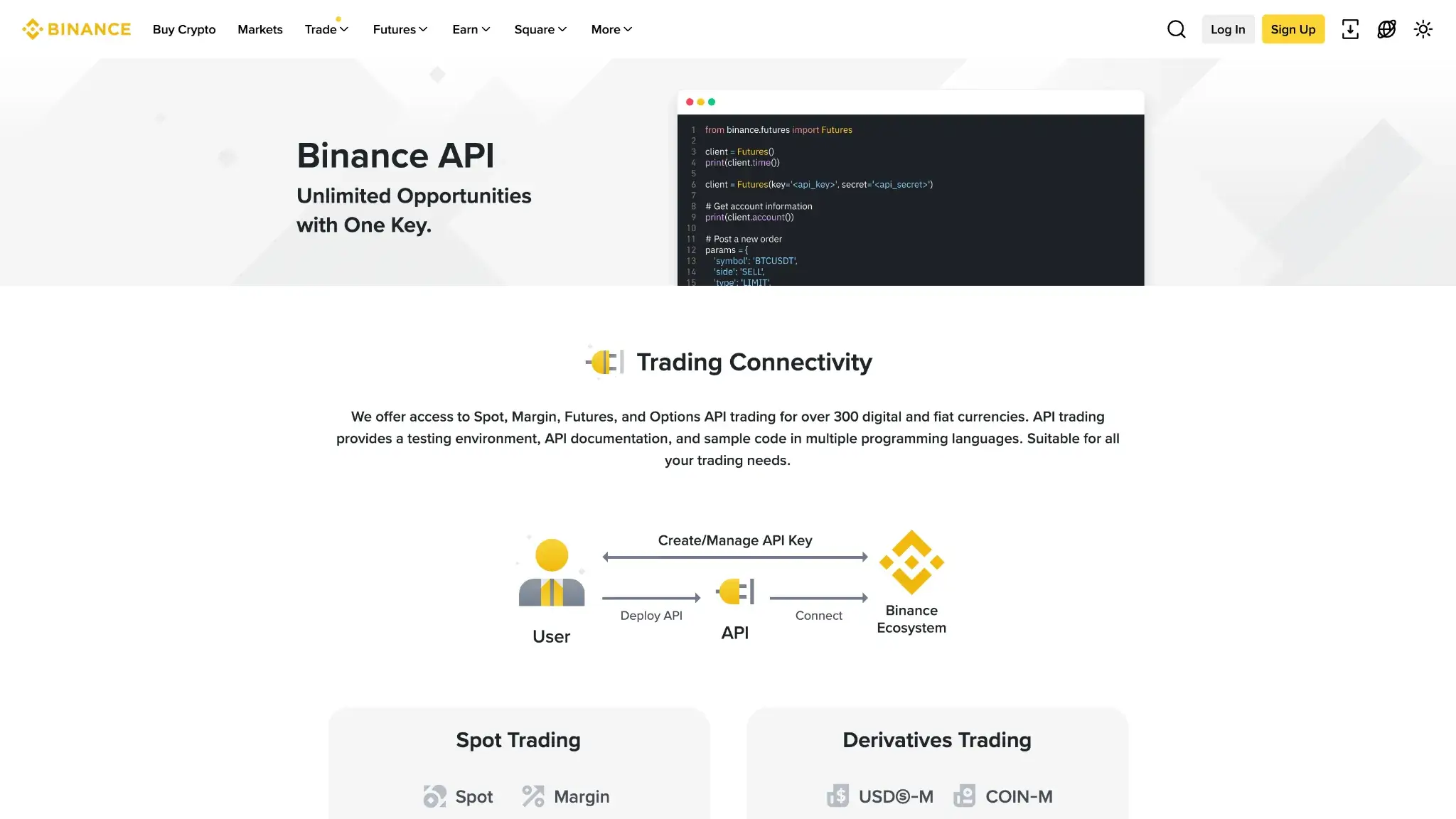

API and Programmatic Trading

Interfaces and capabilities. Binance provides REST and WebSocket APIs for spot, margin, futures, and options. Endpoints cover market data, account/balances, orders/trades, and user data streams. Rate limits use request‑weight and order‑count buckets with HTTP 429 on violation and limits are subject to periodic updates, so treat values as time‑bound. Testnet environments exist for spot and derivatives.

Authentication and permissions. API keys are created in‑app with scopes for read‑only, trading, and product access (spot/margin/futures/options). Signed requests use HMAC‑SHA256 with key/secret and a timestamp. Withdrawals and internal transfers via API are disabled by default and require explicit enablement plus IP allowlisting. Regular rotation and least‑privilege settings are recommended.

Account structure and access controls. Sub‑accounts support segregated balances and per‑sub‑account API keys. IP allowlists, device approvals, and optional 2FA prompts protect key actions. Admin users can require approvals for key creation and enforce IP/ACL policies across sub‑accounts.

Reliability and environments. Public status and changelog pages announce maintenance windows, breaking changes, and new endpoints. Live latency depends on product and region and user‑data streams provide push updates for orders and balances. Testnets allow paper trading and integration testing without risking funds.

Developer resources. Canonical documentation, SDKs (official connectors for Python/Java/TypeScript), and changelogs are available in the developer portal and GitHub organization. Support channels include ticketed developer support and community forums. Production issues should reference request IDs and timestamps for triage.

Other Notable Features

Tax tooling and reporting. Binance provides downloadable CSV exports and native tax reports in supported regions. Reports summarize trades, gains, income, and transfers. Users can choose tax year, filter by account or product, and export files for third‑party software. Region‑specific forms may be available where required. Access lives in Profile, look for Tax or the Tax portal in app.

Institutional/Prime. Institutional clients can enable sub‑accounts, consolidated reporting, and RFQ/OTC block trading with post‑trade settlement. Optional portfolio margin and segregated custody routes are available to qualified entities. Onboarding requires corporate KYC and authorization documents and account features activate after review.

Web3 and NFT. The Binance Web3 Wallet connects to dApps through an in‑app browser and extension and see Wallet and self‑custody options for architecture and security details. Binance also operates an NFT marketplace for primary drops and secondary trading on supported networks, with availability and features varying by region and over time.

Listings and Delistings Policy

Binance communicates new listings, monitoring tags, and delistings through its Announcements hub and posts service updates on the public Status page. Each notice includes effective UTC times and explains when trading, deposits, and withdrawals will be paused or closed.

Binance states that assets are reviewed periodically based on factors such as development progress, security, liquidity, regulatory considerations, and community signals. Tokens that no longer meet criteria can receive a Seed or Monitoring Tag, face trading suspension, and ultimately be delisted. Delisting posts set out timelines, bot shutdown windows, and withdrawal deadlines. Policies and impacted assets differ by entity and jurisdiction, so users should always confirm details in the latest announcement for their region.

Binance Fees and Trading Costs

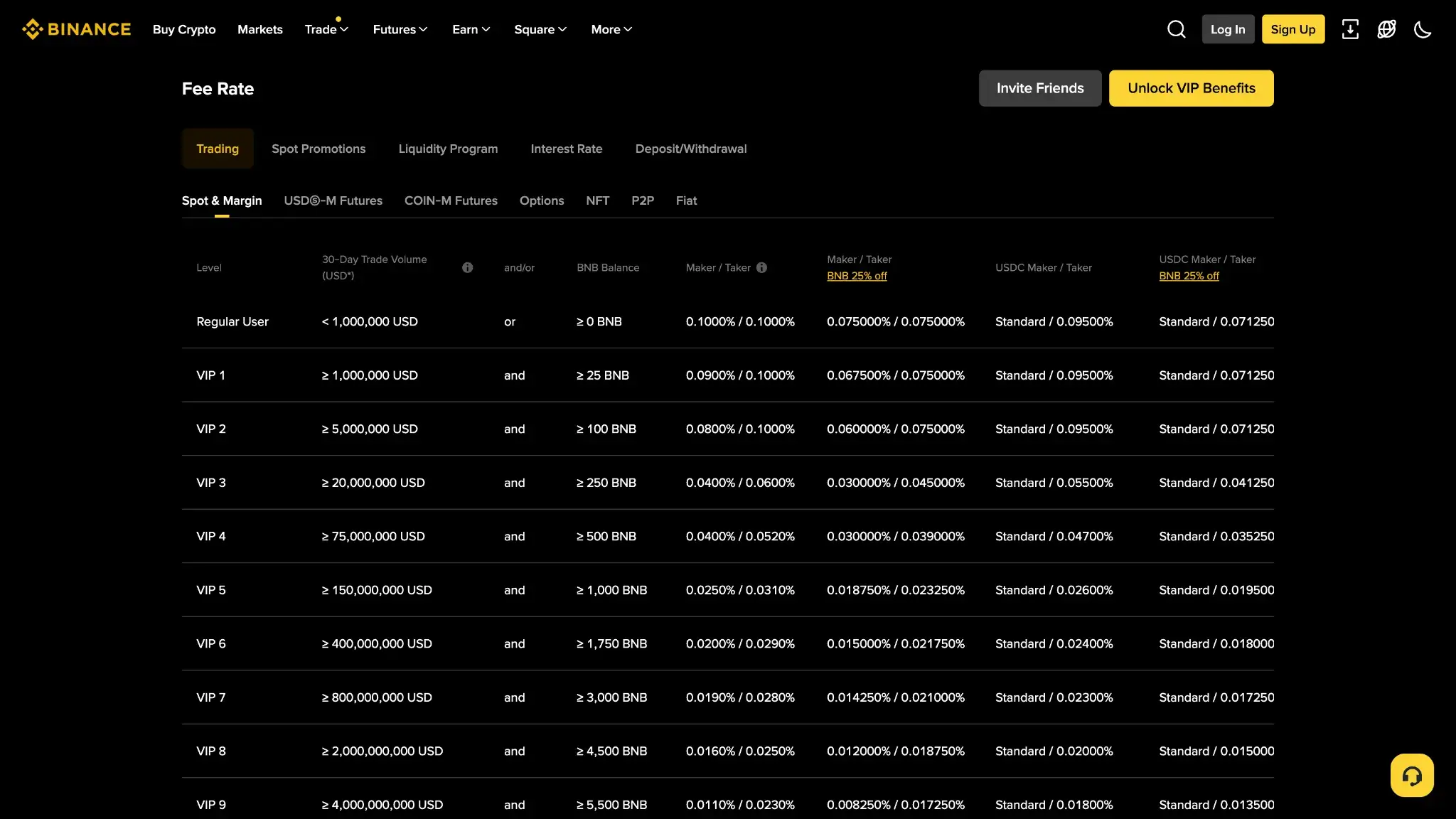

The Binance fees structure is built around a 30‑day USD‑equivalent volume schedule that sets VIP trading tiers, with separate tables for fiat deposits and withdrawals. Rates are quoted in percent for maker/taker and vary by product.

Binance Fees

Advanced trading. Spot trading starts at 0.1% maker / 0.1% taker (VIP 0) and can fall to 0.011% / 0.023% at VIP 9 based on 30‑day volume in USD equivalent. USDⓈ‑M/COIN‑M futures use a baseline 0.02% maker / 0.05% taker at entry tier with tiered reductions at higher volumes.

Simple buy/sell. Convert/Buy Crypto quotes a firm execution price at checkout and the difference from mid‑market reflects an all‑in spread that varies with liquidity and volatility. The final rate is shown before confirmation.

Fiat deposits/withdrawals. ACH/SEPA typically carry no Binance platform fee and local processors or banks may charge their own fees. Settlement windows are commonly same‑day to 1–2 business days for deposits and 1–5 business days for withdrawals, depending on method and region.

Crypto withdrawals. Binance passes through a flat network fee per asset and network. Fees adjust with congestion and can differ significantly across networks (e.g., ERC‑20 vs TRC‑20 vs BEP‑20). Depositing crypto is free.

Binance deposit and withdrawal fees in practice. For fiat, Binance deposit fees and fiat withdrawal fees are usually limited to charges from your bank or payment provider, with the Binance platform fee at $0/€0 on common rails like ACH and SEPA in many cases. For crypto, the Binance BTC withdrawal fee, Binance USDT TRC‑20 withdrawal fee, and other network charges are set per asset and network on the withdrawal screen and adjust with on‑chain conditions. Binance does not add an extra percentage‑based crypto withdrawal fee on top of these network costs, but absolute amounts and supported networks can change.

Staking commission. ETH staking on Binance carries a 10% commission on rewards before distribution. Other Earn products display net APRs, which are variable and not guaranteed.

Discounts and how to pay less. Paying fees in BNB reduces spot and margin trading fees by 25% and futures fees by 10% when enabled. Volume‑tiered VIP levels lower maker/taker further. Practical ways to minimize cost: use the advanced interface instead of instant buys for large orders and place maker orders where possible and increase 30‑day volume to reach lower tiers and pick low‑fee withdrawal networks and batch withdrawals.

VIP Tiers and Fee Discounts

| Tier | 30‑day volume | Maker | Taker | Notes on discounts or exclusions |

|---|---|---|---|---|

| Regular User | < $1,000,000 USD eq. | 0.1000% | 0.1000% | 25% spot/margin discount when paying fees in BNB. |

| VIP 3 | ≥ $20,000,000 USD eq. and ≥ 250 BNB | 0.0400% | 0.0600% | BNB fee payment lowers displayed rates by 25% on spot/margin. |

| VIP 9 | ≥ $4,000,000,000 USD eq. and ≥ 5,500 BNB | 0.0110% | 0.0230% | Default schedule only and temporary zero‑fee promos are excluded. |

Discount scope. BNB fee discounts apply to spot and margin trades and a 10% BNB discount applies to futures trading fees when enabled. Discounts do not apply to Convert quotes or card purchase spreads.

Payments and Fiat Support

Binance supports fiat on‑ramps and off‑ramps across bank transfers, cards, P2P, and integrated processors. Primary account base currencies include USD, EUR, and GBP, with additional local currencies in select markets. Rails vary by region and may use third‑party partners. Limits are enforced per transaction and via rolling 24‑hour windows tied to verification level.

| Payment method | Minimum deposit | Minimum withdrawal | Maximum withdrawal |

|---|---|---|---|

| ACH (US) | — | — | $1,000,000 by wire and ACH daily limits apply |

| SEPA (EUR) | €2 | €2 | — |

| Faster Payments (GBP) | — | — | — |

| Card (Visa/Mastercard) | — | — | — |

| P2P marketplace | Varies by ad | Varies by ad | Varies by ad |

| Crypto (on‑chain) | Varies by asset/network | Varies by asset/network | Varies by verification/asset |

Methods and prerequisites. In the US, ACH and domestic wire are available after identity verification. In the EU/EEA, SEPA supports EUR deposits and withdrawals and SEPA Instant is offered in supported banks. In the UK, Faster Payments supports GBP where enabled. Cards are broadly available for instant buys and may appear through processors. P2P provides local rails in many countries. Some methods require additional checks such as bank‑name matching or an initial micro‑deposit.

Minimum deposits and withdrawal limits. There is no single global Binance minimum deposit or Binance minimum withdrawal amount. Each fiat rail and crypto asset has its own minimum shown directly in the deposit or withdrawal flow.

For example, SEPA currently shows a minimum deposit of €2 for many EEA users, while crypto networks enforce small on‑chain minimums per asset and network. Your Binance daily withdrawal limit and overall Binance withdrawal limits 2025 depend on verification level, jurisdiction, and operating entity and the app’s Identification → Limits page is the source of truth for the minimum deposit on Binance and maximum withdrawal amounts in your country.

Settlement times. ACH deposits typically clear in 1–5 business days and withdrawals in a similar window. SEPA deposits often post same day to next business day and SEPA Instant can be near instant. Faster Payments is near instant during banking hours. Wires can take same day to several days depending on cut‑offs and corridors. Card purchases are instant once approved.

Currency matching and conversion. Funding in a currency that differs from your trading or withdrawal currency may trigger conversion. Cards and Convert show a firm quote that includes any spread. Bank rails usually deposit as native EUR or GBP, which you can then trade. Always review the quoted rate and currency before confirming.

Address and beneficiary management. Bank accounts must match the verified name on your profile. You can enable withdrawal address whitelists for crypto and set cool‑downs after security changes. Some fiat channels require an approved beneficiary account before first withdrawal. Exchanges may enforce a 1x turnover on fresh fiat before withdrawal to reduce payment risk.

Partners and responsibility. Where third‑party processors handle the payment, their timelines and fees apply in addition to Binance’s schedule. Issues with bank acceptance or card declines are handled by the payment provider and Binance reflects status updates in the transaction history.

Fiat Rails by Region

| Region | ACH | SEPA | Faster Payments | Wire | Cards | PayPal | Notes |

|---|---|---|---|---|---|---|---|

| US | Yes | — | — | Yes | Yes | No | ACH after verification and wires for higher limits and card buys supported |

| EU/EEA | — | Yes | — | Yes | Yes | No | SEPA and SEPA Instant where supported and card buys via processors |

| UK | — | — | Yes | Yes | Yes | No | FPS availability may vary by partner and card buys supported |

| RoW | — | — | — | Yes | Yes | — | Availability depends on country and P2P extends local methods |

Withdrawal Networks and Fees Matrix

| Asset or network | Fee model | Typical confirmation window | Notes |

|---|---|---|---|

| BTC on‑chain | Network only | About 10–60 minutes | Priority and mempool affect speed |

| ETH ERC‑20 | Network only | About 5–15 minutes | Gas varies with network load |

| USDT TRC‑20 | Network only | About 2–10 minutes | Lower fee versus ERC‑20 |

| USDT ERC‑20 | Network only | About 5–15 minutes | Higher gas at peaks |

Where an asset supports multiple networks, choose a lower‑fee network that your destination wallet also supports, then test with a small transfer before sending larger amounts.

Is Binance Safe? Security and Proof of Reserves

Binance is relatively safe for most active crypto traders but it is not risk free. It holds most client assets in cold storage, operates an emergency SAFU fund, and publishes monthly proof‑of‑reserves snapshots, yet these are not full financial audits and coverage varies by entity and region. Long‑term holders should still treat Binance as a trading venue rather than a primary vault.

Controls. Binance states that a majority of client assets are held in cold storage and a precise percentage is not disclosed. Keys are managed internally and detailed HSM or MPC design for exchange custody is not disclosed. User security includes two‑factor authentication (TOTP, passkeys, or hardware keys), anti‑phishing codes, device and session management, and optional withdrawal address whitelists. Security changes can trigger temporary withdrawal holds. Defaults: 2FA is prompted at onboarding and whitelists and passkeys are opt‑in.

Custody and insurance. Client crypto is custodied in‑house and segregated from corporate assets. Crypto is not government‑insured. Where fiat programs exist, cash balances held at partner institutions may benefit from banking protections per local rules. Binance operates the Secure Asset Fund for Users (SAFU), described as an emergency fund sized at ~$1 billion in recent disclosures and composition and valuation can change over time.

Proof of reserves. Binance publishes a monthly proof‑of‑reserves update using a Merkle‑tree liabilities snapshot with zero‑knowledge enhancements. Users can log in to verify inclusion of their balances and view on‑chain addresses for covered assets. PoR shows asset‑to‑liability ratios for major coins and is not a full financial audit. An external auditor is not named in current publications, and PoR does not detail fiat obligations or off‑exchange liabilities, so you should treat it as one data point rather than a guarantee.

Binance incidents and remediation

- Apr. 15, 2025 — Brief, precautionary withdrawal pause (about 23 minutes) during a cloud connectivity incident and services resumed after resolution.

- Jul. 31, 2025 — Wallet maintenance window and deposits and withdrawals paused for ~15 minutes as part of a live upgrade and normal operations resumed.

- May 2019 — Hot‑wallet breach of about 7,000 BTC and client balances were reimbursed via SAFU and additional controls were added.

Users can access the latest proof‑of‑reserves report on Binance’s PoR page, check snapshot dates and Merkle roots, and use the in‑account tool to confirm that their balances were included. The public Status page and Announcements hub provide live maintenance and incident updates with UTC timestamps and an archive of past events.

UX and Customer Support — KYC and Geographic Access

Day to day, Binance feels fast on web and mobile with frequent app updates and a responsive interface. Primary support runs through 24/7 live chat and a searchable Help Center, with a public Status page for maintenance windows and incident notes.

UI and Navigation

Layout and workflows. Web uses a top navigation for Trade, Derivatives, Earn, and Wallet. Markets pages include search, filters, watchlists, and favorites. Common flows are easy to reach: Convert for one‑click swaps and Advanced for full trading. The advanced ticket exposes chart, order book, and depth without crowding the page.

Performance and stability. Order books and trades stream live. Page transitions are quick on modern browsers and the desktop app. Maintenance and upgrades are announced with precise UTC times. Frequent mobile updates help keep crash rates low and address bugs quickly.

Accessibility and localization. Dark mode is available on web and mobile. Keyboard navigation works for core tasks such as switching tabs and placing orders. Interface text is localized into dozens of languages and prices display in local currency where supported.

Binance App Review and Download Options

Binance offers native apps for iOS and Android plus desktop builds from the official Download page. Regional availability depends on store policy and local rules. In some countries the app may not appear in stores at all, which usually reflects local restrictions rather than a technical issue.

The app supports Lite and Pro modes. Pro exposes full charts, order books, margin and futures trading, P2P, Earn, Copy Trading, and the Web3 Wallet. Core order entry and portfolio tools are available on both mobile and web, with layout differences rather than feature gaps.

Recent release notes highlight frequent stability and performance updates. Security controls mirror the web experience, with 2FA, anti‑phishing codes, device management, and withdrawal address whitelists under Account then Security. Push alerts cover order fills, margin events, futures liquidations, and price alerts with per‑channel opt‑in controls.

Registration

- Tap Sign up and choose email or phone. You can also use Google or Apple to start.

- Enter country, set a strong password, and confirm the verification code sent to your contact.

- Open Identification to start KYC. Submit government ID and complete a selfie or liveness check.

- When prompted, add proof of address to increase limits.

- Add a payment method or deposit crypto and place your first trade once verification clears.

Security setup. During onboarding, Binance prompts 2FA. Users can enable TOTP, passkeys, or a hardware key and set an anti‑phishing code. Device approvals and session reviews are available before funding.

KYC and Geographic Access

Policy and triggers by level. Binance uses tiered identity checks: Verified (government ID + liveness) unlocks trading, deposits, and withdrawals and Verified Plus (adds proof of address and disclosures) raises fiat/crypto limits and enables higher‑risk products where permitted. KYC is required before fiat rails and derivatives access and re‑verification can be triggered by profile changes, security events, or risk flags during large or unusual withdrawals. Product menus are geofenced by residence and entity terms.

Accepted documents and typical timelines. Accepted ID includes passport, national ID, or driver’s license and proof of address typically uses a utility bill or bank statement issued in the last 90 days, and a selfie/liveness check is standard. Straight‑through approvals can clear in minutes to hours and manual reviews can take 1–3 days at peaks. Submissions are rejected if the document is expired, cropped, unreadable, or does not match the account name.

Is Binance available in the US, UK, and Canada? Binance.com does not serve all countries. Retail users in parts of the United States and Canada instead use Binance.US or other regulated local platforms with narrower product menus and different fee schedules, and some states or provinces have historically been more restricted than others. In the UK, Binance offers spot trading, Earn, and the Web3 wallet but does not provide retail crypto derivatives. Availability changes over time, so always confirm current access and product menus via the latest Terms of Use, local notices, and the entity banner shown in your account before registering or funding.

Official restricted list. Binance maintains a canonical Terms of Use with a List of Prohibited Countries and product‑specific restriction notices on the Announcements hub. Users should confirm eligibility there before onboarding.

Verification Levels and Withdrawal Limits

| Level | Required documents | Fiat deposit limit | Fiat withdrawal limit | Crypto withdrawal limit | Typical review time |

|---|---|---|---|---|---|

| Verified | Government ID + selfie/liveness | Shown in‑app and varies by rail and region (per 24h) | Shown in‑app and varies by rail and region (per 24h) | Shown in‑app and varies by entity and asset (per 24h) | Minutes to 24h (auto) |

| Verified Plus | Verified + proof of address (≤90 days) + disclosures | Higher limits shown in‑app (per 24h) | Higher limits shown in‑app (per 24h) | Higher limits shown in‑app and may enable portfolio margin | 1–72h (manual possible) |

| Entity (Corporate) | Company docs, UBO/KYB, POA, board authorization | By agreement | By agreement | By agreement | 2–10 business days |

Limits are presented in USD‑equivalent or local currency and can differ by operating entity and jurisdiction. Exact figures and intervals display on Identification → Limits after you select your country and rail.

Geo Access and Entity Mapping

| Region or country | Operating entity | What is available | Notes |

|---|---|---|---|

| EU/EEA | Global Binance entity serving EEA users | Spot, margin, Earn, Copy Trading and derivatives availability varies | Stablecoin pairs subject to MiCA and product menus differ by country |

| UK | Global Binance entity | Spot, Earn, Web3 Wallet and no retail crypto derivatives | Funding via Faster Payments where supported and marketing rules apply |

| Japan | Local Binance Japan entity | Spot, Earn, Web3 Wallet and local product list | Japan‑specific account, tax and suitability rules |

| Rest of world | Global Binance entity | Spot, margin, derivatives (where permitted), Earn, Copy Trading, Card (select) | Check entity‑ and product‑level notices before onboarding |

Customer Support

Channels and availability. Official support runs a 24/7 live chat with identity verification as needed, plus ticketed email follow‑ups. Self‑serve resources include a searchable Help Center and a public Status page for maintenance and incidents. Support language coverage follows the app’s localization footprint.

Responsiveness and SLAs. First responses on live chat are typically prompt and triaged by a bot before human hand‑off. Resolution windows vary by case complexity (KYC/EDD/withdrawal reviews often require manual checks). No formal global SLA is published and users should reference ticket IDs for escalation.

Authentication and safety. Support will not ask for your password, full 2FA codes, or recovery keys. Authenticate via the in‑app chat entry point or the official website, verify domains, and use the account’s Security page to manage devices and sessions.

Self‑serve resources. Use the Help Center for step‑by‑step guides on deposits/withdrawals and KYC. Check the Status page for known incidents before opening tickets. Most rails and product menus have region‑specific FAQs.

Escalation and account holds. Urgent cases (account lockouts, security incidents, or frozen withdrawals) escalate after identity checks and document uploads. Large or unusual withdrawals can trigger Enhanced Due Diligence and provide proof of address, source‑of‑funds, and requested invoices or statements to clear holds.

Who is Binance Best for

Binance suits active traders and portfolio builders who value low trading fees, deep liquidity, and a broad asset list in one app. It fits users comfortable with pro‑grade interfaces and those who plan to reduce costs through BNB fee payments, maker orders, and VIP tiers. It is a less natural fit for first‑time buyers who want the simplest flow or for users in tightly regulated markets where product menus are curtailed. Consider your payment rails, verification requirements, and security preferences before committing funds.

Final Verdict

Binance remains a strong all‑rounder for most active crypto traders, pairing low trading costs with deep liquidity and a broad coin list. It suits users who want low fees with BNB discounts and VIP tiers, advanced tools including margin and futures where allowed, and fast funding options across multiple rails. Weigh trade‑offs like higher costs on instant buys, a busier interface for first‑timers, and region‑specific availability and card support. Ensure your payment methods, verification requirements, and security preferences align before funding.

Overall Score

9.0Best For

Active spot and derivatives traders who want deep liquidity, low fees, and broad asset coverage.

PROS

- 0.1% base spot fees with a 25% BNB discount and volume tiering

- Deep liquidity across majors and mid caps with tight spreads

- 500+ assets and hundreds of pairs for portfolio building

- Robust mobile and web apps with Lite and Pro modes

- Copy trading, staking, and automation tools in one place

CONS

- Instant buys and card purchases include a spread over spot

- Busy interface can overwhelm first‑time users

- Proof of reserves is not a full financial audit

- Availability and card support vary by country

Disclaimer: CryptoSlate may receive a commission when you click links on our site and make a purchase or complete an action with a third party. This does not influence our editorial independence, reviews, or ratings, and we always aim to provide accurate, transparent information to our readers.