10 Best Platforms to Buy Crypto With a Prepaid Card

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships. However, this potential compensation never influences our analysis, opinions, or reviews. Our editorial content is created independently of our marketing partnerships, and our ratings are based solely on our established evaluation criteria. Read More

The prepaid card is a fast method to enter into crypto when you do not want to deal with transfers through the bank. The more popular options that allow purchasing with prepaid cards are Best Wallet, Binance, and KuCoin. Nevertheless, this is not necessarily the most cost-effective way, as the fees might be higher, the restrictions might be more stringent, and there are some sites that will require additional verifications prior to the payment.

Prepaid cards can also help you stay within a budget, since you’re spending what’s already loaded on the card. While some exchanges won’t accept them, the ones that do can be straightforward to use. Pick platforms with a solid reputation, watch the charges at checkout, and move the crypto to your own wallet once the purchase clears.

- In This Article

-

- 1. Best Wallet - Low-Fee Crypto Buys With No KYC

- 2. Binance - Prepaid Card Crypto Purchases And P2P

- 3. KuCoin - Card Purchases For Over 1,000+ Tokens

- 4. Crypto.com - Visa Prepaid Card With Rebates

- 5. CEX.IO - Card Purchases For 200+ Coins

- 6. OKX - Prepaid Cards For P2P Trades

- 7. BTCC - USDT Purchases Via Card Providers

- 8. Bybit - Mastercard Prepaid Card Rewards Program

- 9. Bitunix - Prepaid Cards For Crypto And Fiat

- 10. BitPay - Debit Card Buys For More Than 60 Cryptos

- In This Article

-

- 1. Best Wallet - Low-Fee Crypto Buys With No KYC

- 2. Binance - Prepaid Card Crypto Purchases And P2P

- 3. KuCoin - Card Purchases For Over 1,000+ Tokens

- 4. Crypto.com - Visa Prepaid Card With Rebates

- 5. CEX.IO - Card Purchases For 200+ Coins

- 6. OKX - Prepaid Cards For P2P Trades

- 7. BTCC - USDT Purchases Via Card Providers

- 8. Bybit - Mastercard Prepaid Card Rewards Program

- 9. Bitunix - Prepaid Cards For Crypto And Fiat

- 10. BitPay - Debit Card Buys For More Than 60 Cryptos

Show Full Guide

Key Takeaways

- The top platforms to buy crypto with a prepaid card include exchanges, wallets, and payment processing platforms.

- They vary in terms of card providers, fees, cryptocurrency availability, and KYC.

- You can buy crypto with a prepaid card by creating an account, adding your card to Google/Apple Pay, and making a purchase.

- Some of the benefits of prepaid cards include no debt and increased security, while drawbacks include higher fees and limited acceptance.

To safely purchase crypto with a prepaid card, use trusted exchanges, beware of phishing scams, and protect your card details.

Best Wallet is a non-custodial hot wallet that supports 1,000+ cryptocurrencies across 60 blockchains. You can trade crypto using its integrated DEX that aggregates liquidity from multiple pools in real time. What’s more, you won’t have to go through KYC verification, which makes Best Wallet ideal for anonymous trades. What makes Best Wallet stand out is its tokens page, which provides early access to new coins, like HYPER, MAXI, and PEPENODE. Best Wallet doesn’t charge fees for receiving and storing crypto, while fees for fiat purchases range between 1% and 3%, depending on the third-party provider. On the downside, Best Wallet removed its sell/offramp feature, meaning you won’t be able to convert crypto to cash. Pros Cons Binance is one of the biggest crypto exchanges, and it’s known for low trading fees and high leverage. It offers spot and derivatives trading, plus copy trading. For payments, Binance can accept Visa and Mastercard prepaid cards through card gateways and partners. You can also buy crypto with prepaid cards using its P2P marketplace. Buying crypto with a credit card, Apple Pay, or Google Pay can come with a 2% fee, which can sting if you trade often. However, Binance also offers the Binance Card, a Visa debit card that works like a prepaid option and allows you to earn 3% in cashback rewards. It was initially launched and shut down in 2023, but has since resurfaced. Pros Cons KuCoin is popular with traders who want access to many coins in one place. It lists 1,000+ tokens and starts trading fees at about 0.1%. Beyond basic buying and selling, it also offers margin trading, futures, options, and staking. If you want to pay by card, KuCoin uses Mercuryo to process Visa, Mastercard, and some prepaid cards. Card deposits usually require advanced verification, and only prepaid cards with 3D Secure (3DS) will work. Fees are often in the 2%–3% range, and each purchase must be between $5 and $5,000. KuCoin also links to gift card services like CoinGate Gift Cards and Jour Cards Store, so you can spend crypto on goods and services. Pros Cons Crypto.com is a centralized exchange for traders who want more than basic buys. It offers spot markets, perpetual futures, and strike options for crypto derivatives, including CFTC-regulated products in the U.S. For diversification, it sells 18 curated crypto baskets and also offers a Level Up Visa prepaid card. The Crypto.com Visa card has no monthly or annual card fees, but Level Up requires a paid subscription plan. To apply, you download the Crypto.com app and pick a plan. Perks can include rebates on services like Spotify and Netflix. If you don’t use the card for 12 months, a $4.95 monthly inactivity fee applies. Pros Cons CEX.IO is a centralized exchange that supports over 200 cryptocurrencies, as well as spot and margin trading. You can buy crypto using Mastercard and Visa debit, credit, and prepaid cards. However, you won’t be able to use prepaid cards for withdrawals, which is a bit of a letdown. To buy crypto with a prepaid card, you must download the CEX.io mobile app, create an account, and go through KYC verification. The minimum requirement for Visa and MasterCard deposits stands at $20, while the deposit fee amounts to 2.99%. You can also take advantage of its Instant Buy feature to buy crypto with credit/debit cards, at higher fees. Pros Cons OKX is one of the best crypto exchanges that stands out for its low fees, wide selection of coins and tokens, and deep liquidity. This CEX offers staking, spot, futures, and options trading. Plus, you can store crypto on its self-custodial Web3 wallet. OKX enables its users to buy using the most popular tokens using standard debit/credit cards and bank transfers. To buy crypto with prepaid cards, you must use its P2P Express Buy service. This service supports 90+ fiat currencies, Visa and Mastercard prepaid cards, as well as Apple Pay and Google Pay. The deposit fee for credit/debit cards stands at 2.49%. OKX is also partnered with Pay with Moon, which means that OKX users can spend their digital assets using Moon’s virtual credit cards and prepaid gift cards. Pros Cons BTCC is a beginner-friendly crypto exchange that supports spot, futures, and copy trading. You can also practice your trading skills on its demo platform with 100,000 virtual funds. BTCC is partnered with third-party payment providers like MoonPay and Simplex, meaning you can buy crypto with prepaid cards issued by Visa and MasterCard. BTCC doesn’t charge deposit fees. However, the minimum purchase amount for credit/debit cards stands at $200 (for the first purchase), which is quite high. On the other hand, crypto deposits don’t require KYC verification, as long as your withdrawals are below 10,000 USDT per day. Pros Cons Bybit is one of the best crypto futures trading platforms. It supports USDT, USDC, and inverse futures contracts with up to 200x leverage for specific contracts. This CEX also integrates TradingView charts and technical analysis tools, making it suitable for advanced traders. Besides futures, Bybit supports spot and margin trading, options, staking, and demo trading. You can buy crypto using a Bybit Card. This prepaid card issued by Mastercard supports USD and six cryptocurrencies: BTC, ETH, XRP, USDT, USDC, and TON. Bybit Card is available in a virtual and physical form. You can apply for the card by completing the KYC verification. You can also link the card with Samsung Pay via the Samsung Pay app. Pros Cons Bitunix is a centralized exchange that supports 300+ cryptocurrencies, spot, futures, copy trading, and staking. You can also earn rewards by completing specific tasks via its Task Center. Bitunix is partnered with various third-party payment providers, like Volet and Revolut Pay. This enables you to buy crypto with prepaid cards issued by Visa and MasterCard. You can use credit/debit cards to buy USDT, BTC, USDC, ETH, and 30+ fiat currencies. The daily transaction limits range from a minimum of $50 to a maximum of $5,000, which makes Bitunix less convenient for high-volume investors. The platform doesn’t charge deposit fees. However, you must complete the KYC verification for your first card purchase. Pros Cons BitPay is a cryptocurrency payment service provider that enables you to buy 60+ cryptocurrencies with Visa and MasterCard prepaid cards thanks to its partnership with Sardine, Simplex, and MoonPay. You can buy crypto using the BitPay Wallet app or the BitPay buying widget. You can also use Apple Pay or Google Pay. BitPay offered its own prepaid MasterCard; however, the Mastercard program was discontinued in 2023. BitPay users can still use its app to make various types of payments (including bills), and can purchase gift cards for Ikea, the PlayStation Store, Darden, and Wayfair. Pros Cons Below is a comparison of our top-rated exchanges and services where you can use a prepaid card to buy crypto, along with their key features: Trading fees: third‑party dependent Trading fees: 0.1% Trading fees: 0.1% Trading fees: 0.4% Trading fees: 0.25% / 0.15% (taker/maker) Trading fees: 0.180% / 0.490% (maker/taker) Trading fees: 0.2% / 0.3% (maker/taker) Trading fees: 0.1000% maker / 0.1000% taker Trading fees: 0.0800% / 0.1000% (maker/taker) Trading fees: 1%-2% per transaction + 25¢ Best Wallet is one of the best platforms to buy cryptocurrency with a prepaid card. Its seamless integration with Google Pay allows users to leverage prepaid Visa/Mastercard options for instant, anonymous purchases without bank linking or KYC requirements. The non-custodial wallet supports over 60 blockchains and offers competitive fees, robust security features like biometric authentication and two-factor protection, and a built-in DEX for cross-chain swaps. It is ideal for users seeking privacy, control, and convenience in their crypto transactions. Open the Google or Apple Pay app, click on the Tap & Pay button→card→add card. Scan the card with your phone’s camera or enter the card details manually. Verify your identity using OTP. Go to Best Wallet’s official website and tap the Download Best Wallet button or download the app from the App Store/Google Play. Open the app and tap the Get started button. Enter your email and create a 4-digit passcode. You can also link your Google or Apple account and enable 2FA. Tap the Trade button on the navigation bar. Now, click on the Buy icon, choose a coin you wish to buy, enter the desired amount, and select the Pay with Google/Apple Pay option. You can use Visa and Mastercard prepaid cards without the need to open a bank account. I.e., you can fund the card via direct deposits. This makes prepaid cards suitable for traders who are unable to open bank accounts. Prepaid cards can also be loaded with a fixed amount of cash, which will help you manage your budget and avoid overspending. Moreover, you can link prepaid cards to Google Pay and Apple Pay. Prepaid cards are not linked to your personal bank account, which makes them more secure than standard credit/debit cards. Namely, if your card gets stolen, you’ll only lose the preloaded balance. Visa and Mastercard prepaid cards also support the 3D Secure standard to prevent fraud. 3D Secure standards may include Face ID or one-time codes sent via SMS. Prepaid cards don’t allow you to access a credit line, which means you won’t be able to accumulate debt. You can only spend the amount you have on your card, no more, no less. This is very useful for traders, knowing that the crypto market is very volatile. Prepaid cards also come with daily and weekly limits, which will help you control your spending. Prepaid cards may charge various fees, such as activation, maintenance, inactivity, replacement, and reload fees. For example, if you use the Bybit prepaid card, you won’t have to pay annual or inactivity fees. However, you’ll need to pay a 2.70% fee per transaction for non-EU and 1.1% for EU-issued Mastercard cards. On the other hand, the Crypto.com prepaid card comes with a high inactivity fee that amounts to $4.95 per month. Not all crypto exchanges accept prepaid cards, which means you’ll have limited choice when it comes to buying crypto with prepaid cards. Although platforms like Bybit and Crypto.com enable their users to use their own prepaid cards, most exchanges support prepaid cards via third-party payment providers, like Moonpay and Simplex. In most cases, using third-party providers equals paying higher transaction fees. Unlike standard credit and debit cards, prepaid cards offer limited legal protection to their holders. For example, prepaid cardholders are not entitled to a mandatory chargeback. What’s more, if someone steals your card, you won’t be able to freeze the funds or recover the money since prepaid cards are not linked to bank accounts or insured by government agencies. The bottom line is that prepaid cards work well for small, quick purchases, while bank transfers are more suitable for high-volume traders or regular investors. The safer move is to transfer your crypto to a non-custodial software or hardware wallet. Software wallets are apps connected to the internet. They’re free, easy to set up, and suitable for everyday use. Based on our research, Best Wallet is the best hot wallet for crypto storage. This non-custodial multi-chain wallet is powered by Fireblocks. It also utilizes advanced MPC technology, cloud wallet backups, biometric login options, and 2FA. Hot wallets are convenient, but they’re more vulnerable to malware or phishing because they’re online. For stronger protection, consider cold wallets. The best cold wallets are hardware devices like Ledger and Trezor. They keep your private keys offline, making them very hard to hack. They cost money and aren’t as quick to use, but they’re ideal for holding larger amounts long term. A balanced approach works best: keep a little in an exchange for quick trades, some in a hot wallet for easy access, and your primary stash in a cold wallet for security. A bank transfer is the direct transfer of money from your bank to the exchange, either ACH in the US or SEPA in Europe, or a wire transfer for foreign payments. The majority of transactions, such as this one, are conducted this way because it is less expensive to execute, and the lower prices are usually transferred to the prices you pay. Pros Cons They are payment services that are convenience-oriented. There are also some that allow you to pay directly with PayPal, and others can also take Apple Pay or Google Pay as a payment option on your card. They are good when you use them, and they are not going to charge you less. Pros Cons You can also buy crypto from other users through P2P marketplaces like Paxful or Binance P2P. The platform typically locks the crypto in escrow while you complete the payment, then releases it once everything checks out, which helps reduce the risk of getting scammed. Pros Cons Platforms like Paxful and Bitrefill let you trade store gift cards, such as Amazon or iTunes, for crypto. It’s a niche route, but it can be useful if you’re sitting on gift cards you won’t use and want to turn that value into coins instead of letting it go to waste. Pros Cons These alternatives show you don’t have to rely on prepaid cards. Bank transfers save you money, PayPal and Apple Pay give you speed, P2P adds flexibility, and gift card swaps make use of balances you’d otherwise forget. Here are some essential safety tips: Stick to well-known crypto exchanges or services when using your prepaid card. If a platform is obscure or brand-new and promises “no fees, no ID required,” that’s a red flag. Scammers often set up fake websites to lure people looking to pay with cards. Do a bit of research on the exchange’s reputation. Check exchanges and crypto wallet reviews or forums if you’re unsure. It’s better to go with a trusted platform even if their fees are a tad higher, for the peace of mind that you’ll receive your crypto. Always make sure you’re on the official website of the exchange or service. Some types of crypto scams, such as phishing, may look identical to the real ones but have a slightly different URL. They aim to steal your card info or login credentials. Double-check the URL (look for the lock symbol and correct domain spelling). Should you receive an email or a message that there is an issue with your account and that it contains a link, then do not take action immediately. Scammers are also posing as support by typing the address or via a formal app. Do not use your password, full card details, or 2FA codes in chat, and even in DMs, real support will not request it. Treat your prepaid card info like cash. Only enter the card number on secure, encrypted payment pages (the ones that start with https://). Never give out your card number, CVV, or PIN to anyone who contacts you unsolicited. An exchange will have you input those independently; they will never ask for them via email or text. After you’ve used the card, keep an eye on its balance or transaction history. The card may have been compromised if you see charges you don’t recognize. The good news is that a prepaid card’s exposure is limited to its balance, but still, you don’t want someone draining it. One advantage of prepaid cards is a bit of anonymity, but don’t let that make you careless. You might be less traceable from a banking perspective, but your actions can still be tracked online if you’re not careful. Don’t post on social media bragging that you just bought crypto with a gift card—that could attract scammers. Also, avoid any offer that sounds too good to be true, like someone on Telegram saying, “Send me a prepaid card or gift card, and I’ll send you double the Bitcoin.” That’s almost certainly a scam. Remember, only scammers will insist on weird payment methods like gift cards in exchange for crypto outside official channels. Use the proper P2P platforms if you want to trade gift cards for crypto, and avoid random individuals making offers. This isn’t about the card, but it is crucial for your overall security. Turn on Two-Factor Authentication (2FA) on your exchange account (typically via an authenticator app like Google Authenticator or Authy). This means even if someone somehow got your password, they still can’t log in without that one-time code. It helps protect your account from hackers. Also, if the exchange offers features like anti-phishing codes (where emails from them include a code word you set) or withdrawal confirmations via email, use them. These little layers make a big difference. If you ask for help on forums or social media, watch out for people who jump into your replies or DMs pretending to be support. Real support won’t message you first, and they won’t ask for your login details, seed phrase, or private keys. Ignore and report them, and use only the official support links on the exchange’s website. When you’re paying with a prepaid card, treat the final confirmation screen as your last checkpoint. Double-check the amount, read the fees, and make sure every detail is correct. If you’re sending crypto to an external wallet, confirm the wallet address one more time before you hit confirm. A small typo in a wallet address can’t be undone after the fact. Also, confirm that the site isn’t throwing any unusual warnings or errors. If something looks off (like the site lagging or showing the wrong currency), it might be safer to cancel and try again later rather than risk it. Where prepaid cards shine is accessibility; they work well if you don’t want to link a bank account or have gift cards you’d rather turn into Bitcoin or Ethereum. They’re also fast—suitable for acting quickly on a market dip. But they’re best suited for small or one-off purchases, not long-term investing or big sums. Best Wallet is ideal if you buy crypto with a prepaid card. It’s non-custodial, so you hold the keys, not the exchange. It supports hot storage for quick access and cold storage with Ledger or Trezor for long-term security. Use it to keep your prepaid purchases safe.

Top 10 Platforms to Buy Crypto with a Prepaid Card

Take a look at our list to discover which platforms offer the best options for buying crypto with prepaid cards:

The Best Exchanges to Buy Crypto with a Prepaid Card Reviewed

Now that you’ve seen our list of exchanges that support prepaid cards, let’s get into more detail. In the following section, we’ll review each platform to help you find the one that suits you best.1. Best Wallet – Low-Fee Crypto Buys With No KYC

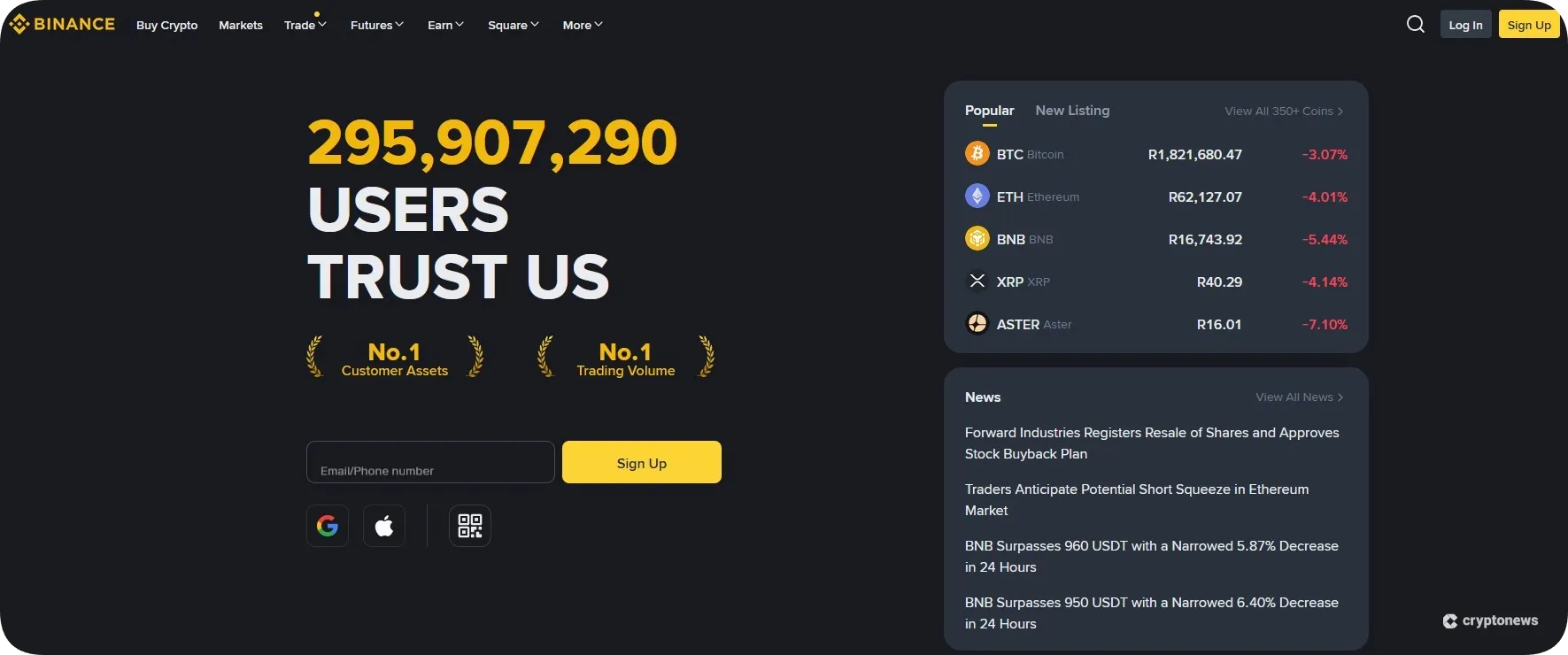

2. Binance – Prepaid Card Crypto Purchases And P2P

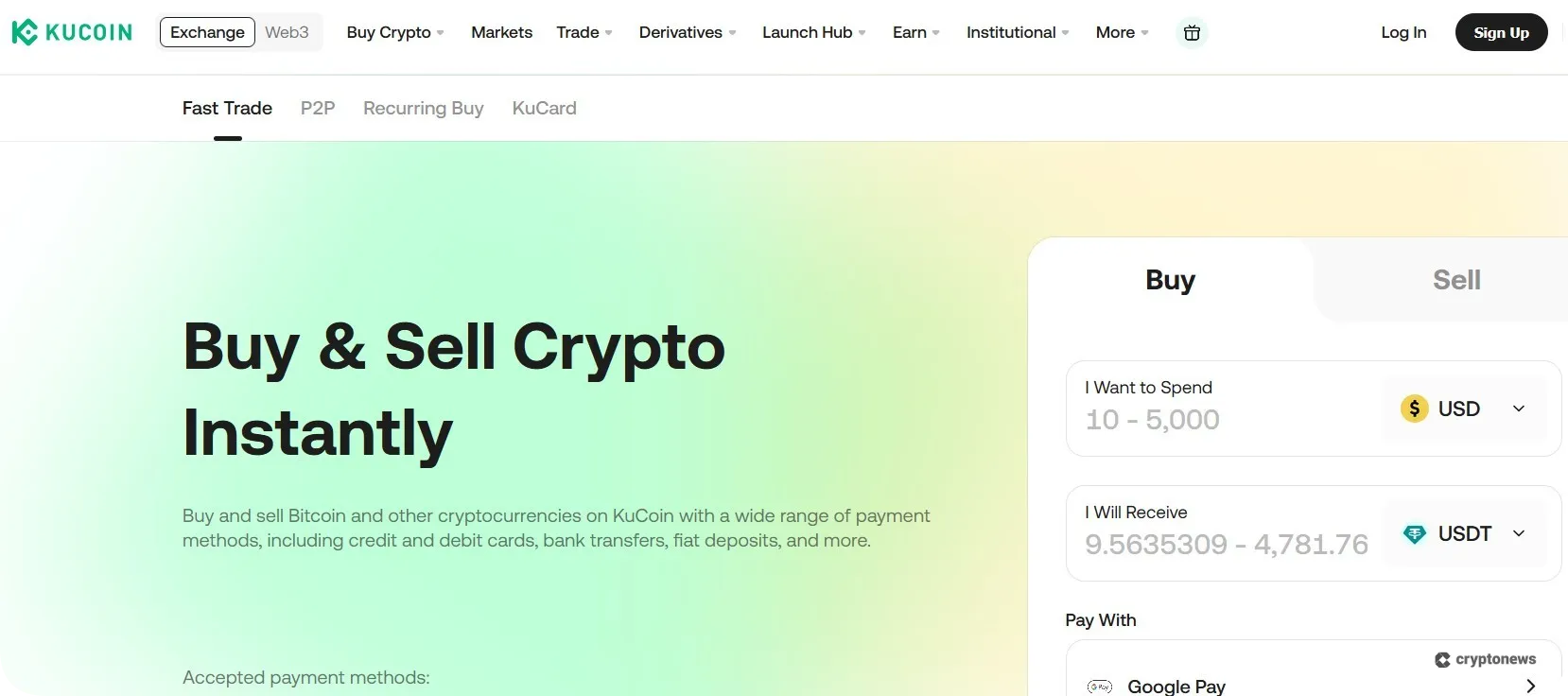

3. KuCoin – Card Purchases For Over 1,000+ Tokens

4. Crypto.com – Visa Prepaid Card With Rebates

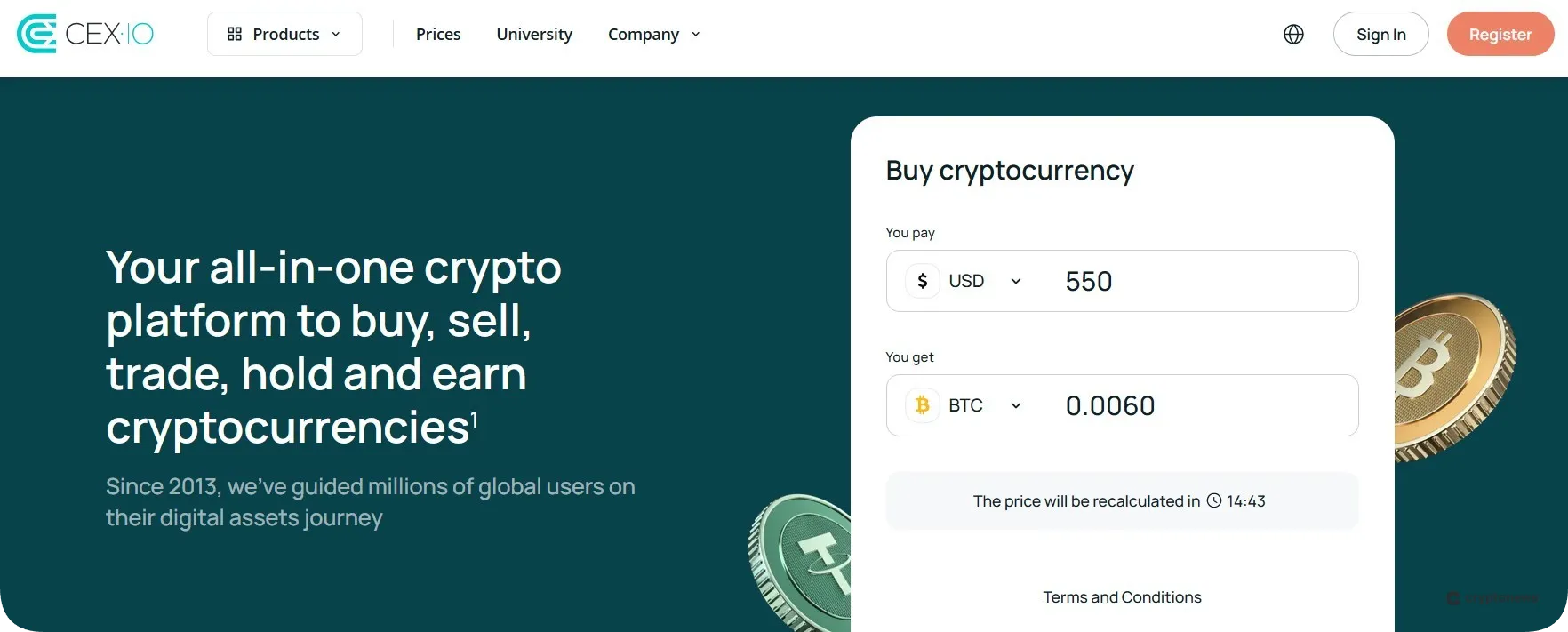

5. CEX.IO – Card Purchases For 200+ Coins

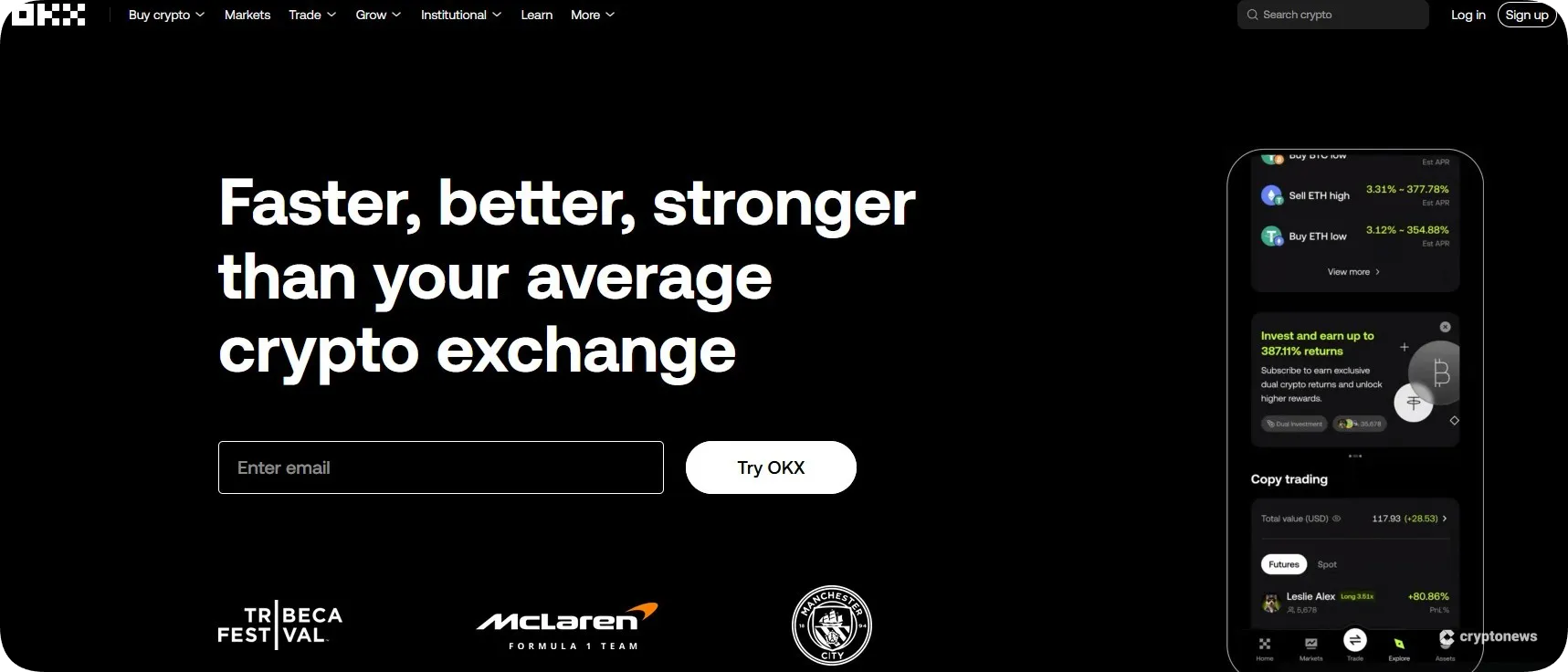

6. OKX – Prepaid Cards For P2P Trades

7. BTCC – USDT Purchases Via Card Providers

8. Bybit – Mastercard Prepaid Card Rewards Program

9. Bitunix – Prepaid Cards For Crypto And Fiat

10. BitPay – Debit Card Buys For More Than 60 Cryptos

Buying Crypto with a Prepaid Card – Platforms Compared

Not every crypto exchange is friendly to prepaid cards, but several popular platforms accept them (usually any Visa or Mastercard, regardless of whether it is prepaid or bank-issued).

Exchange

Prepaid Card Support

Fees (Deposit & Trading)

Crypto Selection

KYC Required?

Best Wallet

Yes – Visa/Mastercard (via Google Pay)

Deposit: 1%‑3%, depending on the third-party provider

Over 1,000 coins

No

Binance

Yes – Visa, Mastercard (via card payment gateways)

Deposit: 2% card fee (variable by region);

Over 350 coins

Yes

KuCoin

Yes – supports Visa/Mastercard (including prepaid)

Deposit: 2-3% card processing fee via third-party;

Over 1,000 coins

Optional for small trades, yes for card purchases

Crypto.com

Yes – Visa prepaid card

Deposit: 0% card fee

Over 400 coins

Yes

CEX.io

Yes – all Mastercard/Visa debit, credit, and prepaid

Deposit: 2.99% card fee;

Over 200 coins

Yes

OKX

Yes – Mastercard/Visa debit, credit (via P2P Express Buy)

Deposit: 2.49%;

Over 350 coins

Yes (for payments over $3,000 and refunds)

BTCC

Yes – Mastercard/Visa debit, credit (via third-party providers)

Deposit: No fees

Over 300 coins

Yes

Bybit

Yes – Mastercard prepaid card

Deposit: 2.70% per transaction for non‑EU and 1.1% for EU-issued Mastercard

Over 720 coins

Yes

Bitunix

Yes – Mastercard/Visa debit, credit (via third-party providers)

Deposit: No fees

Over 300 coins

Yes

BitPay

Yes – Mastercard/Visa debit cards (via third-party providers)

Deposit: No fees

Over 60 coins

Yes

How to Buy Crypto with a Prepaid Card – Step-by-Step

Ready to put that prepaid card to use and get some of the best crypto to buy? In this section, we’ll give a straightforward step-by-step walkthrough. Even if you’re a total beginner, these steps will help you confidently make your first purchase. We’ll use our top pick, Best Wallet, as an example.Step 1: Add Your Prepaid Card to Google/Apple Pay

Step 2: Download the Best Wallet App

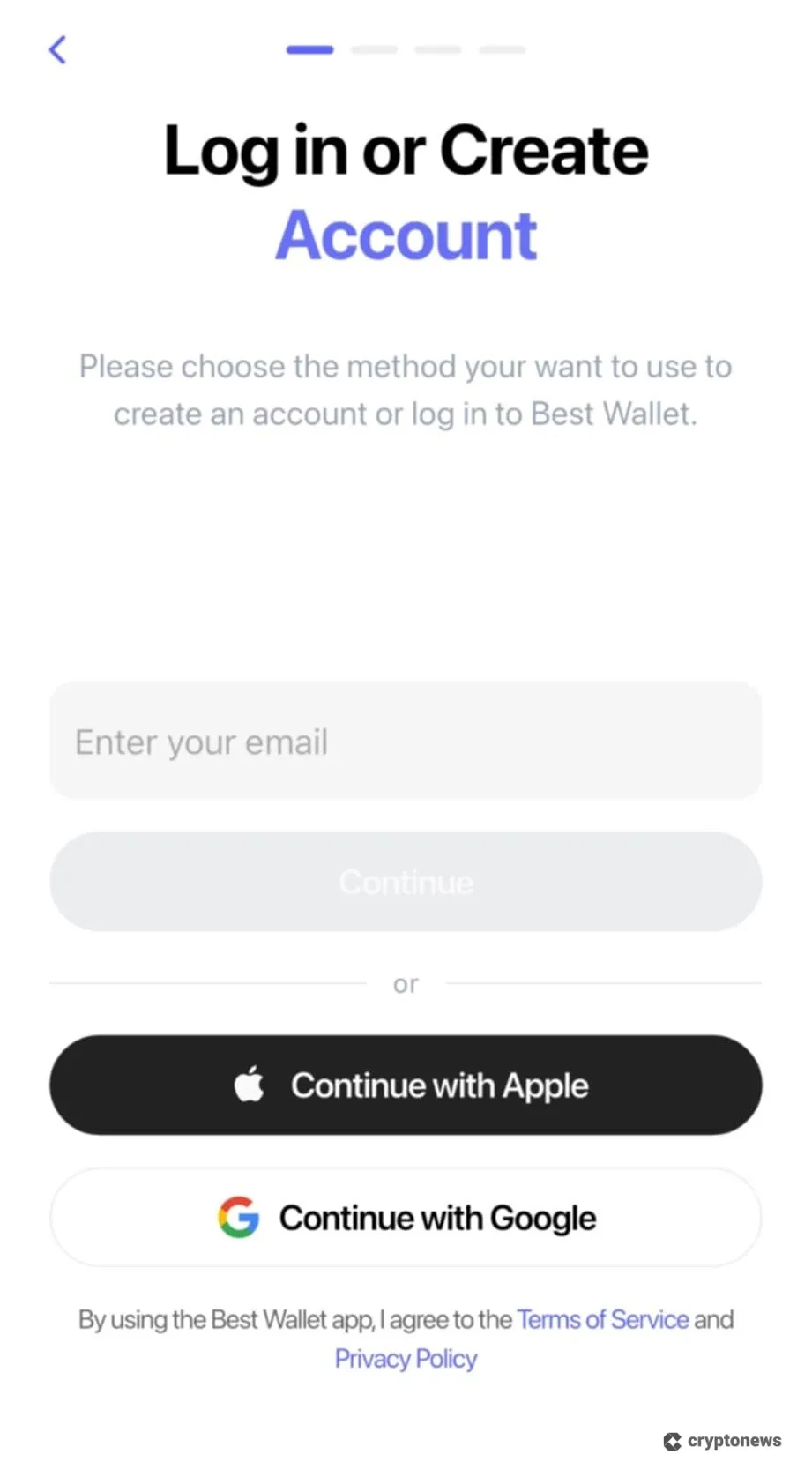

Step 3: Create an Account

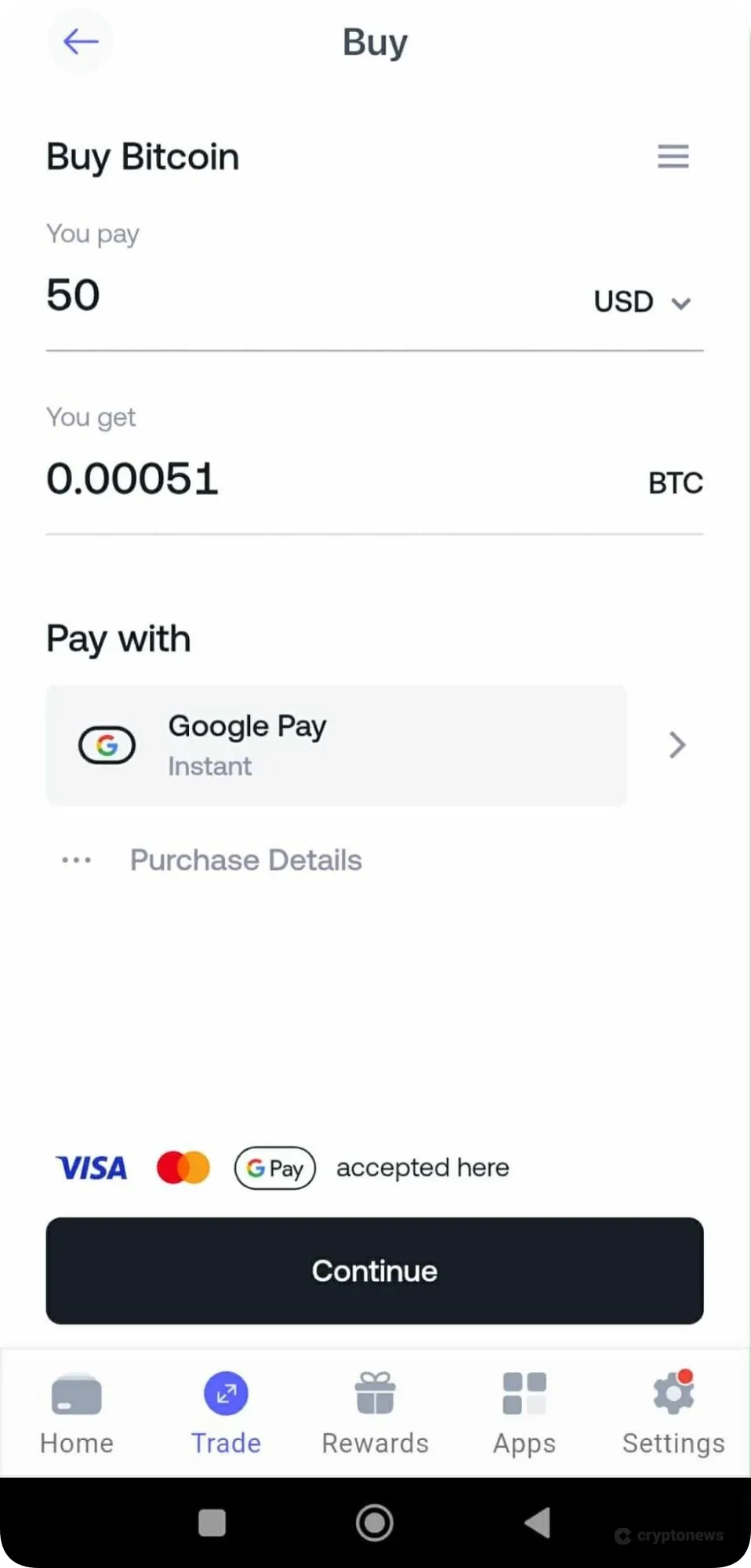

Step 4: Buy Crypto

Advantages of Buying Crypto with a Prepaid Card

Now that we’ve shown you how to buy Bitcoin with prepaid card(s), here are the main advantages of using this payment method:No Need For a Bank Account

Enhanced Security

No Risk of Debt

Drawbacks of Buying Crypto with a Prepaid Card

Prepaid cards come with a few disadvantages, which we’ll discuss in more detail in the following segment:Higher Fees

Limited Acceptance

Limited Legal Protection

How Do Fees Work When Buying Crypto with a Prepaid Card?

Buying crypto with a prepaid card is fast. However, you may pay higher fees and face tighter limits.

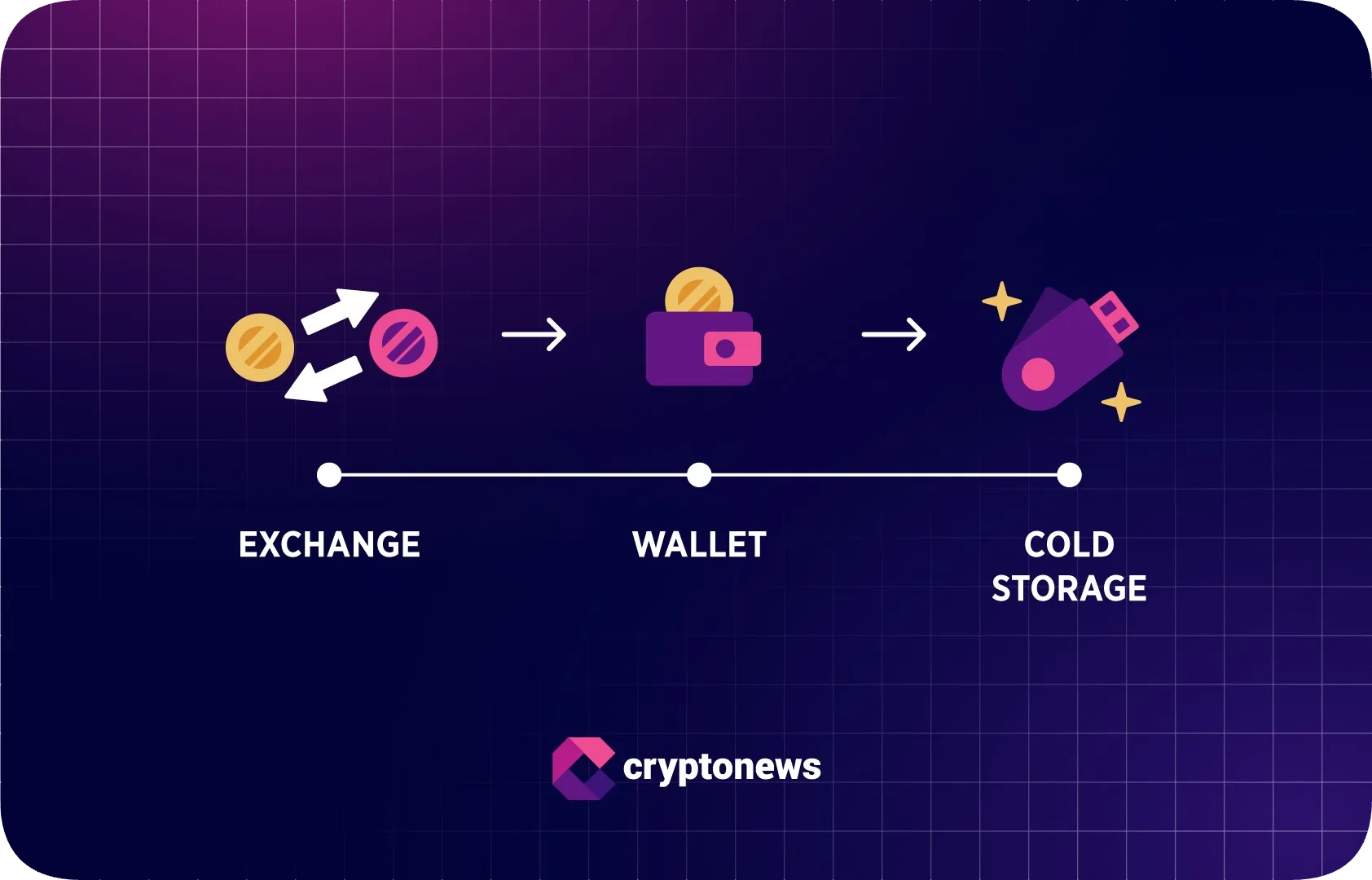

How to Store Your Crypto After Buying with a Prepaid Card

After you buy crypto, the next step is deciding where to keep it. Leaving funds on an exchange is fine if you plan to trade soon, but it’s risky for the long term. Exchanges hold your private keys, and your coins are exposed if they freeze withdrawals or get hacked.

Alternatives to Buying Crypto With a Prepaid Card

In case prepaid cards seem expensive or include an excessive number of restrictions, other options to purchase crypto exist. Both options are a compromise between cost, speed, and convenience; thus, the best option is the one that suits your needs, whether that is paying less, being more accessible, or having more payment options.🏦 Bank Transfer

📱 PayPal or Apple Pay

👥 Peer-to-Peer (P2P) Trading

🎁 Gift Cards → Bitcoin Swaps

Safety Tips for Using Prepaid Cards to Buy Crypto

When money meets the online world of crypto, you’ll want to take some precautions. Using a prepaid card can add a layer of safety by limiting the amount on the card, but you should still be vigilant.🔒 Use Trusted, Reputable Exchanges

👀 Beware of Phishing Scams

💳 Protect Your Card Details

🕵️♀️ Stay Anonymous

📲 Enable Two-Factor Authentication (2FA)

🤖 Watch Out for Bots and Impersonators

✋ Double-Check Before You Confirm

Final Thoughts – Should You Buy Crypto With a Prepaid Card?

Buying crypto with a prepaid card is convenient, but you pay for that speed. Fees are higher than with a bank transfer, often taking 2–4% of the transaction. For a small buy, losing a few dollars may not bother you, but it adds up quickly on larger amounts. If saving on fees is your top priority, a bank transfer is likely a better choice.FAQs on Buying Crypto With Prepaid Cards

Can you buy crypto with a prepaid card?

Can I buy Bitcoin with a prepaid Visa card?

Can I buy Ethereum with a prepaid Mastercard?

Is buying crypto with a prepaid card anonymous?

Which exchanges accept prepaid gift cards?

What are the fees for buying crypto with a prepaid card?

Can I cash out crypto to a prepaid card?

Reference

About Cryptonews

Our goal is to offer a comprehensive and objective perspective on the cryptocurrency market, enabling our readers to make informed decisions in this ever-changing landscape.

Our editorial team of more than 70 crypto professionals works to maintain the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re looking for breaking news, expert opinions, or market insights, Cryptonews has been your go-to destination for everything cryptocurrency since 2017.