10 Best Crypto Exchanges in South Africa for 2026: Secure and Regulated

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships. However, this potential compensation never influences our analysis, opinions, or reviews. Our editorial content is created independently of our marketing partnerships, and our ratings are based solely on our established evaluation criteria. Read More

Based on our research, PrimeXBT is currently the best crypto exchange in South Africa. This FSCA-licensed exchange supports direct ZAR deposits via credit/debit cards and bank transfers. It’s also partnered with multiple South African banks, enabling it to provide instant ZAR withdrawals.

Although cryptocurrencies are legal in South Africa, crypto exchanges were not required to obtain an FSCA license until 2023. This made compiling our list a challenging task. Our ranking methodology covered key aspects such as regulatory compliance, available markets, ZAR support, trading tools and services, security, and ease of use.

We tested over 30 platforms to identify the top 10 crypto exchanges in South Africa, which we’ll discuss in more detail to help you find the one that suits you best.

- In This Article

-

- 1. PrimeXBT - The Best Crypto Exchange in South Africa Overall

- 2. Coinbase - Top-Rated South African Crypto Exchange for Beginners

- 3. Luno - Best Crypto Exchange for Direct ZAR Deposits

- 4. Best Wallet - Best Crypto Exchange in South Africa for No-KYC Trading

- 5. Binance - Best SA Exchange for Day Traders

- 6. OKX - Top-Rated Crypto Exchange in South Africa for P2P Trading

- 7. AltCoinTrader - Best South African Crypto Exchange for Staking

- 8. eToro - Best Crypto Exchange in SA for Trading Stocks

- 9. VALR - Best Crypto Exchange in South Africa For Institutional Traders

- 10. Yellow Card - Best South African Crypto Exchange to Buy/Sell Altcoins Using Local Fiat Currencies

- In This Article

-

- 1. PrimeXBT - The Best Crypto Exchange in South Africa Overall

- 2. Coinbase - Top-Rated South African Crypto Exchange for Beginners

- 3. Luno - Best Crypto Exchange for Direct ZAR Deposits

- 4. Best Wallet - Best Crypto Exchange in South Africa for No-KYC Trading

- 5. Binance - Best SA Exchange for Day Traders

- 6. OKX - Top-Rated Crypto Exchange in South Africa for P2P Trading

- 7. AltCoinTrader - Best South African Crypto Exchange for Staking

- 8. eToro - Best Crypto Exchange in SA for Trading Stocks

- 9. VALR - Best Crypto Exchange in South Africa For Institutional Traders

- 10. Yellow Card - Best South African Crypto Exchange to Buy/Sell Altcoins Using Local Fiat Currencies

- Show Full Guide

List of Approved Crypto Exchanges in South Africa

Take a look at our table to see what our top-rated crypto exchanges in South Africa offer and how they compare to each other.

| Exchange | Suppored Coins | Maker/Taker Fees | ZAR Deposits/Purchases | South Africa Regulatory Status |

| PrimeXBT | 50+ | 0.01% / 0.02% – 0.045% | Credit/debit cards and bank transfers | FSCA |

| Coinbase | 340+ | 0.4% / 0.6% | Debit/credit cards, local bank transfers | Not regulated |

| Luno | 50+ | -0.01% to 0.4% / 0.2% to 0.6% | Credit/debit card, direct bank transfers | FSCA |

| Best Wallet | 1,000+ | No fees for basic wallet functions | Via third-party providers | Not regulated |

| Binance | 600+ | 0.1% / 0.1% | Linked bank accounts, bank transfers (EFT), credit/debit cards | FSCA |

| OKX | 340+ | 0.05% / 0.07% | Debit/credit card, Payeer, ABA Bank, Payoneer, Wing Money | Not regulated |

| AltCoinTrader | 40+ | 0.1% / 0.1% | Bank transfers (EFT), Capitec Pay, Simplex credit card | FSCA |

| eToro | 100+ | $1-$2 commission fee for opening and closing a position | Debit/credit card, PayPal, Neteller | FSCA |

| VALR | 25+ | 0.08% / 0.1% | Bank transfers (EFT), credit/debit card | FSCA |

| Yellow Card | 11 | Free transactions | Bank transfers (EFT) | FSCA |

10 Best Crypto Exchanges in South Africa: Full Reviews

Now that you’ve seen our list, it’s time to learn what makes these platforms stand out from the competition and what their main strengths and limitations are.

1. PrimeXBT – The Best Crypto Exchange in South Africa Overall

- Supported coins: 50+

- Maker/taker fees: 0.01% (maker) /0.02%-0.045% (taker)

- Payment methods: Credit/debit cards and bank transfers

- Regulatory status: FSCA license

PrimeXBT is a centralized crypto exchange that recently expanded its operations to South Africa. This FSCA-licensed platform enables trading crypto, commodities, shares, forex, and indices. You can also trade futures, FX, and CDFs with leverage.

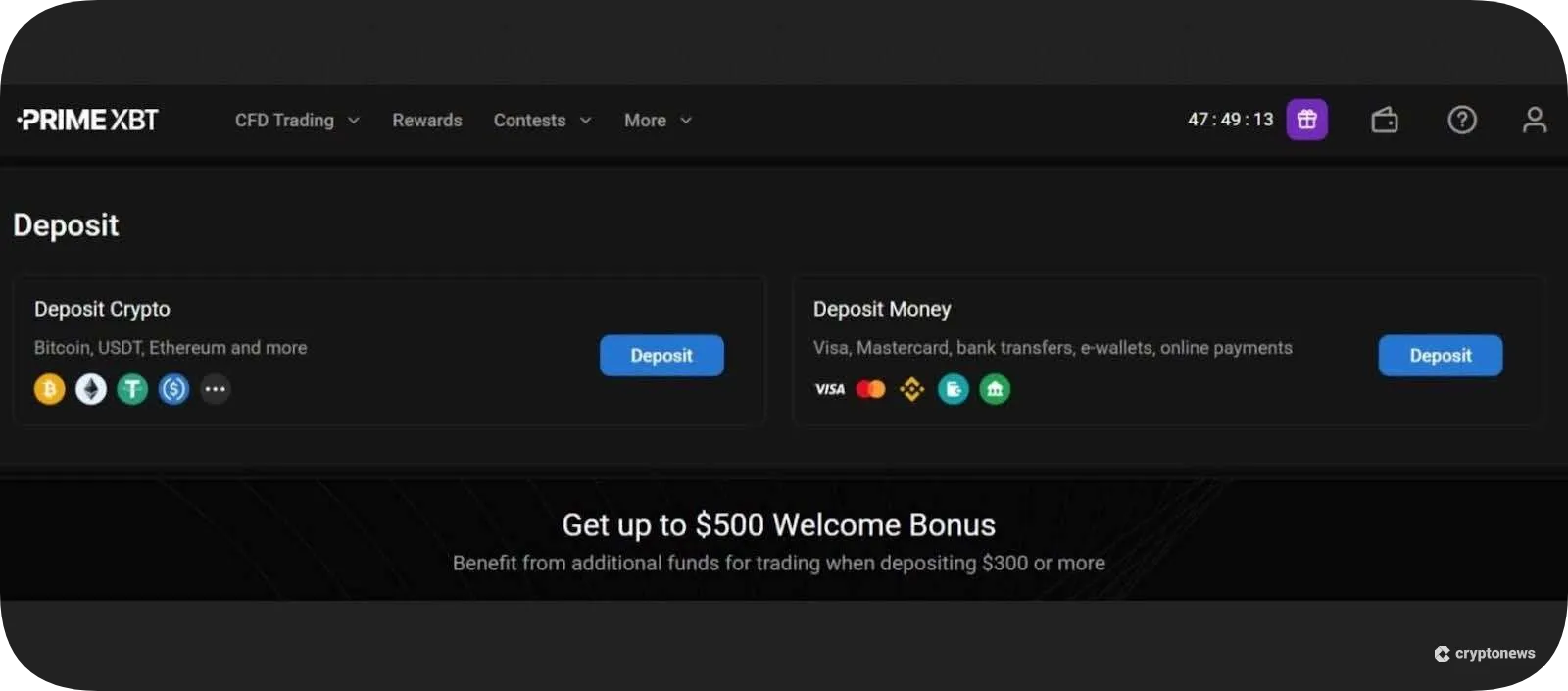

The exchange supports ZAR deposits via credit/debit cards (minimum deposit of R300) and bank transfers (minimum deposit of R1,000). PrimeXBT is partnered with multiple South African banks, including Absa, Nedbank, Investec, African Bank, and Capitec Bank, which enables it to support instant withdrawals for most transactions.

The withdrawal fee for credit/debit cards is 3.5% plus R30, while for bank transfers, the fee is R150. ZAR deposits will be automatically converted to USD, allowing you to trade crypto assets denominated in USD.

PrimeXBT Key Takeaways

- Different types of instruments: Trade crypto, forex, indices, commodities, shares, futures, and CDFs with leverage.

- High leverage: Crypto futures offer up to 200x leverage, while indices, commodities, and forex pairs provide up to 1000x leverage.

- Demo account.: Practice trading with virtual funds.

Pros

- Supports ZAR deposits via credit/debit cards and bank transfers

- Partnered with multiple South African banks

- Instant withdrawals for most transactions

- Automatic ZAR-to-USD conversion

- Competitive trading fees

Cons

- Withdrawal fee for credit/debit cards is 3.5% + R30

2. Coinbase – Top-Rated South African Crypto Exchange for Beginners

- Supported coins: 340+

- Maker/taker fees: 0.4% maker / 0.6% taker

- Payment methods: Debit/credit cards, local bank transfers

- Regulatory status: Not regulated

Coinbase is recognized as one of the most beginner-friendly exchanges thanks to its clean interface and learn platform, where you’ll find multiple tips and tutorials related to crypto trading. This platform has recently partnered with Yellow Card, which means that Coinbase Wallet users in SA can now buy USDC via local payment methods, as well as receive USDC using Coinbase’s Base chain.

SA traders can also earn USDC rewards on the Base app and trade Coinbase Wrapped BTC (cbBTC). However, they won’t be able to convert USDC back into fiat. They can only convert USDC into other cryptos.

The biggest downside of this platform is its higher-than-industry-standard trading fees. This makes Coinbase less suitable for day traders. Moreover, Coinbase doesn’t support direct ZAR deposits and withdrawals.

Coinbase Key Takeaways

- Spot and derivatives trading and staking: Coinbase supports 550+ spot pairs and 150+ perpetual and futures contracts. You can also stake 130+ assets.

- Coinbase Wallet: Buy and sell USDC via local payment methods and earn USDC rewards.

- Coinbase Learn: Find multiple tips and tutorials related to crypto trading.

Pros

- Beginner‑friendly interface

- Partnered with Yellow Card

- Coinbase Wallet users from SA can buy USDC via local payment methods

- Earn USDC rewards on the Base app

- Trade cbBTC

Cons

- Doesn’t support direct ZAR deposits and withdrawals

3. Luno – Best Crypto Exchange for Direct ZAR Deposits

- Supported coins: 50+

- Maker/taker fees: -0.01% – 0.40% (maker) / 0.20% to 0.60% (taker)

- Payment methods: Debit/credit cards, direct bank transfers

- Regulatory status: FSCA licence

Luno is one of the few crypto exchanges that support direct ZAR deposits and withdrawals. On that note, you can fund your account using direct bank transfers (EFT) and instant deposits. You can also buy cryptocurrencies using a debit or credit card. The fees range from 3.9% for card purchases and 1.4% for instant deposits.

Standard withdrawals incur no fees, while express withdrawals carry a fee of R20.00 (if your bank is an RTC participant) or R80.00 (if your bank is not an RTC participant). SA traders can take advantage of Luno Pay. This service lets you use the Luno wallet to pay for goods and services by scanning a QR code. However, this service is only available at Pick’n Pay stores.

Besides trading crypto, you can win up to $10,000 in Bitcoin by predicting its price, invest in 60+ stocks and ETFs, and earn up to 11% APY by staking ADA, ETH, NEAR, DOT, ATOM, and SOL.

Luno Key Takeaways

- Direct ZAR support: Deposit and withdraw ZAR via direct bank transfers.

- Luno Pay: Pay for goods and services by scanning QR codes.

- Staking: Earn up to 11% APY by staking ADA, ETH, NEAR, DOT, ATOM, and SOL.

Pros

- Supports direct ZAR deposits and withdrawals

- Free bank transfer (EFT) deposits

- Verified SA users can invest in tokenized stocks and ETFs

- Users from South Africa can stake ADA, ETH, NEAR, DOT, ATOM, and SOL

- Use the Luno wallet to pay for goods and services at Pick’n Pay stores

Cons

- Limited crypto selection

4. Best Wallet – Best Crypto Exchange in South Africa for No-KYC Trading

- Supported coins: 1,000+

- Maker/taker fees: No fees for basic wallet functions

- Payment methods: Via third-party providers

- Regulatory status: Not regulated

If you’re looking for crypto wallets with built-in exchanges, opt for Best Wallet. This non-custodial multi-chain wallet features an integrated DEX that enables swapping over 1,000 cryptocurrencies across Bitcoin, Ethereum, BNB Smart Chain, Polygon, Base, and Solana networks. You can also invest in presale tokens and interact with a wide range of dApps directly from the wallet.

To purchase crypto with ZAR, you’ll have to use third-party providers, like Alchemy, Banxa, Coinify, and Gate. For example, Alchemy supports ZAR deposits via local banks, while Banxa supports ZAR payments via Visa/Mastercard, Apple Pay, Google Pay, and bank transfers (ACH).

Best Wallet is available as a mobile app (Android and iOS). It doesn’t require KYC verification, meaning you can trade crypto anonymously, and it’s insured by Fireblocks.

Best Wallet Key Takeaways

- Integrated DEX: Conduct cross-chain swaps with competitive fees.

- Upcoming tokens page: Invest in presale tokens before they get listed on major exchanges.

- Fiat on-ramp service: Best Wallet is partnered with multiple on-ramp providers, enabling you to buy crypto using your bank account, bank cards, Apple/Google Pay, and other payment methods.

Pros

- Non-custodial storage

- Access to presales

- No KYC requirement

- No fees for basic wallet functions

Cons

- Lack of sell/offramp feature

- No direct ZAR deposits

5. Binance – Best SA Exchange for Day Traders

- Supported coins: 600+

- Maker/taker fees: 0.1000% (maker) / 0.1000% (taker)

- Payment methods: Linked bank accounts, bank transfers (EFT), credit/debit cards

- Regulatory status: FSCA license

Next on our list of South African crypto exchanges is the behemoth in the crypto world – Binance. Binance is recognized as a crypto exchange with some of the lowest trading fees that start at 0.01%. Moreover, BNB token holders can get an additional 25% discount on trading fees, which makes Binance ideal for day traders.

The platform supports spot, futures, copy trading, margin trading, and options. However, options trading is no longer available to SA users. On a positive note, Binance supports direct ZAR deposits via linked bank accounts, bank transfers (EFT), and credit/debit cards. Plus, you can withdraw ZAR to your linked bank account via Stitch.

We also noticed that Binance frequently offers zero-fee ZAR deposit promotions to all new users in South Africa.

Binance Key Takeaways

- Spot trading: Trade 1,500+ spot trading pairs, including BTC/ZAR, ETH/ZAR, and USDT/ZAR.

- Futures: Trade USDC and USDT perpetuals, USDT delivery, COIN-M perpetuals, and COIN-M delivery contracts.

- Futures Next: A new platform that enables you to earn rewards by predicting the upcoming listings on the Binance USDⓈ-M futures market.

Pros

- Supports direct ZAR deposits

- Frequent zero-fee ZAR deposit promotions for new users

- Withdraw ZAR to your linked bank account via Stitch

- Low trading fees

Cons

- Options trading is no longer available to SA users

- Credit card deposits are subject to fees (up to 3%)

6. OKX – Top-Rated Crypto Exchange in South Africa for P2P Trading

- Supported coins: 340+

- Maker/taker fees: 0.050% (maker) / 0.070% (taker)

- Payment methods: Debit/credit card, Payeer, ABA Bank, Payoneer, Wing Money

- Regulatory status: Not regulated

OKX is a great cryptocurrency exchange for peer-to-peer (P2P) traders. You can use ZAR to buy 340+ cryptocurrencies via its P2P platform for zero fees. Moreover, you can use a wide range of payment options, including debit/credit cards, Payeer, ABA Bank, Payoneer, and Wing Money, or post buy and sell ads by becoming a merchant. Anyone who creates and verifies their account on OKX will be eligible to trade on the P2P marketplace. However, only Lite members can post buy ads in ZAR.

We noticed that OKX occasionally launches P2P campaigns exclusively for African users. In the last campaign, SA users could share a 500 USDT prize pool by joining the OKX Africa Telegram group, following OKX on X, and referring 10 new eligible users to join the OKX Africa communities.

In addition to P2P trading, OKX offers futures and spot trading with leverage, options, and copy trading. Plus, you can use pre-built trading bots or test your trading skills via a demo account.

OKX Key Takeaways

- P2P merchant program: Become a Lite, Super, or Diamond merchant to unlock more P2P features and benefits.

- Trading bots: Automate your trades using pre-built trading bots.

- Jumpstart: Gain access to new crypto projects.

Pros

- Use ZAR to buy crypto via OKX’s P2P platform for zero fees

- Post buy and sell ads in ZAR

- P2P campaigns exclusively for African users

- Three different P2P merchant program tiers

Cons

- No direct local bank-fiat deposit in ZAR

- Only Lite members can post buy ads in ZAR

7. AltCoinTrader – Best South African Crypto Exchange for Staking

- Supported coins: 40+

- Maker/taker fees: 0.1% (maker) / 0.1% (taker)

- Payment methods: Bank transfers (EFT), Capitec Pay, Simplex credit card

- Regulatory status: FSCA license

AltcoinTrader is a South African-based crypto exchange that enables buying and selling crypto with ZAR and vice versa. This platform is ideal for SA traders who are into staking. You can stake xZAR, DOT, SOL, TAO, AVAX, TRX, TON, POL, ADA, SUI, ETH, and BNB for zero fees and with no lock-in periods. The platform also lets you make a deposit using ZAR, crypto, or gold/silver. Supported payment methods include bank transfers (EFT), Capitec Pay, and Simplex credit card.

AltcoinTrader charges a 0.5% deposit fee for ZAR bank transfers (the maximum fee is R95.00 per transaction) and a 2% fee for Capitec Pay deposits. You’ll also have to pay an additional 5% for all cash deposits, while the fee for its Easy Buy & Sell service stands at 0.75%.

Like Binance, AltCoinTrader charges 0.1% maker and taker fees. However, the platform supports only 40 cryptocurrencies, which makes it less suitable for diversification.

AltcoinTrader Key Takeaways

- Easy Buy & Sell: Buy BTC without any technical knowledge. Enter the amount of ZAR you wish to spend, and the platform will automatically calculate the amount of BTC you can buy.

- ACT Pay: Use xZAR to pay for products and services in 600,000 stores across South Africa.

- Easy Save: Earn passive income by staking xZAR, DOT, SOL, TAO, AVAX, TRX, TON, POL, ADA, SUI, ETH, and BNB with no lock-in periods.

Pros

- Supports direct ZAR deposits and withdrawals

- Stake 12 tokens, including xZAR, for zero fees and with no lock-in periods

- Competitive maker/taker fees

- Use xZAR to pay for products and services in stores across South Africa

Cons

- 5% fee for all cash deposits

- Limited number of supported crypto

8. eToro – Best Crypto Exchange in SA for Trading Stocks

- Supported coins: 100+

- Maker/taker fees: $1-$2 commission fee for opening and closing a position

- Payment methods: Debit/credit card, PayPal, Neteller

- Regulatory status: FSCA license

eToro is our number one pick for trading stocks. You can trade over 6620 stocks on 20 exchanges for a fixed commission fee that ranges between $1 and $2 for opening and closing a position. You can also invest in whole units or fractional shares. In addition to stocks, SA users can trade crypto, ETFs, commodities, and indices.

We noticed that the minimum first deposit requirement varies depending on your country of residence. On that note, the minimum first deposit requirement for SA users stands at $2,000. The platform supports opening an account in three currencies – USD, GBP, and EUR. This means that for ZAR deposits and withdrawals, you must pay a conversion fee that ranges between 1.5% and 3%. eToro also charges a fixed withdrawal fee of $5.

eToro supports multiple deposit methods, including debit/credit cards and e-wallets (PayPal, Neteller). In addition to that, it offers swap-free accounts (Islamic accounts) with zero interest on open positions.

eToro Key Takeaways

- Stock trading: Trade over 6620 stocks on 20 exchanges for a fixed commission fee (between $1 and $2). Invest in whole units or fractional shares.

- Social trading: Share your trades, follow other traders, and comment on trades.

- Swap-free accounts: Open accounts with zero interest on open positions and trade 5,000+ instruments across various asset classes.

Pros

- Trade 6620+ stocks on 20 exchanges for a small commission fee

- Open swap-free accounts

- Buy crypto with debit/credit cards and e-wallets

- Free demo account

Cons

- The minimum first deposit requirement for SA users stands at $2,000

- Deposits and withdrawals in ZAR are subject to conversion fees

- High inactivity fee ($10 per month)

9. VALR – Best Crypto Exchange in South Africa For Institutional Traders

- Supported coins: 25+

- Maker/taker fees: 0.080% (maker) / 0.100% (taker)

- Payment methods: Bank transfers (EFT), credit/debit card

- Regulatory status: FSCA license

VALR is a centralized exchange based in Johannesburg, South Africa. This platform supports staking, lending, spot, futures, margin trading, as well as tokenized stocks. Institutional traders can take advantage of its highly adaptable and scalable sub-accounts, white-glove OTC service, and a free money transfer app (VALR Pay) that enables instant payments in crypto or fiat.

You can use ZAR to make a deposit via bank transfers (EFT) or credit/debit cards. Bank deposits are free, while card deposits come with a 3.9% fee. VALR offers multiple options for buying crypto. You can use the simple buy/sell option to buy crypto directly with USDC or ZAR, or enable the auto buy feature to purchase multiple cryptocurrencies directly from your bank account. Both options come with a fixed 1.6% fee.

We also liked VALR’s crypto competitions. For example, if you buy R1,000 in crypto, you can earn R200.

VALR Key Takeaways

- VALR Pay: Send and receive fiat and crypto instantly without fees.

- Simple Buy/Sell: Buy cryptocurrencies directly with USDC or ZAR. The maximum amount to spend is 1 BTC or 25 ETH per trade.

- OTC trading: Execute large orders with competitive pricing. The minimum ticket size stands at $50,000.

Pros

- Supports staking, lending, spot, futures, margin trading, and tokenized stocks

- Direct ZAR deposits and withdrawals

- Personal and corporate accounts

- Crypto competitions and promotions

Cons

- Withdrawal limits (0.2 BTC per day for fully-verified accounts and 100 BTC per day for fully-verified PLUS accounts)

- Card deposits come with a 3.9% fee

- Simple buy/sell and auto buy features come with a fixed 1.6% fee

10. Yellow Card – Best South African Crypto Exchange to Buy/Sell Altcoins Using Local Fiat Currencies

- Supported coins: 11

- Maker/taker fees: Free transactions

- Payment methods: Bank transfers (EFT)

- Regulatory status: FSCA license

Yellow Card is an on-/off ramp platform that lets you buy and sell popular cryptocurrencies and stablecoins, like BTC, ETH, USDC, and USDT, using local fiat currencies like ZAR. You can make a deposit using bank transfers (EFT) for a fee of 1.15%. However, we noticed that the transaction limit for South African users is R200 (minimum purchase amount) and R100,000 (maximum purchase amount).

Yellow Card supports standard and instant EFT withdrawals. The former comes with a 1.15% fee, while the latter requires a payment of R12. The platform’s standout feature is its on-ramp/off-ramp widget, which allows buying crypto from any exchange or dApp with local fiat currencies. The widget supports 20 countries across the African continent, and it handles full KYC, AML, and transaction monitoring.

On the downside, Yellow Card doesn’t support ZAR deposits via credit/debit cards. Plus, you can only trade 11 digital assets, which is quite limiting compared to other exchanges on our list.

Yellow Card Key Takeaways

- On-ramp/off-ramp widget: Buy crypto from any exchange or dApp with local fiat currencies.

- Yellow Pay: Send and receive cash across 20 African countries for free.

- Dedicated mobile app: Trade on the go via Yellow Card’s Android and iOS app.

Pros

- Buy and sell popular cryptocurrencies and stablecoins using local fiat currencies

- Send and receive cash across 20 African countries

- Complies with global AML and KYC regulations

Cons

- Limited number of supported coins

- The maximum purchase amount for SA users is R100,000

- Doesn’t support ZAR deposits via credit/debit cards

What is a Cryptocurrency Exchange?

A crypto exchange is an online platform that lets you buy, sell, and swap cryptocurrencies for fiat or other digital assets. To conduct a trade, you must create an account, make a deposit, and create a buy or sell order. Crypto exchanges can also support staking, lending, spot, futures, copy trading, margin trading, and options.

Types of Crypto Exchanges in South Africa

A South African crypto exchange can be centralized or decentralized. It can also support Peer-to-peer (P2P) and in-wallet trading. In the next segment, we’ll explain how each model works.

Centralized Exchanges

Centralized exchanges (CEXs), such as Coinbase and Binance, are operated by a central authority that acts as an intermediary between buyers and sellers. This means that the exchange will be responsible for your funds and private keys. Crypto transactions on CEXs are usually settled off-chain, on a centralized server, which reduces their costs. They also operate in accordance with KYC and AML regulations.

The main advantages of centralized exchanges include user-friendliness, high liquidity, and support for fiat conversions. However, since they hold large amounts of funds, CEXs are more vulnerable to cyberattacks. Moreover, they may face regulatory and compliance issues, which can lead to account freezes and withdrawal restrictions.

Decentralized Exchanges

Decentralized exchanges (DEXs) are not operated by a central authority, meaning you’ll have full control over your private keys and funds. You’ll also conduct trades anonymously, that is, without the need to go through KYC requirements. Instead of order books, DEXs use automated market makers or smart contracts to conduct trades on-chain. This means that you won’t have to wait for another trader to match your order since the process will be automated.

The main limitations of DEXs are the lack of fiat-on/off-ramp options and lower trading volumes. Plus, you won’t be able to trade crypto against fiat – you can only trade crypto-crypto or crypto-stablecoin pairs. On a positive note, DEXs often support small-cap tokens with the potential to explode, making them suitable for early-stage investors (if we exclude the risk of rug pulls).

Peer-to-Peer (P2P) Marketplaces

Peer-to-Peer platforms enable crypto trading between two individuals without intermediaries. They will hold the assets in escrow until both parties confirm the transaction. P2P platforms charge low to no fees. For example, OKX and Binance enable buying crypto via their P2P platforms for zero fees.

P2P platforms also support more payment options compared to traditional exchanges, making them suitable for traders who want to use ZAR. On the downside, P2P platforms offer lower liquidity than CEXs. This can be an issue if you want to trade niche altcoins, as you may have difficulty finding a match.

In-Wallet Trading

Some crypto exchanges offer native wallets, enabling you to trade crypto directly from the wallet app, i.e., without the need to transfer your assets to a separate exchange. For example, Best Wallet is a non-custodial wallet that enables crypto swaps through its built-in DEX that connects with hundreds of liquidity pools.

However, crypto wallets (especially hot wallets) are vulnerable to hacks and phishing attacks. Plus, they require technical knowledge, such as understanding seed phrases, backups, and address verifications.

Are Crypto Exchanges Legal in SA?

To be considered legal, a crypto exchange in South Africa must comply with the regulatory requirements. First, it must be registered as a Crypto Asset Service Provider (CASP). Secondly, it must obtain a license from the Financial Sector Conduct Authority (FSCA). Finally, it must adhere to anti-money laundering (AML) regulations.

Who Regulates Crypto Exchanges in South Africa?

Crypto Exchanges in South Africa are regulated by the following bodies:

- Financial Sector Conduct Authority (FSCA). FSCA’s role is to enhance the efficiency and integrity of financial markets, promote fair customer treatment, provide financial education, and assist in maintaining financial stability. The FSCA also issues licenses for crypto asset service providers (CASPs).

- Financial Intelligence Center (FIC). The FIC is South Africa’s central body for AML and CFT compliance, established by the Financial Intelligence Center Act (FICA).

- South African Reserve Bank (SARB). SARB’s role is to monitor, analyze, and assess the risks that crypto assets pose to the financial system.

- South African Revenue Services (SARS). SARS is responsible for the taxation of crypto assets.

How to Choose a South African Crypto Exchange

In this segment, we’ll show you how to find a crypto exchange in South Africa. We’ll also provide specific examples to make your choice easier.

Regulations

If you want to trade crypto in South Africa, open an account on crypto exchanges that are licensed by the FSCA or another relevant regulatory body. FSCA-licensed exchanges comply with AML and KYC laws, making them safer for trading. FSCA-licensed exchanges on our list include PrimeXBT, Luno, Binance, AltCoinTrader, eToro, VALR, and Yellow Card.

Keep in mind that crypto exchanges in South Africa were not required to obtain an FSCA license until 2023, which is why many platforms are still in the application phase. According to FSCA, 248 CASPs have been approved so far.

Available Markets

Opt for crypto exchanges that support a wide range of coins and tokens, from popular cryptocurrencies like BTC, ETH, and SOL, to hot meme coins like DOGE, SHIB, PEPE, and BONK. This enables you to diversify your portfolio. Our list also includes platforms that allow SA traders to invest in presale tokens. These include Best Wallet, Binance, and OKX.

ZAR Support

Choose crypto exchanges that support direct ZAR deposits and withdrawals, such as Luno, Binance, AltCoinTrader, VALR, and Yellow Card. This way, you’ll avoid conversion fees that can go up to 3%. You should also give an advantage to platforms that support multiple payment options, from bank transfers (EFT) to credit/debit cards and e-wallets. For example, VALR offers free bank transfer (EFT) deposits.

Trading Tools

Trading tools will help you track the crypto market in real time. This will help you assess when it’s a good time to enter or exit a position. For example, OKX offers pre-built trading bots that automate your trading strategies. PrimeXBT offers multiple indicators and drawing tools, whereas Coinbase provides advanced charting capabilities powered by TradingView.

Features

In addition to buy, sell, and swap options, the best crypto exchange will offer other services, such as fiat on-ramp services, P2P marketplaces, OTC trading, sub-accounts, demo accounts, and swap-free accounts. You should also opt for crypto exchanges that support multiple trading options, from spot and futures to staking and lending.

For example, PrimeXBT lets you trade crypto, commodities, shares, forex, and indices, while VALR supports staking, lending, and tokenized stocks.

Security

Finding a safe crypto exchange is a must, especially since crypto-related hacks increased by 131% during 2025, driven by Bybit’s exploit, which accounted for 92% of total losses. This is why we listed platforms that utilize advanced security measures, such as cold storage, 2FA, biometric/PIN/app locks, and anti‑phishing codes. To keep your crypto safe, avoid sharing your private keys and seed phrases and use a cold wallet for long-term storage.

Ease of Use

A good crypto exchange must have an intuitive interface and offer straightforward trading options. That said, the most beginner-friendly platforms on our list of South African crypto exchanges include Coinbase, Best Wallet, and AltcoinTrader.

Creating an account on Best Wallet requires only two steps – entering an email and a PIN. Coinbase offers multiple tips and tutorials related to crypto trading, while AltcoinTrader stands out with its Easy Buy & Sell option. You can also opt for platforms that offer demo accounts, like PrimeXBT and eToro, to practice your trading skills with virtual funds.

How to Use a Crypto Exchange in South Africa: Step-by-Step Guide

In this segment, we’ll show you how to use a cryptocurrency exchange in South Africa, using our top pick, PrimeXBT, as an example.

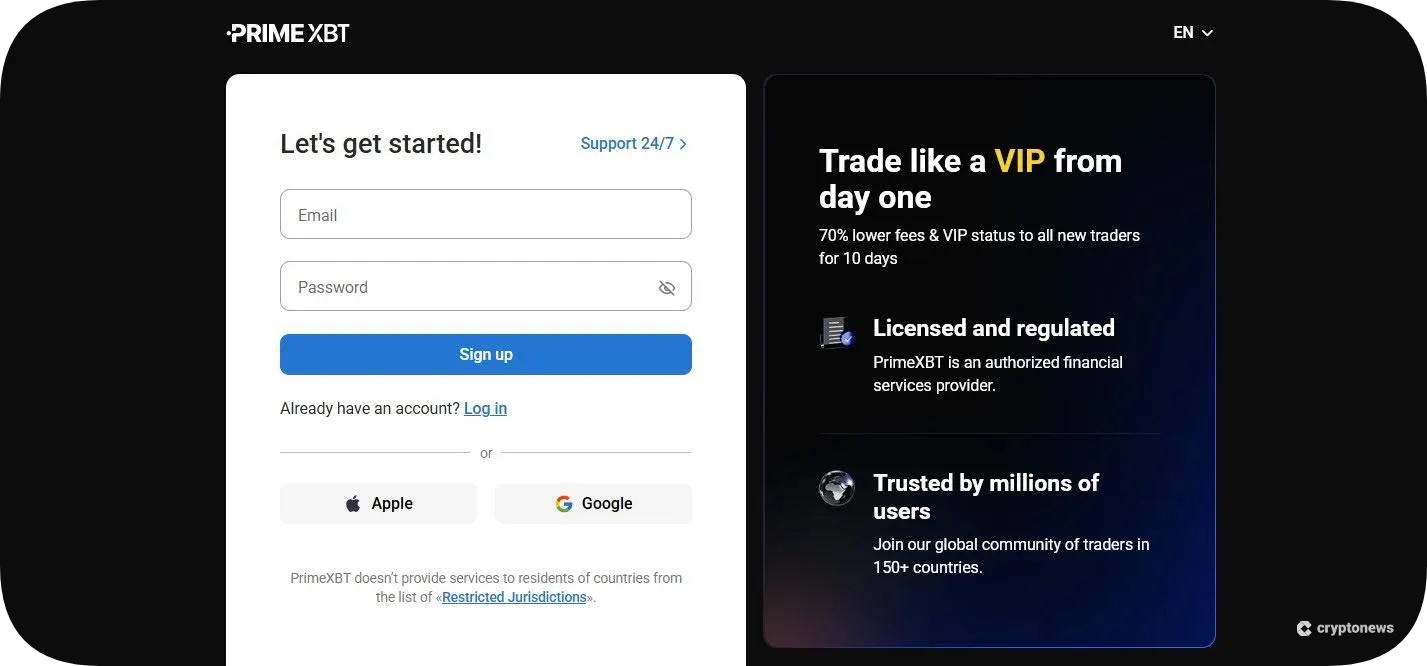

Step 1. Visit PrimeXBT

Tap the Register button, located in the upper right corner of the screen. Enter your email address and password and tap the Sign up button. You can also create an account using your Apple ID or Google account. Open your email and click on the verification code to activate your account.

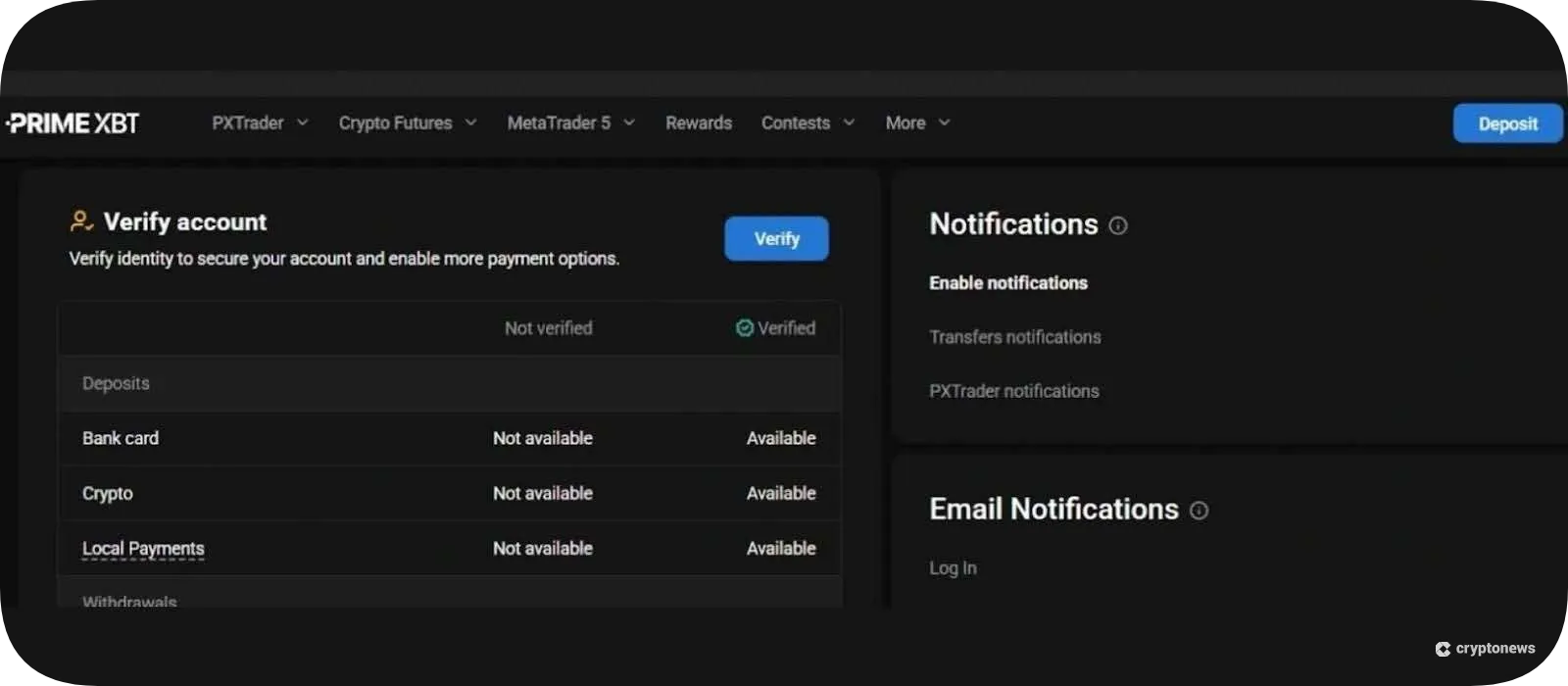

Step 2. Verify Your Account

Enter your account, tap the Verify button, and complete the verification form. Enter your first and last name, address, date of birth, and select your country. You must also upload a photo of your government-issued ID.

Step 3. Make a Deposit

Tap the Deposit button, select your preferred bank, and enter the amount you wish to deposit. ZAR deposits will be automatically converted to USD.

How Are Crypto Profits Taxed in South Africa?

In South Africa, crypto is not recognized as legal tender. It’s classified as an asset or trading stock. This means that crypto profits are taxed as capital gains or income tax, depending on the nature of the transaction.

If you hold, trade, or sell digital assets for a profit, SARS will treat that profit as a capital gain, subject to capital tax. On that note, the first R40,000 of annual gains is exempt from tax. However, if you make a capital gain above R40,000, the remaining gains will be multiplied by 40%. The maximum effective tax rate on gains exceeding R40,000 stands at 18%.

Profits gained through mining, staking, DeFi investments, and airdrops are subject to income tax that ranges between 18% and 45%, depending on the total income. The same rule applies to receiving crypto as payment.

Here are the personal income tax brackets for the 2025/26 tax year:

| Taxable Income (ZAR) | Tax Rate |

| 0 – 237,100 | 18% |

| 237,101 – 370,500 | 26% |

| 370,501 – 512,800 | 31% |

| 512,801 – 673,000 | 36% |

| 673,001 – 857,900 | 39% |

| 857,901 – 1,817,000 | 41% |

| 1,817,001 and above | 45% |

Keep in mind that legal entities are subject to different taxation rules. That said, legal entities won’t receive the annual R40,000 exclusion, while the standard corporate income tax stands at 27%. If legal entities make capital gains from cryptocurrencies, they’ll be subject to an inclusion rate of 80% (80% of the profits will be considered taxable). The effective tax rate in this case will be 21.6%.

All crypto income and losses must be reported to the South African Revenue Service (SARS).

Conclusion – What is the Best Crypto Exchange in South Africa?

In our book, the best SA crypto exchange must be licensed by the FSCA to enable you to trade crypto safely. It must also support direct ZAR deposits and withdrawals, which eliminates conversion fees. Other features that make a good crypto exchange include support for a wide range of coins and tokens and trading services, advanced security, and a user-friendly interface.

Based on our research, PrimeXBT has all the necessary elements to secure the number one spot on our list. First, this is an FSCA-licensed platform. Secondly, it supports direct ZAR deposits and withdrawals. And lastly, PrimeXBT is partnered with well-known SA banks, such as Absa, Nedbank, and Investec, meaning you can make deposits using your local bank and credit/debit cards.

Visit PrimeXBTFAQs

How do I cash out crypto in South Africa?

Is VALR or Luno better?

What happened to Berry exchange?

Can South Africans use Coinbase?

Is Binance legal in South Africa?

Can I deposit ZAR into Binance?

References

- Fireblocks

- Financial Sector Conduct Authority (FSCA)

- Financial Intelligence Center (FIC)

- South African Reserve Bank (SARB)

- South African Revenue Services (SARS)

- List of crypto asset service providers (CASPs) (FSCA)

- Crypto Hacks Soar to $1.63 Billion in Q1 2025, Bybit and Phemex Among Biggest Targets (CoinMarketCap)

About Cryptonews

Our goal is to offer a comprehensive and objective perspective on the cryptocurrency market, enabling our readers to make informed decisions in this ever-changing landscape.

Our editorial team of more than 70 crypto professionals works to maintain the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re looking for breaking news, expert opinions, or market insights, Cryptonews has been your go-to destination for everything cryptocurrency since 2017.