Top 10 Crypto On-Ramp Platforms for 2026

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships. However, this potential compensation never influences our analysis, opinions, or reviews. Our editorial content is created independently of our marketing partnerships, and our ratings are based solely on our established evaluation criteria. Read More

Fiat on-ramp providers allow investors to purchase cryptocurrencies with local payment methods. They typically connect with exchanges and wallets, although some providers offer standalone services. We found that Best Wallet is the overall best crypto on-ramp, while Binance and MEXC represent viable alternatives.

To identify reputable on-ramp partners, we tested 15+ providers in great detail. The team evaluated the most important factors for crypto investors, including available payment methods and currencies, supported digital assets, processing fees, and average settlement times.

Read on to explore our findings, where we rank and review the top 10 crypto on-ramps for 2026.

- In This Article

-

- 1. Best Wallet: the Overall Best Fiat on-Ramp for Crypto

- 2. Binance: Best Fiat on-Ramp Exchange for Experienced Traders

- 3. Mexc: Best on-Ramp Platform for Crypto Diversification

- 4. Okx: Best on-Ramp for U.s. Clients Using ACH

- 5. Margex: Best Bitcoin on-Ramp for Small Purchase Amounts

- 6. Blofin: Best Crypto on-Ramp for Instant USDT Purchases

- 7. Moonpay: Best on-Ramp Service for GBP and EUR Payments

- 8. Coinbase Onramp: Best Crypto on-Ramp for Verified Decentralized Ecosystems

- 9. Onramper: Best on-Ramp Provider for B2b Clients

- 10. Ramp Network: Best Crypto on-Ramp for Mobile Investors

- In This Article

-

- 1. Best Wallet: the Overall Best Fiat on-Ramp for Crypto

- 2. Binance: Best Fiat on-Ramp Exchange for Experienced Traders

- 3. Mexc: Best on-Ramp Platform for Crypto Diversification

- 4. Okx: Best on-Ramp for U.s. Clients Using ACH

- 5. Margex: Best Bitcoin on-Ramp for Small Purchase Amounts

- 6. Blofin: Best Crypto on-Ramp for Instant USDT Purchases

- 7. Moonpay: Best on-Ramp Service for GBP and EUR Payments

- 8. Coinbase Onramp: Best Crypto on-Ramp for Verified Decentralized Ecosystems

- 9. Onramper: Best on-Ramp Provider for B2b Clients

- 10. Ramp Network: Best Crypto on-Ramp for Mobile Investors

- Show Full Guide

What Are the Best Fiat on-Ramps for Crypto?

According to our research, Best Wallet, Binance, and MEXC are the best crypto on-ramps. Here are the top providers compared by core metrics:

| On-Ramp Platform | Supported Cryptos | Supported Fiat Currencies | Available Payment Methods | Fees |

|---|---|---|---|---|

| Best Wallet | 1,000+ | 20+ | Visa, MasterCard, American Express, PayPal, Skrill, Google/Apple Pay, Neteller, and more | Sources real-time exchange rates from partnered gateways |

| Binance | 430+ | 95+ | Varies by country. Options include Visa, MasterCard, Google/Apple Pay, and bank transfers | Card and e-wallet payments average 2%. |

| MEXC | 4,200+ | 100+ | Visa, MasterCard, American Express, PayPal, Payeer, Airtm, Payoneer, and more | Depends on the currency, but often starts from 1% above the spot price |

| OKX | 300+ | 100+ | ACH, Google/Apple Pay, Visa, MasterCard, SEPA, iDEAL, SWIFT, and more | Free for ACH, and approximately 2–3% on instant payment methods |

| Margex | 55+ | 5 | Visa, MasterCard, Google/Apple Pay, Revolut, Paysafe Card, AstroPay, Skrill, and more | Ranges from 1% to 5% depending on the asset, pair, and gateway provider |

| BloFin | 460+ | 85 | Visa, MasterCard, Google/Apple Pay, SEPA, SWIFT, and more | Typically under 2% on debit/credit card purchases |

| MoonPay | 170+ | 34+ | Visa, MasterCard, American Express, PayPal, Skrill, Google/Apple Pay, SEPA, Open Banking, and more | Free deposits for UK and EU customers, and a 0–2% ecosystem fee |

| Coinbase Onramp | 250+ | 60+ | Visa, MasterCard, PayPal, Google/Apple Pay, and Coinbase Account Balance | Wallets and dApps include fees in the final quote. Average spreads of 3-5% |

| Onramper | Depends on the partnered exchange or wallet | 175+ | Visa, MasterCard, PayPal, Skrill, Google/Apple Pay, Neteller, Venmo, and more | Determined by each partner |

| Ramp Network | 100+ | 40+ | Visa, MasterCard, Google/Apple Pay, PIX, and Easy Bank Transfers | Between 1.4% and 5.45% (€2.49 minimum), depending on the payment method and currency |

The Best Crypto on-Ramps: Full Reviews

Investors compare on-ramp services by preferred currency and deposit method, supported cryptocurrencies, and fees. The following platform reviews discuss these factors and more. Discover the best on-ramp crypto provider for you.

1. Best Wallet: the Overall Best Fiat on-Ramp for Crypto

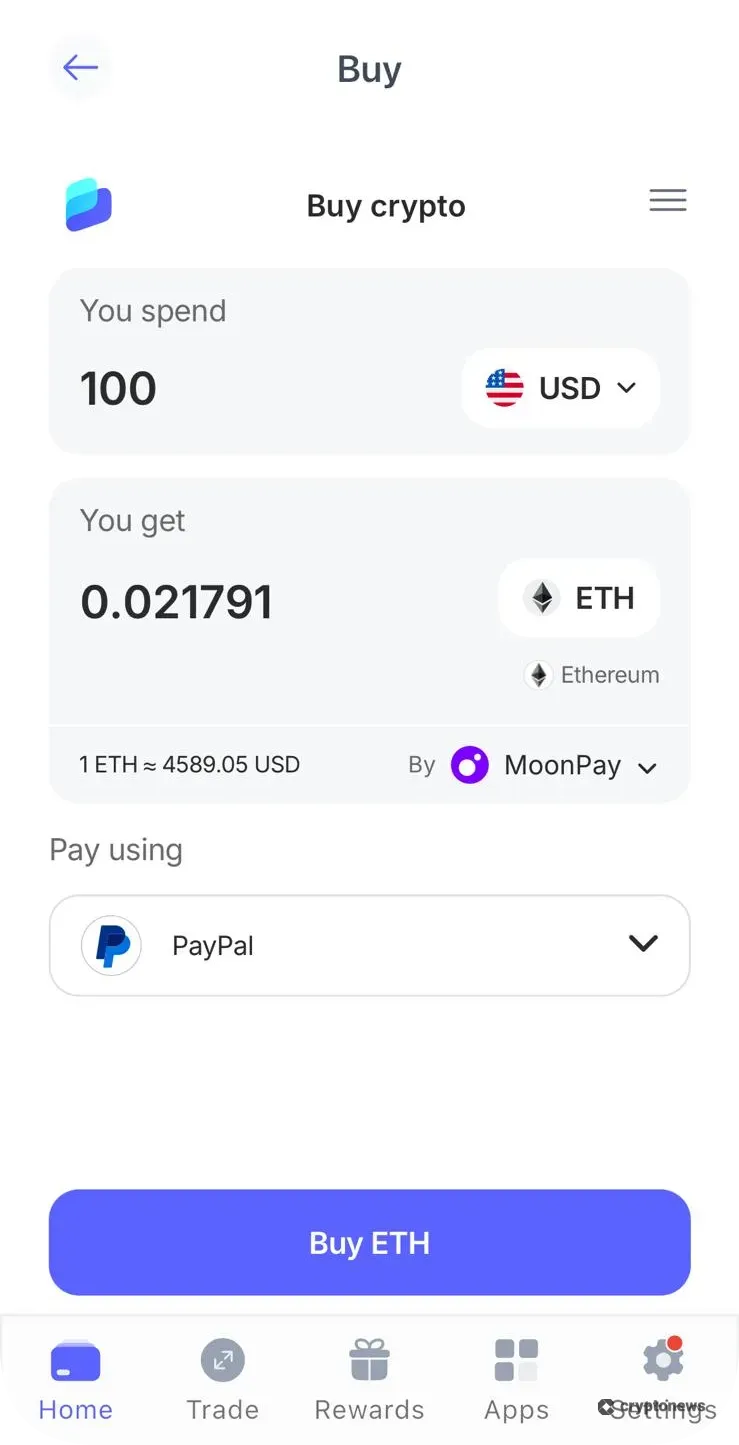

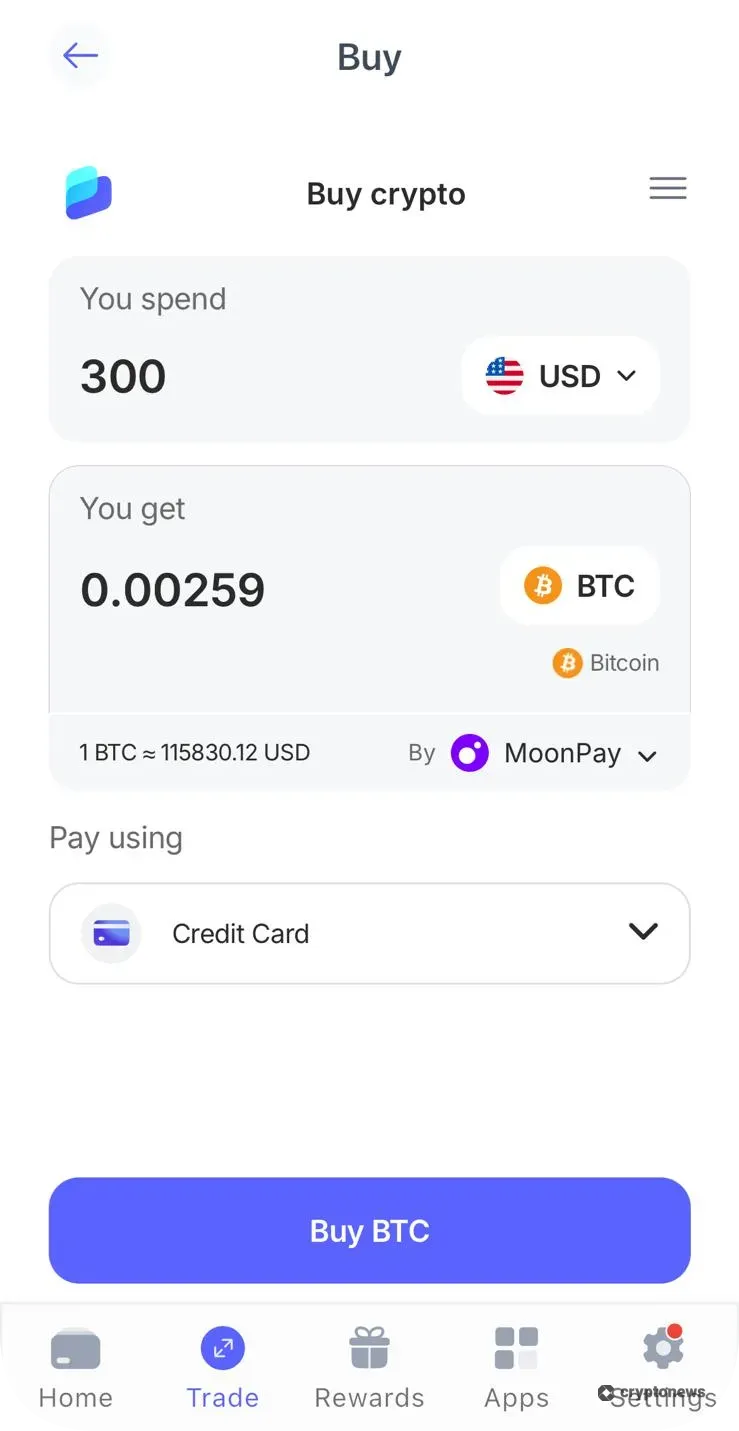

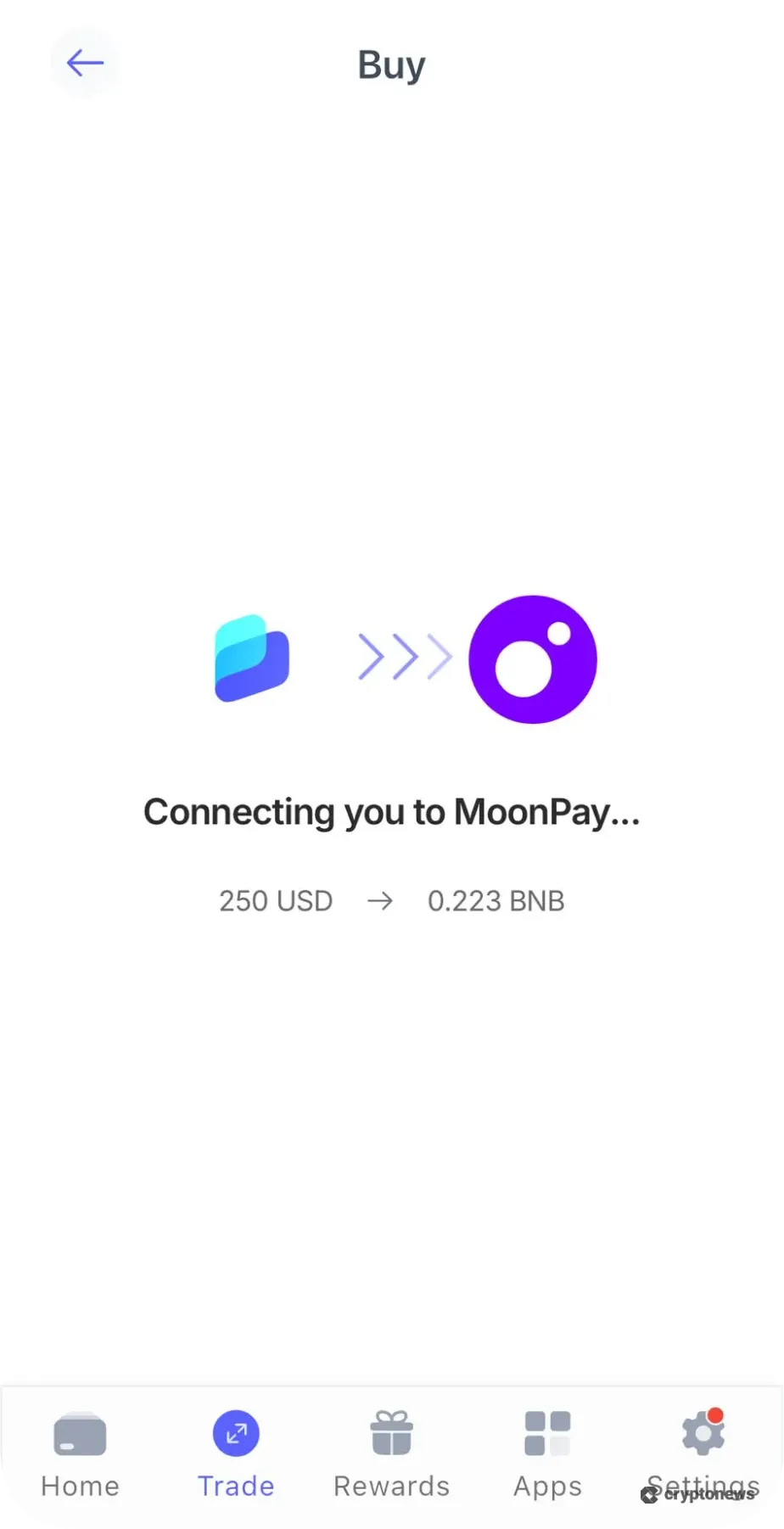

Our research shows that Best Wallet provides the overall best on-ramp service to invest in cryptocurrencies. Rather than rely on one on-ramp partner, the non-custodial wallet connects with multiple fiat gateways. This dynamic ensures users get the most competitive exchange rates and access to the widest selection of payment methods.

Partnered gateways include Banxa, Moonpay, Topper, Onramper, and Ramp Network. These providers support dozens of currencies across debit/credit cards and e-wallets like PayPal, Neteller, and Google/Apple Pay. Once investors input the trade parameters, Best Wallet displays the best-price offers almost instantly.

In terms of assets, Best Wallet supports the best cryptocurrencies to buy on over 60 networks. From Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) to BNB (BNB) and Polygon (POL), users diversify into the hottest markets in a decentralized environment. The Best Wallet app ensures safety through encrypted payment data, biometrics, and two-factor authentication.

Best Wallet Key Features

- A safe and private non-custodial wallet that connects with multiple on-ramp providers

- Always secure the best exchange rates based on trading parameters

- Gateways automatically deposit purchased crypto assets to the wallet address

- The overall best crypto on-ramp for 2026

- Buy digital assets instantly in a non-custodial ecosystem

- Automatically connect with the best-priced fiat gateway to save fees

- Access thousands of additional assets via the built-in decentralized exchange (DEX)

- Users enjoy an anonymous trading experience with strong security measures

- Currently only available as an iOS and Android app

- Limit orders and dollar-cost averaging launch later in the development roadmap

2. Binance: Best Fiat on-Ramp Exchange for Experienced Traders

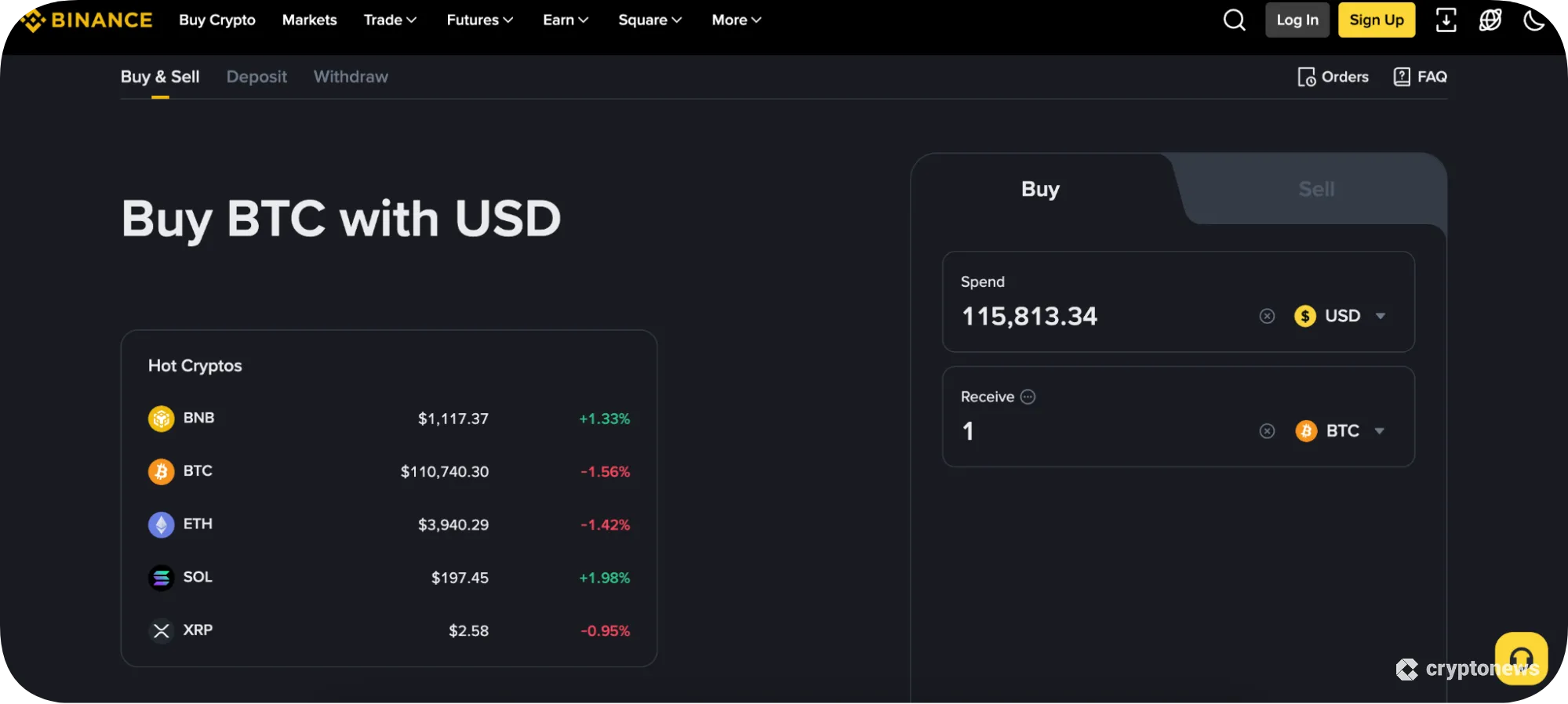

Due to regional regulatory restrictions, Binance relies on fiat on-ramp providers in many places. The most common payment methods include debit/credit cards by Visa and MasterCard, as well as e-wallet payments via Google/Apple Pay. Select nationalities, including most of Europe, also deposit funds on the SEPA banking network.

While gateways determine fees, we found that card and e-wallet purchases average 2%. Those living in countries without an available on-ramp use Binance’s peer-to-peer (P2P) exchange, which supports hundreds of additional payment methods.

As the on-ramp feature connects with the main Binance spot exchange, account holders access over 430 coins and tokens. Markets include the best meme coins to buy, such as Pepe (PEPE), Floki (FLOKI), and Dogecoin (DOGE). Please note that Binance requires all customers to complete Know Your Customer (KYC) verification before using fiat services.

Binance Key Features

- Invest in over 430 cryptocurrencies with instant payment methods

- The P2P platform serves investors without direct on-ramp support

- Funded accounts trade on the world’s biggest exchange for liquidity

- Instant purchase methods include Google/Apple Pay and debit/credit cards

- Trusted exchange with over 295 million registered users

- The trading platform supports hundreds of spot and derivative markets

- Available on browsers, desktop software, and mobile apps

- Direct on-ramp facilities are unavailable in some countries

- The exchange has mandatory KYC requirements

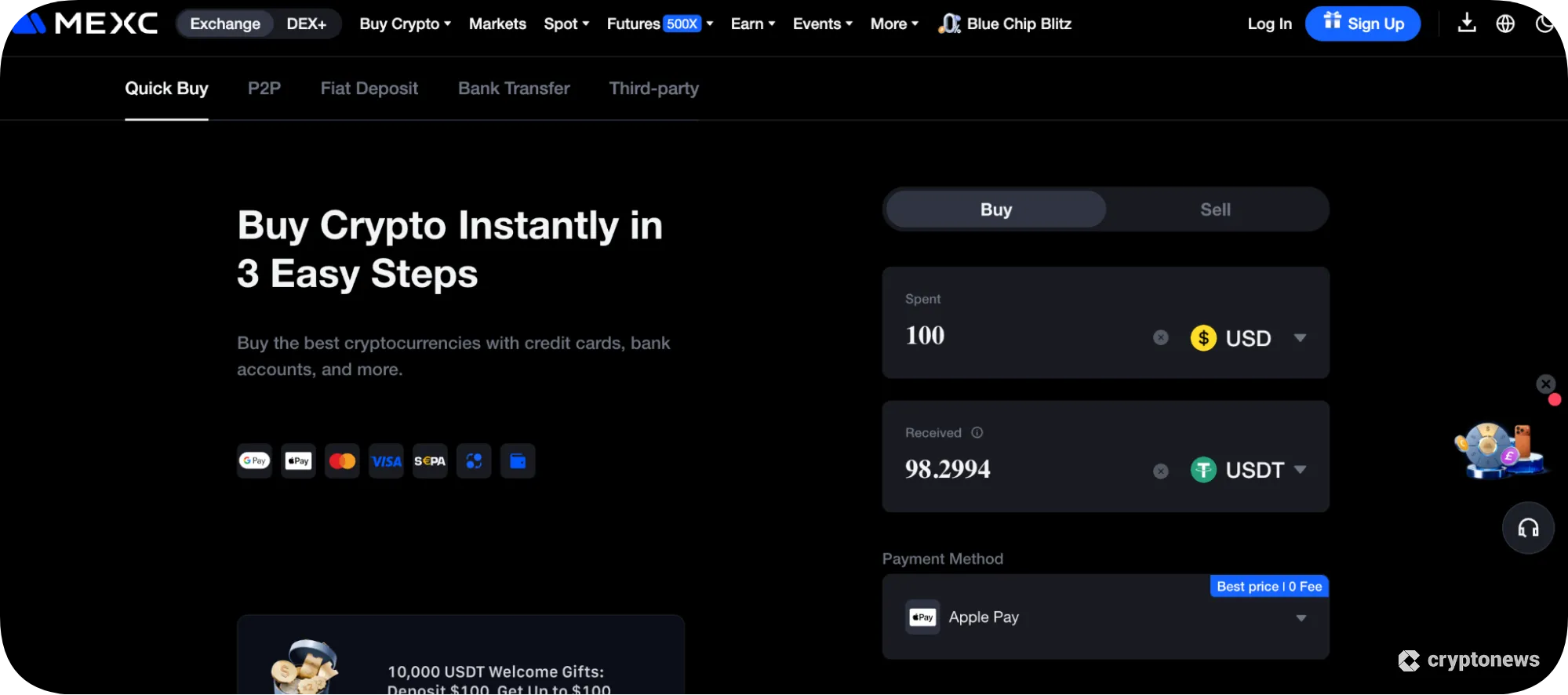

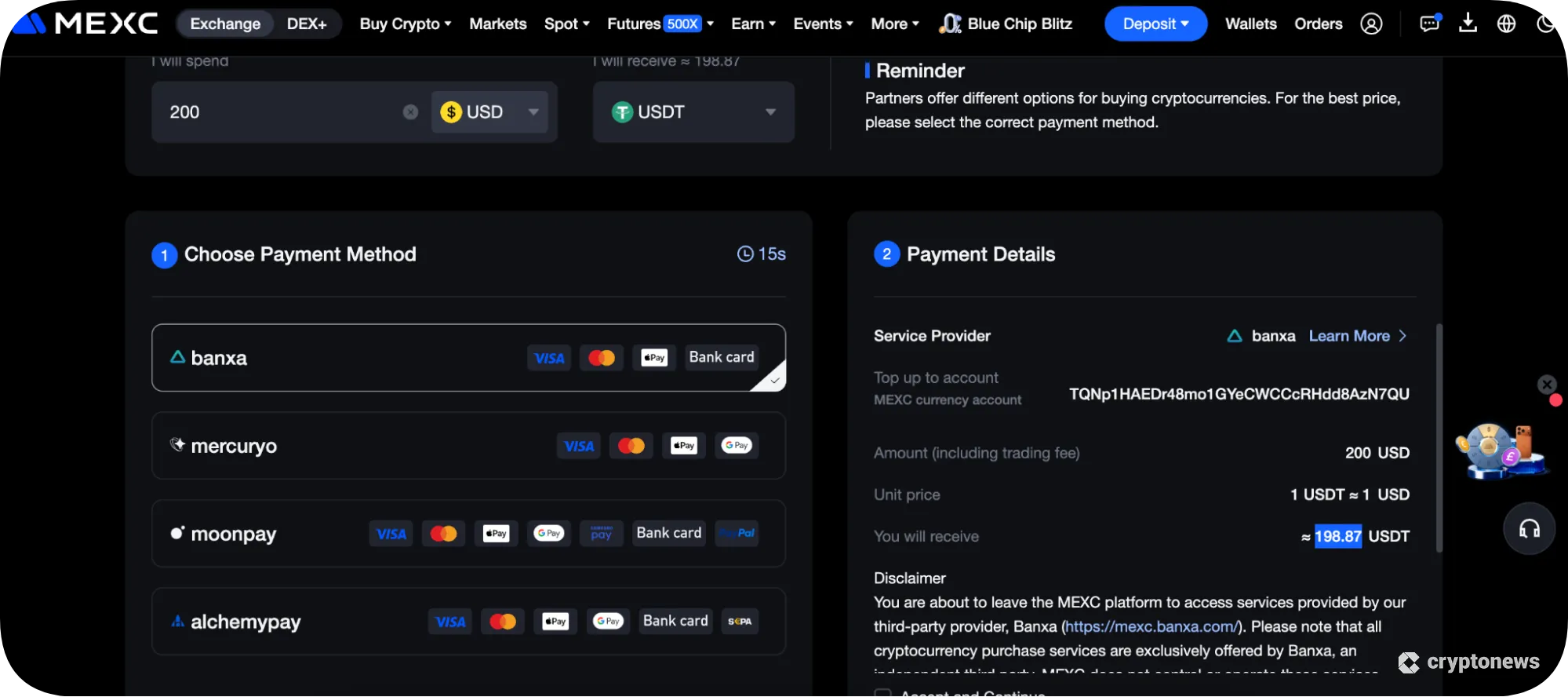

3. Mexc: Best on-Ramp Platform for Crypto Diversification

MEXC ranks as one of the best crypto exchanges for asset diversification. While the fiat service supports just 11 digital assets, the spot exchange lists over 4,200 cryptocurrencies. To access these extensive trading markets, users purchase Tether (USDT) and trade the stablecoin for their preferred coin or token.

KYC-verified traders use Visa, MasterCard, and Google/Apple Pay, which MEXC processes directly. Users incur competitive fees that average 1% above the spot price. The exchange also partners with third-party on-ramp providers like MoonPay, which support a much larger range of payment options. Additional methods include PayPal, Payeer, Airtm, and American Express.

Once platform users fund their accounts, they access one of the best-priced crypto exchanges in the market. MEXC spot commissions are 0% and 0.05% for makers and takers, while futures traders pay 0.01% and 0.04%, respectively. MEXC adjusts its fee schedule to reflect platform conditions, yet it typically beats most industry competitors.

MEXC Key Features

- Direct fiat payments average 1% above the global spot price

- Buy cryptocurrencies with over 100 local currencies

- Offers a huge selection of digital asset markets

- The best crypto on-ramp exchange to build diversified portfolios

- The spot trading platform offers more than 4,200 assets

- Competitive spreads when using MEXC’s direct fiat service

- Third-party processors offer additional deposit methods like Payeer and Airtm

- External gateway providers charge higher fees

- The quick buy feature supports just 11 crypto options

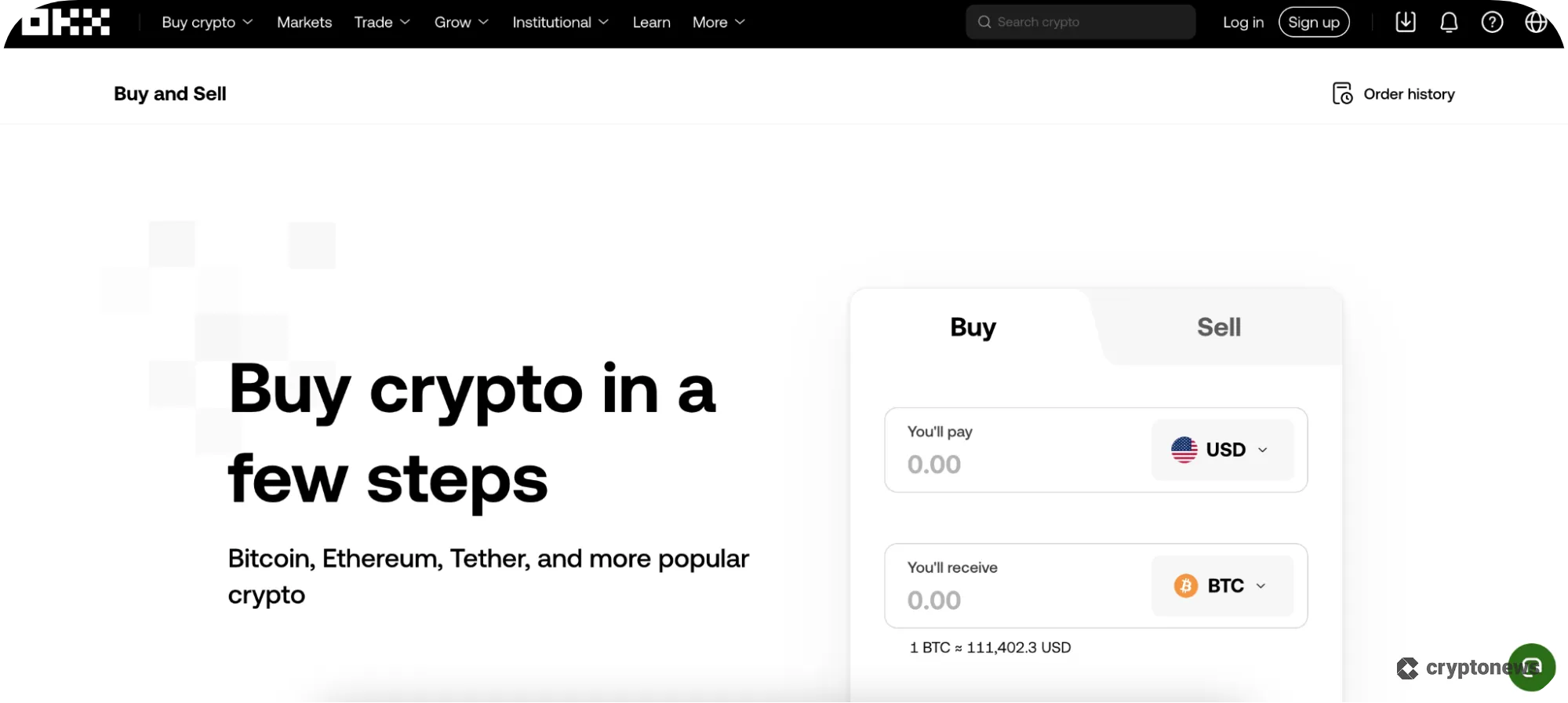

4. Okx: Best on-Ramp for U.s. Clients Using ACH

We found that OKX is the best option for U.S. clients who prefer depositing US dollars via traditional ACH payments. The Tier 1 exchange, which holds full U.S. licensing, credits ACH deposits instantly, so users avoid the standard 2–3 business day timeframe. While users cannot withdraw assets until the payment clears, they purchase cryptocurrencies right away.

OKX offers high transaction limits on ACH deposits without hidden costs. It also supports other instant payment types like credit and debit cards, PayPal, and Google/Apple Pay, yet these methods incur variable charges (2–3% on average).

One drawback is that U.S. traders pay higher fees compared with the global exchange. Makers and takers pay 0.14% and 0.23%, while international traders get 0.1% on both order types. The spot exchange offers USD-denominated pairs, though, which helps U.S. customers avoid stablecoins.

OKX Key Features

- U.S. investors get instant and fee-free ACH deposits

- Trade cryptocurrencies directly against the US dollar

- Offers over 300 markets, including the top altcoins

- Direct US dollar deposits on the ACH network

- Other payment options include PayPal, SEPA, and Google/Apple Pay

- USD-driven crypto pairs eliminate stablecoin requirements

- Backed by a Tier 1 exchange with full U.S. licensing

- U.S. traders pay higher fees than international clients

- No digital asset withdrawals until the ACH payment clears

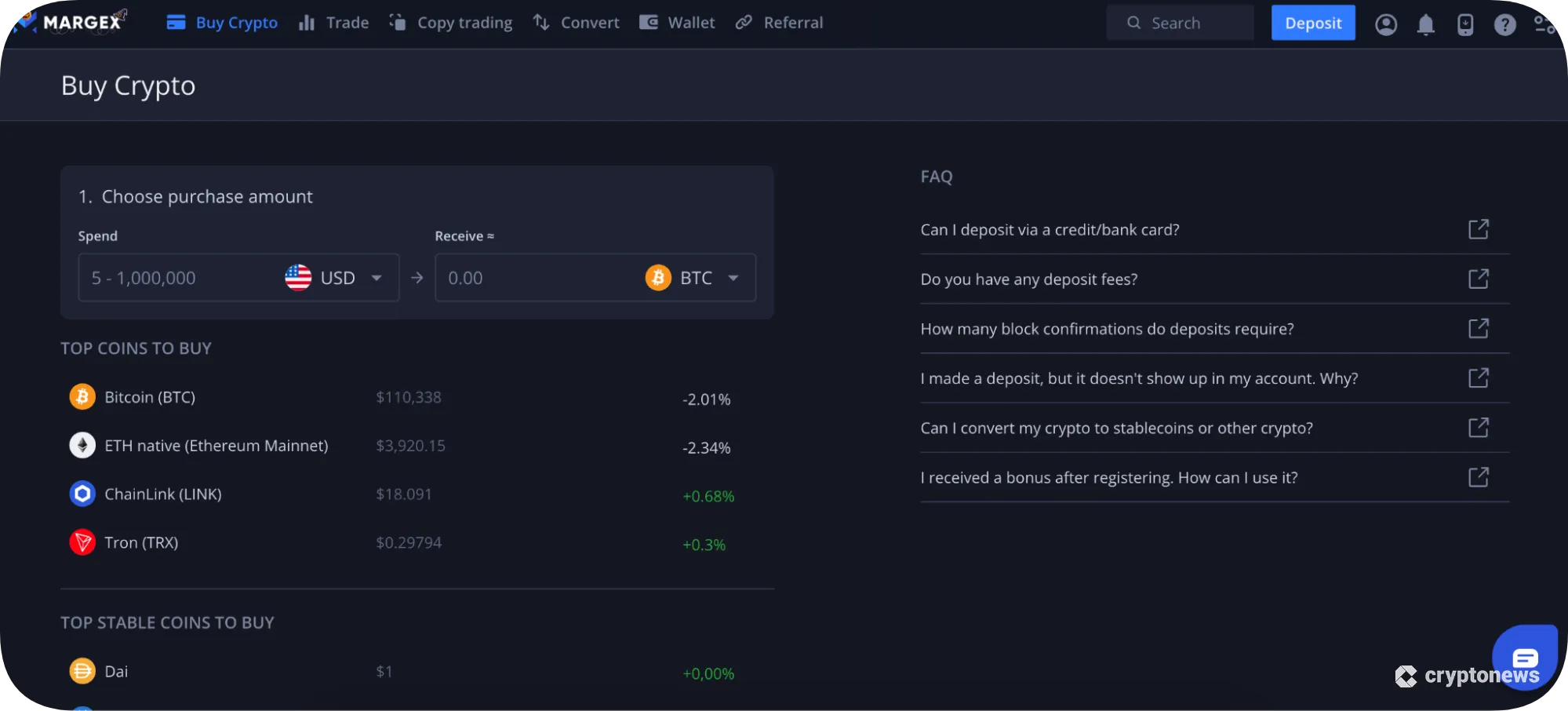

5. Margex: Best Bitcoin on-Ramp for Small Purchase Amounts

Margex is a derivative exchange that also supports real crypto purchases. It partners with over a dozen gateways, which unlocks fiat services for more than 150 payment types. From Revolut and Paysafe Card to debit/credit cards, Neteller, and Skrill, Margex users purchase top digital assets seamlessly.

Investors can buy BTC from just $5 per transaction, which suits those on a budget. Other cryptocurrencies like USDT, ETH, and SOL have slightly higher minimums of $10. Once users input their purchase requirements, Margex displays available gateways and exchange rates. Fees vary widely, as buyers pay anywhere from 1% to 5% above the spot price.

Margex offers several options after users invest in cryptocurrencies. The exchange offers flexible staking accounts with 7% APYs, which include BTC. It also supports over 55 perpetual futures markets with leverage of up to 100x. Alternatively, users may withdraw their digital assets to a private wallet, which Margex processes daily.

Margex Key Features

- The exchange supports over 150 payment methods

- Earn 7% APYs on idle crypto investments without lock-up terms

- Trade perpetual futures with 100x leverage

- Buy Bitcoin from just $5 per transaction

- Purchase options include Paysafe Card, Revolut, Visa, and MasterCard

- Transparent fee structure with instant settlement

- Flexible staking accounts offer generous APYs

- The fiat feature supports just five fiat currencies

- Some payment providers charge up to 5%

- Margex processes wallet withdrawals once per day

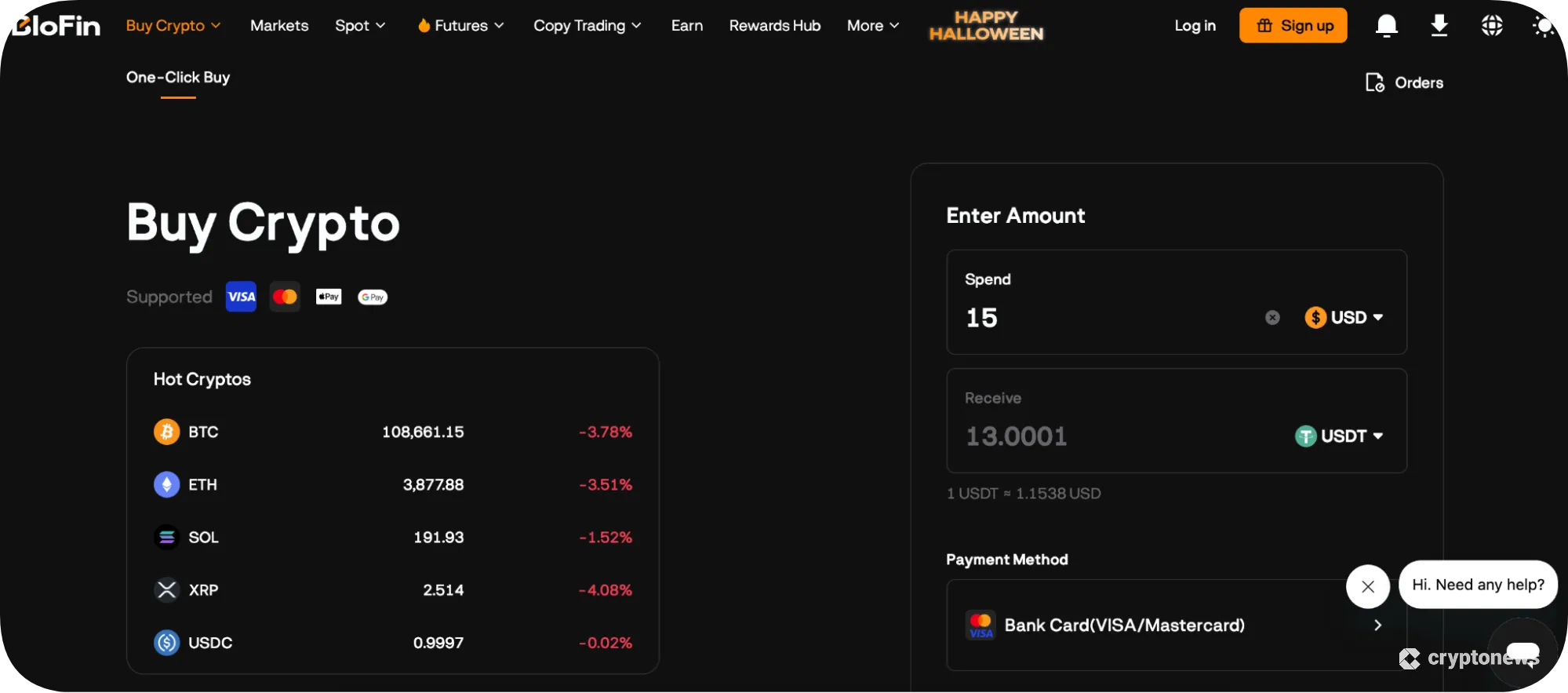

6. Blofin: Best Crypto on-Ramp for Instant USDT Purchases

The BloFin exchange offers a fast and hassle-free way to purchase USDT. The quick buy feature supports instant Visa and MasterCard payments, and fees average just under 2%. The minimum purchase requirement is $15, and users select from over 85 fiat currencies. Through gateway integration, the platform also accepts e-wallets and bank transfers with just a few clicks.

With USDT in the trading account, BloFin users access over 460 coins and tokens. They also trade perpetual futures with inverse and linear settlement, and the maximum leverage available is 150x. Those without prior derivative experience use the copy trading feature. It allows investors to copy successful traders through profit-sharing agreements.

We also rate BloFin’s yield products. Platform users earn up to 10% on flexible USDT accounts, which permit instant withdrawals at any time. It also runs promotional rates on select assets, such as 100% on BTC and ETH on seven-day terms. Note that while BloFin accepts US dollar purchases, it does not accept U.S. clients.

Blofin Key Features

- Our top pick for buying USDT with Visa and MasterCard

- Purchase assets in over 85 currencies

- Get 10% yields on stablecoin deposits

- Instant debit/credit card payments for USDT, BTC, and ETH

- The main exchange lists over 460 markets

- A great option to earn competitive APYs with flexible terms

- Offers one of the best mobile trading apps for iOS and Android

- No-KYC accounts allow crypto deposits only

- Wider spot exchange spreads on non-major altcoins

- SEPA deposits take up to two working days

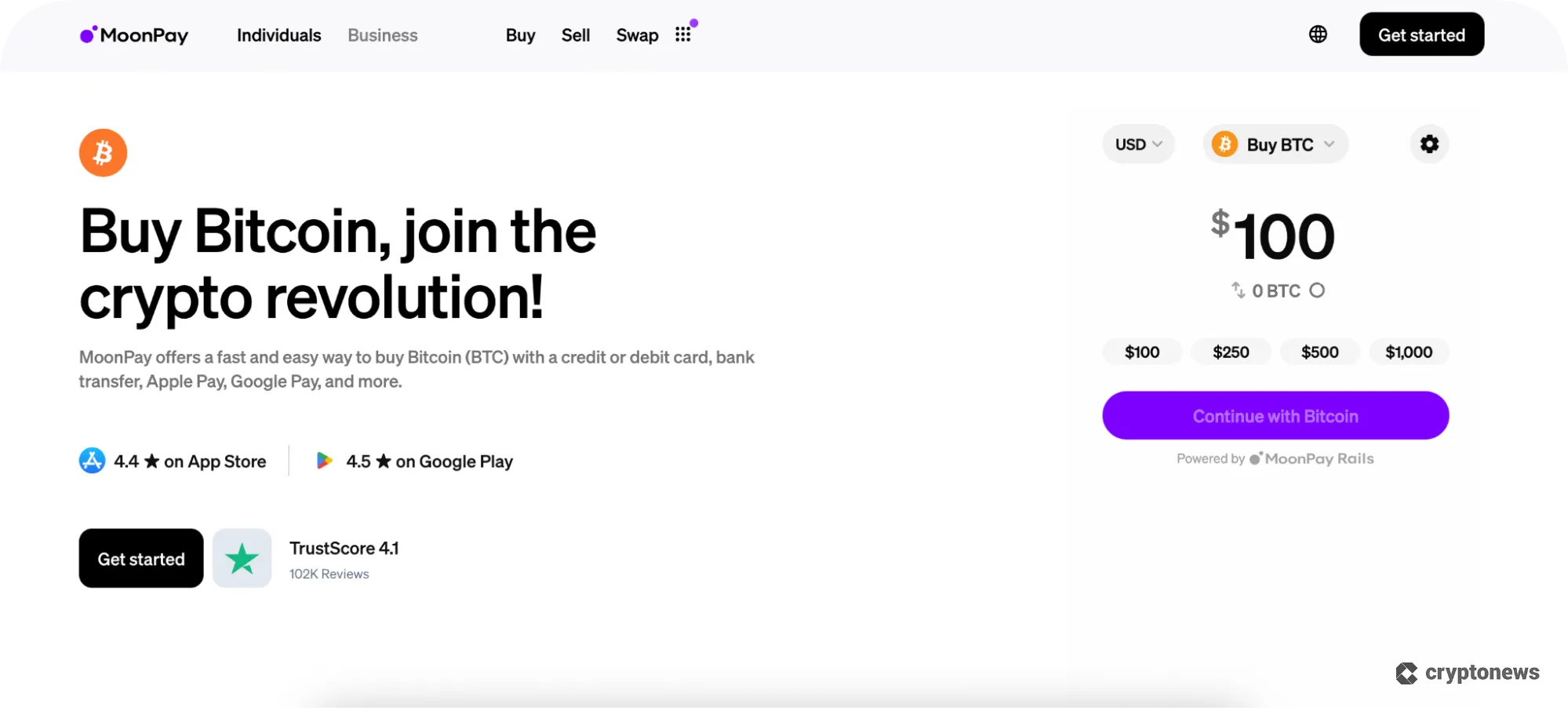

7. Moonpay: Best on-Ramp Service for GBP and EUR Payments

MoonPay is one of the largest fiat on-ramp providers in the crypto sector. It partners with over 100 exchanges and non-custodial wallets, and offers direct services on a native iOS and Android app. The app supports more than 170 digital assets and 34 fiat currencies, including USD, BRL, HKD, AUD, and MXN.

Investors who use GBP or EUR receive the best deal, as they are eligible for a MoonPay Balance. The service offers free and instant deposits through SEPA and Open Banking. Once users top up their accounts, they can buy and sell cryptocurrencies with ecosystem fees ranging from 0% to 2%, depending on the pair.

The MoonPay app, which has excellent ratings on Google Play and the App Store, also enables fiat off-ramp tools. Verified users sell crypto for fiat money and withdraw the proceeds to a bank account. Instant token swaps are available, too. Traders swap assets across different network standards without needing a centralized exchange account.

Moonpay Key Features

- Deposit GBP and EUR without paying transaction fees

- Choose from over 170 popular cryptocurrencies

- Cash out cryptocurrencies through local bank transfers

- Beginner-friendly app that supports over 34 fiat currencies

- UK and EU clients get fee-free and instant bank deposits

- Robust security and excellent user ratings

- Ecosystem fees of up to 2% on non-major assets

- Non-GBP and EUR payments incur higher commissions

- The app is too basic for advanced crypto traders

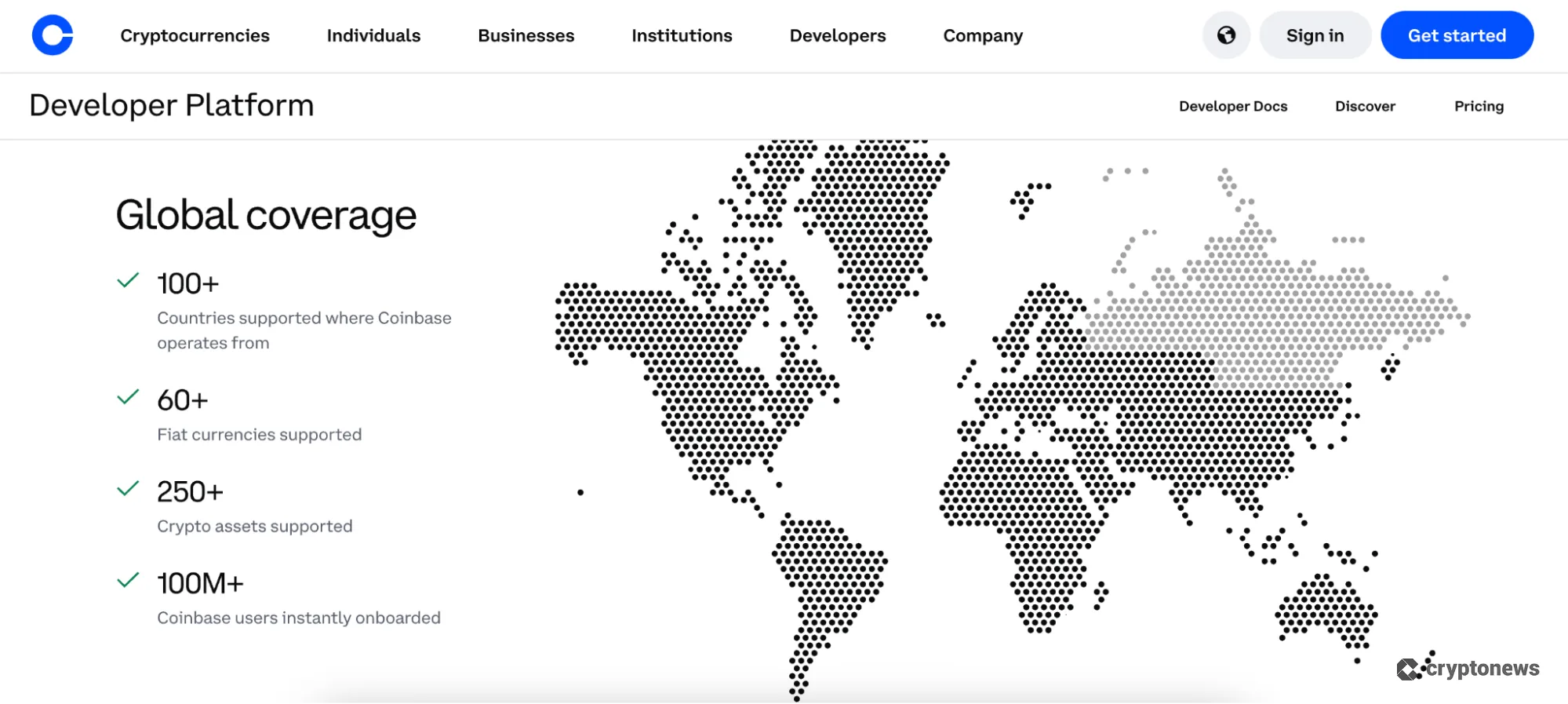

8. Coinbase Onramp: Best Crypto on-Ramp for Verified Decentralized Ecosystems

Coinbase Onramp operates separately from the main Coinbase exchange. It provides fiat payment services on third-party platforms, which include non-custodial wallets and decentralized applications (dApps). Popular partners include Phantom, Trust Wallet, MetaMask, and Uniswap.

The service enables users to buy cryptocurrencies using over 60 traditional currencies. Deposit methods include Visa, MasterCard, Google Pay, Apple Pay, and PayPal. Verified Coinbase users also connect their exchange account to the on-ramp tool without paying additional fees.

While Coinbase Onramp offers fee-free USDC purchases on the Base network, other assets and blockchains incur commissions. Each partner gets custom, non-public fee schedules, which they include in exchange rate quotes. Our research found that fees average 3-5% across most payment options.

Coinbase Key Features

- Provides off-ramp services to decentralized finance wallets and applications

- Supports traditional payment methods and Coinbase account balances

- No fees when users buy USDC on the Base network

- A regulated exchange that ensures safety and regulatory compliance

- Easily add funds to self-custodial wallets and dApp protocols

- Available in over 100 countries and 60 fiat currencies

- Non-public fees average 3-5% per transaction

- Strict KYC requirements are more cumbersome than other on-ramps

- The provider does not accept American Express payments

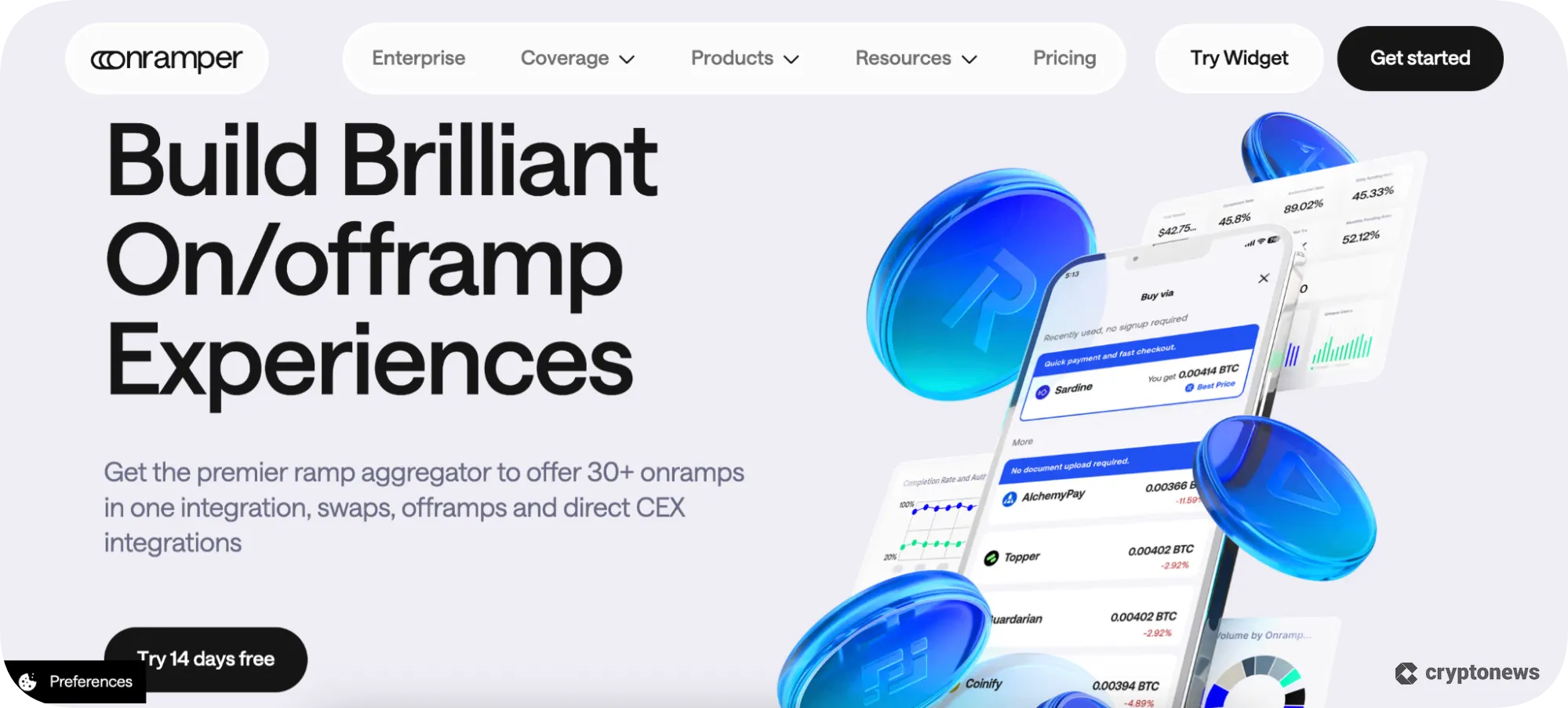

9. Onramper: Best on-Ramp Provider for B2b Clients

Onramper serves business-to-business (B2B) clients, which means end users cannot buy cryptocurrencies directly. It partners with some of the biggest names in crypto, including Gate.io, Coinbase Wallet, and Kraken, as well as Pump.fun, Exodus, and Bitpanda. Retail traders on these major platforms buy digital assets with over 175 payment methods.

U.S. deposit types include Venmo and ACH, while Asian clients typically use 7-Eleven, Alipay, and GrabPay. Popular international methods, such as debit/credit card, PayPal, and Skrill, are also available.

Although Onramper provides bespoke pricing for each client, it integrates with over 30 external on-ramp services. This, along with its smart routing feature, ensures that traders receive the most competitive exchange rates.

Onramper Key Features

- The best on-ramp crypto service for B2B partners

- Notable users include Phantom, Kraken, and Exodus

- The gateway supports over 175 payment methods

- Integrates with over 30 processors to secure competitive quotes

- Offers on-ramp, off-ramp, and swap services

- The provider does not directly serve retail clients

- Only premium plans unlock full functionality

- Lacks a consistent KYC framework

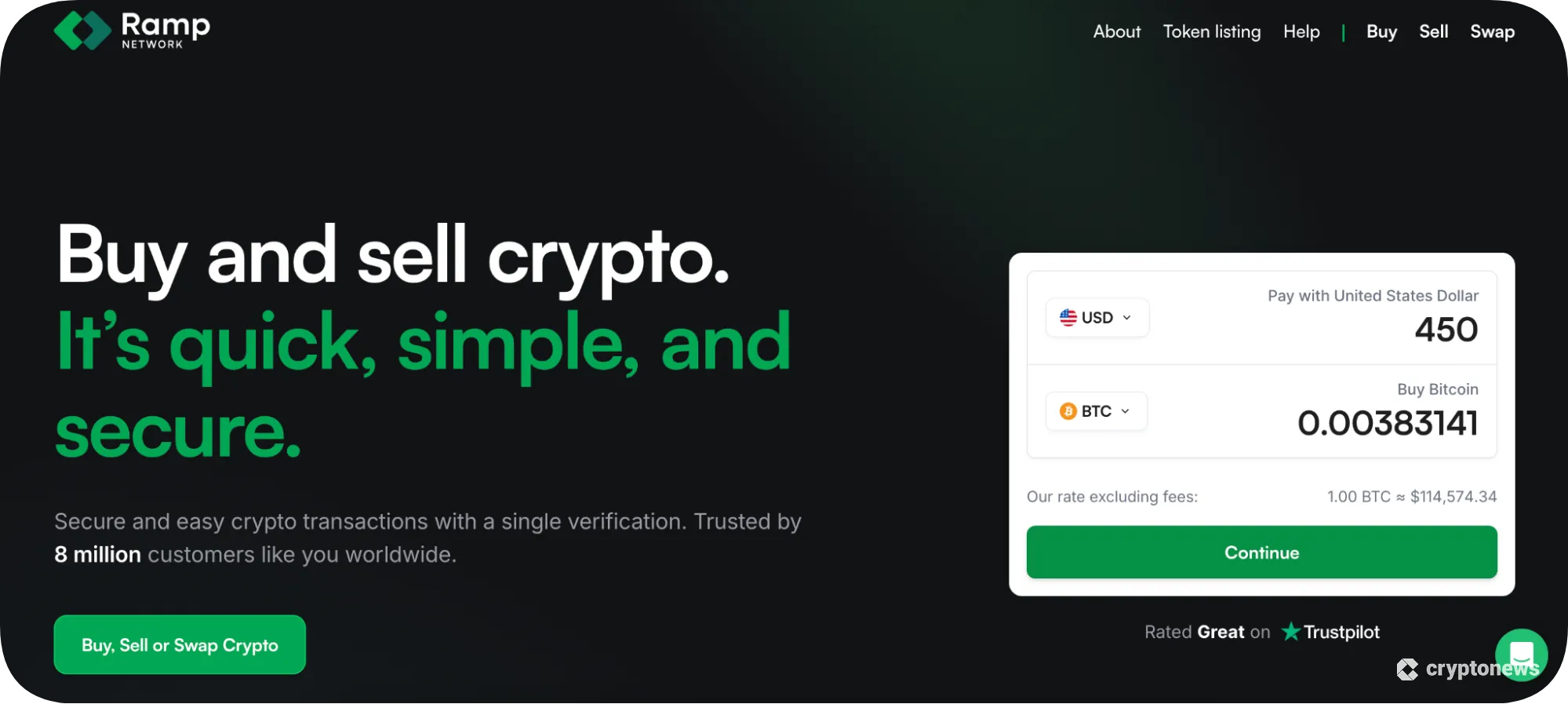

10. Ramp Network: Best Crypto on-Ramp for Mobile Investors

Ramp Network offers a popular iOS and Android app to over 8 million users. It supports over 100 cryptocurrencies and 40 fiat currencies. Besides its direct on-ramp service, it also serves the best crypto wallets like Trust Wallet, MetaMask, and Exodus.

Available purchase methods include debit/credit cards by Visa and MasterCard, Google/Apple Pay, PIX, and UK/EU bank transfers. Apart from bank payments (usually 10–20 minutes), the app processes crypto purchases instantly.

Unlike many fiat on-ramp providers, Ramp Network has a clear pricing structure for each payment method and currency. Card and e-wallet payments in USD, EUR, and GBP cost 3.9%, while other currencies are more expensive at 5.45%. Manual bank transfers provide the cheapest solution at 1.4%. Note that all methods carry a minimum transaction fee of €2.49.

Ramp Network Key Features

- More than 8 million investors use the mobile trading app

- The mobile ecosystem lists over 100 assets

- Place orders in over 40 local currencies

- The gateway provider is registered in the US, the UK, and Ireland

- Transparent fees for all supported deposit types

- Cards issued in non-major currencies incur a 5.45% fee

- Charges a minimum commission of €2.49 on small purchases

- Additional spreads apply when using Ramp Network on third-party platforms

What is a Crypto on-Ramp?

Crypto on-ramps bridge the gap between digital assets and real-world currencies like USD, EUR, and GBP. They help investors buy cryptocurrencies with traditional money through user-friendly interfaces. The most commonly accepted deposit options include Visa and MasterCard, as well as e-wallets such as PayPal, Skrill, and Google Pay and Apple Pay.

Most on-ramp providers serve third-party clients like crypto exchanges, derivative platforms, and non-custodial wallets. This framework enables stakeholders to process fiat payments for their platform users, since they lack the required licensing to accept direct deposits. Certain on-ramps like MoonPay and Ramp Network also facilitate fiat-to-crypto swaps for end users.

How to Choose a Crypto on-Ramp Platform?

While on-ramp gateways offer similar services, each differs in available assets, supported payment methods and currencies, KYC requirements, and other core factors.

Consider these metrics when choosing the best crypto on-ramp for you.

Check the Supported Cryptocurrencies

Evaluate whether the on-ramp supports your preferred digital assets before you proceed. Our research found that some providers, particularly exchanges, support fewer coins and tokens compared with their main trading platforms.

Margex is one example. It allows users to buy 11 cryptocurrencies using instant payment methods, while its primary spot exchange supports an additional 4,200 markets. Many users purchase USDT to access these markets, as over 95% of pairs contain the stablecoin.

Verify the Available Fiat Currencies and Payment Methods

We recommend using an on-ramp platform that supports your local currency. Otherwise, foreign exchange (FX) fees apply, which typically average 3-5%. These FX charges are in addition to standard payment fees.

Exploring available payment methods is also essential. Debit/credit cards and e-wallets are the most convenient options, while SEPA, ACH, and other banking networks are often the cheapest.

Assess Security Features

Since on-ramp companies provide fiat services, they typically hold the correct licenses, consumer protections (e.g., honoring chargeback requests), and strong security controls. Users should assess these safety measures independently.

Remember that exchanges and wallets often rely on on-ramp gateways to complete KYC checks. We recommend that users evaluate the provider’s ID verification policy and determine whether it shares personal information with its partners.

Compare Fees

Buying and selling cryptocurrencies through fiat on-ramps can be costly. Some providers lack transparent fee schedules, as they include commissions and spreads in the final quote. Ramp Network, which publishes prices publicly, charges 5.45% on debit/credit cards made in currencies other than EUR, USD, and GBP.

In contrast, we found that Best Wallet sources the best fees in the market. It partners with dozens of fiat partners to ensure users get competitive exchange rates for their currency and payment method.

MEXC offers reasonable prices on direct debit/credit card purchases, as spreads average 1% above the spot price.

What Are the Different Types of Fiat on-Ramps?

Fiat-on ramp accessibility ranges from exchanges and wallets to P2P platforms and direct services. Learn more about each type to make an informed decision.

Centralized Crypto Exchanges: Best for Active Crypto Traders

Most crypto exchanges use on-ramp providers, even regulated platforms with direct banking relationships. Binance, for example, allows direct SEPA bank transfers, while it relies on third-party gateways for debit/credit card and e-wallet purchases.

Exchanges are the best option to access the broader crypto ecosystem with traditional money. Once users fund a Binance account, they trade hundreds of markets in one safe place. Besides its spot exchange, Binance offers crypto derivatives like futures and options.

Visit BinanceCrypto Wallets: Best for Long-Term Investors

Long-term investors prefer non-custodial wallets with built-in gateways. Best Wallet, our top pick, lets users buy cryptocurrencies with fiat money in a decentralized environment.

Partnered on-ramp providers, which include MoonPay and Banxa, deposit purchased assets into the wallet balance automatically. As Best Wallet users hold encrypted private keys, they manage their crypto investments with full autonomy.

Although Best Wallet offers security features like biometrics and two-factor authentication, the safest crypto wallets offer hardware solutions with cold storage. Manufacturers such as Cypherock X1 and Ledger offer on-ramp tools via their native companion apps.

Visit Best WalletSpecialized on-Ramp Platforms

Specialized on-ramps offer direct fiat payment services to retail clients, usually through a native mobile app. MoonPay is one option, which sells over 170 cryptocurrencies in over 34 local currencies.

After a quick KYC process, MoonPay users invest instantly with debit/credit cards and e-wallets. UK and EU clients avoid deposit fees when they use SEPA Instant and Open Banking, respectively. Although MoonPay serves crypto traders directly, it also partners with over 100 exchanges and wallets.

Visit MoonPayP2p Exchanges

P2P platforms offer an alternative way to buy digital assets with local money. They connect buyers with sellers in the same country, which ensures that trades execute in their preferred currency and payment type.

The main perk is that P2P websites support a huge selection of deposit methods. Options often include local bank transfers, mobile payments (e.g., GrabPay), and regional e-wallets, so both parties avoid FX fees. According to our research, the best P2P crypto exchanges are MEXC, OKX, and Binance.

What Fees Do Crypto on-Ramps Charge?

Understanding on-ramp charges is often challenging, as most providers include transaction fees in the quoted rate. Without a clear breakdown of those charges, buyers must compare rates with the real-time spot price.

In the above example, a MEXC user buys $200 worth of USDT. The partnered gateway, Banxa, quotes 198.87 USDT for that $200 purchase. Based on USDT/USD parity, the on-ramp charges competitive commissions of just 0.56%. As such, MEXC remains one of the lowest-fee crypto exchanges for fiat purchases.

Some on-ramp platforms charge significantly higher fees, so always compare exchange quotes manually.

Do Crypto on-Ramps Require KYC Verification?

To buy Bitcoin with a credit card with no verification, accessibility depends on several factors. On-ramp providers rarely implement a one-size-fits-all approach to KYC.

Some gateways allow no-KYC purchases up to a certain amount, while others have stricter controls for specific currencies or payment methods. The best crypto on-ramp platforms comply with anti-money laundering laws, or they face potential regulatory consequences.

While completing ID verification may feel cumbersome, most services use automated systems to streamline the process. We found that verification is often near-instant, so users can purchase their preferred crypto without delay.

Pros and Cons of Fiat on-Ramps for Crypto

Consider these benefits and drawbacks of crypto on-ramp providers:

Benefits of Crypto on-Ramps

- Instant Payments: Most on-ramps offer lightning-fast settlement. Payment methods like debit/credit cards and e-wallets allow users to buy crypto instantly.

- Ideal for Beginners: On-ramps suit complete beginners who want to invest in digital assets for the first time. They simply enter the crypto, amount, and payment details, and the gateway processes the order.

- Local Currencies: Some fiat services support over 100 currencies. By using local money, investors purchase cryptocurrencies without FX fees.

- Broad Asset Support: Providers typically offer a wide selection of assets, from major coins like BTC and ETH to speculative meme coins such as Pepe (PEPE) and Floki (FLOKI).

- Low Purchase Requirements: As inexperienced investors typically use fiat on-ramps, minimum purchase requirements are often low. Margex lets users buy cryptocurrencies from just $5.

Drawbacks of Crypto on-Ramps

- High Fees: We found that crypto on-ramps sometimes charge higher fees than direct fiat deposits, particularly on non-major currencies.

- KYC Requirements: While platforms may allow no-KYC purchases up to a certain amount, most on-ramp providers require a government-issued ID.

How to Use a Fiat on-Ramp Platform: Step-by-Step Guide

This walkthrough explains how to purchase cryptocurrencies instantly on the Best Wallet app. The non-custodial wallet partners with multiple gateways, so users secure top quotes across many payment methods.

Step 1: Download and Secure the Best Wallet App

Visit Best Wallet and download its free mobile app for iOS or Android. Encrypted private keys are installed on your device automatically.

It takes minutes to activate the app, including the security procedure. Enter and verify an email address, then select a PIN.

Best Wallet displays a 12-word seed phrase. If you lose access to the app, the phrase lets you regain access to the wallet from another device.

In the “Settings” tab, set up biometric and two-factor authentication logins.

Step 2: Choose a Crypto

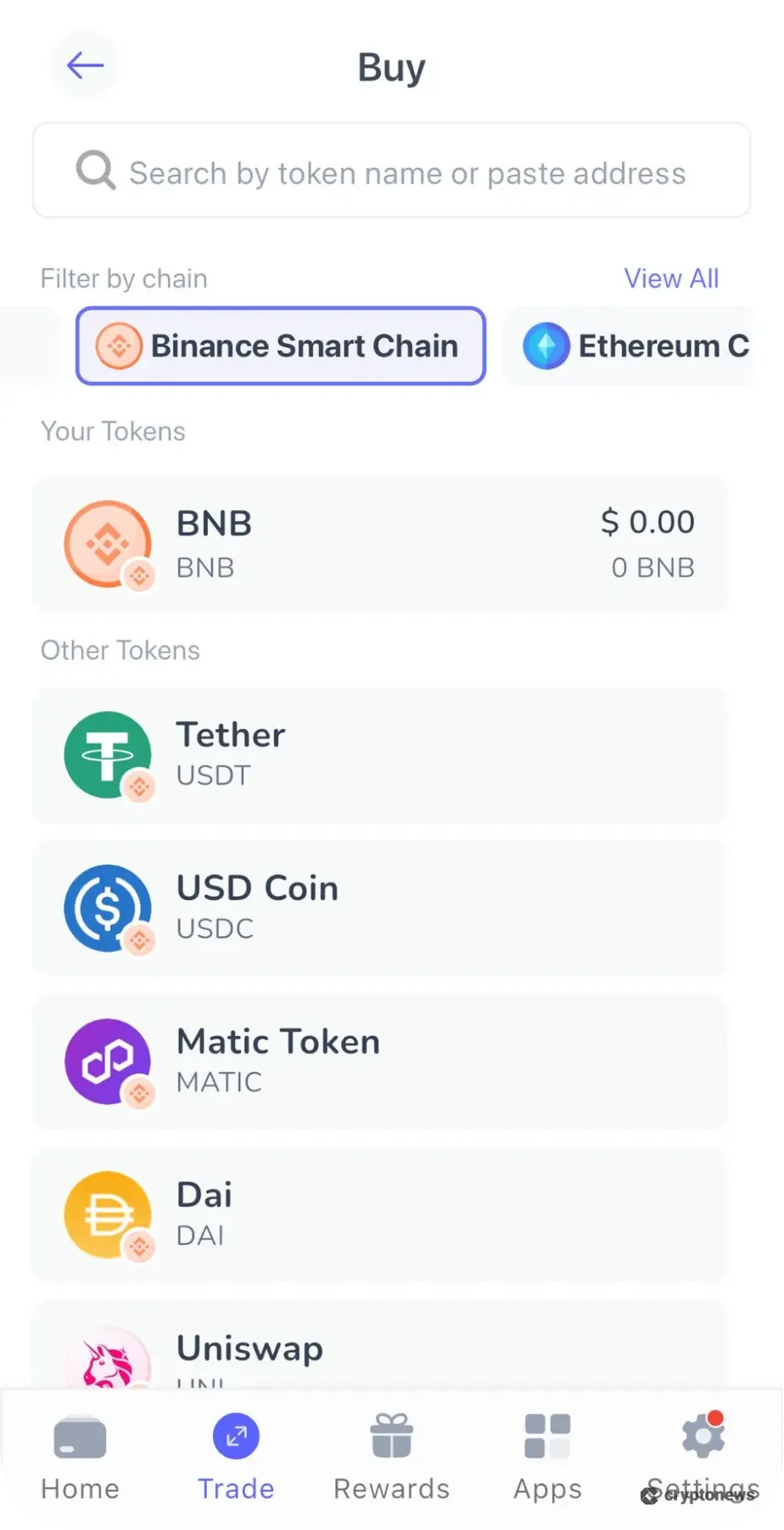

Tap “Trade” and “Buy” to access the on-ramp feature, then choose a coin or token. Best Wallet supports a wide range of markets, including BTC, SOL, BNB, and ETH.

Search for the crypto, or tap a specific blockchain to browse popular assets.

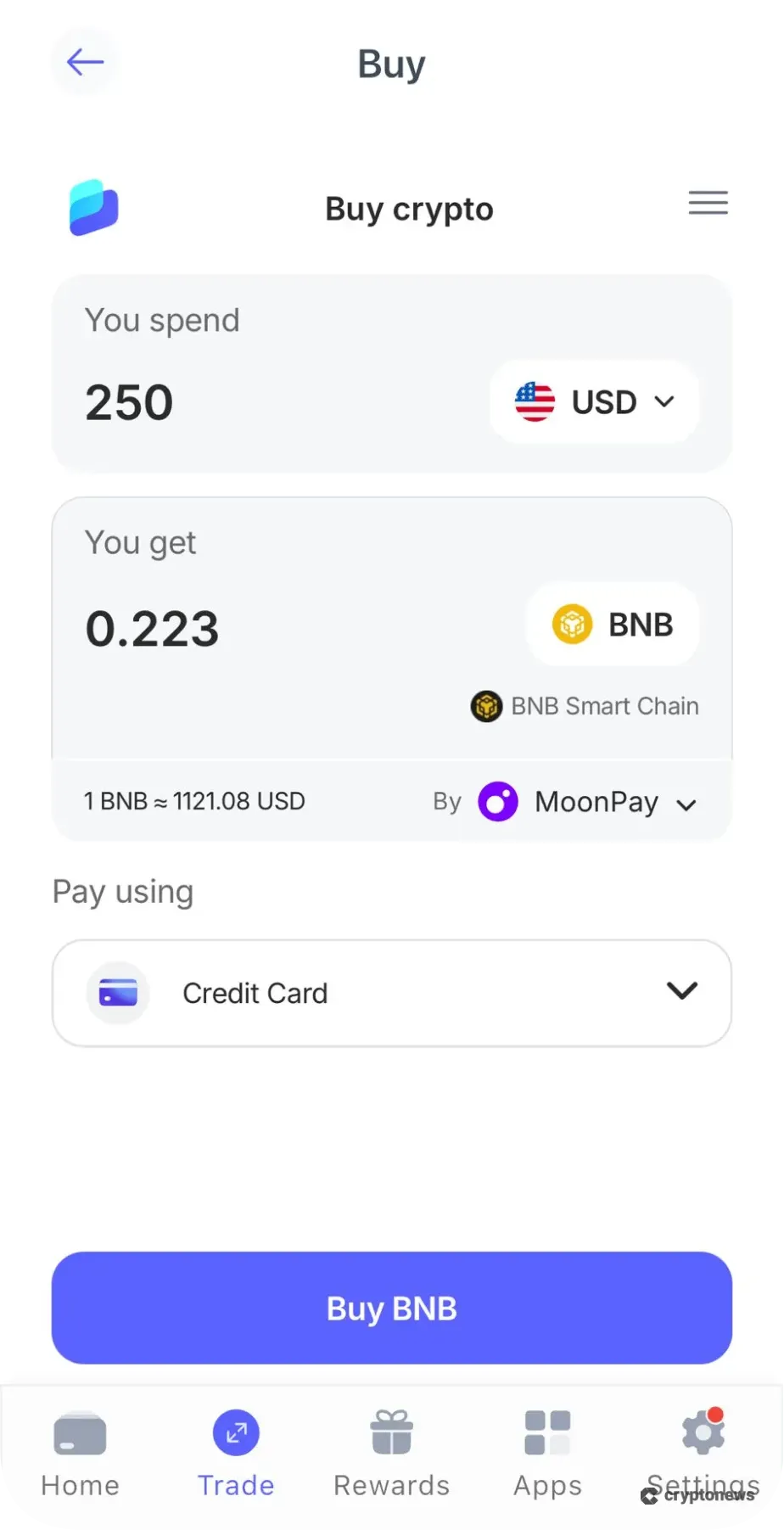

Step 3: Enter the Purchase Requirements

Select the preferred fiat currency from the drop-down list. The app supports over 25 options, including USD, AUD, and EUR.

Then input the purchase amount and payment method. Deposit types cover PayPal, Visa, MasterCard, Google Pay and Apple Pay, and Skrill.

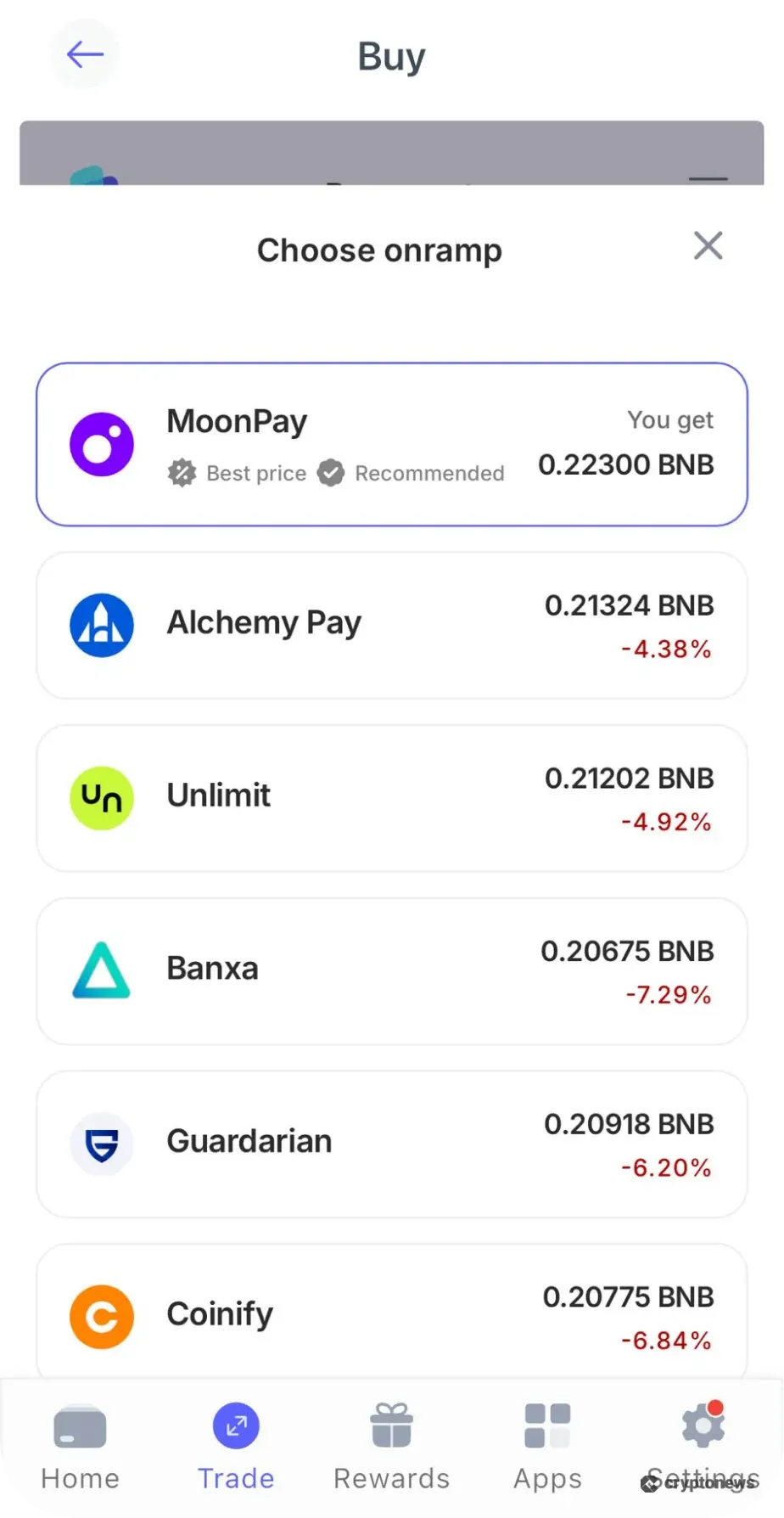

Step 4: Review on-Ramp Providers and Fees

The app aggregates real-time prices from partnered gateways, which reflect the chosen investment parameters.

Tap the selected on-ramp provider to ensure you get the best quote. Gateways include fees in the quote, so review prices before you proceed.

Step 5: Complete the on-Ramp Payment

The final step is to complete the purchase with the crypto on-ramp.

All partnered providers are reputable and safe, and the app encrypts payment details to ensure security.

Once processed, the purchased assets appear in the Best Wallet app. They remain in non-custodial storage until you decide to transfer or sell your investments.

Conclusion

Fiat on-ramps simplify crypto investments with instant payments in local currencies. People beginning their crypto journey can avoid trading on spot exchanges, since gateways execute purchases at fixed quotes.

In terms of providers, our research suggests that Best Wallet is the overall best fiat on-ramp in the crypto space.

The app supports a wide range of assets and payment methods, including PayPal, debit/credit cards, and Google/Apple Pay. As the non-custodial wallet sources prices from multiple gateways, users get competitive prices.

👉 Learn More: Top 10 Best Crypto Off-Ramp Platforms for 2026

Visit Best WalletFAQs

What is the Difference Between Crypto on-Ramps and Off-Ramps?

Can I Integrate a Crypto on-Ramp Into My Own Platform?

What is the Best Crypto on-Ramp in the Usa?

What Are the Drawbacks of Crypto on-Ramps?

References

- Customer identification: Know your customer (KYC) (Australian Transaction Reports and Analysis Centre)

- Single Euro Payments Area (SEPA) (European Central Bank)

- What are fiat “on-ramps” and “off-ramps”? (Coinbase)

- What Is a Foreign Transaction Fee? (Experian)

- Anti-Money Laundering (AML) (Financial Industry Regulatory Authority)

About Cryptonews

Our goal is to offer a comprehensive and objective perspective on the cryptocurrency market, enabling our readers to make informed decisions in this ever-changing landscape.

Our editorial team of more than 70 crypto professionals works to maintain the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re looking for breaking news, expert opinions, or market insights, Cryptonews has been your go-to destination for everything cryptocurrency since 2017.