10 Best Low Cap Crypto Gems to Surge in 2026

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships. However, this potential compensation never influences our analysis, opinions, or reviews. Our editorial content is created independently of our marketing partnerships, and our ratings are based solely on our established evaluation criteria. Read More

In 2026, low-cap coins are still where you find the biggest swings, for better and for worse. But the market is changing with investors getting tired of “ghost coins” that launch on hype, pump briefly, and then fade.

Projects like Bitcoin Hyper (HYPER), Maxi Doge (MAXI), and BMIC Token (BMIC) are popular picks because they sit early in their lifecycle and have a technical backbone, before wider exchange liquidity arrives.

And yes, the failure rate is brutal. Since 2021, a huge number of new crypto projects have died, mostly because anyone can launch a token and hype it for a week. Still, a few outliers do deliver. Below, we break down what to look for, how to filter risks, and how to buy without getting careless.

- In This Article

-

- 1. Bitcoin Hyper (HYPER) – Bitcoin Layer-2 Scalability Network

- 2. Maxi Doge (MAXI) – Doge-Themed Meme Coin for Degen Investors

- 3. BMIC Token (BMIC) – Upcoming Quantum-Resistant Wallet Token

- 4. LiquidChain (LIQUID) – Cross-Chain Layer 3 With Unified Liquidity

- 5. SUBBD (SUBBD) – AI-Powered Web3 Creator Token

- 6. Celer Network (CELR) – Cross-Chain Interoperability Protocol

- 7. Moonbeam (GLMR) – Low-Cap Project Bringing Ethereum Compatibility to Polkadot

- 8. Seedify.fund (SFUND) – Web3 Launchpad and Incubator

- 9. Bio Protocol (BIO) – DeSci Network for Tokenized Biotech IP

- 10. cat in a dogs world (MEW) – Underdog Cat-Themed Meme Coin

- In This Article

- Show Full Guide

-

- 1. Bitcoin Hyper (HYPER) – Bitcoin Layer-2 Scalability Network

- 2. Maxi Doge (MAXI) – Doge-Themed Meme Coin for Degen Investors

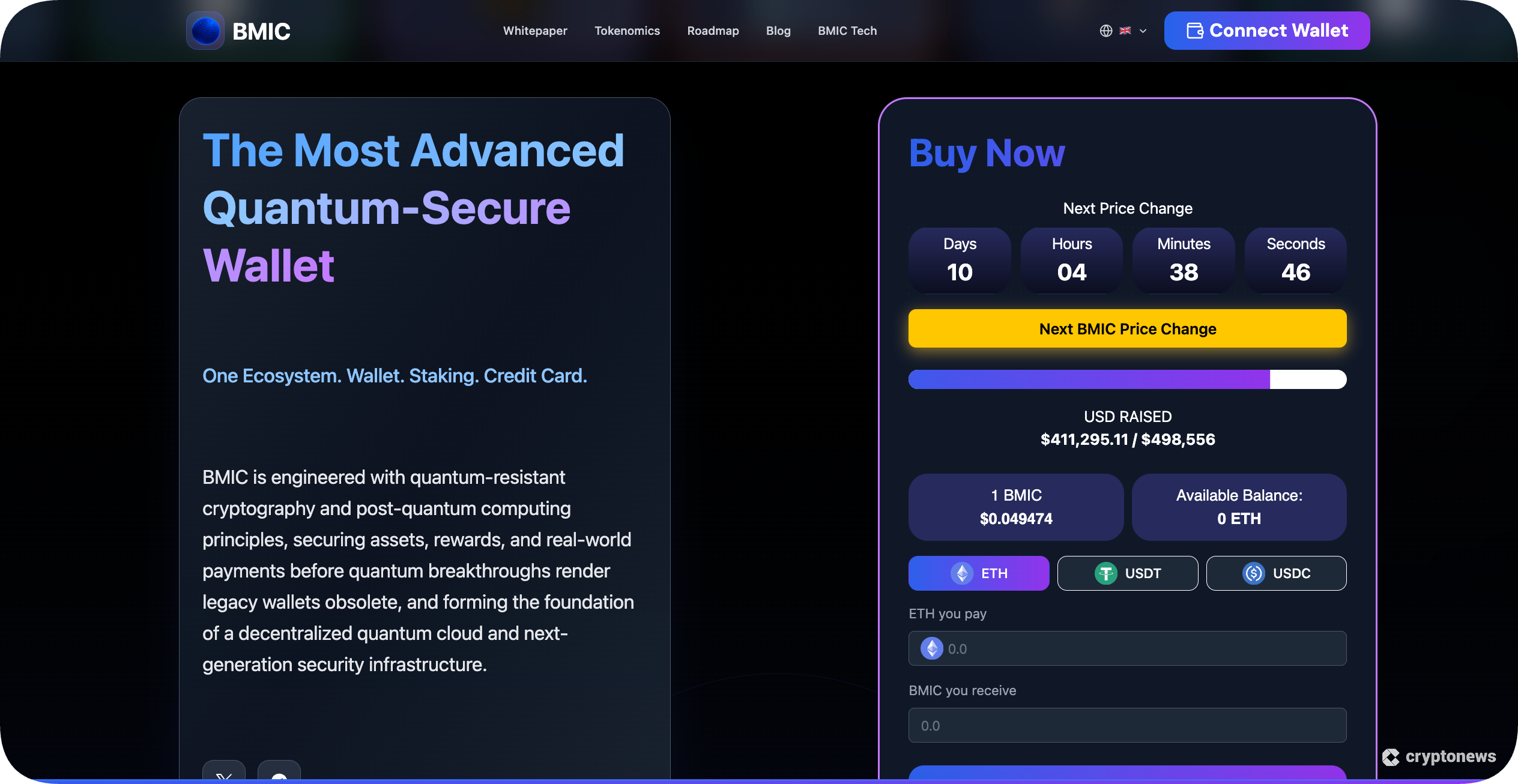

- 3. BMIC Token (BMIC) – Upcoming Quantum-Resistant Wallet Token

- 4. LiquidChain (LIQUID) – Cross-Chain Layer 3 With Unified Liquidity

- 5. SUBBD (SUBBD) – AI-Powered Web3 Creator Token

- 6. Celer Network (CELR) – Cross-Chain Interoperability Protocol

- 7. Moonbeam (GLMR) – Low-Cap Project Bringing Ethereum Compatibility to Polkadot

- 8. Seedify.fund (SFUND) – Web3 Launchpad and Incubator

- 9. Bio Protocol (BIO) – DeSci Network for Tokenized Biotech IP

- 10. cat in a dogs world (MEW) – Underdog Cat-Themed Meme Coin

Low-Cap Crypto – Key Takeaways

- A low market cap cryptocurrency has a market capitalization of less than $100 million. This is determined by multiplying the number of circulating coins by the current price.

- They are often referred to as low-cap gems, as they have more upside potential than large-cap coins and usually receive less attention.

- Investing in low-cap crypto carries more risk due to increased price volatility and a higher probability of failure. For this reason, they are usually considered high-risk, high-reward cryptocurrencies.

- Low-cap cryptocurrencies are often completely new projects, coins in an emerging sector, or coins with limited utility in their current state.

Best Low Market Cap Crypto Shortlisted

According to our analysis, some of the best low market cap projects to invest in span across three key sectors. These include cryptocurrencies in presale, Layer 2 networks, and GameFi.

- Introducing the first Bitcoin L2 solution

- Allows users to trade BTC almost instantaneously

- Enhanced transaction security with ZK-proofs

- USDC

- ETH

- usdt

- Meme-powered Dogecoin derivative with the focus on 1,000x leverage trading

- Maxi Doge will feature community contests and partner events to engage with its audience

- The project offers high staking rewards to its early supporters

- ETH

- usdt

- USDC

- +2 more

- Infrastructure token built to withstand quantum-powered attacks

- BMIC is burned to create credits for quantum computing

- Extra holder utility through staking and governance

- ETH

- usdt

- USDC

- Next-gen platform merging live content, AI tools, staking, crypto payments and more

- SUBBD holders get access to AI-optimized content and experiences

- Loyalty is rewarded with staking bonuses, XP boosts, and daily creator drops

- Bank Card

- ETH

- bnb

- +1 more

- VFX Token powers the next-gen forex broker Vortex FX

- Offers daily rebates from trading volume

- Stake VFX tokens to earn APYs up to 67.7%

- ETH

- usdt

- bnb

Best Low-Cap Coins: Overview

Here is a quick comparison of our top low-cap coin picks, broken down by their utility and current status, as well as some market data to give you a general idea of the project:

| Project | Symbol | Niche / Utility | Market Cap/Amount Raised | Price |

|---|---|---|---|---|

| Bitcoin Hyper |  HYPER +18.91% HYPER +18.91% |

Bitcoin Scaling / SVM L2 | $31.28M | $0.01367520 |

| Maxi Doge |  MAXI +12.08% MAXI +12.08% |

Meme / Leverage Trading | $4.58M | $0.00028020 |

| BMIC |  BMIC +2.04% BMIC +2.04% |

Quantum Protection | $425.87K | $0.049474 |

| LiquidChain |  LIQUID +22.27% LIQUID +22.27% |

Cross-Chain L3 (Bitcoin, Ethereum, and Solana) | $517K | $0.01345 |

| SUBBD |  SUBBD +4.50% SUBBD +4.50% |

AI Content Creation Platform | $1.47M | $0.05747500 |

| Celer Network |  CELR 11.96% CELR 11.96% |

Cross-Chain Interoperability | $24.37M | $0.0024 |

| Moonbeam | Ethereum-Compatible Smart Contracts on Polkadot / EVM | $15.80M | $0.013 | |

| Seedify.fund | Web3 Gaming Launchpad | $3.42M | $0.034 | |

| Bio Protocol | DeSci Funding and Governance | $82.97M | $0.024 | |

| cat in a dogs world |  MEW 16.84% MEW 16.84% |

Cat-Themed Meme Community | $50.18M | $0.00056 |

Some of these tokens are in their early presale stages with potential upside, while others are already established but overlooked. Early presale bets like HYPER, MAXI, and BMIC come with the highest upside potential but also the highest execution risk.

While established coins like CELR, GLMR, and SFUND have real usage and history, but are overlooked by the market. The success of these projects depends heavily on the broader ecosystem to which they are tied.

Best Low-Cap Crypto Gems Reviewed: A Closer Look

To narrow our list to the best low-market-cap crypto coins to buy in 2026, we analyzed 120+ small-cap tokens based on four research criteria: development team, technology and innovation, market potential, and community.

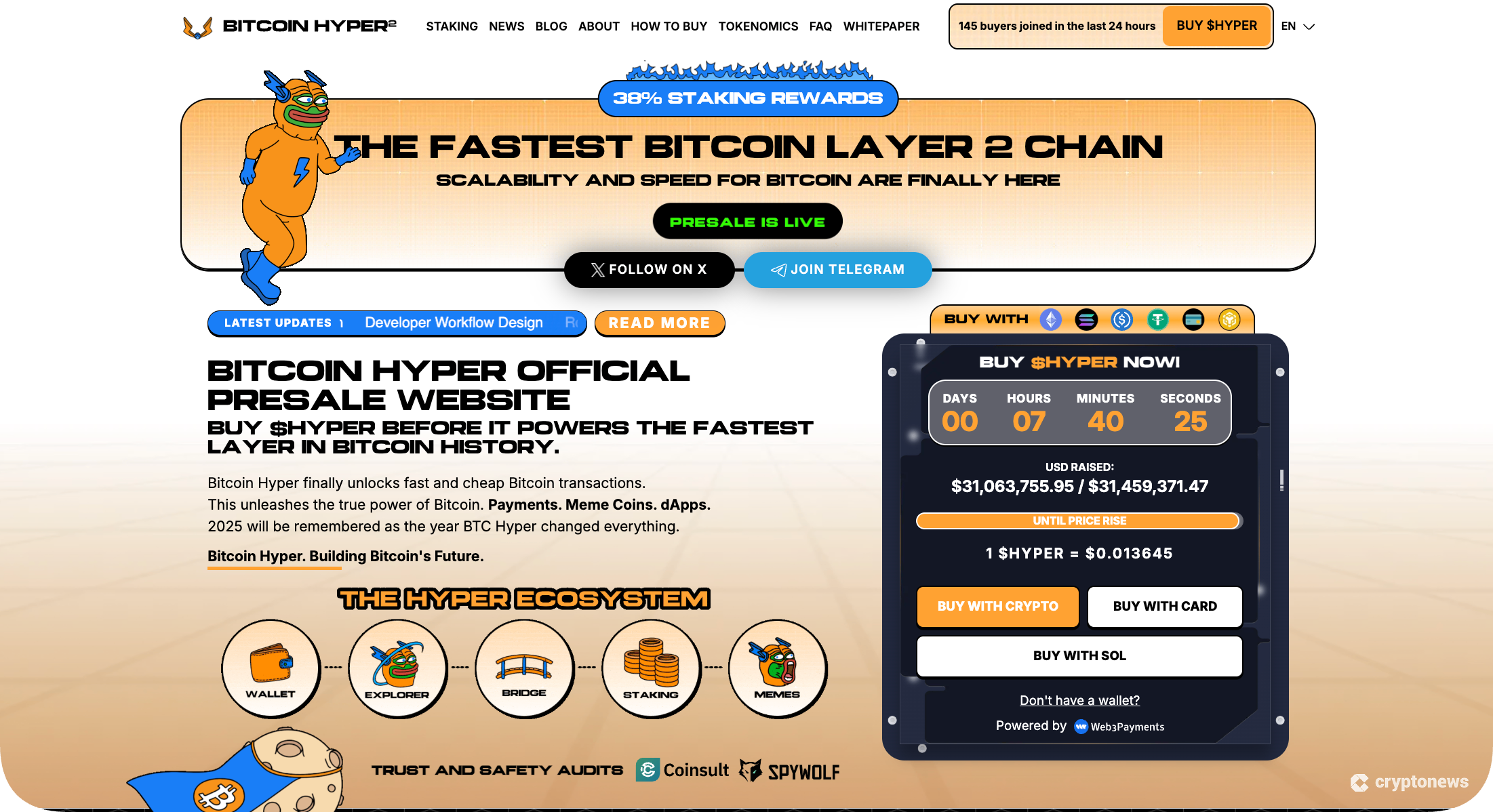

1. Bitcoin Hyper (HYPER) – Bitcoin Layer-2 Scalability Network

The best low-cap crypto to buy right now with 100x potential in the next crypto bull run is Bitcoin Hyper  HYPER +18.91%. It earned the top spot because of its focus on the main problem in Bitcoin’s ecosystem: speed. This Web3 project introduces the very first Bitcoin Layer 2 ecosystem that supports smart contracts.

HYPER +18.91%. It earned the top spot because of its focus on the main problem in Bitcoin’s ecosystem: speed. This Web3 project introduces the very first Bitcoin Layer 2 ecosystem that supports smart contracts.

Powered by the highly efficient Solana Virtual Machine (SVM), Bitcoin Hyper enhances BTC scalability by reducing network fees and enabling hyper-fast transactions. This makes it a unique addition to the low-cap coins. The L2 chain’s native token, HYPER, will be used for network transaction payments, future tokenized governance, and staking.

Users can purchase HYPER through the Bitcoin Hyper presale, which raised over $31.28M. At the mainnet launch, Bitcoin Hyper will activate its Canonical Bridge for seamless BTC native deposits and withdrawals.

| HYPER Launch Date | Q1 2026 |

| Chain | Ethereum |

| Current Price | $0.01367520 |

| % Price Change Since Start |  HYPER +18.91% HYPER +18.91% |

| Raised So Far | $31.28M |

Next Price Increase In:

2. Maxi Doge (MAXI) – Doge-Themed Meme Coin for Degen Investors

Maxi Doge  MAXI +12.08% is a new Doge-themed meme coin fueled with vibes and light-hearted humor. The project features a jacked Doge mascot that is trying to max out 1000x leverage, down a can of pre-workout, and blow the speakers out with bull market energy.

MAXI +12.08% is a new Doge-themed meme coin fueled with vibes and light-hearted humor. The project features a jacked Doge mascot that is trying to max out 1000x leverage, down a can of pre-workout, and blow the speakers out with bull market energy.

MAXI is everything about that gym-core feel that you get in Telegram trader chats. If you want yield, you can lock your tokens and earn staking rewards, with an advertised APY of up to 68%. All you have to do is to keep in mind that the rate is not fixed.

The presale has raised so far a little more than $4.58M. That is still low-cap, and thus there will be large swings and low liquidity once the market kicks in, so watch it, but only bet it to the extent that you can afford to risk and the period you are willing to wait around.

| MAXI Launch Date | Q1 2026 |

| Chain | Ethereum |

| Current Price | $0.00028020 |

| % Price Change Since Start |  MAXI +12.08% MAXI +12.08% |

| Raised So Far | $4.58M |

Next Price Increase In:

3. BMIC Token (BMIC) – Upcoming Quantum-Resistant Wallet Token

BMIC  BMIC +2.04% is a utility token tied to a quantum-resistant wallet service built for long-term security. The core idea is simple: store crypto with stronger protection as computing power grows. It positions itself as a first-mover in the post-quantum wallet sector, a niche that’s expected to gain more attention by 2028.

BMIC +2.04% is a utility token tied to a quantum-resistant wallet service built for long-term security. The core idea is simple: store crypto with stronger protection as computing power grows. It positions itself as a first-mover in the post-quantum wallet sector, a niche that’s expected to gain more attention by 2028.

BMIC focuses on practical use inside its wallet ecosystem. Holders can unlock wallet features, stake tokens, and vote on upgrades as the project moves toward DAO governance by 2028. It also uses a deflationary model where burned tokens convert into compute credits, which the network uses to fund future computing workloads.

BMIC is still early. The presale has raised close to $425.87K, and the token price sits around $0.049474, which keeps it in penny-token territory. The upside is the clear security narrative, but there’s no MVP yet, and the €40 million fundraising goal is steep, so you need to research carefully.

| BMIC Launch Date | TBA |

| Chain | Ethereum |

| Current Price | $0.049474 |

| % Price Change Since Start |  BMIC +2.04% BMIC +2.04% |

| Raised So Far | $425.87K |

4. LiquidChain (LIQUID) – Cross-Chain Layer 3 With Unified Liquidity

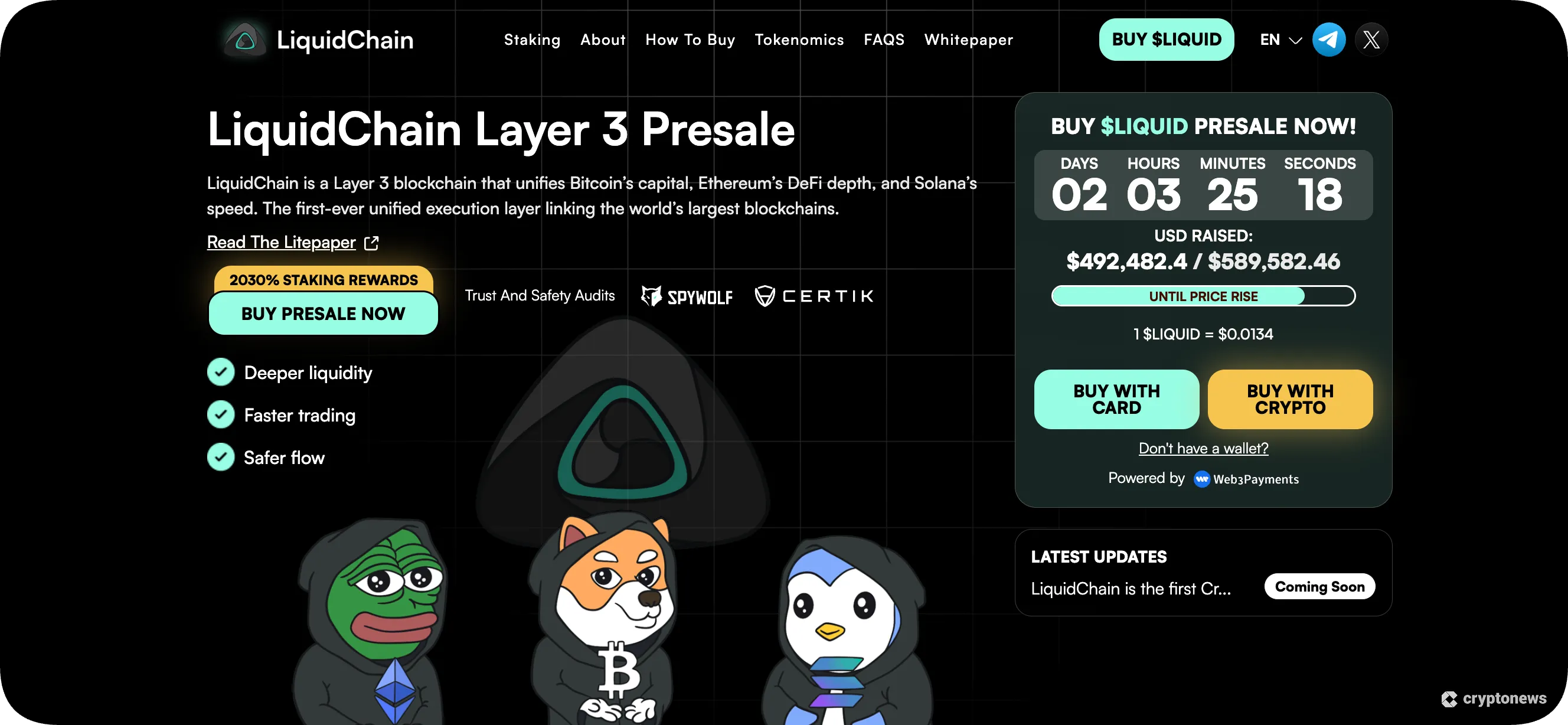

LiquidChain’s  LIQUID +22.27% token drives a Layer-3 network, which is attempting to smush Bitcoin liquidity, Ethereum DeFi, and Solana speed into a single smooth layer of execution. It is all about unified pools and hassle-free proofs, and you are able to swap, fork tables and bet on markets on the spot across chains.

LIQUID +22.27% token drives a Layer-3 network, which is attempting to smush Bitcoin liquidity, Ethereum DeFi, and Solana speed into a single smooth layer of execution. It is all about unified pools and hassle-free proofs, and you are able to swap, fork tables and bet on markets on the spot across chains.

The presale has raised about so far, with LIQUID priced at $0.01345. The pitch is simple: builders deploy once and reach users across multiple ecosystems, while traders get deeper liquidity and faster routing without juggling bridges or wrapped assets. Launch timing targets Q1 2026.

On the contract side, audits from SpyWolf and CertiK describe a non-upgradeable ERC-20 using OpenZeppelin, with all supply minted at deployment, zero taxes, and no blacklist or owner backdoors. Risks sit elsewhere: the team isn’t doxxed, supply looks concentrated, and front-end security gaps increase phishing risk.

| LIQUID Launch Date | Q1 2026 |

| Chain | Bitcoin, Ethereum, and Solana (Layer 3) |

| Current Price | $0.01345 |

| % Price Change Since Start |  LIQUID +22.27% LIQUID +22.27% |

| Raised So Far | $517K |

5. SUBBD (SUBBD) – AI-Powered Web3 Creator Token

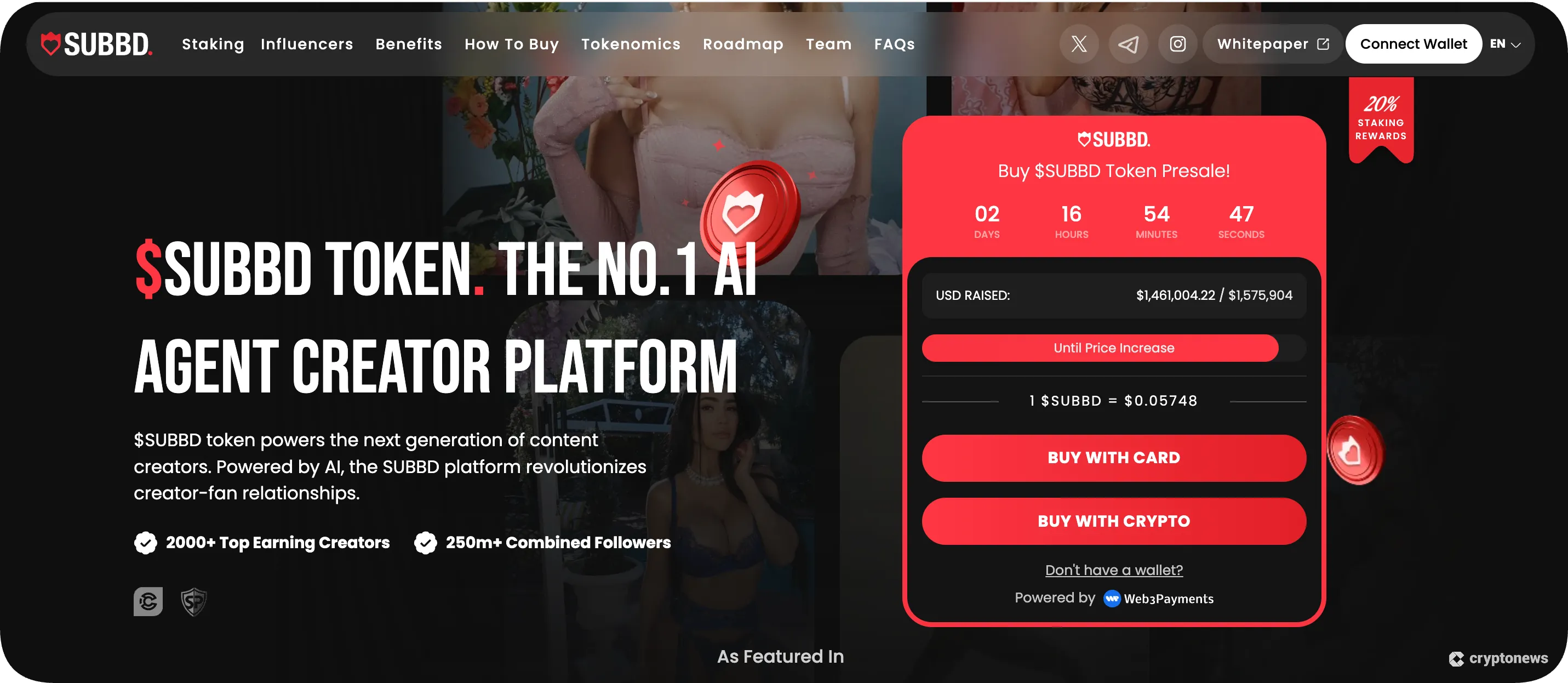

SUBBD  SUBBD +4.50% is the native token of the SUBBD platform by the same name, which aims to transform the $85 billion content industry. The token gives holders special privileges on the platform, such as access to premium creator content, governance voting rights, and staking rewards.

SUBBD +4.50% is the native token of the SUBBD platform by the same name, which aims to transform the $85 billion content industry. The token gives holders special privileges on the platform, such as access to premium creator content, governance voting rights, and staking rewards.

SUBBD combines AI features with Web3 payments to address creator pain points: high platform fees and scattered tools for subscriptions, tips, and community management. The idea is to let creators keep more revenue and run everything from one place, without relying on a single platform.

In the presale, buyers can stake for rewards and get beta access to features still in development. Total supply is 1 billion tokens, with 30% of funds set for marketing and 20% for product development. Holders also receive voting rights on platform decisions over time.

| SUBBD Launch Date | Q1 2026 |

| Chain | Ethereum |

| Current Price | $0.05747500 |

| % Price Change Since Start |  SUBBD +4.50% SUBBD +4.50% |

| Raised So Far | $1.47M |

Next Price Increase In:

6. Celer Network (CELR) – Cross-Chain Interoperability Protocol

Celer Network  CELR 11.96% is a Layer-2 platform launched in 2019 to make blockchain apps faster and cheaper. It moves activity off-chain using generalized state channels and sidechains, so dApps can run high-throughput interactions without clogging the base layer. It supports multiple chains, including Ethereum and Solana.

CELR 11.96% is a Layer-2 platform launched in 2019 to make blockchain apps faster and cheaper. It moves activity off-chain using generalized state channels and sidechains, so dApps can run high-throughput interactions without clogging the base layer. It supports multiple chains, including Ethereum and Solana.

Celer also works as an interoperability hub. It can route cross-chain swaps, bridge tokens and NFTs, and support DeFi and GameFi flows like yield farming and liquidity management. The CELR token has about 10 billion supply and is used for fees, staking, and governance votes.

As of February 2026, CELR trades near $0.0024 with roughly a $24.37M market cap. It is already far below its 2021 peak, but the fully diluted value is close to the circulating supply, so token inflation is limited.

| Launched | March 2019 |

| Chain | Celer Network |

| Current Price | $0.0024 |

| 24h Price Change |  CELR 11.96% CELR 11.96% |

| Market Cap | $24.37M |

7. Moonbeam (GLMR) – Low-Cap Project Bringing Ethereum Compatibility to Polkadot

Moonbeam GLMR 12.91% lets developers use familiar Ethereum tools while deploying on Polkadot’s connected networks. That matters more in 2026 as Polkadot’s interoperability and modular design regain developer attention. Picture Ethereum-style Lego bricks snapping into a larger Polkadot set. It reduces friction when linking the ecosystems directly.

GLMR is the network’s utility token. You spend it on transaction fees, stake it to help secure the chain, and vote on upgrades. To get GLMR, you can buy it with fiat or crypto on exchanges such as Kraken, then withdraw it to a compatible wallet easily.

Moonbeam’s niche is being a practical bridge between Ethereum users and Polkadot’s broader interoperability stack. If Polkadot keeps expanding cross-chain messaging and shared security, Moonbeam can capture that flow. But adoption still depends on app demand and competitive EVM chains. It’s worth monitoring through 2026.

| Launched | 2021 |

| Chain | Polkadot, compatible with Ethereum |

| Current Price | $0.013 |

| 24h Price Change | |

| Market Cap | $15.80M |

8. Seedify.fund (SFUND) – Web3 Launchpad and Incubator

Seedify.fund SFUND 6.02% is a launchpad focused on blockchain gaming. It uses community staking and voting to decide which projects get support, plus funding tools to help teams raise capital. If you follow Web3 games, think of Seedify as a filter and a funding rail in one place.

SFUND is the token that makes the system work. You stake it to qualify for allocations, earn rewards, and take part in governance decisions. You can also use SFUND to back new gaming projects on the platform. In practice, your access depends on rules like tiers and snapshots.

Seedify isn’t a bet on one game. It’s a bet on the pipeline. That cuts single-project risk, but adds platform risk: if fewer quality games launch, demand for allocations drops. It has supported multiple Web3 gaming projects, including titles like PEPENODE and GUNZ.

| Launched | 2021 |

| Chain | Binance Smart Chain |

| Current Price | $0.034 |

| 24h Price Change | |

| Market Cap | $3.42M |

9. Bio Protocol (BIO) – DeSci Network for Tokenized Biotech IP

Bio Protocol BIO 16.87% is the science of decentralization. It also allows scientists and communities to fund and direct biotech initiatives by creating BioDAOs and BioAgents to handle repeatable knowledge tasks. In essence, it is a coordination layer that transforms research ideas into actual funded projects.

Everything is powered by the token BIO. You can vote on governance, stake, and receive rewards based on BioAgents and research work. It also introduces liquidity to tokenized IP, thereby allowing funding and ownership to move on-chain. As a matter of fact, you can access it depending on the regulations and configuration of each BioDAO.

Bio Protocol is diversifying the risk among a group of research tracks rather than making a bet on a biotech success. Your upside depends on DeSci adoption and whether tokenized IP markets gain real traction. It launched in 2024 and is backed by Binance Labs.

| Launched | 2024 |

| Chain | Ethereum |

| Current Price | $0.024 |

| 24h Price Change | |

| Market Cap | $82.97M |

10. cat in a dogs world (MEW) – Underdog Cat-Themed Meme Coin

In March 2024, cat in a dogs world  MEW 16.84% was released with a simple hook, a cat kicking back against dog-era memes such as Dogecoin and Shiba Inu. It trades near $0.00056, with about a $50.18M market cap. Here, you are not purchasing the technology, but the story, thus the buzz in the community.

MEW 16.84% was released with a simple hook, a cat kicking back against dog-era memes such as Dogecoin and Shiba Inu. It trades near $0.00056, with about a $50.18M market cap. Here, you are not purchasing the technology, but the story, thus the buzz in the community.

MEW does not complicate tokenomics. It has 88.89B MEW total and 88.89B in circulation. They liquidated 90% of the liquidity upon launch and invested 10% in the Solana community airdrops. It is traded on Solana DEXs such as Raydium or Jupiter mostly, although some CEXs such as Bitfinex still trade it.

With MEW, you’re betting on attention and rotation. Product features don’t drive this one, and it has no direct utility. After launch, it saw $150M transaction volume within hours. That speed cuts both ways. Pumps and dumps arrive fast, so size position carefully.

| Launched | 2024 |

| Chain | Solana |

| Current Price | $0.00056 |

| 24h Price Change |  MEW 16.84% MEW 16.84% |

| Market Cap | $50.18M |

What is a Low Market Cap Crypto (Market Cap vs. Price)?

Low-cap cryptos generally refer to tokens that have a market cap between $10 and $500M. This refers to the market cap, not the token’s price. A coin can cost $0.01 and still have a high market cap. These coins include categories like mini-cap and small-cap cryptos, often defined by their dollar amounts in the market.

The definition varies, though. Some define low-market-cap cryptos as those under $1 billion, with micro-cap below $50 million and small-cap between $50 million and $1 billion. Others set the threshold for low-cap at under $100 million. Essentially, there’s no universally accepted standard for these classifications.

Know that investing in low-market-cap cryptos is riskier due to their potential for high volatility and lower liquidity. However, they also offer high growth potential compared to more established, higher-cap cryptos.

How to Find the Best Low Market Cap Cryptocurrencies

There are several important factors you should consider when looking for the best small-cap crypto. While it’s true that crypto is volatile and unpredictable, having a checklist may improve your chances of finding the best low-cap crypto gems in 2026. Here are some crucial factors to consider:

- Define your goals and scrutinize tokenomics: Know how much you can/want to invest in the project after you’ve done thorough research.

- Test liquidity rigorously: Use CoinMarketCap to track the liquidity of the project by focusing on projects that have less than $5M trading volume.

- Vet fundamentals for real-world survival: Focus on the project’s fundamentals and utility rather than hype. Research the team and verify if the project has undergone an audit.

Here’s a detailed outlook on each tip.

1. Define Your Goals & Scrutinize Tokenomics

Determining your investment goals and researching tokenomics is the first and most important step to finding low-cap cryptos. With this step, you have two options: accept high volatility for quick gains, or choose more stable long-term cryptos for gradual growth.

- Short-term targets: Prioritize tokens with catalysts like exchange listings within 3-6 months.

- Long-term holds: Look for projects with frequent GitHub activity, established roadmaps, and actual utility.

- Dissect tokenomics: Search for projects with a reasonable total supply, inflation rates, and vesting schedules. Good tokenomics proves that the team is not only competent, but isn’t attempting to profit from parasitic token mechanics.

2. Test Liquidity Rigorously

Liquidity pool levels directly impact trade execution. Thin liquidity causes high slippage (losing 5-10% on trades) and enables whale manipulation. Protect yourself:

- Track daily volume: Target less than $5M across over 3 exchanges (you can use CoinMarketCap).

- Check order book depth: Ensure selling $1,000 moves prices less than 2%.

- Compare liquidity against peers: Avoid tokens with stagnant volume. Deep pools signal contenders for the next big crypto coin.

If you look in the top right corner of the image below from CoinMarketCap, you can see that Seedify.fund has less than $1 million in daily trading volume. You can also use CoinMarketCap to track the order book depth of any cryptocurrency as well.

3. Vet Fundamentals for Real-World Survival

Ignore hype. Validate fundamentals systematically. Start with the team: Confirm members have shipped real products (LinkedIn/Portfolio checks). Audit the technology: Open-source GitHub repos with weekly commits signal active development.

Crucially, real-world applicability is demanded — projects must solve concrete problems. For example, a DeFi tool reducing loan processing time from days to minutes has clear utility. Finally, verify adoption metrics: user growth, transaction volume, and partner integrations. Projects that clear these checks withstand bear markets.

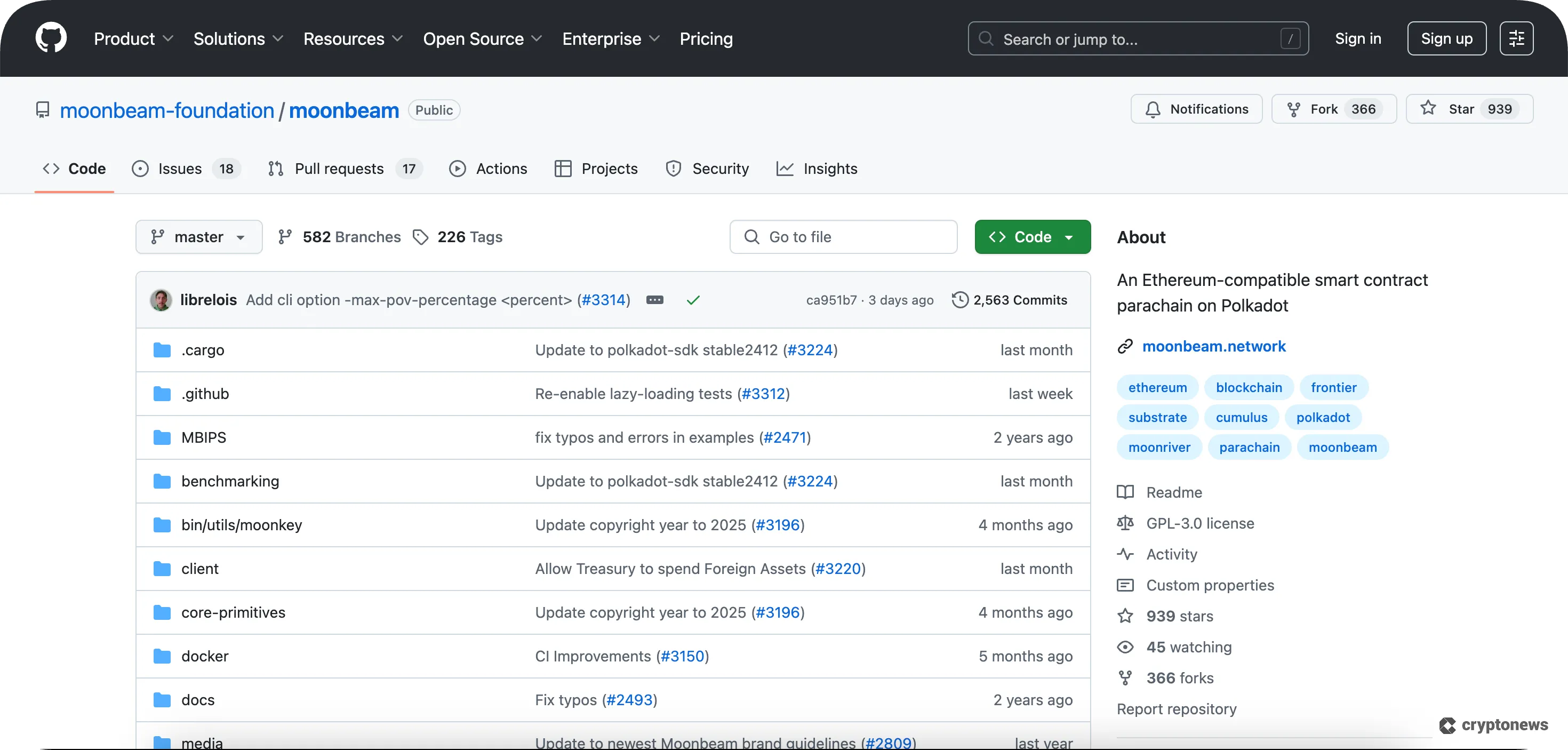

In the following example, Moonbeam has 366 forks, 2,563 commits, 582 branches, and 226 tags. These are all good examples of an active and popular project.

Is it Worth Investing in Low-Cap Cryptocurrencies?

Yes, low-cap cryptocurrencies offer strong upside potential. Low-cap cryptocurrencies require much less capital to earn higher returns. However, you should still approach them with caution and only invest what you can afford to lose.

We’ve reviewed the best low-cap cryptos to buy, including some micro-cap cryptos, and explained how to find them. Next, we’ll go over the potential advantages of investing in these crypto assets.

Low-Cap Crypto Assets Have the Potential to Grow

Most low-cap cryptocurrencies are fairly new projects or are in the early stages of development. Some of the assets in this category are cryptocurrencies that haven’t yet shown to be resilient in the market. Because of the volatility in the space, small-cap cryptocurrencies are high risk.

That said, low-cap crypto assets are also the coins with the most upside, with good potential to grow in the next bull run in 2026. It’s also possible to invest in a project in its presale phase at a discount before it goes live on an exchange. However, investors should only ever allocate the funds they can afford to lose, since there’s a chance these projects don’t succeed.

Some Low-Cap Cryptocurrencies Are Good for Day Traders

The best low-cap cryptos to buy for day traders will likely be meme cryptocurrencies or new projects.

Additionally, many new low-cap crypto assets experience an influx of new investors when they are listed on a major exchange. As such, those who bought tokens during the presale phase could opt to sell for a profit at the height of an early rally.

How to Avoid Low-Cap Crypto Scams

When investing in less well-known crypto projects, some scams can be a risk, so follow these tips to make sure you and your investments are safe:

- Analyze the whitepaper critically: Legitimate projects have detailed whitepapers explaining the project. Avoid documents that add no value.

- Verify the development team: Check the team’s backgrounds on LinkedIn and coding activity on GitHub/GitLab.

- Ignore excessive marketing hype: Be skeptical of promises of high returns or “free” tokens and focus on utility.

- Never share private keys: Any request for your private keys is a definite scam tactic.

Investing in low market cap cryptocurrencies can offer significant returns, but it also comes with higher risks of scams. Here’s how to navigate these waters safely.

Analyze the Whitepaper

Start with the project’s white paper as your first safeguard. Legitimate small-cap coins publish papers that explain the blockchain technology, token design, and how funds will be utilized. Seek clear structure, full detail, plain language. Skip projects whose papers are vague, sloppy, or shallow—common hallmarks of scam attempts.

Verify the Development Team

It’s best to look for projects with transparent teams. Make sure that the team is sharing their real names and social profiles. You can use LinkedIn and GitHub/GitLab to check their work history. Stay clear of projects that do not share the team’s profiles, use stock images, or have unverifiable claims.

Be Skeptical of Marketing Hype

Real projects focus more on utility and technical advancement than raising funds. Be wary of aggressive marketing tactics that promise high returns or “free” tokens, which are typical red flags.

Legitimate projects emphasize their project’s utility and technological updates rather than just fundraising milestones.

Guard Your Private Keys

Never share your private keys. Authentic transactions and projects won’t require access to them. Ignore any communication that asks for them since this is a common tactic used in scams.

By following these steps, you can protect yourself from low-cap crypto scams while making informed investment decisions.

Is it Too Late to Buy Low-Cap Coins in 2026?

The recent market pullback makes low-cap crypto coins in 2026 even more enticing. Even as the market matures, they still offer room for outsized growth, and many of today’s leading projects started as small-cap tokens before multiplying in value.

New trends, such as AI-driven finance, NFTs, and blockchain scaling solutions, are emerging, and innovative low-cap coins often pioneer these niches. Improved access via decentralized exchanges and growing institutional interest also make it easier to discover and support early-stage projects, increasing their potential for adoption and returns.

With new projects emerging every day, it’s never too late to invest in crypto coins with a low market cap. Still, you have to be careful and remember to:

- Always do your own research

- Verify the project’s roadmap and community engagement

- Don’t invest in one niche; keep your portfolio diverse

It’s best to keep a small portion of your portfolio dedicated to low-cap coins, about 5-10%. Don’t forget to use only trusted websites to avoid falling for scams and stay secure.

Methodology: How We Rated the Best Small-Cap Crypto Projects

For this article, we created a rating system for evaluating low-cap cryptocurrencies where we considered various factors that can affect their potential for success and risk. Below, you’ll find an explanation of the key criteria and how they were weighted.

Development Team (25%)

We examined the development team’s experience, track record, and whether they had successfully completed any other projects. We also noted their transparency and communication with the community, the quality of the code, and whether updates were meaningful and valuable to the project’s users.

Technology and Innovation (25%)

Having a unique and innovative project was an important factor when we decided how to rank these low-cap coins, as each project had to fill a specific niche in the market. We also looked at technological features, scalability, and how the team was adopting the latest tech.

Market Potential (25%)

We also examined each project’s competitors and differentiation in the market, what made it stand out from others attempting something similar, and whether there were any partnerships and collaborations in place that could enhance its market potential.

Community and Social Presence (25%)

How big is the community surrounding the project, and how engaged is it? Does the project have an active social media presence? Do its followers talk about it positively? What about community-driven initiatives and projects? Are there any incentives for token holders? All of these could be indicators of how low market cap coins will perform in the future. The more boxes they ticked, the higher they went on this list.

Conclusion: What’s the Best Low Market Cap Crypto Coin to Buy in 2026?

Crypto coins under a $100M market cap represent new projects with untested potential. Bitcoin Hyper stands out as a top contender due to its innovative L2 solution for Bitcoin, which is becoming increasingly more important now that Bitcoin has hit a new all-time high of $126,173.18.

If Bitcoin Hyper can successfully launch its L2 solution, follow its roadmap, and achieve a significant level of adoption, it could have considerable upside in the current market that values scalability solutions and infrastructure around Bitcoin.

Next Price Increase In:

FAQs

What low-cap cryptocurrency is the best?

Which cryptocurrency has the lowest market capitalization?

Is there any low market cap crypto on Coinbase?

Are there any low-cap altcoin gems with 1000x potential?

Are low market cap currencies a good investment?

Which cryptocurrencies have a low supply of tokens?

How low is a low-cap crypto?

About Cryptonews

Our goal is to offer a comprehensive and objective perspective on the cryptocurrency market, enabling our readers to make informed decisions in this ever-changing landscape.

Our editorial team of more than 70 crypto professionals works to maintain the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re looking for breaking news, expert opinions, or market insights, Cryptonews has been your go-to destination for everything cryptocurrency since 2017.