ISO 20022 Crypto: Top List of Compliant Coins in 2025

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships. However, this potential compensation never influences our analysis, opinions, or reviews. Our editorial content is created independently of our marketing partnerships, and our ratings are based solely on our established evaluation criteria. Read More

As of 2025, the main ISO 20022-ready cryptos are XRP, ADA, QNT, ALGO, XLM, HBAR, IOTA, and XDC. These coins are built to plug into existing bank rails, so they can carry payment data in the same format banks already use.

That matters because more cryptocurrencies now touch traditional finance, especially for cross-border transfers. ISO 20022 is the common language that keeps these payments structured, secure, and easier to track across borders and systems.

By the end of 2025, over 70% of banks worldwide planned to move to ISO 20022 messaging, showing how central it is for modern payments. Below, we break down 2025’s main ISO 20022 coins, their roles, and how projects like XRP, Cardano, and Quant aim to support the next wave of digital money.

- In This Article

-

- 1. XRP (XRP) – Global Cross-Border Payment ISO Crypto

- 2. Cardano (ADA) – Proof-of-Stake Blockchain Adopting ISO 20022

- 3. Stellar (XLM) – Open Network for Low-Cost Global Money Transfers

- 4. Hedera Hashgraph (HBAR) – Enterprise-Grade, ISO-Compliant DLT With Governance

- 5. Quant (QNT) – ISO Compliant Crypto and Interoperability Innovator

- 6. Algorand (ALGO) – Efficient and Secure Blockchain for Global DeFi

- 7. IOTA (IOTA) – Scalable Ledger for IoT Fee-free Transactions

- 8. XDC Network (XDC) – Hybrid Blockchain for Enterprise-Grade Finance

- In This Article

-

- 1. XRP (XRP) – Global Cross-Border Payment ISO Crypto

- 2. Cardano (ADA) – Proof-of-Stake Blockchain Adopting ISO 20022

- 3. Stellar (XLM) – Open Network for Low-Cost Global Money Transfers

- 4. Hedera Hashgraph (HBAR) – Enterprise-Grade, ISO-Compliant DLT With Governance

- 5. Quant (QNT) – ISO Compliant Crypto and Interoperability Innovator

- 6. Algorand (ALGO) – Efficient and Secure Blockchain for Global DeFi

- 7. IOTA (IOTA) – Scalable Ledger for IoT Fee-free Transactions

- 8. XDC Network (XDC) – Hybrid Blockchain for Enterprise-Grade Finance

- Show Full Guide

Alternatives to ISO 20022-Compliant Coins – Editor’s Pick

- Introducing the first Bitcoin L2 solution

- Allows users to trade BTC almost instantaneously

- Enhanced transaction security with ZK-proofs

- USDC

- ETH

- usdt

- Meme-powered Dogecoin derivative with the focus on 1,000x leverage trading

- Maxi Doge will feature community contests and partner events to engage with its audience

- The project offers high staking rewards to its early supporters

- ETH

- usdt

- USDC

- +2 more

- Gamifies mining of meme coins

- Add nodes to your server to increase mining ability

- Pay outs and bonuses in other top meme coins

- ETH

- USDC

- usdt

- +1 more

Top ISO 20022 Crypto Coins Reviewed

ISO 20022-compliant coins are cryptocurrencies that utilize a financial messaging standard to create interoperability between blockchain and traditional finance institutions. The coins in this list consider themselves as extensions of the financial system that’s already in place. They also offer cheap and fast transactions. Let’s see them in detail:

1. XRP (XRP) – Global Cross-Border Payment ISO Crypto

- Fast Transaction Speeds: Transactions settle in 3-5 seconds.

- Low Fees: Minimal transaction costs compared to traditional banking.

- Scalability: Can handle 1,500 transactions per second.

XRP is Ripple’s native cryptocurrency. It debuted in 2012 to enable fast, low-cost cross-border payments (i.e., remittances). It’s a top-five cryptocurrency by market cap. In 2020, XRP +5.40% became the first blockchain company to join the ISO 20022 standard.

XRP settles payments in 3-5 seconds — orders of magnitude faster than traditional banks.

With ISO’s 20022 shift to richer, more structured messaging and SWIFT’s full migration in November 2025, settlement windows can shrink from days down to just minutes, or even less. This also supports XRP’s role as a bridge asset in ISO-enabled networks. Growing adoption by U.S. banks supports XRP’s vision for instant global transactions as finance modernizes.

2. Cardano (ADA) – Proof-of-Stake Blockchain Adopting ISO 20022

- Proof-of-Stake Consensus: Secure and saves energy.

- Formal Verification: Keeps code correct and secure.

- Decentralized Governance: Allows for decisions to be made by the community.

Founded by Charles Hoskinso, Cardano is a blockchain that uses Proof of Stake consensus. He built it with a strong focus on academic research and peer-reviewed development. ADA +7.54%‘s architecture provides security and allows for the ongoing development of new features and upgrades.

Adopting ISO 20022 standards helps Cardano streamline financial communications and creates compatibility with existing financial infrastructure (e.g., banks, credit, etc.). This move supports Cardano’s goal of creating a more secure and sustainable financial ecosystem.

3. Stellar (XLM) – Open Network for Low-Cost Global Money Transfers

- Fast Transactions: Transactions settle in 2-5 seconds.

- Low Fees: Minimal transaction costs, often less than a penny.

- Global Access: Designed to be accessible to anyone, anywhere.

Stellar is an open-source, decentralized blockchain that facilitates inter-regional transactions between multiple currencies. It is known for its fast transaction times and low costs. Jed McCaleb, co-founder of Ripple, launched it in 2014. XLM +6.98% targets connectivity with financial institutions, payment systems, and individuals. This will enable efficient and cost-effective financial services.

In taking on the ISO 20022 standard, Stellar aims to enhance its compatibility with existing financial systems. This integration supports Stellar’s mission to create a global financial infrastructure that is accessible to everyone, including the unbanked. As a result, it aims to reduce the friction and costs historically associated with banking systems.

4. Hedera Hashgraph (HBAR) – Enterprise-Grade, ISO-Compliant DLT With Governance

- High Throughput: Capable of processing over 10,000 transactions per second.

- Low Latency: Fast transaction finality, typically within seconds.

- Enterprise Focused: Designed for robust, enterprise-level applications.

Hedera is a distributed ledger that uses directed acyclic graph (DAG) based technology, rather than a blockchain. Unlike blockchains,  HBAR +6.87% technology allows for faster transactions, making it suitable for enterprise-level applications. Launched in 2018, Hedera aims to provide a secure and scalable platform for businesses and developers to build decentralized applications (dApps).

HBAR +6.87% technology allows for faster transactions, making it suitable for enterprise-level applications. Launched in 2018, Hedera aims to provide a secure and scalable platform for businesses and developers to build decentralized applications (dApps).

Hedera adopting ISO 20022 allows for improved integrations with finance systems. It also supports its goal of being the top enterprise platform for digital operations. With a market cap of over $5.65B, Hedera is seeing increasing adoptions by large institutions like IBM, Boeing, and NASA.

5. Quant (QNT) – ISO Compliant Crypto and Interoperability Innovator

- Overledger Technology: Facilitates interoperability across blockchains.

- Enterprise Solutions: Tailored for large-scale business applications.

- Secure and Scalable: Designed for robust performance.

Quant is a unique blockchain whose use case focuses on interoperability between different blockchain networks. Through its Overledger technology, QNT +2.70% lays the foundation for communication and transactions across various distributed ledger technologies. This capability is important for building interconnected blockchain ecosystems where assets and data can move freely and securely.

Quant’s adoption of the ISO 20022 standard aims to strengthen its ability to connect blockchain networks with traditional financial systems. By leveraging ISO 20022, Quant seeks to provide enterprises with reliable and standardized messaging capabilities that seamlessly integrate with blockchain technology, using familiar systems.

6. Algorand (ALGO) – Efficient and Secure Blockchain for Global DeFi

- Pure Proof-of-Stake (PPoS): Highly secure and energy-efficient consensus mechanism.

- High Throughput: Capable of processing thousands of transactions per second.

- Low Latency: Fast transaction finality.

Another ISO 20022-compliant coin is Algorand. Turing Award-winning cryptographer Silvio Micali developed Algorand to solve the blockchain trilemma. ALGO +7.10%‘s Pure Proof-of-Stake (PPoS) consensus mechanism ensures that the network remains secure without sacrificing decentralization.

By aligning with ISO 20022 standards, Algorand offers the opportunity to integrate with traditional financial systems. This in turn supports Algorand’s goal to create a borderless world that allows for value exchange among users. In this case, adopting ISO 20022 is a strategic move that will enhance Algorand’s appeal to institutional users and large enterprises.

7. IOTA (IOTA) – Scalable Ledger for IoT Fee-free Transactions

- Fee-less Transactions: No transaction fees, ideal for microtransactions.

- Scalability: Designed to handle a high volume of transactions.

- IoT Focus: Tailored for the Internet of Things applications.

IOTA is a cryptocurrency designed for the Internet of Things (IoT). It supports secure communication for sales and trading data streams between devices. Unlike traditional blockchains,  IOTA 10.33% uses a unique ledger technology called the Tangle. It is built in a way that supports feeless and highly scalable transactions.

IOTA 10.33% uses a unique ledger technology called the Tangle. It is built in a way that supports feeless and highly scalable transactions.

If IOTA adopts ISO 20022 standards, it will be able to improve its interoperability with everyday devices. This will allow for seamless IoT transactions integration into the global financial system. Also, this compliance supports IOTA’s goal to create a more secure and efficient infrastructure for the IoT industry, allowing billions of devices to transact and communicate.

8. XDC Network (XDC) – Hybrid Blockchain for Enterprise-Grade Finance

- Hybrid Blockchain: Combines public and private blockchain features.

- Scalable and Secure: Designed for enterprise-level applications.

- Cost-Effective: Low transaction fees and high efficiency.

XinFin launched the XDC Network. aims to enhance global trade finance through cost-effective blockchain solutions. It has a hybrid architecture that allows both public and private transactions, which caters to businesses that require confidentiality and compliance.

Adopting ISO 20022 standards helps XDC Network with adoption in the traditional financial sector. Simultaneously, this alignment supports XDC’s goal of providing a reliable infrastructure for global trade and finance, making it easier for businesses to integrate blockchain technology into their operations.

What is ISO 20022 Crypto?

An ISO 20022 cryptocurrency is a coin that can “speak the same language” as banks and payment systems that use the ISO 20022 standard.

Think of old payment messages like handwritten letters: messy, different formats, easy to misunderstand. ISO 20022 is like switching to clear, standardized emails that every bank can read in the same way. Coins that support this format can plug more easily into bank rails and cross-border payments.

The goal is that by the end of 2025, most financial institutions will be able to send and receive ISO 20022-style payments.

Here’s a quick break down of the adoption of ISO 20022 timeline:

When a crypto is ISO 20022 compliant, it means that the asset adheres to this standard. This allows for a much smoother integration with traditional financial systems and enhanced transaction efficiency.

The ISO 20022 protocol is designed to streamline communication, reduce errors, and improve the overall speed and security of financial transactions. Adopting this standard can improve cryptocurrencies’ utility and acceptance within the global financial ecosystem.

SWIFT ISO 20022 Migration: What You Need to Know

SWIFT’s full migration to ISO 20022 took effect in November 2025. This shift replaces legacy MT messages with a much more rich MX format that enables fast and transparent payments.

So far only XRP is known to be directly involved with the standard. It has worked with banks testing ISO 20022-based cross-border flows.

The remaining coins in our list are ISO-aligned and not officially tested within the messaging environment.

ISO 20022 Compliant Coins in 2025 Compared

Here’s a quick comparison of key ISO 20022-compliant coins and what sets each one apart.

| Coin | Price | Market Cap | Definition | ISO 20022 Status* |

|---|---|---|---|---|

| XRP | $1.91 | $191.22B | Bank-focused cross-border payment ledger | Compatible / integrated |

| Cardano | $0.37 | $17.06B | Research-driven smart contract blockchain | Compatible / integrating |

| Stellar | $0.22 | $11.02B | Cross-border payments and remittances network | Compatible via partners |

| Hedera | $0.11 | $5.65B | Hashgraph-based enterprise DLT network | Compatible / integrating |

| Quant | $74.18 | $1.10B | Interoperability layer for institutions | Overledger maps to ISO 20022 |

| Algorand | $0.11 | $976.24M | Fast low-cost transactions blockchain | Compatible / integrating |

| IOTA | Coin data not available | Coin data not available | DAG network for IoT payments | Compatible / integrating |

| XDC Network | $0.047 | $1.79B | Hybrid chain for trade finance | ISO 20022-compliant messaging |

*Per recent technical overviews, these networks and/or their middleware support ISO 20022–compatible messaging and integrations with banks and payment systems, rather than being “ISO-certified coins” themselves.

How Will ISO 20022 Change Crypto?

ISO 20022 is expected to have a positive impact on compliant crypto projects. While it doesn’t attest to the legitimacy of a crypto project, blockchain protocols that institute this standard may have a better chance at gaining adoption in existing systems.

Because ISO 20022 establishes a standard for certain financial messaging, compliant protocols will easily interface with traditional finance. This could transpire to sending cryptocurrency directly from your bank account, using a crypto debit or debit card at the grocery store, and so on.

Moreover, while most crypto assets are already borderless, ISO-compliant digital assets could benefit from the standard’s acceptance across over 70 countries, expanding their global reach. Experts believe that ISO coins will attract both institutional and retail investors due to their increased safety.

Digital Token Identifiers (DTIs) and Their Role in ISO 20022 Integration

Even though they are not part of ISO 20022, Digital Token Identifiers (DTIs) play a supporting role in helping crypto work better with traditional finance.

Simply put, a DTI is a cryptocurrency’s ID number. Similar to stocks and bonds, which have codes that banks can use to track them, DTIs give crypto standard identifiers to make it easier to deal with the assets. Banks, regulators, and payment systems will easily recognize and work with these digital assets. For example, XRP’s DTI is L6GTZC9G4, while Bitcoin’s DTI is 4H95J0R2X.

When a coin gets assigned a DTI, it can gain trust, be taken more seriously, and be more compatible with global finance systems.

Also, new DTIs can help authenticate crypto transfers using ISO 20022 standards. This adds a layer of security and clarity to transactions.

The Benefits of ISO 20022 for Crypto

Being an ISO token brings a lot of benefits to the token beyond the possibility of wider adoption, including improved quality of data, interoperability, transaction speeds, and overall regulatory compliance.

🧮 Enhanced Data Quality

One of the primary benefits of ISO 20022 compliance is the significant improvement in data quality. Because it ensures a unified dictionary and schema for crafting messages, it reduces the potential for errors when passing messages between institutions. For cryptocurrencies, this means transactions can be more transparent and easier to audit.

🤑 Interoperability with Financial Systems

ISO 20022 improves interoperability among different financial systems, which allows assets to integrate with traditional banking systems. This will result in the possibility of interactions between not only institutions but also different nations.

🏃 Faster Transactions

ISO 20022’s standardized messaging format can also allow for faster transaction processing times. Since it provides more clear and concise information, the standard reduces the need for intervention if mistakes are present and decreases the chances of delays.

This can result in quicker confirmation times and much more efficient transaction flows for value transfers, thereby enhancing user experience and operational efficiency.

🔧 Regulatory Compliance

Lastly, ISO 20022 compliance also helps crypto assets to align with regulatory requirements. As financial regulators worldwide are beginning to adopt this standard, crypto assets following ISO 20022 can more easily comply with legal and regulatory frameworks.

This alignment can improve the legitimacy and acceptance of cryptocurrencies, which will open doors to institutional investments and market participation.

Disadvantages of ISO 20022 for Crypto

Even though adopting this standard comes with great benefits, it also comes with significant disadvantages worth keeping an eye out for, including:

🛠️ Complexity of Implementation

Implementing ISO 20022 standards can be a bit challenging for systems. The standard requires very detailed and structured financial messaging and file formats, which can be challenging to integrate into already existing crypto systems. This might create technical hiccups for developers and will likely also need great resources to implement effectively.

💲 Cost of Adoption

Switching to ISO 20022 is expensive. Banks, payment providers, and even crypto platforms might need to get new systems and staff training to meet the standard. For smaller projects, these costs could create major barriers.

🤓 Increased Regulatory Scrutiny

While ISO 20022 compliance can enhance alignment with regulatory bodies, it also increases scrutiny. Cryptocurrencies adhering to this standard may face more rigorous oversight from regulators, which could conflict with decentralized protocols.

This heightened scrutiny might deter some projects from pursuing ISO 20022 compliance, particularly those seeking to maintain operational flexibility.

Are ISO 20022 Coins a Good Investment?

The main goal of ISO-compliant crypto projects is to build a secure and efficient infrastructure for payments and other financial operations – making them less about speculation and more about long-term utility.

However, adopting the ISO standard can be a bullish signal for crypto assets, as the move can lead to increased demand and interest from institutional investors.

As a result, ISO coins could offer strong potential for long-term investment.

How Do I Buy ISO 20022 Coins?

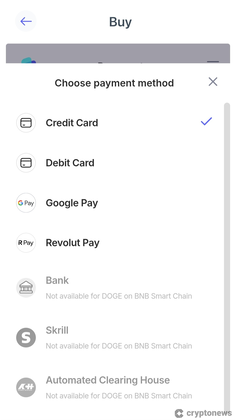

There are several ways to buy ISO 20022 compliant coins, depending on your preferences and experience level. One of the easiest ways to do this is through Best Wallet, which supports XRP, ADA, and other ISO 20022 coins, although not all of them.

The great thing about Best Wallet is that it offers the swap feature directly in the app by connecting with major decentralized exchanges (DEXs).

Unlike major crypto exchanges like Coinbase, Best Wallet gives you full custody and control over your assets.

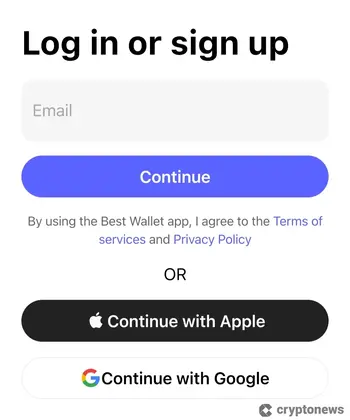

Here is a quick guide on how to buy ISO coins with Best Wallet:

Step 1: Download Best Wallet

Search for Best Wallet on Google Play Store or Apple App Store and install it for free.

Step 2: Set Up and Secure Your Wallet

Open the app, set it up based on instructions, and secure it by enabling two-factor authentication (2FA).

Step 3: Fund Your Wallet

If you hold USDC, USDT, or ETH, you can deposit it into Best Wallet to swap for ISO coins. You can transfer crypto from another wallet or purchase it directly in the app with your credit card.

Step 4: Find ISO Coins

Find the ISO coins of interest in the wallet’s search box or by scrolling through the supported cryptocurrencies.

Step 5: Buy the Token

After selecting the crypto coin, you can initiate the purchase. Best Wallet will connect to a DEX like Uniswap, offering the best rates. If you want to buy ISO 20022 coins that are not supported on Best Wallet, you can do so through a centralized crypto exchange like Coinbase or Binance.

ISO 20022 Myths Busted

On the table below, check the myths and facts about ISO 20022 coins:

| ❌ Myth | ✅ Fact |

|---|---|

| Aligning with ISO 20022 means banks approve a coin. | It’s a messaging standard, not an endorsement or investment rating. |

| ISO 20022 coins are regulated and endorsed by governments. | ISO 20022-compliance means the crypto project can structure messages in a specific format, not that it’s licensed or endorsed by any government. |

| ISO 20022-compliant cryptocurrencies are guaranteed to succeed. | Compliance can improve the coin’s integration into traditional finance, but market dynamics and project fundamentals still drive its performance. |

| ISO 20022 means instant crypto adoption by SWIFT. | SWIFT adoption of ISO 20022 applies to messaging and has no direct link to crypto integration. ISO coins may become more compatible but will not automatically be integrated into the SWIFT system. |

Conclusion

ISO 20022 compliance could create smoother operations among institutions attempting to merge cryptocurrencies with traditional financial systems. While many of its benefits are apparent, some of them are perhaps hyperbolic.

ISO 20022’s implementation could lead to increased mainstream adoption and, simultaneously, more regulatory scrutiny from regulatory bodies. This may not be as big a deal for established protocols, but it could hurt emerging projects.

As the financial industry continues to evolve, adopting ISO 20022 could play a role in bridging the gap between traditional financial systems and the emerging world of digital assets.

FAQs

How many ISO 20022 coins are there?

Which crypto coins are ISO 20022?

Is XRP an ISO 20022 coin?

Is ISO 20022 a big deal, and what is it replacing?

Is Bitcoin ISO 20022?

Is Ethereum ISO 20022?

Is ISO 20022 crypto safe?

How do cryptocurrencies comply with ISO 20022?

References

- Ripple says US banks will want to use its systems (CNBC)

- What is Cardano? The green cryptocurrency (The Independent)

- Google Cloud adopts Hedera HashGraph (Fortune)

- Adoption of ISO 20022 falling behind estimates (EY)

- Payment Infrastructure Migration Journey (Maveric Systems)

- Celent Report on ISO 20022 Adoption (2022) (Celent)

About Cryptonews

Our goal is to offer a comprehensive and objective perspective on the cryptocurrency market, enabling our readers to make informed decisions in this ever-changing landscape.

Our editorial team of more than 70 crypto professionals works to maintain the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re looking for breaking news, expert opinions, or market insights, Cryptonews has been your go-to destination for everything cryptocurrency since 2017.