Why Buying XRP Before the End of 2026 Could be Good for Your Portfolio

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships. However, this potential compensation never influences our analysis, opinions, or reviews. Our editorial content is created independently of our marketing partnerships, and our ratings are based solely on our established evaluation criteria. Read More

XRP could be a good investment decision by the end of 2026 because of increased adoption with strategic institutional partnerships, a favorable regulatory landscape, and correlation with greater second-order forces, such as correlation with Bitcoin and the greater macroeconomic landscape.

In early 2026, that decision increasingly comes down to how much institutional capital is entering XRP through ETFs, payment rails, and regulated banking channels.

This article will explore the core factors that influence your decision. We’ll break down XRP’s role in global payments, its ongoing legal landscape, and the major pros and cons you must consider. We aim to give you a clear, balanced view of XRP’s potential. This will help you decide if this cryptocurrency aligns with your investment strategy and risk tolerance.

Why These Next Few Months Could be Good for XRP Investors

2026 could be a strong year for XRP because the lawsuit overhang has mostly lifted. With the SEC effectively ending the core case against Ripple, secondary-market trading risk looks lower than in past cycles. That shifts the story away from “court headlines” and back to whether XRP can ride a broader bull market and real usage.

There’s also a potential ETF boost. Firms like Grayscale, WisdomTree, and Bitwise have filed for XRP products, while Bitwise and Grayscale face final SEC decisions in January-February 2026, which would likely add a new source of demand if it happens. On the utility side, Ripple is pushing bank and payments adoption, including RLUSD and partnerships like AMINA Bank’s integration in Japan, keeping the payments narrative alive.

Another tailwind is XRP’s alignment with ISO 20022; the global financial messaging standard that banks are migrating to. Ripple’s payment infrastructure fully supports ISO 20022 formats, which lets banks modernize their messaging systems while using XRP as a fast settlement layer, keeping it relevant in 2026.

How Has XRP Performed as an Investment?

From 2020 to 2025, XRP’s price was shaped largely by its fight with the U.S. SEC. The lawsuit weighed on sentiment, and some major exchanges limited or paused trading for a period, which kept a lid on demand.

Then the tide turned. As the legal pressure eased and the wider market turned risk-on, XRP ripped higher in late 2024, jumping close to 500% at one point. It pushed back above $3 after spending years far lower, often around the $0.20–$0.30 range.

XRP had a strong but bumpy 2025. It moved up from a low near $1.61 to about $1.91 now, after hitting a high close to $3.67 earlier in the year. Overall, that’s roughly a 20–30% gain, even though some runs more than doubled from the early-year lows before prices cooled again.

A few things pushed it higher. The SEC case against Ripple wrapped up with a $125 million fine, which removed a lot of the fear around listings. There was also more talk about XRP investment products, plus steady news about Ripple’s payments work and the RLUSD stablecoin. Bitcoin’s rally helped, too. Even so, XRP still swung a lot, like most altcoins.

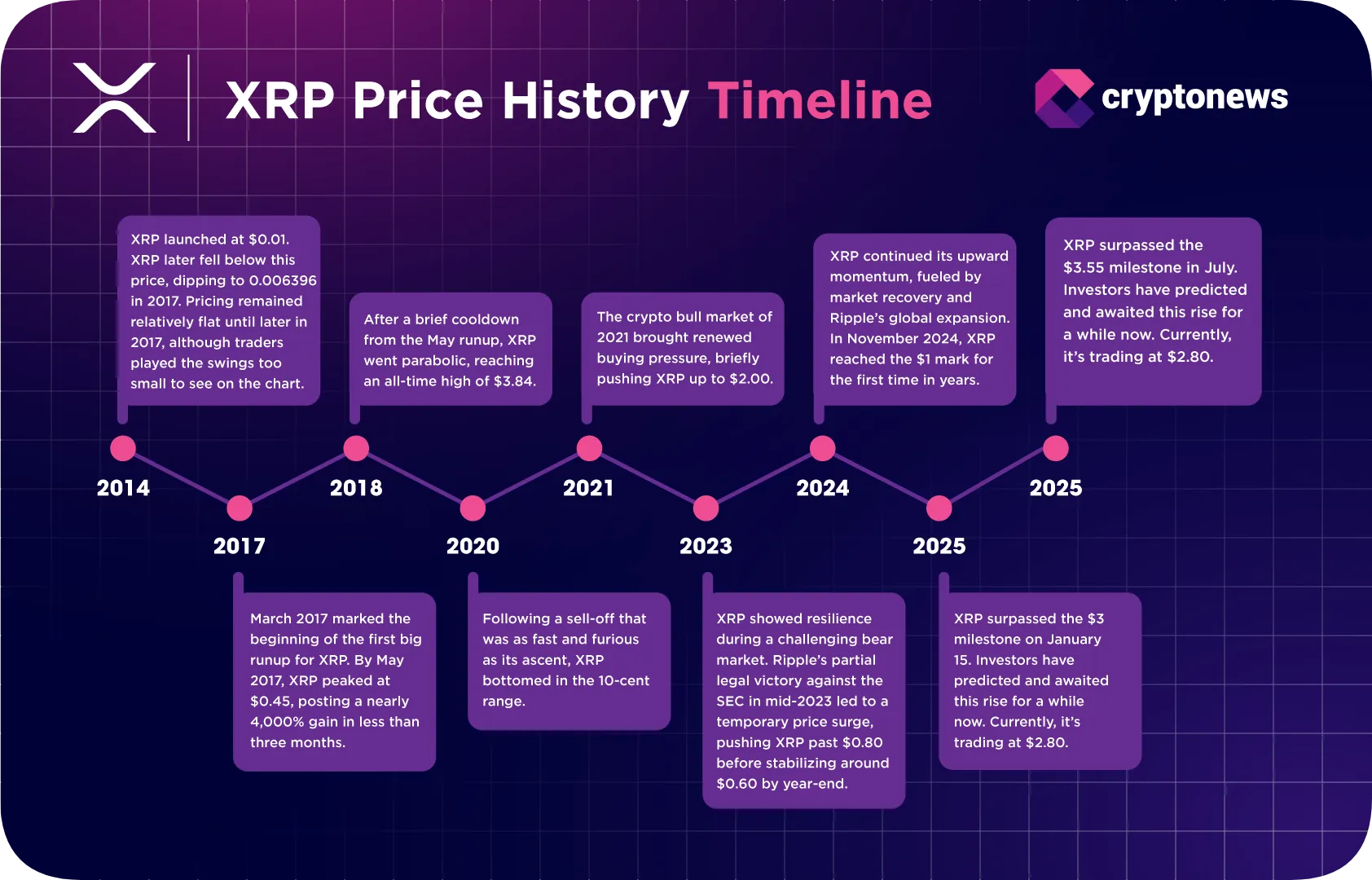

2014: XRP, one of the best crypto dinosaurs, launched at $0.01. It later fell below this price to 0.006396 in 2017. Its value remained relatively flat until later in 2017. 2017: March 2017 marked the beginning of the first big runup for XRP. By May 2017, XRP peaked at $0.45. This amounted to about a 4,000% gain in less than three months. 2018: After a brief cooldown from the May runup, XRP went parabolic. It reached an all-time high of $3.84. 2020: After a quick sell-off, XRP bottomed in the 10-cent range. 2021: The crypto bull market of 2021 brought renewed buying pressure. It briefly pushed XRP up to $2.00. 2023: XRP held strong during the bear market. Ripple’s partial legal victory against the SEC in mid-2023 led to a temporary price surge. XRP pushed past $0.80 before stabilizing around $0.60 by year’s-end. 2024: XRP kept climbing as the broader market improved and Ripple expanded overseas. In November 2024, XRP traded back around $1 for the first time in years. 2025: XRP moved above $3.55 on January 15. It’s now trading at $1.44. Ripple has kept adding partners, and more payment firms have tested or used its tools for cross-border transfers. That helped keep XRP in the spotlight, with higher trading activity and more interest from larger investors at points during the cycle. Even with rules still shifting across regions, XRP has remained one of the most-watched assets in the market. Expert forecasts for XRP in 2026 show a wide but generally optimistic range. The consensus suggests a trading band of $1.52 to $1.59, driven by growing institutional adoption in cross-border payments and hard-won regulatory clarity. This baseline reflects steady, upward momentum throughout the year. Potential for breakouts to $1.67 exist, but it depends entirely on major catalysts like a favorable SEC case outcome or an ETF approval. Conversely, bearish views warn of possible dips if market volatility or regulatory setbacks resurface. Furthermore, XRP may react to changes in monetary policy, particularly from the Fed, despite a favorable regulatory environment. Due to a government shutdown in the U.S., the Fed is likely to pause interest rate cuts, which is likely a bearish event for XRP and crypto. Looking out to 2030, many forecasts put XRP somewhere between $2.26 and $3.39. This assumes Ripple keeps signing new partners and its payment tools keep getting used. It also assumes XRP keeps a place in cross-border transfers, where speed and low costs matter most. Even so, the numbers are all over the place. Some forecasts stay close to $3.39, while the most bullish ones go as high as $4.91. That top end would need XRP to be used far more widely in global payments, which is possible but unlikely. The intermingling of the XRP Ledger (XRPL) and Ripple Labs is important when evaluating an XRP investment. Initially, XRPL allocated 80% of the XRP supply to Ripple. 55% was placed in a locked escrow for price stability. This escrow permits the monthly release of up to one billion tokens. XRP presents a compelling long-term case when you consider its growing institutional, hard-won regulatory clarity, and XRP futures trading. These strengths provide a solid foundation for its future demand. Today, XRP’s value is increasingly tied to RippleNet’s On-Demand Liquidity (ODL) volumes, where XRP is used as a bridge asset for real cross-border settlement rather than passive holding. Moreover, XRP’s technological efficiency as a fast, low-cost bridge currency, combined with major financial institutions projecting significant price growth, offers the potential for substantial long-term appreciation. This makes it an attractive option for growth-focused investors. XRP’s story began in 2011 with Jed McCaleb, David Schwartz, and Arthur Britto. They began XRP Ledger’s development, with XRP as the native token. The network was live by 2012. The project’s goals initially mirrored Bitcoin’s own, which amounted to using XRPL as a global payments ledger. The original open-source project was named Ripple and was the namesake of Ripple Labs, the company that would arise around and from the XRP Ledger. Ripple was originally named OpenCoin before rebranding in 2013. Jed McCaleb of XRP and Chris Larsen founded the company in 2012. Ripple CEO Brad Garlinghouse is a driving force behind the Company’s growth and frequently appears on financial broadcasts to educate investors on XRP and Ripple’s network built on XRPL. David Schwartz is the company’s CTO, founder of XRP, and industry icon. Chris Larsen, a Ripple co-founder, still serves on the board of directors. While XRPL and Ripple are distinct entities, the deep links between them remain, and some of the earliest pioneers of the crypto industry help guide both Ripple and XRP forward. Through Ripple, XRP is used as a payment and settlement asset in real-world applications, as well as on XRP meme coins. Fast transaction times and low fees make it possible to transfer money anywhere in the world in seconds. The integration of AMINA Bank in Japan signals Ripple’s growing dominance in Asian payment corridors, driving institutional transaction volumes higher. Compared to the legacy SWIFT system, which can take up to five days, XRP-powered transactions are much more efficient. This value proposition isn’t lost on Ripple’s rapidly growing list of partners. Ripple’s RLUSD stablecoin supports this system by improving liquidity efficiency for institutions, while settlement still relies on XRP as the bridge asset. Litigation in the US has led to an international focus. Ripple has onboarded dozens of financial institutions and service providers globally, and can host other tokens. This makes the platform well-suited to tokenizing real-world assets. Ripple does not rely on mining like Bitcoin or staking like Ethereum. Instead, it uses a network of trusted validators (nodes) to confirm transactions. Because the system doesn’t require heavy computing work, transfers can settle quickly while using far less electricity than mining-based networks. XRP’s supply is fixed at 100 billion tokens, and they were created upfront. That means there’s no ongoing mining process and no extra energy spent producing new coins over time. In simple terms, the supply doesn’t grow, and the network doesn’t need miners to keep issuing more XRP. XRP’s legal picture improved a lot in August 2025. The SEC case was dismissed, and Ripple paid a $125 million fine. At the same time, Ripple kept a key point: public sales of XRP were not treated as securities. With secondary-market XRP sales affirmed as non-securities, XRP enters 2026 as one of the few major altcoins with a clear U.S. regulatory status, making it safer for investment. Ripple and the SEC also dropped their appeals together, which brought the long court fight to a close. With that uncertainty mostly gone, XRP no longer trades under the same legal shadow it did for years, which helped sentiment and made the asset easier to support for larger players. The next big question is ETFs, since several spot XRP ETF applications are waiting on a decision. If one gets approved, it could bring in new institutional demand, but approval is still not guaranteed. Supply is another concern. Ripple-held reserves and regular escrow releases can create fear of extra selling pressure. XRP also faces heavy competition from stablecoins, other major chains, and newer payment systems, any of which could take share in cross-border transfers. The XRP Ledger itself is getting major upgrades. It’s adding features like Ethereum compatibility and lending, making it more attractive to big financial players. Think of it as the network getting a serious engine overhaul. And it’s not just about tech. Accelerator programs are actively funding startups to build useful tools on the XRPL. Between these efforts, its core job in cross-border settlements, and potential ETF approvals, XRP is building a case for long-term utility. The foundation is being laid, brick by brick. Deciding whether to buy XRP now requires weighing its solid progress against real risks. The project has strong institutional backing, and its legal clarity has improved dramatically, which are huge positives for its long-term case. Here’s a quick look at the expert consensus: As with any investment, never risk more than you can afford to lose. Diversifying your cryptocurrency portfolio can help mitigate volatility risks. Although XRP is slated for strong growth in the future, taking a balanced approach to investing in it will prove prudent.

XRP Latest Events

In 2026, XRP achieved important milestones and market activity. Below are the key events that marked this year:

XRP Price History Timeline

Similar to other cryptocurrencies, XRP has seen parabolic growth but has fallen hard from its peaks. However, XRP’s all-time high came in 2018 rather than 2021, as was the case for Bitcoin, Ethereum, Cardano, and other top-ten cryptocurrencies.

XRP Price Forecast

Is Ripple a good investment? CryptoNews analysis gives an XRP price prediction as high as $1.67 in 2026. We will provide you with a detailed review for the next five years, and below you can check the main predictions until 2035:Year Potential Low (ROI) Average Price (ROI) Potential High (ROI) 2027 $1.64 (14.21%) $1.85 (28.43%) $2.05 (42.64%) 2028 $1.85 (28.75%) $2.32 (61.12%) $2.83 (97.12%) 2029 $2.06 (43.21%) $2.84 (97.36%) $3.79 (163.69%) 2030 $2.26 (57.18%) $3.39 (135.96%) $4.91 (241.20%) 2031 $2.45 (70.20%) $3.96 (175.22%) $6.14 (326.68%) 2032 $2.61 (81.78%) $4.50 (213.03%) $7.41 (415.22%) 2033 $2.75 (91.49%) $4.99 (247.00%) $8.63 (500.20%) 2034 $2.86 (98.93%) $5.39 (274.74%) $9.69 (573.88%) 2035 $2.93 (103.75%) $5.67 (294.05%) $10.48 (628.49%) 2036 $2.96 (105.74%) $5.80 (303.24%) $10.89 (657.47%) XRP Price Forecast 2026

XRP Price Forecast 2030

Is XRP a Good Long-Term Investment in 2026?

XRP is a solid investment if you look at it as a play on future market sentiment, rather than fundamentals or utility.Strong and Experienced Leadership

Expanding Partnerships and Use Cases

Energy-Efficient Transaction Validation

Regulatory Status

Risks of Investing in XRP

XRP still comes with real downside risk, even with better clarity than in past cycles. Rules can change again, and new enforcement actions or global regulations could reduce exchange support, limit demand for XRP-related products, or slow bank use. XRP is also closely tied to Ripple’s success, so problems at Ripple can quickly hurt sentiment and price.What Does the Future Hold for XRP?

XRP probably won’t die in the near future. However, it depends on tangible developments, not just price moves. You can see this in its new custody services with partners in South Korea and its recent launch of the RLUSD stablecoin. These steps are building its real-world use for institutional payments.What Experts Say on Whether You Should Buy XRP

Conclusion: Is Ripple a Good Investment?

In 2026, XRP shows strong investment potential due to regulatory clarity now that the SEC case was officially dismissed. That shift reduced legal risk and made it easier for bigger investors to consider XRP through exchange-traded products.FAQs

Can XRP hit $10?

How high can XRP realistically go?

How much will 1 XRP be worth in 2030?

What makes XRP a better investment than other cryptocurrencies?

References

About Cryptonews

Our goal is to offer a comprehensive and objective perspective on the cryptocurrency market, enabling our readers to make informed decisions in this ever-changing landscape.

Our editorial team of more than 70 crypto professionals works to maintain the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re looking for breaking news, expert opinions, or market insights, Cryptonews has been your go-to destination for everything cryptocurrency since 2017.