Quick Take

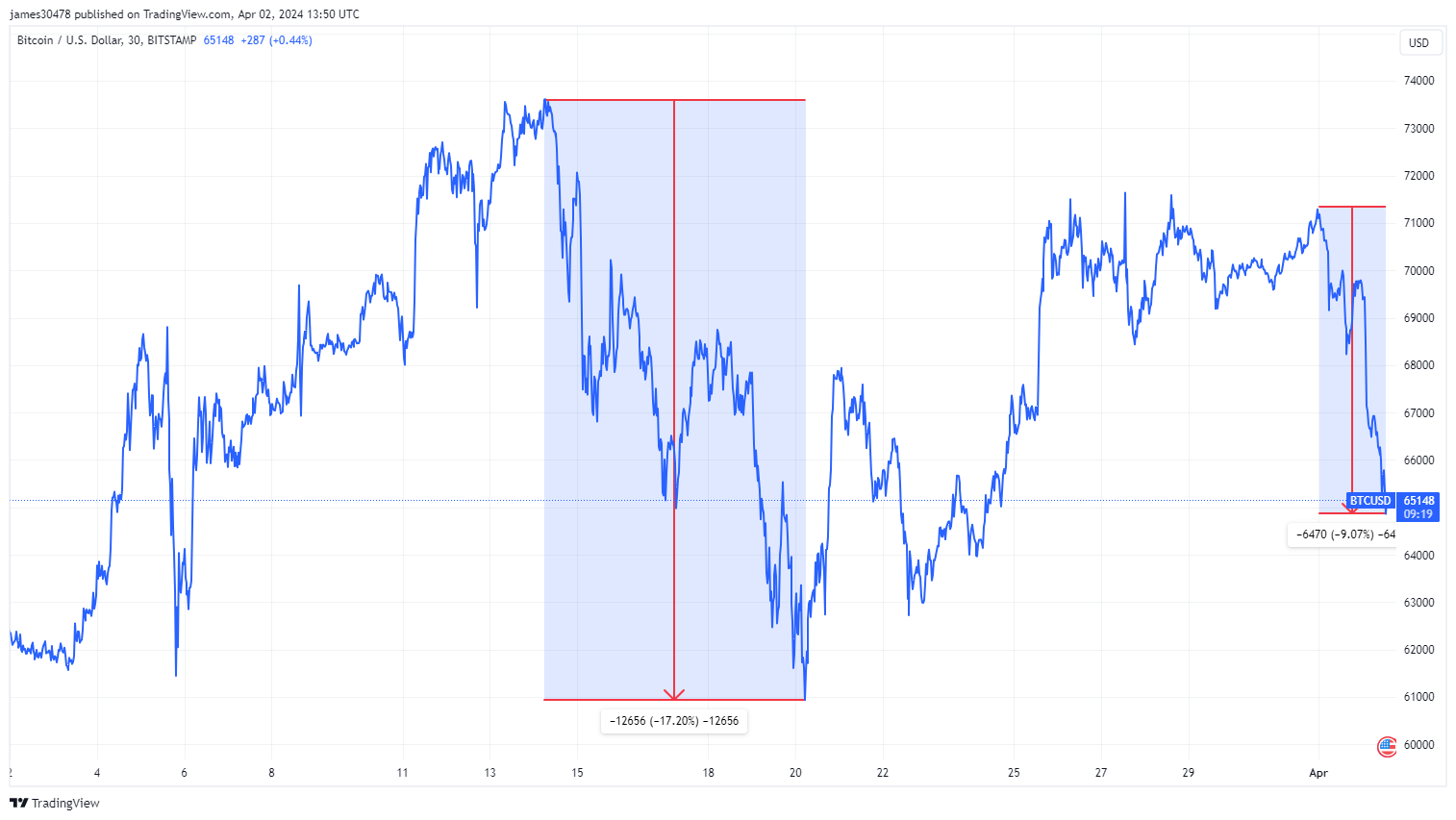

With the halving event looming roughly 18 days away, Bitcoin is showing a predictable downturn. It has dipped below $65,000, marking a 12% decline from its all-time high and nearly 10% lower since the beginning of April.

In a pattern reminiscent of March, when Bitcoin reached its peak, it promptly retreated to around $60,000, experiencing a 17% decrease.

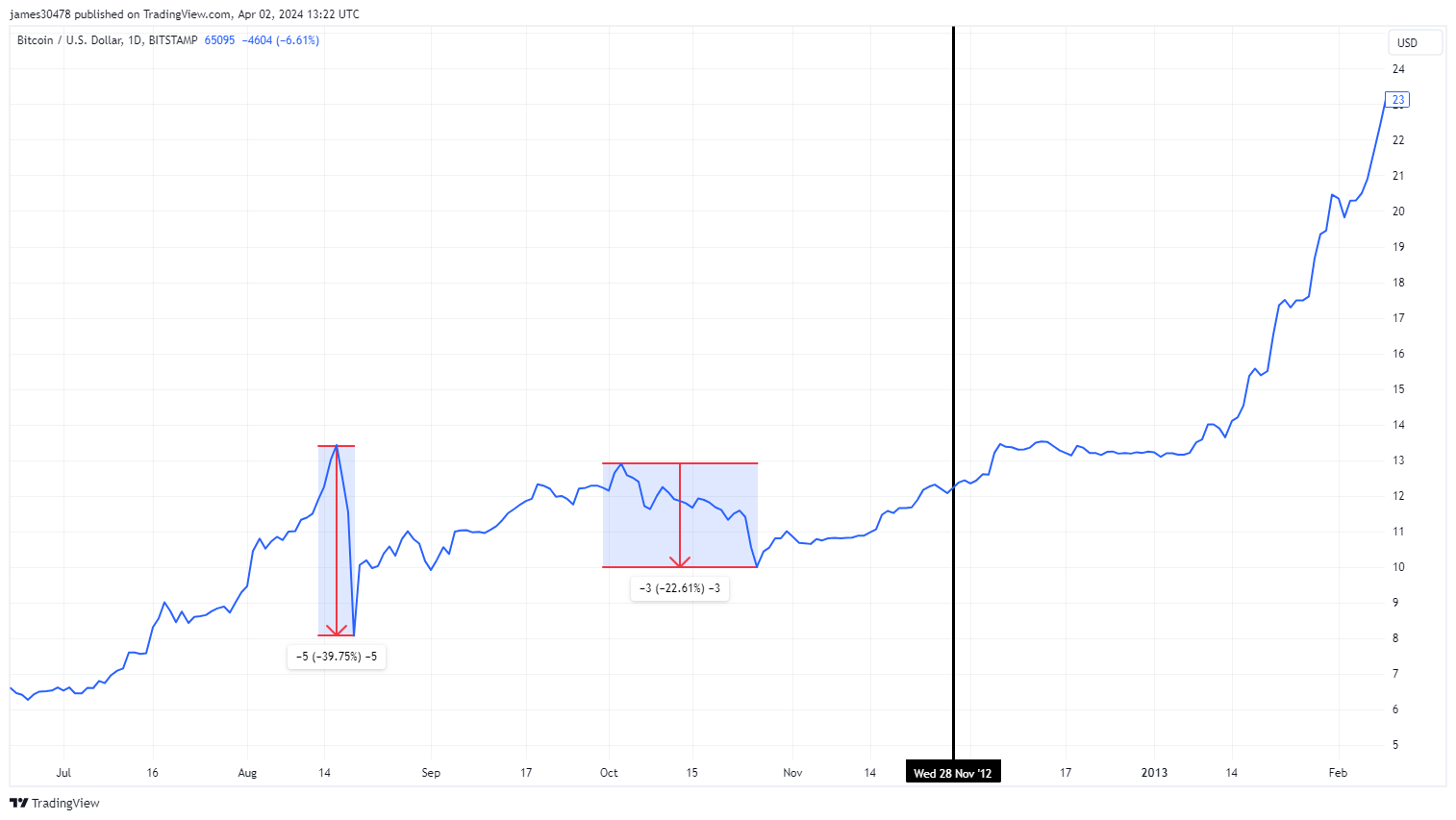

Historical data reveals drawdowns of comparable or larger magnitude preceding prior halving events.

For instance, before the first halving in November 2012, Bitcoin experienced a 40% decline in August and a 23% drop in October of the same year.

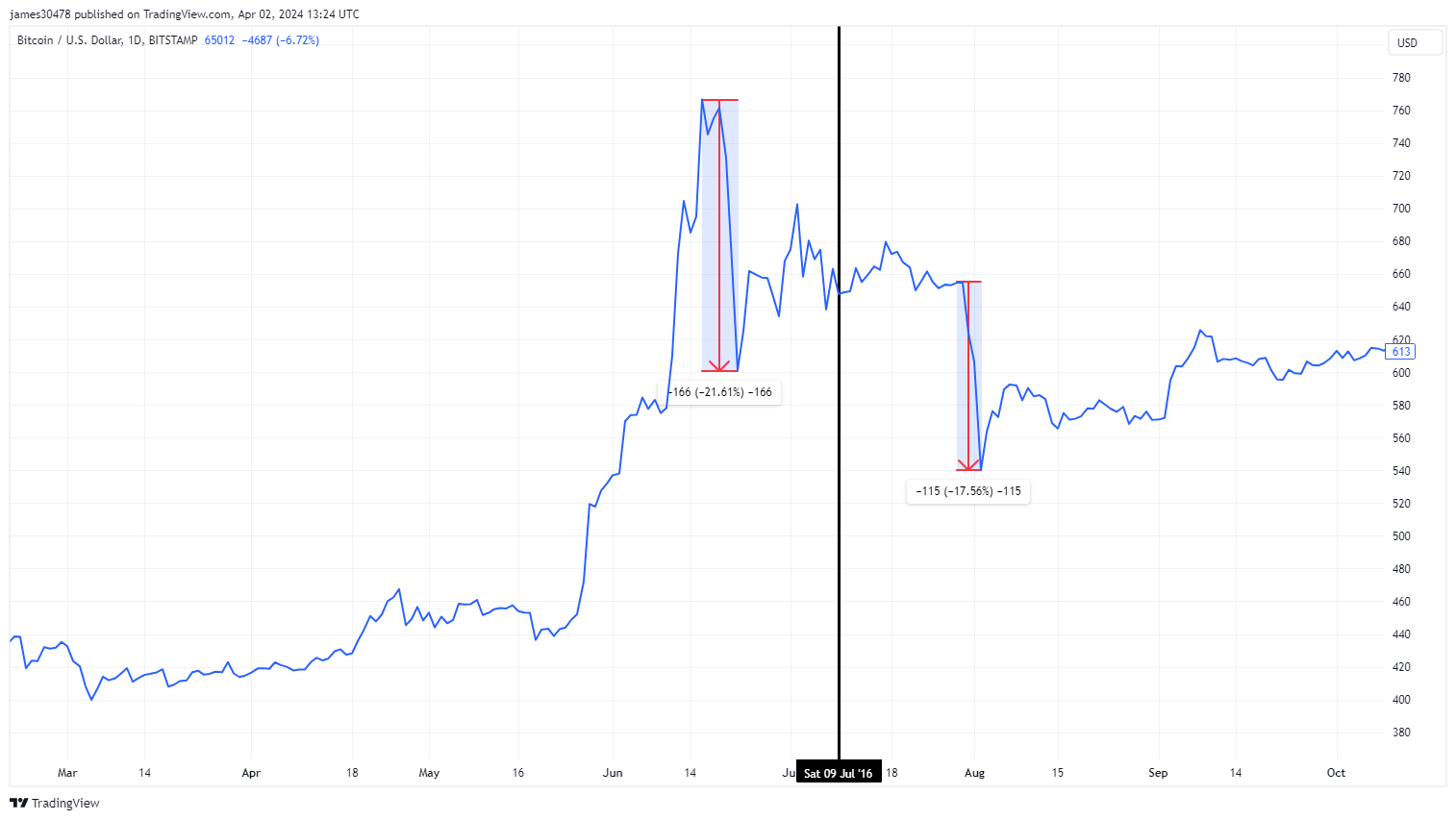

Leading up to the second halving in July 2016, Bitcoin encountered a 22% decrease in June, followed by an 18% decline in August after the halving.

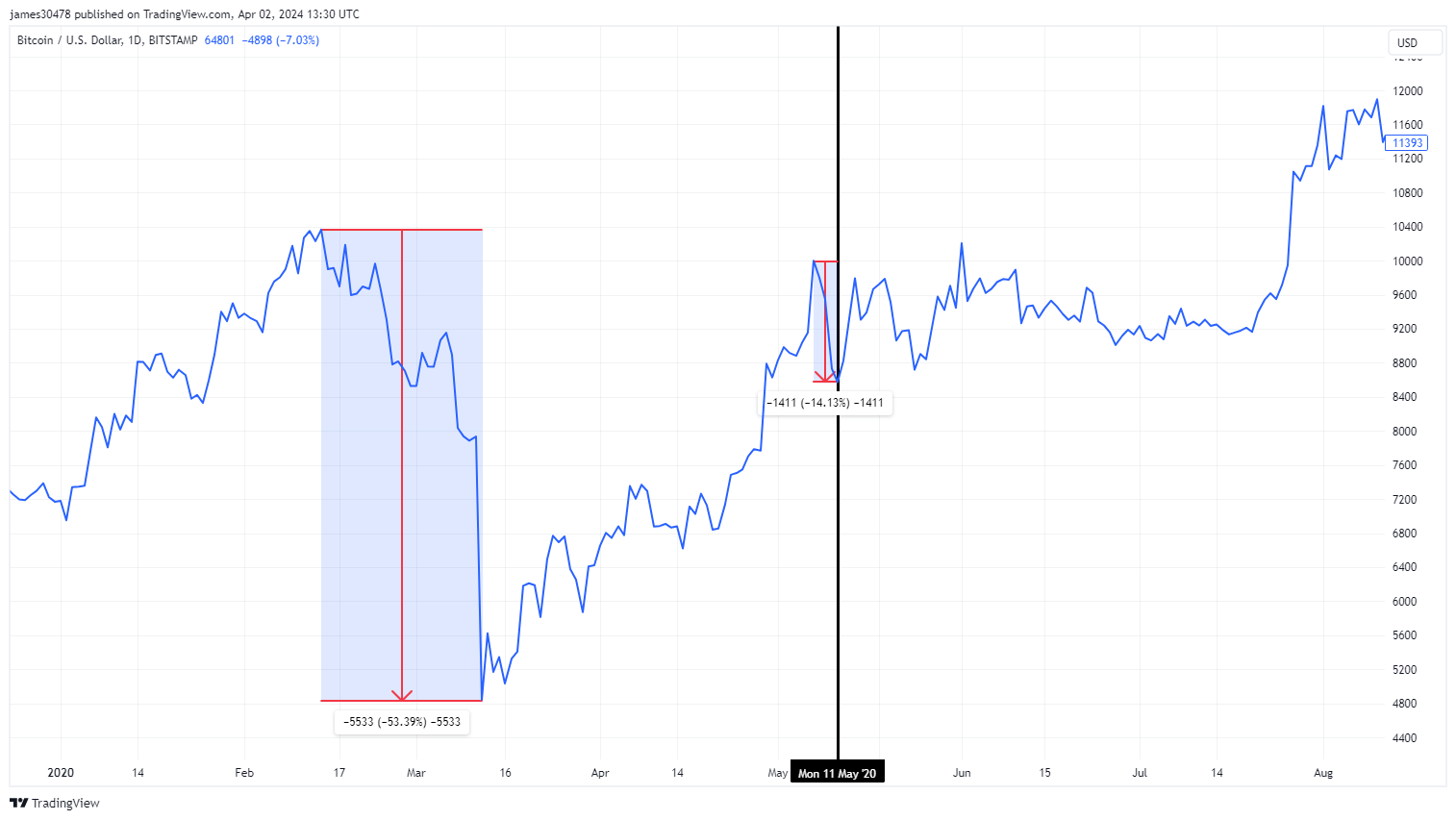

The 2020 halving in May was followed by an anomalous 53% crash attributed to the impact of COVID-19. However, Bitcoin had fully recovered from the significant crash within the same month.

Meanwhile, Bitcoin experienced a 14% decline just before the halving.

Though this volatility may concern some investors, it aligns with the characteristic fluctuations observed during halving periods.