Quick Take

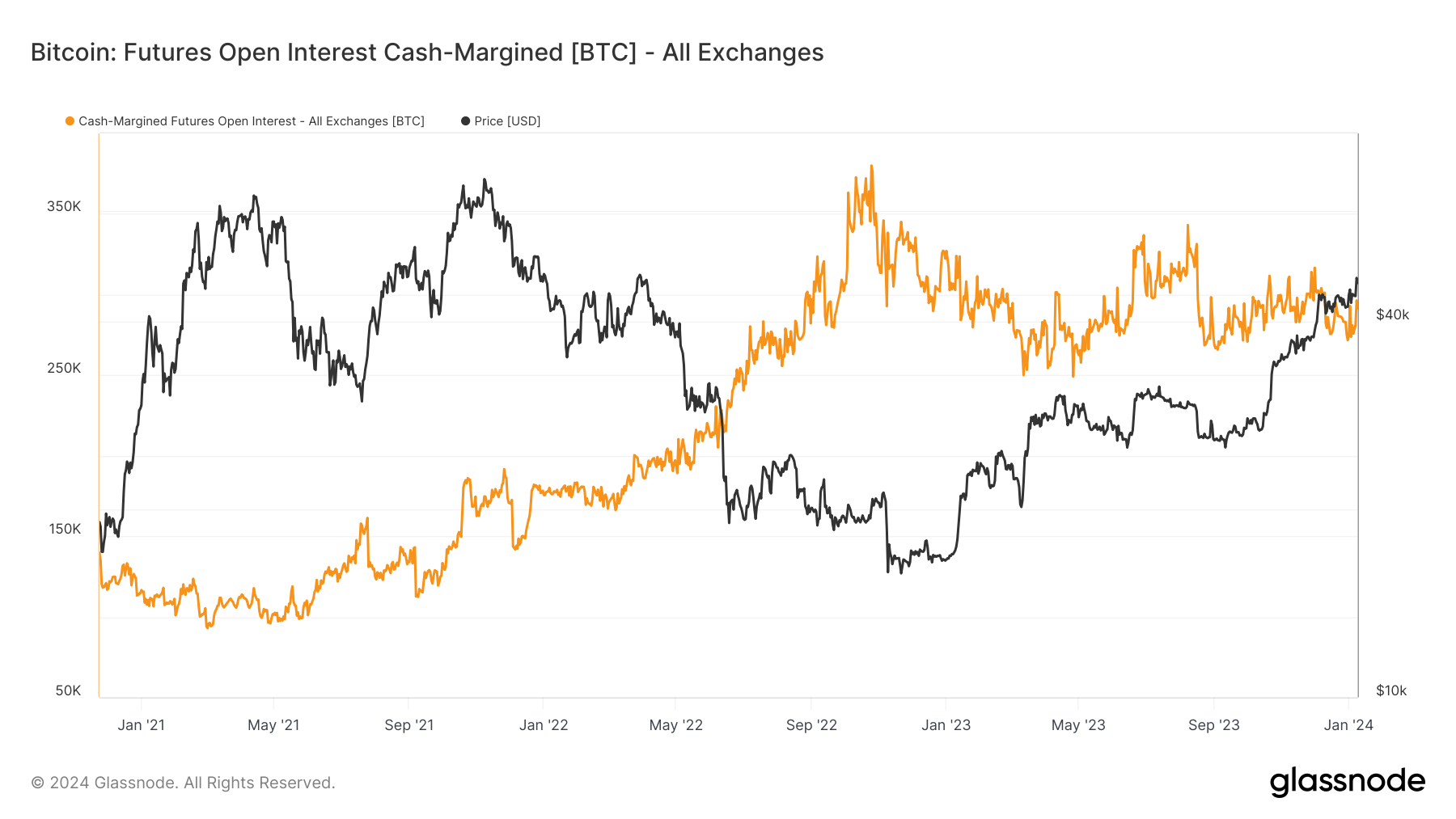

A noteworthy shift is visible in the landscape of Bitcoin futures contracts, as evidenced by the current state of open interest margined in native Bitcoin (BTC). There has been a significant fall in BTC-margined futures contracts, down from a peak of 240,000 BTC during the 2021 bull market to an all-time low of 82,000 BTC. Multiple exchanges mirror this trend. Binance currently holds 21,500 BTC, nearing a new low.

Similarly, Bitmex and Bybit are at all-time lows with holdings of 6,000 and 14,500 BTC, respectively. Deribit, while not at its lowest, has seen a significant reduction from its December high of 34,000 BTC, now sitting at 22,000 BTC. OKX's holding has stagnated at 15,000 BTC since April 2023, while Kraken and Huobi hold a few thousand BTC each.

The Bitcoin futures market sees fewer contracts margined in native coins; roughly 22% of all futures contracts use crypto-margin. Meanwhile, cash-margin remains steady at around 300,000 Bitcoin. Bitcoin's shift from volatile futures to more stable cash margins could signal reduced market volatility.