Best New Uniswap Listings to Watch in 2026

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships. However, this potential compensation never influences our analysis, opinions, or reviews. Our editorial content is created independently of our marketing partnerships, and our ratings are based solely on our established evaluation criteria. Read More

Uniswap, a decentralized crypto exchange, is great for discovering new tokens. For 2026, Bitcoin Hyper (HYPER) and Maxi Doge (MAXI) stand out as our top Uniswap listings to watch.

Each one of these tokens has unique strengths, making them excellent candidates for traders seeking high-potential assets and potential listing on Uniswap.

We want to explore new Uniswap listings to watch in 2026. All the projects we review have various use cases, solid tokenomics, and a micro-cap valuation.

Please note: This article is mostly speculative and based on our research only. There’s no guarantee that some of the tokens mentioned in this list will be listed.

Ranking the Upcoming & Newest Uniswap Listings for 2026

We provided our rankings for the best coins recently listed on Uniswap. Here, you’ll also discover unique selling points about each one.

| Coin | Symbol | Market Cap | Current Price |

|---|---|---|---|

| Bitcoin Hyper |  HYPER +18.74% HYPER +18.74% |

$31.12M | $0.01365500 |

| Maxi Doge |  MAXI +12.04% MAXI +12.04% |

$4.55M | $0.00028010 |

| SUBBD |  SUBBD +4.50% SUBBD +4.50% |

$1.47M | $0.05747500 |

| Mantle | $4.92B | $0.79 | |

| Huma Finance |  HUMA +0.00% HUMA +0.00% |

$79.19M | $0.03056 |

Our Analysis of the Top New Uniswap Listings for 2026

The top new listings for Uniswap in 2026 span several sectors, such as meme coins, DeFi, and utility tokens. Here is our breakdown of some of the tokens with the potential to be listed on Uniswap:

1. Bitcoin Hyper (HYPER): Layer 2 Utility Token Poised for Uniswap Launch

Bitcoin Hyper  HYPER +18.74% could be one of the most exciting tokens to hit Uniswap this year. This audited Bitcoin-native Layer 2 project is designed to make BTC faster and cheaper. It uses SVM rollups to batch transactions and settle them back on Bitcoin. So far, the project has raised $31.12M in its presale and offers up to 38% APY through staking.

HYPER +18.74% could be one of the most exciting tokens to hit Uniswap this year. This audited Bitcoin-native Layer 2 project is designed to make BTC faster and cheaper. It uses SVM rollups to batch transactions and settle them back on Bitcoin. So far, the project has raised $31.12M in its presale and offers up to 38% APY through staking.

The team has been active, already releasing demos, including a bridge and block explorer to show investors some of the project’s features, with ongoing token burns and block-based staking math planned. Even though mainnet timing depends heavily on finalizing ZK proofs, Bitcoin Hyper is gaining momentum. Once the presale ends, HYPER is expected to launch on Uniswap, unlocking liquidity and market access immediately.

Listing on Uniswap allows the team to manage liquidity pools, support price stability, and enable global trading without centralized approval. It also connects HYPER to a broad DeFi ecosystem, helping users stake, farm, or integrate it with other decentralized tools. This aligns with the project’s decentralized vision and boosts early visibility.

| Bitcoin Hyper Launch Date | Q4 2025 |

| Purchase Methods | ETH, USDT, BNB, USDC, Credit card |

| Chain | Bitcoin |

| Current Price | $0.01365500 |

| Price Change | +18.74% |

| Raised So Far | $31.12M |

Time until next price increase:

2. Maxi Doge (MAXI): Doge-Themed Meme Coin Hosting Weekly Competitions

Maxi Doge  MAXI +12.04% is a new meme coin that’s gym-culture themed. It offers staking rewards of up to 69%, futures integration, and leverage trading. Maxi Doge’s smart contract has been audited by both Coinsult and SolidProof, offering a great option for those who value high-risk investments.

MAXI +12.04% is a new meme coin that’s gym-culture themed. It offers staking rewards of up to 69%, futures integration, and leverage trading. Maxi Doge’s smart contract has been audited by both Coinsult and SolidProof, offering a great option for those who value high-risk investments.

While other meme coins have seen massive returns, MAXI stands out with over $4.55M raised so far. With a fixed token supply of 150B, Maxi Doge has an advantage over inflationary rivals. For anyone scanning Uniswap for explosive tokens, Maxi Doge merits attention. It has a presale price of $0.00028010 and a hard cap reflecting its total token supply. ERC-20 compatibility and audited contracts support its Uniswap listing potential for substantial returns.

For anyone scanning Uniswap for explosive tokens, Maxi Doge merits attention. It has a presale price of $0.00028010 and a hard cap reflecting its total token supply. ERC-20 compatibility and audited contracts support its Uniswap listing potential for substantial returns.

| Maxi Doge Launch Date | Q4 2025 |

| Purchase Methods | ETH, USDT |

| Chain | Ethereum |

| Current Price | $0.00028010 |

| Price Change | +12.04% |

| Raised So Far | $4.55M |

Time until next price increase:

3. SUBBD (SUBBD): Creator Economy Token Targeting Uniswap Integration

SUBBD  SUBBD +4.50% is a token built for a platform that helps creators and fans connect directly. It supports payments, staking, and content access within one app. The token is based on Ethereum and has drawn attention through its presale, where early buyers also unlock beta access and staking rewards.

SUBBD +4.50% is a token built for a platform that helps creators and fans connect directly. It supports payments, staking, and content access within one app. The token is based on Ethereum and has drawn attention through its presale, where early buyers also unlock beta access and staking rewards.

A Uniswap listing gives SUBBD immediate global access. Users can trade the token without going through centralized exchanges. It also supports real-time price discovery based on what people are actually willing to pay. That transparency builds trust and helps early traders find value from the start.

The team can also control the token’s liquidity pool on Uniswap, adjusting supply as needed. And because Uniswap connects to a vast network of wallets and DeFi tools, $SUBBD becomes easier to use across the Web3 space. For both creators and fans, this makes the token more flexible and useful from day one.

| SUBBD Launch Date | Q4 2025 |

| Purchase Methods | ETH, USDT, BNB, USDC, Credit card |

| Chain | Bitcoin |

| Current Price | $0.05747500 |

| Price Change | +4.50% |

| Raised So Far | $1.47M |

Time until next price increase:

4. Mantle (MNT): ZK-Powered Liquidity Layer for Ethereum

Mantle is a ZK rollup scaling Ethereum. Likewise, it executes transactions off-chain and settles them on Ethereum. This allows it to have lower fees and swifter execution, while inheriting its Ethereum’s security.

Naturally, holders can use MNT for gas fees and governance, which gives them voting rights. Although Mantle is an Ethereum Layer 2, it also comprises an entire ecosystem for restaking, gaming, DeFi, and other use cases.

The project markets itself as a “liquidity chain.” It has its own liquid-staking and liquid-restaking tokens that let you earn yield on certain assets in DeFi. This is made possible, in concert, with EigenLayer’s restaking technology.

| Launch Date | July 2023 |

| Chain | Ethereum |

| Current Price | $0.79 |

| 24H Price Change | -9.39% |

| Market Cap | $4.92B |

5. Huma Finance (HUMA): PayFi Token that Bridges Real-World Income

Huma Finance facilitates payment finance (PayFi) solutions. In other words, it enables credit by collateralizing real-world income. Its protocol uses programmable payments and on-chain underwriting for automated settlements. HUMA tokens power governance and ecosystem incentives.

In May 2025, Huma Finance listed HUMA on Uniswap. However, HUMA is primarily traded on other markets, so its liquidity is relatively low — less than $20k across all Uniswap liquidity pools. Needless to say, it has some room to grow.

With its Uniswap integration, HUMA gains access to an entire layer of liquidity across all EVM-compatible networks. Thanks to Uniswap’s unique approach to addressing fractured liquidity (i.e., composable, atomic swaps), HUMA has the potential to grow on the DEX.

| Launch Date | May 2025 |

| Chain | BSC |

| Current Price | $0.024 |

| 24H Price Change | -0.08% |

| Market Cap | $247.47M |

What Are Uniswap Listings?

Uniswap listings are tokens added to the Uniswap decentralized exchange, allowing users to trade them directly without intermediaries. Unlike traditional exchanges, anyone can list a token by creating a liquidity pool by depositing equal values of the new token and another asset into a smart contract. This makes Uniswap permissionless, meaning no approval is needed, and users can freely swap tokens once the pool exists. You can learn more in our Uniswap Review 2026.

These listings depend on liquidity providers who fund the pools and earn fees from trades. Prices adjust automatically based on supply and demand in the pool. While this system supports thousands of tokens, it carries risks, such as price volatility and possible loss of liquidity for providers.

Why Invest in the Next Uniswap Listings?

There are various reasons why you may want to invest in new Uniswap listings, including favorable prices, long-term price potential, and frontrunning CEX listings. Let’s break these reasons down in further detail.

Initial Listing Price Increase

Although this isn’t always the case, new coins on Uniswap often witness an immediate increase in value. This is because there’s often a lot of excitement around a new project being listed, especially on Uniswap. After all, Uniswap is one of the largest decentralized exchanges, with daily volumes often exceeding $1 billion.

For example, Wisdom Protocol rose 6,000% in just 14 hours after being listed. Crucially, when investors see that a new Uniswap listing is ‘mooning,’ it encourages them to jump on board, which can result in even more parabolic gains.

Long-Term Price Potential

Some investors will buy new Uniswap coins and cash out within a few hours. Although this can still yield notable gains, much larger growth can be secured over time. This is because some projects have solid fundamentals with identifiable use cases. These projects have the best chance of growing 100x or more.

Small Market Capitalization

Uniswap is often the first exchange for newly created cryptocurrencies, especially those that have just completed their presale campaigns. In most cases, new Uniswap coins have a very small market capitalization. This will appeal to investors who are prepared to take on additional risk to target significant gains.

- For example, consider a new project that is listed on Uniswap with a market capitalization of just $2.5 million.

- If the tokens increased by 15x, this would give the project a valuation of $37.5 million.

- And at 150x, its market capitalization would still only be $375 million.

These valuations are still paltry when compared to the broader cryptocurrency market, which is currently worth over $2.9 trillion. This means that the best low-cap cryptocurrencies on Uniswap can produce significant returns.

Preparation for Centralized Exchange Listings

We’ve established that new projects will often list on Uniswap as their initial exchange. The reason for this is simple: Uniswap is a decentralized exchange, so there isn’t a listing application process. Instead, any cryptocurrency can be listed on Uniswap simply by adding the smart contract address and some liquidity.

However, Uniswap is just a building block for new cryptocurrencies. Projects can list on centralized exchanges as they increase their token holders, trading volume, and community members. This gives them access to a much larger pool of investors and liquidity.

Therefore, new Uniswap listings allow you to buy cryptocurrencies before launching on more popular exchanges, such as Binance, KuCoin, or Gate.io.

How to Find the Upcoming Coins to List on Uniswap

Uniswap doesn’t have a list of new coins added to its exchange. This is likely because of the sheer number of new listings. Plus, Uniswap can’t differentiate between legitimate and scam projects, as it’s merely a decentralized protocol that facilitates trades.

To find the best new Uniswap listings, you’ll need to think outside the box. Consider the methods below to get the ball rolling.

DexTools

The best place to find new listings on Uniswap is DexTools. This is a data aggregation website that extracts information on pricing from decentralized exchanges.

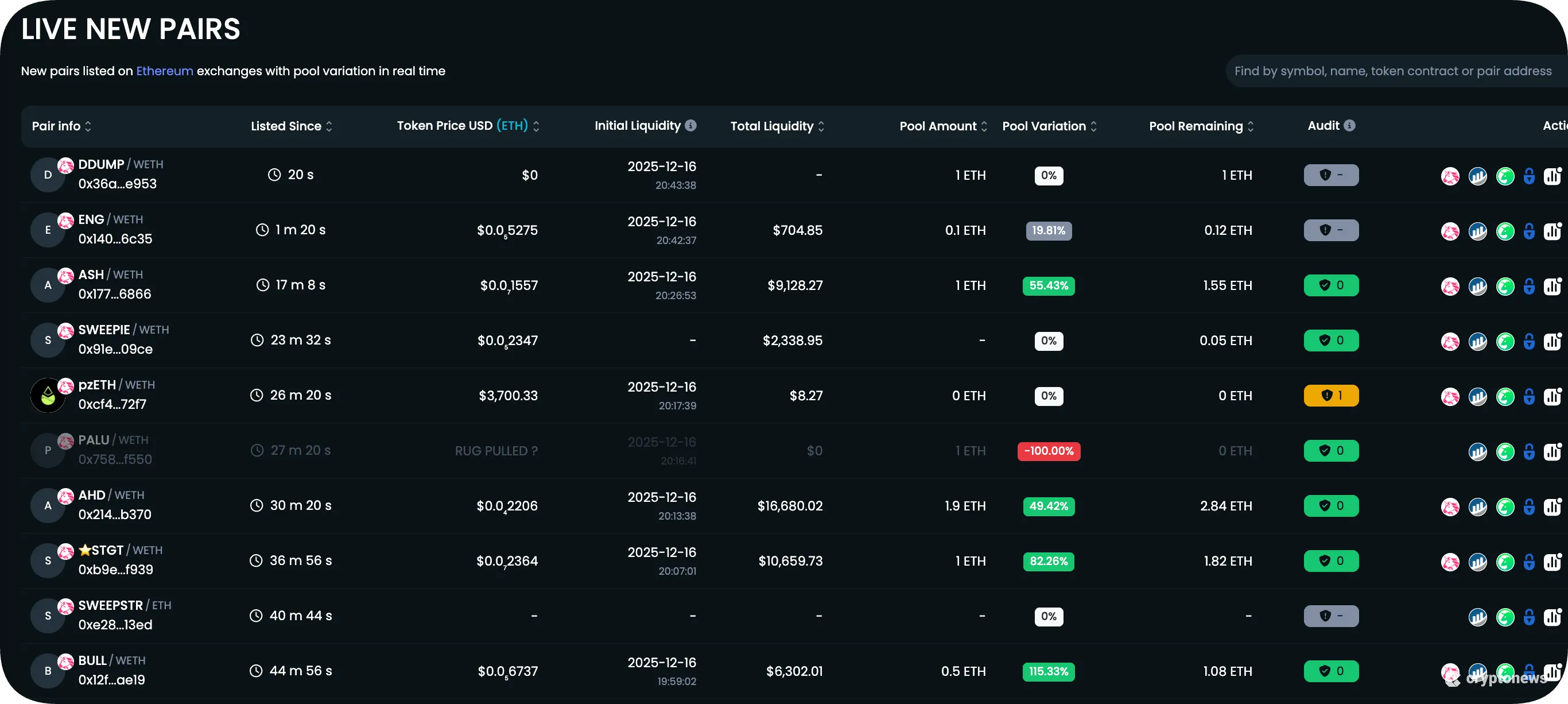

You’ll need to visit the DexTools website and head over to the ‘Live New Pairs’ section. Unfortunately, there isn’t a filter specifically for Uniswap. That said, by default, DexTools displays new listings on the Ethereum network.

In most cases, New ERC-20 listings initially appear on Uniswap. You can verify this by looking for the Uniswap logo on the right-hand side, as shown in the image above. DexTools displays tokens by listing time, meaning you can view the newest Uniswap listings.

Next, click on a project for price-related data, including market capitalization, liquidity, and trading volume. The project’s website usually has a link to its whitepaper and assessment of its token use cases.

ListingSpy

Another way to find Uniswap’s new pairs is on ListingSpy. This is also a data aggregation platform, although ListingSpy specifically focuses on new listings. You’ll be shown cryptocurrencies based on the listing date and time, alongside useful data.

The information covers the current price, liquidity, and total locked value (TLV). You’ll also find links to every project’s website and social media accounts. However, ListingSpy doesn’t have as many listings as DexTools, although it is much more user-friendly.

DexTools vs. ListingSpy

Both tools focus on new token listings, but DexTools offers broader analytics while ListingSpy focuses on simplicity for spotting launches. Here’s how the two differ:

| Feature | DexTools | ListingSpy |

| Listing Frequency | Very high (near real-time pairs) | Moderate (fewer listings) |

| Primary Focus | Broad DEX analytics, charts, trust scores | New listings on DEX/CEX |

| Uniswap Filtering | Integrated DEX visibility | Direct new token visibility |

| User-Friendliness | Moderate (data-heavy) | High (simple interface) |

| Filter Options | Advanced charts and metrics | Basic price/liquidity data |

| Best For | Spotting listings immediately after launch | Early detection of potential gems |

Presale and ICO Listing Websites

DexTools and ListingSpy are ideal for finding cryptocurrencies that have just been listed on Uniswap. But what about upcoming Uniswap coins that aren’t live yet?

In this instance, you’ll want to focus on new cryptocurrency presales (ICOs). They are often built on the Ethereum blockchain and have confirmed they’ll be listed on a decentralized exchange.

ICOBench and ICODrops are good options, as they display upcoming and existing presales. You can then learn more about each presale project and its proposed listing date.

Risks and Considerations for New Token Investments

Don’t rush to invest in any of the new Uniswap listings before understanding the risks and doing your due diligence. Here are some of the risks you should know about:

❌ Smart Contract Risk

Many new tokens don’t have robust teams and funding to spend on smart contract audits and bug detection. If they have poorly written code, hackers can exploit it.

👉 To minimize risks, invest in tokens with audited smart contracts. Also, it’s a good idea to avoid projects whose contracts allow for arbitrary token minting or owner control of funds.

❌ Liquidity Risk

New tokens usually have low liquidity on Uniswap, which means you may find it difficult to sell your tokens at a fair price.

👉 Before investing, check the token’s liquidity on Uniswap to avoid those with less than $100,000 in total value locked (TVL).

❌ Rug Pulls & Exit Scams

DEXs don’t vet new projects like major crypto exchanges, leaving room for scam projects. Bad actors can implement pump-and-dump schemes, honeypot scams, or rug pulls, abandoning the project while causing losses for unsuspecting investors.

👉 To protect yourself, avoid tokens launched by anonymous teams with no history and no partnerships with reputable Web3 players.

❌ Volatility

Needless to say, new tokens can be much more volatile compared to the broader crypto market due to a lower market cap.

👉 To mitigate this risk, you can diversify your exposure by purchasing multiple listings. Also, invest only what you can afford to lose.

Our Methodology When Ranking Uniswap New Listings

We spent hours researching the best new coins on Uniswap. Here’s an overview of our methodology while reviewing each one:

Listing Time Frame (20%)

For a project to be considered a new Uniswap listing, it must meet one of two criteria. First, if the tokens are already trading on Uniswap, they must have been listed within the prior 72 hours.

Alternatively, if the project still raises presale funds, its first exchange listing must be Uniswap. These criteria ensure investors get exposure to new Uniswap coins from the beginning.

Small Market Cap (20%)

All the projects discussed have a small market capitalization, ensuring an upside. We set an upper limit of $10 million, although some Uniswap coins are valued in the six figures. While small-cap cryptocurrencies are highly volatile and risky, diversification can help investors mitigate their risk.

Project Goals and Use Cases (20%)

We also focused on the project’s fundamentals. We picked out projects that have steady goals, clear strategies, and achievable objectives. We examined each token’s use case, prioritizing coins that offer the best utility.

Price Performance Since Listing (20%)

Some of the new Uniswap coins discussed were selected because of their price performance since being listed. This strategy is separate from fundamental research, focusing exclusively on momentum. Ultimately, some investors buy coins on Uniswap because they are exploding in value. This creates hype and FOMO, helping the tokens to continue their parabolic trajectory.

Presale Upside (20%)

We also selected upcoming Uniswap listings that are currently offering a presale upside, as this is the core differentiator in our ranking methodology. Presales allow investors to buy tokens at a discounted price before they’re listed on Uniswap. This approach targets risk-reward setups that momentum-based lists typically miss.

In addition to risk and bankroll management, remember that diversification is crucial. After all, you only need one investment to explode and make sizable gains, even if the other tokens don’t perform well.

Conclusion: Our Final Thoughts on the Best Uniswap Listings for This Year

New listings on Uniswap give crypto watchers the chance to invest in brand-new cryptocurrencies before they take off. These new projects span from decentralized finance to gaming to governance-focused tokens, with each one aiming to bring unique utility and value to the ecosystem.

For those who want to invest in tokens with potential high growth, we recommend Bitcoin Hyper (HYPER) and Maxi Doge (MAXI) as they offer steady use cases, active communities, and strong tokenomics. Yet, for those who want to integrate AI into their crypto investments, they can try Huma Finance (HUMA).

When investing in Uniswap listings, due diligence remains crucial. Market volatility and liquidity fluctuations can impact trading, especially with an influx of new tokens. When choosing new Uniswap tokens, consider their utility, tokenomics, team transparency, and community support.

FAQs

Where can I find new Uniswap listings?

Is there a way to get Uniswap new listings alert?

How often are new tokens listed on the Uniswap exchange?

How do coins get listed on exchanges?

How do I find newly launched tokens?

About Cryptonews

Our goal is to offer a comprehensive and objective perspective on the cryptocurrency market, enabling our readers to make informed decisions in this ever-changing landscape.

Our editorial team of more than 70 crypto professionals works to maintain the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re looking for breaking news, expert opinions, or market insights, Cryptonews has been your go-to destination for everything cryptocurrency since 2017.