Best Altcoins to Invest in February 2026

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships. However, this potential compensation never influences our analysis, opinions, or reviews. Our editorial content is created independently of our marketing partnerships, and our ratings are based solely on our established evaluation criteria. Read More

Altcoins are picking up attention again as traders look for extra upside and some diversification after Bitcoin’s latest moves. If you’re choosing where to focus, Bitcoin Hyper and Maxi Doge stand out as the main options. Meanwhile, large caps like Ethereum, BNB, Solana, and XRP still attract buyers for their liquidity, active ecosystems, and established communities.

While altcoins can offer bigger gains than Bitcoin, the idea behind them is simple: they’re any cryptocurrency that isn’t BTC—alternative coins with their own networks, use cases, and risk levels.

To build our top altcoins list, we analyzed over 100 projects throughout 2026. Our picks target a mix of early upside and stability from established names. Altcoins usually carry more risk than Bitcoin but can deliver stronger returns in bull markets.

Read our complete evaluation below for a detailed breakdown of why HYPER, MAXI , ETH, BNB, SOL, and XRP stand out, with technical and fundamental reasons for each pick.

- In This Article

-

- 1. Ethereum (ETH) – The Leader Among Infrastructure Altcoins

- 2. Solana (SOL) – High-Speed Blockchain for Scalable Applications

- 3. BNB (BNB) – Utility Altcoin Powering the Expansive BNB Chain

- 4. XRP (XRP) – Leading World Bridge Currency Project

- 5. TRON (TRX) – Scalable Blockchain Ecosystem Dominating Stablecoin Settlement Volumes

- 6. TONCOIN (TON) – Telegram-Integrated Blockchain Enabling Seamless, Scalable Crypto Payments

- 7. Cardano (ADA) – Research-Driven Smart Contract L1 Blockchain

- 8. Chainlink (LINK) – Decentralized Oracle Network Connecting Smart Contracts to Real-World Data

- 9. Avalanche (AVAX) – High-Throughput Network Powering DeFi Subnet Innovation

- 10. Polkadot (DOT) – Interoperable Multi-Chain Network Connecting Independent Blockchains Securely

- 11. Hedera Hashgraph (HBAR) – Enterprise Hashgraph Network Built for Real-World Use

- 12. Sui (SUI) – High-Throughput Layer-1 Powering the Next Wave of dApps

- In This Article

- Show Full Guide

-

- 1. Ethereum (ETH) – The Leader Among Infrastructure Altcoins

- 2. Solana (SOL) – High-Speed Blockchain for Scalable Applications

- 3. BNB (BNB) – Utility Altcoin Powering the Expansive BNB Chain

- 4. XRP (XRP) – Leading World Bridge Currency Project

- 5. TRON (TRX) – Scalable Blockchain Ecosystem Dominating Stablecoin Settlement Volumes

- 6. TONCOIN (TON) – Telegram-Integrated Blockchain Enabling Seamless, Scalable Crypto Payments

- 7. Cardano (ADA) – Research-Driven Smart Contract L1 Blockchain

- 8. Chainlink (LINK) – Decentralized Oracle Network Connecting Smart Contracts to Real-World Data

- 9. Avalanche (AVAX) – High-Throughput Network Powering DeFi Subnet Innovation

- 10. Polkadot (DOT) – Interoperable Multi-Chain Network Connecting Independent Blockchains Securely

- 11. Hedera Hashgraph (HBAR) – Enterprise Hashgraph Network Built for Real-World Use

- 12. Sui (SUI) – High-Throughput Layer-1 Powering the Next Wave of dApps

Key Takeaways

- The top altcoins to buy now are Bitcoin Hyper (HYPER), Maxi Doge (MAXI), Ethereum (ETH), Binance Coin (BNB), and Solana (SOL).

- They are major altcoins supporting smart contracts, dApps, and blockchain ecosystems beyond Bitcoin.

- We selected them by analyzing 100+ top cryptocurrencies, balancing potential upside and stability.

- Altcoins carry higher risk than Bitcoin; expect volatility and sensitivity to market sentiment.

- Do rigorous due diligence before investing; analyze team, tokenomics, adoption, audits, roadmaps, and regulatory exposure.

Top Altcoins in February 2026 Shortlisted

All the altcoins on our shortlist are independent Layer 1 chains, but each of them has a unique purpose and vibe. Below are brief, objective descriptors to help you quickly understand what each coin is and how it stands out.

- Bitcoin Hyper (HYPER): Speculative Bitcoin Layer-2 presale for DeFi

- Maxi Doge (MAXI): Gym-bro meme coin tied to 1000x trading culture

- BMIC (BMCI): Quantum-resistant ERC-20 for post-quantum security

- LiquidChain (LIQUID): Layer-3 unifying BTC, ETH, SOL liquidity

- Ethereum (ETH): Leading smart contract blockchain powering DeFi and dApps

- Solana (SOL): High-speed Layer 1 blockchain optimized for scalability and low fees

- Binance Coin (BNB): Exchange token powering a major smart-contract ecosystem

- XRP (XRP): Low-cost payments token powering fast cross-border transfers

- TRON (TRX): High-speed blockchain supporting stablecoin transfers and dApps

- Toncoin (TON): Telegram-integrated L1 enabling in-app crypto payments and Web3 access

- Cardano (ADA): Public Layer 1 blockchain taking an academic approach to development

- Chainlink (LINK): Oracle network connecting real-world data to blockchains

- Avalanche (AVAX): Modular chain offering custom subnets and transactions with instant finality

- Polkadot (DOT): Interoperability Layer 1 protocol connecting multiple custom-built chains

- Hedera Hashgraph (HBAR): Enterprise-grade hashgraph for tokenization and DeFi

- Sui (SUI): High-speed Layer-1 for DeFi, gaming, and apps

- Bittensor (TAO): Decentralized AI network rewarding machine learning models

- Render (RNDR): GPU-powered network for decentralized 3D rendering jobs

- The Graph (GRT): Indexing layer providing searchable blockchain data for dApps

- Ondo (ONDO): Real-world asset tokenization for on-chain yield

- Provenance Blockchain (HASH): Financial-grade chain for tokenized real-world assets

- Tether Gold (XAUt): Tokenized gold tracking physical bullion prices

Emerging Altcoins With Promise for 2026

The altcoins we included in this section are high-risk ventures that trade on innovation, hype, and timing. Unlike blue-chip projects like Ethereum or BNB, they’re often untested and speculative, but that’s also where the potential for outsized returns lies if the project actually delivers.

- Introducing the first Bitcoin L2 solution

- Allows users to trade BTC almost instantaneously

- Enhanced transaction security with ZK-proofs

- USDC

- ETH

- usdt

- Meme-powered Dogecoin derivative with the focus on 1,000x leverage trading

- Maxi Doge will feature community contests and partner events to engage with its audience

- The project offers high staking rewards to its early supporters

- ETH

- usdt

- USDC

- +2 more

- Infrastructure token built to withstand quantum-powered attacks

- BMIC is burned to create credits for quantum computing

- Extra holder utility through staking and governance

- ETH

- usdt

- USDC

These tokens appeal to investors with higher risk tolerance — those comfortable entering before exchanges list them and who understand that liquidity, regulation, and delivery risks are part of the game.

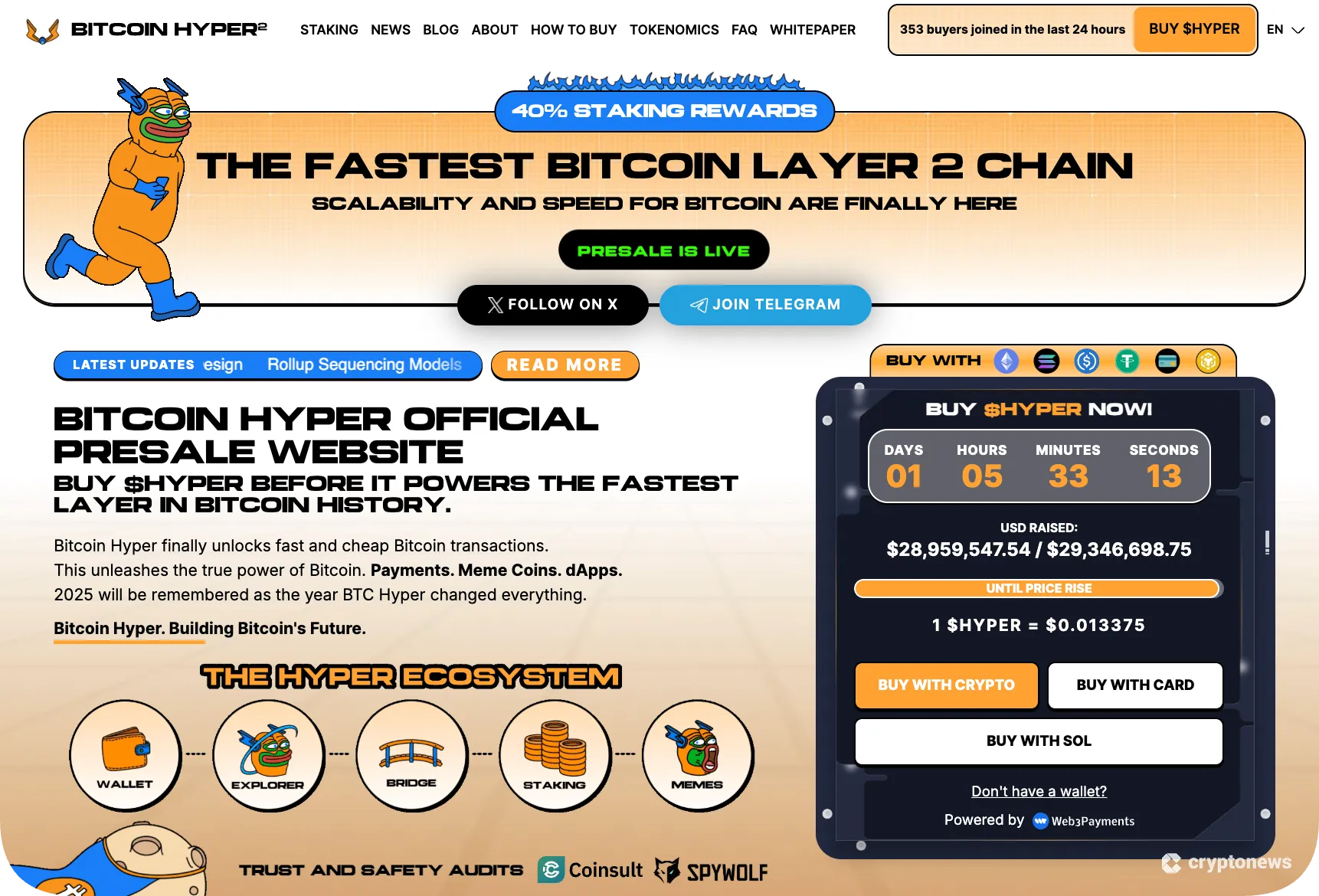

1. Bitcoin Hyper (HYPER) – New L2 Building a High-Speed SVM Engine for Bitcoin

The top altcoin to consider is Bitcoin Hyper  HYPER +18.91%. This crypto project introduces the first Layer 2 scaling solution for Bitcoin that utilizes smart contracts powered by the Solana Virtual Machine (SVM).

HYPER +18.91%. This crypto project introduces the first Layer 2 scaling solution for Bitcoin that utilizes smart contracts powered by the Solana Virtual Machine (SVM).

Through SVM smart contracts, Bitcoin Hyper unlocks DeFi access for Bitcoin, allowing native BTC holders to stake and lend their coins for additional earning opportunities.

It’s currently in its presale phase, which has raised over $31.26M through sales of its native utility token, HYPER. Also, early investors can benefit from a high staking APY of up to 38%.

| Presale Started | May 2025 |

| Chain | Ethereum |

| Purchase Methods | ETH, USDT, USDC, SOL, BNB |

| Current Price | $0.01367510 |

| Price Increase | +18.91% |

| Raised So Far | $31.26M |

| Staking APY | 38% |

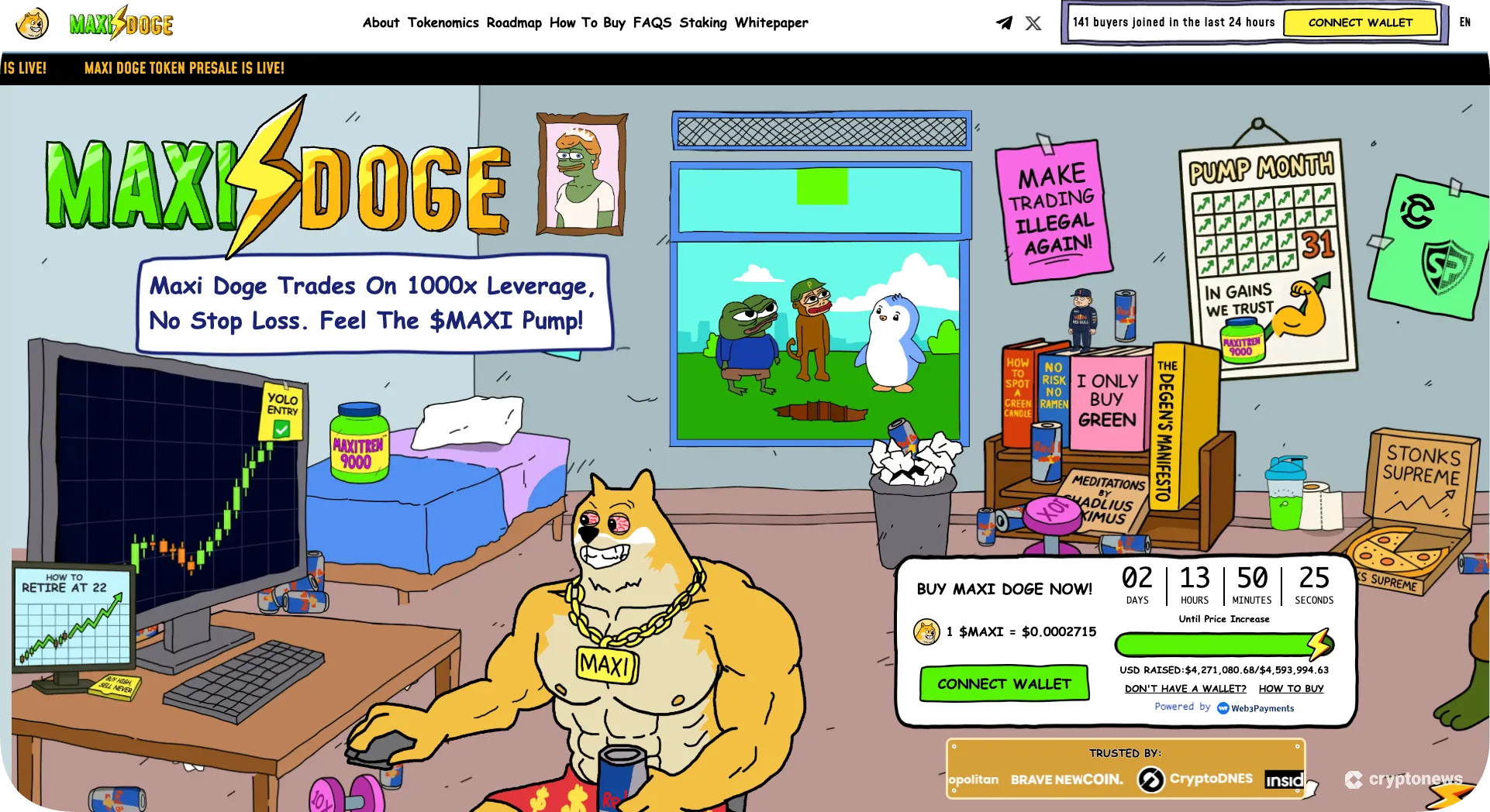

2. Maxi Doge (MAXI) – High-Risk, High-Reward Meme Altcoin

If you’ve been chasing the next meme coin with actual cult energy behind it, Maxi Doge  MAXI +12.08% might be worth a serious look. It is inspired by Doge and comes with an unapologetic gym-rat personality. It has no utility or promises, but what it has is pure fixed-supply momentum built for traders who think leg day and limit orders are both non-negotiable.

MAXI +12.08% might be worth a serious look. It is inspired by Doge and comes with an unapologetic gym-rat personality. It has no utility or promises, but what it has is pure fixed-supply momentum built for traders who think leg day and limit orders are both non-negotiable.

Already, the presale that started off in July has pulled in over $4.57M, which is impressive considering the team isn’t promising any “future utility”. That said, Maxi isn’t pretending to be stable.

It lives (and dies) on meme strength, degen hype, and a staking APY of 68%. If you can stomach the swings and play the game hard, MAXI could end up outperforming more “serious” tokens this cycle.

| Presale Started | July 2025 |

| Chain | Ethereum |

| Purchase Methods | ETH, BNB, USDT, USDC, Bank Cards |

| Current Price | $0.00028020 |

| Price Increase | +12.08% |

| Raised So Far | $4.57M |

| Staking APY | 68% |

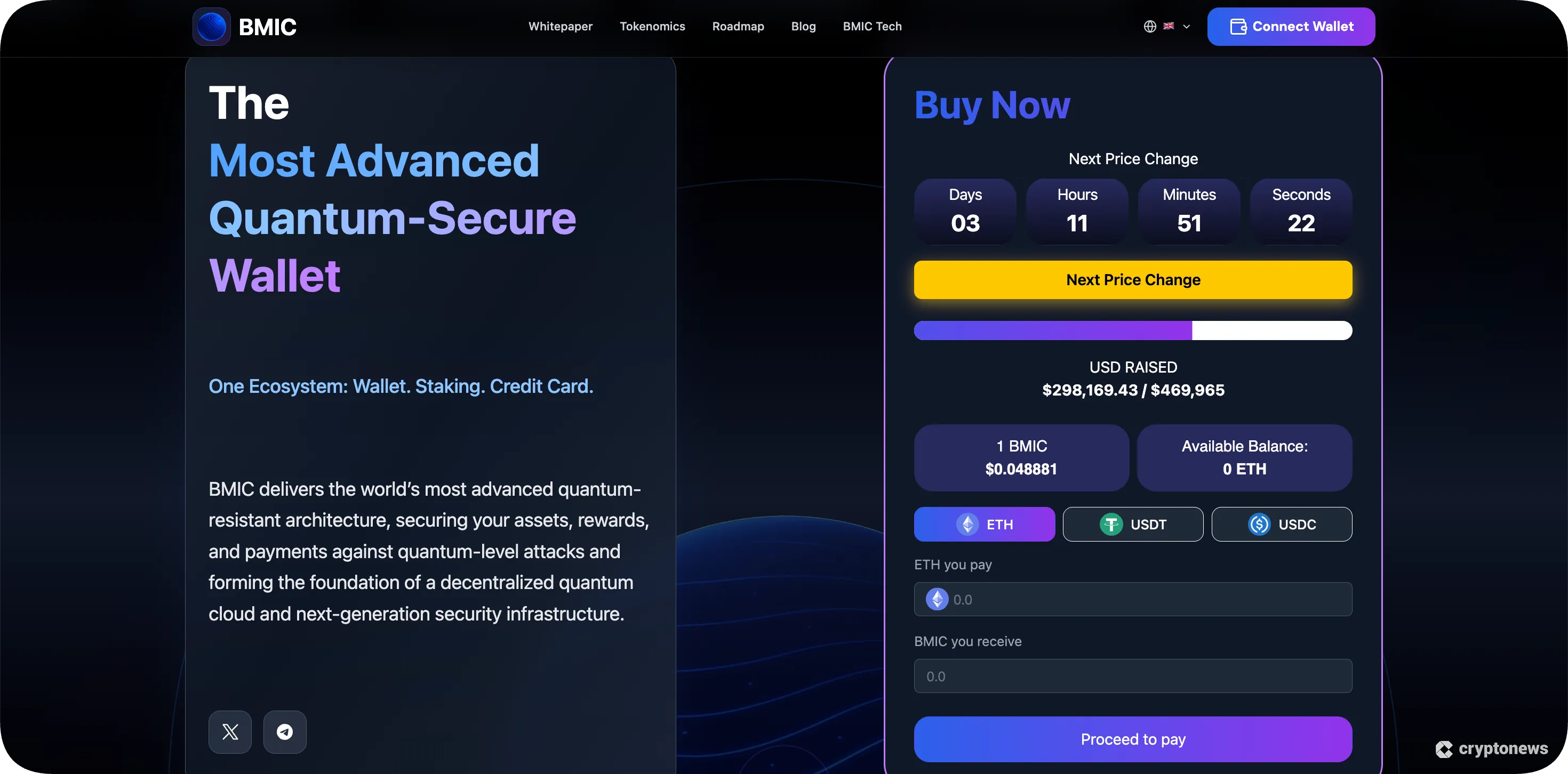

3. BMIC (BMCI) – Quantum-Safe Crypto Token

BMIC  BMIC +2.04% brings together blockchain, AI, and quantum computing to tackle one problem: future-proofing crypto security. The project is building a decentralized quantum cloud and using post-quantum cryptography to protect digital assets.

BMIC +2.04% brings together blockchain, AI, and quantum computing to tackle one problem: future-proofing crypto security. The project is building a decentralized quantum cloud and using post-quantum cryptography to protect digital assets.

BMIC is in early presale stages, with 50% of the supply allocated to the sale and a total supply of 1.5 billion tokens. Alongside the token, the team plans a non-custodial wallet, staking features, and a payment layer designed to use post-quantum protection from day one.

The BMIC token is designed to be useful inside the ecosystem, not just something you hold. It supports staking, authentication, and governance, so you can interact with the network’s features. Over time, it’s also meant to unlock access to decentralized quantum computing services as they roll out.

Presale Started

October 2025

Chain

Ethereum

Purchase Methods

ETH, USDT

Current Price

$0.049474

Price Increase

+2.04%

Raised So Far

$425.87K

Staking APY

TBA

4. LiquidChain (LIQUID) – Layer 3 Unified Liquidity Network

LiquidChain  LIQUID +22.27% is a new Layer 3 project built to connect Bitcoin capital, Ethereum DeFi, and Solana-like speed in one execution layer. Its main pitch is unified liquidity pools that aim to reduce friction between chains. The goal is to move assets and trade across ecosystems without relying on wrapped tokens.

LIQUID +22.27% is a new Layer 3 project built to connect Bitcoin capital, Ethereum DeFi, and Solana-like speed in one execution layer. Its main pitch is unified liquidity pools that aim to reduce friction between chains. The goal is to move assets and trade across ecosystems without relying on wrapped tokens.

The team plans a Solana-compatible virtual machine designed for fast, real-time DeFi. LiquidChain targets instant swaps, complex derivatives, and active prediction markets without bogging down under load. Developers could deploy an app once and reach users across multiple chains, while traders get deeper liquidity in a single place.

The presale launched in November 2025 and has raised about $517K so far, with LIQUID priced at $0.01345 and a $20M hard cap. It lists audits from SpyWolf and CertiK. Buyers can stake for a 1,980% presale APY, but that rate may not last, and cross-chain execution adds risk.

Presale Started

November 2025

Chain

Bitcoin, Ethereum, and Solana (Layer 3)

Purchase Methods

ETH, USDT, USDC, BNB, SOL, Credit card

Current Price

$0.01345

Price Increase

+22.27%

Raised So Far

$517K

Staking APY

1,980%

Best Established Altcoins to Invest in Right Now – Detailed Reviews

We wrote in-depth reviews of the leading altcoins. Our rankings rely on a precise and data-driven altcoin ranking methodology to ensure legitimacy. We update our list based on use cases, adoption, community strength, market resilience, and other important factors in order to find the best crypto to buy now.

1. Ethereum (ETH) – The Leader Among Infrastructure Altcoins

Ethereum ETH 6.35% is the largest smart contract chain and remains the top pick for next altseason. Its latest upgrades, including Shanghai, Dencun, Pectra, and Fusaka, have enhanced its scalability by slashing fees and speeding up transactions.

Fusaka is the most recent upgrade, going live on December 3, 2025. It focuses on deeper data availability and Layer 2 scaling. Ethereum now enables faster and more efficient data handling for L2 rollups, reducing node storage requirements and enhancing security. The upgrade also increases block gas limit to 150M, boosting transaction capacity.

Meanwhile, institutional entities are showing growing interest in its tokenization potential, with financial behemoths like BlackRock exploring the network for real-world assets. Major ecosystem events throughout the year further support developer innovation and community engagement, reinforcing its leading position in the smart contract space.

| Launch Date | July 2015 |

| Chain | Ethereum |

| Current Price | $2,111.74 |

| YTD Price Change | -29.17% |

| Market Cap | $253.90B |

2. Solana (SOL) – High-Speed Blockchain for Scalable Applications

Solana SOL 5.24% is a Layer 1 network that competes with Ethereum by offering superior performance and ultra-low fees. It has the largest daily transaction count among major chains and accounts for the largest number of new tokens, although the majority of them are low-effort projects.

Its high speed, efficiency, diverse ecosystem, and institutional interest make it one of the best altcoins. Solana’s recent “Alpenglow” upgrade slashes transaction times and boosts capacity above 1 million TPS.

This technical strength is backed by significant institutional confidence, with over 63% of SOL tokens staked. A growing developer community and substantial grant funding continue to drive its ecosystem forward.

| Launch Date | March 2020 |

| Chain | Solana |

| Current Price | $91.94 |

| YTD Price Change | -25.92% |

| Market Cap | $54.12B |

3. BNB (BNB) – Utility Altcoin Powering the Expansive BNB Chain

BNB Coin BNB 8.23% powers the BNB Chain ecosystem, an interconnected network supporting smart contracts, DeFi, gaming, and even its own rollup layer, opBNB.

It’s the fuel for transactions, staking, and governance, and its dual burn systems (Auto-Burn and BEP-95) steadily reduce supply, giving it deflationary appeal. What makes BNB stand out now is its thriving ecosystem and strong technical scalability.

Still, investors should note its ties to Binance’s regulatory history and somewhat centralized validator set. Overall, BNB remains a high-utility, growth-focused altcoin with long-term momentum.

| Launch Date | July 2017 |

| Chain | BNB Chain |

| Current Price | $693.44 |

| YTD Price Change | -18.96% |

| Market Cap | $96.52B |

4. XRP (XRP) – Leading World Bridge Currency Project

XRP XRP 10.31% is one of the best altcoins in 2026 due to its price performance and efficiency in cross-border payments. Ripple’s On-Demand Liquidity (ODL) product leverages XRP to facilitate instant value transfers across the world.

This utility feature, combined with a better regulatory situation, positions XRP as a leader in the remittance market. Meanwhile, its status as one of the few ISO 20022-compliant coins allows it to resonate with banks and financial institutions worldwide.

XRP’s major development in 2025 was its settlement with the U.S. SEC, which provided unprecedented regulatory clarity. This resolution encourages institutional adoption by banks and funds. The ecosystem is also expanding with new projects like Ripple’s RLUSD stablecoin and is supported by active community events that foster development on the XRP Ledger.

| Launch Date | June 2012 |

| Chain | XRP Ledger |

| Current Price | $1.43 |

| YTD Price Change | -21.53% |

| Market Cap | $143.37B |

5. TRON (TRX) – Scalable Blockchain Ecosystem Dominating Stablecoin Settlement Volumes

TRON TRX 2.30% stands out for combining high-speed, low-fee blockchain performance with massive stablecoin activity, especially USDT transfers that now dominate on-chain volume.

Its delegated proof-of-stake model keeps transactions fast and cheap, while integrations like BitTorrent and SunPerp show real expansion beyond just payments.

It’s an appealing play for investors seeking utility and scalability over hype. However, Tron’s tight association with Justin Sun and ongoing scrutiny around network centralization and illicit-use claims add some risk. Still, its liquidity strength and consistent user growth keep it firmly on the radar.

| Launch Date | September 9, 2017 |

| Chain | TRON |

| Current Price | $0.28 |

| YTD Price Change | -1.48% |

| Market Cap | $24.21B |

6. TONCOIN (TON) – Telegram-Integrated Blockchain Enabling Seamless, Scalable Crypto Payments

Toncoin TONCOIN +0.55% is the native cryptocurrency of The Open Network, a high-performance Layer 1 chain. Originally designed by Telegram to make crypto-native experiences seamless for millions of users, it launched independently with a delay due to regulatory pressure on the messaging app. Still, it remains deeply integrated into Telegram through TON Space and in-app payments, leveraging a user base that few blockchains can boast.

Toncoin’s 2026 future is associated with the 1B+ user base of Telegram, the expansion of mini-apps, and a further increase in the use of USDT on TON. The projections of the prices vary significantly, with averages ranging from about $8 to $23, and conservative estimates around $1.5 to $2.1. The uncertainty that is represented by that spread is high, and the speed of adoption of fees is swift.

Telegram wallet upgrades, gasless payments, and sharding with very high throughput, Telegram DNS, and DeFi tooling to drive TVL even higher are all growth drivers. Monitor milestones in early 2026, such as config upgrades and slashing modifications. There are still risks, including regulation, corrections after 2025, and pressure on Solana and Ethereum, in particular, in the event of slow user growth.

| Launch Date | May 7, 2020 |

| Chain | The Open Network (TON) |

| Current Price | $1.39 |

| YTD Price Change | -16.53% |

| Market Cap | $7.12B |

7. Cardano (ADA) – Research-Driven Smart Contract L1 Blockchain

Next on our list is Cardano ADA 5.94% — a crypto token known for its robust security and innovative technology. It uses a PoS consensus mechanism called Ouroboros, which ensures secure and energy-efficient blockchain operations. Cardano’s ongoing development, including the recent Voltaire upgrade, aims to make the network fully self-sustaining.

In 2026, Cardano is focusing on developing its Layer 2 solution called Hydra, which is expected to improve transaction speed and capacity. This upgrade may lead to a rebound in DeFi activity, which has nosedived to the lowest level in over a year. Hydra’s testnet implementation went live in October 2025.

It may also boost real-world adoption, particularly in regions where it’s already popular, including struggling African economies. Institutional interest from firms like Grayscale further underscores its methodical, research-driven development approach.

| Launch Date | September 2017 |

| Chain | Cardano |

| Current Price | $0.28 |

| YTD Price Change | -15.21% |

| Market Cap | $12.67B |

8. Chainlink (LINK) – Decentralized Oracle Network Connecting Smart Contracts to Real-World Data

Chainlink LINK 4.85% is the backbone connecting blockchains to real-world data — think price feeds, APIs, and off-chain events. Its decentralized oracle network powers DeFi platforms, insurance protocols, and even tokenized real-world assets, making it essential infrastructure rather than just another coin.

That utility gives LINK steady, long-term relevance across the crypto economy. Right now, it’s particularly exciting due to Chainlink’s growing institutional reach. Its oracles are being used in tokenized asset pilots with major banks.

The downside? Growth depends on continued DeFi expansion, and heavy reliance on partnerships adds execution risk. Still, LINK feels foundational.

| Launch Date | September 19, 2017 |

| Chain | Ethereum (ERC-677 token) |

| Current Price | $9.15 |

| YTD Price Change | -24.75% |

| Market Cap | $9.15B |

9. Avalanche (AVAX) – High-Throughput Network Powering DeFi Subnet Innovation

Avalanche AVAX 4.72% is a high-performance L1 chain built for speed, flexibility, and real-world utility. Its unique multi-chain design and consensus mechanism let developers launch customizable “subnets” for DeFi, gaming, and tokenization, all while maintaining near-instant finality.

It’s become a serious hub for asset tokenization, enterprise projects, and high-throughput dApps. What makes Avalanche a top altcoin right now is its expansion into institutional adoption, including treasury-backed growth plans and tokenized real-world assets.

Still, competition from Ethereum and Solana, plus complex subnet management, could temper momentum. Yet AVAX’s innovation edge keeps it compelling.

| Launch Date | September 21, 2020 |

| Chain | Avalanche |

| Current Price | $9.59 |

| YTD Price Change | -23.86% |

| Market Cap | $4.39B |

10. Polkadot (DOT) – Interoperable Multi-Chain Network Connecting Independent Blockchains Securely

Polkadot DOT 7.05% is a Layer 0 network built to connect multiple blockchains into one interoperable ecosystem. Its Relay Chain and parachains let developers launch specialized blockchains that share security and communicate seamlessly, solving one of crypto’s biggest problems.

This makes Polkadot ideal for projects needing speed, flexibility, and trustless data exchange across chains. What’s enticing now is its next-gen JAM upgrade and push toward full smart contract integration.

Meanwhile, the main risk is complexity. Its tech is ambitious, and governance is intricate, but that’s also what gives DOT its long-term edge.

| Launch Date | May 26, 2020 |

| Chain | Polkadot |

| Current Price | $2.57 |

| YTD Price Change | -0.57% |

| Market Cap | $1.11B |

11. Hedera Hashgraph (HBAR) – Enterprise Hashgraph Network Built for Real-World Use

Hedera  HBAR 4.69% uses hashgraph technology to deliver fast, low-cost transactions with high throughput, making it suitable for tokenization, payments, and data-heavy apps used by major companies. Its carbon-negative design also appeals to projects with ESG goals.

HBAR 4.69% uses hashgraph technology to deliver fast, low-cost transactions with high throughput, making it suitable for tokenization, payments, and data-heavy apps used by major companies. Its carbon-negative design also appeals to projects with ESG goals.

Hedera doesn’t use a classic blockchain. Instead, it runs on hashgraph, which is built to handle thousands of TPS with confirmation in a few seconds. A council that includes companies like Google, IBM, and Boeing oversees upgrades, and EVM support lets developers bring over existing smart contracts.

To investors, HBAR allows you to support a network that is designed with the goal of supporting a business, not merely the short-term trading interest. Its council-like government structure and harsh competition with such chains as Solana and Cardano are the primary drawbacks. Nonetheless, its pace, low price, and major associates continue to place it on numerous watchlists.

| Launch Date | September 2019 |

| Chain | Hashgraph |

| Current Price | $0.088 |

| YTD Price Change | -16.86% |

| Market Cap | $4.43B |

12. Sui (SUI) – High-Throughput Layer-1 Powering the Next Wave of dApps

Sui  SUI 6.68% stands out for combining very fast, low-fee transactions with a design built for scale, letting DeFi, gaming, and real-world apps run in parallel without clogging the network.

SUI 6.68% stands out for combining very fast, low-fee transactions with a design built for scale, letting DeFi, gaming, and real-world apps run in parallel without clogging the network.

Sui is built to handle lots of activity at once, using its own version of smart contracts and an object-based design to process many transactions in parallel. That keeps confirmations very fast and fees very low. On top of this, tools like zkLogin, native USDC, and the DeepBook orderbook help traders and app developers plug in easily.

Investment-wise, Sui continues to be exposed to obvious risks: it is also competing with Solana and Aptos directly and is actively trying to decentralize control outside a smaller group of validators. Nonetheless, to individuals who are not interested in older networks, it provides a method to support a newer and faster chain of networks that already has a growing DeFi, gaming, and app presence.

| Launch Date | May 2023 |

| Chain | Sui |

| Current Price | $1.05 |

| YTD Price Change | -24.70% |

| Market Cap | $10.50B |

Analyzing the Best AI Altcoins

AI altcoin projects apply machine learning on-chain for data markets, model inference, trading tools, security scanners, and agent networks. The best shows real usage: active repositories, shipped features, and partners testing in public. Evidence beats promises. The upside exists only when tokens power useful functions today.

We assess leading projects by problem clarity and whether blockchains add necessary trust or coordination. Strong token design matters: clear utility, sensible supply, and transparent distribution. Market reach counts as well, measured through active users, real fees, developer velocity, liquidity quality, and durable exchange depth.

1. Bittensor (TAO) – Decentralized Network For Collaborative Machine Learning

Bittensor  TAO 4.48% builds a permissionless network where independent AI models train, compete, and exchange value. TAO tokens reward contributors based on measured model performance, while a reputation layer ranks quality.

TAO 4.48% builds a permissionless network where independent AI models train, compete, and exchange value. TAO tokens reward contributors based on measured model performance, while a reputation layer ranks quality.

The system supports varied machine-learning approaches and links to other blockchains and AI frameworks, breaking closed silos and enabling collective intelligence.

What’s enticing now is expanding subnets, deeper framework interoperability, and steady developer traction. Meanwhile, the main risk is complexity: incentive design, model evaluation, and coordination at scale are hard. That same ambition—open, market-driven training—gives TAO a long-term edge as decentralized AI infrastructure matures.

| Launch Date | November 1, 2021 |

| Chain | Subtensor |

| Current Price | $184.70 |

| YTD Price Change | -17.26% |

| Market Cap | $3.88B |

2. Render (RENDER) – Decentralized GPU Network For Rendering And AI Compute

Render  RNDR 4.98% powers a peer-to-peer marketplace that distributes graphics and compute tasks across idle GPUs worldwide. Creators submit jobs; node operators process them and earn RNDR.

RNDR 4.98% powers a peer-to-peer marketplace that distributes graphics and compute tasks across idle GPUs worldwide. Creators submit jobs; node operators process them and earn RNDR.

This model delivers scalable rendering for film, games, VR, and AI workloads while lowering costs and opening access compared with traditional, centralized infrastructure.

Tailwinds include its Solana migration for faster settlement, a DAO guiding upgrades, and deep ties to Octane and major GPU stacks. Key risks are coordination complexity, demand cycles, and competition from large clouds. Even so, network effects and industry integrations give RENDER a durable position as usage grows.

| Launch Date | April 27, 2020 |

| Chain | Render Network |

| Current Price | $1.48 |

| YTD Price Change | +12.48% |

| Market Cap | $785.97M |

3. The Graph (GRT) – Open Indexing And Query Layer For Blockchain Data

The Graph GRT 3.71% is a protocol that organizes blockchain data into open APIs called subgraphs, letting global applications query on-chain information securely across many networks.

Indexers, curators, and delegators secure the system while sharing incentives, removing data silos, and unreliable scraping. It suits dApps needing fast, reliable access to consistent on-chain data.

Momentum comes from multi-chain expansion, subgraph standards, and rising query volume for analytics and AI. The main risk is complexity: incentives, data quality, and governance are demanding. That ambition gives GRT staying power as on-chain data infrastructure grows.

| Launch Date | October 22, 2020 |

| Chain | Ethereum |

| Current Price | $0.028 |

| YTD Price Change | -16.84% |

| Market Cap | $309.19M |

Best RWA Altcoins to Invest in 2026 Reviewed

Real-world asset (RWA) tokens put off-chain assets—treasuries, credit, real estate—on-chain with clear claims and cash-flow rules. This list favors transparent issuers, auditable reserves, compliant structures, reliable pricing/oracles, liquid secondary markets, predictable fees, and simple redemption paths that tie token value to the underlying asset.

1. Ondo (ONDO) – RWA Tokenization Platform Linking Treasuries and DeFi

Ondo ONDO 6.64% is a protocol that turns traditional assets like U.S. Treasuries into on-chain products such as OUSG and USDY, giving crypto users regulated dollar-yield exposure across Ethereum, Solana, Sui, and its own Ondo Chain.

Ondo deposits real assets on-chain in a variety of forms: OUSG and USDY convert U.S. Treasuries into yield-bearing tokens, whereas its Global Markets platform wraps stocks and ETFs to trade them 24/7. Chainlink regulated RWA is hosted on Ondo Chain, and Chainlink CCIP and collaborators such as BlackRock and Mastercard contribute towards adoption.

Demand is growing as more investors look for tokenized T-bills, also helped by BlackRock ties and the launch of Ondo Chain, which is built for regulated asset flows. The main risks are rule changes, large token unlocks, and heavy exposure to U.S. government debt. Even so, Ondo remains a key name in the real-world asset boom.

| Launch Date | January 2024 |

| Chain | Ethereum |

| Current Price | $0.26 |

| YTD Price Change | -26.07% |

| Market Cap | $2.63B |

2. Provenance Blockchain (HASH) – Enterprise RWA Network Powering On-Chain Loans and Securities

Provenance Blockchain (HASH) is a Layer-1 built for banks, lenders, and asset managers, letting them tokenize mortgages, loans, and securities on-chain and settle them over a compliant, finance-focused network.

Provenance focuses on real-world finance, not trading buzz. Banks and lenders use it to move mortgages, loans, and securities on-chain, and the chain is built with Cosmos technology so it can connect to other networks in that ecosystem.

In 2025, the main sign of progress is Provenance Marketplace, which has processed over $10BN in deals for more than 50 institutions, with staking support from partners like Anchorage Digital. For investors, HASH offers exposure to on-chain loans and securities, but thin volume, large holders, and low visibility mean it’s best kept as a small, high-risk bet rather than a core holding.

| Launch Date | April 2021 |

| Chain | Cosmos |

| Current Price | $0.02779 |

| YTD Price Change | +44.65% |

| Market Cap | $2.92B |

3. Tether Gold (XAUt) – Digital Gold Token for On-Chain Safe-Haven Exposure

Tether Gold  XAUT 3.08% is a gold-backed token where each unit represents one troy ounce of physical gold stored in Swiss vaults. Holding XAUt is simply a digital way to track gold’s price, not a bet on Tether’s growth or tokenomics.

XAUT 3.08% is a gold-backed token where each unit represents one troy ounce of physical gold stored in Swiss vaults. Holding XAUt is simply a digital way to track gold’s price, not a bet on Tether’s growth or tokenomics.

The token allows you to focus on the gold price without having to deal with bars and laying out storage. You may redeem it at any time, keep small amounts, and in a few instances, use it as collateral for a loan or in savings-type products. The total costs are usually less than the purchase, storage, or insurance of physical gold.

The popularity of gold has increased again after reaching record levels at the end of 2025 due to the buying of gold by central banks, inflation concerns, and global tensions. Within this context, Tether Gold will be able to serve as a digital gold hedge within a crypto portfolio. Just remember you still rely on Tether as the issuer, and this is a commodity play, not a growth-focused altcoin.

| Launch Date | January 2020 |

| Chain | Ethereum and Tron |

| Current Price | $4,895.21 |

| YTD Price Change | +13.24% |

| Market Cap | $1.21B |

What Are Altcoins?

Altcoins are simply any cryptocurrencies that aren’t Bitcoin. The word comes from “alternative” and “coin,” since they were created as alternatives to Bitcoin’s original design. While Bitcoin laid the foundation for decentralized digital money, altcoins expand on it in different ways.

Some run on their own blockchains, like Ethereum, which introduced smart contracts for decentralized apps. Others are tokens built on existing networks, like HYPER on Ethereum.

Each altcoin usually has a specific goal.

For example:

- XRP streamlines international payments

- Litecoin focuses on faster transactions

- Stablecoins like USDT maintain price stability by pegging to the dollar

Altcoins cover everything from experimental projects to major platforms shaping the crypto ecosystem.

The Different Types of Altcoins to Invest In

It’s important to understand the distinct categories of altcoins before investing in them. Altcoins aren’t just “everything that’s not Bitcoin;” they serve specific roles across infrastructure, governance, finance, and even entertainment.

Each type has different risk profiles, value drivers, and use cases depending on how it interacts with its underlying protocols or ecosystems.

Below is a breakdown of the major types of altcoins, along with examples that are well-established and technically representative:

| Altcoin Type | Overview | Examples |

|---|---|---|

| Utility Tokens | Tokens are used within a specific ecosystem to access services or pay for functions. Not typically for investment. | Chainlink (LINK), The Graph (GRT), Render (RNDR) |

| Layer 1 or Infrastructure Tokens | Native coins of base-layer blockchains that secure the network, enable smart contracts, and settle transactions. | Ethereum (ETH), Cardano (ADA), Avalanche (AVAX) |

| Layer 2 Tokens | Support scaling solutions built atop Layer 1s, enabling faster, cheaper transactions without compromising security. | Polygon (MATIC), Stacks (STX), Bitcoin Hyper (HYPER) |

| Governance Tokens | These give holders voting rights on protocol changes, treasury management, and governance proposals, often in DAOs. | Compound (COMP), Uniswap (UNI), Maker (MKR) |

| Privacy Coins | Focused on anonymizing transactions using cryptographic techniques like zk-SNARKs or ring signatures. | Monero (XMR), Zcash (ZEC), Dash (DASH) |

| DeFi Platform Coins | Used in decentralized finance protocols for borrowing, lending, trading, and liquidity provision. | Aave (AAVE), Synthetix (SNX), Curve (CRV) |

| Exchange Tokens | Issued by centralized exchanges, offering benefits like trading discounts, staking, and launchpad access. | Binance Coin (BNB), OKB (OKB), HTX Token (HT) |

| Meme Coins | Community-driven tokens with viral appeal, minimal technical utility, and value driven by social momentum. | Dogecoin (DOGE), Shiba Inu (SHIB), Maxi Doge (MAXI) |

| Gaming Tokens | Used in blockchain games to buy assets, mint NFTs, reward players, or govern ecosystems. | Axie Infinity (AXS), The Sandbox (SAND), Big Time (BIGTIME) |

| Stablecoins | Pegged to fiat or assets to maintain stable value. Essential for DeFi and cross-border transfers. | Tether (USDT), USD Coin (USDC), Dai (DAI) |

| Asset-Backed Tokens | Represent real-world assets like gold or real estate for fractional, liquid, and verifiable ownership. | PAX Gold (PAXG), Tether Gold (XAUT), Homebase Token (HMT) |

| AI Coins | Power decentralized AI projects across use cases like AI agents, infrastructure, and applications. | Bittensor (TAO), Artificial Superintelligence Alliance (FET), Render (RENDER) |

Understanding these categories helps you evaluate altcoins more strategically, not just by hype or market cap, but by how they function within the broader crypto economy. When building your portfolio, consider each type’s utility, underlying tech, and long-term viability.

If you want to know more about the best altcoins to buy right now, watch the video below:

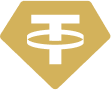

What is Altcoin Season?

Altcoin season is when altcoins (cryptocurrencies other than Bitcoin) start outperforming Bitcoin in price growth.

It often happens after Bitcoin rallies and then stabilizes, leading investors to rotate profits into smaller, riskier coins that can move faster. During this period, projects like Ethereum, Solana, or meme tokens may surge more aggressively than Bitcoin.

To track this shift, traders use the Altcoin Season Index, which measures how many of the top 50 or 100 altcoins are beating Bitcoin over a set timeframe, typically 90 days.

If the majority outperform, the index signals we’re in altcoin season. This matters because it helps investors spot market rotation early and manage risk while chasing higher potential returns.

What Factors Affect Altcoin Prices?

Altcoin valuations fluctuate based on several factors, including changes in key metrics, adoption rates, regulatory frameworks, and broader economic conditions. It’s important to conduct your own research to make more informed decisions when investing in crypto.

It is also essential to consider the potential risks and rewards associated with investing in altcoins and the importance of diversifying your portfolio to minimize risk.

📈 Market Trends

The prices of altcoins can be influenced by the overall crypto market performance and even global macroeconomic conditions. Moreover, crypto sectors, such as meme coins, AI agents, and Web3 coins, always go in and out of favor.

The concept of ‘altcoin season’ is an index that measures how well altcoins are performing compared to Bitcoin. It is a valuable metric for gauging the recent overall performance of altcoins.

🔧 Adoption Rates & Utility

Altcoins often launch with new technology and concepts, aiming to innovate and bring something new to the crypto market. However, the success of such coins ultimately depends on their adoption rates — this refers to the extent to which they are used compared to comparable competitor projects.

Real utility is a critical factor in determining the long-term performance of the vast majority of altcoins. Altcoins that offer practical solutions to real-world problems are more likely to experience sustained growth and adoption.

Projects with growing adoption rates are likely to outperform the rest of the market as they benefit from a growing user base and a larger pool of investors.

💯 Regularity Clarity

Regulation has the potential to completely stifle an altcoin, especially if it is striving for institutional adoption. We have witnessed several examples of this, such as XRP’s notorious court battle with the SEC, in which it ultimately emerged victorious after years of deliberation.

Governments can also introduce restrictions to make it more difficult for citizens to buy crypto, reducing the number of retail investors in the crypto market.

💬 Community Sentiment

Community sentiment may reflect investor appetite at any given moment. While major Layer 1 coins are often driven by institutional interest, meme coins rely heavily on social media hype.

Altcoins that keep their community engaged and provide regular updates have higher chances of succeeding.

What Are the Benefits of Investing in Altcoins?

Altcoins are more flexible and volatile than Bitcoin, offering compelling opportunities for higher returns. However, most of them carry a higher risk due to their lower liquidity and volumes compared to Bitcoin. To get the most out of altcoins, it’s wise to invest during a confirmed altcoin season. To reduce risks, take your time for careful crypto portfolio allocation. Below, we break down key factors to consider before investing.

- High Growth Potential:Altcoins have lower market cap figures than Bitcoin, which leaves room for higher growth potential during bull markets.

- Ecosystem Utility:Many altcoins play a key role in complex ecosystems, with their functionalities ranging from governance and staking to payments and access.

- Portfolio Diversification: They reduce over-reliance on Bitcoin’s price swings by spreading exposure across emerging technologies and market sectors.

What Are the Risks of Investing in Altcoins?

In crypto, higher upside potential usually comes with increased risk. To begin with, the small-cap token segment is flooded with crypto scams. To stay safe, it’s best to stick to established projects that have stood the test of time. Here are the main risks you should know about:

- Higher Failure Risk: Low-liquidity projects with tiny market caps are prone to sudden crashes or project abandonment.

- Scam Vulnerability: Minimal oversight enables “rug pulls” and exit scams, where developers drain funds and disappear overnight.

- Fierce Competition: New crypto coins with superior tech can rapidly obsolete older projects, fracturing investor capital across thousands of coins.

Thorough research is non-negotiable. While altcoins offer exciting upside, their risks require a disciplined strategy and vigilance.

Where Can I Find the Best Altcoins?

If you’re wondering where to find the best altcoins in February 2026, start with the right tools. Big crypto exchanges like Coinbase and Kraken highlight trending coins, while altcoin-heavy platforms like KuCoin, Bitget, and OKX offer broader access to niche tokens.

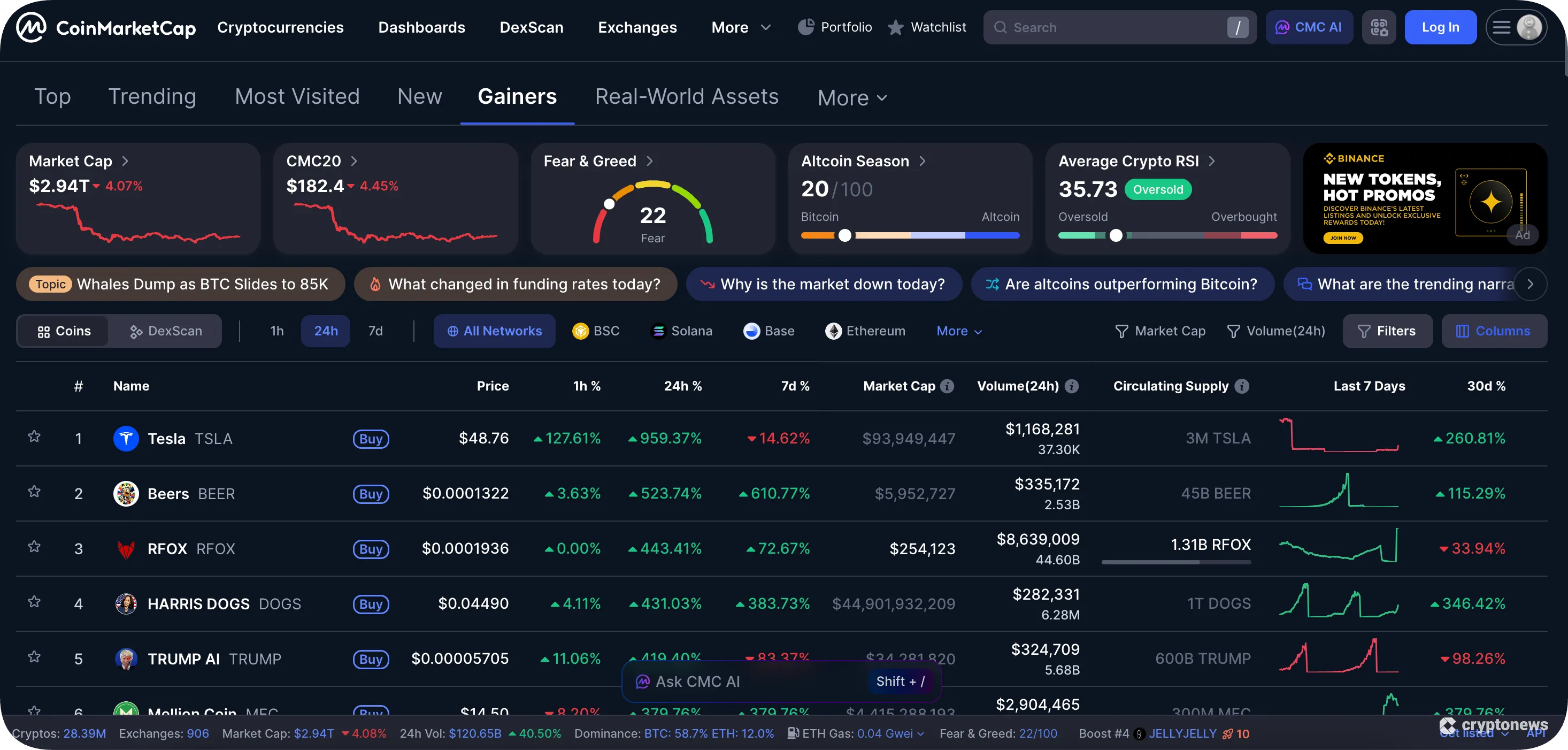

Want to see what’s hot right now? CoinMarketCap and CoinGecko track winners, losers, and newly added coins – great for spotting early movers. Best Wallet also has a tab for new upcoming tokens that makes it easier to find new altcoins.

Social media is another goldmine. Founders often announce new launches directly on X and Telegram. Set alerts for terms like “new crypto” to stay ahead. Tools like Best Wallet give you early access to new token launches, while Dextools and Bogged Finance are perfect for tracking decentralized exchange activity.

Finally, don’t skip the basics: research project fundamentals, check the team, and understand the roadmap. Combine that with some technical analysis, and you’re in a much better spot to find your next high-potential altcoin.

Best Altcoin Exchanges

Choosing the best altcoin exchange matters. You’ll want to consider fees, security, how many tokens they offer, and how easy they are to use. Remember, no single exchange is perfect for everyone. Match the exchange to your specific needs.

Here’s a quick comparison of the top options:

| Exchange | Key Strengths | Fees (Maker/Taker) | Altcoins Supported | Best For |

|---|---|---|---|---|

| Binance | Largest volume, wide variety, deep liquidity | 0.1% / 0.1% (lower w/BNB) | 350+ | Advanced traders & altcoin hunters |

| BitMart | Huge selection (1,700+), copy trading | 0.04% to 0.6% (tiered) | 1,700+ | Access to rare altcoins |

| OKX | Advanced features, DeFi integration | 0.08% / 0.10% | 300+ | Spot & margin traders, DeFi users |

| KuCoin | Niche tokens, low fees | ~0.10% / 0.10% | 700+ | Altcoin hunters |

| Kraken | Strong security, margin trading, regulated | 0.25% / 0.40% | 350+ | Security-focused traders |

| Coinbase | Beginner-friendly, high security, regulated | 0.40% / 0.60% | 200+ | Beginners |

| Crypto.com | Best mobile app | 0.25% / 0.50% | 220+ | Mobile users |

| Bybit | Low fees, derivatives focus, copy trading | 0.1% / 0.1% | 350+ | Derivatives traders |

| MEXC | Massive selection (2,900+), new token launches | Competitive fees | 2,900+ | Altcoin hunters & new launches |

| Gate.io | Largest token selection (3,800+), advanced tools | Variable fees | 3,800+ | Advanced traders & diversity |

How to Evaluate Altcoins Before Investing

With so many different altcoins on the market, investors must narrow their search criteria to find something worthwhile. Here are some tips to help you select winning altcoins in 2026:

1. Analyze the Project’s Utility

Evaluating use cases and utility is essential because a token’s long-term value depends on real demand within its ecosystem, not just speculation.

👉 Ask: Does it power transactions, enable governance, incentivize security, or access core platform features?

Start by reading the project’s whitepaper and documentation to understand its revenue model and the token utility. Look beyond hype and check how the token is actually used in the network. If it’s integral to the system’s operations, like gas fees or governance, that’s a strong sign of sustainable value.

2. Research the Team

Bitcoin is fully decentralized, and it operates without a central team, but that doesn’t mean the same is true for altcoins. Utility tokens often rely on talented teams that can turn great ideas into successful projects. When assessing an altcoin, look into the founders’ backgrounds, reputation, past projects, and their level of involvement.

If you’re into coding, check development activity, including GitHub commits and progress on technical achievements.

3. Check the Tokenomics

Tokenomics can make or break an altcoin, no matter how strong the tech is. You’ll want to look at total supply, inflation rate, vesting schedules, and how tokens are distributed across investors, teams, and the community.

A project might seem promising, but if insiders hold too long or tokens unlock too aggressively, price pressure is inevitable. Look for altcoins with transparent and sustainable tokenomics models that incentivize long-term participation.

4. Gauge Market Capitalization

Market capitalization tells you a coin’s size, and you can calculate it by multiplying the current price by the circulating supply to get it. This number lets you compare projects fairly, since a $1 coin with many tokens can be bigger than a $100 coin with few. Use market cap to judge scale, not sticker price.

Next, ask what that size means. Large caps are usually steadier; small caps swing harder—more risk, more upside. Compare circulating supply with total or FDV to spot dilution. Don’t stop at cap: check volume, liquidity, real utility, and on-chain activity. Sudden cap spikes can signal fresh demand—or exit pressure.

5. Monitor Community and Sentiment

Community and ecosystem growth are key indicators of a project’s traction and staying power. A thriving developer base means more dApps, integrations, and real use cases. Meanwhile, active user communities drive adoption, governance participation, and social visibility.

Check GitHub contributors, developer grants, Discord or Telegram crypto group activity, and ecosystem dashboards to gauge this. Also, watch for third-party partnerships or integrations as they signal real-world confidence. Without strong community and developer engagement, even robust projects can quickly stagnate and lose relevance.

6. Use Technical Analysis

Using technical analysis gives you a clear plan in a noisy market. It turns price action into objective signals, so you’re not trading on headlines or gut feel. Charts help you judge trend, momentum, and key levels, making entries and exits more disciplined and keeping risk in check when volatility spikes.

Start with the chart to see if the price trends up, down, or sideways.

- Mark support (a floor where buyers stepped in) and resistance (a ceiling where sellers faded rallies): Buy near support, trim near resistance.

- Use a 50-day moving average: Price above it often signals strength.

- Check RSI: Over 70 = overbought; under 30 = oversold.

- Confirm with volume: Big moves with heavy trading carry more weight.

- Note patterns: Triangles, flags, and head-and-shoulders can precede breakouts or reversals.

Be patient. Technicals guide timing, not certainty. Practice on a watchlist before risking real capital.

Our Methodology: How We Ranked the Best Altcoins to Buy Now

We developed a methodology for evaluating the top altcoins to buy now, with each factor weighted at 20%. This way, we can uncover and present a comprehensive overview of the potential growth of different altcoins. Ultimately, we want you to make informed decisions based on your preferences and risk tolerance.

Innovation (20%)

We assess each coin’s innovation by examining its underlying technology and novel features. This encompasses scalability, online/offline security, smart contract capabilities, and potential for further innovation.

Use Cases and Adoption (20%)

Furthermore, we gauge each altcoin’s adoption level and tangible applications. The most successful coins often prioritize integrations within the existing infrastructure, utility in decentralized applications, and the role it might play in various industries.

Community Strength (20%)

Our team assesses the size and engagement level of each altcoin community. More specifically, we pay close attention to developer involvement and community updates. Discussions must also take place across forums, social media channels, and developer platforms.

Market Resilience and Liquidity (20%)

We also scrutinize the altcoin’s market resilience and liquidity, as indicated by factors such as market capitalization, trading volume, and liquidity across major exchanges. Furthermore, we look into the stability of trading pairs and accessibility across different trading platforms.

Regulatory Alignment (20%)

We analyze every altcoin’s alignment with regulatory frameworks in prominent jurisdictions. All major developers and projects must navigate any potential legal or compliance hurdles.

Conclusion: What Is the Best Altcoin to Buy in February 2026?

No one can say which cryptocurrencies will succeed long-term, but projects with real-world use and active development tend to stand out. There are dozens of ambitious altcoins out there chasing innovation, but Ethereum still stands head and shoulders above them.

Its largest developer community, robust DeFi and NFT ecosystems, and massive stablecoin and RWA volume (Ethereum hosts ~$165B in stablecoins alone) give it unmatched utility.

Additionally, its transition to Proof-of-Stake reduced issuance and made ETH stakeable. While newer chains promise faster speeds, they can’t match Ethereum’s entrenched network effects and institutional confidence.

FAQs

Are altcoins safe?

How many different altcoins are available?

Are altcoins worth buying?

What’s happening in the altcoin market right now?

What are the best altcoins in 2026?

Is an altcoin different from a cryptocurrency?

What is an altcoin season?

References

- Ethereum Pumps To Five-Month High As Treasury Companies Stockpile ETH (Decrypt)

- Rising Price, Record ETF Inflows—Is Ether Turning a Corner? (Investopedia)

- A deep dive on Solana, a high performance blockchain network (Visa)

- Voltaire — Cardano Roadmap (Cardano)

- Why Altcoins Are Dragging Their Feet as Bitcoin, Ethereum Soar (Decrypt via Yahoo! Finance)

- Fusaka 🦓 (Ethereum)

About Cryptonews

Our goal is to offer a comprehensive and objective perspective on the cryptocurrency market, enabling our readers to make informed decisions in this ever-changing landscape.

Our editorial team of more than 70 crypto professionals works to maintain the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re looking for breaking news, expert opinions, or market insights, Cryptonews has been your go-to destination for everything cryptocurrency since 2017.