Top 9 Crypto Trading Bots (Tested for February 2026)

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships. However, this potential compensation never influences our analysis, opinions, or reviews. Our editorial content is created independently of our marketing partnerships, and our ratings are based solely on our established evaluation criteria. Read More

Crypto trading bots allow for automatic trading following the rules you set up. By analyzing live prices and indicators, these bots run different investing strategies like arbitrage or trend trading, allowing you to get fast and logical decisions. It’s important that you set up the bots carefully with strong risk controls in place to stay safe.

Our research shows that the best crypto trading bots in February 2026 are Dash 2 Trade, Learn 2 Trade, Cryptohopper, and Coinrule. From the beginner-friendly Dash 2 Trade and the accessible Learn 2 Trade to copy trading-focused Coinrule, our picks cater to different investor preferences and budgets.

In addition to reviewing the best crypto bots in depth, we go over what crypto trading bots are, how they work, whether they’re legitimate, and how to pick the best crypto trading bot for you.

Top Crypto Trading Bots Compared

Here is a comparison table breaking down our top platform picks based on features like grid trading, backtesting, copy trading, and free plans.

| App | Grid Trading | Backtesting | Copy Trading | Free Plan | Key Features | |

|---|---|---|---|---|---|---|

| Dash 2 Trade | ✅ | ✅ | ✅ | ❌ | ✅ | All‑in‑one signals and bot platform |

| Learn 2 Trade | ✅ | ❌ | ❌ | ✅ | ✅ | Automated algorithmic trading via Telegram |

| Coinrule | ✅ | ✅ | ✅ | ❌ | ✅ | No‑code rule‑based crypto trading automation |

| Cryptohopper | ✅ | ✅ | ✅ | ✅ | ✅ | Cloud‑hosted AI crypto trading bot |

| Bitsgap | ✅ | ✅ | ✅ | ❌ | ✅ | Multi‑exchange AI bots and terminal |

| Bybit | ✅ | ✅ | ❌ | ✅ | ✅ | Grid and DCA bot trading platform |

| Gates.io | ✅ | ✅ | ✅ | ✅ | ✅ | Free AI‑powered grid and arbitrage bots |

| Pionex | ✅ | ✅ | ❌ | ❌ | ✅ | Smart assistant rule‑based trading platform |

| Kryll | ✅ | ✅ | ✅ | ❌ | ✅ | Web3 AI sidekick for crypto trading |

The best crypto trade bot providers can help investors tremendously. Before picking a crypto bot, investors should read through the reviews below. It’s also recommended that investors do their due diligence to educate themselves on the risks associated with crypto bots.

The best crypto trade bot providers can help investors tremendously. Before picking a crypto bot, investors should read through the reviews below. It’s also recommended that investors do their due diligence to educate themselves on the risks associated with crypto bots.

Best Crypto Bots Reviews

There are plenty of cryptocurrency trading bots available in the market today. This means that investors have a range of options to choose from. At the same time, this can also make it challenging to find the right provider.

To help clear the mist, below we review some of the best crypto bots for bear markets, and also for the bullish ones, available for investors in 2026.

1. Dash 2 Trade – Crypto Analytics Platform Supporting Automated Trading

- Editor’s Choice 🏆: Best for beginners

- Price: Free to $120/year

- Our Security Rating: 9.4/10

- Ideal For: Beginners

- Non-Custodial API Keys: Depends

Dash 2 Trade is one of the ideal automated arbitrage bots for beginners in crypto trading. Developed by Learn2Trade, it offers in-depth market insights and helps you find top trending crypto coins. The platform offers trading signals, social features, and key metrics. You can build your own trading strategies here. It also provides indicators and analytical tools to support your decisions.

Test your strategies in live markets to check their profit potential. If strategy building isn’t your thing, use Dash 2 Trade’s signals instead. These signals tell you entry points, exit points, and order types. It’s like having a guide for your trades without doing all the research yourself.

Link your exchange via API to use the auto-trader. This bot runs your strategies automatically, just as you set it. The platform reviews bot performance so you can tweak strategies first. You also get on-chain data and price alerts. Pay your subscription with D2T tokens, ETH, or regular money.

Pros:

- Offers access to tons of useful tools for crypto trading

- Supports auto crypto trading robot

- Available features include crypto signals, price alerts, on-chain analytics, and more

- D2T tokens are available for presale at just 0.05 USDT (as of writing)

Cons:

- Subscriptions can be paid only using D2T tokens

- Strictly follows its own trading strategies

- Lacks market volatility sensitivity

- There are limited bot types

2. Learn2Trade – Advanced Crypto Trading Bot to Generate Gains in Volatile Trading Conditions

- Price: Free to £58.2/month or £1499 for lifetime access

- Our Security Rating: 9.2/10

- Ideal For: Access via Telegram

- Non-Custodial API Keys: N/A

Learn2Trade excels in helping traders navigate volatile trading conditions. Built by experts, it leverages 1500+ lines of code and 100+ technical indicators. This AI trading bot identifies favorable market conditions and executes trades. It scours the market for signals and sends automated alerts via Telegram. This helps you make quick investment decisions.

The platform integrates with Cornix, combining Learn2Trade’s market data with Cornix’s quick investing protocol to execute trades automatically. It is compatible with Binance and Bybit, but you need a Cornix account first.

Learn2Trade offers a flexible subscription model with three packages, providing up to 40 trades per month with a 79% success rate. The platform supports both automated and manual trades, catering to those who prefer a hands-on approach.

Pros:

- Automated trading bot

- Data-backed-up algorithm

- Affordablefees

- Integration with Telegram for instant alerts

Cons:

- Must have a Telegram account

- Mixed signal performance reported

- Faces customer support issues

- Limited automation features

3. Coinrule – Set Rules for Automated Crypto Trading

- Price: Free to $29.99/month

- Our Security Rating: 8.9/10

- Ideal For: Setting live rules

- Non-Custodial API Keys: Yes

Coinrule was set up with the aim of making crypto trading simpler for investors. This trading bot allows users to devise strategies based on the ‘if-this-then-that’ condition. For instance, investors can tell the Coinrule trading bot to buy $100 worth of Ethereum if the price of the digital token increases by 1%.

Coinrule stands out for being very user-friendly, especially for beginners. It offers clear tutorials to help you easily set up your trading bot. You start by connecting Coinrule to your chosen crypto exchange using an API. The platform also includes technical indicators like moving averages and RSI to help investors build strategies.

You can test your trading rules before using them live. Coinrule has a strong free tier: set two live rules and access seven template strategies. However, trading volume is limited. Paying $29.99 monthly removes limits, increases rules to seven, and unlocks up to $300,000 in monthly trading volume.

Pros:

- Easy to use and beginner-friendly

- Option to set up to seven live rules

- Both free and paid versions are available

- Supports backtesting

Cons:

- Limit on trading volume

- Features on the free version are limited

- Depends heavily on third-party exchanges

- There’s a lack of backtesting

4. Cryptohopper – Trading Platform With Copy Trading AI-Powered Bots

- Editor’s Choice 🏆: Best for professionals

- Price: Free to $107.50/month

- Our Security Rating: 8.8/10

- Ideal For: Copy trading

- Non-Custodial API Keys: Yes

Cryptohopper is a full-fledged crypto platform that caters to the needs of investors across all levels. It comes with several features, which include an advanced trading platform, portfolio management tool, crypto bots, technical indicators, and more.

Cryptohopper lets you copy other traders’ positions directly through its marketplace. You can also subscribe to its trading signals; these tell your bots when to buy or sell. If you prefer simplicity, choose one of their ready-made bot templates instead. It gives you several ways to automate your trading strategy.

Cryptohopper has a free plan, and the platform offers a free ‘Explorer’ subscription, which includes 15 market-scanning bots, when users connect Crypto.com as their exchange. This promotion has no end date and thereby gives free access to automated trading. Otherwise, the Explorer plan begins at $24.16 a month, and there are three paid tiers in total, all offering different flavors of trading bots.

Pros:

- Features predefined bot trading strategies

- Offers a range of services

- Supports copy trading

- Offers affordable subscription plans

Cons:

- A bit complex for beginners

- Occasional delays in trade execution reported

- Complaints about support issues

5. Bitsgap – Top Crypto Trading Bot, Offering GRID & DCA Strategies

- Price: Free to $149/month

- Our Security Rating: 8.4/10

- Ideal For: Dollar-cost averaging strategies

- Non-Custodial API Keys: Yes

Bitsgap has earned the trust of over 800,000 users due to its ability to provide unique crypto trading strategies. Presently, it boasts more than 4.7 million crypto trading bots on its platform, making it possible for traders to pick the one that best suits their investment goals.

Bitsgap offers different bots, each with unique functions. The Combo bot merges DCA and Grid strategies to increase profits. Their standard DCA bot aims for lower-risk gains in volatile markets. The Grid bot helps find better entry and exit points. For futures trading, the DCA Futures bot focuses on regular long-term investments.

Bitsgap plans start at $29 monthly for the basic tier. This lets you run two active Grid bots and ten DCA bots. The advanced plan costs $68 monthly. It increases your limits to five Grid bots and fifty DCA bots. You choose the plan matching your trading activity level.

Pros:

- Trusted by over 500,000 users

- Offers over 3.7 million trading bots

- Scans the market for resistance levels

- Unique automated strategies

Cons:

- It does not offer any free plans other than the 7-day trial

- High prices might not compel beginners

- Faces frequent bugs and interface issues

- There’s no mobile app

6. Bybit – Low Investment Crypto Trading Bot Offers Multiple Trading Strategies

- Price: 0.06% to 0.1% fee on trades

- Our Security Rating: 9.1/10

- Ideal For: Low minimum investment

- Non-Custodial API Keys: Yes

Bybit, a leading centralized crypto exchange, has over 15 million users worldwide. You can automate your crypto trades using its trading bot. Choose the ‘Spot Grid’ for short-term trades. For more risk, use the ‘Futures Grid’ to go Long or Short on crypto. The bot also supports leverage trading, which can be volatile but potentially profitable.

For instance, the DOGE/USDT Futures bot reports an average APY of over 77%. But you should know: its volatility ratio is 443%. This means it is extremely volatile. High potential returns come with high risk. You should always consider market volatility before using strategies like this.

For beginners, it’s best to start with just $1 in certain markets, investing in popular pairs like BTC/USDT, as they work with both Futures and Spot Grid. They can also decide how long the positions can stay open (from 24 hours to over 30 days). This flexibility helps match trades to the investor’s timeline and comfort level.

Pros:

- Low minimum investment

- Multiple trading strategies

- Short investment times

- Easy-to-use for beginners

Cons:

- Highly volatile returns

- Faces major security breaches

- There are still some regulatory restrictions

- No Fiat withdrawals available

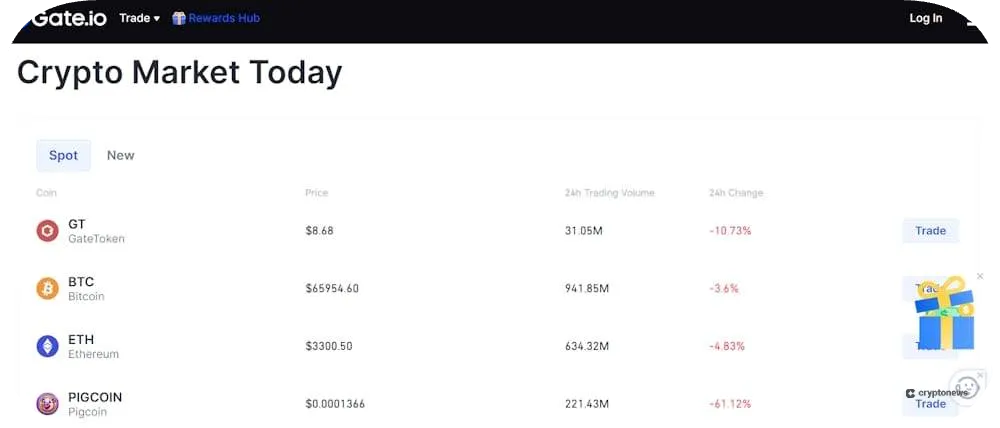

7. Gate.io – Massive Range of Features to Build Your Own Crypto Trading Bot

- Price: 0.015% to 0.2% fee on trades

- Our Security Rating: 8.6/10

- Ideal For: Customized crypto trading bots

- Non-Custodial API Keys: Depends

With over 1700 cryptocurrencies to choose from and a reputation for high levels of liquidity, Gate.io remains a popular choice for crypto investors. Founded in 2013, Gate.io is one of the oldest platforms around and is respected for its wide range of products and features. For those looking for a comprehensive crypto trading bot resource, Gate.io is a good place to start.

Gate.io attracts users with its wide range of trading bots. You get hundreds of tools to help make trading decisions. Choose between using a ready-made bot or building your own from scratch. This flexibility lets you pick the automation method that best fits your approach and skills.

If you build your own bot and publish it, you earn a share of profits when others use it successfully. If you use someone else’s pre-built bot, you pay a small fee from your profitable trades. This open model fosters a helpful community around shared bot strategies.

Pros:

- 1700+ cryptocurrencies available

- Wide range of payment methods

- Massive range of trading-bot features

- Adopt a pre-built model or create your own

Cons:

- No fiat off-ramp

- User interface could be better

- Not available in major markets

- Some reported account freezes and locked funds

8. Pionex – 16 Free Built-in Crypto Trading Bots

- Editor’s Choice 🏆: Best value

- Price: Free

- Our Security Rating: 8.1/10

- Ideal For: Free crypto trading bots

- Non-Custodial API Keys: Depends

Pionex is one of the best free crypto trading bots available in the market today. It offers not one or two but 16 free in-built trading bots. Pionex allows its users to automate trading using strategies such as dollar cost averaging, arbitrage trading, grid trading, and more.

Pionex works differently: it’s not a bot for other exchanges. Think of it as its trading platform. You directly trade hundreds of crypto pairs here, including derivatives and leveraged positions. You can also buy crypto with a credit card or stake tokens to earn rewards. Use its mobile app to track things anytime.

Good news: using Pionex’s bots costs you nothing. But remember, trades do have fees. You pay 0.5% for regular spot trades. Leveraged trades cost less at 0.1%. That’s it for trading fees: no hidden extras, just these clear rates when you execute your trades on Pionex.

Pros:

- Offers 16 free cryptocurrency robots

- Has several in-built trading strategies

- Supports leveraged positions

- Easy to use for all-level trading

Cons:

- No scope for customization

- Flat fee of 0.5% for spot trades

- Lack of transparency

- Limited Fiat support

9. Kryll – Access a Pay-As-You-Go Pricing Structure with this Crypto Bot

- Price: 0.033% fee on trades (estimated average)

- Our Security Rating: 7.9/10

- Ideal For: Pay-as-you-go trading bots

- Non-Custodial API Keys: Depends

The next top cryptocurrency trading bot on our list is Kryll. With Kryll, investors can access some of the best crypto trading bots – including Grid bots, Golden Crossover bots, and daily signal strategies.

Kryll offers different bots for different goals. Use the DCA bot to invest a fixed amount regularly for the long haul. Choose the Spot Grid Bot for quicker trades; it constantly scans for good entry points on specific assets. You also get various indicators and real-time metrics to refine your strategies.

One more thing to note is that you only need to pay fees on the crypto you actually trade, without needing to pay subscriptions or sign-up costs. For example, if you trade $100, it would cost about $0.33, keeping costs tied directly to your usage. Also, holding Kryll’s native token ($KRL) reduces this fee.

Pros

- Pay-as-you-go pricing system

- Risk-management tools

- Low fee for trading

- Long-term and short-term strategies

Cons

- Discounts given only to $KRL token holders

- Limited exchange support

- Quite complex for beginners

- No full DeFi trading integration yet

What Are Crypto Bots and How Do They Work?

Crypto bots are software programs that use complex algorithms and AI to analyze crypto markets and execute trades on behalf of users. They can implement user-defined strategies based on strict parameters and thus eliminate the negative effects of human emotions. These bots can connect to exchanges like Binance and Coinbase through APIs to identify patterns and place orders when certain conditions are met.

By using crypto bots, investors can specify how they want their trades to be executed and when. In some cases, the provider will even have templates to pick from – which means that traders are not required to figure out what conditions the bot has to meet.

Instead, the trading bot will automatically find the best crypto to trade, execute orders, and rebalance portfolios based on market conditions.

Crypto bots help investors save tons of time in research and eliminate the need to watch over the market every moment. However, the success of this strategy will depend almost entirely on the chosen provider.

Investors can get started with crypto trading bots by signing up on their chosen platform.

Most of the best crypto robots on our list offer both free and paid versions, and investors can choose an option based on the features that are most useful to them.

A crypto trading bot can work in the following ways:

- Some platforms allow users to set up their own trading strategies. In this case, traders can establish specific rules such as entry and exit price levels.

- A few bots also let traders specify risk management rules. Once programmed, these rules will be automatically executed by the bot.

- In other cases, the trading bots provider might already have a pre-defined set of strategies, such as DCA crypto bots. Users only need to pick one that best suits their trading style and deploy it.

- Advanced trading bot platforms also allow users to create their own algorithms. However, depending on the provider, this might require knowledge of coding.

Using crypto trading bots does not mean that returns are guaranteed, but rather, these tools can help make the investment process easier and less time-consuming.

Are Crypto Bots Legit?

The crypto space is moving at a rapid pace. New platforms, bots and robo advisors are sprouting up every other day, promising huge returns and high success rates. As with everything else on the internet, not every crypto bots provider is legitimate.

Some of these platforms can turn out to be scams, and investors can end up losing their money. Traders need to be particularly careful when signing up for a Discord crypto bot, meme coin trading bot, or an open-source crypto bot that claims to guarantee huge profits.

After all, there is no way any crypto platform can assure profits. So, be sure to check crypto trading bots reviews before using any provider.

That being said, there are also crypto trading bots that have proven track records. For instance, Dash 2 Trade is the product of Learn 2 Trade, a well-established crypto signals provider that has been around for many years.

The platform’s Telegram channel has over 70,000 subscribers and a great reputation in the crypto space. This indicates that the team behind Dash 2 Trade is highly experienced and, as such, can offer investors valuable insights.

Finding the best crypto bot can be challenging – so we have included a section on how to find the right provider later in the guide.

Types of Legitimate Crypto Trading Bots

There are several types of crypto trading bots that have no harmful effect on the market. In fact, some of them can have a positive impact. For example, market-making bots can bring more liquidity to crypto exchange platforms, making the broader market healthier and more stable.

Let’s explore some of the most widely used legitimate crypto trading bots:

⚖️ Arbitrage Trading Bots

Crypto arbitrage bots analyze the prices of digital assets across multiple crypto exchanges and place trades to take advantage of any discrepancies.

For instance, let’s say that the price of Bitcoin is $28,085 on one exchange. On another exchange, this might be $28,095. Such a price disparity is common across exchanges due to the differences in trading volume, fees, and liquidity.

Now, typically, by the time a human trader spots this disparity, there won’t be sufficient time to execute a profitable trade. On the other hand, a crypto arbitrage bot is fast enough to identify these price differences.

They can place buy and sell orders at different trading exchanges simultaneously in order to turn a profit for the user. In other words, trading bots are an effective way to make money with crypto arbitrage.

🤖 Market-Making Bots

As their name suggests, market-making bots work as market makers. They place buy and sell limit orders near the current market price. They aim to secure profits by capitalizing on the small spread between the bid and ask prices.

These bots bring more liquidity to exchange platforms. Meanwhile, bot managers generate steady, low-margin profits in high-volume crypto markets.

🏁 Grid Trading Bots

Grid trading bots place multiple buy and sell orders in a grid-like pattern at predefined intervals, hovering around a certain price level.

This “grid” of trades allows bot operators to profit from price fluctuations even when the market is highly volatile.

🖥️ AI Trading Bots

AI trading bots use artificial intelligence (AI) and machine learning (ML) technologies to analyze market trends in real-time, allowing them to identify relevant patterns that could lead to profits. These bots can also adjust strategies dynamically to process data, including price action, investor sentiment, and on-chain metrics.

They are popular thanks to their ability to automate the trading process, eliminate emotions when making decisions, and react in real-time.

📚 Portfolio Automation Bots

Portfolio automation bots are software tools that help users manage and rebalance their crypto portfolios automatically. Users can set a wide range of parameters and allocation rules, ensuring that their portfolios don’t deviate from their general investment strategy and risk tolerance.

📻 Signal-Based Bots

Signal-based trading bots open and close positions based on certain signals. For example, traders can program them to place buy or sell orders when specific technical indicators reach certain thresholds.

Users can subscribe to signal providers to trigger their bots, automating their strategies and increasing the chances of profits.

Unethical or Illegal Crypto Trading Bots

While crypto trading bots can automate the trading process and boost efficiency, some of them break the legal boundaries to manipulate markets or exploit specific vulnerabilities. As a result, they can create unfair conditions for regular traders.

Here are the most common unethical bots:

🥪 MEV Bots

Maximal Extractable Value (MEV) bots target proof-of-stake (PoS) chains where validators can manipulate transaction orders. While not all MEV bots are bad, some can be used for front-running and sandwich attacks, causing price slippage to profit at the expense of others.

🐳 Spoofing Bots

Spoofing bots place large fake buy or sell orders to trick traders into believing there is significant market demand. Once unsuspecting traders react to those fake orders, the bots cancel them and take the profits from the resulting price movements. This practice is not legal in traditional markets as it can affect fair price discovery.

🏚️ Pump-and-Dump Bots

These bots run pump-and-sump schemes to coordinate large buys of low-liquidity tokens to artificially inflate their prices and then quickly exit the market at their peak. Unsuspecting investors who contribute to the rally are left with heavy losses. These schemes have been popular with initial coin offering (ICO) tokens and are used to this day. In traditional markets, pump-and-dumps are illegal.

💧 Wash-Trading Bots

Wash-trading bots operate by executing trades from multiple accounts that are controlled by the same owner to create the impression of high volume and liquidity. This type of bot can mislead retail investors, making tokens appear more popular than they actually are.

🗡️ Liquidity Sniping Bots

Liquidity sniping bots are looking for new token launches or liquidity pools and try to buy large amounts as soon as liquidity is activated, amassing the token at a low price before human traders can react. This gives bot operators an unfair advantage and can destabilize token launches, draining liquidity before markets can find their fair price.

Do Free Crypto Trading Bots Work?

According to our research, the best crypto bots are the paid ones. While some offer free plans, they also offer limited features. You can try them for simple testing or learning, but they probably won’t provide serious or profitable trading.

Some paying platforms offer free trials for short durations, allowing users to become familiar with the tools and decide whether to choose them. During the trial period, you could explore premium features, experiment with strategies, and get a feel for the platform before you commit to any payment plans. If you think they’re worth it, you can eventually subscribe to keep the full version.

Given the advantages of crypto bots, it might indeed be worth considering investing in a paid plan offered by a credible provider. Genuine bots can offer significant advantages, including automation, speed, and advanced algorithms.

To recap, free bots can work as a starting point or learning tool, but if you aim for steady gains, upgrading to a paid plan may provide far better value.

How to Pick the Best Crypto Bot for You

Finding the best crypto trading bot is no easy feat. After all, as this guide and our Kraken trading bot articles have pointed out, there are tons of options at the investor’s disposal.

In the following sections, we explore what factors investors need to consider to select the best crypto bot.

Features and Tools

Cryptocurrency robots come in all shapes and sizes. While some offer the bare-bone basics and provide a set of pre-configured bots, others offer more flexibility to users. With platforms such as Dash 2 Trade, traders can access tons of technical indicators, crypto signals, market analysis tools, and other metrics to come up with an automated trading strategy.

Moreover, the best crypto bots also facilitate the backtesting of strategies. In other words, the features offered by cryptocurrency bots can vary from one platform to another. Therefore, investors need to consider what trading tools are imperative to their strategy before choosing the best crypto sniper bot.

Fees

For many investors, fees will play an important role in choosing the best Solana sniper bot, or any other trading bot. Before signing up with a cryptocurrency robot, investors should check what fees apply and whether there are any ongoing charges. For instance, while some platforms charge a flat subscription fee, others levy a percentage of the stake. With some providers, a trading commission can also apply.

Conclusion

Crypto trading bots can improve the trading experience through automation. They are able to identify opportunities and respond faster than any professional trader. A great advantage of legit bots is their ability to reduce the negative effects of human psychology, ensuring the best timing for entering and exiting positions.

The crypto bot market is diverse, offering multiple types of applications. Our top-rated picks, including the Dash 2 Trade, Coinrule, and Cryptohopper, stand out for their features, reliability, and ease of use.

Before choosing a bot, it’s important to define your strategy and think about the features that you may need, such as backtesting, signals, or copy trading. You should pick the trading bot and plan that match your risk profile.

There is no arguing that bots can be useful in aiding investors with cryptocurrency trading. However, bear in mind that you will need to do some homework to prepare yourself to use a bot adequately and effectively.

FAQs

Which crypto trading bot is best?

Is trading using a crypto bot profitable?

Which crypto bots are free?

Do bots get blocked by exchanges like Binance or Coinbase?

How much do paid crypto bots cost?

Can crypto bots trade for me?

What is the best risk-free arbitrage bot?

About Cryptonews

Our goal is to offer a comprehensive and objective perspective on the cryptocurrency market, enabling our readers to make informed decisions in this ever-changing landscape.

Our editorial team of more than 70 crypto professionals works to maintain the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re looking for breaking news, expert opinions, or market insights, Cryptonews has been your go-to destination for everything cryptocurrency since 2017.