9 Best Crypto Presales in January 2026 (Audited & Vetted)

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships. However, this potential compensation never influences our analysis, opinions, or reviews. Our editorial content is created independently of our marketing partnerships, and our ratings are based solely on our established evaluation criteria. Read More

Based on our research, Bitcoin Hyper (HYPER), Maxi Doge (MAXI), and BMIC (BMIC) are the best crypto presales to invest in right now. HYPER stands out thanks to its extensive utility and strong momentum, having raised $30.35M in just six months. MAXI and BMIC are ranked next due to their innovative engagement mechanisms, like holder contests and virtual mining.

We curated this list of 12 top-selling crypto presales with high potential from over 50 projects currently live. We started with a ‘risk-first’ filtering process, first checking red flags and structural vulnerabilities to eliminate weak projects and outright fraud. To do this, we reviewed smart contract audits, team transparency, and compliance with MiCA regulations, among other factors.

Through this process, we aim to provide you with recommendations with a decent risk-reward profile. After passing our vetting criteria, we prioritize presales that have raised between $1-$30 million — high enough to show real demand, yet leaving room for growth.

- In This Article

-

- 1. Bitcoin Hyper (HYPER) – Best Blockchain Infrastructure Presale Building a Bitcoin L2

- 2. Maxi Doge (MAXI) - Best Ethereum Meme Coin Presale

- 3. BMIC (BMCI) – Decentralized Quantum Computing and Security Network

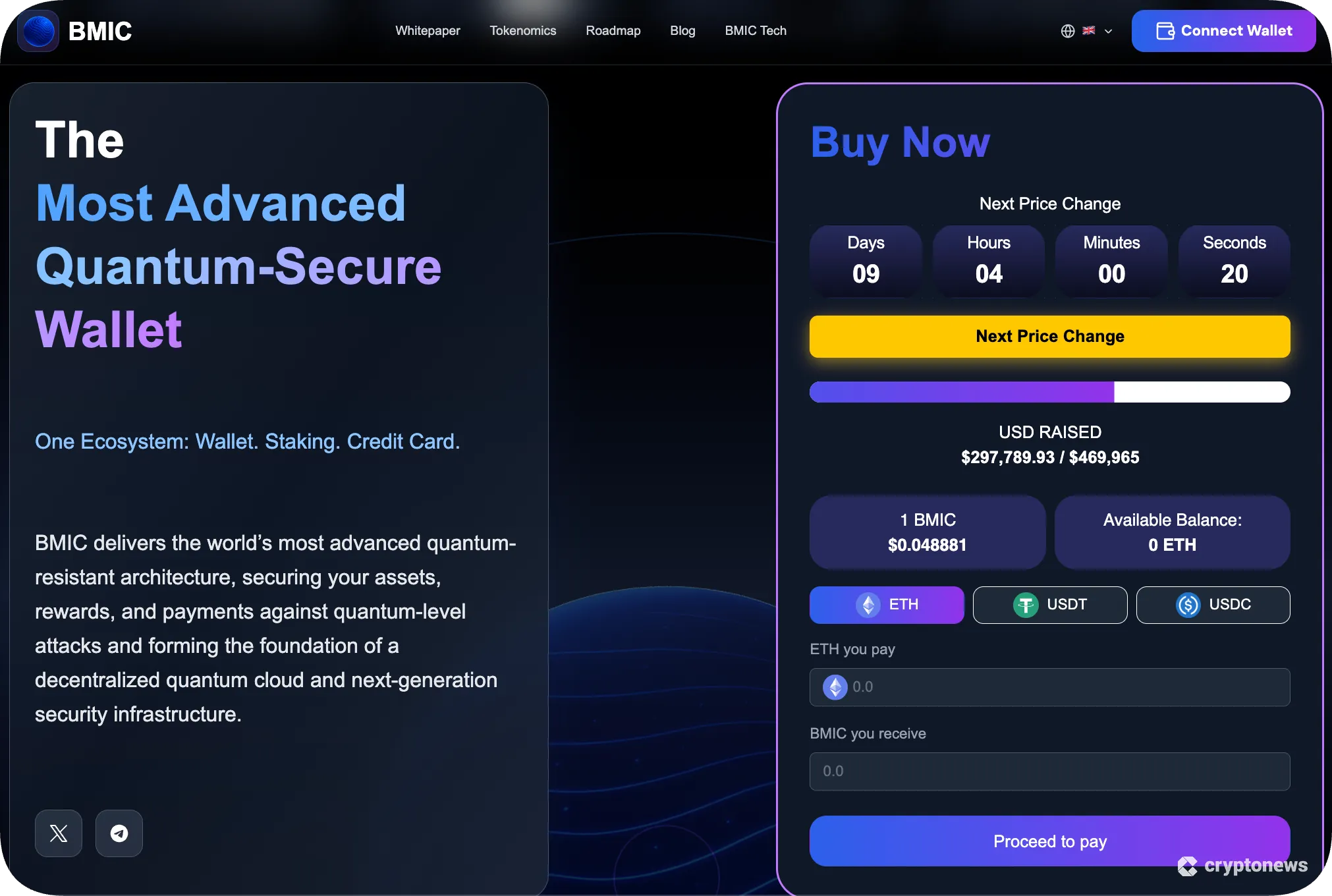

- 4. LiquidChain (LIQUID) – Layer-3 Project With Unified Liquidity for Fast, Cross-Chain DeFi

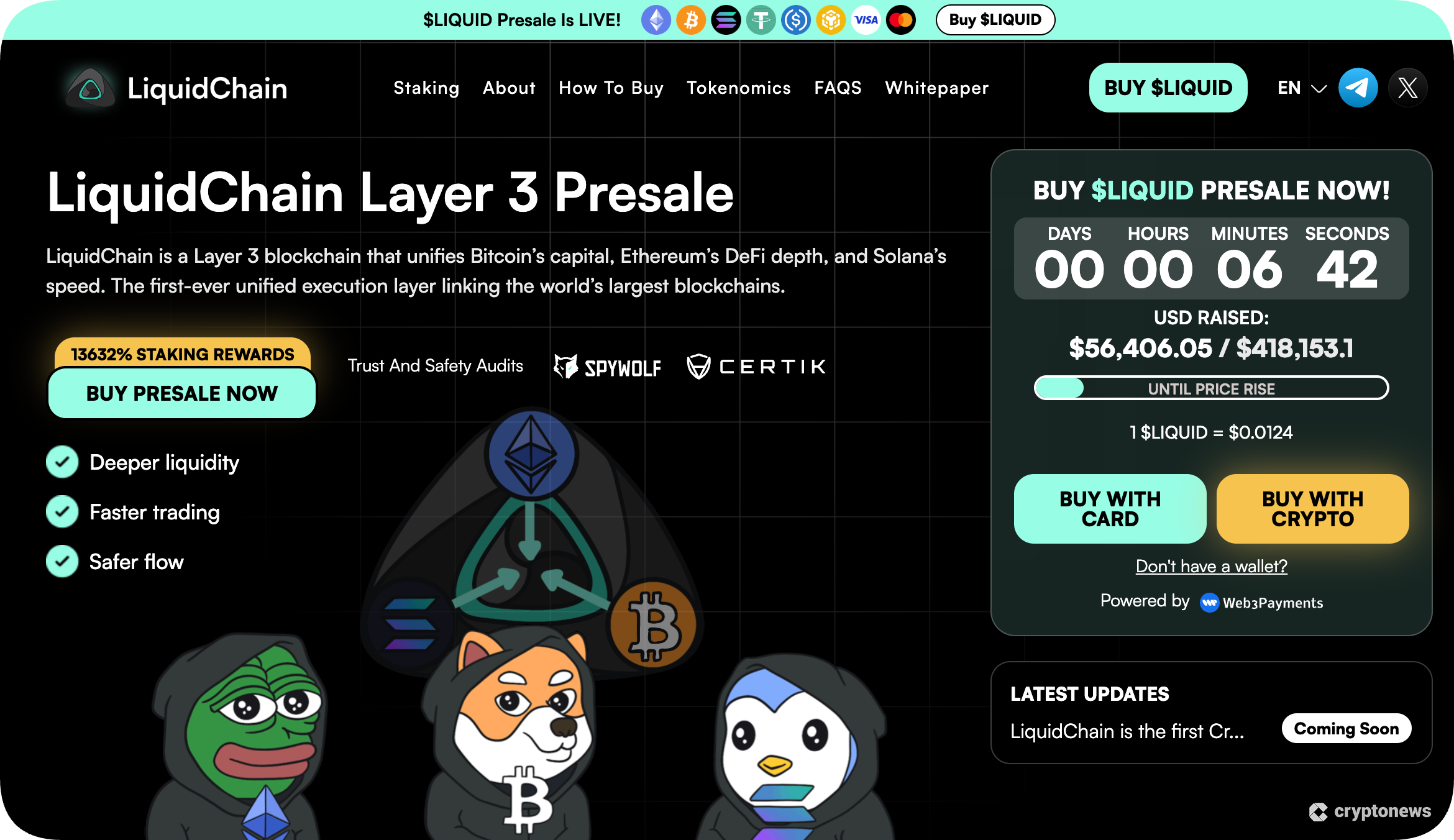

- 5. SUBBD (SUBBD) – Best New AI Crypto Presale

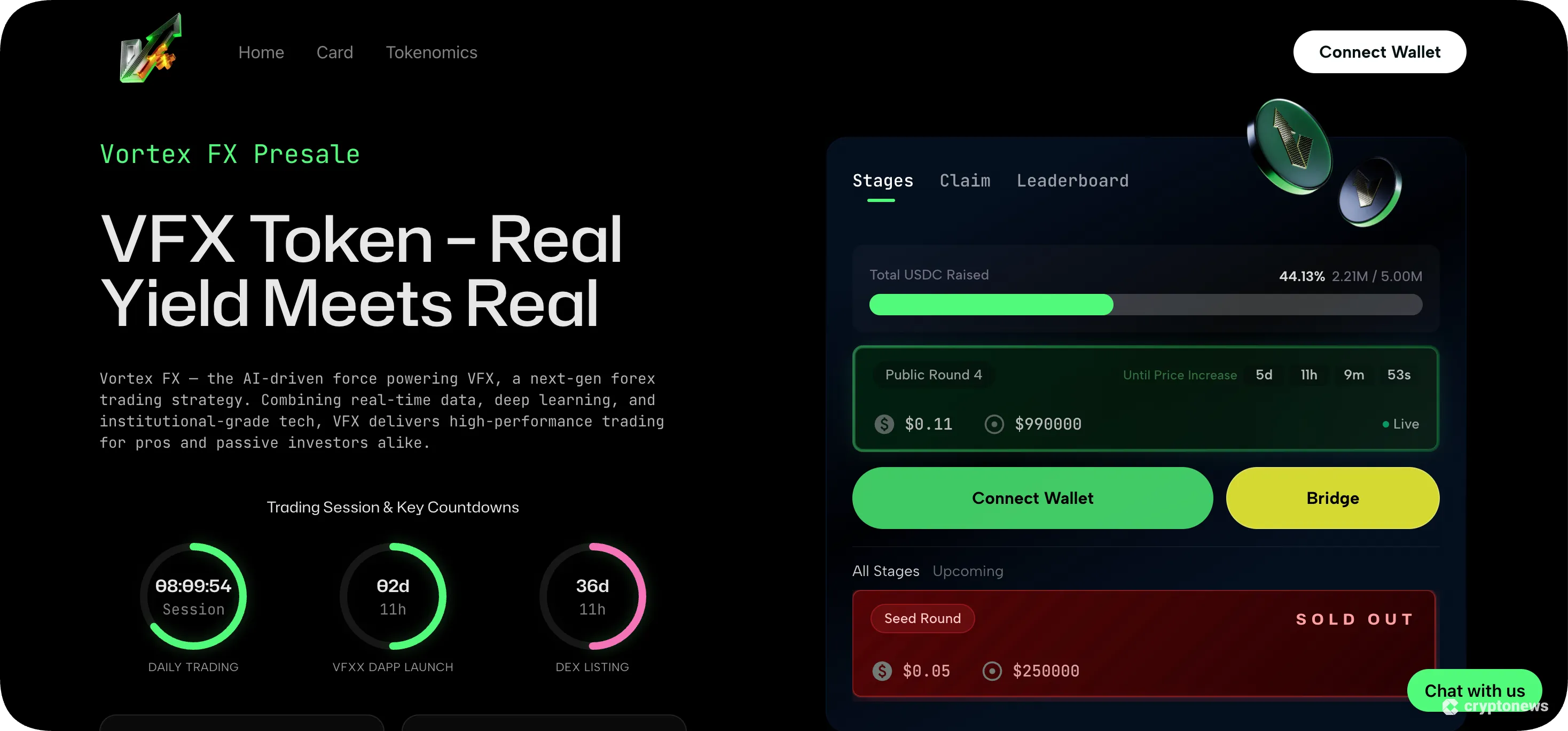

- 6. Vortex FX (VFX) - Web3 Bridge for Real-World Forex Trading and AI-Driven Yield

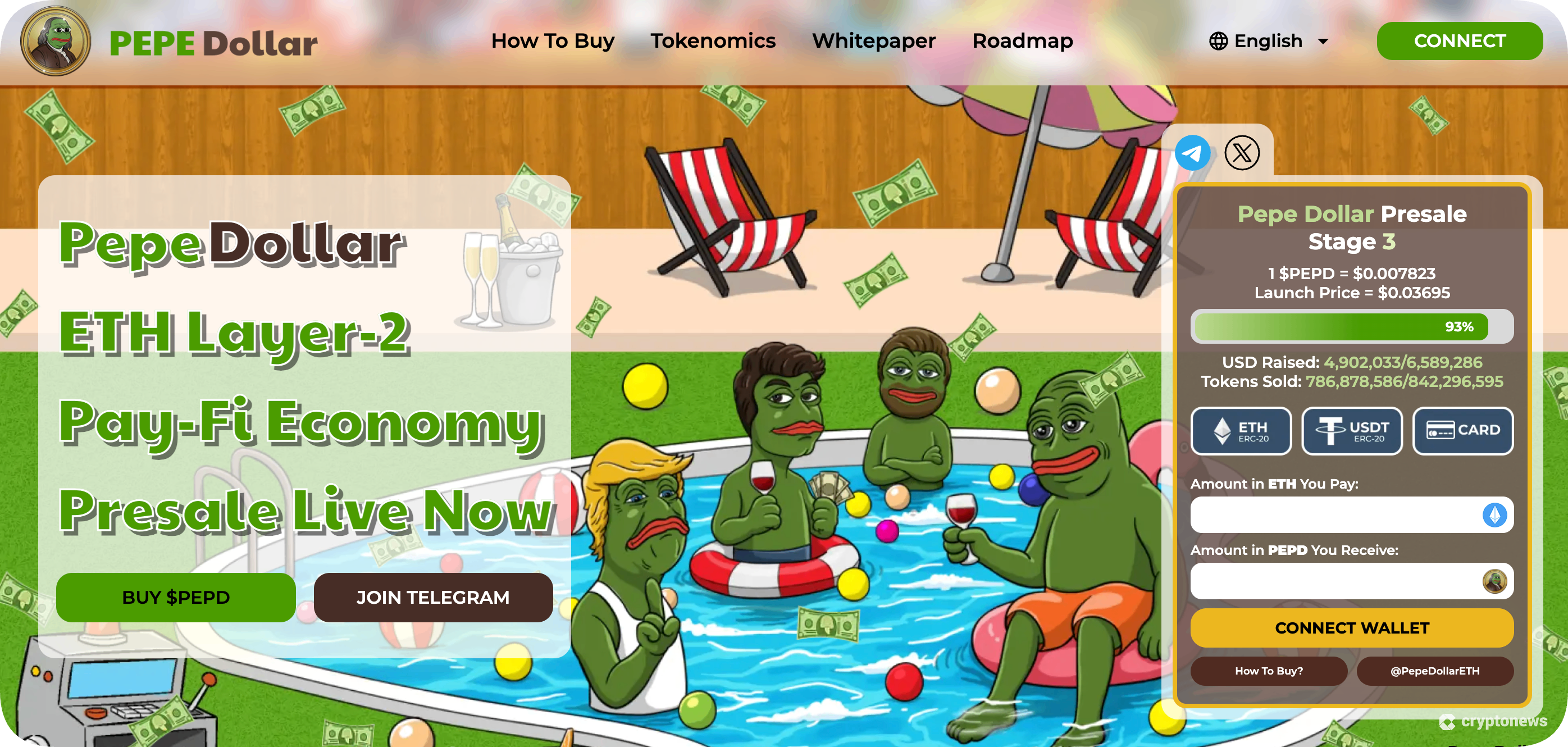

- 7. Pepe Dollar (PEPD) – Best Ethereum L2 Presale Token

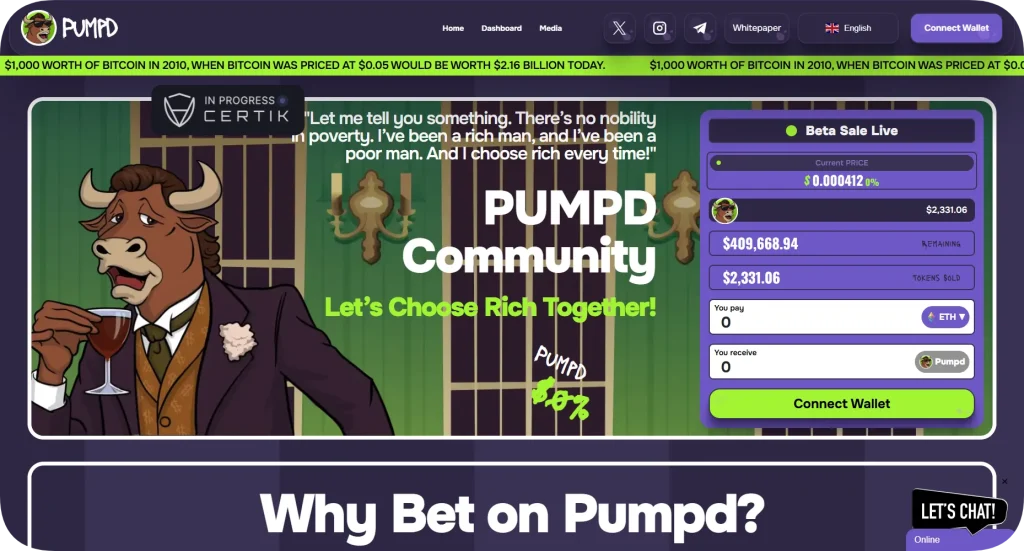

- 8. PUMPD (PUMPD) - Best AI Presale With Meme Branding

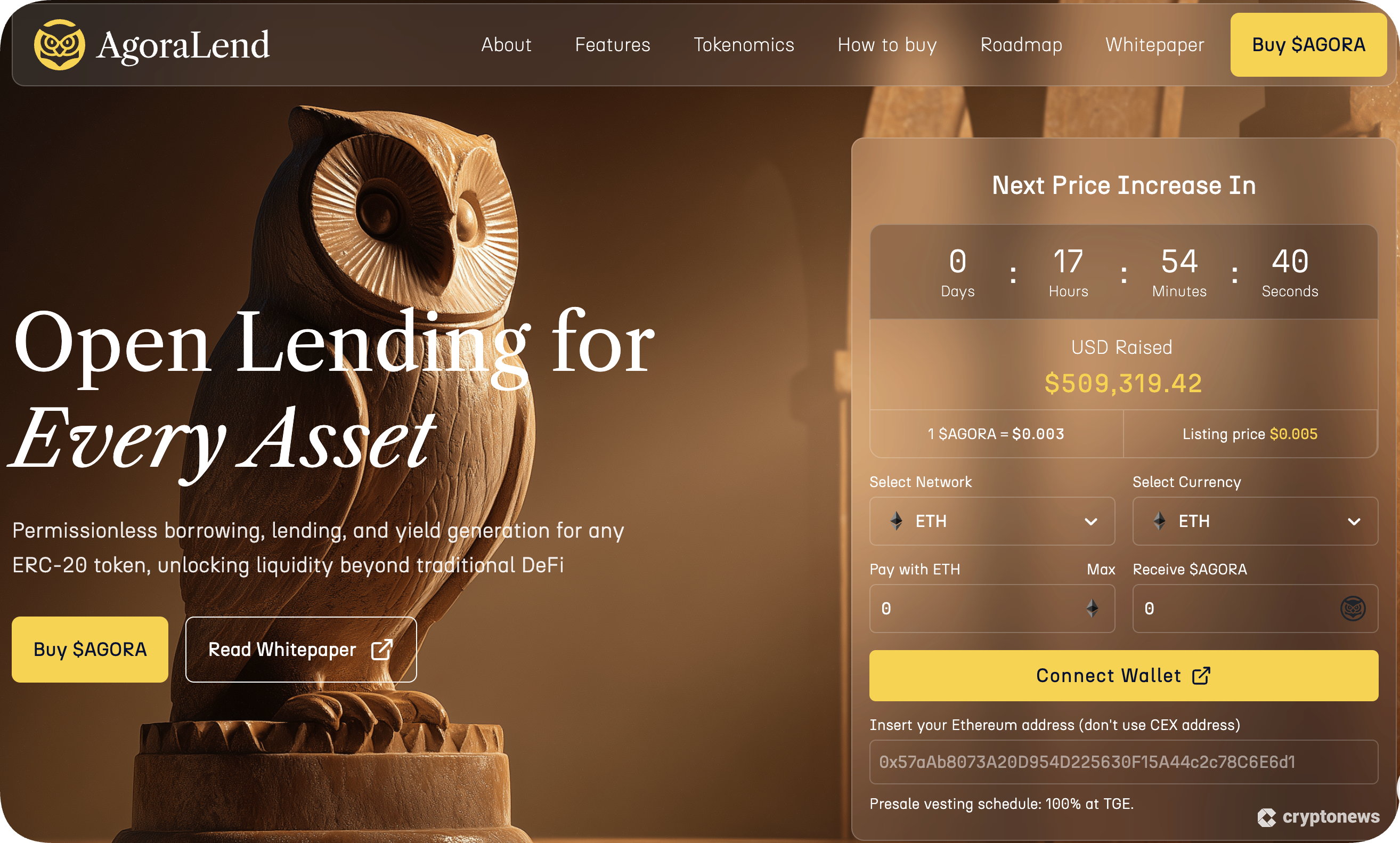

- 9. AgoraLend (AGORA) – Best Lending Protocol Presale Crypto

- In This Article

- Show Full Guide

-

- 1. Bitcoin Hyper (HYPER) – Best Blockchain Infrastructure Presale Building a Bitcoin L2

- 2. Maxi Doge (MAXI) - Best Ethereum Meme Coin Presale

- 3. BMIC (BMCI) – Decentralized Quantum Computing and Security Network

- 4. LiquidChain (LIQUID) – Layer-3 Project With Unified Liquidity for Fast, Cross-Chain DeFi

- 5. SUBBD (SUBBD) – Best New AI Crypto Presale

- 6. Vortex FX (VFX) - Web3 Bridge for Real-World Forex Trading and AI-Driven Yield

- 7. Pepe Dollar (PEPD) – Best Ethereum L2 Presale Token

- 8. PUMPD (PUMPD) - Best AI Presale With Meme Branding

- 9. AgoraLend (AGORA) – Best Lending Protocol Presale Crypto

Key Takeaways

- Bitcoin Hyper (HYPER), Maxi Doge (MAXI), and BMIC (BMIC) are the best presales right now.

- They stand out for audited contracts, regulatory compliance, clear use cases, and defined presale terms like hard caps, tokenomics, and vesting schedule.

- Crypto presales let you buy new tokens before they list on exchanges; the upside is early entry pricing.

- The risks include eventual failure, low liquidity, and steep corrections after launch.

- You can lower risk by checking team, audits, tokenomics, vesting, liquidity plans, and by spreading funds across a few presales.

Top Crypto Presales in 2026

The top crypto presales listed below include utility tokens, Layer 2 projects, meme coins, and AI-powered platforms.

- Introducing the first Bitcoin L2 solution

- Allows users to trade BTC almost instantaneously

- Enhanced transaction security with ZK-proofs

- USDC

- ETH

- usdt

- Meme-powered Dogecoin derivative with the focus on 1,000x leverage trading

- Maxi Doge will feature community contests and partner events to engage with its audience

- The project offers high staking rewards to its early supporters

- ETH

- usdt

- USDC

- +2 more

- Infrastructure token built to withstand quantum-powered attacks

- BMIC is burned to create credits for quantum computing

- Extra holder utility through staking and governance

- ETH

- usdt

- USDC

- Layer 3 unifying Bitcoin, Ethereum, and Solana

- Promises deeper liquidity, faster trading, and safer flows

- Combines a high-performance VM with trust-minimized verification

- ETH

- usdt

- USDC

- +3 more

- Next-gen platform merging live content, AI tools, staking, crypto payments and more

- SUBBD holders get access to AI-optimized content and experiences

- Loyalty is rewarded with staking bonuses, XP boosts, and daily creator drops

- Bank Card

- ETH

- bnb

- +1 more

- VFX Token powers the next-gen forex broker Vortex FX

- Offers daily rebates from trading volume

- Stake VFX tokens to earn APYs up to 67.7%

- ETH

- usdt

- bnb

- Innovative PayFi meme coin with layer-2 payment infrastructure

- Upcoming gaming competitions in Telegram fuelled by $PEPD

- 29% of the supply will be burned to boost scarcity

- ETH

- usdt

- Bank Card

- PUMPD airdrops for early holders

- Alpha calls and meme energy in lead-up to launch

- Stepped price growth throughout presale

- ETH

- usdt

- Solana

- +2 more

- Earn yield or borrow against any ERC-20 token

- Peer-to-contract and peer-to-peer lending features

- 40% of protocol revenue used to buy-and-burn $AGORA

- ETH

- bnb

- Solana

- +1 more

Top List of Active Crypto Presales

See our top list of crypto presales, with a summary of what each one is about:

- Bitcoin Hyper (HYPER): Bitcoin Layer 2 using Solana technology for fast, cheap BTC transfers.

- Maxi Doge (MAXI): Ethereum meme coin with audited contracts and trader-focused incentives.

- BMIC (BMIC): New blockchain infrastructure project built on Ethereum targeting post-quantum risks.

- LiquidChain (LIQUID): Layer-3 cross-chain protocol unifying liquidity across the largest chains.

- SUBBD (SUBBD): Creator subscription platform with token-gated content and AI assistants.

- Vortex FX (VFX): A Web3 bridge for real-world Forex traders and AI-driven yield.

- Pepe Dollar (PEPD): Ethereum Layer 2 payment rail with QR PayFi tools and deflationary mechanics.

- PUMPD (PUMPD): Solana meme token with deflationary mechanisms, AI signals, and launchpad plans.

- AgoraLend (AGORA): Permissionless lending for any ERC-20 collateral with yield-bearing derivatives.

Best Crypto Presales by Category

The best crypto presales don’t all fit the same mold. They usually track whatever narratives are pulling attention right now, like meme coins, AI x crypto, DeFi tools, or infrastructure. That’s why it helps to sort presales by category instead of trying to rank them all in one list. Below, you’ll find the top active presales across five major sectors.

| Presale Category | Description | Top Pick | Symbol |

|---|---|---|---|

| Blockchain Infrastructure | Foundational technology that contributes to at least one of the four core functions of a blockchain (e.g., settlements or execution) | Bitcoin Hyper |  HYPER +17.96% HYPER +17.96% |

| Meme Coins | Any cryptocurrency derived from or inspired by internet memes | Maxi Doge |  MAXI +11.00% MAXI +11.00% |

| DeFi | Applications or protocols that facilitate on-chain financial activity | LiquidChain |  LIQUID +18.18% LIQUID +18.18% |

| AI | Any product or service that incorporates artificial intelligence | SUBBD |  SUBBD +4.41% SUBBD +4.41% |

Top Crypto Presales in 2026 Reviewed

Crypto presales allow anyone to buy the native tokens of pre-launch crypto projects. However, investors should be aware that they vary significantly by quality, and only a minority are likely to yield positive returns.

We have thoroughly reviewed the most popular crypto presales, ranking them according to their trustworthiness, investment potential, and overall quality.

And as part of our risk-first filtering process, we focused on projects that provide clear smart contract audits because audited code reduces exploitation risks or developer-controlled functions that could affect investors negatively.

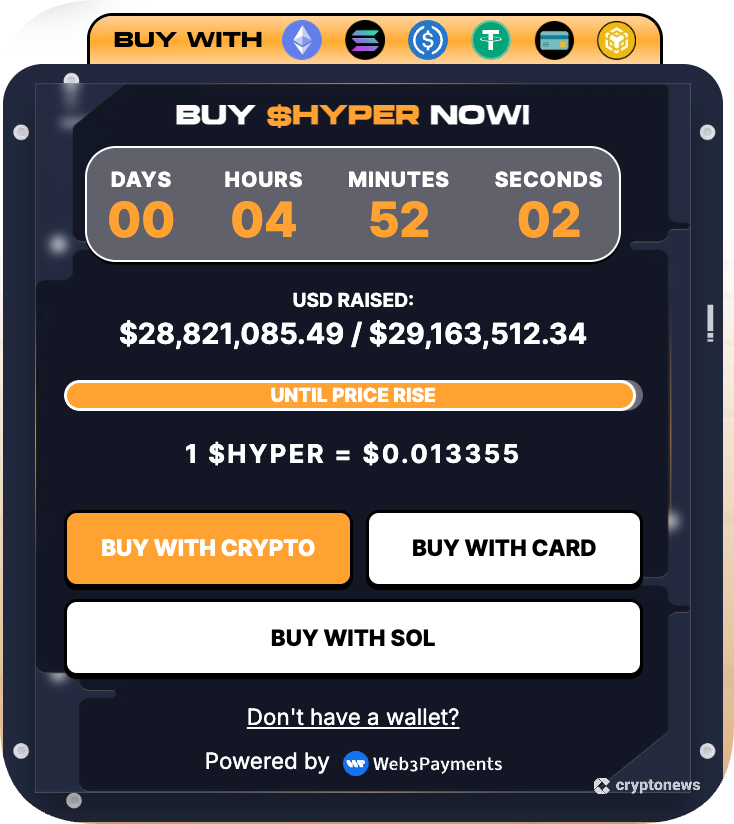

1. Bitcoin Hyper (HYPER) – Best Blockchain Infrastructure Presale Building a Bitcoin L2

- Symbol:

HYPER +17.96%

HYPER +17.96% - Raised Amount: $30.35M

- Hard Cap: $52.8M

- Current Price: $0.013565

Bitcoin Hyper is developing a Layer 2 solution for Bitcoin, the dominant cryptocurrency with a market cap of $1.81T. It leverages the Solana Virtual Machine (SVM) to achieve higher speed and lower costs for BTC transactions, which can take up to one hour to confirm on Bitcoin’s mainnet.

Bitcoin remains the most sought-after store of value (SOV) asset, attracting institutional and retail interest. Almost two-thirds (14 out of the 25) largest U.S. banks are already building Bitcoin products, reflecting its high demand. However, its infrastructure remains quite rigid, and Bitcoin Hyper aims to combine BTC with Solana-grade performance while unlocking its path into DeFi.

It remains to be seen how HYPER’s meme coin branding helps it stand out amid intensifying competition from projects like Rootstock, Stacks, and the more limited Lightning Network. HYPER’s price prediction reaches up to $0.5614 by 2030, but much depends on execution and competition from established and new players.

| Presale Start Date | May 2025 |

| Blockchain | Ethereum |

| Smart Contract Audited? | Yes (Coinsult and SpyWolf) |

| Purchase Methods | ETH, USDT, BNB, USDC, Credit Card |

Pros

- Unlocks Bitcoin liquidity by enabling the coin to be used in DeFi

- Uses Solana technology to speed up Bitcoin transactions

- Offers generous staking rewards

Cons

- There is no MVP product yet to test its capabilities

- Competition in the Layer 2 sector is high

- Success depends on the broader crypto market

2. Maxi Doge (MAXI) – Best Ethereum Meme Coin Presale

- Symbol:

MAXI +11.00%

MAXI +11.00% - Raised Amount: $4.45M

- Hard Cap: $15.7M

- Current Price: $0.0002775

Maxi Doge is an Ethereum meme coin that reflects degen trader culture and combines the popularity of DOGE with bodybuilding and leverage trading themes. The token comes with a structured rewards system and its smart contracts were audited by SolidProof and Coinsult.

Buying MAXI tokens enables users to earn dynamic rewards through a daily staking pool while joining contests (like ROI competitions for top traders) and partner events aimed at high-risk, high-reward traders.

Unlike the countless number of meme coins that choose Solana for its efficiency, MAXI sticks to Ethereum to leverage its broader EVM ecosystem. While its unique branding and “1000x leverage” branding set it apart from other meme coin presales, MAXI is entering a highly saturated market of Shiba-inspired coins.

| Presale Start Date | July 2025 |

| Blockchain | Ethereum |

| Smart Contract Audited? | Yes (Coinsult and SolidProof) |

| Purchase Methods | ETH, USDT |

Pros

- Dual security audits (SolidProof, Coinsult)

- Branded around high-leverage degen culture

- Offers high leverage to boost potential gains

Cons

- Heavy marketing allocation at 40%

- Roadmap is mostly humor, light on tech details

- The use of leverage creates high risks

3. BMIC (BMCI) – Decentralized Quantum Computing and Security Network

- Symbol:

BMIC +1.23%

BMIC +1.23% - Raised Amount: $324K

- Hard Cap: $40M

- Current Price: $0.049079

BMIC is a new project that mixes several complex ideas, including blockchain, AI, and quantum computing. It’s designing a decentralized quantum cloud while offering post-quantum security to protect digital assets. BMIC claims that the current state of crypto security is not strong enough to survive future quantum computers and wants to be ready for when that happens.

The project is currently in early presale stages with a large allocation of 50% and a total supply of 1.5 billion. The team is also introducing a non-custodial wallet, a staking system, and a layer payment that’s protected by post-quantum cryptography.

The native token, BMIC, has a wide range of utility across the ecosystem. It can be used for staking, authentication, governance, and more. It can also grant golders access to decentralized quantum computing in the future.

| Presale Start Date | October 2025 |

| Blockchain | Ethereum |

| Smart Contract Audited? | Yes (Virtual Caim) |

| Purchase Methods | ETH, USDT |

Pros

- Exposes holders to quantum-resistant tech

- Offers staking rewards, governance rights, and NFT perks

- Plans to launch a beta marketplace in Q2 2026

Cons

- Regulatory uncertainties regarding quantum projects

- Competition from established projects (eg, IBM Qiskit)

- Possible technological underperformance

4. LiquidChain (LIQUID) – Layer-3 Project With Unified Liquidity for Fast, Cross-Chain DeFi

- Symbol:

LIQUID +18.18%

LIQUID +18.18% - Raised Amount: $359K

- Hard Cap: $20M

- Current Price: $0.013

Next on our list is LiquidChain, a brand-new project that’s building a Layer 3 network. It aims to unify Bitcoin’s capital, Ethereum’s DeFi access, and Solana’s transaction speed into a single execution layer. To achieve this, the project will build unified pools that eliminate the need for wrapping assets while settling transactions via trust-minimized proofs.

LiquidChain plans to build its own Solana-compatible virtual machine, tuned for fast, real-time DeFi activity. It aims to power instant swaps, complex derivatives, and busy prediction markets without slowing down. Developers can launch apps once and reach users across multiple chains, while traders gain deeper liquidity and faster trades in one place.

The idea of a single liquidity engine across BTC, ETH, and SOL is already attracting early supporters from the Web3 sector, with the LiquidChain presale raising $359K shortly after launch. Investors can buy LIQUID for $0.013 before the price increases in the upcoming presale round. Buyers can also stake their holdings for an annual reward of 2,635% during the presale.

| Presale Start Date | November 2025 |

| Blockchain | Bitcoin, Ethereum, and Solana (Layer 3) |

| Smart Contract Audited? | Yes (SpyWolf and CertiK) |

| Purchase Methods | ETH, USDT, USDC, BNB, SOL, Credit card |

Pros

- Unique Layer 3 solution that unifies Bitcoin, Ethereum, and Solana ecosystems

- High-performance virtual machine

- Generous staking rewards

Cons

- Relies heavily on cross-chain technology implementation

- High staking APY might be seen as unsustainable

- Limited info on the underlying technology

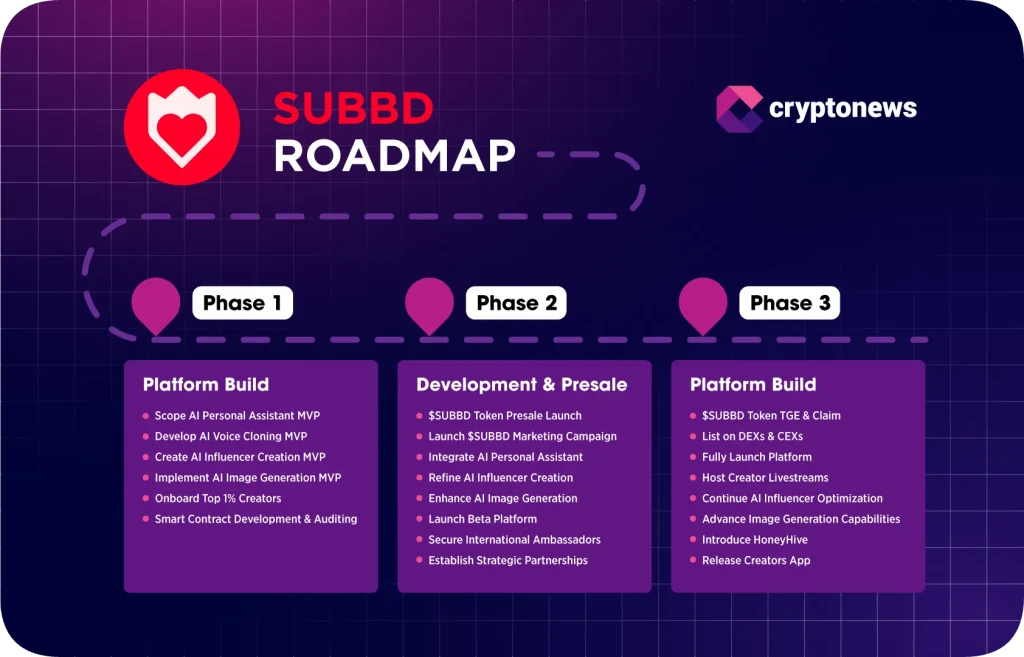

5. SUBBD (SUBBD) – Best New AI Crypto Presale

- Symbol:

SUBBD +4.41%

SUBBD +4.41% - Raised Amount: $1.44M

- Hard Cap: $55M

- Current Price: $0.057425

SUBBD is building a creator platform and community-driven ecosystem that connects content creators with their audiences. The native token, SUBBD, plays a key role in the project’s economic model, unlocking premium content and allowing holders to participate in governance. In addition, the token can be staked for an APY of 20% and rewards in the form of credits and the ability to boost favored creators.

The platform offers AI tools that enable creators to generate unique content and automate admin tasks. Its upcoming AI Creator Builder will expand these features, allowing anyone to create and monetize virtual influencers. Meanwhile, fans can use SUBBD to subscribe, tip, and request AI-generated or live content.

The SUBBD presale has raised $1.44M, which is still a small fraction of its $55 million hard cap. Even without hitting that target, SUBBD remains one of the largest presales, and it plans to go live shortly after the token generation event (TGE). The project aims to increase its user base by leveraging its existing creator network, which boasts a combined reach of over 250 million followers.

| Presale Start Date | April 2025 |

| Blockchain | Ethereum |

| Smart Contract Audited? | Yes (Coinsult and SolidProof) |

| Purchase Methods | ETH, USDT, BNB, USDC, Credit card |

Pros

- Token-gated livestreams and exclusive drops

- Launch partners reach 250 million followers

- The token has real utility within AI-powered ecosystem

Cons

- High $55 million hardcap

- Unproven AI content moderation system

- The platform may face regulatory uncertainty

6. Vortex FX (VFX) – Web3 Bridge for Real-World Forex Trading and AI-Driven Yield

- Symbol:

VFX +491.67%

VFX +491.67% - Raised Amount: $2.21M

- Hard Cap: N/A

- Current Price: $0.355

Vortex FX positions itself at the intersection of the $ 7 trillion-per-day forex market and the innovation of Web3. The presale for VFX, the native token, launched in September 2025 and has raised over $2.21M so far.

With its existing trading business executing over 1,500 lots per day across forex, gold, and crypto, Vortex FX anchors its token in a market known for depth, liquidity, and disciplined risk management. The VFX token functions as an interface layer rather than a disruptor, providing access to staking rewards, daily trading rebates, zero-fee trading tiers, and governance.

Half of the firm’s monthly trading revenue is directed toward staking rewards and token buybacks, giving the token a real-yield component most presales lack. Meanwhile, the VFX Card extends utility into everyday spending while automatically burning tokens, reducing long-term supply.

| Presale Start Date | September 2025 |

| Blockchain | Ethereum |

| Smart Contract Audited? | Yes (SolidProof) |

| Purchase Methods | ETH, USDT, USDC |

Pros

- Backed by a licensed forex and commodities trading firm with real revenue

- Dual-yield model combining staking rewards and AI-assisted trading profits

- Practical token utility through rebates, zero-fee trading, and the VFX Card

Cons

- Still early in its Web3 expansion phase

- Forex-anchored tokens may appeal more to disciplined traders than casual users

- Long-term sustainability depends on continued trading performance

7. Pepe Dollar (PEPD) – Best Ethereum L2 Presale Token

- Symbol:

PEPD +66.87%

PEPD +66.87% - Raised Amount: $4.95M

- Hard Cap: N/A

- Current Price: $0.007823

Pepe is an Ethereum Layer 2 (L2) payment rail, which turns meme coins into liquidity, making them spendable. Whereas before, meme coins had little to no utility, now, holders can use them to pay for goods and services, thereby creating demand and a real market for meme coins. The 3.695B hard cap mirrors U.S. debt, with 29% set for a “Federal Burn,” plus QR PayFi plugins for global cross-border spending, Telegram games, and Pepedollar.fun’s no-code meme launchpad.

Service providers will be able to integrate QR code, PayFi plugins into their platforms for global cross-border spending, Telegram games, and Pepedollar.fun’s no-code meme launchpad. This unlocks uses for meme coins beyond speculation, but adds little benefit to anyone who doesn’t already own meme coins.

Although the roadmap mentioned in the Pepe Dollar whitepaper is very ambitious, creating an L2 that gives meme coins demand, benefits token holders and creators, more than it benefits the platforms and people that the project targets.

| Presale Start Date | June 2025 |

| Blockchain | Ethereum |

| Smart Contract Audited? | Yes (Coinsult) |

| Purchase Methods | ETH, USDT, USDC, Credit card |

Pros

- Offers proprietary Layer 2 payment infrastructure

- Fixed 3.695 billion token supply that prevents dilution

- 29% Federal Burn reduces float

Cons

- Layer 2 scaling is still unproven

- Unclear meme IP, regulatory exposure

- Will face competition from major Layer 2 players

8. PUMPD (PUMPD) – Best AI Presale With Meme Branding

- Symbol:

PUMPD +0.00%

PUMPD +0.00% - Raised Amount: $9.2K

- Hard Cap: N/A

- Current Price: $0.000412

PUMPD is a meme coin taking a shot at breaking into the overcrowded meme space. The project is transparent about its positioning: it is a high-risk, high-reward token aimed at “degens.” Beyond its meme coin status, PUMPD offers an AI-powered market analysis system that is accessible only to token holders.

This AI crypto aims to scan X, Telegram, and market trends for potential pumps once the project fully launches. PUMPD is also developing a crypto presale launchpad for similar degen-oriented meme tokens. These features address user pain points by finding potential “pumps,” but alternatively introduce complexities for the user through the token.

While the features add utility to the token, the token itself introduces an extra step to access the services offered. This is beneficial for early token holders, but has fewer benefits for the users of said features (who must hold the token to access features). Ultimately, the monetization model prioritizes token demand.

| Presale Start Date | July 2025 |

| Blockchain | Solana |

| Smart Contract Audited? | Yes (SolidProof) |

| Purchase Methods | USDT and SOL |

Pros

- Clear smart contract with daily price increases

- AI market intelligence for trading signals

- Transparent about potential high risks

Cons

- High presale allocation risks centralization

- Presale pledges “guaranteed” daily pumps

- Limited investor interest during the presale

9. AgoraLend (AGORA) – Best Lending Protocol Presale Crypto

- Symbol:

AGORA +750.00%

AGORA +750.00% - Raised Amount: $510K

- Hard Cap: $6M

- Current Price: $0.00425

AgoraLend is a decentralized lending protocol for ERC-20 tokens. Many token communities are underserved on DeFi platforms, especially those holding niche tokens or less popular meme coins. AgoraLend addresses this gap by unlocking liquidity for everyone.

The protocol transforms any ERC-20 token into a yield-generating asset. For example, if you hold an Ethereum-based meme token, you can deposit it to mint yield-generating derivatives that automatically earn interest based on lending activity. This is in contrast to most lending platforms, which curate a list of available assets.

To assure platform safety, the protocol over-collateralizes loans, caps volatile assets for collateral, and maintains an insurance fund. However, the risk of accumulating bad debt and platform insolvency persist. To remain successful, AlgoraLand must maintain conservative LTV ratios and have reliable liquidations if it is going to allow volatile assets as collateral.

| Presale Start Date | September 2025 |

| Blockchain | Ethereum |

| Smart Contract Audited? | Yes (Sherlock, CertiK, and more) |

| Purchase Methods | ETH, BNB, USDT, USDC, SOL, TRX, TON |

Pros

- Revenue-backed buyback and redistribution cycle

- No team or VC allocations

- Yield opportunities for ERC-20 token holders

Cons

- Illiquid tokens raise liquidation risk

- Overcollateralization may reduce capital efficiency

- Lending is the largest sub-sector in DeFi, and competition is intense

Other Crypto Presales We Considered

Besides the presales mentioned above, we also considered several other projects that seemed great picks at first glance. However, these didn’t make our list due to red flags and poor tokenomic designs.

1. BlockDAG

BlockDAG is developing a native Layer 1 chain to compete with the likes of Ethereum and Solana. It stands out by merging two popular consensus approaches: directed acyclic graph (DAG) technology and proof-of-work (PoW).

However, it didn’t explain how exactly this tandem will work. The project pledges to offer high speed and throughput to make blockchain technology more practical for individual and enterprise use cases. The native token, BDAG, has reportedly raised an impressive $437 million.

Why BlockDAG didn’t make the cut:

The project has repeatedly delayed the launch date since August 2025. The next announced date is February 2026, but investor expectations are low after so many failed attempts. The resulting credibility erosion, coupled with a lack of genuine smart contract audits and possible connections to past scams, makes BlockDAG a risky bet.

2. Nexchain

Another project building an independent Layer 1 chain is Nexchain. Like BlockDAG, it combines two consensus algorithms: a typical Proof of Stake (PoS) and a proprietary AI-powered mechanism called NEX AI. It plans to reach a throughput capacity of 400,000 transactions per second, beating Solana several times. The NEX token has raised over $12 million.

Why Nexchain didn’t make the cut:

While Nexchain seems to be a promising project on paper, we are worried about the centralization risks detected by Certik. Also, there is no information about the team, as all team references were removed following allegations of fake identities.

3. DeepSnitch AI

DeepSnitch AI is a Solana-based platform for on-chain intelligence. It helps traders track whales, scan contracts, and spot scams in one place. Fragmented tools are a big issue, as data sits across bots, dashboards, and blockchains with little real coordination for everyday users.

Projects like DeepSnitch bundle these features into live agents and Telegram alerts. The DSNT token, used for fees and staking, has raised $735,000 so far.

Why DeepSnitch AI didn’t make the cut:

There are several concerns with DeepSnitch, including hype-driven marketing and unclear tokenomics. In addition, limited audit detail and team opacity leave centralization and rug risks only partly addressed at this stage.

👉 Check out our DeepSnitch AI (DSNT) Price Prediction 2026-2030.

4. Remittix

Remittix is a cross-border payments solution that offers a crypto-to-fiat gateway to streamline remittance payments. Users can connect a wallet to the platform, select a crypto asset to pay, and insert the bank account details.

Remittix handles all the behind-the-scenes work to send the funds to beneficiaries in their local currency. The project competes with the likes of Ripple and Stellar, and has already raised over $28 million.

Why Remittix Protocol didn’t make the cut:

We are concerned about several red flags for Remittix. Particularly, the independent audit shows that the team can whitelist wallet addresses, which may prevent token holders from selling. Another problem is that early-stage investors are sitting on gains of over 400%, which could motivate them to sell tokens and create bearish pressure.

5. IPO Genie

IPO Genie is an ERC-20 presale that aims to tokenize private market deals, like pre-IPO startups and real estate, so smaller buyers can get fractional access. The project says it uses AI to score deals. The presale price sits around $0.00011060, and it reports $465K raised so far.

We see several concerns that outweigh the upside right now. The marketing leans hard on huge return claims that aren’t backed by independent proof, and the product still looks unproven with limited public detail on real partnerships. Add heavy vesting risk, low team transparency, and stiff competition in launchpads and RWAs, and it’s a skip for now.

Why IPO Genie didn’t make the cut:

We are concerned about several red flags for Remittix. Particularly, the independent audit shows that the team can whitelist wallet addresses, which may prevent token holders from selling. Another problem is that early-stage investors are sitting on gains of over 400%, which could motivate them to sell tokens and create bearish pressure.

What Are Crypto Presales?

A cryptocurrency presale is an early fundraising stage where a project sells tokens to investors before public launch, often at lower prices, to raise capital and build initial liquidity for exchanges.

They follow a structured process of selling tokens before public exchange listings. These early sales use smart contracts, tiered pricing, and token allocation models to raise capital, bootstrap adoption, and distribute ownership.

How Do Crypto Presales Work?

Crypto presales follow a structured process of selling tokens before they are listed on public exchanges. Let’s break down how the process works from setup to launch.

1. The Team Announces the Presale Project

Before a presale starts, the team, whether known or anonymous, typically announces the project, publishes a whitepaper, and launches a website. The whitepaper usually explains the project’s goal, what problem it wants to solve, how the token will be used, and what the team plans to build over time.

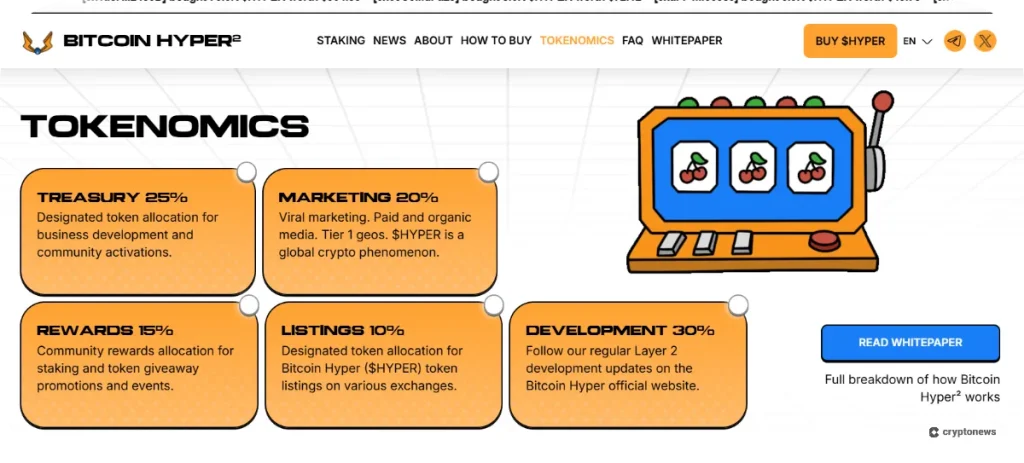

An important aspect is the so-called tokenomics, which touches upon the economic model used by the project. For example, the token may have a limited total supply or an uncapped one that fluctuates based on market sentiment. The presale allocation, vesting, and emission schedules are also part of tokenomics.

The whitepaper typically can’t do without a roadmap, which is the blueprint for the project’s phased launch. This example shows the roadmap of SUBBD:

The market team makes sure that the crypto presale is visible on relevant social media platforms, mainly X, Telegram, Discord, and Reddit. This is especially important for community-driven meme tokens, whose price performance literally depends on social media activity.

2. Investors Participate in the Presale

Once the presale goes live, investors can participate by connecting their wallets, such as Best Wallet or MetaMask, and depositing accepted coins, e.g., ETH, BTC, USDT, USDC, etc.

To create a sense of FOMO, presales are often divided into multiple stages, with the price gradually increasing at every stage. Therefore, early-stage buyers benefit from lower entry points.

In addition, most projects set a soft cap and a hard cap, which refer to the minimum and maximum funding targets. The most common presale pricing models include tiered pricing, fixed pricing, and whitelisting.

- Tiered Pricing: Irrespective of the initial price, the tiered price strategy implies a gradual increase with each new presale stage. This is meant to benefit early buyers, creating momentum as the presale progresses.

- Fixed Pricing: This pricing model is the most straightforward one. You would pay the same price at any given time throughout the presale. Once the tokens are sold out or the funding target is hit, the sale ends, and the tokens go to secondary markets for price discovery.

- Whitelist With Set Allocation: In this setup, investors must first join a whitelist, often by completing tasks like joining a launchpad or holding a certain NFT. Once they’re approved, each whitelisted wallet can buy a fixed amount of tokens at a set price.

When the hard cap is hit or the set deadline passes, the team stops raising funds and starts getting ready to launch the actual product.

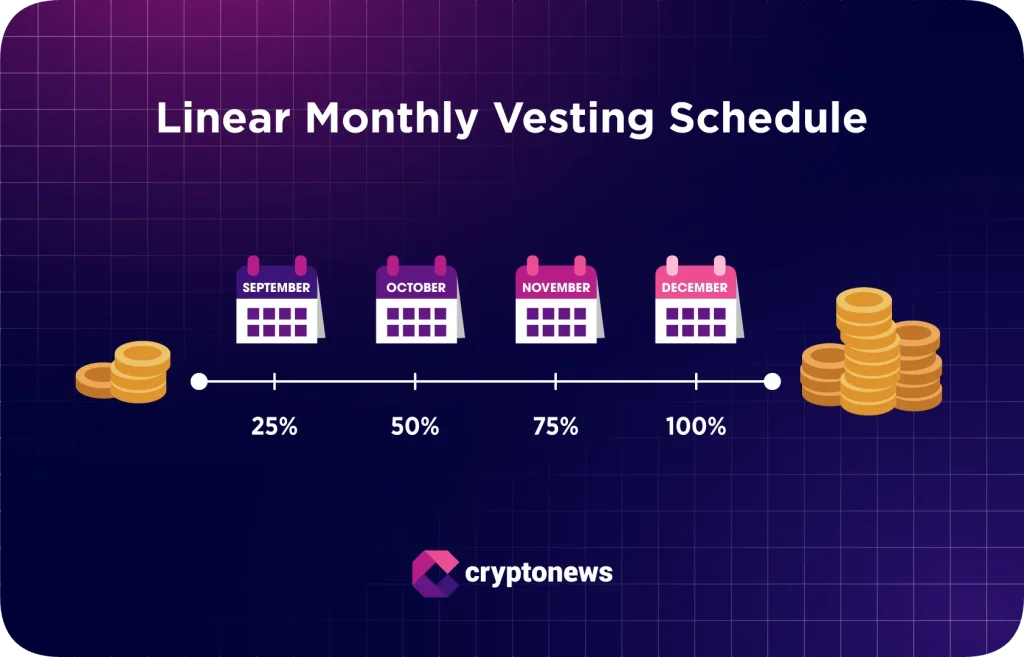

3. The TGE, Claim, and Token Vesting Take Place

At this stage, investors cannot join the presale anymore to benefit from discount prices.

The team allocates contributions according to the tokenomics model, locking a good chunk for gradual release as outlined in the vesting schedule.

Any unsold tokens are either burned, returned to the treasury, or reserved for future use as incentives. Compliant projects will let auditors and communities check that on-chain allocations match the published tokenomics. This reinforces confidence in the project.

Once the presale ends, investors experience the “quiet period” before the Token Generation Event (TGE), when tokens are finally created on-chain and distributed. Once the new tokens are released through the TGE, presale investors can claim their holdings, often manually.

Many presales impose vesting schedules, which automatically release tokens gradually over several months or even years. This aspect is essential because it prevents mass sell-offs. Tokens may be locked or released in tranches, which determines when and how much you can sell.

The vesting schedule often follows a cliff linear model, such as 10% released at TGE and the remaining 90% over 6–18 months. This approach creates an effect of scarcity, supporting the token’s price.

Make sure to always verify contract details and vesting terms to avoid surprises like sudden price dilution or liquidity shortage.

4. The Token Lists on Exchanges

Most new tokens take their first steps on decentralized exchanges (DEXs) such as Uniswap, PancakeSwap, or Raydium, depending on which blockchain they run on. Once liquidity pools are live on these platforms, anyone with a non-custodial wallet can start trading and take part in early price discovery.

Listing on these trading venues is a major milestone for any new project, as it enables open, market-driven price discovery to commence.

When a new token is listed on one of the largest centralized exchanges, such as Binance, Coinbase, OKX, or KuCoin, it is a jackpot victory. These listings tend to cause vehement price fluctuations as they introduce deeper liquidity and a greater number of traders, as well as much more visibility than smaller markets can provide.

CEX listings add credibility for investors, as these platforms prioritize their reputation and conduct strict verifications, including KYC/AML checks, team vetting (even if it remains anonymous), and compliance reviews.

Moreover, listing fees can exceed $1 million, which reflects the project’s commitment to sustainable growth.

How to Avoid Scams & Vet Legitimacy

Crypto presales let you buy pre-launch tokens early. This can be a great opportunity, but it’s also a bit of a minefield. Your main job is to find projects with real potential and avoid scams. This doesn’t need to be complicated. You just need a clear process.

Below, we’ll show you how to carry out each step.

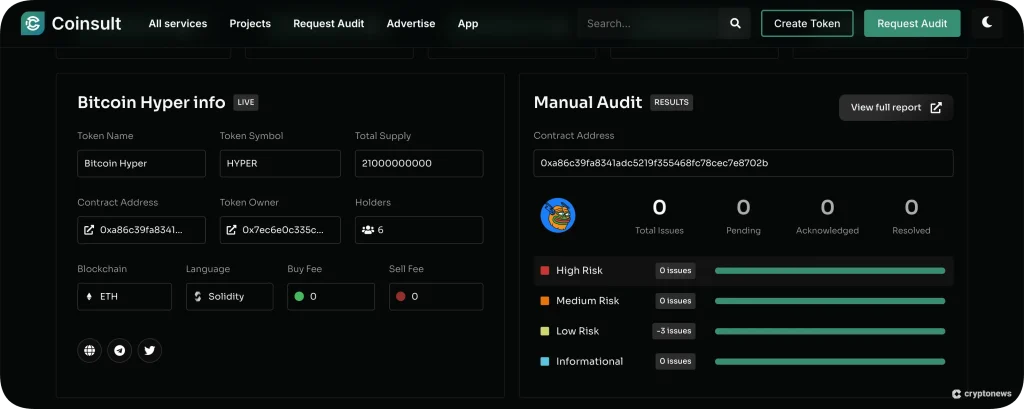

1. Analyze Smart Contract Audits and Security

Smart contract audits look for weaknesses in a project’s code and help confirm basic security. You can usually find audit reports linked on the project’s website or official social channels.

Examples of trusted auditors include:

- Coinsult

- CertiK

- SolidProof

- Consensys

Verified audits add credibility, reducing the risk of scams. Always verify the audit’s legitimacy by cross-checking with the auditor’s official site. It is a common practice for presales scam to add the audit badges to their site without having actually done them.

2. Team Transparency

The strongest projects usually have team members with real experience in their field. For example, a play-to-earn game should be run by people who understand both blockchain and gaming, not just basic crypto buzzwords. Relevant backgrounds make it more likely they can actually deliver what they promise.

When the team remains anonymous, then you have to take a closer look at the project itself. Confirm that there is a smart contract audit and that the purpose of the token and supply distribution are well-explained. This will assist you in determining whether the project is serious.

💡 An analysis of over 1,000 crypto fundraisers found that over 50% of projects fail to provide any details on their promoters and that the names on the whitepaper usually don’t match up with the real token issuers.

3. Check Tokenomics and Vesting Schedules

When checking a crypto project’s tokenomics and pricing structure, focus on the basics:

- Total supply and distribution: How many tokens exist, and who controls them (team, presale buyers, exchanges, or a handful of wallets)? Heavy concentration is a red flag.

- Vesting and utility: Are tokens released gradually, and do they have real use in the ecosystem? This prevents insiders from dumping early and gives the token purpose.

- Deflationary mechanics: Deflationary cryptocurrencies burn tokens to reduce supply. Theoretically, this can support price, but only if the system is transparent and sustainable.

- Pricing model: See if tokens are sold at one fixed price or in rising tiers. Early buyers often pay less, but make sure the setup still feels fair.

Clear and balanced tokenomics, along with transparent pricing, are signs of a healthier project, while hidden allocations or vague rules are reasons to think twice.

4. Evaluate Community Activity Signals

When you’re checking out a crypto presale, social media and community activity can tell you a lot about how real and promising a project is. Spaces like X, Reddit, Telegram, and Discord show real user opinions, how open the team is, and how much interest there is in the market.

Look for:

- Aggressive promotions

- Bot-like hype messages

- Echo chambers filled only with praise

- Question censorship or bans

- Admin-only conversations

- Sudden follower spikes

Be cautious of:

- Aggressive promotions

- Bot-driven hype

- Echo chambers filled only with praise

A real community isn’t just loud — it’s interactive, thoughtful, and transparent. Join crypto Discord channels or Telegram groups and observe how questions are answered and whether the dialogue feels authentic.

Strong social presence and genuine engagement often lead to sustained interest, which is far more valuable than short-lived buzz.

5. Assess Website and Documentation Quality

A legitimate presale clearly and consistently explains what it’s building, why it needs a token, and how it plans to execute.

🟢 Green flags include:

- A clean, functional website with working links

- A whitepaper that explains the product architecture, token utility, roadmap milestones, and risks

- Language that’s specific rather than buzzword-heavy

- Clear FAQs and transparent disclaimers

🔴 Red flags include:

- Vague promises

- Heavy marketing language (“guaranteed returns,” “next 100x”)

- Grammar issues

- Copied sections from other projects

- Missing details about how the protocol actually works

In essence, you should be able to understand the core idea without feeling sold to.

6. Look for External Validation

External validation helps you confirm that a project exists beyond its own marketing (but it should be used as supporting evidence, not proof on its own).

Start by looking for coverage from reputable crypto media or research platforms. These should explain the project’s tech or use case, not just repeat a press release. Check whether the article discloses sponsorships. Independent analysis is far more valuable than paid exposure.

Next, review the project’s GitHub activity if it’s technical. Regular commits, multiple contributors, and meaningful code changes suggest real development. An empty repo or a sudden burst of shallow commits is a red flag.

Partnerships can also signal legitimacy, but verify them. You should also be skeptical of influencer endorsements. Many are paid and don’t reflect deep due diligence. A few respected builders or researchers engaging organically with the project is a much stronger signal.

7. Understand the Main Presale Scam Types

Understanding the main types of presale scams is key because scams often follow repeatable patterns. Once you recognize those patterns, red flags stand out quickly, and you’re less likely to be swayed by hype, urgency, or fake social proof.

Even legitimate-looking projects can hide malicious mechanics, so knowing how people get scammed helps you evaluate risk more rationally.

Common presale scam types include:

- Rug pulls – Developers raise funds, launch the token, then abandon the project and drain liquidity.

- Team impersonation – Scammers use fake or stolen identities to appear credible.

- Liquidity traps – Tokens launch but are coded so investors can’t sell.

- Malicious smart contracts – Hidden functions allow wallet draining, token minting, or blacklisting.

- Pump-and-dump presales – Early insiders unload tokens immediately after launch.

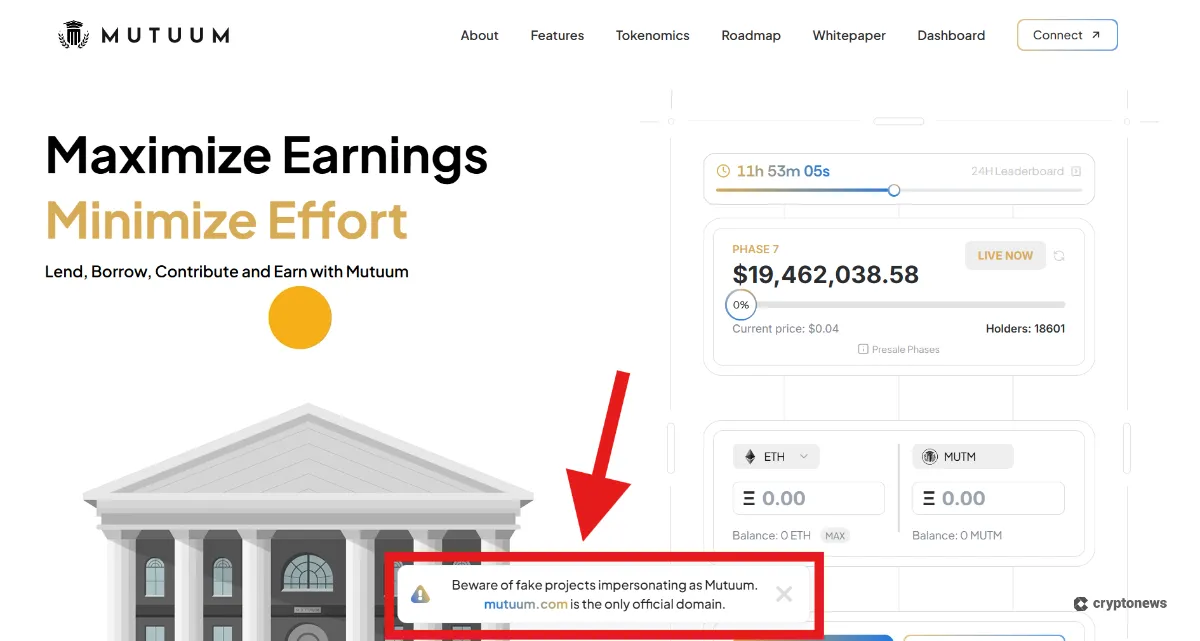

- Fake presale websites – Cloned sites with similar URLs trick users into sending funds to attacker wallets.

How to Find New Crypto Presales Early

Many crypto presales offer their tokens directly from their official websites, but some hubs gather these projects in one place, allowing investors to spot options that match their goals.

Below are some of the most reliable methods for finding legitimate presale cryptocurrencies.

- Browse reliable crypto launchpads: They manage the presale process for projects that pass their checks. Centralized exchange launchpads are generally safer because they use stricter verification rules. Examples include: Binance Launchpad, OKX Jumpstart, and Best Wallet.

- Utilize token launch aggregator platforms: They list useful details like presale start and end dates, what the token is used for, audit status, and more. This makes it easier to decide what to back and how to spot obvious red flags.

- Monitor development platforms and communities: Monitoring developer hubs like GitHub, Discord, and specific forums often reveals which teams are actively working on which projects. It also keeps you updated on their activities.

What Are the Advantages of Investing in Presales?

Crypto presales are early token sales that happen before an exchange listing. The main appeal is getting in at an earlier price and, sometimes, getting perks that disappear after launch. Outcomes vary a lot, so it helps to stay selective and keep position sizes small.

- Lower entry price: Presales often sell tokens below the expected public launch price.

- Extra perks: Some offer staking rewards, airdrops, NFTs, or early governance access.

- Early access to the community: You can join from day one and follow progress closely.

- Bigger upside on winners: If a project takes off, early buyers usually capture most of the move.

- Easier to diversify small bets: You can spread small amounts across multiple vetted presales instead of relying on one.

What Are the Risks of Investing in Presales?

In finance and crypto, there is no gain without risk. Therefore, presales can’t avoid downsides, and they actually carry high risks.

Unfortunately, many projects never deliver on their promises, leaving investors without their tokens. Here are the main cons to consider.

- High risk of fraud, rug pulls, and scams: Roughly 40–50% of presale projects never launch properly or disappear within a year, and rug pulls are a constant risk, especially with meme coins.

- Extreme volatility: New tokens are the most volatile category in crypto due to their low market cap, limited liquidity, and rapidly shifting sentiment.

- No guarantee of success: There are many factors that new crypto projects cannot control, including competition, unnoticed smart contract loopholes, low community engagement, and a gap between expectations and actual market behavior.

- Lack of liquidity: Roughly 30% of projects struggle with low trading volume for their first three months. Lack of liquidity can trap your investment, forcing you to watch the value drop with no exit.

- Lack of regulation: A sudden crackdown in a big market can block trading or wipe out the value of your tokens. A project can be well built and still get derailed by a regulator’s decision.

- Vesting periods and token dumps: Vesting periods slow down big dumps, but they also keep your tokens locked up. Read the vesting schedule closely. It dictates how much flexibility you really have.

Risk Management Tips for Investing in Crypto Presales

Investing in crypto presales can be exciting, but it’s also unpredictable. Projects often evolve quickly, and hype can cloud judgment. The best way to protect yourself is to slow down and think strategically.

Here’s a structured approach that can help you spot weak points early and focus only on crypto presales with high potential.

1. Only Invest What You Can Afford to Lose

The “only invest what you can afford to lose” motto matters even more in presales because most projects fail or vanish after launch. Presales often have no liquidity, limited audits, and no proven history, so a full loss is a realistic outcome. Treating this money as expendable protects your basic needs, reduces stress, and keeps you from making desperate, emotion-driven decisions when prices crash.

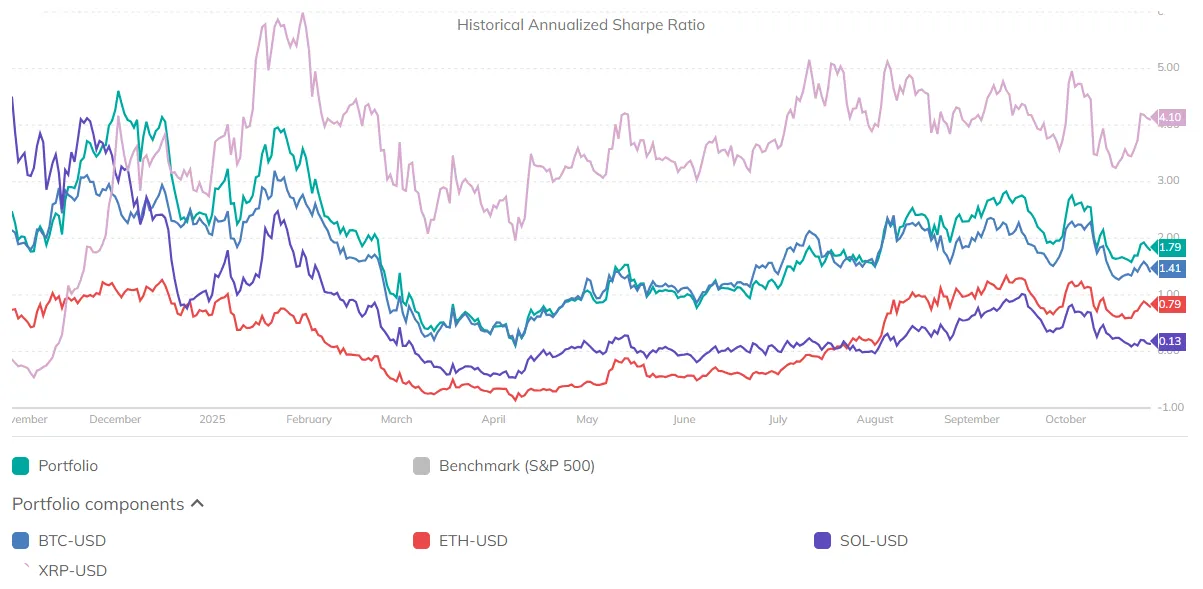

2. Diversify Your Portfolio With Established Cryptos

Diversifying your crypto portfolio into bigger coins like BTC, ETH, and SOL doesn’t remove presale risk, but it stops one bad bet from wrecking everything. Most of your money stays in larger, more liquid assets, so a total loss on a 1–5% presale barely moves your overall balance. Blue-chips and stablecoins also swing less than tiny presales, which helps smooth big drawdowns.

A simple structure could be:

- 60–80% in majors and stablecoins

- 20–40% in higher-risk plays like presales and memes

Rebalancing helps too: when presales pump, take some profit back into majors; when they dump, your core holds up, and you still have capital for the next opportunities.

3. Stick to Vetted Sources and Reputable Launchpads

Not all information is trustworthy. Anyone can spin up a website, Telegram group, or tweet promising “the next 100x presale.” That’s why sticking to vetted, reliable sources is so important.

Always use vetted sources, like Cryptonews, CoinMarketCap, and CoinGecko, to get your information, and reputable launchpads such as Binance, Bybit and OKX. They check contract addresses, verify presale stages, and often require proof of audits or KYC before listing a new presale. This dramatically reduces the risk of stumbling into fake or rug-pull projects.

When you research a project, always compare details on several trusted sites and double-check links. Only use the project’s official website and social channels to avoid fakes or phishing pages.

How to Buy Crypto Presales: A Step-by-Step Guide

Many crypto projects run their presales on their own websites before they appear on decentralized or centralized exchanges. To join a presale, you first connect a supported crypto wallet to the project’s official site.

The problem with this approach is the high prevalence of scam websites, which impersonate legitimate projects, drain the wallet you connect to it, sell fake tokens, or disappear after raising funds. This leaved victims with permanent losses and no legal recourse.

These scam websites often use fake audits, cloned domains, and aggressive marketing to look legitimate. The best way to protect yourself from potential scams is to buy presale tokens through launchpad platforms like Best Wallet, Binance Launchpad, and OKX Jumpstart.

The reason it’s much safer is that top crypto launchpads carry out due diligence and KYC checks on the development team. This professional vetting filters out most scams, including rug pulls. With that in mind, let’s dive into our simple step-by-step guide on how to buy presale crypto safely.

1️⃣ Download and Set Up Best Wallet

You need a crypto wallet to claim and hold the tokens you purchased after the presale ends.

We selected Best Wallet for this tutorial because in addition to doing everything a typical wallet does, it comes with built-in scam-detection features and a token launchpad, which is much safer than buying through presale websites, as mentioned above.

It allows you to buy and track your presale token holdings within the mobile app in its unique “Upcoming Tokens” tab, making the whole process far easier and safer.

Additionally, it is highly recommended that you create a separate crypto wallet for each crypto presale you invest in, as there is a small chance that the site contains malicious code. You can create multiple wallets within Best Wallet’s single app, which is another key advantage.

To install Best Wallet, you’ll first need to download it. You can do so via Best Wallet’s official website or through Google Play or Apple App Store. Once the app is installed on your phone, follow the on-screen instructions to create an account.

Visit Best Wallet2️⃣ Buy Presale Tokens

To buy presale tokens, click “Upcoming Tokens” on Best Wallet’s homepage, and select the project you want to invest in. You’ll be taken to a page describing it in detail. Click “Buy Now” on the bottom-right corner of the screen to proceed.

Presales usually accept payment in major coins like ETH, BNB, or USDT. But on Best Wallet, you can also purchase presale tokens with a credit or debit card, which makes the process much simpler. Choose the one you prefer.

Enter the amount you want to spend in USD or the number of tokens you want to purchase, and click “Buy.” You can enable token staking to earn a dynamic yield.

3️⃣ Claim Your Tokens After Launch

Once the presale ends, return to the Best Wallet app to claim your tokens. To do so, visit the “Upcoming Tokens” tab, click on the presale you participated in, and claim your tokens.

At this point, you can decide to stake your tokens (i.e., lock them for seven days), to earn a yield on your holdings.

Once claimed, your tokens will appear in “Tokens” tab, ready for trading or holding.

Methodology: How We Selected the Top Crypto Presales

Before any scoring or ranking takes place, we apply a ‘risk-first’ filtering process. Initially, our goal is not to find the best presales, but to eliminate those with clear red flags, structural weaknesses, or credibility gaps.

We actively look for reasons not to proceed, such as unverifiable audits, unclear tokenomics, missing accountability, or purely narrative-driven products. Projects that fail this initial screening are excluded entirely, regardless of claims or potential upside. After a presale passes this defensive filter, we evaluate and rank it across our core criteria.

Technical Audit and Proof of Build (25%)

Reviewing technical audits and proof of build is critical. Many scams fail at this layer, since code and development history are harder to fake than marketing. That’s why this is always the first step in our filtering process.

We begin by analyzing third-party audits and whether they come from reputable firms, are recent, and reference the correct smart contract (many scam presales use the deceptive tactic of showing a positive audit for a smart contract that’s not the one deployed for the project). We review the findings, focusing on critical issues, owner privileges, and whether identified risks were fixed or just acknowledged.

We also examine GitHub activity, searching for consistent commits over time, multiple contributors, meaningful code changes, and clear documentation. Red flags include an empty repository, copied code, and bursts of shallow commits.

When available, we evaluate the project’s Minimum Viable Product (MVP), testnet, working demo, or live contract, including its basic functionality and if progress aligns with the roadmap. The goal here is to know whether they’re building something real.

Regulatory Compliance (25%)

Evaluating regulatory compliance allows us to determine whether a presale is operating like a real business or deliberately avoiding accountability.

To do this, we begin by assessing their Know Your Customer (KYC) and Anti-Money Laundering (AML) mechanics. Legitimate presales typically require these checks for participants or at least for team members. This reduces the risk of illicit activity and shows that the project expects regulatory scrutiny in the future.

Even if the team has not undergone KYC or AML checks, the members should be doxxed. This adds a layer of accountability since publicly identifiable founders with verifiable backgrounds are harder to fake and to disappear.

Next, we look for a legal entity (i.e. a real company registration in a verifiable jurisdiction), so that the project can be held legally responsible. We confirm this either through public business registries or disclosures in the whitepaper or terms.

Lastly, for EU-facing projects, we see if the project acknowledges Markets in Crypto-Assets Regulation (MiCA), explains its token classification, and outlines compliance plans. In practice, we assess all of this by reading legal pages, verifying registrations, cross-checking identities, and scrutinizing how the team discusses regulation.

Tokenomics (25%)

When scrutinizing tokenomics, we aim to understand how incentives are structured and whether the presale is designed for sustainable growth or a short-term boom and bust. Even technically sound projects can fail if their token economics encourage dumping or excessive inflation, for example.

Some of the most important factors we evaluate in this step include:

- The emission rate: Or, how quickly new tokens enter circulation. High or poorly controlled emissions dilute value, which will likely suppress price growth. Releases shouldn’t be arbitrary; they should be tied to network usage, staking, or other clearly defined ends.

- Distribution: We look into who owns what percentage of the supply and unhealthy or suspicious concentration in insider or opaque wallets.

- Vesting schedule: We examine how tokens allocated to the team, advisors, and early investors unlock over time. Ideally, the project will feature long vesting periods with cliffs, which is a sign of a long-term vision. Quick or missing vesting increases sell pressure upon TGE.

Our analysis combines whitepaper review, contract inspection, audit reports, and supply-curve modeling to evaluate whether the tokenomics support long-term growth. For vesting schedules specifically, we try to verify them against on-chain data or audited documentation when possible.

Utility (25%)

Finally, evaluating token utility is important because it determines whether the token has a real function within the protocol or exists mainly for fundraising and speculation. Tokens without clear utility tend to lose relevance quickly.

In our analysis, we look for concrete functions such as paying fees, securing the network through staking, governing on-chain decisions, or enabling access to core features. We then verify whether these use cases are technically enforced in the smart contracts or merely described in marketing materials.

We also examine whether the utility is necessary or optional. If the product could function just as well without the token, that’s a weak signal. For the final step, we evaluate how utility scales with usage, so that there’s continued demand for the token as the protocol grows.

Final Thoughts: Are Crypto Presales Worth It?

Crypto presales can be exciting but come with real risk, since these projects haven’t proved themselves yet. To stay on the safe side, dig into the details, check who’s behind the project, and make sure the token design isn’t lopsided. Focusing on clear use cases, standout ideas, and strong branding can help filter out weaker options.

The market can turn quickly in either direction. Never put in money you’d struggle to lose, and balance presale bets with established coins that add some stability to your portfolio. Move slowly, stay skeptical of hype, and choose projects that actually fit your time frame and risk tolerance.

Among current presales, Bitcoin Hyper is one of the more notable names. It’s a Bitcoin Layer 2 aiming to boost speed and cut costs, offering wrapped BTC transfers, a proof-of-stake style security model, strong early presale demand, near-zero fees thanks to batched transactions, and a high safety and compliance rating.

Next Price Increase In:

Frequently Asked Questions (FAQs)

Are cryptocurrency presales safe and legal?

What is the fastest-growing crypto presale right now?

How to tell if a presale crypto is real?

How long does a crypto presale last?

How many stages are there in a crypto presale?

What happens after a crypto presale ends?

What is the most successful crypto presale?

References

- Cryptocurrency/ICOs (U.S. Securities and Exchange Commission (SEC))

- Which Digital Tokens Pose a Greater Contagion Risk? (Journal of International Financial Markets, Institutions and Money)

- Offerings and Registrations of Securities in the Crypto Asset Markets (U.S. SEC)

- Regulation (EU) 2023/1114 of the European Parliament and of the Council of 31 May 2023 on markets in crypto-assets (EUR-Lex)

- MiCA Regulations and the Legal Requirements for Crypto Presales and Token Offerings in the European Union (Global Banking & Finance Review)

About Cryptonews

Our goal is to offer a comprehensive and objective perspective on the cryptocurrency market, enabling our readers to make informed decisions in this ever-changing landscape.

Our editorial team of more than 70 crypto professionals works to maintain the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re looking for breaking news, expert opinions, or market insights, Cryptonews has been your go-to destination for everything cryptocurrency since 2017.

BMIC

BMIC  VFX

VFX  PEPD

PEPD  PUMPD

PUMPD  AGORA

AGORA