World Liberty Financial has faced sharp volatility following political developments in the United States. Price action weakened after President Donald Trump issued strong remarks against Canada this week.

Trump first threatened to decertify Canadian-made aircraft and impose tariffs of up to 50%. He later warned Canada of a “very substantial” response if it pursues a trade agreement with China. These comments intensified trade tensions and weighed heavily on market sentiment, spilling over into WLFI price action.

SponsoredTrump Scares WLFI Holders

Trump’s remarks triggered a rapid wave of selling among World Liberty Financial holders. Panic spread quickly as investors rushed to reduce exposure. Data shows that supply held by top non-exchange addresses fell by roughly 380 million WLFI over the past week. At current prices, that supply is valued at more than $51 million.

Such behavior reflects heightened fear rather than structural weakness. Large holders typically act as stabilizing forces during uncertainty. Their rapid exit highlights how sensitive WLFI has become to geopolitical headlines. This distribution added immediate pressure on price and amplified short-term volatility.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

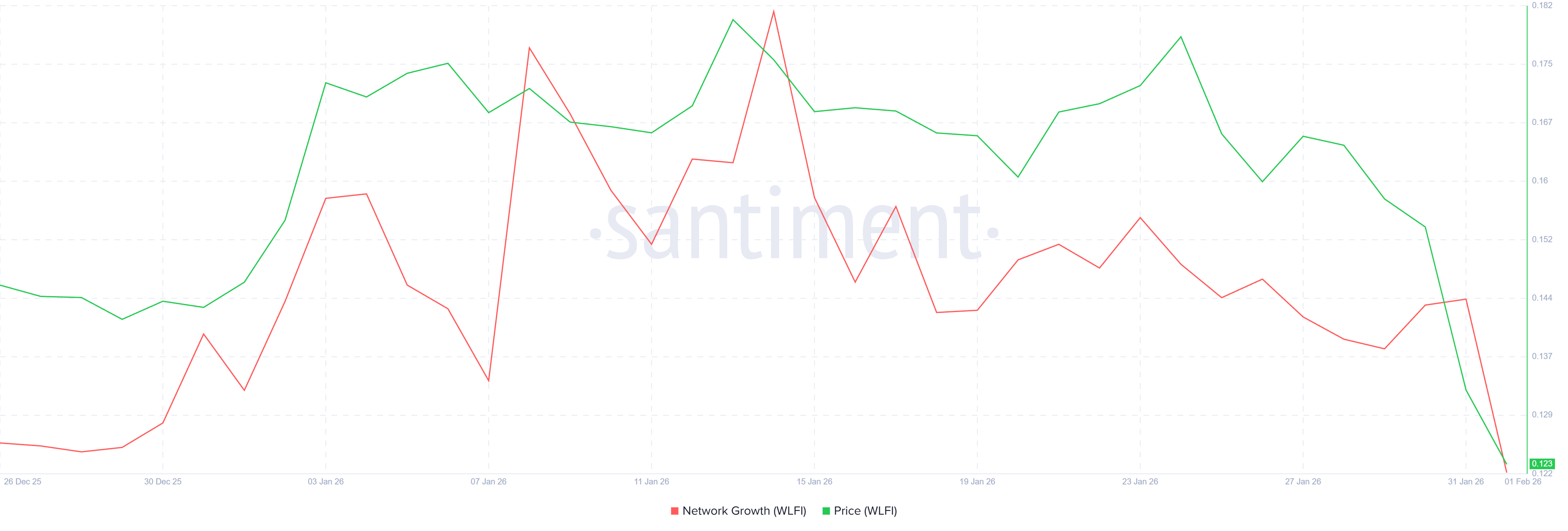

The panic was not limited to existing holders. New investor participation also declined sharply following the comments. Network growth, which tracks addresses conducting their first transaction, dropped significantly. Over the past 48 hours, the metric fell from 369 to 148.

This 59% decline shows hesitation among potential entrants. New investors appear unwilling to commit capital amid political uncertainty. Reduced network growth often weakens demand-side support. As a result, WLFI has struggled to attract fresh liquidity during the sell-off.

Sponsored

WLFI Price Confirms Crash

World Liberty Financial’s price dropped 25% over the past three days. The decline accelerated after Trump’s statements intensified risk aversion. This move confirmed the 28% crash scenario previously outlined by BeInCrypto earlier in the week. Despite a brief upside fakeout, the pattern materialized as a technical weakness aligned with macro uncertainty.

WLFI is now trading near $0.123 at the time of writing. The token has broken down from an ascending wedge pattern. That structure projected a 28.7% decline, targeting $0.1156.

This level sits close to the $0.113 support zone. A decisive break below $0.122 would likely push the price toward that area.

A recovery scenario remains possible if buyers step in at current levels. Sustained demand could allow WLFI to rebound. Reclaiming $0.131 would be the first signal of stabilization.

A move above $0.143 would invalidate the bearish thesis. Such a shift would suggest that selling pressure has been absorbed and confidence is returning.