Ethereum price has weakened sharply over the past several sessions, extending losses as market sentiment deteriorated. The recent dip reflects broader bearish conditions and also deliberate investor actions.

Increased selling pressure has made recovery more challenging. At the same time, continued distribution risks push ETH further lower before meaningful stabilization occurs.

SponsoredEthereum Holders Move To Sell Their Holdings

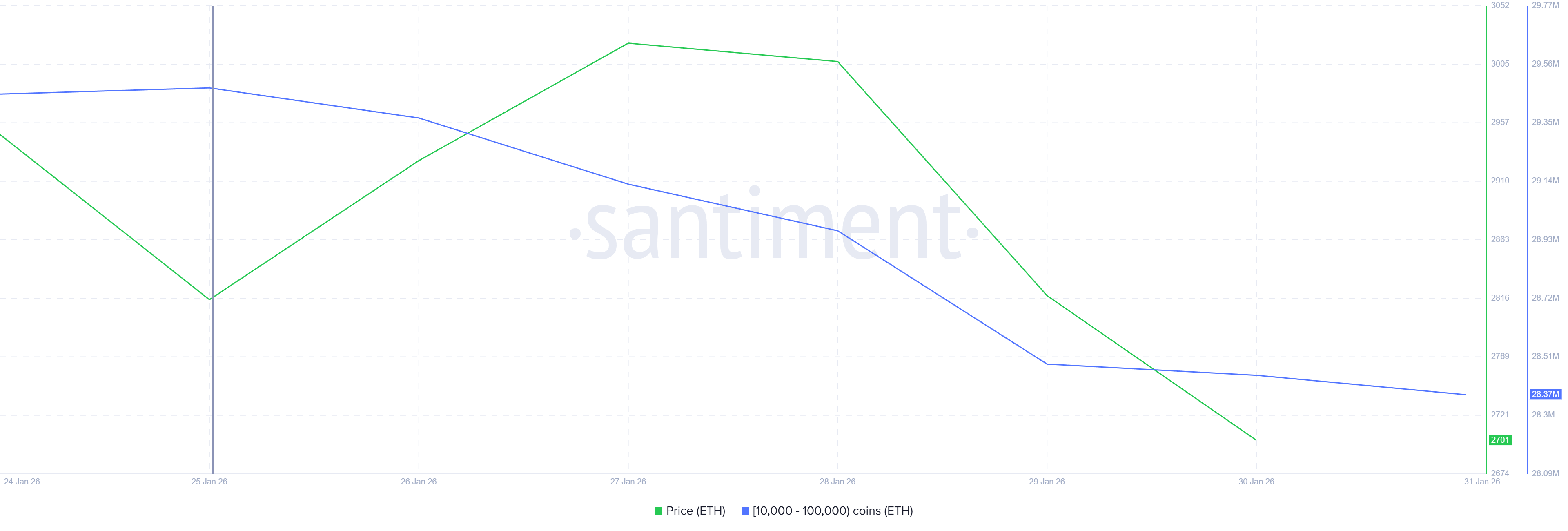

Whale activity has played a significant role in Ethereum’s latest decline. Over the past week, addresses holding between 10,000 and 100,000 ETH reduced exposure aggressively. These large holders sold more than 1.1 million ETH during this period. At current prices, the value of that distribution exceeds $2.8 billion.

Such large-scale selling adds direct pressure on spot markets. When whales reduce holdings, liquidity absorbs supply at lower prices. This behavior often accelerates short-term downtrends.

In Ethereum’s case, the sell-off reinforced bearish momentum and contributed to the recent breakdown below key technical levels.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

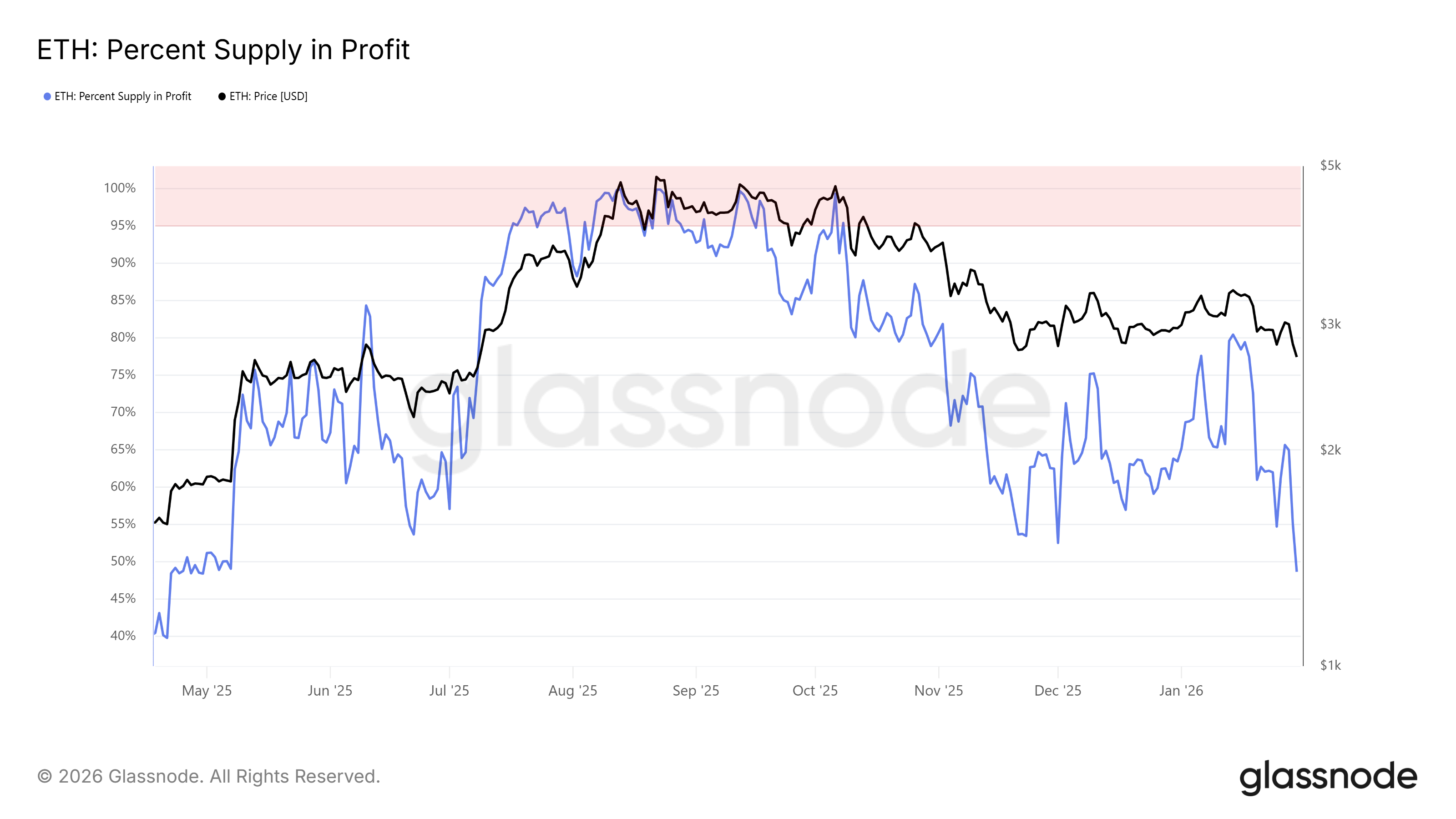

Macro indicators present a mixed outlook for Ethereum. Data shows that the total supply in profit has dropped below the 50% threshold. When fewer holders sit on unrealized gains, fear often increases. This environment can temporarily reduce sales, as investors hesitate to realize losses.

However, the same metric also carries downside risk. If losses deepen further, behavior can shift quickly. Investors may sell to prevent additional drawdowns. Under such conditions, the Ethereum price could face renewed pressure despite short-lived stabilization attempts driven by reduced profit-taking.

ETH Price Has A Long Way To Go

Ethereum is trading near $2,636 at the time of writing. The asset has fallen 12.7% over the past two days. This decline confirmed a bearish ascending wedge pattern. The formation projects a further 16% drop, targeting the $2,465 level if momentum persists.

The probability of this scenario has increased following the loss of key support. ETH broke below $2,802, confirming the pattern’s breakdown. Technical structures often gain credibility once support levels fail. As long as the price remains below the former support, bearish continuation remains the dominant risk.

A recovery path still exists under improved conditions. If Ethereum holds the $2,570 support level, buyers may attempt a rebound. A sustained move back toward $2,802 would be critical. Reclaiming that level as support would invalidate the bearish thesis and signal renewed strength.