7 Best XRP Futures Trading Platforms in 2026

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships. However, this potential compensation never influences our analysis, opinions, or reviews. Our editorial content is created independently of our marketing partnerships, and our ratings are based solely on our established evaluation criteria. Read More

XRP (XRP) futures offer various advantages over traditional spot trading. Futures traders go long or short via perpetual contracts, and low margin requirements provide them with significantly more XRP exposure than they deposit.

This guide compares the top crypto futures platforms for XRP trading. We tested and evaluated the top exchanges for futures commissions, margin requirements, and other core factors. Read on to discover our findings and choose the right XRP futures provider in 2026.

- In This Article

-

- 1. CoinFutures: The Overall Best User Experience for XRP Futures Trading in 2026

- 2. Bybit: Trade XRP Perpetual Futures via Linear or Inverse Contracts

- 3. Binance: Best Option to Trade XRP Futures With Expiration Dates

- 4. MEXC: Traders Get 300x Leverage on XRP Perpetual Futures

- 5. KuCoin: Great Choice for Market Diversification With 470+ Futures Pairs

- 6. Kraken: Regulated Spot and Futures Exchange With Robust Security

- 7. OKX: Tier-One Exchange With Automated Bots for XRP Futures

- In This Article

-

- 1. CoinFutures: The Overall Best User Experience for XRP Futures Trading in 2026

- 2. Bybit: Trade XRP Perpetual Futures via Linear or Inverse Contracts

- 3. Binance: Best Option to Trade XRP Futures With Expiration Dates

- 4. MEXC: Traders Get 300x Leverage on XRP Perpetual Futures

- 5. KuCoin: Great Choice for Market Diversification With 470+ Futures Pairs

- 6. Kraken: Regulated Spot and Futures Exchange With Robust Security

- 7. OKX: Tier-One Exchange With Automated Bots for XRP Futures

- Show Full Guide

Top XRP Futures Trading Platforms Compared

The table below compares the best XRP futures trading platforms in 2026:

| XRP Futures Type | Contract Specification | Settlement | Maximum XRP Leverage | Effective Margin Requirement | KYC? | |

|---|---|---|---|---|---|---|

| CoinFutures | Simulated | Linear-style | USDT | 1,000x | 0.1% | No |

| Bybit | Perpetuals | Linear and inverse | USDT, USDC, and XRP | 75x | 1.33% | No |

| Binance | Perpetuals and delivery | Linear and inverse | USDT and XRP | 75x | 1.33% | Yes |

| MEXC | Perpetuals | Linear and inverse | USDT | 300x | 0.33% | No |

| KuCoin | Perpetuals | Linear and inverse | USDT | 75x | 1.33% | Yes |

| Kraken | Perpetuals | Linear | USDT | 50x | 2% | Yes |

| OKX | Perpetuals | Linear and inverse | USDT | 50x | 2% | Yes |

XRP Futures Trading Platforms Reviewed

Read on to learn more about the top XRP futures trading platforms. We reveal the most important metrics for futures traders, including contract types, settlement terms, maximum leverage, and payment methods.

1. CoinFutures: The Overall Best User Experience for XRP Futures Trading in 2026

- Supported Futures Markets: 11

- Maximum XRP Leverage: 1,000x

- Futures Trading Fees: PnL-based or Fixed fee

- KYC Required? No

CoinFutures is our top pick for beginners and experienced traders alike. The trading platform offers XRP futures with long and short positions, and the initial margin requirement is the industry’s lowest at just 0.1%. Traders gain $1,000 in XRP exposure with an original deposit of just $1, which converts to 1,000x leverage. We also rank CoinFutures as one of the best crypto futures trading platforms for other top digital assets.

Popular markets include Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), and Solana (SOL), and each is paired with USDT. As the platform uses simulated futures, orders execute instantly, regardless of market depth or liquidity. Regarding legitimacy, CoinFutures is part of the CoinPoker umbrella. It launched in 2017, serves over 50,000 players, and holds a regulatory license. Client funds are safe, since CoinPoker uses Fireblocks vaults and offers publicly audited proof-of-reserves.

Traders avoid KYC requirements when they register, and crypto wallet deposits are fast and anonymous. Traditional deposit methods include debit/credit cards, plus Google Pay and Apple Pay. Automated systems process instant and hassle-free withdrawals.

Pros

- Offers XRP futures with leverage of up to 1,000x

- Risk just $1 when placing long or short positions

- Avoid slippage and unfilled orders through simulated products

- Other futures markets include BTC, ETH, and SOL

- Safe trading environment backed by proof of reserves

- Anonymous trading accounts when depositing crypto

Cons

- The platform doesn’t support PayPal

- Lacks trailing stop losses for advanced risk management

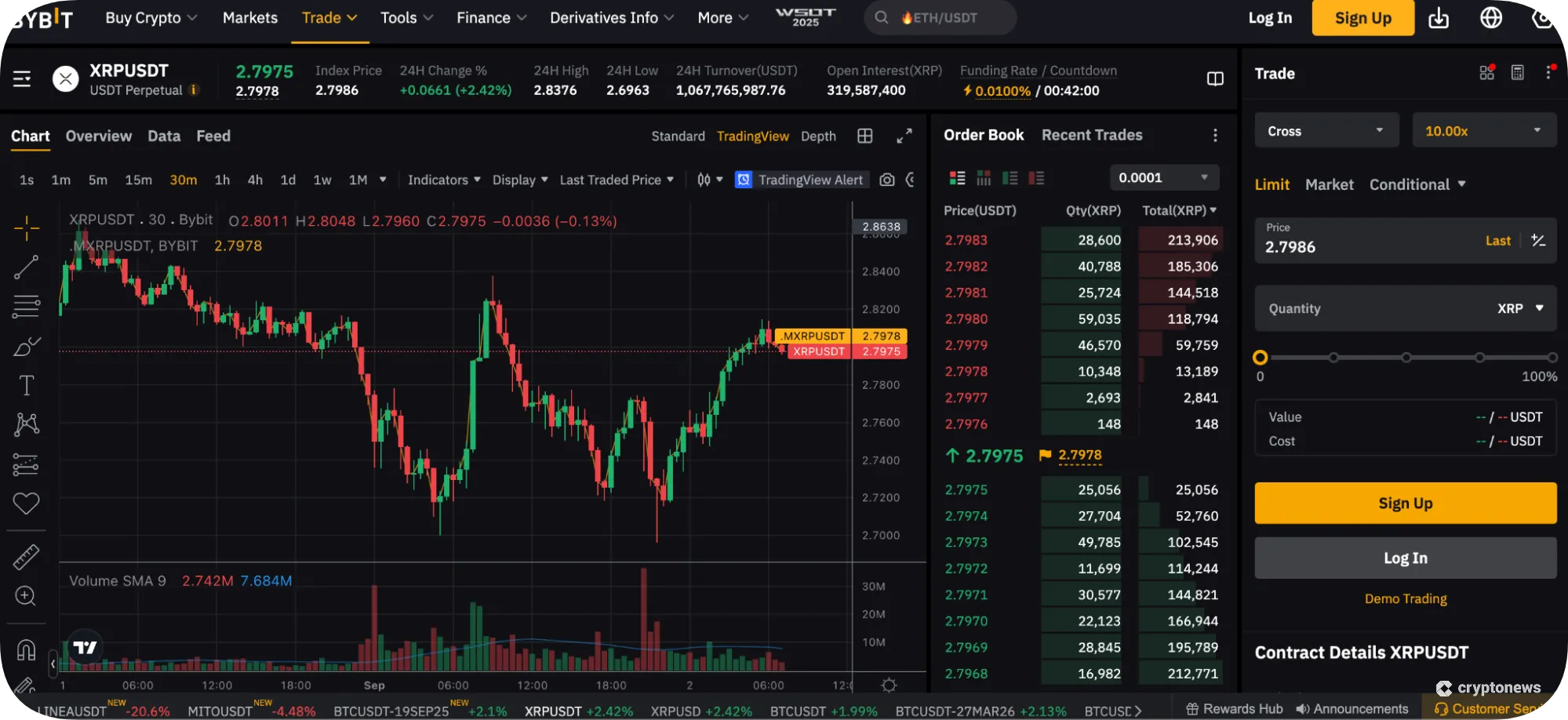

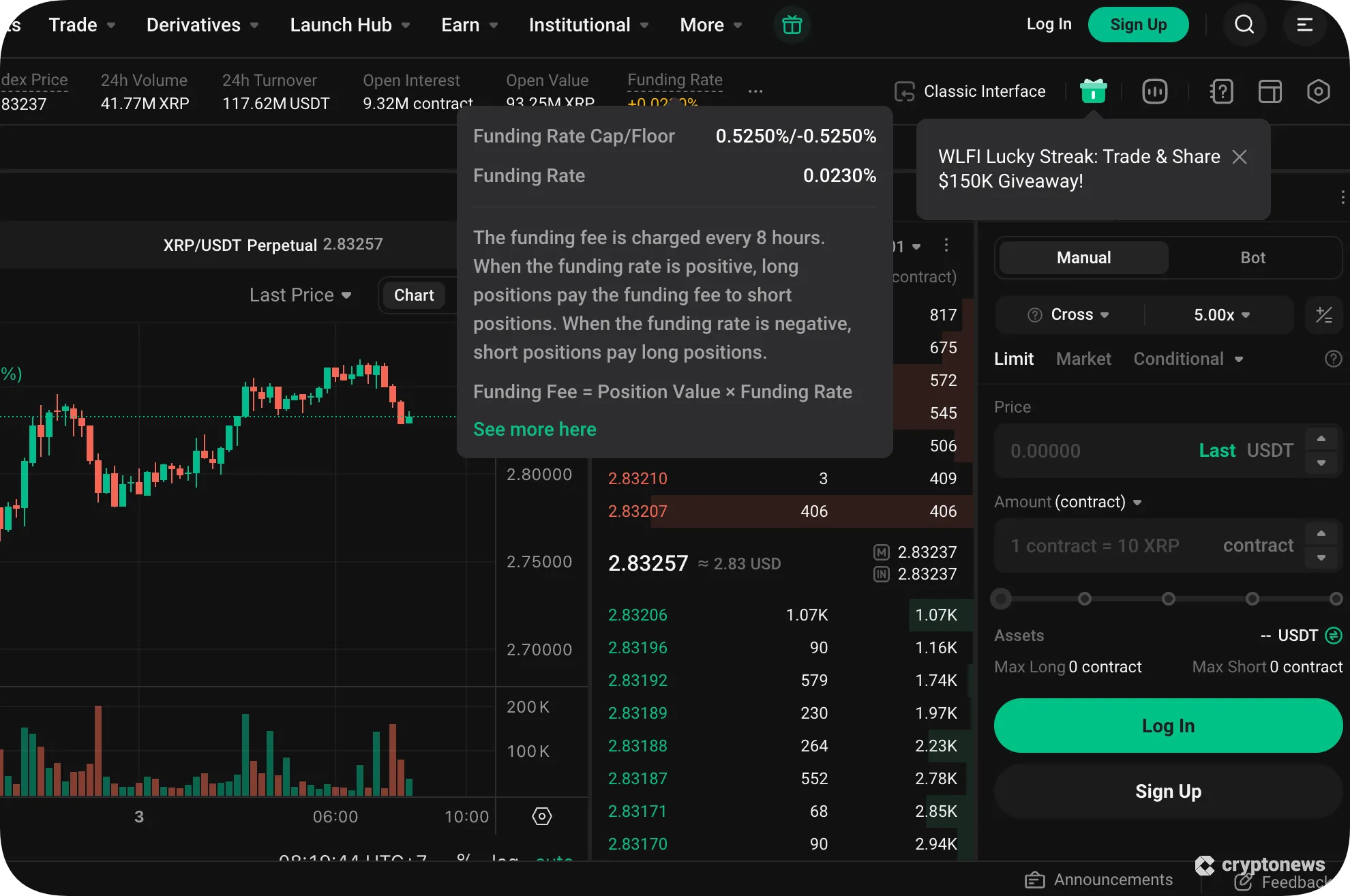

2. Bybit: Trade XRP Perpetual Futures via Linear or Inverse Contracts

- Supported Futures Markets: 610+

- Maximum XRP Leverage: 75x

- Futures Trading Fees: 0.02% maker/ 0.055% taker

- KYC Required? No

Bybit offers several XRP futures markets. The most popular are XRP/USDT perpetual contracts, which typically handle over $1 billion in daily trading volume. Traders may also trade XRP perpetuals against USDC, and both products offer maximum leverage of 75x. Another option is XRP inverse futures, which are margined and settled in XRP. Experienced futures traders favor these derivative instruments because they amplify the potential risk-reward.

Bybit trading commissions are 0.02% on limit orders, and traders secure discounts when they increase their VIP status. Placing market orders increases the commission to 0.055%. Exchange users avoid KYC, although Bybit’s recent European Union-approved license may change this dynamic. Users deposit funds with debit/credit cards and other fiat methods, either directly with Bybit or through the peer-to-peer platform.

After testing Bybit extensively, we found its charting tools suit seasoned investors with analytical-based strategies. Experienced traders will also appreciate the platform’s unified trading account, which allows them to use their spot assets as collateral for futures trading.

Pros

- Trade XRP futures with linear or inverse contracts

- Settlement assets include USDT, USDC, and XRP

- Supports fiat and crypto payments

- Has an excellent reputation in the crypto trading community

Cons

- The maximum leverage limit is 75x

- UK clients are prohibited from joining

3. Binance: Best Option to Trade XRP Futures With Expiration Dates

- Supported Futures Markets: 580+

- Maximum XRP Leverage: 75x

- Futures Trading Fees: 0.02% maker/ 0.04% taker

- KYC Required? Yes

Binance is a good choice for trading XRP delivery futures. It offers quarterly and bi-quarterly expiration contracts, making them ideal for swing traders. Delivery futures eliminate funding cycles, which reduces fees on longer-term strategies.

Users also get exposure to XRP perpetual contracts, with both linear and inverse settlement. While Binance offers 125x leverage on BTC and ETH, it reduces limits to 75x on XRP futures. Leverage declines at certain thresholds, so large-scale positions incur higher margin requirements.

Trading fees at Binance vary depending on 30-day trading volumes and whether you place limit or market orders. The entry-level fee is 0.05% for takers and 0.025% for makers. Holding BNB (BNB) in the Binance account offers additional discounts. Technical traders rate Binance as the best XRP futures platform for indicators and other charting tools. TradingView integration extends analysis capabilities, and API support allows automated strategies via algorithmic bots.

Pros

- Best option to trade XRP futures with delivery dates

- Industry-leading charting tools for technical traders

- Home to the largest trading volumes in crypto

- Get commission discounts when you hold BNB

Cons

- Leverage limits decline on large trading orders

- Product access varies widely by the trader’s location

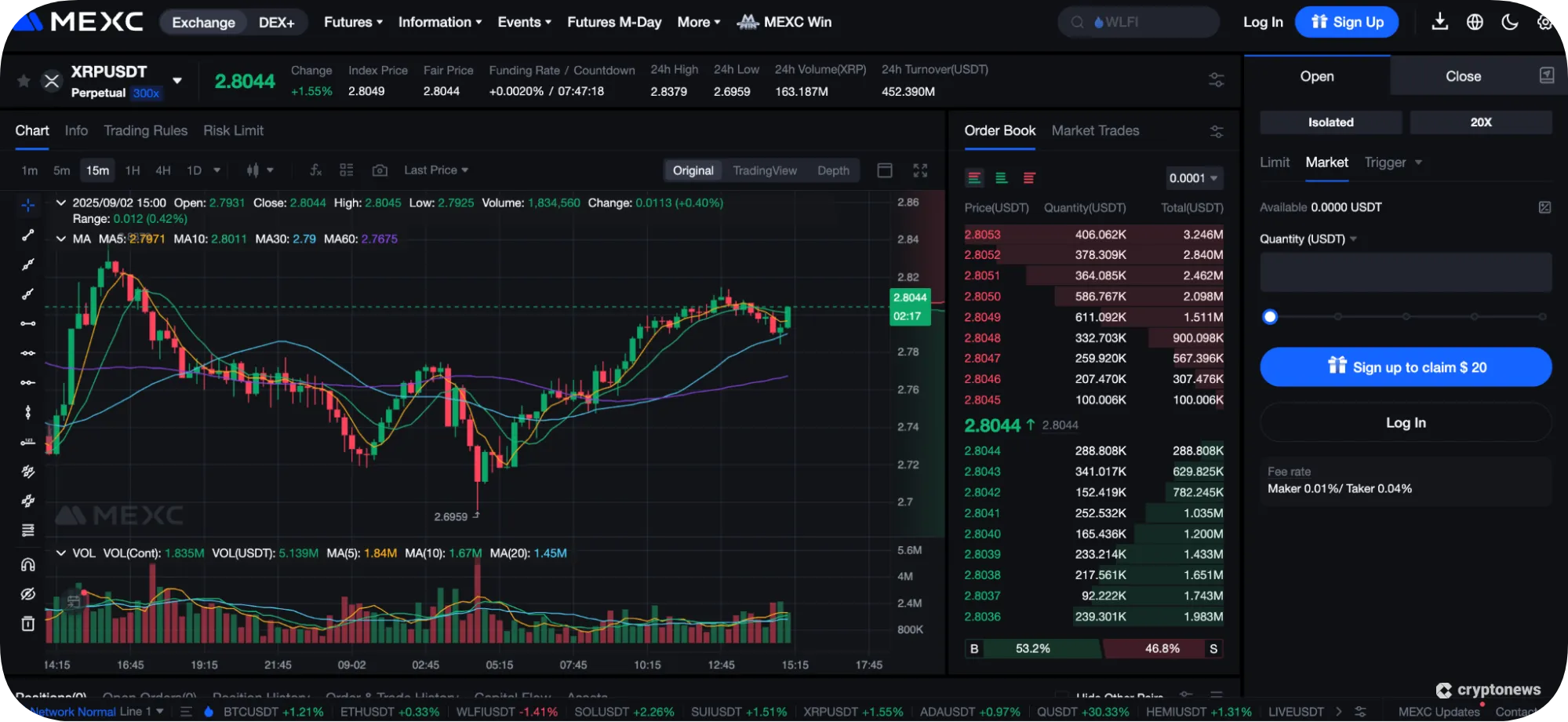

4. MEXC: Traders Get 300x Leverage on XRP Perpetual Futures

- Supported Futures Markets: 780+

- Maximum XRP Leverage: 300x

- Futures Trading Fees: 0% maker/ 0.02% taker

- KYC Required? No

MEXC has an approximate margin requirement of just 0.33% on XRP futures. This framework lets users trade XRP with 300x leverage. Contracts settle in USDT or USDC via a linear structure, and trading volumes reflect tier-one levels. The exchange also offers inverse contracts with XRP margin and settlement.

Our research shows that MEXC is one of the best crypto exchanges for competitive fees. As a market maker, you pay just 0.02% per side. Traders cut their commissions to just 0.1% on limit orders. A further 50% reduction is available when users hold MX tokens in their MEXC account for 24 hours.

Another popular feature is MEXC’s commitment to anonymous trading. Unless you withdraw significant amounts (10 BTC daily or about $1 million), the platform doesn’t collect KYC information. MEXC is a global exchange available in most regions, although it does block access from certain IP addresses, including those in the U.S.

Pros

- One of the highest XRP leverage limits at 300x

- No KYC unless you withdraw over 10 BTC per day

- Market takers pay just 0.02% on XRP futures

- Most withdrawals are processed instantly

Cons

- Blocks IP addresses from the U.S.

- No regulatory bodies license the platform

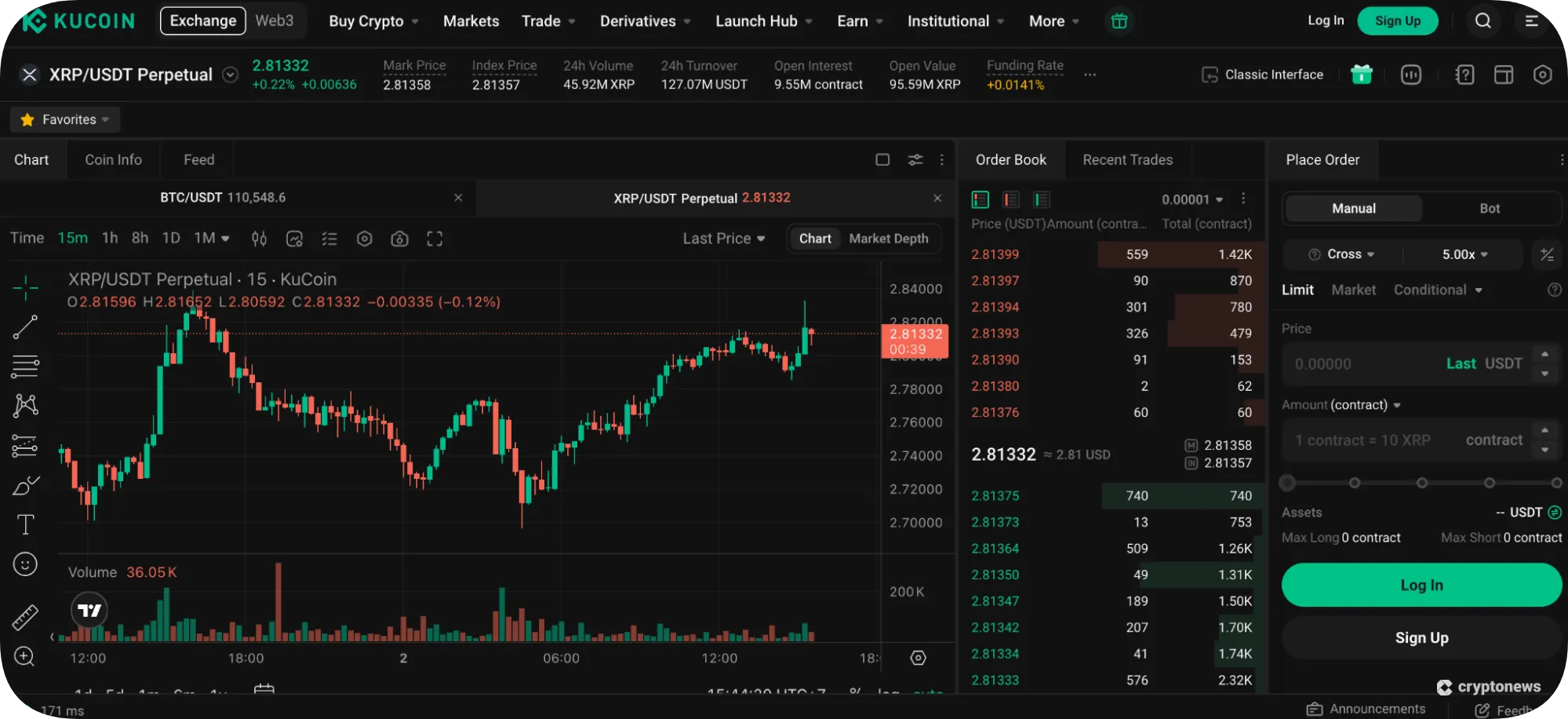

5. KuCoin: Great Choice for Market Diversification With 470+ Futures Pairs

- Supported Futures Markets: 470+

- Maximum XRP Leverage: 75x

- Futures Trading Fees: 0.02% maker/ 0.06% taker

- KYC Required? Yes

KuCoin ranks among the top XRP futures trading platforms for market diversification. In addition to XRP, platform users may trade over 470 other futures pairs, with a broad range of linear and inverse perpetuals to choose from. Popular markets include the best meme coins like Floki (FLOKI), Pump.Fun (PUMP), Shiba Inu (SHIB), and dogwifhat (WIF).

In terms of leverage, KuCoin offers 75x on XRP futures and up to 125x on BTC. KuCoin also offers other ways to trade XRP with leverage. Users access XRP margin accounts with 10x leverage and XRP ETF derivatives at 3x. All products allow traders to speculate in both market directions.

Although KuCoi has advanced trading tools and charting tools, we like its transparency on key margin data. It displays the margin liquidation price, contract specifications, and estimated return on investment. The dashboard shows funding rates in real-time to help traders make informed decisions.

Pros

- Trusted crypto exchange with over 40 million registered users

- Supports over 470 futures trading pairs

- Also offers XRP leverage via ETF derivatives and margin accounts

Cons

- Higher margin requirements than some futures platforms

- High fees when buying crypto with debit/credit cards

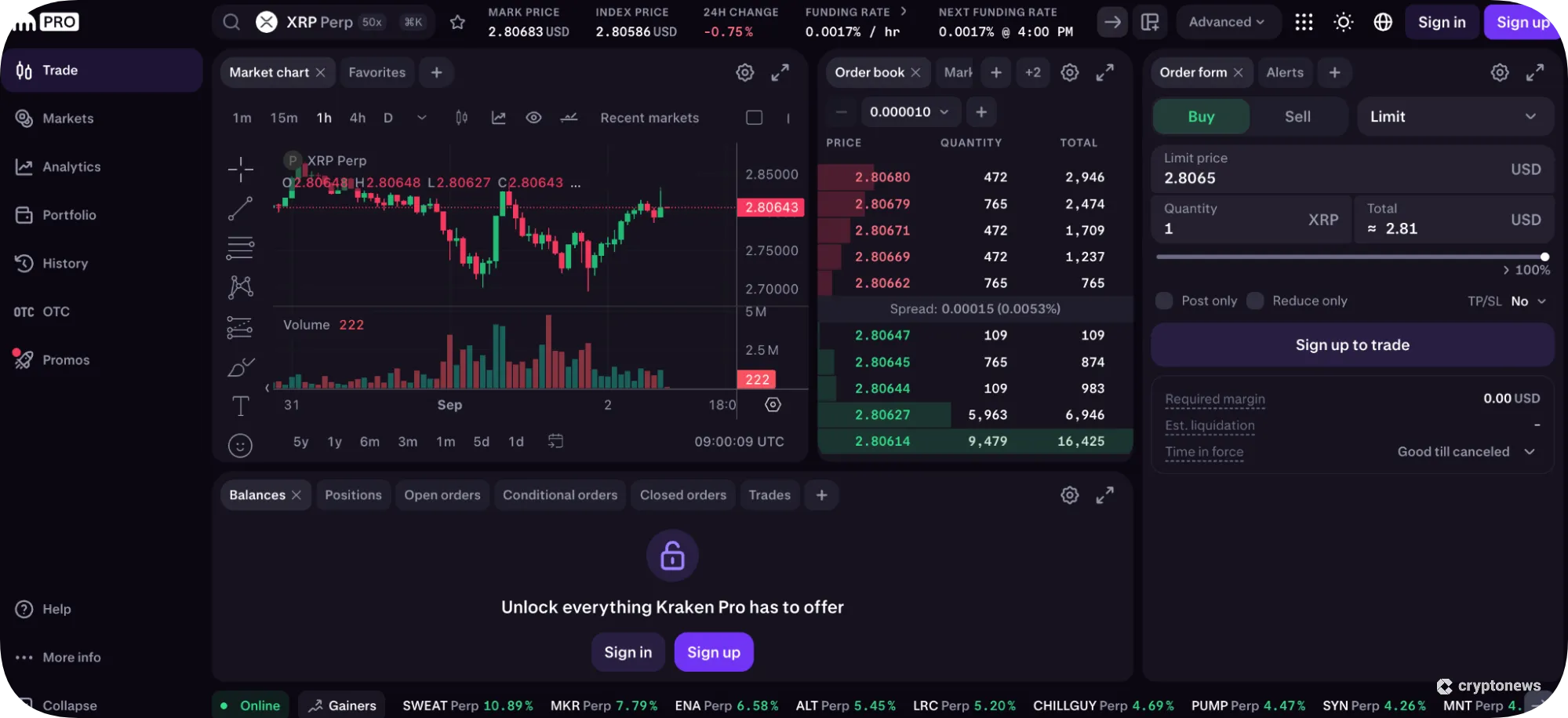

6. Kraken: Regulated Spot and Futures Exchange With Robust Security

- Supported Futures Markets: 340+

- Maximum XRP Leverage: 50x

- Futures Trading Fees: 0.02% maker/ 0.05% taker

- KYC Required? Yes

Research shows that Kraken is one of the safest exchanges to trade XRP futures. Founded in 2011, several tier-one regulators authorize and license the platform, including authorities in the U.S. and Europe. The established exchange remains unhacked since its inception, and security controls include cold storage wallets with 24/7 armed surveillance.

Regarding XRP futures, the provider offers perpetual contracts that settle in US dollars. The maximum leverage limit is 50x up to the first $500,000, which is reduced as the market exposure increases. Kraken supports hundreds of other futures pairs, including the top altcoins like BNB, Kaspa (KAS), and Internet Computer (ICP).

Kraken fees align with other futures platforms at 0.2% (limit orders) and 0.5% (market orders), respectively. The key drawback is that while Americans can access crypto futures in a regulated environment, the U.S. platform doesn’t support XRP.

Pros

- Regulated in the U.S., Europe, and other regions

- XRP futures settle in US dollars

- Powerful charting and analysis tools via Kraken Pro

Cons

- Strict KYC procedures delay the onboarding process

- U.S. clients cannot access XRP

- The exchange caps leverage at 50x

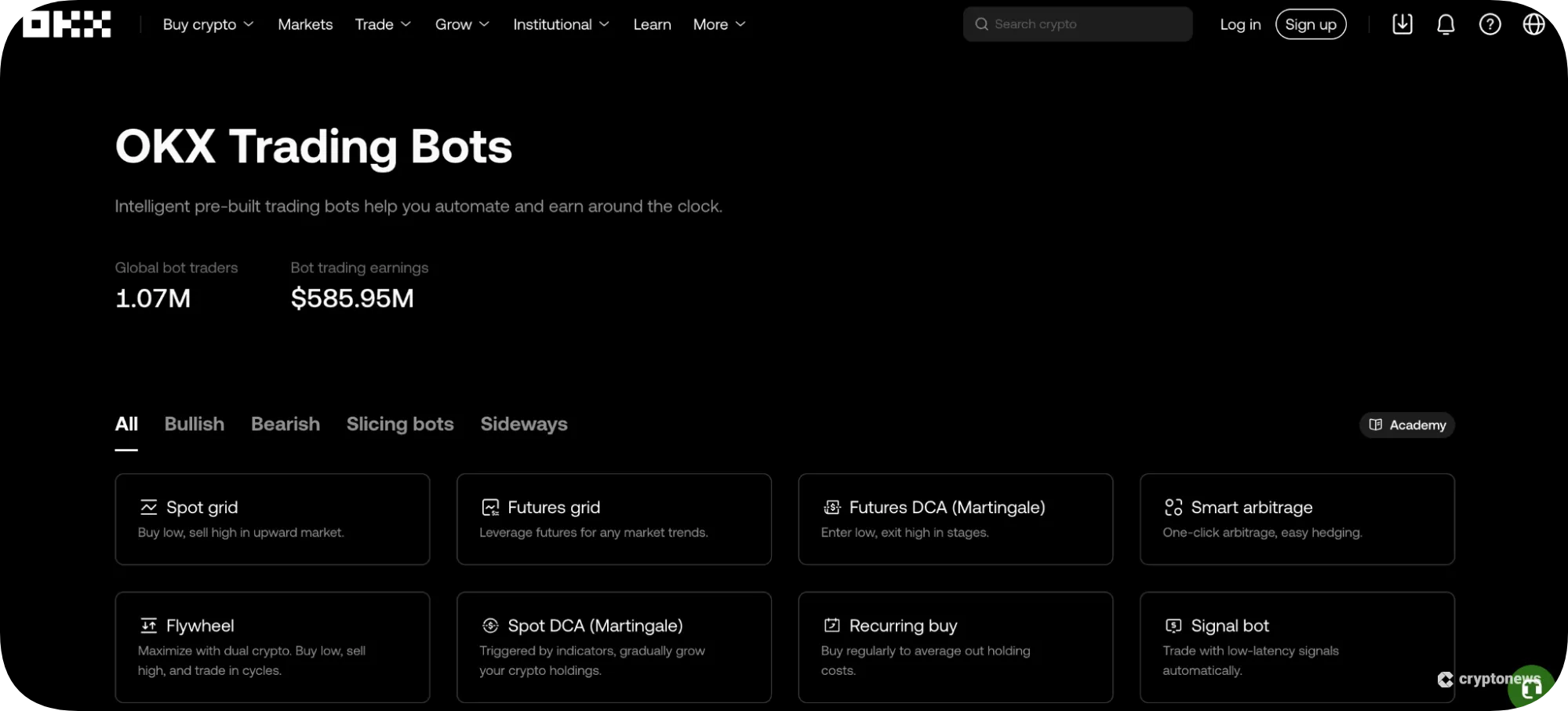

7. OKX: Tier-One Exchange With Automated Bots for XRP Futures

- Supported Futures Markets: 270+

- Maximum XRP Leverage: 50x

- Futures Trading Fees: 0.02% maker/ 0.05% taker

- KYC Required? Yes

OKX offers over 300 automated bots that specialize exclusively in XRP. The majority of bots trade perpetual futures with varying leverage levels and strategies. The process lets OKX users long and short futures contracts passively, since the bot determines which orders to place.

Popular systems include Martingale DCA and grid trading, although users can find their ideal strategy via the search filters. The platform provides ample data on each bot, such as profit and loss, maximum drawdown, and individual positions.

Those who prefer human traders can use the copy trading tool. The top traders have substantial profit returns, including on XRP futures. Most connect to OKX via APIs for fast execution speeds and custom order deployment. You can also trade futures on OKX manually. Its charting dashboard offers full customization, including bespoke order book analysis and indicators. Makers and takers pay 0.2% and 0.5% per side, reflecting the market average.

Pros

- Trade XRP futures passively via automated bots

- Find the ideal strategy via trading filters

- Also a great choice for trading crypto options

Cons

- Some bot providers charge profit-sharing commissions of 30%

- Prohibits exchange access until users complete KYC

- Minimum 30-day trading volume of $50 million to reduce commissions

What Are XRP Futures?

XRP futures are contracts traded between buyers and sellers that provide market exposure without ownership. Traders speculate long or short, depending on whether they believe the XRP price will rise or fall.

Most futures platforms offer XRP perpetual contracts. They typically stay open indefinitely unless closed by the contract holder. The perpetual contract aligns with spot prices, since exchanges charge funding fees to ensure market correlation.

The key benefit when trading XRP futures is that they provide margin facilities. Rather than cover the full contract value, traders pay a small percentage upfront. This structure amplifies the XRP position size by significant amounts, making margin a popular choice with crypto traders.

The 2 Main Types of XRP Futures

XRP futures are broadly categorized into two main types: retail-friendly exchanges and the institutional-grade Chicago Mercantile Exchange (CME).

Here’s what you need to know about each futures exchange type.

Exchange-Based XRP Futures

Exchange-based futures suit casual traders, and the most commonly traded contracts are called perpetuals. These contracts function differently from traditional futures because they never expire. Their perpetual framework provides a flexible approach to trading, but they incur funding fees, which makes them unsuitable for long-term holdings.

When trading XRP perpetuals, contracts are usually margined and settled in USDT or USDC. Some platforms offer inverse contracts too, which settle in XRP rather than stablecoins.

A small selection of exchanges also supports XRP delivery futures. As they resemble conventional futures with expiration dates, they’re often a better fit for swing trading strategies. Bi-quarterly contracts, for instance, usually remain open for six months without funding fees.

Another option is simulated XRP futures. We found they’re a good option for first-time traders, as secure algorithms replace order books to ensure accurate prices without liquidity risks.

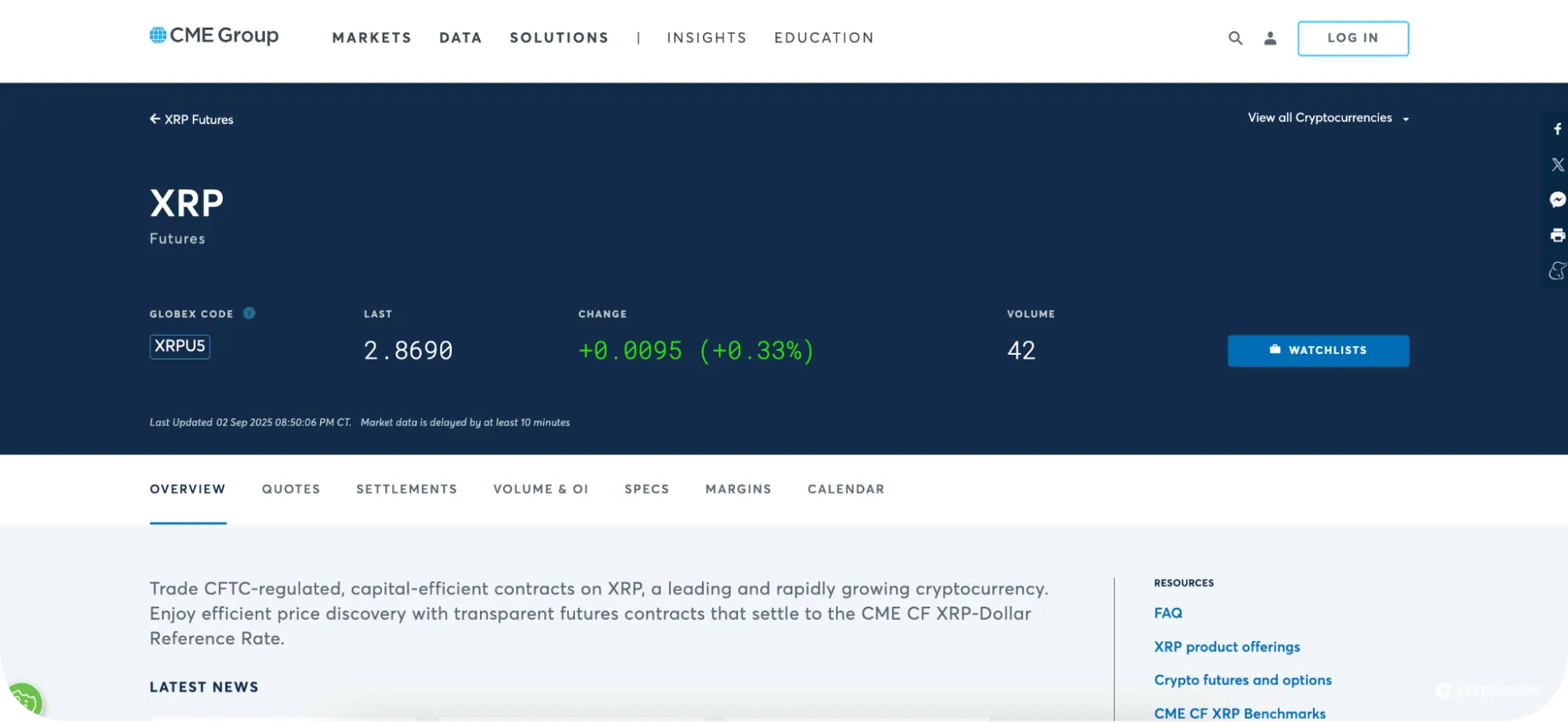

CME-Listed XRP Futures

CME is one of the biggest derivative exchanges globally. While primarily specializing in traditional derivative assets like indices, commodities, and currency swaps, it launched the world’s first regulated Bitcoin futures market in 2017. In May 2025, CME added XRP to its growing futures portfolio.

Most CME traders are institutional or accredited investors with significant resources. They bypass intermediary brokerages by meeting large contract minimums. Standard XRP futures have a 50,000 XRP contract minimum and an approximate margin requirement of about $62,000.

In contrast, retail-friendly platforms like CoinFutures have a 0.1% margin requirement, or about $100 for every $100,000 traded.

How Do XRP Futures Work?

Futures contracts are complex financial instruments. Traders must understand the different XRP derivative types, like perpetual and delivery futures, as well as how contracts settle. Liquidation is another important area, as it results in traders losing their initial margin.

Read on to learn everything you need to know about XRP futures.

Contract Types

All XRP futures loosely track the XRP spot price and allow traders to speculate in both directions.

Most retail traders prefer simulated or perpetual futures because they eliminate expiration dates. Traders simply submit a buy or sell order and close the position to lock in profits or cut losses.

Delivery futures are less convenient to trade. Investors must consider rollover terms should they wish to remain in the market past the contract expiration. There is less alignment between the XRP spot and futures prices, demanding more advanced futures strategies.

Settlement: Linear vs Inverse

Our research shows that most XRP futures platforms let users choose between linear and inverse contracts.

Unless you’re an experienced trader, opt for linear futures. Traders use USDT or USDC as the upfront margin (more on that shortly), which limits the risk exposure to that amount. The XRP futures settle in the same stablecoin, so profits or losses reflect traditional fiat currency accounts.

Inverse futures amplify the trader’s exposure, often by substantial amounts during periods of market volatility. They require XRP as the margin and settlement asset, so even small adverse price movements can reduce the margin collateral and liquidate the position.

Leverage, Margin, and Liquidation

When you set up an XRP futures trade, the leverage multiple determines two critical metrics: the initial and maintenance margin.

The initial margin is the required collateral to open the leveraged position. For example, suppose you go short on XRP futures with 100x leverage, and wish to trade with $50,000. Just $500 (1%) is needed upfront, which reflects the initial margin.

The maintenance margin dictates the minimum collateral to avoid liquidation and keep the futures trade open. It’s always less than the initial margin in percentage terms, but varies widely by the exchange, pair, and trade value.

Here is the key takeaway: If the margin balance drops below the maintenance requirement, exchanges liquidate trades. In this instance, you lose the initial margin and automatically exit the trade at a loss.

Although beginners may find margin and liquidation terms complex, CoinFutures simplifies the process with clear exit prices. As you adjust the leverage, helpful risk management tools show the exact liquidation price, allowing you to increase or decrease your risk accordingly.

How to Trade XRP Futures: Step-by-Step

We’ve created a simple step-by-step guide on how to trade XRP futures with CoinFutures. The platform offers a beginner-friendly experience with small trade minimums and a user-centric dashboard. Follow these steps to speculate on XRP futures with leverage.

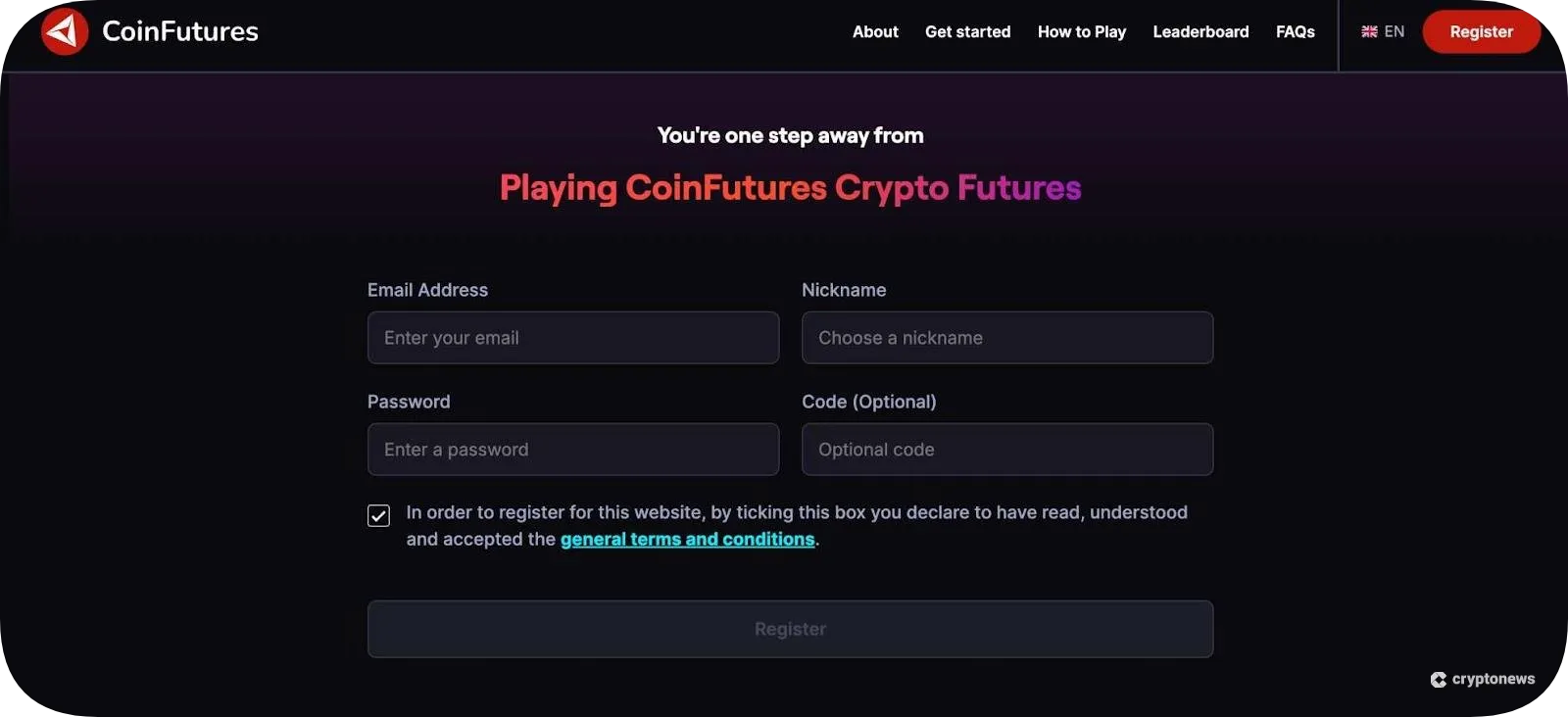

Step 1: Open a Trading Account and Download the CoinPoker Interface

Go to the CoinFutures website to open an account. CoinFutures users get started without KYC, so simply enter an email address and choose a nickname and password.

The futures trading dashboard is accessible on the CoinPoker software, which owns the CoinFutures brand. Download the software to your desktop or mobile device and log in with your email and password.

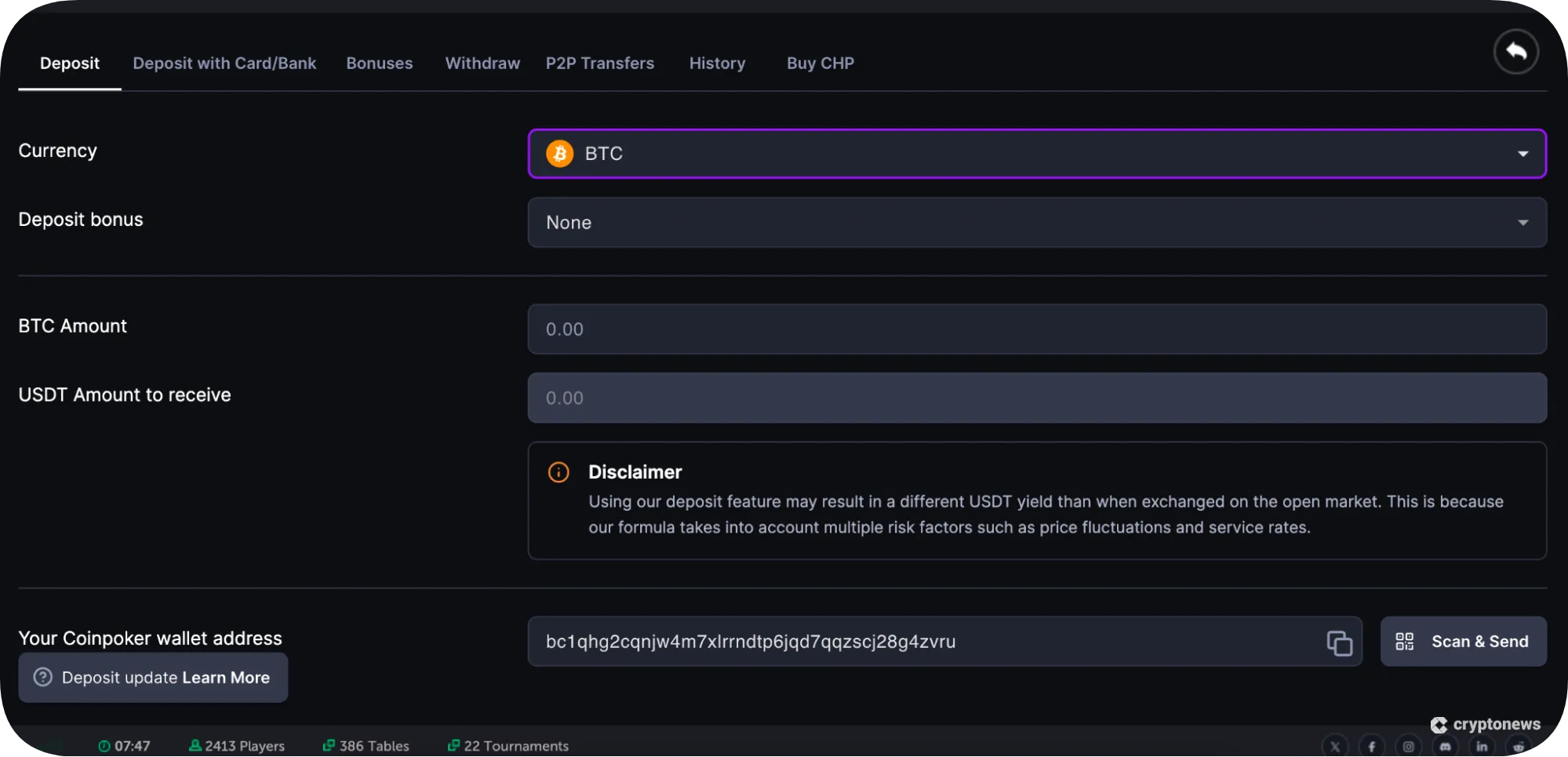

Step 2: Make a Deposit (No Minimum)

Click the wallet icon to access the deposit dashboard. CoinFutures accepts crypto and fiat payments.

The best option is to transfer cryptocurrencies from a private wallet, since you avoid KYC and potential charges from your banking or credit card provider.

The platform supports the best cryptocurrencies to buy, like BTC, ETH, USDT, SOL, and Tron (TRX). Click the respective coin or token, and the system generates a new wallet address. Copy the address or scan it from a mobile wallet, and complete the transfer.

If you prefer to deposit money with traditional payment methods, click the “Deposit With Card/Bank” button. Available deposit types include Visa, MasterCard, and Google/Apple Pay. Select the currency (USD or EUR) and the deposit amount, and follow the on-screen instructions.

Step 3: Find the XRP/USDT Futures Market

Return to the main dashboard area and click “Crypto Futures”.

Select “BTC/USDT” to reveal available markets, and then click XRP/USDT.

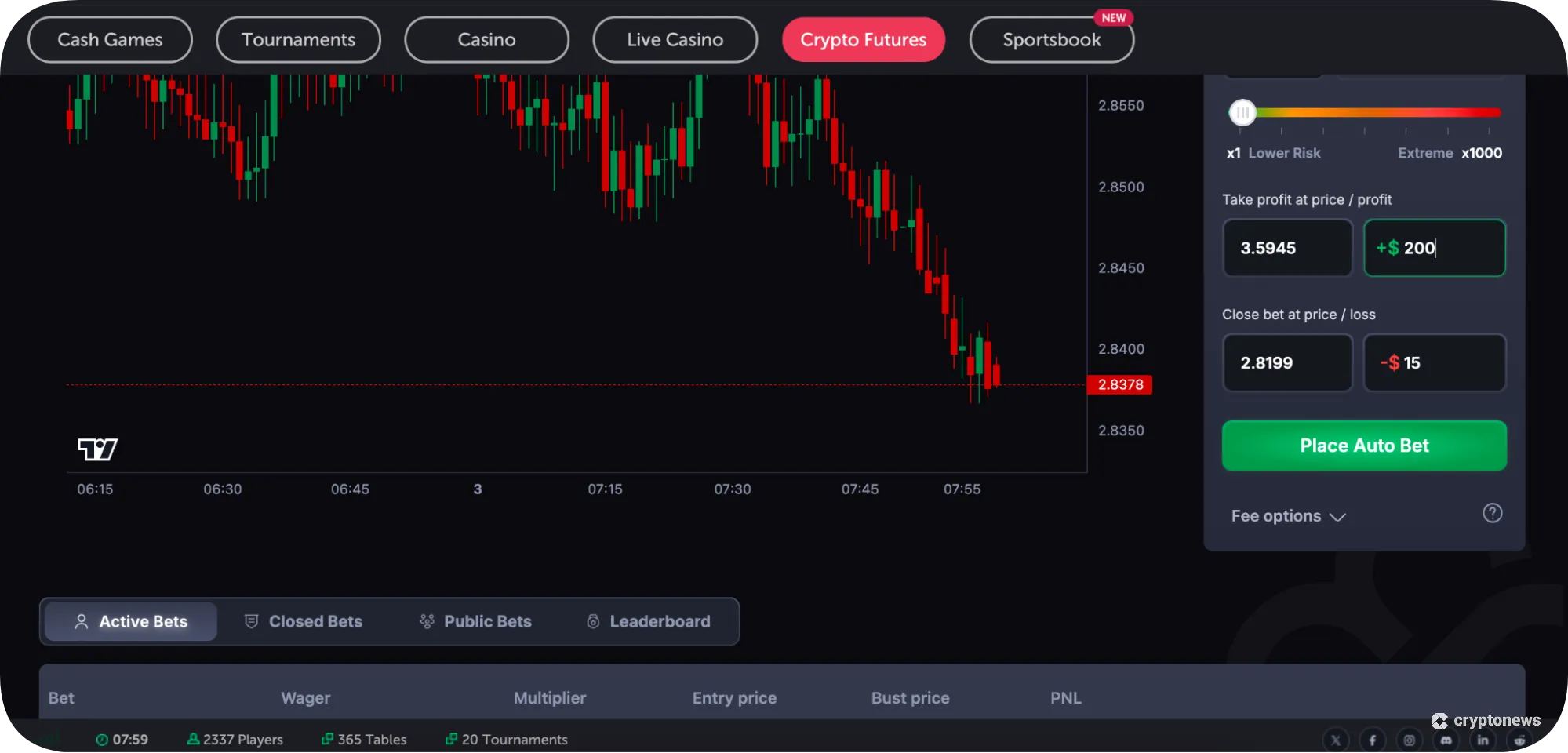

Step 4: Set up an XRP Futures Trade

This step requires you to enter the futures trade parameters based on your market prediction and risk tolerance.

First, choose between “Up” and “Down”. The “Up” option is essentially a buy order, which means you predict the XRP price will rise. Select “Down” if you believe prices will decline.

The “Wager” amount reflects your risk threshold. In the example above, the trader wagers $50, which is the maximum they can lose on the futures position.

Choose your preferred leverage multiple from 1x to 1,000x, and evaluate the “Bust Price” (liquidation). This example shows a 15x trade with a $2.8478 entry price and a $2.7881 liquidation price.

Step 5: Enter Stop-Loss/Take-Profit Levels and Place Futures Trade

To avoid liquidation and ensure you secure trading profits automatically, set up stop-loss and take-profit orders. You’ll find these order types by clicking the “Auto” button.

As the best XRP futures trading platform for beginners, CoinFutures lets users set their exit prices in USD terms. In our example, the futures position closes automatically if the trade value declines by $15. We’ve set the take-profit amount at $200. In essence, the trade risks $15 to target a $200 gain.

Click “Place Auto Bet” to enter the trade. You don’t need to monitor price movements, as the platform closes the position when one of the exit price targets is reached.

Visit CoinFuturesAdvantages of Trading XRP Futures

Here are the advantages of XRP futures compared with traditional spot trading.

Control Large XRP Trading Positions

While XRP remains one of the cheapest cryptocurrencies to buy, you need significant capital to make life-changing gains. This is because of XRP’s large-cap valuation, which is currently $142.21B.

Futures are a potential solution for bullish XRP investors with limited upfront capital. They allow traders to control substantially large positions with a small initial margin, which, depending on the platform, is as low as 0.1%. At CoinFutures, you can enter a $100,000 XRP trade with just $100.

Small Price Movements Can Yield Significant Gains

Trading XRP futures with high leverage unlocks unprecedented profit potential, even with small price movements. An XRP trader who goes long with 1,000x leverage makes a 1,000% gain for every 1% price increase.

This framework is particularly suitable for day traders, who typically keep positions open for minutes or hours.

Some Futures Contracts Offer Limited Downside

Choosing the right XRP futures contracts is essential to managing risk. When you trade linear contracts with isolated margin, you cannot lose more than the initial bet size. This risk-reward spectrum appeals to traders who want to limit risk and still target massive profits.

However, not all futures contracts offer capped risk potential. Cross margin contracts draw from the full exchange account balance as collateral. A rapid, adverse XRP price movement could wipe your balance entirely.

Downsides of Trading XRP Futures

Evaluate the following risks before you trade XRP futures.

Regular Funding Cycles on Some Contracts

Unless you trade delivery contracts, XRP futures incur frequent funding cycles. Similar to other derivative products like contracts-for-differences, platforms subtract those funding fees from the margin collateral. Exchanges use the funding system to ensure uniformity between spot and futures prices.

XRP futures platforms usually charge funding fees every eight hours. The fee is percentage-based and multiplied by the total position size (not the initial margin).

While these fees quickly add up, only long or short traders incur them. If the funding rate is positive, long traders pay fees to shorts, and vice versa.

High Leverage Makes Futures Liquidation Probable

Applying high leverage to your XRP futures trades may be tempting, as the potential profits could be significant. The overarching issue is that higher leverage equals greater liquidation risks.

The maintenance margin, which is the minimum collateral balance to remain in the position, decreases as the leverage rises. Liquidation means exchanges close the trade instantly, causing you to lose the original bet amount. These risks reduce considerably when trading with modest leverage multiples.

Futures are Complex Derivative Instruments

Futures trading isn’t just about going long or short on the XRP price. Traders must understand key terminology, especially contract and collateral specifications like inverse, linear, cross, and isolated.

The best practice is to initially trade via demo accounts that replicate live futures markets. You can then move on to real money positions with small amounts, and gradually increase stakes as you become more confident.

Methodology: How We Ranked The Top XRP Futures Platforms

Understanding our research methods helps traders make informed decisions. To rank the best XRP futures trading platforms for this guide, we initially created a minimum criteria threshold. Metrics included support for XRP futures, safe trading experiences, sufficient/deep liquidity, and reliable payment systems.

We then scored each platform by secondary factors, such as trading commissions, average spreads, contract availability (e.g., linear and inverse), minimum trade requirements, and other supported futures markets.

The team then tested the end-to-end user experience to ensure research validity. Steps included the account onboarding process, searching for futures markets, setting up orders, and testing execution speeds. We compared all research findings and ranked providers based on their overall score.

Conclusion

XRP futures remain popular with crypto traders seeking high leverage facilities and the option to speculate on rising and falling prices. Choosing the right platform ensures a smooth trading experience with competitive fees and fast payouts.

Our research methodology suggests that CoinFutures is the overall best place to buy and sell XRP futures. The no-KYC provider offers XRP futures with 1,000x leverage, instant order execution, and a beginner-friendly trading dashboard. Getting started takes seconds, and the minimum margin requirement is only $1.

FAQ

Are there XRP futures?

What is the difference between XRP futures and options?

Are XRP futures legal?

Where can you trade XRP futures?

What are perpetual XRP futures?

References

- Answers to Common Questions About Futures (Charles Schwab)

- Derivatives exchange CME set to launch XRP futures in crypto push (Reuters)

- XRP Futures – Margins (Chicago Mercantile Exchange)

- Inverse futures contract meaning (Ledger)

- Margin types (International Derivatives) (Coinbase)

About Cryptonews

Our goal is to offer a comprehensive and objective perspective on the cryptocurrency market, enabling our readers to make informed decisions in this ever-changing landscape.

Our editorial team of more than 70 crypto professionals works to maintain the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re looking for breaking news, expert opinions, or market insights, Cryptonews has been your go-to destination for everything cryptocurrency since 2017.