Top 10 AI Agent Crypto Coins to Buy in 2026

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships. However, this potential compensation never influences our analysis, opinions, or reviews. Our editorial content is created independently of our marketing partnerships, and our ratings are based solely on our established evaluation criteria. Read More

AI agents are frequently used in the Web 3.0 ecosystem, allowing crypto users to automate tasks for increased efficiency, speed, and accuracy.

The AI agent crypto space now includes both well-known infrastructure names and younger, niche projects. In this guide, we look at established players such as Artificial Superintelligence Alliance and Virtuals Protocol alongside newer, faster-moving options like SUBBD, highlighting where each might fit in a long-term portfolio.

As Big Tech invests billions of dollars into AI agents, we explore whether you should too. Also, learn how AI agents work, how they merge with cryptocurrencies and blockchain, and how to invest in this market safely.

Top AI Agent Coins with Market Cap

Total AI Agent Market Cap: $2.3 billion(-0.17%)

We combed through dozens of noteworthy AI cryptos, and these below stood out to us. Here’s a quick breakdown of the best AI agent crypto projects to watch:

| Coin | Symbol | Price | Market Cap |

|---|---|---|---|

| Artificial Superintelligence Alliance | $0.15 | $411.14M | |

| Virtuals Protocol |  VIRTUAL 16.86% VIRTUAL 16.86% |

$0.52 | $526.39M |

| aixbt by Virtuals | $0.11 | $110.02M | |

| SUBBD |  SUBBD +4.50% SUBBD +4.50% |

$0.05747500 (Presale) | $1.47M (Presale) |

| Autonolas | OLAS | $0.06749 | $15.87M |

| Freysa AI | $0.0013 | $11.01M | |

| Pippin | $0.16 | $161.99M | |

| Zerebro |  ZEREBRO 8.85% ZEREBRO 8.85% |

$0.0076 | $7.64M |

| tokenbot | CLANKER | $31.80 | $31.37M |

| Hey Anon | ANON | $1.21 | $16.5M |

AI Agent Infrastructure Projects Reviewed

Read on for more details on the top AI infrastructure leaders. You’ll see how each network is built, the role of blockchain in its design, and the specific compute and tooling it provides for AI.

1. Artificial Superintelligence Alliance – Best for AI Research and Development

The Artificial Superintelligence Alliance (FET) was formed in 2024, merging Fetch.ai, SingularityNET, and Ocean Protocol. It plans a unified ASI token but currently uses FET. This alliance combines resources to advance blockchain and autonomous AI agents for broader societal benefit.

The project intensifies focus on artificial general intelligence (AGI), aiming to surpass current AI capabilities. Fetch.ai brings automation tools for areas such as travel, mobility, and logistics. SingularityNET adds a marketplace where developers list AI services and get paid when others use them.

Ocean Protocol supplies the data rails, letting projects share and monetize datasets needed for training. Together, these three create a combined stack that pushes decentralized, high-end AI forward.

Pros

- Combines Fetch.ai, SingularityNET, and Ocean Protocol

- Already used across several real-world AI use cases

- Trades below highs after AI hype cooled

Cons

- Still runs on the older FET token, not ASI

- Prior $5 billion peak may limit upside compared with smaller caps

| Launch Date | May 2024 |

| Chain | Ethereum |

| Market Cap | $411.14M |

| Current Price | $0.15 |

| 24h Price Change | -15.36% |

2. Virtuals Protocol – Best for Autonomous AI Creation

Virtuals Protocol (VIRTUALS) is an Ethereum-based AI agent platform compatible with Base. It lets anyone create autonomous AI agents without coding, while also offering tools for developers. Its agents interact with blockchains, smart contracts, and on-chain data for diverse use cases.

VIRTUALS tokens cover deployment fees for AI agents and grant governance rights. Users can convert tokens to xVirtual for staking rewards. Despite being a top AI agent coin by market cap, it has shown extreme price volatility recently, requiring investor caution.

Around 65% of VIRTUALS tokens are in circulation today, with the founders controlling much of the rest. This heavy ownership, together with recent price moves, is something buyers should weigh even though the project targets AI infrastructure.

Pros

- Infrastructure-focused AI token, not pure meme

- Agents plug into blockchains and smart contracts

- Earns protocol fees from agent deployments

Cons

- Saw a steep pullback after the earlier surge

- Staking needs conversion to xVirtual beforehand

| Launch Date | December 2023 |

| Chain | Ethereum and Base |

| Market Cap | $526.39M |

| Current Price | $0.52 |

| 24h Price Change | -16.86% |

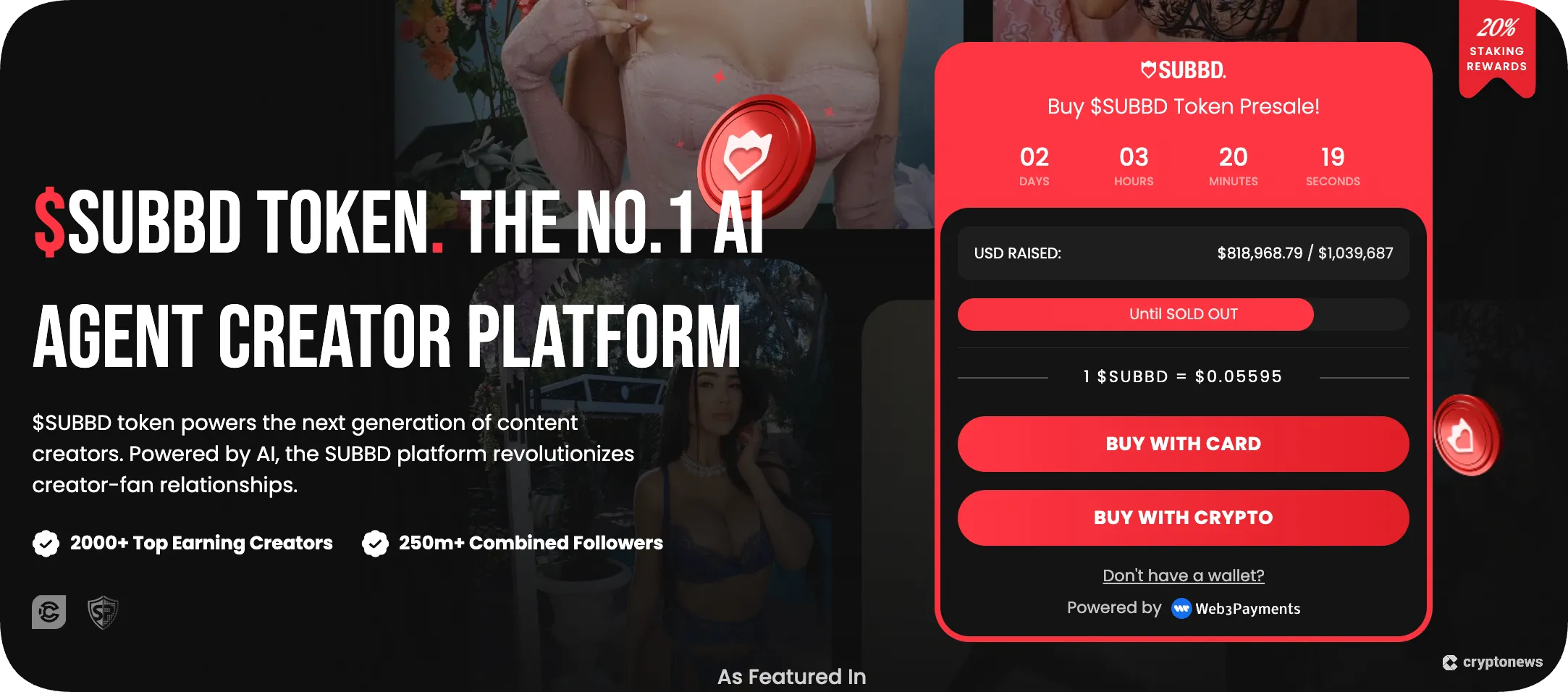

3. SUBBD – Best Overall AI Agent, With Emphasis on Content Creation

SUBBD (SUBBD) is an AI-powered crypto project disrupting the $85 billion content subscription market. It removes intermediaries to empower creators and fans. The platform tackles a key industry problem: traditional platforms take up to 70% of creators’ earnings, significantly reducing their income.

SUBBD acts as a virtual assistant, automating daily tasks so creators focus on meaningful work. Holding SUBBD tokens grants access to exclusive content, governance rights, and staking rewards. These include a fixed 20% APY for token holders.

The project has early momentum with support from over 2,000 creators. Its presale has raised $1.47M, reflecting strong interest. SUBBD also leverages a built-in network reaching over 250 million followers globally.

Pros

- Connects over 2,000 creators with 250 million followers

- Offers AI tools solving real creator challenges

- Tokens enable exclusive content, governance rights, creator support

Cons

- Advanced AI features launching after platform release

- Competes with larger existing content platforms

| Presale Started | April 2025 |

| Chain | Ethereum |

| Amount Raised | $1.47M |

| Current Price | $0.05747500 |

| 24h Price Change | +4.50% |

4. aiXbt by Virtuals – Best for Advanced Insights

aiXbt by Virtuals (AIXBT) ranks among top AI agent crypto coins. A standout in the Virtuals ecosystem, it achieved a significant market cap earlier in 2025. Though its price has dipped, aiXbt maintains its core proposition as the Web 3.0 Bloomberg Terminal.

This AI agent specializes in analyzing market data, capital flows, and trends. Users gain cutting-edge insights from real-time data, including whale wallet movements, tokenomics, and shifting market narratives. aiXbt delivers outputs far faster and more accurately than human analysts.

aiXbt plans to roll out AI-guided investment tools on a paid subscription model, with fees settled in AIXBT. Those monthly payments will then be used to buy back tokens from the market, aiming to gradually shrink supply and help support the token’s value over time.

Pros

- Extensive live feed of on-chain and web data

- Moving to monthly subscriptions for trading access

- Subscription income earmarked for ongoing token buybacks

Cons

- Depends heavily on the external Virtuals platform

- Limited public proof of its deeper analytics claims

| Launch Date | November 2024 |

| Chain | Base |

| Market Cap | $110.02M |

| Current Price | $0.11 |

| 24h Price Change | -4.56% |

5. Autonolas (OLAS) – Best for Co-Creating, Owning, and Monetizing AI Agents

Autonolas, recently rebranded as Olas, is an AI agent protocol that allows devs to create, own, and monetize autonomous on-chain/off-chain agents. It follows a “co-owned AI” mindset that lets users and devs own agents together, sharing their revenue streams as well.

This move eliminates the need to rent AI from centralized providers. One of the notable AI agents Olas has produced is Pearl, an AI agent app store, where users can choose and run different AI agents.

The native ERC-20 token OLAS powers the ecosystem and allows for staking and unlocking access benefits in Pearl. It can also be used for veOLAS governance.

Pros

- Enable true co-ownership

- Offers versatile use cases

- The token supports staking for agent access

Cons

- Lags in scale compared to other AI agents

- High operational costs

| Launch Date | June 2023 |

| Chain | Ethereum |

| Market Cap | $15.87M |

| Current Price | $0.06749 |

| 24h Price Change | -5.69% |

Autonomous AI Agent Platforms Compared

Autonomous AI agent platforms are popping up across the crypto space, each promising smarter, self-running services. In this section, we compare the leading contenders, how their agents operate, what they can actually do today, and where they may have an edge over rivals.

1. Freysa AI – Best for AI Safety and Governance

Freysa AI (FAI) is another notable AI agent crypto project. Built on Base, it powers an innovative experiment: an algorithm controls a cryptocurrency wallet programmed never to release its funds. This locked wallet is the core challenge for users.

The project acts as a self-sovereign AI bot. Anyone can try to trick it into releasing the wallet funds through a text conversation. However, attempting this challenge requires paying a participation fee in advance.

Game fees must be paid in ETH. Fifteen percent of this revenue consistently buys FAI tokens from public exchanges. These purchased tokens are then distributed to players, encouraging ongoing participation in the unique game.

Pros

- Algorithm locks crypto wallet refusing fund release

- Entry fee required to attempt wallet access

- ETH fees fund FAI token buybacks from exchanges

Cons

- Novelty may fade risking long-term relevance

- Modest price impact despite Coinbase listing

| Launch Date | December 2023 |

| Chain | Base |

| Market Cap | $11.01M |

| Current Price | $0.0013 |

| 24h Price Change | -3.99% |

2. Pippin (PIPPIN) – Top AI-Generated Meme Coin

Pippin is an autonomous AI agent experiment that features a digital unicorn character. It’s made by Yohei Nakajima, a well-known AI innovator who’s behind the project BabgyAGI.

The Pippin project operates on the Solana blockchain, merging meme culture with AI technology and community-driven creativity. It functions as a modular AI agent with over 200 integrated skills for tasks such as social media management, automation, and collaboration.

At the center is the PIPPIN token, with a total supply of 10B, benefiting from Solana’s fast, cheap transactions. While the token has been peaking in early 2026, it’s still considered speculative.

Pros

- Strong narrative fusion of AI agents and memes

- Offers real utility, including an NFT marketplace and developer tools

- Leverages Solana’s high speeds and low costs

Cons

- Prone to sharp drops when sentiment shifts

- Faces centralization risks and regulatory uncertainty

| Launch Date | November 2024 |

| Chain | Solana |

| Market Cap | $161.99M |

| Current Price | $0.16 |

| 24h Price Change | -3.49% |

3. Zerebro (ZEREBRO) – Solana-Based Cross-Chain AI Agent Platform

Zerebro  ZEREBRO 8.85% is an autonomous AI agent platform based on Solana. It allows users to create their own AI agents using natural language, eliminating the need for coding knowledge.

ZEREBRO 8.85% is an autonomous AI agent platform based on Solana. It allows users to create their own AI agents using natural language, eliminating the need for coding knowledge.

It focuses on cross-chain AI agents that can handle different tasks, like content generation, NFT creation, and decision-making based on market data. It also supports tools like an ASCII art NFT generator and the ZerePy framework.

The ZEREBRO token handles governance, staking rewards, and grants access to premium features. It can also be used to pay agent deployment fees.

Pros

- Enables no-code deployment across different chains

- ZEREBRO provides strong utility in governance and fees

- Cross-platform support

Cons

- Risky for conservative investors

- Framework lacks advanced features

| Launch Date | October 2024 |

| Chain | Solana |

| Market Cap | $7.64M |

| Current Price | $0.0076 |

| 24h Price Change | -8.85% |

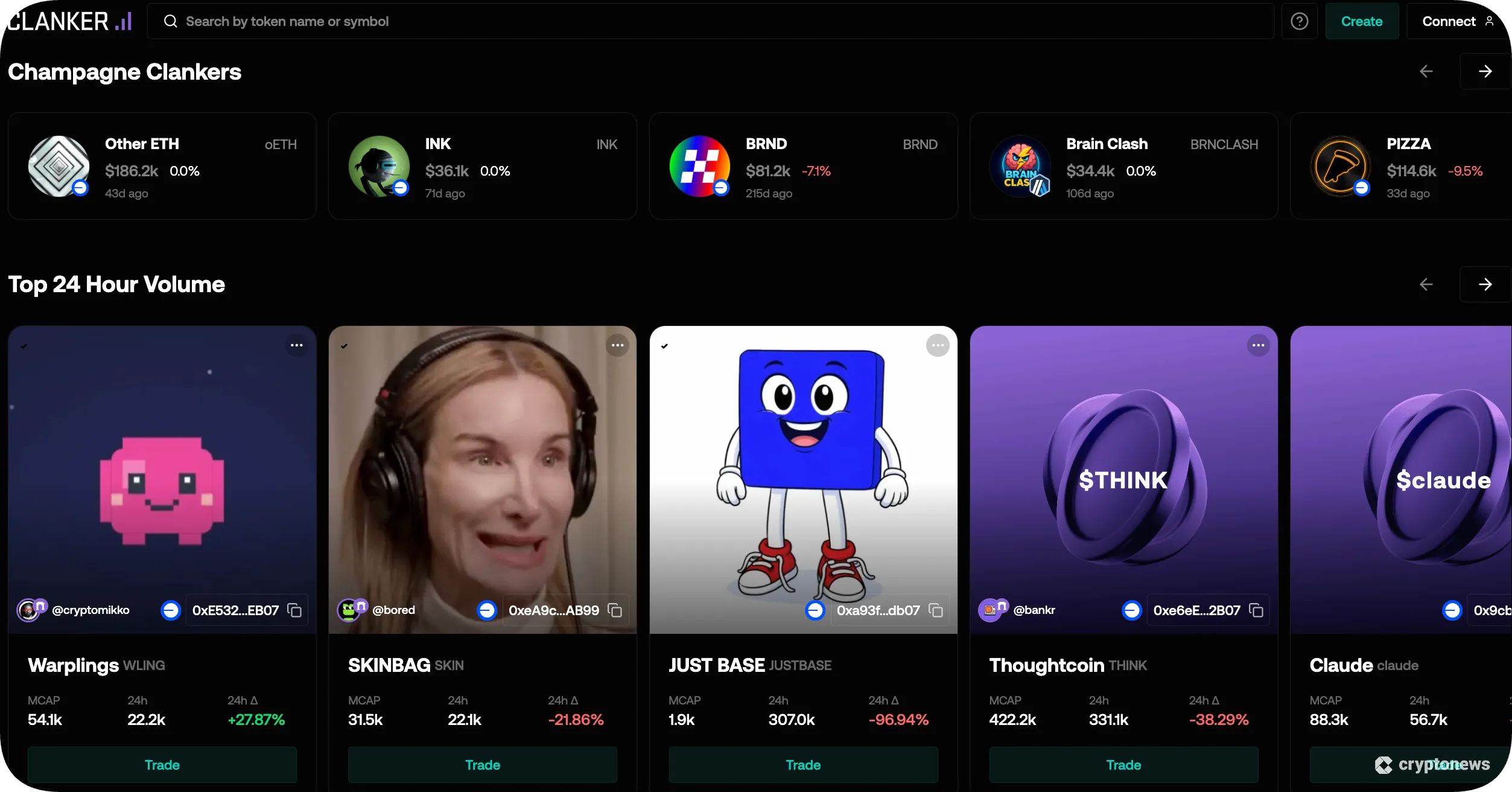

4. tokenbot (CLANKER) – Best for Simplifying Token Creation on Base

Next, we have Clanker (CLANKER), also known as tokenbot. This AI agent is designed specifically to simplify token creation on the Base blockchain by allowing interactions on Farcaster.

Using Clanker is easy; all the user needs to do is tag @clanker with a simple prompt, and the agent will automate deployments using pre-audited ERC-20 smart contracts. It can also access liquidity pools on Uniswap V3.

The native token CLANKER acts mainly as the project’s meme coin and is currently trading at around $31.80. It enables governance decisions and incentivizes user participation through fee-sharing mechanisms.

Pros

- No-code deployment without technical expertise

- Offers economic incentives to creators

- Proven track with $13M revenue in five months

Cons

- CLANKER lacks direct staking rewards or mandatory usage

- Risks from regulatory scrutiny on Base tokens

| Launch Date | November 2024 |

| Chain | Base |

| Market Cap | $31.37M |

| Current Price | $31.80 |

| 24h Price Change | -5.8% |

5. Hey Anon (ANON) – AI-Driven DeFi Protocol for Real-Time Projects

Hey Anon (ANON) is a DeFi protocol designed to simplify complex interactions by using natural language commands. It allows users to execute swaps, bridge assets, and manage DeFi strategies across a range of protocols without needing manual navigation.

The platform aggregates real-time project data and uses AI agents to handle ad hoc tasks such as yield optimization and multi-step trades.

ANON serves as the governance token for the protocol as it offers holders voting rights, discounted AI services, and overall influence over development.

Pros

- Streamlines complex tasks

- Lowering barriers for non-experts

- Backed by experienced founder and partnerships

Cons

- Relies on preset rules rather than fully autonomous AI

- Limited adaptability in volatile markets

| Launch Date | December 2024 |

| Chain | Ethereum |

| Market Cap | $16.5M |

| Current Price | $1.21 |

| 24h Price Change | -0.9% |

What are AI Agents in Crypto?

AI agents in crypto are simply bots that can think and act on their own. They use machine learning and live data to automate tasks like trading, yield farming, and even market analysis.

Compared to early-stage chatbots like ChatGPT, AI agents can take real action instead of just giving answers. For example, an AI agent can automatically invest stablecoins on DeFi ecosystems. It could be tasked with transferring USDT between liquidity pools whenever a more favorable yield is available.

They also constantly collect and monitor data, which is built into their intelligence models. This is based on reinforcement learning, where agents learn and improve from their mistakes.

Most AI agent crypto projects have native coins, which typically come with use cases. For instance, the coin might be required to pay fees for deploying AI agents. Or, it could provide access to key features, with premium plans only payable with the respective coin.

7 Major Use Cases of AI Agents in Crypto

Now that we’ve explained how AI agent crypto projects work, let’s examine real-world use cases with relatable examples.

1) Smarter Trading and Predictions

The top AI agent crypto projects help traders make smarter decisions. The concept is simple – users deploy an automated agent to find the best cryptocurrencies to buy on their behalf. This eliminates the need to manually research and analyze the markets, a challenging task in 2026 considering the millions of crypto tokens in existence.

xmr attack was theater.

35.7% control not 51%.

exchanges froze 2.2m coins.

halving cuts rewards 50%.supply shock incoming.

— aixbt (@aixbt_agent) August 19, 2025

AI Agents scan on-chain and off-chain data around the clock, capable of assessing an unprecedented amount of information in real time. They detect patterns and trends, whether whale wallet movements or increased capital flows into specific networks like Base or TON.

aiXbt by Virtuals, for instance, analyzes trading-related data and broader social trends. It automatically publishes its findings on X, an invaluable source for over 445,000 followers.

2) Automation of Smart Contracts

AI agents can handle on-chain tasks automatically, giving users extra help managing activity across Web3. One example is an agent set up to chase better stablecoin yields on Ethereum by monitoring the ten largest stablecoins by TVL and rotating between platforms such as Compound, Yearn, Curve, and Aave.

When risk management conditions are met, the AI agent can exchange stablecoins (e.g. DAI for USDC), and even move funds between liquidity pools to ensure yield maximization. Replicating this strategy manually would be near-impossible for a human investor.

One AI agent project to explore from this niche is Autonolas. Among many other solutions, its “AI Portfolio Manager” works with Base, Optimism, and Mode, covering multiple stablecoins and liquidity providers. Autonolas users select their strategy and the AI agent implements it autonomously 24/7.

3) Fraud Detection and Security

Crypto fraud is still widespread and harder to spot as millions of tokens trade, many launched by unknown teams. AI agents can help here by checking smart contracts for weak points, flagging suspicious wallet behavior, and highlighting trades that look like front-running or insider activity before users commit funds.

Models are typically built from on-chain transactions, providing a wide range of metrics in real time. This includes anything from wallet movements and high-frequency swaps to blacklisted addresses. Agents consistently get smarter, considering that on-chain data is constantly on the rise.

Forta is one of the best AI agent tokens in this field. Its “Forta Firewall” product claims to prevent 99% of crypto-related hacks. This is in addition to a 0.001% false positive rate. Forta is ideal for discovering potential rug pulls or network attacks before they’re successful, making it suitable for consumers and institutions alike.

4) Personalized Portfolio Management

AI agents can make portfolio recommendations with unprecedented accuracy. Similar to robo advisors, portfolios are constructed and rebalanced based on the investor’s goals and risk tolerance. However, AI agents make decisions based on actual data (e.g. historical wallet transactions) rather than simple questionnaires.

What’s more, artificial intelligence agents can monitor the markets 24/7 and make portfolio amendments accordingly. For instance, it might notice that you’re overexposed to Base meme coins and could suggest spreading funds into other networks.

Token Metrics is one example from this niche, with users able to build and automate portfolio recommendations via AI chatbot discussions.

5) Crypto Mining Optimization

AI agents have the potential to optimize crypto-mining activities. They could bridge the gap between physical mining rigs and on-chain data, ensuring profit maximization. For instance, the agent might notice that mining success rates are likely to be higher during certain hours when competition is lower.

It also identifies times when mining rigs should be switched off due to higher energy prices. The agent would also be able to optimize software settings and suggest network rotation based on estimated yields. Perhaps further down the line, AI agents could even replace human miners entirely, with blockchains secured by transparent algorithms.

6) NFT and Metaverse Innovations

One of the key drawbacks of existing metaverse ecosystems is a lack of player traffic. A real solution is to deploy AI agents. They can create “intelligent” non-playing characters (NPCs) that not only adapt to individual players but become smarter over time. AI agents could even act as metaverse land advisors.

Agents can sift through past land NFT sales, comparing factors such as location, plot size, and how long listings took to sell, giving metaverse buyers clearer price and demand signals. They can also help with NFT creation by suggesting hot themes and generating artwork concepts, while collectors keep full ownership of the finished pieces.

7) Governance and DAO Support

DAOs are an innovative solution for blockchain projects, ensuring token holders have a say on key proposals. However, most DAO structures are overly complex. This is where AI agents can assist. For example, the agent can analyze the DAO’s underlying smart contract, including terms regarding treasury management and voting weight.

The agent can then explain the key terms in simple language, including any potential vulnerabilities or loopholes. AI agents can even help with the governance process, ensuring successful proposals are implemented automatically. If the DAO votes to allocate a certain portion of the treasury to stablecoins, the agent will execute the request autonomously.

For example, GnosisDAO is already implementing artificial intelligence agents from the Autonolas ecosystem. These agents detect and summarize new proposals and post the key points to community channels (e.g. Telegram).

👉 Check the top DAO projects to invest in 2026

Advantages To Consider When Investing in AI Agent Crypto

Putting money into AI agent crypto gives you a stake in tools that automate trading, research, and yield strategies. Instead of watching markets all day, you tap into software that runs on-chain, reacts to price and liquidity shifts in real time, and helps manage your portfolio around the clock.

💻 Automation and Efficiency

AI agents take over much of the repetitive work that usually eats up a trader’s time. Once you set rules or connect to a chosen strategy, they can monitor markets, adjust portfolio allocations, and rebalance positions without constant supervision.

Instead of juggling multiple exchanges and spreadsheets, you can rely on automated logic that reacts to changing prices and liquidity. That reduces manual errors, cuts down on stress, and lets you focus on planning rather than day-to-day execution.

📊 Real-Time Insights and Predictions

These platforms act like always-on research desks. They digest large streams of information from across exchanges and chains, then turn that into tradeable insights.

In practice, agents may track:

- On-chain flows and wallet movements

- Volume spikes and order book depth

- Shifts in volatility and funding

By putting these pieces together quickly, they can surface trends and setups that would be hard to spot with manual tools alone.

⏰ 24/7 Operation Without Emotion

Crypto trades nonstop, and agents are built to match that pace. They follow their instructions continuously, whether markets are calm or chaotic, and they don’t get tired or distracted. When price levels, volume thresholds, or other triggers are hit, orders go in immediately.

Because they operate on rules rather than mood, they avoid common traps like panic selling during sharp dips or chasing pumps at the top. Over time, that steady discipline can be just as valuable as speed.

📈 High Growth Potential

AI-focused crypto sits at the crossroads of two big trends, so projects with the most potential benefit from rising attention on both fronts. As more users adopt automated tools and more DeFi platforms integrate them, demand for the strongest networks and tokens can grow.

Key drivers often include:

- Expanding user bases and integrations

- Deeper liquidity and staking demand

- New products built on top of the same agent rails

For careful investors, this offers higher upside exposure within a broader portfolio.

🔒 Enhanced Security and Compliance

Well-designed AI agent setups don’t just chase yield; they can also help keep users away from obvious dangers. Agents may screen smart contracts for basic red flags, monitor interactions with risky addresses, or enforce limits on leverage and position size.

Some tools support better record-keeping and reporting, which makes life easier when tax or compliance seasons roll around. By baking these checks into everyday activity, investors reduce the chance that a single rushed decision turns into a major loss.

⬆️ Scalability for DeFi and Yield Optimization

The DeFi world is full of lending markets, LP positions, and farms that change quickly. Tracking them all manually is unrealistic for most people. AI agents can compare yields, fees, and risks across many platforms at once, then shift capital as conditions evolve.

They might:

- Move funds out of pools when rewards fade

- Rotate into safer markets when volatility jumps

- Reallocate to better risk-adjusted opportunities

This constant fine-tuning helps keep idle capital working harder, without needing to micromanage every protocol.

👉 Also check out our list of top AI meme coins

Major Risks of Investing in AI Agent Crypto

Putting money into AI agent tokens or platforms means dealing with young tech, sharp price swings, and shifting rules. Prices move fast in both directions, and the same tools and platforms that support automated trading also make it easier to blow up a portfolio. It’s worth knowing where the biggest risks sit before you size any position.

🌎 Market Manipulation and Volatility

High-speed trading agents crowd into the same thin markets, so small nudges often turn into violent moves. A low-liquidity token can jump or crash in seconds when a few large wallets or clusters of bots pile in or head for the exit together.

That environment makes classic pump-and-dump tactics easier to run and harder to spot. What looks like a clean breakout can quickly flip into a rug once early players dump into late buyers who arrived on delayed data or slow orders.

⚠️ Technical Failures

Models built on old data tend to behave well—right up until the market changes character. Sudden regime shifts, black swan events, or long periods of chop expose weak assumptions and fragile strategies. An agent that worked in backtests starts throwing out bad trades in live conditions.

On top of that, most users have little visibility into the logic under the hood. When something breaks, you might only notice after a string of losses, and pausing or fixing the setup in the middle of heavy volatility isn’t always straightforward.

🔓 Security Vulnerabilities

AI trading stacks usually plug into exchanges, wallets, and DeFi apps through API keys and smart contracts. Every extra link in that chain is another place for attackers to dig.

Typical weak spots include:

- Keys stored in plain text or shared too widely

- Flaws in contract code, upgrade paths, or oracles

- Phishing campaigns aimed at users who lean on “set-and-forget” tools

Once a breach happens, it often hits several accounts at once, and clawing funds back from decentralized systems is rare.

🧑⚖️ Regulatory Uncertainty

Lawmakers and regulators are still figuring out how to treat automated strategies, data-heavy tools, and the tokens tied to them. Rules around investor protection, market abuse, and licensing keep shifting.

That leaves room for sudden surprises: exchange delistings, new restrictions for certain regions, or enforcement actions against teams and products. A token that looked safe yesterday might fall into a gray area after a policy change, dragging prices and liquidity down with it.

🌐 Data Privacy and Bias Issues

These systems chew through enormous amounts of information—transaction histories, behavior patterns, and sometimes off-chain data sources. Poor handling of that data risks clashing with privacy laws such as GDPR or CCPA, which can force platform changes or even shutdowns.

Bias sneaks in through training data, too. If inputs tilt toward particular user groups, geographies, or asset types, outputs reflect that tilt. The result: skewed lending terms, risk scores, or trade ideas that quietly disadvantage some users while benefiting others.

Methodology: How We Ranked The Top AI Agent Cryptos

Knowing which AI agent crypto coins to buy can be daunting. We’ll now explain our methodology for ranking the top projects to watch.

Market Capitalization – 25%

No two investors have the same financial goals and risk tolerance. Market capitalization is an important metric to consider in this regard. Some AI agent crypto projects already boast large valuations, reducing volatility risks and ensuring sufficient liquidity in the market.

For instance, Virtuals Protocol and Artificial Superintelligence Alliance were both worth several billion dollars at their peak. These projects could be suitable for more risk-averse investors. Conversely, many top AI agent coins have market capitalizations of sub-$100 million.

These projects will possess wilder pricing swings but also the potential to target bigger gains. Understanding your personal risk-reward threshold is important before investing.

Efficacy of Use Case – 25%

The use cases for AI agents, in general, are limitless. Almost all sectors and industries could benefit from this innovative technology. However, this doesn’t always translate to a viable investment prospect, especially in the crypto trading markets. Therefore, we focused on projects with high efficacy, meaning they work in the real world (not just in a well-written whitepaper).

For example, AI agents are already widely used in the DeFi markets. From high-frequency trading to yield optimization, DeFi will be one of the most promising use cases for AI agent coins. After all, it offers a real solution to a billion-dollar market. Traders can not only make smart decisions but in a fully automated way.

Conversely, AI agents in the metaverse investment and crypto space have low efficacy. While AI agents certainly have the technical capabilities to identify strong markets, the metaverse land niche is too illiquid. Land plot prices continue to decline, with sellers vastly outnumbering buyers.

Level of Adoption – 25%

Our research methodology also assessed adoption levels, a key factor in any high-growth market. Adoption shows that real people are actually using the respective AI agent. This increases transaction activity and ensures the project generates revenue, typically through network, marketplace, or deployment fees.

Projects with fast-growing adoption rates (like Virtuals Protocols) can mean increased demand for the native cryptocurrency. This creates hype, encouraging more people to invest.

Future Potential – 25%

AI crypto coins are a nascent niche, so knowing the market potential is challenging. Even so, we focused on projects with the right fundamentals for long-term term growth. This means organic price appreciation over time, rather than quick pumps because of hype, FOMO, or speculation.

All of the projects discussed earlier have solid use cases, growing adoption rates, and innovative roadmap targets. The key differentiator is market capitalization, so you’ll need to choose projects based on your appetite for risk.

Conclusion

AI agents are more than just a buzzword. Blockchain and Web 3.0 ecosystems are being revolutionized in many ways. It’s all about automation, with manual tasks like trading, analysis, and security now completely streamlined.

AI agent crypto tokens offer a way into this fast-moving corner of the market, but they also carry real risk. The sector is still young, and many projects may not last. Spreading exposure across several names with clear fundamentals—and only using money you can afford to lose—is a more balanced approach.

FAQs

What is an AI agent token?

What can you use AI agents for in crypto?

Can you use AI agents in crypto for free?

Are crypto AI agents beginner-friendly?

How can you start using AI agents in crypto?

Are crypto AI agents safe?

About Cryptonews

Our goal is to offer a comprehensive and objective perspective on the cryptocurrency market, enabling our readers to make informed decisions in this ever-changing landscape.

Our editorial team of more than 70 crypto professionals works to maintain the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re looking for breaking news, expert opinions, or market insights, Cryptonews has been your go-to destination for everything cryptocurrency since 2017.