9 Cryptos With The Lowest Transaction Fees in 2026

Cryptocurrencies with the lowest transaction fees include Solana, Sui, and Sonic, and some blockchains like Nano and Iota, which have zero transaction fees. Whether you’re transferring funds, making payments, or engaging in decentralized finance (DeFi) trading, finding the cheapest crypto to transfer can significantly reduce your transaction costs.

In this article, we explore the cryptos with the lowest transaction fees in 2026, the different types of fees, and how you can reduce your transaction fees.

- In This Article

-

- 1. Nano (XNO) - Cheapest Crypto to Transfer With $0 Fees

- 2. IOTA (IOTA) - Internet of Things (IoT) Crypto With $0 Fees

- 3. SONIC (S) - High-Speed Spiritual Successor to Fantom Blockchain

- 4. Solana (SOL) - Top 10 Crypto With Fee of $0.00025 per Transaction

- 5. Dogecoin (DOGE) - World’s Largest Meme Coin With $0.045 Fee

- 6. XRP (XRP) - $145.32B Market Cap Crypto Charging $0.0014 per Transaction

- 7. Litecoin (LTC) - Low-Cost Token With Fee of $0.003

- 8. Monero (XMR) - Privacy-Focused Crypto With a Low Fee of $0.0010

- 9. Sui (SUI) - Crypto With $10.03B Market Cap and Sub-Cent Fees

- In This Article

-

- 1. Nano (XNO) - Cheapest Crypto to Transfer With $0 Fees

- 2. IOTA (IOTA) - Internet of Things (IoT) Crypto With $0 Fees

- 3. SONIC (S) - High-Speed Spiritual Successor to Fantom Blockchain

- 4. Solana (SOL) - Top 10 Crypto With Fee of $0.00025 per Transaction

- 5. Dogecoin (DOGE) - World’s Largest Meme Coin With $0.045 Fee

- 6. XRP (XRP) - $145.32B Market Cap Crypto Charging $0.0014 per Transaction

- 7. Litecoin (LTC) - Low-Cost Token With Fee of $0.003

- 8. Monero (XMR) - Privacy-Focused Crypto With a Low Fee of $0.0010

- 9. Sui (SUI) - Crypto With $10.03B Market Cap and Sub-Cent Fees

- Show Full Guide

List of Coins With Lowest Gas Fees

So, what crypto has the lowest fees? Many cryptocurrencies have competitive transaction fees; however, in this guide, we will look at the top nine. Let’s dig deeper into the list of the best crypto with the lowest fees.

| Crypto | Symbol | Transaction Fee | Transaction Speed | Market Cap |

|---|---|---|---|---|

| Nano |  NANO +2.10% NANO +2.10% |

$0 | Instant | $78.18M |

| IOTA |  IOT 10.33% IOT 10.33% |

$0 | Instant | $456.43M |

| Sonic |  S +10.67% S +10.67% |

$0.0017 | 0.2 seconds | $151.47M |

| Solana | $0.00025 | 2.5 seconds | $51.36B | |

| Dogecoin | $0.045 | 1 minute | $14.66B | |

| XRP | $0.0014 | 4 seconds | $145.32B | |

| Litecoin | $0.003 | 2.5 minutes | $4.22B | |

| Monero |  XMR +6.45% XMR +6.45% |

$0.0010 | 2 minutes | $5.90B |

| Sui |  SUI +11.18% SUI +11.18% |

$0.006 | 0.4 seconds | $10.03B |

9 Cheapest Cryptos to Transfer – Lowest Gas Fees

Based on our findings, these are some of the most affordable cryptocurrencies to trade. They’re ideal for frequent transfers, cross-border payments, and everyday Web3 use without draining your balance on gas.

Below, we highlight nine networks that consistently offer fast, low-cost transactions and practical utility for budget-conscious crypto users.

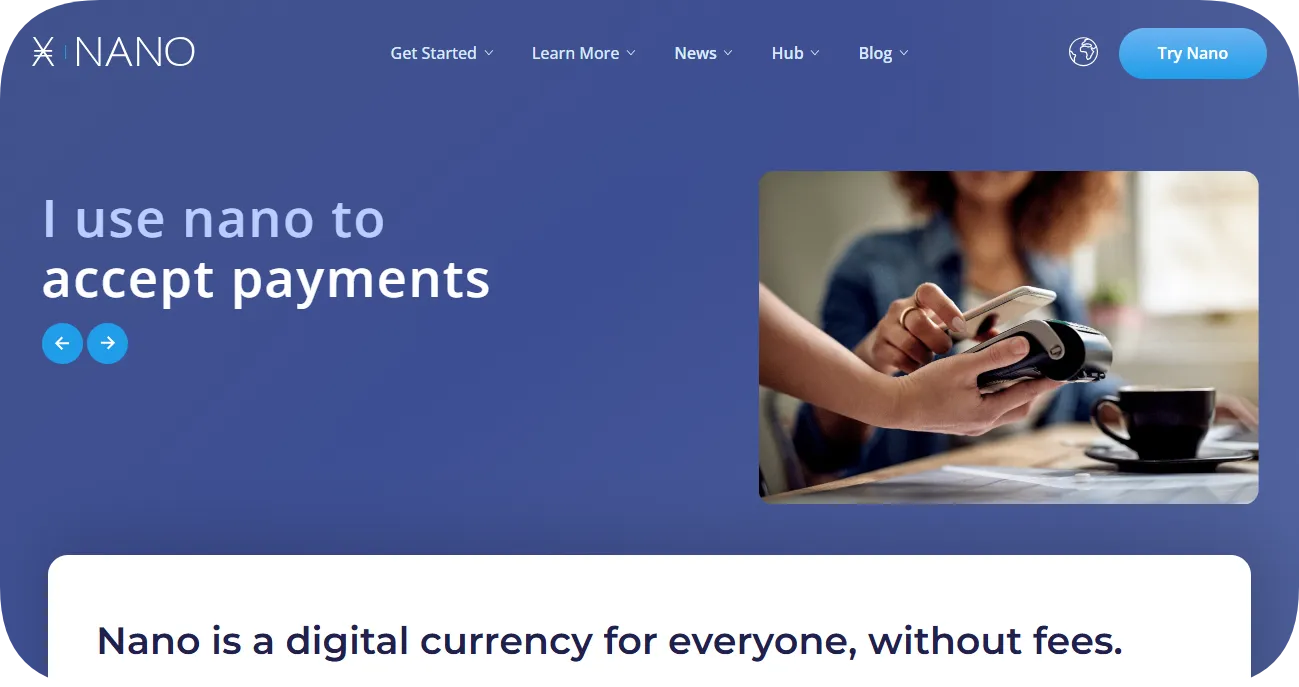

1. Nano (XNO) – Cheapest Crypto to Transfer With $0 Fees

Nano stands out as one of the best options for those seeking cryptocurrencies with no transaction fees. With its unique architecture, Nano offers zero transaction fees, making it an attractive choice for micro-transactions and everyday use. Nano’s instant transaction speed further enhances its usability, allowing for real-time payments without any cost.

Nano’s zero-fee model is particularly beneficial for users who need to make frequent transfers or small payments, as it reduces the cost barrier. The network’s efficiency and low energy consumption also contribute to its appeal, positioning Nano as a sustainable and cost-effective cryptocurrency.

Its commitment to providing fast, seamless transactions ensures its relevance in a market where transaction costs are a significant concern. The project’s Q1 2026 roadmap includes phased node upgrades to improve scalability on its current structure.

| Transaction Fee | $0 |

| Transaction Speed | Instant |

| Market Cap | $78.18M |

| 24-Hour Price Change |

2. IOTA (IOTA) – Internet of Things (IoT) Crypto With $0 Fees

Built specifically for the Internet of Things (IoT), IOTA has some of the lowest crypto transaction fees. Utilizing Tangle, a unique revolutionary distributed ledger technology, IOTA facilitates fee-less transactions and high scalability. This unique approach allows for secure and efficient machine-to-machine transactions, making it ideal for applications centered around IoT.

Its zero-fee structure makes it a cost-effective choice for various use cases, from everyday transactions to complex IoT operations. The IOTA Foundation introduced the “IOTA Rebased” proposal, which transitioned the network’s Layer 1 to a Move-based object ledger in 2025. This upgrade enhanced programmability, scalability, and decentralization, enabling over 50,000 transactions per second with sub-second confirmation times.

Concurrent with the Rebased proposal, IOTA launched a public testnet to allow developers and community members to experiment with the new features. The token is available on major exchanges like Binance and MEXC, providing easy access for users who want to buy IOTA tokens.

| Transaction Fee | $0 |

| Transaction Speed | Instant |

| Market Cap | $456.43M |

| 24-Hour Price Change |  IOT 10.33% IOT 10.33% |

3. SONIC (S) – High-Speed Spiritual Successor to Fantom Blockchain

Sonic is a high-performance, Layer 1, EVM blockchain. It is the spiritual successor to its predecessor, Fantom. It is similar to other Ethereum-compatible blockchains, offering smart contract functionality, but differs by offering sub-dollar fees and sub-second finality.

Sonic was originally the Fantom Foundation, the research company for the Fantom Network. It was rebranded to Sonic in December 2024, and the FTM token migrated to S. Holders were allowed to convert their FTM tokens to S at a 1:1 ratio. Sonic Labs, co-founded by Andre Cronje (Yearn Finance), maintains Sonic.

However, despite the rebranding and significant infrastructure upgrades, the S token has been steadily declining, currently trading at $0.047 versus $0.86 last year. While Sonic faces intense competition in the EVM space, it remains one of the networks with the lowest fees on the market.

| Transaction Fee | $0.0017 |

| Transaction Speed | 0.2 seconds |

| Market Cap | $151.47M |

| 24-Hour Price Change |

4. Solana (SOL) – Top 10 Crypto With Fee of $0.00025 per Transaction

Solana is known for being one of the lowest gas fee cryptos, costing close to $0.00025 per transaction. As a high-performance blockchain, Solana offers rapid transaction speeds, often completing transfers in approximately 2.5 seconds. Solana’s scalable architecture supports high throughput, making it suitable for decentralized applications (dApps) and large-scale blockchain projects.

The minimal transaction fees on Solana are a significant advantage, allowing users to perform numerous transactions without worrying about high costs. So far in 2026, Solana’s roadmap includes Alpenglow, a consensus and block propagation rewrite slated for early to mid-year.

Solana is available on major exchanges such as Binance and Coinbase, providing easy access for users. Robinhood announced the addition of SOL to its cryptocurrency trading platform for U.S. users, further enhancing accessibility.

| Transaction Fee | $0.00025 |

| Transaction Speed | 2.5 seconds |

| Market Cap | $51.36B |

| 24-Hour Price Change |

5. Dogecoin (DOGE) – World’s Largest Meme Coin With $0.045 Fee

Dogecoin, created as a joke in 2013 by software engineers Billy Markus and Jackson Palmer, has grown into one of the most popular cryptocurrencies in the market. Initially based on the popular “Doge” meme featuring a Shiba Inu dog, Dogecoin was intended to be a lighthearted and fun alternative to Bitcoin. However, its strong and enthusiastic community, coupled with high-profile endorsements from figures like Elon Musk, has propelled Dogecoin into the mainstream.

Despite its humorous origins, DOGE offers practical benefits for cryptocurrency users, particularly in terms of transaction costs. The average transaction fee for Dogecoin is approximately $0.04, making it an economical choice for small-scale and frequent transactions.

Following Donald Trump’s election victory, Dogecoin’s value witnessed a surge that was attributed to expectations of reduced regulation and Musk’s appointment to the DOGE department. Still, Dogecoin’s transaction fees remain attractive and among the lowest.

| Transaction Fee | $0.045 |

| Transaction Speed | 1 minute |

| Market Cap | $14.66B |

| 24-Hour Price Change |

6. XRP (XRP) – $145.32B Market Cap Crypto Charging $0.0014 per Transaction

XRP is renowned for its low fees, averaging roughly $0.0014 per transaction. Developed by Ripple Labs, XRP aims to facilitate fast and affordable cross-border payments, leveraging its high-speed blockchain technology. XRP’s focus on financial institutions and remittances makes it a key player in the payment processing sector.

The low transaction fees of XRP are a major benefit, allowing users to transfer funds quickly and cheaply. XRP’s transaction speed, typically around 4 seconds, further enhances its efficiency, making it a preferred choice for financial transactions.

Last year, the SEC concluded its lawsuit against Ripple, which sent XRP’s price into an uproar. Not long after, XRP received its first spot ETF. It has since made it onto the balance sheet of many companies that wish to hold it as a reserve asset in their digital asset treasuries.

| Transaction Fee | $0.0014 |

| Transaction Speed | 4 seconds |

| Market Cap | $145.32B |

| 24-Hour Price Change |

7. Litecoin (LTC) – Low-Cost Token With Fee of $0.003

Litecoin offers low transaction fees and is one of the cheapest cryptos to transfer between exchanges, costing nearly $0.003 per transaction. As one of the earliest cryptocurrencies, Litecoin was designed to provide fast and affordable payments, leveraging a simplified version of Bitcoin’s technology. Litecoin’s quick transaction times, typically around 2.5 minutes, make it a practical choice for everyday use.

The low transaction fees on Litecoin are a significant advantage, allowing you to transact without incurring high costs. Litecoin’s efficiency and speed make it an attractive option for users seeking a cost-effective cryptocurrency. Litecoin is available on most major exchanges, including Binance and Coinbase.

Technical analysis indicates a bullish trend for Litecoin, with a golden crossover between the 100-day and 200-day moving averages. This pattern suggests potential for continued price appreciation.

| Transaction Fee | $0.003 |

| Transaction Speed | 2.5 minutes |

| Market Cap | $4.22B |

| 24-Hour Price Change |

8. Monero (XMR) – Privacy-Focused Crypto With a Low Fee of $0.0010

Monero is known for its focus on privacy and low fees, with an average transaction fee starting from $0.0010. Designed to provide secure and anonymous transactions, Monero uses advanced cryptographic techniques to ensure user privacy. Monero’s commitment to privacy makes it a popular choice for users seeking confidentiality in their transactions.

Monero’s relatively low cryptocurrency transaction fees are an advantage, allowing users to transfer funds securely and affordably. Monero’s focus on privacy and security sets it apart from other cryptocurrencies, making it a unique option for users.

Recent data indicates a rise in Monero transactions, suggesting growing adoption and usage despite a brief incident of selfish mining, which many misinterpreted as a 51% attack. Still, Monero maintains a market capitalization of $5.90B, showcasing resilience.

| Transaction Fee | $0.0010 |

| Transaction Speed | 2 minutes |

| Market Cap | $5.90B |

| 24-Hour Price Change |  XMR +6.45% XMR +6.45% |

9. Sui (SUI) – Crypto With $10.03B Market Cap and Sub-Cent Fees

Mysten Labs created Sui, a high-throughput Layer 1 blockchain with a novel design. It is known for its association with the Aptos blockchain, both of which were started by engineers from Meta’s scrapped Diem blockchain project.

It uses a proof-of-stake (PoS) mechanism and introduces a dynamic price-setting mechanism to determine its. Moreover, users pay separate fees for storing data and execution. The native programming language of the Sui ecosystem is an altered version of Move, a language created by Meta.

Since its inception, Sui has made many strides, including creating stablecoins in combination with Ethena Labs, the launch of the AI agent platform, Surge, and an SEC-registered yield token launched by Figure on chain.

| Transaction Fee | $0.006 |

| Transaction Speed | 0.4 seconds |

| Market Cap | $10.03B |

| 24-Hour Price Change |  SUI +11.18% SUI +11.18% |

What Are Transaction Fees in Crypto?

Transaction fees in the crypto world are charges that users incur when they transfer digital assets from one address to another or when they trade on both centralized and decentralized exchanges. These fees are necessary to reward miners or validators who maintain and secure the blockchain ecosystem. Essentially, fees ensure that transactions are processed efficiently and that the network remains robust and reliable.

Cryptocurrency transaction fees vary significantly depending on the cryptocurrency and the network’s current demand. High transaction fees can be a deterrent for users, especially during periods of heavy network congestion. Understanding the different types of fees and how to manage them can help users minimize costs and make the most of their crypto transactions.

Different Types of Crypto Transaction Fees

There are various types of fees in crypto, from gas fees to the cost of trading, depositing, and withdrawing, and more. It is important to be aware of them and how exactly they are incurred.

Gas Fees

Gas fees are specific to blockchain networks like Ethereum. These fees are paid to miners who validate and process transactions on the network. Gas fees can vary depending on network usage and the complexity of the transaction.

For instance, simple transfers might incur lower gas fees, while more complex smart contract interactions require higher fees. IOTA and NANO are two of the cheapest gas fee cryptos. To minimize transaction costs on higher-fee chains, such as Ethereum, use a gas fee live tracker and calculator.

![]()

Trading Fees

Trading fees are charged by cryptocurrency exchanges whenever a user buys or sells digital assets. These crypto exchange fees are typically a percentage of the transaction amount and can vary from one crypto exchange to another.

Some exchanges, like Coinbase, offer lower fees for high-volume traders or users paying trading fees with the platform’s native token. It is also one of the cheapest ways to send Bitcoin.

Network Fees

Network fees are transaction costs imposed by the blockchain network. They are necessary to maintain the network’s security and efficiency.

For example, Bitcoin’s network fee compensates miners for the computational power used to verify transactions and add them to the blockchain. One of the cheapest blockchain networks is Solana. It’s worth noting that gas fees are a type of network fee imposed by EVM chains like Ethereum.

Exchange Withdrawal Fees

A withdrawal fee is charged when users transfer their assets from a crypto exchange to an external wallet or bank account. These fees can vary widely between crypto exchanges and depend on the cryptocurrency being withdrawn. Some exchanges offer fee discounts for high-volume withdrawals or for using certain cryptocurrencies. Binance has some of the most competitive withdrawal rates, charging 0.01 for SOL withdrawals.

How to Reduce Crypto Transaction Fees

Those who have experience participating in crypto trading will have picked up some tips on how to lower transaction costs. This isn’t often the case for beginners, who usually learn the hard way. However, let’s go through some of these tips with you.

Trade on Centralized Exchanges (CEXs)

Centralized exchanges (CEXs) often offer lower transaction fees compared to decentralized platforms because trading happens inside their internal databases. Some even offer zero transaction fees for certain cryptocurrencies. By using centralized exchanges for trading, users can benefit from reduced costs, particularly for high-volume transactions.

Additionally, some exchanges offer fee discounts for using their native tokens or for holding a certain amount of the token. You should factor in the withdrawal fees if you need to transfer to your wallet outside of the exchange, however.

Binance offers fees of 0.1% for regular users with trading volume under $1M, as well as low withdrawal fees.

Use Layer 2 Networks

Layer 2 networks are built to improve the level of scale and efficiency of blockchain transactions. By conducting transactions on Ethereum Layer 2 projects like Polygon or Optimism, users can significantly reduce fees while still benefiting from the security of the underlying blockchain.

Avoid Transfers During High Trading Activity

Cryptocurrency transaction fees can spike during periods of high network activity and volatility. To minimize these costs, try to avoid transferring assets during peak times in the market. Monitoring network congestion and choosing off-peak hours for transactions can lead to lower fees.

Select a Slower Transaction Speed

Many wallets, like Metamask, allow you to choose their transaction speed or priority. Opting for a slower transaction speed can result in a lower transaction fee, although it means the transaction will take longer to process. This option is beneficial for users who are not in a hurry to complete their transactions and want to save on costs.

Which Networks Have the Highest Transaction Fees?

Certain blockchain networks are notorious for their high transaction fees, with Ethereum being the most well-known example. High fees on these networks are often a result of network congestion and the computational complexity of transactions. Users might find it worthwhile to avoid these networks during peak times or consider alternatives with lower fees.

| Network | Transaction Fees (2026) | Transaction Speed | Coins Available |

| Ethereum | $0.15 – $12 | 15 seconds | ETH, ERC-20 tokens |

| Bitcoin | $0.51 – $0.18 | 10 minutes | BTC |

| Binance Smart Chain | $0.03 – $0.30 | 3 seconds | BNB, BEP-20 tokens |

| Arbitrum | $0.01 – $0.08 | 0.25 seconds | ERC-20 tokens |

| Litecoin | $0.003 | 2.5 minutes | LTC |

Lowest-Fee Exchanges (Trading Fees)

Even if a coin is cheap to move on-chain, your costs can spike up at the exchange level. This is why trading fees matter, especially if you buy and sell often. In 2026, these platforms stand out for keeping maker/taker fees competitive:

- Binance: Still one of the cheapest large exchanges, as it has a base trading fee of 0.1% that drops further down to 0.075% if you pay using BNB.

- Kraken Pro: It uses a volume-based fee model that has entry-level maker fees higher than Binance, but they fall as your monthly trading volume increases, which is perfect for frequent traders.

- MEXC: It’s known for aggressive fee promotions with some spot pairs running with zero maker fees, posing a suitable option for fee-sensitive traders.

- Coinbase One: The standard Coinbase fees are high, but the subscription ($29.99/mo) flips that as it allows users to pay a flat monthly fee and trade up to a certain capped amount with zero trading fees.

Conclusion

Understanding transaction fees in the crypto space is crucial for efficient and cost-effective trading. By familiarizing themselves with the types of fees and adopting strategies to minimize them, users can make the most of their cryptocurrency transactions.

While coins such as NANO and IOTA can have transaction fees as low as $0, there are a range of other major coins with respectably low transaction fees. These include giants such as Solana, Dogecoin, and XRP.

FAQs

Which crypto coin has the lowest transaction fees?

What is the cheapest crypto to transfer?

What is the cheapest way to send Bitcoin?

What is the cheapest blockchain?

Are there any cryptos with no transaction fees?

References

- Coinbase lowers fees for high-volume traders (Financial Times)

- Ethereum launches solution to fix high gas fees (Fortune)

- Tether boosts crypto liquidity: $3B in USDT minted across ETH and TRX (AMB Crypto)

- WisdomTree capitalizes on XRP’s momentum and launches an ETP for this asset in Europe (CincoDías)

- Dogecoin spikes after Trump announces a Department of Government Efficiency — DOGE (CNBC)

- Bitcoin Cash Paints 50% Rally Setups As Rival Bitcoin Nears $100,000 (FXEmpire)

- Bitcoin Cash (BCH) Sees Spike in Active Addresses (CCN)

About Cryptonews

Our goal is to offer a comprehensive and objective perspective on the cryptocurrency market, enabling our readers to make informed decisions in this ever-changing landscape.

Our editorial team of more than 70 crypto professionals works to maintain the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re looking for breaking news, expert opinions, or market insights, Cryptonews has been your go-to destination for everything cryptocurrency since 2017.