Top 10 Crypto-Related Stocks to Buy in 2026

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships. However, this potential compensation never influences our analysis, opinions, or reviews. Our editorial content is created independently of our marketing partnerships, and our ratings are based solely on our established evaluation criteria. Read More

- In This Article

-

- 1. Coinbase Global (COIN) - Top Crypto Exchange Stock

- 2. Block (XYZ) - Fintech Merchant Services

- 3. Strategy (MSTR) - Software and Digital Asset Treasury Company (Formerly Microstrategy)

- 4. Paypal Holdings (PYPL) - Online Payment Platform and Digital Wallet

- 5. Riot Platforms (RIOT) - Top Bitcoin Mining and Engineering Company

- 6. Canaan (CAN) - the First ASIC Miner Manufacturer

- 7. Bullish (BLSH) - Top Institutional Crypto Exchange

- 8. MARA Holdings (MARA) - Top Crypto Exchange Stock

- 9. Robinhood Markets (HOOD) - Top Crypto Exchange Stock

- 10. Hut 8 (HUT) - Top Crypto Exchange Stock

- In This Article

-

- 1. Coinbase Global (COIN) - Top Crypto Exchange Stock

- 2. Block (XYZ) - Fintech Merchant Services

- 3. Strategy (MSTR) - Software and Digital Asset Treasury Company (Formerly Microstrategy)

- 4. Paypal Holdings (PYPL) - Online Payment Platform and Digital Wallet

- 5. Riot Platforms (RIOT) - Top Bitcoin Mining and Engineering Company

- 6. Canaan (CAN) - the First ASIC Miner Manufacturer

- 7. Bullish (BLSH) - Top Institutional Crypto Exchange

- 8. MARA Holdings (MARA) - Top Crypto Exchange Stock

- 9. Robinhood Markets (HOOD) - Top Crypto Exchange Stock

- 10. Hut 8 (HUT) - Top Crypto Exchange Stock

- Show Full Guide

Best Crypto Stocks to Buy Compared

By our analysis, the best crypto stocks to buy span multiple sectors. We evaluated our list based on a multitude of factors, including earnings, revenue, holdings, number of users, and more.

| Stock | Sector | Price | 24h Price Change |

| Coinbase Global (COIN) | Crypto Exchange | $166.02 | +1.03% |

| Block (XYZ) | Blockchain | $50.80 | +2.01% |

| MicroStrategy (MSTR) | Investment | $128.67 | -3.89% |

| PayPal Holdings (PYPL) | Payments | $40.81 | +1.29% |

| Riot Platforms (RIOT) | Mining | $14.65 | -3.75% |

| Canaan (CAN) | Mining | $0.46 | -7.26% |

| Bullish (BLSH) | Crypto Exchange | - | - |

| MARA Holdings (MARA) | Mining | $7.51 | -5.18% |

| Robinhood Markets (HOOD) | Trading Platform | $75.44 | -0.70% |

| Hut 8 (HUT) | Mining | $52.94 | -1.73% |

Top 10 Crypto Stocks Reviewed

The top crypto stocks are stacked with a lineup of the best companies, according to their respective sectors. These include exchanges, mining, investment companies, and more.

1. Coinbase Global (COIN) – Top Crypto Exchange Stock

Coinbase is a U.S.-based cryptocurrency exchange that serves users domestically and globally. It operates a brokerage, custodial, and merchant service, and has a suite of products and tools for developers to build on-chain.

Coinbase is currently trading at $166.02, with a change of +1.03% in the last 24 hours. The company went public in 2021 through a direct listing on the Nasdaq, and had a reference price of $250. By the end of the day, COIN closed at $328.28 and reached an initial market cap of $85.8 billion.

In Q2 2025, Coinbase earned $1.5 billion in revenue and $1.4 billion in net income. Its Base blockchain remains one of the top Layer 2 chains with the second-highest total value locked (TVL).

| Crypto Stock | Coinbase Global |

| Current Price | $166.02 |

| 24h Price Change | +1.03% |

| 52-Week High | $444.65 |

| 52-Week Low | $139.36 |

| Daily Trading Volume ($) | 16.4M |

2. Block (XYZ) – Fintech Merchant Services

Twitter co-creator Jack Dorsey co-founded Block in 2009, initially under the name Square. Block is a fintech company that provides financial services through its subsidiaries. Some of its investors include Goldman Sachs, JPMorgan Chase, and Visa.

Block owns a suite of fintech businesses, the most popular include Square, Cash App, Afterpay, and Tidal. However, a majority of Block’s income comes from Square and Cash App, to the tune of 99%.

Block’s co-founder, Jack Dorsey, is also a famous Bitcoin maximalist and has strategically positioned it and its subsidiaries, like Square and Cash App, to integrate Bitcoin into everyday transactions. In Q3 2025, Block made $2.14 billion in revenue from Bitcoin. This equated to about 35% of its total revenue for that quarter.

| Crypto Stock | Coinbase Global |

| Current Price | $50.80 |

| 24h Price Change | +2.01% |

| 52-Week High | $85.55 |

| 52-Week Low | $44.27 |

| Daily Trading Volume ($) | 7.9M |

3. Strategy (MSTR) – Software and Digital Asset Treasury Company (Formerly Microstrategy)

Michael Saylor founded MicroStrategy in 1989 but rebranded it to Strategy in 2025. It is a software company that provides solutions for business intelligence (BI), analytics, and mobile applications. Thanks to its ambitious leader’s aggressive investment strategy, it is the largest corporate holder of Bitcoin.

Strategy was the first company to hold Bitcoin as its primary treasury reserve asset in 2020. It funds its aggressive Bitcoin acquisitions through debt and equity financing (i.e., convertible notes, senior secured notes, convertible preferred stock, and common stock).

Strategy holds 640,418 BTC (~ $71 billion) with a total acquisition cost of about $47.3 billion and an average cost of $74,010 per BTC.

| Crypto Stock | Strategy |

| Current Price | $128.67 |

| 24h Price Change | -3.89% |

| 52-Week High | $457.22 |

| 52-Week Low | $104.17 |

| Daily Trading Volume ($) |

4. Paypal Holdings (PYPL) – Online Payment Platform and Digital Wallet

PayPal is a money service business (MSB) that allows you to:

- Send and receive money

- Utilize online and POS merchant services

- Manage transactions without directly accessing your bank account, debit, or credit cards

In 2023, PayPal made headlines when it launched the PYUSD stablecoin. Paxos issues and manages PYUSD, which has a market cap of $2.7 billion, and its redemption assets include cash (USD), U.S. Treasury bonds, and repurchase agreements.

PYPL has a trading volume of 20.1M, with a market cap of $48 billion. It ranks as number 307 in the largest companies by market cap.

| Crypto Stock | PayPal Holdings |

| Current Price | $40.81 |

| 24h Price Change | +1.29% |

| 52-Week High | $79.50 |

| 52-Week Low | $38.46 |

| Daily Trading Volume ($) | 20.1M |

5. Riot Platforms (RIOT) – Top Bitcoin Mining and Engineering Company

Riot Platforms is a prominent Bitcoin mining company. While most people recognize it as a large-scale Bitcoin miner, it also designs power distribution and custom electric products for various customers, like data centers.

Riot Platforms is one of the top three public Bitcoin companies by market cap (at $8.25 billion), and one of the top 10 companies by hash rate. In Q2 2025, it made approximately $495.3 million in adjusted EBITDA.

In mid-2025, the company made headlines when it expanded its credit facility with Coinbase Credit, increasing its Bitcoin-backed credit line to $200 million. It has also expanded its total acreage to 858 acres, owing much to its Corsicana facility, and completed its acquisition of Rhodium Assets.

| Crypto Stock | Riot Platforms |

| Current Price | $14.65 |

| 24h Price Change | -3.75% |

| 52-Week High | $23.94 |

| 52-Week Low | $6.19 |

| Daily Trading Volume ($) | 15.3M |

6. Canaan (CAN) – the First ASIC Miner Manufacturer

Canaan is a leading Bitcoin miner manufacturer that shipped the world’s first ASIC Bitcoin miner in 2013 under the brand name Avalon. It completed its IPO in 2019 on the Nasdaq Global Market after previous attempts in Hong Kong and China were unsuccessful.

In October 2025, Benchmark announced that it would maintain coverage of CAN and rated it as a Buy recommendation. Shortly thereafter, Canaan announced an at-the-market equity offering program to sell up to $270 million worth of shares, hinting at a likely expansion.

Canaan made a gross profit of $9.3 million in the second quarter of 2025. This constituted a significant increase from the previous quarter and from the same time in the previous year.

| Crypto Stock | Canaan |

| Current Price | $0.46 |

| 24h Price Change | -7.26% |

| 52-Week High | $2.22 |

| 52-Week Low | $0.46 |

| Daily Trading Volume ($) | 17.5M |

7. Bullish (BLSH) – Top Institutional Crypto Exchange

Bullish Group is a holding company that owns a global cryptocurrency exchange (Bullish) and owns the crypto media company Coindesk. The exchange brands itself as a regulated trading venue for institutional investors, supports over 100 assets, and has a total trading volume exceeding $1.5 trillion.

Stock data not found for symbol: BLSH

The Bullish exchange prides itself on security. It is audited by Deloitte, segregates its assets from its business operations, and holds a majority of its assets in cold storage. It is licensed and regulated in:

- U.S.

- Gibraltar

- Germany

- Hong Kong

Bullish (BLSH) debuted on the New York Stock Exchange (NYSE) in 2025 at nearly $13.2 billion. It priced its IPO at $37 but traded as high as $118 on the first day. As of February 2026, it has a market cap of $8.19 billion.

| Crypto Stock | Bullish |

| Current Price | - |

| 24h Price Change | - |

| 52-Week High | - |

| 52-Week Low | - |

| Daily Trading Volume ($) | - |

8. MARA Holdings (MARA) – Top Crypto Exchange Stock

MARA is a digital technology and Bitcoin mining company. Formerly Marathon Digital Holdings, MARA was incorporated in the U.S. in 2010 and went public in 2011. Since then, it has grown to become one of the top five Bitcoin mining companies by market capitalization.

MARA’s current price is $7.51, with a daily trading volume of 40.6M. In Q2 2025, its Bitcoin holdings grew by 170% to over 50,000 BTC, making it the second largest corporate holder of Bitcoin.

In 2025, MARA announced strategic partnerships with Google-backed TAE Power Solutions and LG-backed PADO AI to codevelop platforms for next-generation AI infrastructure.

| Crypto Stock | MARA Holdings |

| Current Price | $7.51 |

| 24h Price Change | -5.18% |

| 52-Week High | $23.45 |

| 52-Week Low | $6.66 |

| Daily Trading Volume ($) | 40.6M |

9. Robinhood Markets (HOOD) – Top Crypto Exchange Stock

Robinhood is a U.S.-based brokerage that became extremely popular during the 2010s, due to its commission-free trading model. It became favored by investors, starting with only a few dollars. Robinhood also became infamous during the GME short squeeze, in which members of the wallstreetbets subreddit caused institutional investors to lose a lot of money.

At the end of Q2 2025, Robinhood had approximately 26.5 million funded customers. About 13% of these (3.48 million) were Robinhood Gold Subscribers. Robinhood’s total platform assets are $304 billion.

HOOD is trading at $75.44, with a 24-hour price change of -0.70%. It has a market cap of $127.2 billion and a trading volume of 29.4M.

| Crypto Stock | Robinhood |

| Current Price | $75.44 |

| 24h Price Change | -0.70% |

| 52-Week High | $153.86 |

| 52-Week Low | $29.66 |

| Daily Trading Volume ($) | 29.4M |

10. Hut 8 (HUT) – Top Crypto Exchange Stock

Hut 8 is an energy infrastructure platform. It uses its power to support Bitcoin mining, hosting, data centers, and other businesses in various parts of North America. Hut 8 was formed through the merger of Hut 8 Mining Corp. and U.S. Data Mining Group, Inc. in 2023.

Hut 8 has a collective capacity of 1,020 megawatts of energy across fifteen sites in the U.S. and Canada. In Q2 2025, it had an EBITDA of $221.2 million, a net income of $137.5 million, and revenue of $41.3 million.

The current price of HUT sits at $52.94, constituting a change of -1.73% from the previous day. It has a market cap of $5.26 billion and a daily trading volume of 2.8M.

| Crypto Stock | Hut 8 |

| Current Price | $52.94 |

| 24h Price Change | -1.73% |

| 52-Week High | $66.07 |

| 52-Week Low | $10.04 |

| Daily Trading Volume ($) | 2.8M |

What is a Crypto-Related Stock?

Crypto-related stocks are securities that have direct or indirect exposure to cryptocurrency through their underlying companies. With direct exposure, the underlying company owns the asset (crypto) or earns revenue from crypto activity (like staking or mining); conversely, indirect exposure is when the company holds an asset that has direct exposure, or the company’s performance is partly driven by crypto activity.

The most obvious examples of crypto-related public companies include Strategy, Coinbase, and Robinhood. Some of the less obvious examples of crypto-related companies are:

- Advanced Micro Devices (AMD): A technology company that produces computer processors. Mining companies use processors to create ASICs.

- Tesla (TSLA): Manufacturer of electric vehicles and clean energy-related products. It has one of the largest corporate Bitcoin reserves.

- Trump Media and Technology Group (TMTG): A media and technology company that operates the Truth Social platform, created by U.S. President Donald Trump. It holds a significant amount of Bitcoin.

- GameStop (GME): A video game and consumer electronics retailer, famously known for the GME short squeeze. It also invests in Bitcoin.

In most of these examples, the company directly holds cryptocurrency. However, AMD is an example of a public company that does not directly produce revenue from or hold crypto.

Many proof-of-work cryptocurrencies depend on application-specific miners, which depend on processors. Because AMD manufactures processors, part of its performance, albeit minimally, depends on cryptocurrency activity, thereby making it a crypto-related company.

Crypto Stocks Vs Crypto Etfs: What’s the Difference?

A crypto-related stock is a type of security that represents a share of ownership in a crypto-related company. Any public company that directly holds, sources a significant amount of its revenue from cryptocurrency, or supports cryptocurrency operations or businesses is a crypto-related public company. Examples include Robinhood (HOOD) and Hut 8 (HUT).

Crypto exchange-traded funds (ETFs) are financial products designed for trading on stock exchanges that hold or track a basket of underlying assets. These assets can be stock, bonds, commodities, or, in our case, crypto. They allow investors to gain exposure to those assets without directly owning them.

What Types of Crypto Stocks Are There?

Crypto stocks come in many different “flavors.” We can break them down into six of the following categories:

Crypto Stock TypeExample CompaniesCrypto ExposureRisk

| Exchanges & Brokerages | Coinbase (COIN) | High | High |

| Blockchain Technology | Block (XYZ) | Moderate | Medium |

| Crypto Payments | Paypal (PRPL) | Moderate | Low |

| Bitcoin Mining | Canaan (CAN) | Very High | Very High |

| Hardware Infrastructure | Nvidia (NVDA) | Low | Medium |

| Crypto Investment | MicroStrategy (MSTR) | Very High | Very High |

🏛️ Crypto Exchanges & Brokerages

In layman’s terms, crypto exchanges and brokerages are where you go to buy or trade cryptocurrency. Think of the New York Stock Exchange (NYSE) or WeBull, but specifically for cryptocurrency.

- Robinhood (brokerage)

- Binance (exchange)

🧊 Blockchain Technology

Any company that creates blockchain technology can be considered a part of the blockchain technology sector. Typically, research companies dominate this sector, like Ripple Labs and Offchain Labs, but other companies can fit this classification as well.

- Block

- Square

⛏️ Bitcoin Mining

In crypto, Bitcoin mining is a process where you check if transactions are valid and provide security for the entire blockchain. Not only is the process profitable, but many companies build their business models around it. Bitcoin mining companies are the most profitable of all mining companies in cryptocurrency.

- Riot Platforms

- Marathon Digital Holdings

💳 Crypto Payments

Crypto payment companies are what you call money service businesses. These are non-bank institutions that provide financial services, like transferring money or facilitating payments for businesses.

- PayPal

- Cash App

💻 Hardware Infrastructure

Companies that build physical devices or electronic goods for manufacturers in the tech industry occupy the hardware infrastructure sector. The defining quality of these companies is that their services are not typically consumer-facing.

- Nvidia

- Advanced Micro Devices (AMD)

📈 Crypto Investment

Crypto investment companies are businesses that invest in cryptocurrency as a business model. While some companies may passively hold crypto, these companies actively manage their portfolio and implement strategies to generate revenue.

- Strategy (formerly MicroStrategy)

- Galaxy Digital

How to Choose the Best Crypto Stocks to Buy

Investing in stocks is unlike investing in cryptocurrency — even if the stocks are crypto-related. If you want to choose the best crypto stocks, you will have to choose the type of exposure you want, check the valuation compared to competitors, research the revenue and profitability, and understand the key risks associated with the business.

Choose Type of Exposure (Direct Vs. Indirect)

When you are choosing which crypto stocks to buy, one common method that you can borrow from traditional equities investing is deciding whether you want direct or indirect exposure.

The “Trump brand” is a good example of this. Let’s say you want to invest in the Official Trump (TRUMP) token, but investing in cryptocurrency can be complicated if you’re new to the field or not very technical.

Setting up a wallet and securing it can be a real barrier to entry for new crypto users. You might not want direct exposure to the asset for fear of hacking, losing your private keys, or any other reason.

Therefore, you would invest in the Trump Media and Technology Group (TMTG) stock. As you can see, at least for the time being, TRUMP and TMTG often move alongside each other. Moreover, the “Trump brand” often moves with news about President Trump.

In this scenario, investing in TMTG would be indirect exposure to TRUMP, while TMTG is direct exposure to the company.

Check Valuation Compared to Competitors

Valuations estimate the worth of a company or asset. It is an important part of investing because it differentiates between whether a stock is good enough to invest in or the best one to invest in.

An investor might determine an asset’s worth and then compare it to its competitor. This will help them determine whether that asset is under- or overpriced. With valuations, you should:

- Understand how the market prices companies and then find bargains

- Remember that all valuations depend on assumptions

- Focus on intrinsic value more than comparing multiples (earnings, EBITDA, etc.)

As Aswath Damodaran writes in The Little Book of Valuation, “The intrinsic value of an asset is determined by the cash flows you expect that asset to generate over its life and how uncertain you feel about these cash flows.”

To put it simply, valuations look to the past to make hypotheses about the future, but the real skill is in judging how realistic those assumptions are.

Assess Revenue and Profitability

Analyzing a company’s revenue and profitability is relatively straightforward. The best way to do this is to check a company’s investor relations page on its website. There, you may find balance sheets, quarterly earnings, or even tax filings.

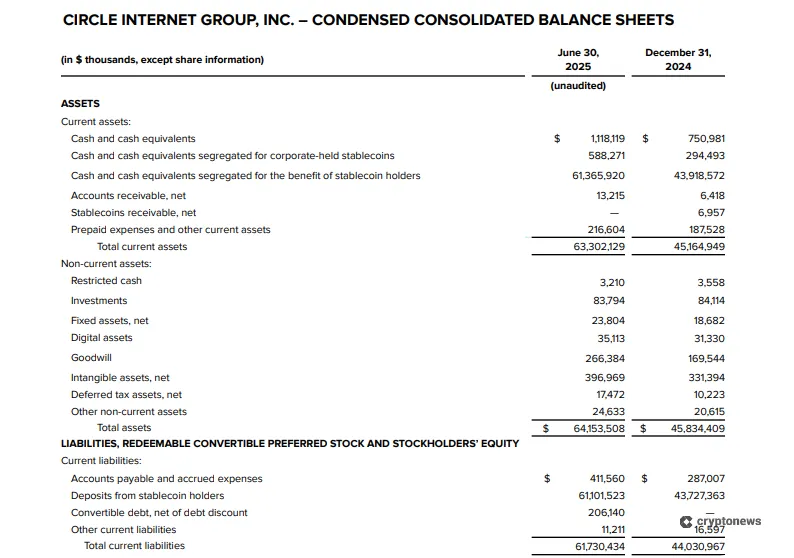

Below, you can see an example of Circle’s balance sheet. It is split up by assets and liabilities, and compares items between 2024 and 2025.

Rather than waiting for news coverage, you can see directly when the company is profitable, how many users it has, etc. You can use this information with new developments like laws or geopolitical events to understand how they will affect the company.

Understand that not all companies are transparent with their earnings. You may have to do some digging or rely on other sources.

Understand the Key Risks

Make no mistake, with every investment there is an associated risk. This is a broad topic to cover for every subsector of crypto-related companies. But, in general, here are some risks you should be aware of:

- Regulatory risk

- Correlates with equity markets (sensitive to monetary policy)

- Liability risks (particularly relevant to Bitcoin mining companies)

The biggest takeaway here is that you should remember, unlike decentralized protocols, crypto-related stocks are tied to companies with real-world costs. They go bankrupt, borrow money, lay off employees, and go belly up. Keep this in mind to understand the key risks.

How to Buy Crypto Stocks: Step-by-Step Guide

Investing in stocks is a simple process. We will show you how in five easy steps.

Step 1 — Pick an Exchange or Brokerage

Pick the trading venue where you would like to buy crypto stocks. For this demonstration, we will use Robinhood.

Many people use an exchange or brokerage on their mobile phones, tablets, or personal computer. Go to the mobile store on your device and download the app. Make sure you sign up to use its services.

Step 2 — Make a Deposit

Before you can trade, you will have to make a deposit. Most platforms support multiple forms of payment, such as debit/credit card, bank transfer, or even third-party payments. Ensure that you deposit enough to make your desired purchase amount.

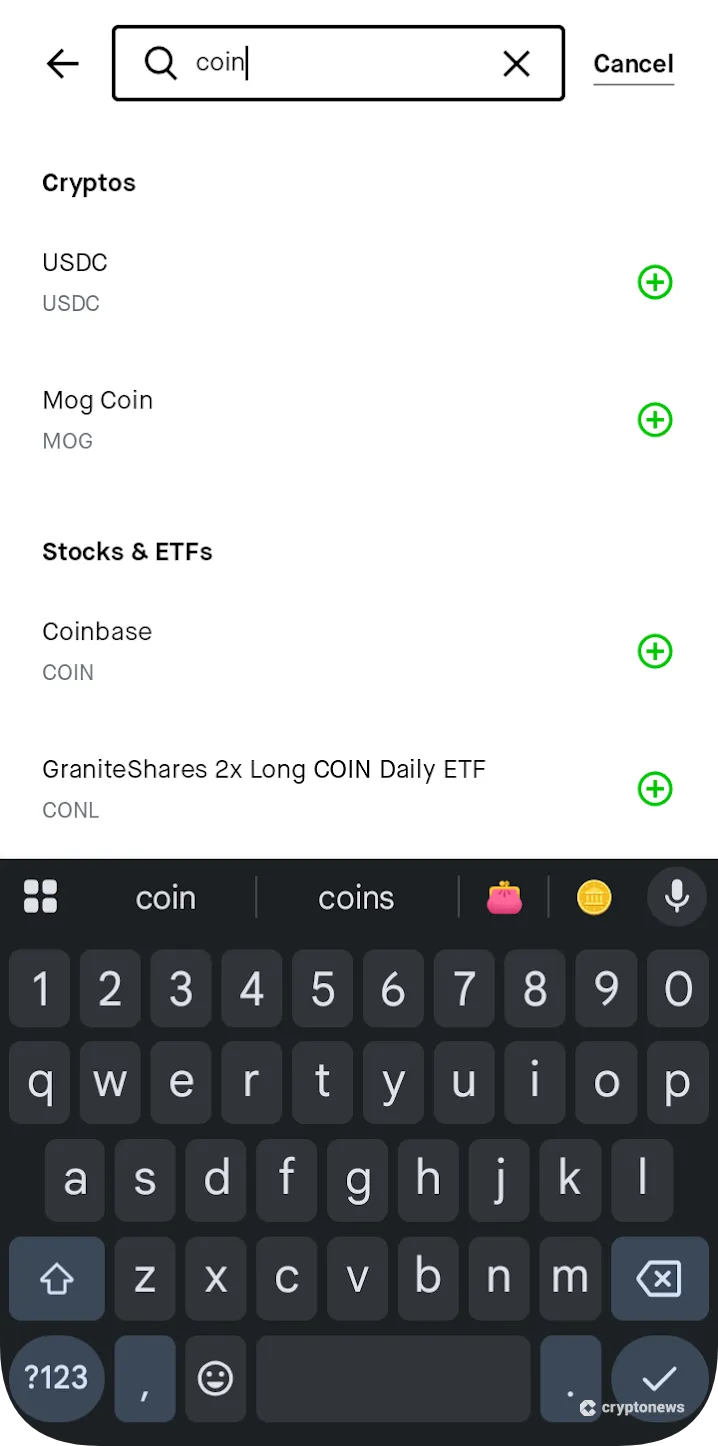

Step 3 — Search for a Crypto Stock

Look for a search bar on the screen. Type in your desired crypto stock and select it. In this example, we search for Coinbase (COIN).

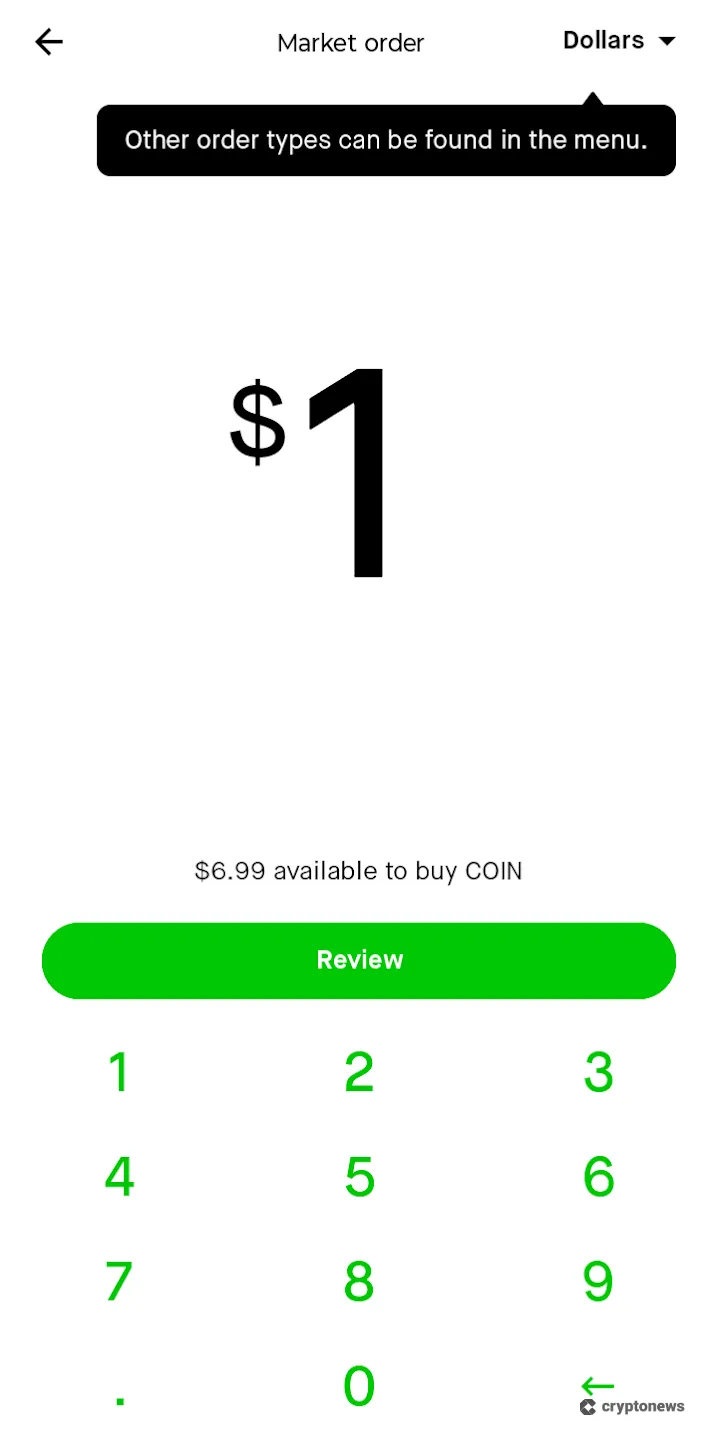

Step 4 — Pick an Amount to Buy

Select the quantity of stocks you would like to purchase. Most applications have a feature where you can set up recurring buys or limit orders. This way, you can automate your purchases or set strict limits on when to buy.

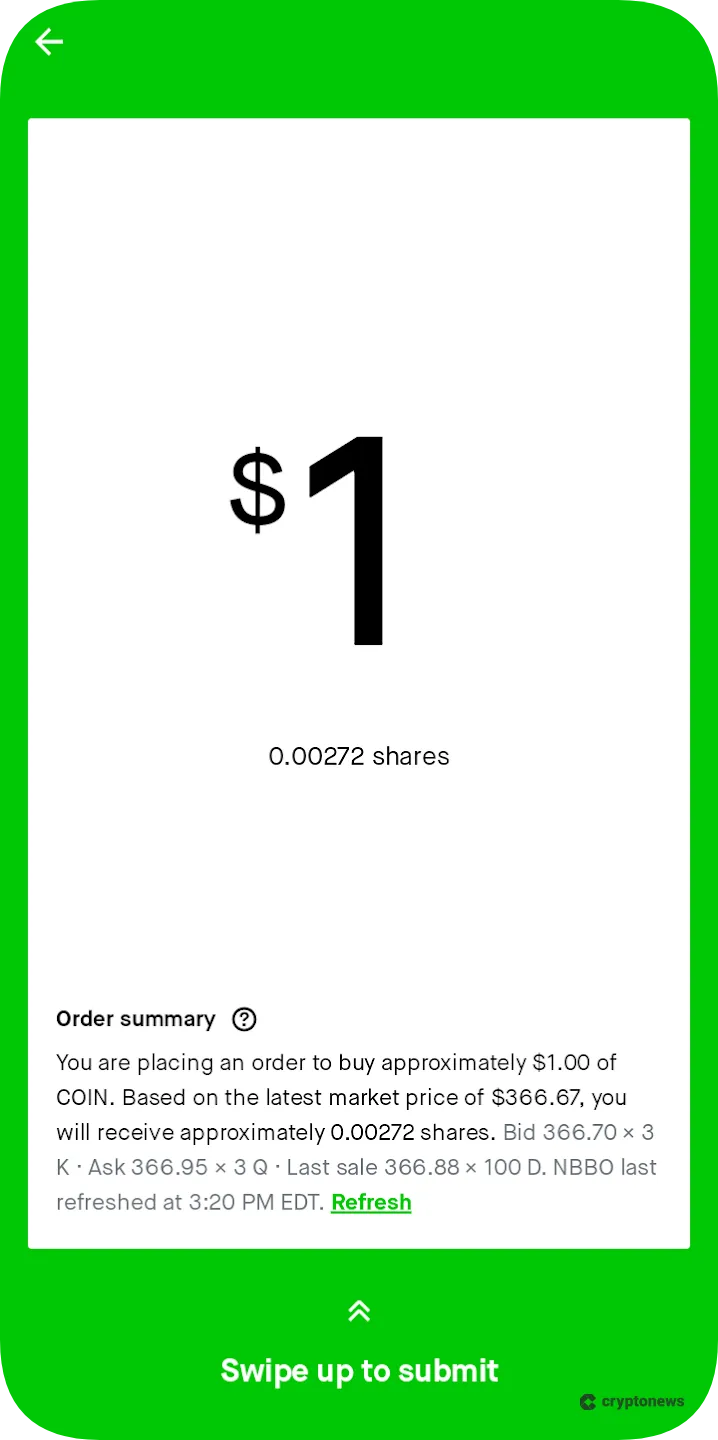

Step 5 — Confirm Your Order

Inspect your order to make sure everything is correct. After you finish, swipe up to complete your purchase.

Conclusion

Investing in crypto doesn’t have to feel intimidating — in fact, it doesn’t even have to involve buying crypto. You can gain exposure to the cryptocurrency market like a professional by investing in the best crypto stocks.

However, investing in crypto-related stocks is unlike investing in crypto; there is a different set of rules and best practices. When you do decide to invest, know that you can do so in a few easy steps. Nevertheless, always take the necessary precautions and do research before investing in any asset.

FAQs

What is the best crypto stock to buy right now?

Is it worth investing in crypto stocks?

Is investing in crypto stocks risky?

Where can I buy crypto stocks?

Why should I buy crypto stocks instead of normal cryptocurrency?

References

- Coinbase stock debuts on Nasdaq in direct listing (CNBC)

- Coinbase – Financials – Quarterly Earnings (Coinbase)

- Description of Block Inc’s Business Segments (CSIMarket)

- Bitcoin Purchases (Strategy)

- PayPal PYUSD Transparency Reports (Paxos)

- Riot Q2 2025 Earnings (Riot Platforms)

- Canaan Inc. Launches $270 Million ATM Program for North American Expansion (TipRanks)

- Benchmark Maintains Canaan Inc. – Depositary Receipt (CAN) Buy Recommendation (Nasdaq)

- MARA Investor Relations (MARA)

- Robinhood Investor Relations (Robinhood)

- Circle Internet Group — Quarterly Filings (Circle)

About Cryptonews

Our goal is to offer a comprehensive and objective perspective on the cryptocurrency market, enabling our readers to make informed decisions in this ever-changing landscape.

Our editorial team of more than 70 crypto professionals works to maintain the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re looking for breaking news, expert opinions, or market insights, Cryptonews has been your go-to destination for everything cryptocurrency since 2017.