7 Best Crypto Exchanges in Russia in 2026

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships. However, this potential compensation never influences our analysis, opinions, or reviews. Our editorial content is created independently of our marketing partnerships, and our ratings are based solely on our established evaluation criteria. Read More

The Russian government relies on cryptocurrencies to trade oil, so it’s no surprise the country has become a major hub for digital asset adoption. Citizens also increasingly turn to crypto to bypass international financial restrictions, especially with Visa, MasterCard, and other major payment providers having suspended services in Russia.

To help you out, we ranked and reviewed the best crypto exchanges in Russia. We tested over 50 platforms, and our core focus was security, RUB support, withdrawal limits, KYC requirements, and available markets. Our research shows that Best Wallet is the overall top option for Russian traders, while MEXC and Margex are also worth consideration.

Read on to learn what made these providers stand out and explore some excellent alternatives for various use cases.

The Top Russian Crypto Exchanges Compared

Consider these top platforms when choosing a crypto exchange in Russia:

| Exchange | Cryptos Supported | KYC Required? | RUB Deposits? | Best For |

| Best Wallet | 1,000+ | No | Yes | Overall best Russia crypto exchange |

| MEXC | 2,180+ | No | Yes | Accessing a wide range of crypto markets |

| Margex | 55 | No | No | Trading perpetual futures with leverage |

| Bybit | 720+ | No | Yes | Buying and selling crypto via P2P |

| KuCoin | 940+ | Yes | Yes | Beginners who want to invest small amounts |

| OKX | 340+ | Yes | No | Automated crypto trading with bots |

| BingX | 940+ | No | Yes | Users who want to avoid KYC requirements |

Best Russian Crypto Exchanges Reviewed

The following sections explore the top Russian exchanges in more detail, including their pros, cons, and core features. Read on to choose the best crypto exchange in Russia for 2026.

1. Best Wallet – Overall Best Russian Crypto Exchange

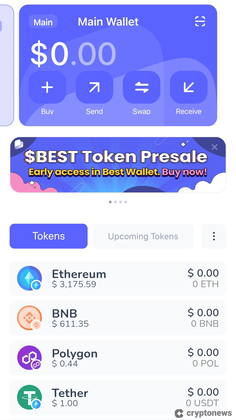

Best Wallet is our overall top pick — the decentralized app for iOS and Android offers an anonymous experience, so Russian traders can access the digital asset market without revealing their identity. The app offers a built-in gateway that supports RUB deposits, making it easy for Russian users to purchase cryptocurrencies with local payment methods and without paying high FX fees. The gateway also supports RUB withdrawals, a great option when cashing out crypto profits.

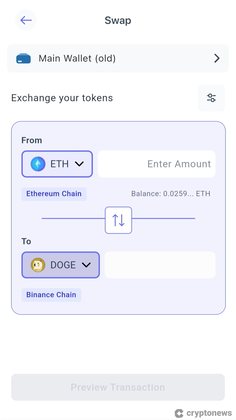

Users can also access a decentralized exchange (DEX) for instant token swaps. Over 1,000 markets are supported, including the best meme coins like Dogecoin (DOGE), Shiba Inu (SHIB), and Floki (FLOKI). The DEX aggregates exchange rates from hundreds of liquidity pools, which ensures users pay the lowest fees.

Best Wallet doubles as a non-custodial wallet that enables users to store their cryptocurrencies safely and away from centralized intermediaries. Security features include two-factor authentication and biometrics, and the wallet can be recovered via a unique backup passphrase. Russians can also invest in new cryptocurrencies on the Best Wallet Launchpad — it provides access to pre-vetted startups from multiple high-growth markets, including decentralized finance (DeFi) and artificial intelligence (AI) agents. If you’re interested in learning more about the provider, check out our in-depth Best Wallet review.

Best Wallet Key Takeaways

- The hybrid app offers a non-custodial crypto exchange and wallet in one safe place

- Buy and sell cryptocurrencies with RUB at competitive fees

- No KYC requirements are in place

Pros

- The overall best place to trade digital assets in Russia

- Purchase Bitcoin and altcoins with local payment types

- Instant token swaps via the built-in DEX aggregator

- The Launchpad provides access to brand-new cryptocurrencies

- The app doubles as a non-custodial wallet for safe storage

Cons

- Doesn’t offer perpetual futures or other leveraged products

- The team is still developing the browser extension

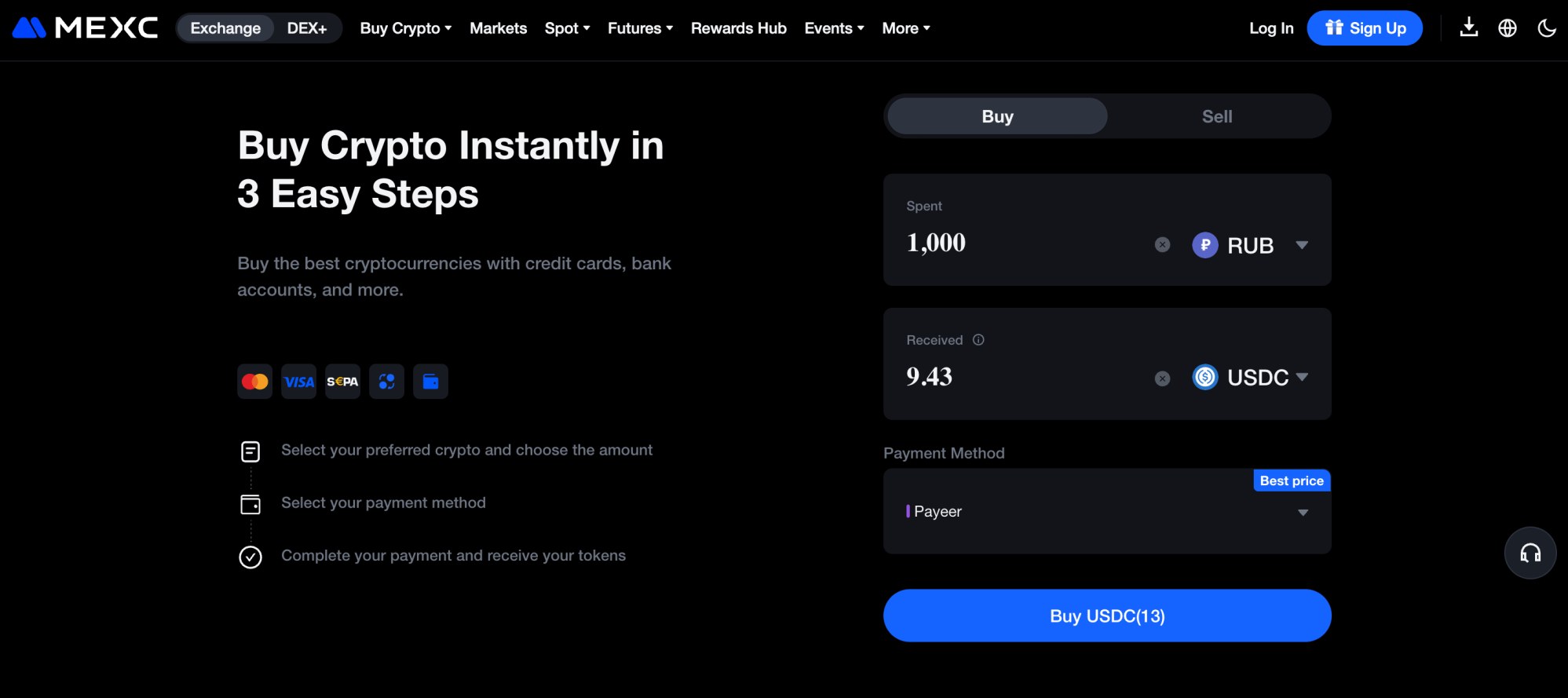

2. MEXC – Best Crypto Exchange in Russia for Supported Markets

MEXC is a global trading platform that supports over 2,100 coins, so it’s a great choice for Russians who want to build diversified portfolios in one safe place. The platform offers popular digital assets like Bitcoin, Ethereum, XRP, and Dogecoin, as well as new cryptocurrencies with small market capitalizations. MEXC also offers perpetual futures with leverage up to 400x, which allow long and short positions.

Russians easily deposit funds into their MEXC account — the exchange accepts instant RUB payments via Payeer, VTB Bank, T-Bank, and other local methods. No personal information or KYC documents are requested when users withdraw under 20,000 USDT daily or 100,000 USDT monthly.

The platform also ranks highly for fees — users who place limit orders avoid commissions entirely. While MEXC charges a small commission of 0.05% on market orders, it’s well below the industry average. Withdrawals are also cost-effective, with users paying just 0.00001 BTC when they cash out Bitcoin.

MEXC Key Takeaways

- Russians can buy crypto instantly in RUB

- The exchange supports over 4,000 digital asset markets

- No KYC requirements when users withdraw under $20,000 daily

Pros

- The best option for Russians who want access to diverse crypto markets

- Minimum deposit requirement of just 500 RUB

- Commissions start from 0%

- Crypto withdrawals are processed instantly

- Also offers peer-to-peer (P2P) services

Cons

- The platform operates without tier-one regulation

- Low-cap markets often have weak liquidity

3. Margex – Best Crypto Exchange in Russia for Trading Perpetual Futures

Margex is a good option for trading cryptocurrencies with leverage — the exchange specializes in perpetual futures. Russians can go long or short on 55 crypto markets, which offer profit potential in both bullish and bearish cycles. With futures contracts featuring a minimum margin requirement of just 1%, users can access 100x leverage. Markets with less liquidity carry higher margin demands, especially meme coins like Shiba Inu and Dogecoin.

The platform has a fixed pricing schedule that depends on whether you’re a market maker (limit orders) or a taker (market orders). While makers pay 0.019% per slide, takers are charged slightly more at 0.06%. Margex users also pay funding fees every eight hours, and specific charges depend on the position direction and leverage size.

The exchange’s main drawback is that RUB payments aren’t accepted. Russians can use traditional payment methods in other currencies or deposit crypto. Both options offer a KYC-free experience, with new customers only needing an email address to register. Be sure to read our detailed Margex review to decide if that’s the right platform for you.

Margex Key Takeaways

- Trade perpetual futures with leverage of up to 100x

- Go long or short on all supported markets

- Russians can’t directly deposit RUB

Pros

- Speculate on digital assets with a 1% margin requirement

- Allows users to profit from rising and falling prices

- Offers a user-friendly mobile app

- Also a top crypto exchange in Russia for copy trading

Cons

- Supports just 55 crypto markets

- Doesn’t have a spot trading exchange

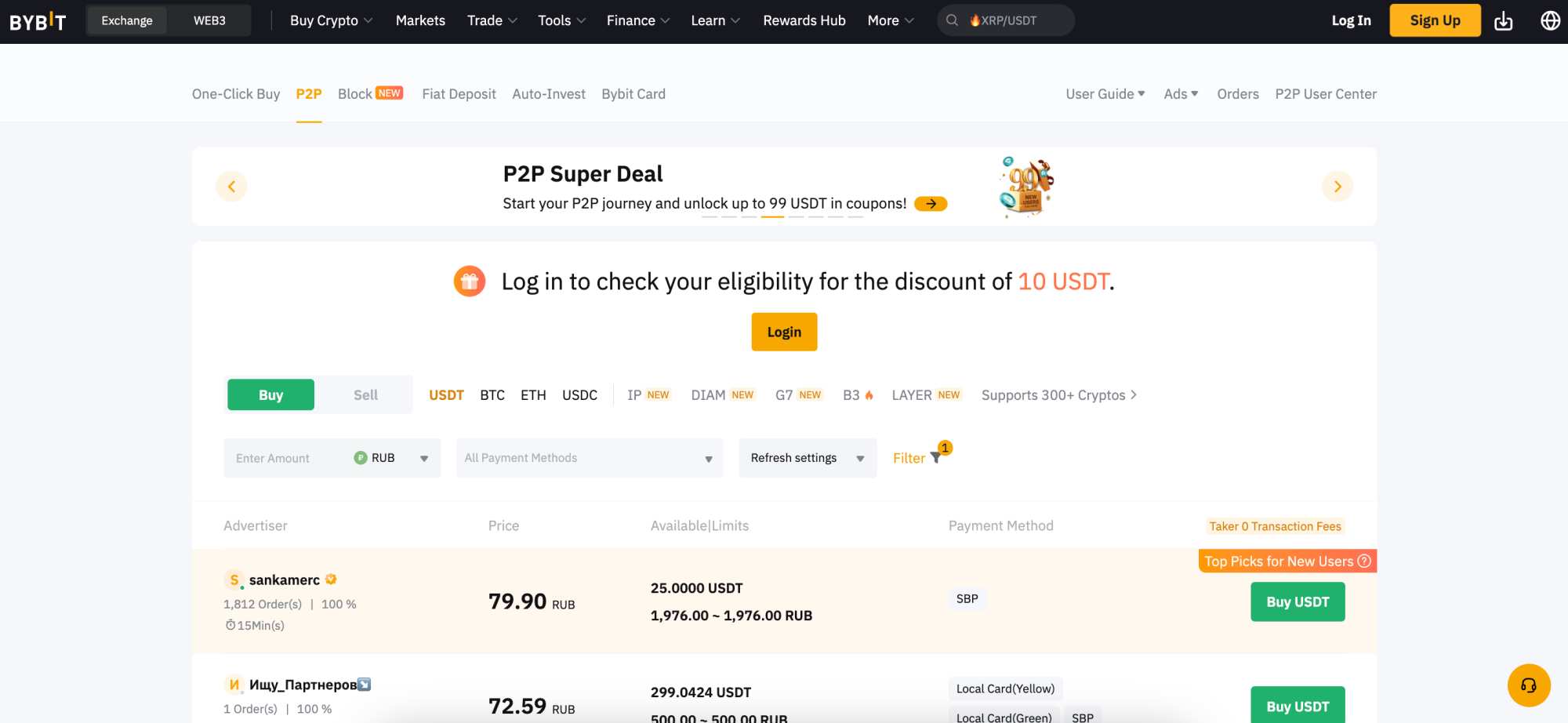

4. Bybit – Best Crypto Exchange in Russia for P2P Trading

Bybit is one of the largest crypto exchanges in the market — it has over 70 million users and handles billions of dollars in daily trading volumes. The exchange is a good option for Russians who want to buy and sell cryptocurrencies via the P2P system. Hundreds of local sellers accept RUB across dozens of payment methods, including bank transfers, Payeer, FFP, MIR, and UniCredit. The P2P platform also lets Russians sell digital assets in their preferred withdrawal method.

While Bybit’s P2P exchange only supports Bitcoin, Ethereum, USDT, and USDC, the main spot trading platform offers over 720 coins and 1,180+ markets. Bybit is also a top Russia crypto exchange for trading leveraged products. It offers perpetual and inverse futures, as well as crypto options. The maximum leverage is 200x, but lower limits are offered on non-large-cap markets.

Bybit is also known for its advanced trading platform that’s ideal for technical traders — it supports indicators, drawing tools, and TradingView integration.

Bybit Key Takeaways

- A popular choice for P2P trading

- P2P sellers accept a wide range of RUB payment methods

- The exchange also supports spot trading and leveraged products

Pros

- Buy cryptocurrencies with RUB via P2P sellers

- Convenient payment options include Payeer and local bank transfers

- The spot exchange offers over 1,900 crypto markets

- Trade perpetual and inverse futures with 200x leverage

Cons

- The platform doesn’t offer any regulatory protections

- Hackers stole over $1.5 billion from Bybit in February 2025

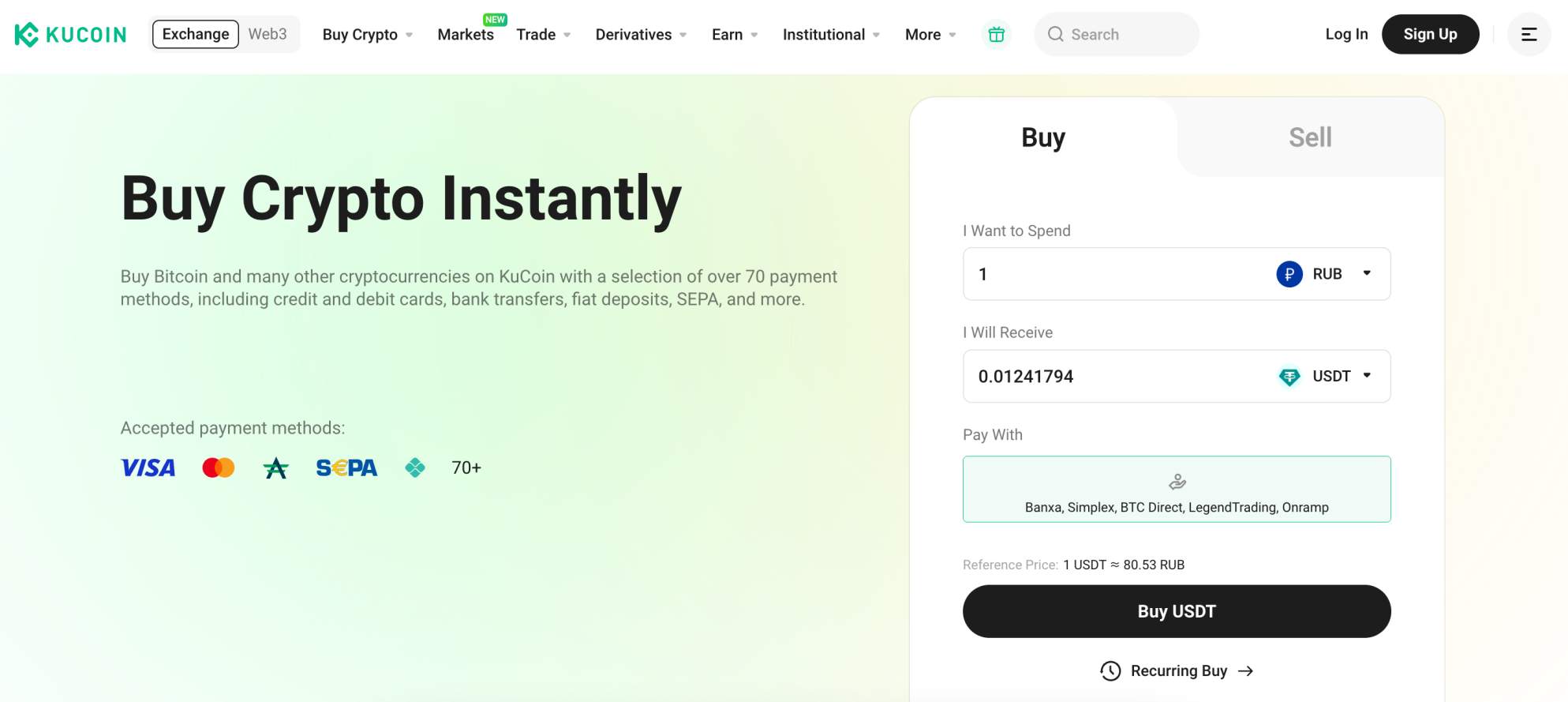

5. KuCoin – Best Crypto Exchange in Russia for Beginners

KuCoin is a great choice for first-time investors who want to buy small amounts of cryptocurrencies. The exchange accepts multiple payment methods, and the minimum purchase requirement is just 1 RUB. The instant buy feature supports the best altcoins to buy, from Monero and Ethereum to Algorand, Chainlink, and OFFICIAL Trump. Users can also buy USDT to access KuCoin’s spot trading exchange, which offers over 900 markets.

KuCoin doubles as a top P2P crypto exchange in Russia, with the platform connecting buyers and sellers without fees. RUB payment types include WebMoney, Google Pay, SBP, and Neteller. P2P trades are protected by the platform’s escrow service, where the seller’s cryptocurrencies are locked while the buyer completes the payment.

Russians can access a wide range of other features, including perpetual futures settled in USDT or the underlying crypto, as well as custom pricing charts with deep order books and technical indicators. The main drawback of KuCoin is that all platform users must complete the KYC process, even when P2P trading.

KuCoin Key Takeaways

- The best option for beginners entering crypto for the first time

- 1 RUB minimum when using Russian payment methods

- Supports spot trading, leveraged futures, and P2P payments

Pros

- No prior experience is needed to buy digital assets

- RUB payments are processed instantly

- Supports over 900 spot trading assets

- Intuitive interface and tools

Cons

- The exchange requires government-issued ID from all users

- Some P2P sellers offer unfavorable exchange rates

- Users must trade significant amounts to get the lowest fees

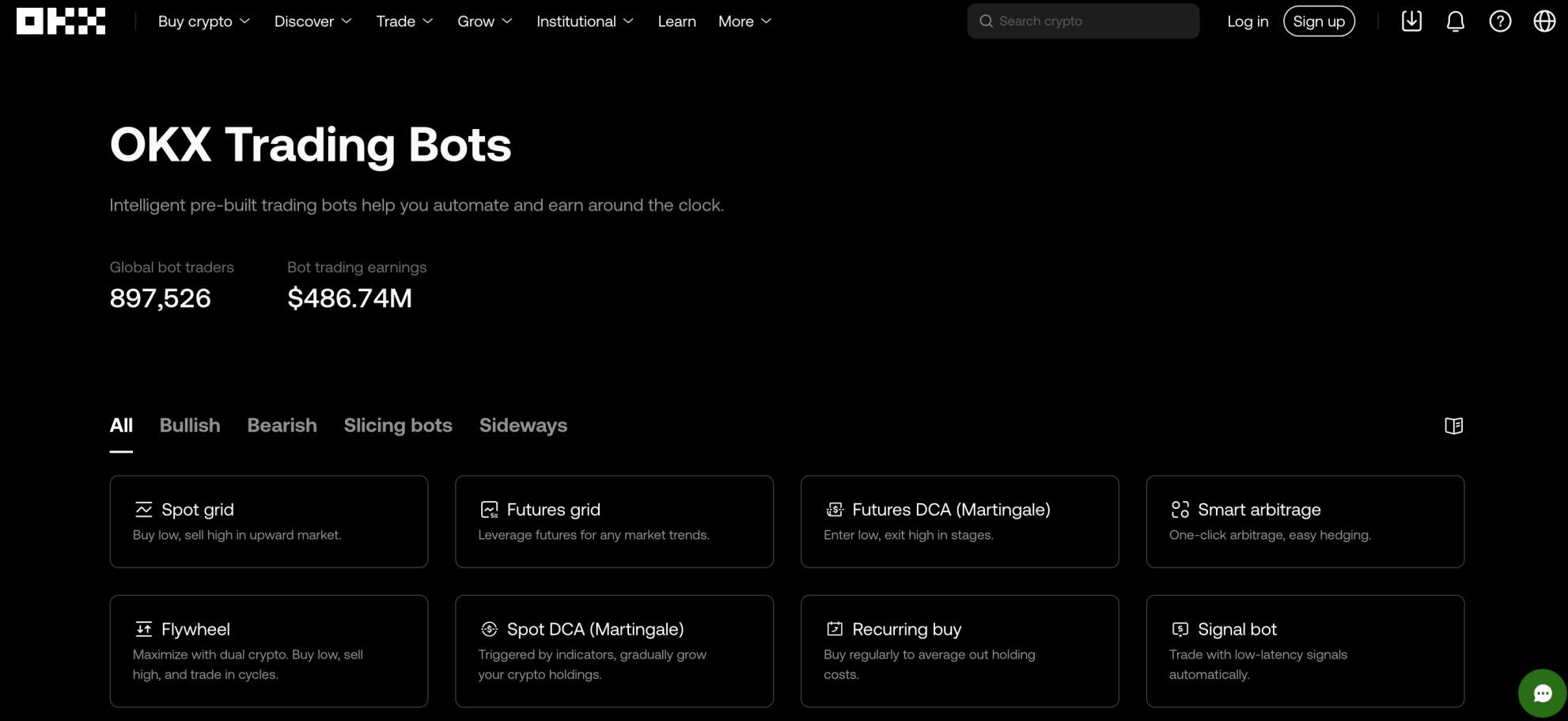

6. OKX – Best Crypto Exchange in Russia for Automated Trading

OKX is a regulated crypto exchange suitable for beginners and experienced pros alike. Novice traders use the convert tool to instantly swap cryptocurrencies without using the spot exchange. Seasoned investors like OKX for its high-level charting tools, customizable trading screens, and pre-market futures.

The platform also features automated trading, with thousands of pre-built bots that offer plug-and-play solutions. Russians can choose from a broad selection of bot strategies, from martingale and signals to arbitrage, grid, and dollar-cost averaging (DCA). Bots operate across all market cycles, including bullish, bearish, and sideways, and there are no additional fees to deploy them.

Having tested OKX’s onboarding process, all new customers must provide personal information and a government-issued ID. Russian users are accepted, but OKX doesn’t support RUB payments, so you’ll need to deposit cryptocurrencies via wallet transfers.

OKX Key Takeaways

- Global crypto exchange with an excellent reputation for safety

- Suitable for all experience levels, including complete beginners

- Features include automated bots, leverage, and an instant conversion tool

Pros

- Supports thousands of free in-house bots for automated trading

- Bot strategies include arbitrage and DCA

- Charges a maximum trading commission of 0.1%

- Offers a decentralized crypto wallet

Cons

- Doesn’t allow users to trade anonymously

- Russians can’t deposit RUB — crypto only

- OKX recently suspended its DEX after security threats

7. BingX – Best Crypto Exchange in Russia for Avoiding KYC Requirements

Launched in 2018, BingX is one of the best no-KYC crypto exchanges for Russians. It takes less than a minute to open an account — only an email address or mobile number is required, and no-KYC users can withdraw up to 20,000 USDT daily. Anonymous accounts benefit from unlimited deposits, and the platform supports instant RUB payments.

The instant buy feature has a 500 RUB minimum, and users can buy Bitcoin, Ethereum, and USDT. The main spot trading platform includes over 1,000 markets that cover small and large-cap assets across multiple crypto niches, including meme coins, AI agents, GameFi, and DeFi. BingX is also popular for its derivative features — crypto futures support 150x leverage, zero slippage, and competitive settlement fees.

With over 20 million registered users, BingX takes a security-first approach. The majority of client-owned funds are held in cold storage, accounts are protected by two-factor authentication, and the platform offers proof-of-reserves with CertiK audits.

BingX Key Takeaways

- An established exchange with no-KYC accounts

- Supports RUB and crypto deposits without limits

- Provides access to over 1,000 digital assets

Pros

- Withdrawal up to 20,000 USDT daily without KYC requests

- RUB payments are instant and cost-effective

- Trade via the spot or derivative markets

Cons

- Leverage limits are lower than other crypto exchanges in Russia

- The welcome bonus comes with unfavorable terms and conditions

- Liquidity on some pairs is below the market average

Methodology: How We Ranked The Top Crypto Exchanges in Russia

The research team tested over 50 platforms to identify the best crypto exchange in Russia. Factors like eligibility, RUB support, and security were weighted based on their importance — here’s an overview of our research methodology.

Availability in Russia (30%)

The exchange’s terms and conditions were analyzed to ensure support for Russian citizens. Any exchanges that explicitly prohibit Russian accounts were avoided. While some platforms do not mention specific countries, they offer no-KYC accounts up to certain limits — this means traders of all nationalities are welcome.

RUB Deposits (20%)

Most Russian users want to deposit funds in RUB, not only for convenience and speed but also to reduce costs. Buying cryptocurrencies in another currency adds foreign conversion fees that average 3-5%, and potentially more when converted back to RUB.

When choosing a crypto exchange in Russia, look for platforms that accept payments via local bank transfers, MIR, and Payeer. The purchase is processed right away, and the platform instantly adds the cryptocurrencies to your account. Note that some exchanges offer RUB payments via the P2P process — this allows you to buy crypto directly from local sellers.

Security (20%)

Security covers a broad range of important metrics from our methodology, including account safeguards like two-factor authentication, device whitelisting, biometrics, and email confirmations. The top exchanges keep client-owned cryptocurrencies in cold storage, which vastly reduces the risks of remote hacks.

The research team also prioritized Russia crypto exchanges with audited proof-of-reserves — this ensures user balances are covered by liquid digital assets like Bitcoin, Ethereum, and Tether.

Supported Cryptos (20%)

The blockchain market includes millions of cryptocurrencies, yet exchanges are limited in how many assets they can support. Most platforms list major layer-1 projects like Bitcoin, BNB, Solana, Ethereum, and Cardano, alongside large-cap meme coins like Dogecoin and Shiba.

Russian investors who seek new cryptocurrencies typically use Best Wallet, which aggregates thousands of tokens from the DEX market. MEXC is also widely used for its diverse range of assets, as the platform supports over 4,000 spot trading pairs.

Trading Tools (10%)

Our researchers also tested the exchange’s built-in trading tools. Many platforms offer custom charts with deep orders, technical and economic indicators, and custom order types. Automated bots and copy trading are popular, too — they allow users to buy and sell cryptocurrencies passively.

A growing number of crypto exchanges in Russia support leveraged products, including perpetual futures and options —these tools allow traders to speculate on digital assets with leverage. MEXC has a minimum margin requirement of just 0.2%, which means users can access 500,000 RUB in market exposure with a 1,000 RUB balance.

Types of Crypto Exchanges in Russia

This section explores the different crypto exchange categories available to Russian traders.

Centralized Exchanges

Centralized exchanges (CEXs) are the most popular option when buying and selling cryptocurrencies online. These exchanges operate similarly to traditional stock brokers — users open an account, deposit funds in RUB, and choose which assets they want to purchase.

The top CEXs handle billions of dollars in daily volume and provide users with deep liquidity. They also offer ultra-low fees, with MEXC users paying a maximum commission of 0.05% per slide.

There are also drawbacks to using CEXs, including strict KYC requirements on some platforms. CEXs also have a single point of failure, which invites counterparty risks like hacks, fraud, or bankruptcy. Experienced Russian investors typically withdraw cryptocurrencies to a non-custodial wallet to eliminate these third-party risks.

Decentralized Exchanges

DEXs represent a small portion of the broader crypto markets, yet trading volumes continue to rise year-on-year. These exchanges operate on the blockchain, so they enable users to trade cryptocurrencies “on-chain”. This distinction offers several benefits — DEX users aren’t required to open an account or upload KYC documents, and trades execute via transparent smart contracts.

Decentralized platforms also offer access to a much wider range of cryptocurrencies — anyone can launch tokens on DEXs, as there’s no listing process. This makes DEXs popular with traders looking for the next 1000x crypto tokens before they blow up.

Our research shows that Best Wallet is a popular crypto exchange in Russia for decentralized trading. It aggregates liquidity from leading DEXs like Uniswap and Raydium to ensure users get the most competitive prices. Users trade cryptocurrencies directly from their non-custodial wallet balance, providing a convenient and secure experience.

P2P Exchanges

P2P exchanges are hugely popular with Russian crypto investors, as many platforms restrict direct RUB payments. The P2P concept enables users to buy cryptocurrencies directly from sellers, who set the exchange rate and their accepted payment methods.

Bybit is a popular example — it offers a free P2P escrow service that requires sellers to deposit cryptocurrencies before the buyer transfers funds. Bybit users have many RUB payment options, including local cards (Yellow and Green), bank transfers, and Pyypl. The escrow releases the funds once the sellers confirms they’ve received the payment.

Instant Swap Exchanges

Instant swap tools are aimed at complete beginners who aren’t comfortable placing orders on spot exchanges. Users choose which cryptocurrencies they want to exchange, such as Bitcoin and Ethereum, and the platform executes it instantly.

While instant swaps are ideal for inexperienced investors, fees are often higher than spot trading commissions. OKX is the exception — its instant conversion feature offers 0% swap fees and slippage-free trades.

Is Crypto Legal in Russia?

In 2020, Russia implemented legislation to legalize digital financial assets (DFA) in the country, but with some caveats. The law enables Russian citizens to buy, sell, and hold cryptocurrencies, but they can’t be used as legal tender, including paying for goods and services.

How are Crypto Exchanges in Russia Regulated?

While Russians can freely trade cryptocurrencies, regulations remain prohibitive for domestic exchanges. Only registered platforms can operate exchange services, which must be approved by the Bank of Russia.

However, it’s important to note that the vast majority of Russians use offshore exchanges — global platforms are better equipped to handle high trading volumes and support diverse markets, including spot trading and leveraged derivatives. Domestic laws do not prohibit Russian residents from using offshore operators, which is why many platforms accept RUB deposits and withdrawals.

Can I Buy Bitcoin and Altcoins With Russian Rubles?

Despite sanctions essentially removing Russia from the global financial system and platforms like Binance pulling out of the country, RUB payments remain available for Russian citizens.

Many offshore platforms partner with fiat gateways that handle global currencies across various methods — users make payment through these providers, and the exchange adds the digital assets to their account. RUB deposit types often include local cards, bank transfers, and e-wallets like Payeer.

Users have several options when choosing a crypto exchange in Russia for RUB payments. Centralized platforms like MEXC and Bybit offer anonymous accounts with high withdrawal limits and access to a huge range of markets.

Best Wallet is a top choice for Russians who want a non-custodial experience — users control their private keys, which eliminates counterparty risks. After buying digital assets on the Best Wallet app, the exchange transfers those tokens to the wallet balance.

Another option is to use RUB at a P2P exchange. Buyers connect with sellers directly, and both parties are protected by the escrow service, which vastly reduces the risks of scams.

How is Crypto in Russia Taxed?

President Putin recently signed a law to introduce tax rules on cryptocurrencies, with digital assets now considered property. Capital gains are added to the individual’s income and taxed accordingly — this means 13% on income up to 2.4 million RUB, and 15% on anything over this figure. Profits are only defined as gains when they’re realized, which means the investor disposes of the digital assets.

Income related to DeFi is taxed in the same way, including staking and liquidity provision. The income is based on the RUB value on the day you receive the DeFi rewards, so keeping track of your earnings is crucial to ensure accurate tax filing.

How to Get Started With a Crypto Exchange in Russia

This section explains how to buy cryptocurrencies on the Best Wallet app, which is the overall top pick for Russian investors. Best Wallet offers a secure, non-custodial, and anonymous experience, and the app supports instant payments with competitive fees.

Follow these steps to get started in under five minutes.

Step 1: Download the Best Wallet App

Visit the Best Wallet website and download the iOS or Android app.

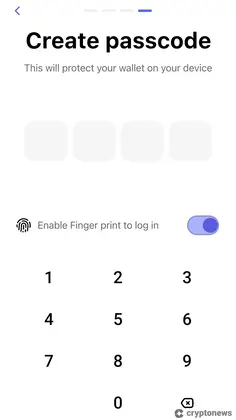

Step 2: Secure the App

Open the Best Wallet app, enter an email address, and choose a PIN. The app displays a 12-word passphrase — write it down in the correct order. You’ll need the passphrase if you lose access to the app.

Click “Settings” and turn on biometrics, which is more secure than a PIN. Activate two-factor authentication by entering a mobile number — type in the verification code to confirm.

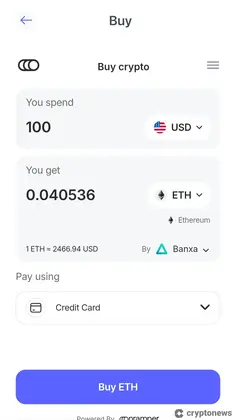

Step 3: Choose a Crypto to Buy

Click the “Trade” and “Buy” buttons to purchase cryptocurrencies on the Best Wallet app. The exchange supports Bitcoin and a wide range of altcoins, including Ethereum, Tether, BNB, Shiba Inu, and Mog Coin.

Step 4: Complete the Order Form and Enter the Payment Details

The next step is to fill out the order form. Choose RUB as the currency, enter the amount, and select the preferred payment method.

The fiat gateway will ask for the payment details — enter them and confirm the purchase. Best Wallet automatically adds the assets to your wallet balance.

Step 5: Trade Crypto

Best Wallet also offers a fully-fledged DEX that supports thousands of cryptocurrencies. You can trade digital assets instantly without using a centralized platform.

Click “Trade” and “Swap”, and specify the cryptocurrencies to trade. A smart contract swaps the respective assets once confirmed and transfers the purchased tokens to your wallet balance.

Conclusion – What is the Best Crypto Exchange in Russia?

While some platforms no longer accept Russian users, many crypto exchanges remain in the market. Important factors when selecting a provider include RUB support, robust security, low fees, and a wide selection of digital assets.

After testing over 50 Russia crypto exchanges, we found that Best Wallet is the overall top choice. The user-friendly app offers thousands of crypto markets, including Bitcoin, Ethereum, and BNB. Users can buy and sell cryptocurrencies with local payment methods, and the app functions as a secure wallet for non-custodial storage.

Visit Best WalletFAQs

Can I withdraw funds from a crypto exchange to my bank account in Russia?

Are Russian crypto exchanges safe?

Which crypto exchange in Russia has the lowest fees?

Is Binance available in Russia?

Can I use Coinbase in Russia?

What is the largest crypto exchange in Russia?

References

- Russia leans on cryptocurrencies for oil trade, sources say (Reuters)

- Crypto’s biggest hacks and heists after $1.5 billion theft from Bybit (Reuters)

- Crypto exchange OKX suspends DeFi service after EU scrutiny (Bloomberg)

- Digital financial assets and their operators (Bank of Russia)

- Down but not out: The Russian economy under Western sanctions (Center for Strategic and International Studies)

- Putin signs law on cryptocurrency tax (The Moscow Times)

About Cryptonews

Our goal is to offer a comprehensive and objective perspective on the cryptocurrency market, enabling our readers to make informed decisions in this ever-changing landscape.

Our editorial team of more than 70 crypto professionals works to maintain the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re looking for breaking news, expert opinions, or market insights, Cryptonews has been your go-to destination for everything cryptocurrency since 2017.