Independent Reserve Review 2026 - Is Independent Reserve Legit?

- Caters to both new and experienced traders with a user-friendly interface and advanced trading tools

- Highly secure, AUSTRAC-registered exchange with ISO 27001 security and Gold Certified by the Digital Economy Council of Australia

- Create multi-user accounts for individuals, families, trusts, and enterprises

Independent Reserve is one of the most trusted crypto exchanges in Australia, offering a wide range of investment solutions for retail and institutional users. In our Independent Reserve review, we examine the platform’s key features, security protocols, and fee structure, along with its advantages and limitations.

We’ll also cover the exchange’s user experience, account types, and explain how to create an account through a step-by-step guide. By the end, you’ll understand why over 450,000 global users have chosen Independent Reserve as their exchange.

Special Offer: Get $20 in free BTC when you sign up and trade on Independent Reserve.

Independent Reserve Overview

Founded in 2013, Independent Reserve is a global cryptocurrency exchange headquartered in Sydney, Australia. Currently, the platform supports 37 cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), XRP (XRP), and Solana (SOL).

Independent Reserve is a centralized exchange (CEX), known for its commitment to regulatory compliance. Since 2021, Independent Reserve has held an ISO 27001 certification, the highest international security standard for data systems. The exchange is also registered with the Australian Transaction Reports and Analysis Centre (AUSTRAC) and carries a Digital Economy Council of Australia (DECA) Gold Certification license.

With various account options and a multi-user feature, Independent Reserve caters to both individuals and businesses interested in investing in cryptocurrencies. Users can easily deposit and withdraw funds via instant AUD transfers, while high-net-worth investors have the option to place large crypto buy orders through the exchange’s Over-the-Counter (OTC) desk service.

After completing our Independent Reserve review, we found that the exchange provides a reliable and user-friendly trading platform where users can engage in both short-term trades and long-term crypto investments. While many of its features are tailored to the Australian market, the platform continues to add features and build partnerships that have enabled it to expand to other regions.

| Established | 2013 |

| Supported Coins | 37 cryptocurrencies, including BTC, ETH, SOL, XRP, and ADA |

| Exchange Type | Centralized Exchange (CEX) |

| Based In | Sydney, Australia |

| Availability | 38 countries in APAC, Europe, and more |

| Licenses | Based and operates in Australia, headquartered in Sydney, New South Wales |

| KYC Verification | Registered Digital Currency Exchange (DCE) with AUSTRAC, ISO 27001 certification, Gold Certified crypto exchange by the Digital Economy Council of Australia |

| Deposit Options | Bank transfer, PayPal, SWIFT, debit/credit cards, and crypto deposits |

| Fees | No deposit fees for AUD bank transfers and EFT bank withdrawals, 0.5% to 0.02% trading fees |

| Key Features | Multi-user accounts, industry-grade security, advanced trading, OTC desk, AutoTrader integration |

Independent Reserve Review: Pros & Cons

Here are the main advantages and limitations of the platform based on our Independent Reserve Australia review.

Pros

- AUSTRAC-compliant exchange with DECA and ISO certifications

- Individual and business accounts available with multi-user functionality

- As low as 0.02% trading fees, together with free AUD deposit and withdrawal options

- Multi-platform exchange for web and mobile

- Over 35 cryptocurrencies supported, including BTC, ETH, SOL, and XRP

- Access advanced trading tools with up to 5x leverage

- Supports BTC, ETH, XRP, SOL, and 30+ other digital assets

- OTC desk supported for high-volume crypto buys

Cons

- Not available in a few major regions, like the U.S. and China

- No crypto staking or earning products

- KYC verification is required for trading and depositing

What Is Independent Reserve?

Independent Reserve is a long-standing crypto exchange in Australia and the Asia-Pacific region. It was founded in 2013 by crypto enthusiasts Adam Tepper, Adrian Przelozny, and Lasanka Perera. Back then, Bitcoin was just $12, and Vitalik Buterin was still conceptualizing Ethereum.

In line with its mission of being APAC’s most trusted cryptocurrency exchange, Independent Reserve became one of the first licensed exchanges in Singapore in 2020. Four years later, the Australia-based exchange opened its first Singapore office to strengthen its presence in the country.

As of this writing, Independent Reserve has grown to accommodate nearly half a million investors from Australia, New Zealand, Singapore, and other regions. It has partnered with established institutions, including Bloomberg, DECA, Iress, and BGL Corporate Solutions.

Cryptocurrencies Supported

Independent Reserve supports a curated selection of cryptocurrencies, ranging from popular stablecoins to some of the best meme coins. All in all, the exchange supports 37 cryptocurrencies, adding and delisting certain tokens over time.

Top cryptocurrencies on the Independent Reserve exchange include:

- Bitcoin (BTC)

- Ethereum (ETH)

- Tether (USDT)

- XRP (XRP)

- Solana (SOL)

- USDC (USDC)

- Dogecoin (DOGE)

- Shiba Inu (SHIB)

- Bitcoin Cash (BCH)

- Basic Attention Token (BAT)

In addition to cryptocurrencies, Independent Reserve accepts the storage and trading of multiple fiat currencies, such as the United States dollar (USD), Australian dollar (AUD), New Zealand dollar (NZD), and Singapore dollar (SGD).

Independent Reserve Products & Services

Beyond its crypto exchange offerings, Independent Reserve provides a broad range of digital asset solutions for advisers, merchants, and asset managers. Let’s break down how the exchange offers specific features depending on clients’ requirements.

- Advisers: The exchange provides educational resources on blockchain technology and digital assets for advisers and their clients. With Independent Reserve, advisers can manage cryptocurrencies just like any other asset.

- Family Offices and Asset Managers: With round-the-clock relationship managers and deep liquidity, Independent Reserve is well-equipped for these clients. Other purpose-built features for family offices and asset managers include high-grade security, advanced trading, API integrations, and multi-fiat currency support.

- Merchants and Retailers: Through its partnership with AFS-licensed crypto payment firm RelayPay, the exchange offers merchants a turnkey solution for accepting customer payments in cryptocurrencies.

By providing these specialized offerings, Independent Reserve showcases its flexibility in offering various products and services for Australian financial professionals and businesses.

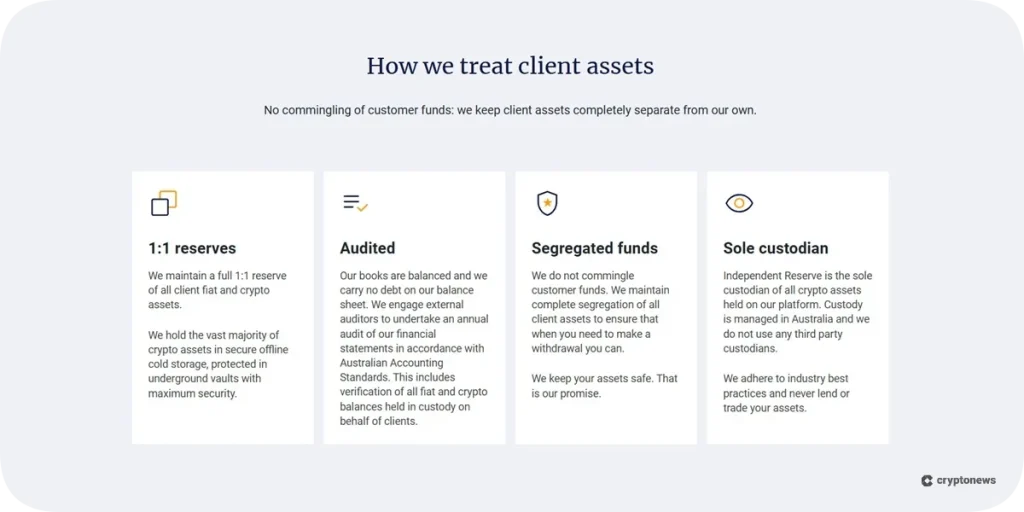

Security Features: Is Independent Reserve Safe?

As a leading crypto exchange in Australia, Independent Reserve is committed to providing the highest quality crypto security for its clients.

The exchange maintains a 1:1 reserve of users’ fiat and crypto holdings, ensuring that clients can withdraw their assets at any time. Furthermore, the vast majority of users’ cryptocurrencies are held in cold storage vaults across multiple dispersed locations.

Independent Reserve also keeps customer assets completely segregated from company funds. The platform does not lend out clients’ money, nor do they use it for operational purposes.

As a sole crypto custodian, the platform does not rely on third-party firms for storing users’ cryptocurrencies. Independent Reserve holds full accountability for users’ digital assets.

Regarding financial audits, the Australian exchange undergoes external audits in accordance with Australian Accounting Standards. This verifies that the company securely holds balanced reserves of clients’ fiat and crypto assets.

Note: As of writing, there have been no documented security incidents involving Independent Reserve.

Since 2021, Independent Reserve has been an ISO 27001-certified exchange, adhering to the highest level of international security standards. As we touched on earlier, the platform is regulated by AUSTRAC, a key financial regulator in the Australian compliance framework.

Tools and Features

In this part of our Independent Reserve review Australia, we take a closer look at the exchange’s key features and offerings.

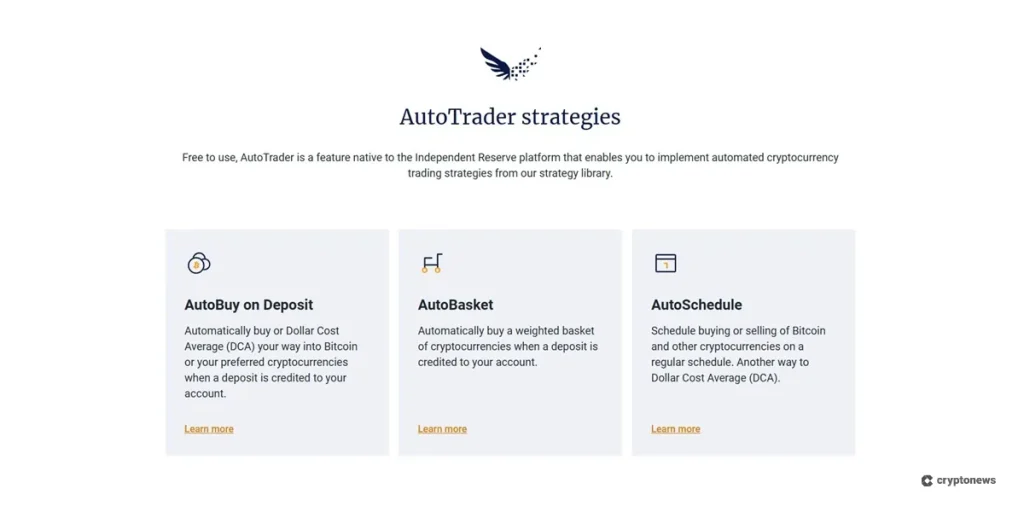

AutoTrader

One of the top features available to Independent Reserve users is AutoTrader, a built-in tool for automating various crypto trading strategies. It offers a hands-free investing experience that’s easy to set up and requires zero technical knowledge.

Let’s break down the AutoTrader setups available to investors:

- AutoBuy on Deposit: Configure automated crypto buys whenever you deposit into your account. AutoBuy is great for Dollar Cost Averaging (DCA), a strategy for gradual crypto investing and trading.

- AutoBasket: Similarly to the AutoBuy strategy, this setup automatically invests in a basket of cryptocurrencies when a deposit is credited to your account. This allows users to diversify their crypto investments effortlessly.

- AutoSchedule: Another way to invest through DCA, AutoSchedule allows users to set times to buy or sell cryptocurrencies in their accounts automatically.

Multi-User Accounts

Independent Reserve provides shared access to crypto accounts through its multi-user feature. It’s incredibly helpful for Australian families, businesses, and teams that need varying levels of access while maintaining a high level of security and control.

Here’s a table showing the different user types that account holders can create for multiple individuals:

| User Type | Details |

| Viewer | Base level; can only view account information, but cannot trade, withdraw, or make any changes. |

| Trader | Same capabilities as Viewer, with added access to buying and selling in the account. No access to withdrawals. |

| Trader with restricted withdrawals | Same as Trader, with additional access to withdrawals limited to addresses that have previously received withdrawals. |

| Trader with withdrawals | Same as Trader with restricted withdrawals, with additional access to adding new bank accounts/crypto addresses and withdrawals to new accounts. |

| Administrator | Highest level; same access to the original account holder. However, they cannot use the leverage trading crypto service or manage credit card or PayPal deposits. |

Over-the-Counter (OTC) Trading

Anyone who wants to purchase over $50,000 AUD in cryptocurrency can leverage Independent Reserve’s OTC trading desk, located in Sydney, Australia. It’s open on weekdays from 9 am to 8 pm Sydney time and supports large-volume buys for some of the best cryptos to buy: BTC, ETH, SOL, USDT, and USDC.

After a quick onboarding call, clients receive expert guidance in the entire OTC purchase process. Independent Reserve has access to deep liquidity, allowing the exchange to offer competitive and transparent pricing for large crypto purchases.

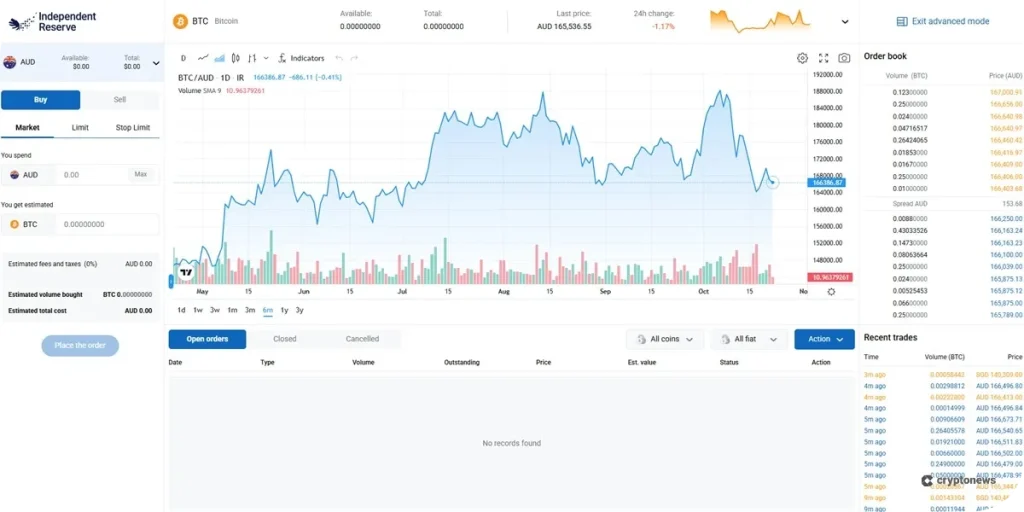

Advanced Trading Interface

Experienced traders on Independent Reserve can use the exchange’s advanced trading interface, which offers detailed tools and indicators for a more technical trading environment. It features a TradingView-powered chart alongside a live order book and recent trades, allowing users to better analyze market conditions and liquidity. The interface also features various order types for smarter digital-asset trading. These include market, limit, and stop-limit orders for enhanced crypto trading risk management.

Additionally, Independent Reserve offers crypto leveraged trading to boost potential market gains. Traders can use up to 5x leverage when opening positions for the following pairs:

- BTC/AUD

- ETH/AUD

- XRP/AUD

- DOGE/AUD

- SOL/AUD

Leveraged trading is not suitable for beginner traders who lack the skills and experience in highly volatile markets. However, more experienced users aiming to use leverage to improve their trades on Independent Reserve should start with lower leverage (2x or 3x).

Local and Global Certifications

Independent Reserve is a member of the Digital Economy Council of Australia (DECA), formerly named Blockchain Australia. Specifically, the company is a Gold Certified cryptocurrency exchange within DECA after demonstrating exceptionally robust security measures and transparency standards.

Furthermore, Independent Reserve is the first crypto exchange licensed by the Monetary Authority of Singapore (MAS). For its Singapore operations, the company holds a Major Payment Institution License under the country’s Payment Services Act.

Carrying these licenses and certifications both locally and internationally reflects Independent Reserve’s focus on client safety, regulatory compliance, and corporate governance.

Independent Reserve Fees

In addition to an extensive set of features, Independent Reserve offers a competitive fee structure with free deposit and withdrawal options for certain AUD and USD transfers.

In particular, AUD bank transfers of any amount and USD SWIFT deposits of 5,000 USD or more incur no transaction fees. Withdrawing AUD from Independent Reserve via Electronic Funds Transfer (EFT) also does not incur fees, while instant withdrawals (NPP/PayID) cost just 1.5 AUD per transfer.

For buying and selling cryptocurrencies on the exchange, Independent Reserve charges trading fees starting at 0.5% per trade. However, every trade is subject to volume discounts based on the user’s past 30-day trading volume.

The highest discount available reduces Independent Reserve’s trading fee to just 0.02% per trade once the user reaches a 30-day volume of 200,000,000 AUD or more. A complete list of each trading fee discount increment is available on the official Independent Reserve site.

Deposit Fees

| Deposit Fee Category | Fee Details |

| AUD Deposits | Bank transfers: No fee Debit & credit cards: 1% fee for Australian cards; 3.5% fee for international cards PayPal: 1% fee |

| NZD Deposits | SWIFT bank transfers: For 5,000 NZD or more, no fee. For deposits of less than 5,000 NZD, a flat 15 NZD fee is incurred Debit cards: 3.5% fee |

| USD SWIFT Deposits | No fee for deposits of 5,000 USD and above. 15 USD processing fee for deposits below 5,000 USD |

| Crypto Deposits | No fee. |

Withdrawal Fees

| Withdrawal Fee Category | Fee Details |

| AUD Withdrawals | AUD EFT withdrawals: No fee AUD PayID/NPP instant withdrawals: 1.5 AUD fee |

| NZD Withdrawals | 29 NZD fee |

| USD SWIFT Withdrawals | 20 USD fee |

| Crypto Withdrawals | Varies depending on the token and network (e.g., BTC withdrawal on Bitcoin incurs a 0.0002 BTC fee) |

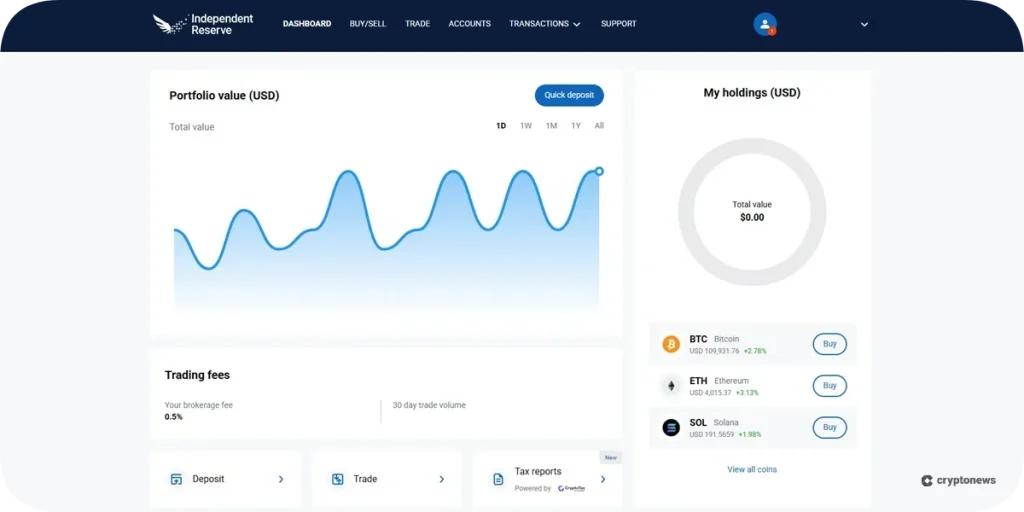

Independent Reserve User Experience

Our Independent Reserve review for the exchange’s user experience considers the platform’s interface and usability.

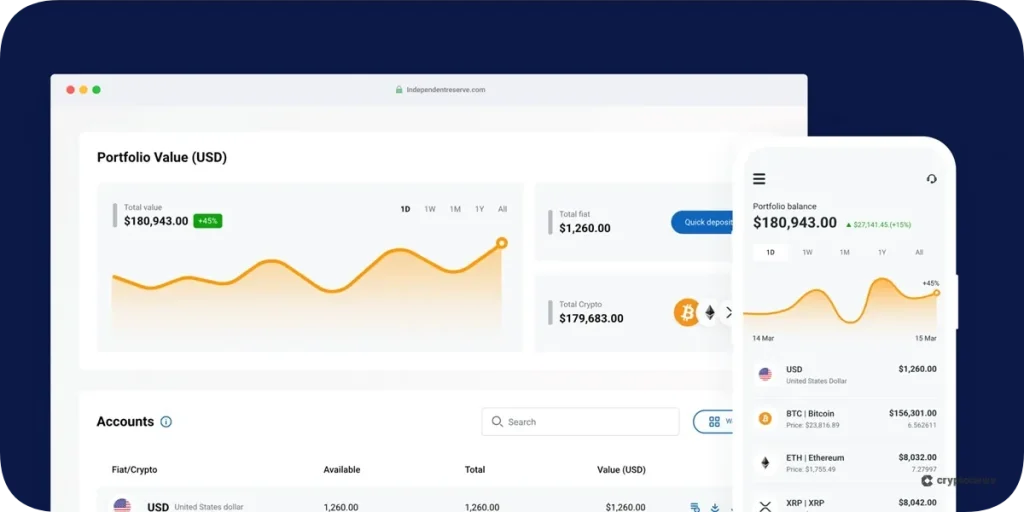

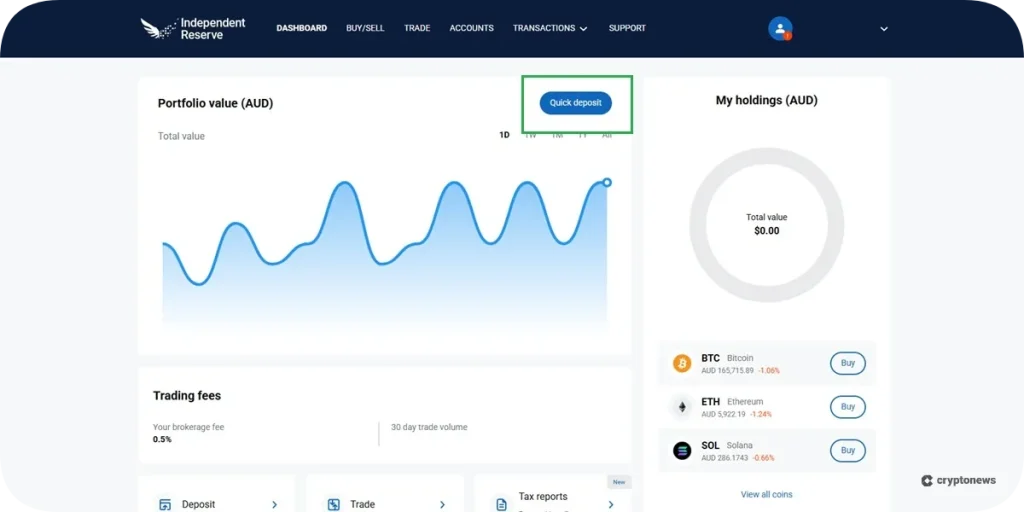

On the desktop platform, the exchange features a straightforward, minimalist design with direct access to buying and selling cryptocurrencies, depositing funds, and showcasing the account’s portfolio value. Users can view their performance on the dashboard over the past day, week, month, or year.

When it comes to usability, Independent Exchange has a streamlined onboarding process with a KYC-first approach. In less than five minutes, Australian customers can create an account and start trading cryptocurrencies. The web client remained responsive, especially when it came to high-performance tasks in the advanced trading interface.

One usability feature worth noting is the exchange’s integrated crypto taxes reporting tool, powered by the trusted firm Crypto Tax Calculator (CTC). Individuals can easily link their Independent Reserve accounts with CTC for accurate and seamless tax compliance.

Independent Reserve Mobile App Experience

Unlike other Independent Reserve reviews, we’ve analyzed the exchange’s mobile app experience for on-the-go crypto investing and management. With a single tap, users can easily navigate to real-time crypto prices, view their portfolios, trade cryptocurrencies, and contact customer support.

The Independent Reserve mobile app is available for iOS and Android devices, easily accessible in their respective app stores. Users can set up two-factor authentication (2FA) and quick biometric logins for a secure and convenient experience. They can also receive in-app notifications and email alerts for market news and platform updates.

Independent Reserve Wallet

Independent Reserve provides a custodial wallet integrated into its crypto exchange platform. Users’ funds remain securely held solely by the company, but customers can buy, sell, and transfer their assets through the built-in wallet, similar to other custodial hot wallets. The company stores users’ hot wallet private keys using multi-layer encryption, ensuring the safest crypto wallet experience with a sole crypto custodian. Additionally, Independent Reserve monitors each address in real-time to sync with the exchange and keep an eye out for high-risk activities. The crypto exchange never exposes hot wallet private keys to users, not even to administrators.

Customer Support

From individual to enterprise accounts, Independent Reserve delivers 24/7 premium support through a team of experts. Users can submit a concern ticket on the platform, which securely logs the request and queues it up for a response.

All messages through the exchange’s support system are encrypted, ensuring that users’ data and funds are protected. Users can also access extensive help documentation on various platform features, tools, and offerings that could help resolve common issues.

In our testing, Independent Review’s support responds within minutes in a professional and accommodating tone. The exchange also engages with its followers through various media channels, including Reddit, Facebook, X, and LinkedIn.

Independent Reserve Deposits & Withdrawals

Australian investors have many options when it comes to depositing to and withdrawing from Independent Reserve. When transferring funds into their accounts using PayID, deposits are credited instantly. Meanwhile, bank transfers (EFT) take 1 to 2 business days, but incur no transfer fees.

Beyond fiat transfers, users can deposit and withdraw cryptocurrencies directly with their Independent Reserve accounts. Crypto deposits take approximately 10 to 15 minutes to register on the exchange, followed by another 20 minutes for confirmation. On the other hand, crypto withdrawals can take around 20 minutes to complete once approved.

It’s important to note that EFT fiat withdrawals have no upper limits, while instant withdrawals (PayID or NPP) are limited to 200,000 AUD per day. Users can deposit and withdraw via crypto without any limits.

| Transfer Type | Details |

| PayID/Osko Deposit (AUD) | PayID/Osko deposits are instantly credited to your account and subject to daily limits. |

| EFT Deposit (AUD) | No fee, typically takes 1-2 business days. |

| PayPal or Credit/Debit Card Deposit (AUD) | Performed directly on the Independent Reserve platform and typically takes 1-2 business days. |

| Crypto Deposit | Requires a total of 30 to 35 minutes to register on the platform and get confirmed on the blockchain. |

| NPP/PayID Withdrawals | Instant withdrawals can be performed either through the NPP network (BSB & account number) or a PayID (email or mobile) |

| Standard EFT Withdrawals | The default withdrawal method, which typically takes 1-2 business days to complete. |

| Crypto Withdrawals | Typically takes about 20 minutes to complete after the transaction is approved. Some crypto withdrawals may be flagged by Independent Reserve for security purposes, taking a few more hours to be finally approved. |

Account Types

Besides individual accounts, users can open various account types on Independent Reserve based on their needs. In this section of our review, we break down each account type provided by the exchange.

SMSF Accounts

Australian clients can upgrade their Self-Managed Super Funds (SMSFs) with crypto management through Independent Reserve’s SMSF account feature. The exchange has served thousands of SMSFs as one of Australia’s most trusted digital asset storage solutions.

The onboarding process takes just 1 to 2 business days to complete, including the verification process. SMSF accounts receive round-the-clock support, special multi-user account privileges, and a personalized service for large trades (OTC desk).

Trust Accounts

Since 2013, Independent Reserve has helped thousands of trust accounts invest in cryptocurrencies. To open a trust account on the platform, you simply need to provide the Trustee’s documentation, such as a photo ID, proof of address, and the trust deed.

Trust accounts can use the same deposit methods as other account types. This includes EFT transfers, PayID, and SWIFT bank transfers, as long as they are made under the same name as the Trustee.

Company Accounts

Independent Reserve opens its doors to businesses seeking crypto solutions for treasury management, integration, or payments. These accounts receive a white glove service for large trade executions, which are settled within the same day.

In addition, the Company accounts have access to deeper liquidity through Independent Reserve’s global network for high-volume transactions in the OTC desk. From the onboarding process to digital asset management, businesses also receive dedicated support from a relationship manager.

Institutional Accounts

Institutions interested in partnering with Independent Reserve can create Institutional accounts with direct investment features and integrations. The exchange can accommodate large AUD, NZD, and USD transactions for Australian companies and SGD transfers for Singaporean entities.

Furthermore, the crypto exchange reports all account transaction records for better tax management and accounting. Digital asset security remains a priority, with strict ISO 27001-compliant safety protocols and institutional-grade workflow management through a Fireblocks integration.

Getting Started with Independent Reserve

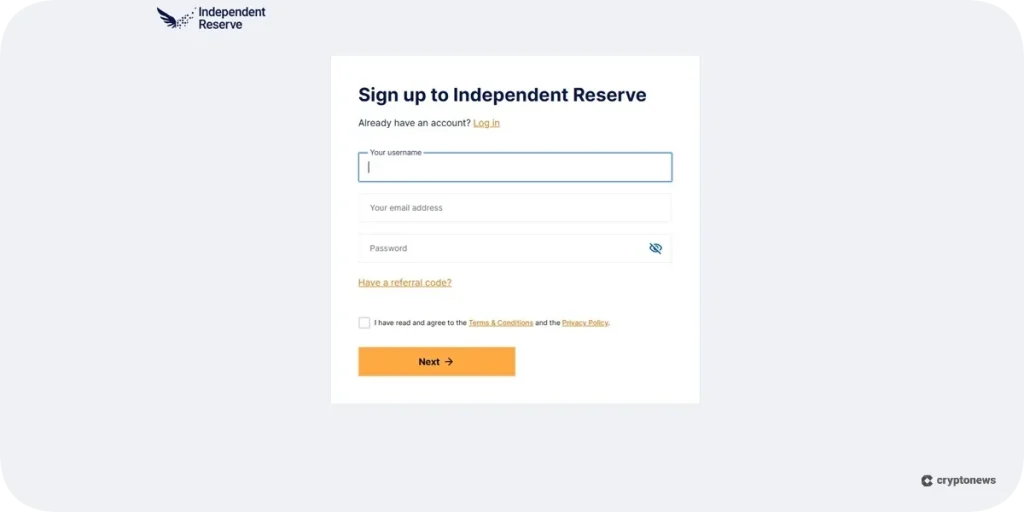

It takes just a few minutes to create an Independent Reserve account and start trading digital assets. Follow this step-by-step guide on how to get started on the exchange.

Step 1: Create an Account

Visit Independent Reserve website and click “Create account.” On the registration form, input your username, email, and password, and click “Next.” Australian residents opening an individual account can create a FastTrack account for instant deposits and trading.

After this, you’ll receive a verification email. Click “Activate my account,” select an account type, and your country of residence.

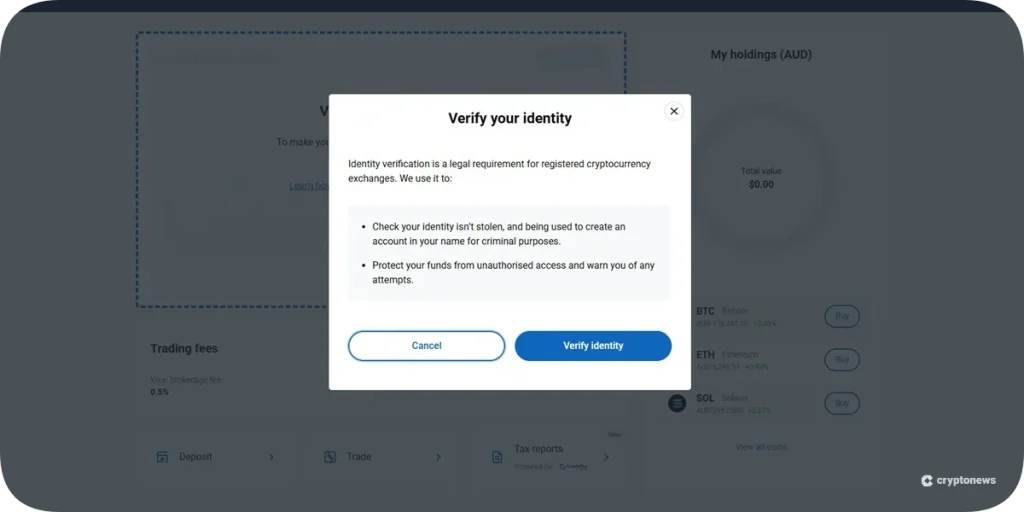

Step 2: Complete KYC Verification

The next step in the registration process is the Know Your Customer (KYC) verification. On the form, enter your legal first and last name, as well as your date of birth. Next, enter your home address and mobile number.

After validating your phone number, you’ll need to complete the KYC process. This requires uploading a photo ID (passport, driver’s license, etc.) and a proof of address (insurance policy, utility bill, or bank statement). Follow the prompts after uploading the documents and wait for confirmation.

Step 3: Deposit Funds

With your account fully verified, it’s time to deposit funds. Log in to your Independent Reserve account and click “Quick deposit” from the main dashboard. Choose one of the supported fiat currencies and select a payment method.

Independent Reserve will require varying payment details, depending on the deposit option. For example, users can directly transfer AUD funds on their chosen banking platforms through Independent Reserve’s banking details. PayPal or credit/debit card deposits can be performed directly on the exchange platform.

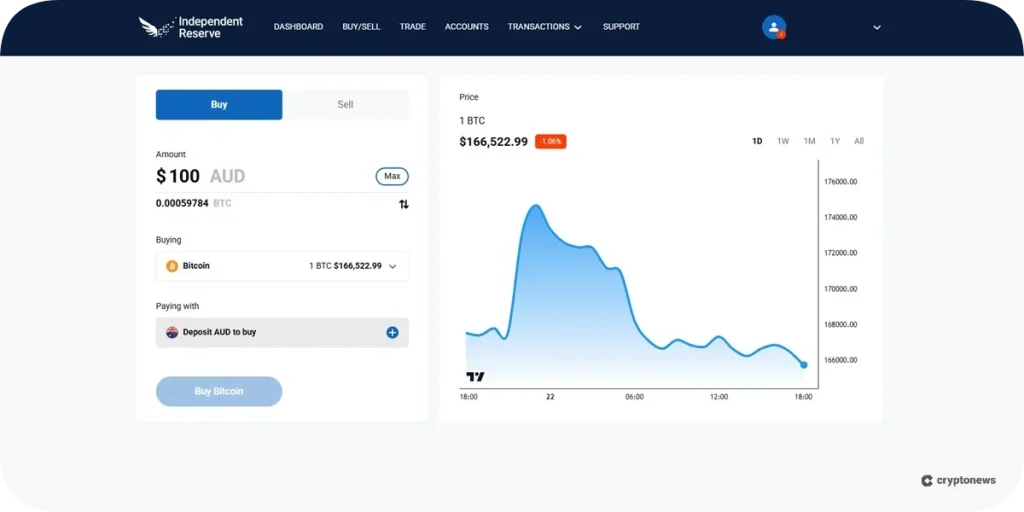

Step 4: Trade Cryptocurrencies

With your account funded, you can buy cryptocurrencies by navigating to the buy/sell tab. Here, Independent Reserve displays all supported cryptocurrencies for purchase. Select a cryptocurrency and enter the fiat amount you wish to exchange for the digital asset.

After finalizing the order, click the buy button to open your position. Users can open a BTC position for as low as 10 USD. Once complete, your purchase will instantly be reflected in your account, portfolio, and transaction history.

Optional: Selling Crypto and Withdrawing Funds

Selling your crypto holdings on Independent Reserve is as easy as buying them. Go to the buy/sell tab and select a token to sell. Enter the amount you wish to exchange for fiat and click the sell button to confirm your order.

To withdraw, go to the accounts tab and select a fiat currency. Click the withdraw button, which will open the default EFT withdrawal option. This requires a BSB and an account number. Alternatively, you can tick the “Send instantly using NPP” option on the withdrawal screen for an instant AUD transfer.

Our Independent Reserve Review Methodology

Our Independent Reserve review methodology relies on thorough research and practical testing. We examined the platform’s licenses, regulatory compliance, and operational history through reputable online sources to evaluate its security and dependability.

We complemented our online analysis of the exchange with hands-on testing, allowing us to evaluate Independent Reserve’s advertised features through typical investor activities. This included creating an account, reaching out to customer support, and setting up crypto trades. The overall assessment also involved identifying the exchange’s strengths and weaknesses in terms of features, tools, and fees.

Independent Reserve Review: Conclusion

Based on our Independent Reserve review, the well-regulated crypto exchange remains a promising digital asset management platform for Australia and other international traders from APAC regions. It caters to a wide range of individuals and groups, from personal users to institutional investors, with a user-friendly interface combined with optional advanced tools.

Secure your crypto with Independent Reserve today and join over 450,000 clients that are benefiting from automated trading, industry-grade asset protection, and seamless crypto management.

Special Offer: Get $20 in free BTC when you sign up and trade on Independent Reserve.

Visit Independent ReserveFAQs

Is Independent Reserve legit in Australia?

Is Independent Reserve an Australian company?

Is Independent Reserve better than CoinSpot?

How secure is an Independent Reserve?

References

- Digital Economy Council of Australia (DECA)

- Independent Reserve Opens Singapore Office (Fintech News Singapore)

- Crypto Payments Australia: Buy & Transfer Bitcoin From Any Wallet (RelayPay)

- ISO/IEC 27001:2022 – Information security management systems (ISO)

- Monetary Authority of Singapore (MAS)