‘Solana Will Eclipse Ethereum Gains in Q4’ | BTC, ETH, SOL October Report

Key Takeaways:

The crypto market entered Q4 2025 against a backdrop of political tensions, interest rate uncertainty, and other ongoing challenges. What will October bring, calm or storm?

Usually, when an altcoin season begins, Ethereum (ETH) takes the lead first, with capital flowing into Solana (SOL) later. This time, the pattern looks different, and some experts argue the altcoin season may have already been underway since early summer.

On a 30-day timeframe, Solana outperformed Ethereum in percentage gains. Solana peaked at +26% on Sept. 18, while Ethereum’s monthly high came earlier, at +8% on Sept. 13, based on CoinMarketCap data. The chart also shows that both tokens followed a similar trajectory through September, but Solana’s stronger momentum left it ahead.

This contrast sets the stage for Q4, raising the question of whether Solana can keep outpacing Ethereum. At the same time, Bitcoin (BTC) remains a key part of the picture. This Cryptonews report explores what lies ahead for these three major players: Bitcoin, Ethereum, and Solana.

‘Solana Will Be in a Great Spot’

Dana Love, President and Chairman at PoobahAI, believes this quarter belongs to Solana:

My hot take: Solana will eclipse Ethereum gains percentage-wise in Q4, flipping the narrative as its blistering upgrades suck in retail and institutional capital alike.

September already gave Solana extra points over Ethereum, as it outpaced ETH in monthly performance. The upcoming weeks could prove decisive for whether it sustains this momentum. Love underlines that the ETF decision, along with these technical milestones, could determine Solana’s next move:

For Solana, October 10 holds the key to its ‘giga rally’ or slump in the future, with the ETF approval expected to be issued by the US SEC. Beyond the ETF, their Soltember vibe is rocking, and on-chain activity is heating up. If Firedancer (a second client, reducing single-client risks), Alpenglow (slashing finality to under 150ms), and state compression all come together, Solana will be in a great spot.

Ethereum, however, retains its own strategic position. While Solana pushes forward with speed and innovation, Ethereum continues to lean on its institutional base, regulatory clarity, and its role as the backbone of stablecoins.

David Dobrovitsky, CEO at Wowduck, explains the distinction between the two networks:

Solana’s focus is on upgrades like Firedancer and ecosystem growth in DeFi, NFTs, and possible ETF inclusion. ETH leans on institutional stability, while SOL offers high-throughput growth with higher volatility.

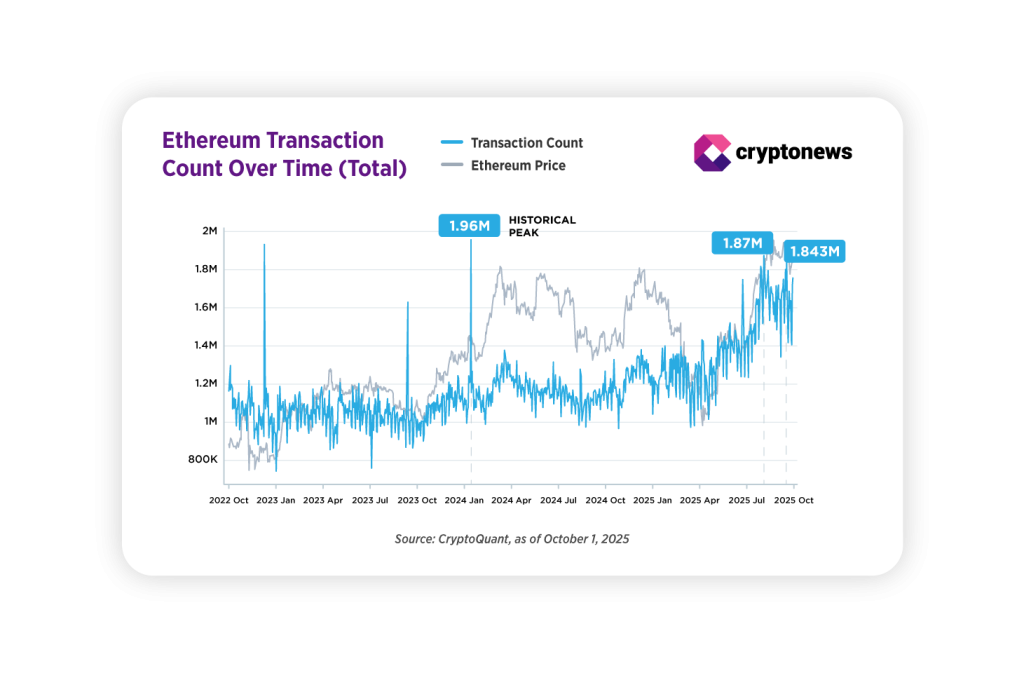

According to CryptoQuant, Ethereum’s transaction count has been climbing, reaching nearly 2 million and approaching historical highs. This shows strong and consistent demand across DeFi, stablecoins, and Layer-2s. Yet this momentum comes with challenges that institutions cannot ignore. Dobrovitsky highlights the trade-offs:

Ethereum is seeing rising institutional demand, regulatory clarity, and Layer-2 growth, but must manage MEV stress and security risks. Its role as the backbone for stablecoins could cement ETH as a digital reserve asset.

Storm or Uptober? Bitcoin and Crypto at a Crossroads

The past few months have been marked by sharp volatility across the crypto market. After a strong summer rally and Ethereum’s long-awaited all-time high, September brought a correction. Some analysts had anticipated the drop, noting that such pullbacks are often necessary.

Joaquin Mendes, COO of Taiko, underlines this point:

Market corrections like September 22 bring overheated prices back to reality and often set the stage for the next phase of growth.

Macro conditions added to the uncertainty. Political tensions in the U.S., including the recent government shutdown and weak economic data, kept investors cautious. One of the most anticipated events is the Federal Reserve’s meeting on Oct. 29, which could shape investor sentiment going into the final stretch of the year.

Still, the market showed resilience. Even with political pressure, Bitcoin managed to hold above $105,000, with the September low at $107,000. By Oct. 2, it had recovered to around $117,000, resisting a broader selloff.

Whether Bitcoin can deliver another rally and set fresh highs remains uncertain. Traders are looking ahead to the so-called “Uptober,” but another correction cannot be ruled out. While the market did not react strongly to recent political events, the impact could yet appear. For now, uncertainty dominates the outlook.

Mendes adds that near-term expectations may be more restrained:

Looking ahead, Bitcoin may see more modest gains from current levels around $108,000–$118,000, while Ethereum shows greater upside potential with possible moves toward previous highs.

Key Economic and Crypto Events to Watch in October 2025

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice.

- [LIVE] Fed Payments Innovation Conference: Real-Time Updates as Federal Reserve Discusses Crypto, Stablecoins, and AI with Industry Leaders

- China’s Alibaba AI Predicts the Price of XRP, Shiba Inu and Bitcoin By the End of 2026

- New ChatGPT Predicts the Price of XRP, PEPE and Ethereum By the End of 2026

- Bitcoin Price Prediction: $800M Short Squeeze Resets Market as BTC Holds $95K

- Ethereum Price Prediction: Nearly 30% of ETH Just Vanished From Circulation – $10,000 Just Weeks Away?

- [LIVE] Fed Payments Innovation Conference: Real-Time Updates as Federal Reserve Discusses Crypto, Stablecoins, and AI with Industry Leaders

- China’s Alibaba AI Predicts the Price of XRP, Shiba Inu and Bitcoin By the End of 2026

- New ChatGPT Predicts the Price of XRP, PEPE and Ethereum By the End of 2026

- Bitcoin Price Prediction: $800M Short Squeeze Resets Market as BTC Holds $95K

- Ethereum Price Prediction: Nearly 30% of ETH Just Vanished From Circulation – $10,000 Just Weeks Away?