Bitcoin Price Prediction: $800M Short Squeeze Resets Market as BTC Holds $95K

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships. However, this potential compensation never influences our analysis, opinions, or reviews. Our editorial content is created independently of our marketing partnerships, and our ratings are based solely on our established evaluation criteria. Read More

Bitcoin is trading near $95,600, stabilizing after a sharp upside move that triggered widespread short liquidations. Nearly $800 million in shorts were wiped out during the rally, confirming that bearish positioning had become crowded and vulnerable. Rather than showing exhaustion, price action now reflects post-squeeze consolidation above former resistance, a typical pause after forced buying.

Liquidity conditions remain supportive. With Bitcoin’s market capitalization near $1.91 trillion and daily volume above $52 billion, depth remains strong. That backdrop usually favors continuation or range-building structures, not abrupt trend reversals, especially after a liquidation-driven impulse.

Short Squeeze Cleared Bearish Exposure

The rally was mechanically driven. As Bitcoin pushed higher, leveraged shorts were forced to close, accelerating the move and resetting positioning. Bitcoin led liquidation totals, followed by Ethereum and Solana, underscoring how concentrated bearish exposure had become before the breakout.

After such events, markets often shift from momentum to digestion. Sellers become more selective, while buyers tend to step in on shallow pullbacks rather than chase strength.

Long Liquidations Signal Cooling, Not Breakdown

Over the past 24 hours, liquidation dynamics have flipped. Total crypto liquidations reached roughly $332.6 million, with long positions accounting for about $272 million, compared with $60 million in shorts. This indicates late bullish leverage is now being trimmed as momentum cools.

Ethereum shows the heaviest stress, with outsized long liquidations near resistance. Bitcoin, by contrast, remains relatively clean, with modest liquidation clusters. That divergence suggests BTC positioning is healthier and less crowded than much of the broader market.

From a structural standpoint, this is deleveraging, not distribution. As long as Bitcoin holds its key support zone, the current liquidation profile supports a consolidation phase that resets leverage while preserving the broader bullish setup.

Bitcoin (BTC/USD) Technical Structure Signals Continuation, Not Distribution

On the 4-hour chart, Bitcoin price prediction seems bullish as BTC has reclaimed prior resistance near $95,000 and is now retesting it as support. This is a classic post-breakout behavior. The 50-EMA has crossed above the 200-EMA, confirming a medium-term trend shift, while higher lows remain intact above the rising trendline.

Candlestick structure shows smaller bodies and brief pauses near $96,500–$97,000, pointing to absorption rather than active selling. Momentum indicators support this view: RSI has cooled into the 55–60 zone, a typical reset seen during trend continuation phases, with no bearish divergence present.

Bitcoin Price Prediction: Path Toward $100,000

From here, the structure resembles a bullish consolidation flag. A shallow dip toward the $95,100–$94,500 demand zone, followed by a higher low, would keep the bullish setup intact. A confirmed break above $97,600 opens the door to $99,000, with the psychological $100,000 level back in focus.

A loss of $93,300 would weaken the near-term outlook, but as long as price holds above that level, dips appear corrective rather than trend-ending.

Outlook: Bitcoin remains positioned for continuation, with consolidation acting as a launchpad rather than a ceiling.

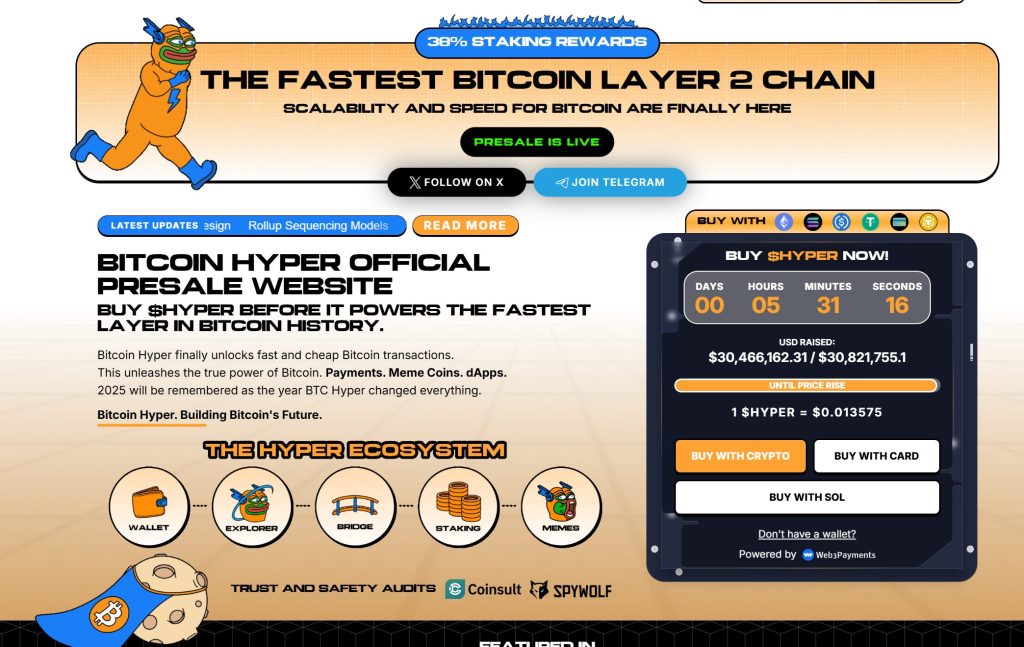

Bitcoin Hyper: The Next Evolution of BTC on Solana?

Bitcoin Hyper ($HYPER) is bringing a new phase to the Bitcoin ecosystem. While BTC remains the gold standard for security, Bitcoin Hyper adds what it always lacked: Solana-level speed. The result: lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Consult, the project emphasizes trust and scalability as adoption builds. And momentum is already strong. The presale has surpassed $30.4 million, with tokens priced at just $0.013575 before the next increase.

As Bitcoin activity climbs and demand for efficient BTC-based apps rises, Bitcoin Hyper stands out as the bridge uniting two of crypto’s biggest ecosystems. If Bitcoin built the foundation, Bitcoin Hyper could make it fast, flexible, and fun again.

Click Here to Participate in the Presale

- [LIVE] Fed Payments Innovation Conference: Real-Time Updates as Federal Reserve Discusses Crypto, Stablecoins, and AI with Industry Leaders

- China’s Alibaba AI Predicts the Price of XRP, Shiba Inu and Bitcoin By the End of 2026

- New ChatGPT Predicts the Price of XRP, PEPE and Ethereum By the End of 2026

- XRP Price Prediction: While the Crypto Market Bleeds, Big Money Is Quietly Flowing Into XRP — What Do They Know?

- Bitcoin Price Prediction: $800M Short Squeeze Resets Market as BTC Holds $95K

- [LIVE] Fed Payments Innovation Conference: Real-Time Updates as Federal Reserve Discusses Crypto, Stablecoins, and AI with Industry Leaders

- China’s Alibaba AI Predicts the Price of XRP, Shiba Inu and Bitcoin By the End of 2026

- New ChatGPT Predicts the Price of XRP, PEPE and Ethereum By the End of 2026

- XRP Price Prediction: While the Crypto Market Bleeds, Big Money Is Quietly Flowing Into XRP — What Do They Know?

- Bitcoin Price Prediction: $800M Short Squeeze Resets Market as BTC Holds $95K