Sui and Libre Open On-chain Access to Range of Investment Funds for Institutions

Layer-1 blockchain Sui has partnered with Libre Capital, a financial instruments tokenization and issuance infrastructure developer. The partnership has brought traditional financial expertise into the digital asset market, said the email sent to Cryptonews.

The integrating infrastructure and Sui’s blockchain enables institutional or accredited investors to access diverse on-chain assets in an efficient and compliant manner. This provides investment opportunities across multiple on-chain funds, including leading hedge funds, private credit funds, and money market funds.

Notably, this “diverse range of attractive investment funds” includes the tokenized Laser Carry Fund (LCF), a market-neutral digital asset strategy from Nomura’s Laser Digital.

Libre’s infrastructure enables investors to access tokenized versions of real-world assets (RWAs), including various alternative asset products on public blockchains. At the same time, Sui is purpose-built for RWAs.

Furthermore, Libre uses the on-chain ‘Libre Gateway DeFi dApps’ on each public chain to allow investors to directly and compliantly access funds on the Sui Chain.

Avtar Sehra, CEO and founder of Libre, commented that the launch of the Libre Gateway on Sui is “a huge step forward to enable access to wealth and treasury management tools for users on Sui.” It allows Libre to enable value-added services like collateralized lending for on-chain users.

Also, by leveraging Libre’s capabilities and Sui’s ecosystem, the collaboration will “expand investment horizons for institutional and accredited investors seeking to diversify their portfolios within the digital asset landscape,” the CEO said.

‘The Beginning of Many Blockchain Integrations’

Sui’s and Libre Capital’s partnership enables the tokenization of a high-yield, market-neutral digital asset strategy Laser Digital. The latter is backed by the global financial services group Nomura.

According to the announcement shared with Cryptonews, Laser Digital provides scalable, robust opportunities across trading, solutions, asset management, and ventures. It adapts to market needs “to move swiftly to capitalization.” It also shares “learnings with clients and partners – bringing greater confidence to the institutional market for the benefit of all.”

Meanwhile, Laser Carry Fund (LCF) is a high-yield, market-neutral strategy that utilizes the funding rates and yield opportunities in the digital asset market for the benefit of the clients. It capitalizes on capital markets and risk management expertise in traditional and digital markets, says the announcement.

It adds that “the LCF launch also reflects efforts to bring expertise from traditional financial institutions to digital asset markets.”

Additionally, Christian Thompson, Sui Foundation’s Managing Director, said that leveraging Sui’s Move-based infrastructure to provide these types of investors with safe and seamless access to RWAs is “a powerful use case for the technology.”

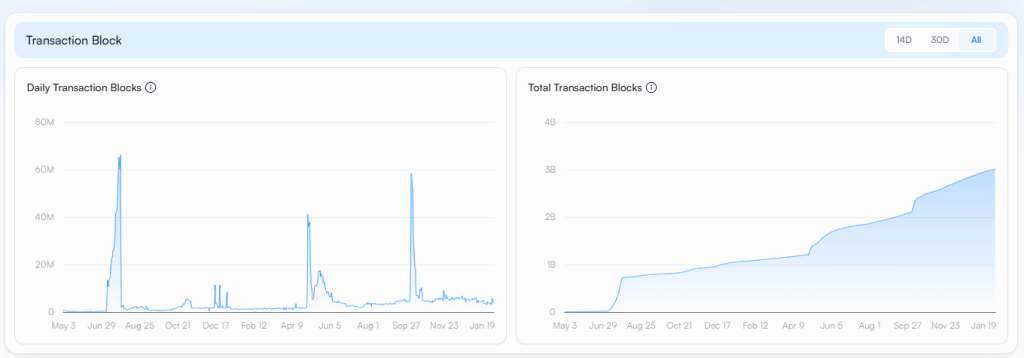

Sui statistics:

“We are pleased to tokenize the Laser Carry Fund (LCF) with Libre on Sui,” added Florent Jouanneau, Partner at Laser Digital. This allows it to leverage the innovative MOVE-based infrastructure.

The milestone is the first step in enabling greater composability, said Jouanneau. It “marks the beginning of many blockchain integrations as we expand access for institutional and accredited investors.”

- [LIVE] Fed Payments Innovation Conference: Real-Time Updates as Federal Reserve Discusses Crypto, Stablecoins, and AI with Industry Leaders

- Crypto Market Prospect: After the Washout, the Soil Looks Richer

- Bitcoin Price Prediction: Why $88,000 Could Be the Calm Before a $94,000 Push

- XRP Price Prediction: $1.9bn ETF Inflows Put $2.15 Breakout Back in Play

- Bitcoin May Not Have Bottomed Yet as Social Media Fear Remains Low: Analyst

- [LIVE] Fed Payments Innovation Conference: Real-Time Updates as Federal Reserve Discusses Crypto, Stablecoins, and AI with Industry Leaders

- Crypto Market Prospect: After the Washout, the Soil Looks Richer

- Bitcoin Price Prediction: Why $88,000 Could Be the Calm Before a $94,000 Push

- XRP Price Prediction: $1.9bn ETF Inflows Put $2.15 Breakout Back in Play

- Bitcoin May Not Have Bottomed Yet as Social Media Fear Remains Low: Analyst