Stablecoin Reserves on Exchanges Hit Record $68B as Binance Commands 67%: CryptoQuant

Tanzeel Akhtar has been reporting on cryptocurrency and blockchain technology since 2015. Her work has appeared in leading publications including The Wall Street Journal, Bloomberg, CoinDesk, Bitcoin...

- TON’s Blueprint for Mass Adoption: Inside Telegram’s Web3 Play

- Coinbase UK CEO Says Tokenised Collateral Is Moving Into Market Mainstream

- Gemini to Exit UK, EU, Aus Market, Shifts Accounts to Withdrawal-Only From March 5

- Tether Makes $100M Strategic Equity Investment in Anchorage Digital

- Uniform Labs’ Multiliquid and Metalayer Launch RWA Redemption Facility on Solana

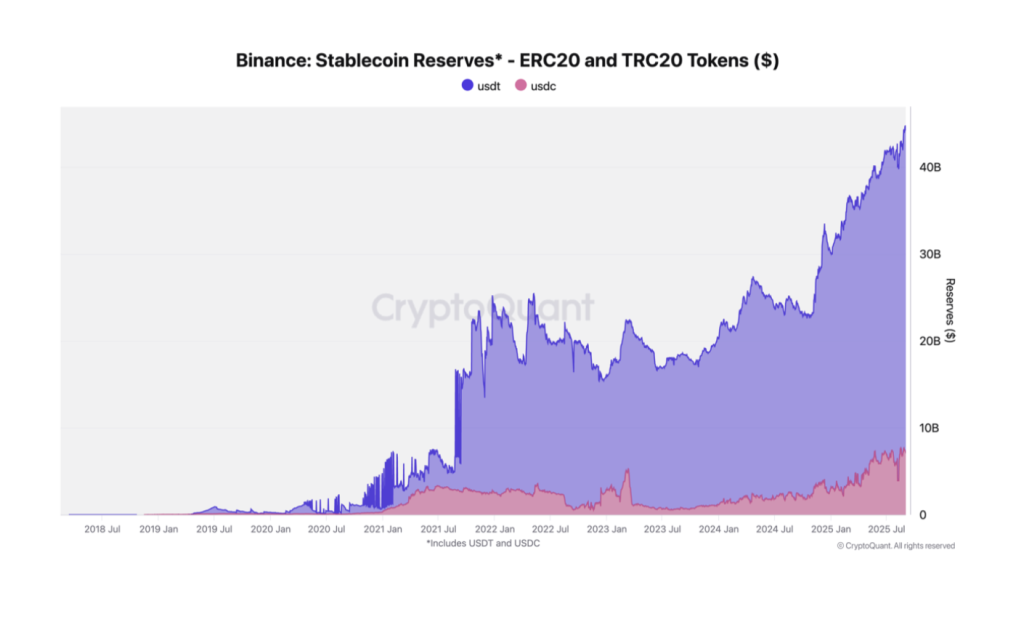

Stablecoin reserves on centralized crypto exchanges have reached an all-time high, climbing to $68 billion in early September, according to latest data from CryptoQuant.

This latest progress shows the growing role of stablecoins in global crypto markets, providing both liquidity and a reliable bridge between fiat and digital assets.

Stablecoin liquidity hits a record $68B.

— CryptoQuant.com (@cryptoquant_com) September 4, 2025

Binance dominates with $44.2B (67% share), while OKX holds $9B.

Growth over the past 30 days driven by Binance (+$2.2B) and OKX (+$800M). pic.twitter.com/LoR94TtGkC

The surge also reflects continued investor demand for stability amid volatile market conditions, as well as the increasing use of stablecoins in trading, yield generation, and cross-border settlements.

Binance Dominates Stablecoin Holdings

Leading the charge is Binance, whose reserves hit $44.2 billion by the end of August. This makes up 67% of all USDT and USDC reserves held across exchanges, reports CryptoQuant.

Of this total, $37.1 billion is in Tether (USDT), while $7.1 billion is in USD Coin (USDC), marking a resurgence in USDC’s presence on the platform.

Binance’s dominance highlights its unmatched role as the global hub for stablecoin liquidity, facilitating massive trading volumes and acting as a primary gateway for digital asset flows.

Other Exchanges Show Flat Growth

In contrast, competing exchanges have seen relatively stagnant stablecoin balances. OKX, the second-largest holder, currently maintains $9.0 billion in reserves, translating to a 14% market share.

Bybit follows with $4.2 billion (6%), and Coinbase holds $2.6 billion (4%). Despite their established positions, these platforms have not experienced meaningful growth in 2025, suggesting that users continue to consolidate activity on the largest exchanges, particularly Binance.

Binance and OKX Lead Recent Expansion

Over the past 30 days, the most notable increases in stablecoin liquidity occurred on Binance and OKX. Binance’s reserves swelled by $2.2 billion, while OKX added $800 million.

This acceleration demonstrates both exchanges’ ability to attract traders and capital, reinforcing their dominance in the sector. Meanwhile, Bybit and Coinbase’s reserves have remained largely flat, pointing to divergent strategies and user preferences across different platforms.

- XRP Price Surges as Ripple CEO Takes Role Influencing Crypto Regulation

- Bitcoin Price Prediction: Billion-Dollar Firm Says BTC is Acting Like a Growth Stock – Is That Good or Dangerous for You?

- Elon’s Grok AI Predicts the Price of XRP, Cardano and Bitcoin By the End of 2026

- XRP Price Prediction: Ripple’s Executive Criticises Bitcoin’s Technology – Can XRP Overtake BTC?

- Bitcoin Price Prediction: BTC Shorts Hit Their Most Extreme Level Since the 2024 Bottom – Is a Massive Squeeze Coming?

About Us

2M+

250+

8

70

Market Overview

- 7d

- 1m

- 1y

- XRP Price Surges as Ripple CEO Takes Role Influencing Crypto Regulation

- Bitcoin Price Prediction: Billion-Dollar Firm Says BTC is Acting Like a Growth Stock – Is That Good or Dangerous for You?

- Elon’s Grok AI Predicts the Price of XRP, Cardano and Bitcoin By the End of 2026

- XRP Price Prediction: Ripple’s Executive Criticises Bitcoin’s Technology – Can XRP Overtake BTC?

- Bitcoin Price Prediction: BTC Shorts Hit Their Most Extreme Level Since the 2024 Bottom – Is a Massive Squeeze Coming?

More Articles

Get dialed in every Tuesday & Friday with quick updates on the world of crypto