How Senator Lummis’s 1 Million Bitcoin Purchase Plan Will Actually Play Out: Draft Bill

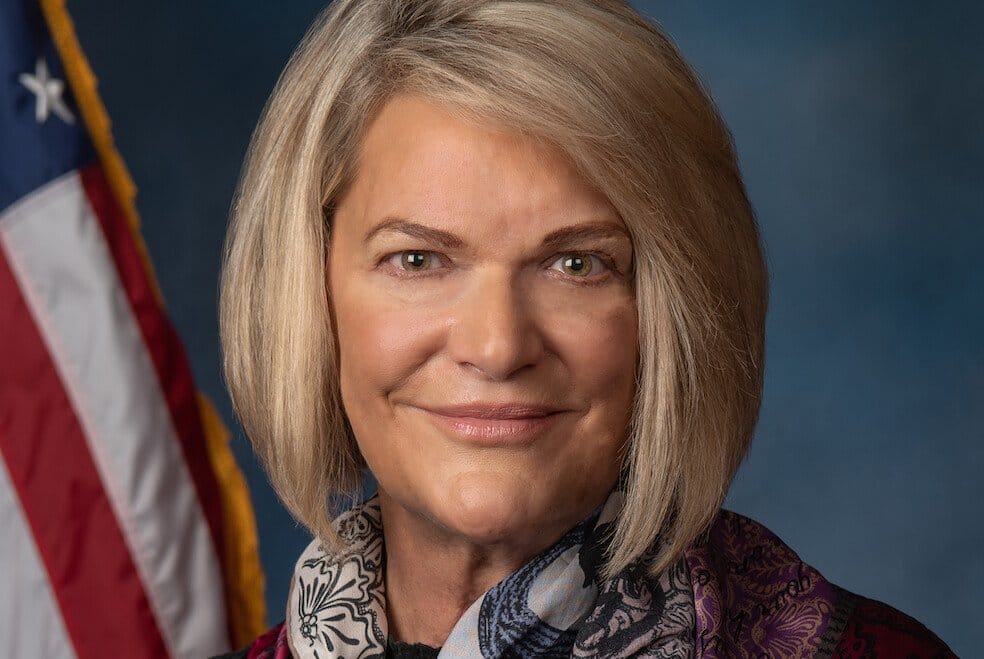

United States Senator Cynthia Lummis (R-Wyoming) revealed a draft bill to CoinDesk on July 31, outlining a plan to establish a federal stockpile of 1 million Bitcoin—a plan substantially different from what her initial comments suggested.

The proposed legislation, dubbed the “Bitcoin Act of 2024,” would establish a “Bitcoin Purchase Program” for the U.S. Treasury.

The Bitcoin Act of 2024 proposes establishing a US Strategic Bitcoin Reserve that would be financed in part by a revaluation of the #Fed’s #gold.

The #Bitcoin Purchase Program aims to deliver up to 200k #BTC /year over five yrs, reaching 1M BTC in total. The Bitcoin will be… pic.twitter.com/foqdApuG73

— Matthew Dixon – CEO Evai (@mdtrade) July 31, 2024

This program would authorize the acquisition of up to 200,000 BTC annually for five years, ultimately capping the federal Bitcoin reserve at 1 million BTC.

The Lummis Bitcoin Act: Key Details of the Proposed Legislation

The path to funding these substantial purchases hinges on a bold proposition: reevaluating the U.S. government’s gold reserves held at Fort Knox. This revaluation seeks to capitalize on gold’s notable price appreciation over the past several decades.

As outlined in the legislation, the process would begin with Federal Reserve banks returning their existing gold certificates to the U.S. Treasury.

Subsequently, the Treasury would issue “new gold certificates” to these banks, reflecting the current fair market value of the gold. This process culminates in the Fed banks remitting the cash value difference between the old and new certificates to the Treasury Secretary.

Funding the Vision: Gold Revaluation and Reserve Surplus

As of July 25, the Federal Reserve’s balance sheet valued its gold stock at a mere $11 billion, seemingly based on the Federal Reserve Bank of New York’s outdated valuation of $42.22 per troy ounce.

However, with gold’s actual market price currently exceeding $2,423 per ounce – over 57 times the Fed’s valuation – the 8,134 tonnes of gold reportedly owned by the Treasury could be worth an astounding $630 billion.

George Selgin, director emeritus at the Center for Monetary & Financial Alternatives at the Cato Institute, considers the government’s current book value for its gold an “accounting fiction.”

He believes that Senator Lummis’s plan to bolster the Lummis Bitcoin initiative through gold revaluation is “certainly feasible.”

The Treasury could then buy $64 billion of BTC using just a fraction of its windfall. Easy!

But…there is always a but.

— George Selgin (@GeorgeSelgin) July 29, 2024

In a tweet on Monday, Selgin suggested, “The Treasury could then buy $64 billion of BTC using just a fraction of its windfall.”

Additionally, the bill proposes funding Bitcoin acquisitions through net earnings the Federal Reserve remits to the Treasury.

Specifically, from fiscal years 2025 to 2029, the legislation seeks to decrease Federal Reserve banks’ discretionary surplus from $6.825 billion to $2.4 billion, allocating the difference to BTC purchases.

This strategy aligns with Senator Lummis’s comments at Bitcoin 2024. However, it would only cover a fraction of the funds needed to achieve the 1 million BTC target, currently at a market value of $66 billion.

While the gold revaluation plan appears theoretically sound, some Bitcoin proponents are skeptical about the actual existence of the gold reserves claimed by the government.

The Treasury has $350b in gold? Now THAT is a wild conspiracy theory. Audits or GTFO.

— Saifedean Ammous (@saifedean) July 30, 2024

Commenting on the Treasury’s reported gold holdings, Saifedean Ammous, author of the Bitcoin Standard, expressed his skepticism on X: “The Treasury has $350b in gold? Now THAT is a wild conspiracy theory.” He referred to half the Treasury’s purported Fort Knox reserves and demanded “Audits or GTFO.”

- XRP Price Could Explode After Tokenization Deal With Fund Manager

- Leading AI Claude Predicts the Price of XRP, Cardano and Ethereum By the End of 2026

- XRP Price Prediction: Could XRP Really Flip Bitcoin and Ethereum? One Analyst Says the Battle Has Already Begun

- Bitcoin Price Prediction: Alarming New Research Warns Millions in BTC at Risk of ‘Quantum Freeze’ – Are You Protected?

- Strange New Chinese AI ‘KIMI’ Predicts the Price of XRP, Dogecoin and Solana By the End of 2026

- XRP Price Could Explode After Tokenization Deal With Fund Manager

- Leading AI Claude Predicts the Price of XRP, Cardano and Ethereum By the End of 2026

- XRP Price Prediction: Could XRP Really Flip Bitcoin and Ethereum? One Analyst Says the Battle Has Already Begun

- Bitcoin Price Prediction: Alarming New Research Warns Millions in BTC at Risk of ‘Quantum Freeze’ – Are You Protected?

- Strange New Chinese AI ‘KIMI’ Predicts the Price of XRP, Dogecoin and Solana By the End of 2026