[LIVE] Bitcoin Price Reacts to Fed’s 25bps Rate Cut: Will Powell’s Guidance Shift Crypto Markets?

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships. However, this potential compensation never influences our analysis, opinions, or reviews. Our editorial content is created independently of our marketing partnerships, and our ratings are based solely on our established evaluation criteria. Read More

The Federal Reserve announces its December interest rate decision at 2:00 PM ET today, with Chair Jerome Powell’s press conference following at 2:30 PM ET.

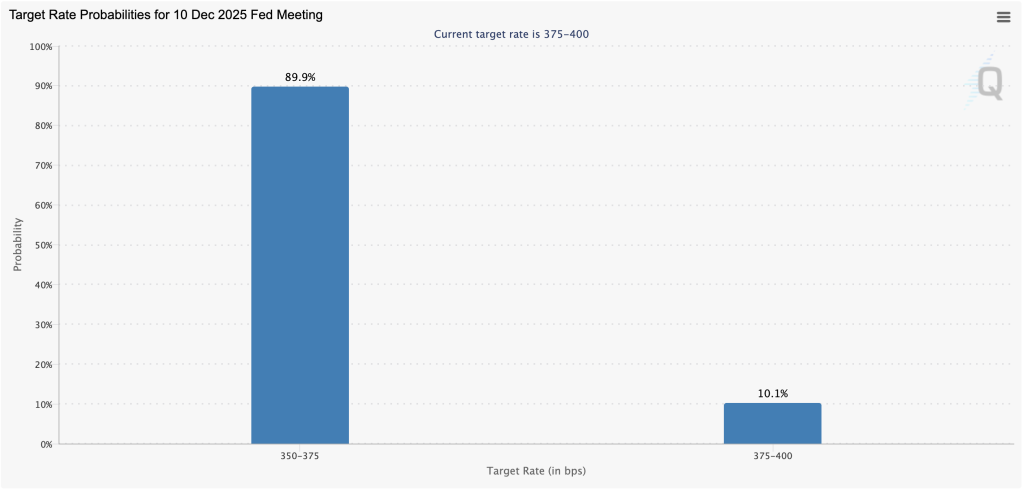

Bitcoin is trading around $92,000 as markets price in an 89% chance of a rate cut that would lower the federal funds rate to 3.50%-3.75%.

The decision comes after a week of conflicting economic signals, including shockingly strong jobless claims (191K vs 219K expected, lowest since 2022), cooling core PCE inflation (2.8% from 2.9%), and yesterday’s JOLTS data showing job openings unchanged at 7.7 million with quits declining 276,000 year-over-year.

The combination of labor market stability and improving inflation supports the case for easing, but some Fed officials have expressed concern about cutting too aggressively, with employment still resilient.

This marks the Fed’s third policy meeting since beginning its easing cycle with a 50 basis point cut in September, followed by another 25 basis point reduction in October.

The central bank officially ended quantitative tightening on December 1, freezing its balance sheet at $6.57 trillion after draining $2.39 trillion from markets since June 2022.

Markets are focused not just on today’s decision but also on Powell’s guidance for 2025. The updated dot-plot projections could signal whether the Fed sees two, three, or four more cuts next year.

Any hawkish shift suggesting fewer cuts in 2025 would likely pressure Bitcoin and risk assets, while dovish guidance reinforcing the easing cycle could provide the catalyst for Bitcoin to break above $92,000 resistance.

Bitcoin’s technical setup shows critical resistance at $92,000 and the descending trendline that’s capped rallies since mid-November, with support holding at $88,000-$90,000. Total crypto market cap sits at $3.23 trillion.

The key risk for crypto is a “hawkish cut”—where the Fed reduces rates 25 basis points today but signals a slower pace of easing in 2025 due to sticky inflation or resilient employment.

Powell’s 2:30 PM press conference will be scrutinized for any hints about the January meeting and the overall trajectory of policy.

With the Fed’s liquidity pivot complete (QT ended) and inflation moving in the right direction, the path of least resistance for Bitcoin is higher—but only if Powell doesn’t pour cold water on aggressive 2025 easing expectations.

Fed Decision Day: Markets Brace for Rate Cut or Hawkish Surprise

- [LIVE] Fed Payments Innovation Conference: Real-Time Updates as Federal Reserve Discusses Crypto, Stablecoins, and AI with Industry Leaders

- China’s DeepSeek AI Predicts the Price of XRP, Bitcoin and Cardano By the End of 2026

- China’s Alibaba AI Predicts the Price of XRP, Shiba Inu and Bitcoin By the End of 2026

- New ChatGPT Predicts the Price of XRP, Ethereum and Solana By the End of 2026

- Ethereum Price Prediction: Banking Giant Standard Chartered Says ETH Will Beat Bitcoin – Can ETH Reach $100,000?

- [LIVE] Fed Payments Innovation Conference: Real-Time Updates as Federal Reserve Discusses Crypto, Stablecoins, and AI with Industry Leaders

- China’s DeepSeek AI Predicts the Price of XRP, Bitcoin and Cardano By the End of 2026

- China’s Alibaba AI Predicts the Price of XRP, Shiba Inu and Bitcoin By the End of 2026

- New ChatGPT Predicts the Price of XRP, Ethereum and Solana By the End of 2026

- Ethereum Price Prediction: Banking Giant Standard Chartered Says ETH Will Beat Bitcoin – Can ETH Reach $100,000?