Japan’s Remixpoint to Buy $3.2M Worth of BTC With Its Balance Sheet

Tim Alper is a British journalist and features writer who has worked at Cryptonews.com since 2018. He has written for media outlets such as the BBC, the Guardian, and Chosun Ilbo. He has also worked...

- Naver-Dunamu Crypto ‘Mega-Company’ Could Be Worth $2.1B a Year – Experts

- Russia Losing ‘Millions of Dollars a Year to Illegal Crypto Miners’ – Report

- Russian Economist: BTC Will Hit $120k-$130k Again Before End of Year

- Russia’s Central Bank: Tokenization Will Let Foreigners Buy Domestic Shares

- S Korean Tax Agency: Pay Your Bills or We’ll Take Your Crypto Cold Wallets

The stock market-listed Japanese firm Remixpoint will use its balance sheet to buy $3.2 million worth of Bitcoin (BTC).

Per an official Remixpoint release and a report from the Japanese-language media outlet CoinPost, the company said it will spend 500 million yen on BTC purchases before the end of the year.

Remixpoint Buys Bitcoin, ETH, and Altcoins

In September this year, the company spent around $5.3 million on BTC, Ethereum (ETH), Solana (SOL), and Avalanche (AVAX) holdings.

It has also amassed smaller Dogecoin (DOGE) and XRP holdings as it looks to diversify its portfolio.

The firm is the former owner of the BITpoint crypto exchange, which it sold to the securities and crypto giant SBI in 2023.

Remixpoint said that it would make a full disclosure if the new BTC purchase “has a significant impact on [its] consolidated financial results.”

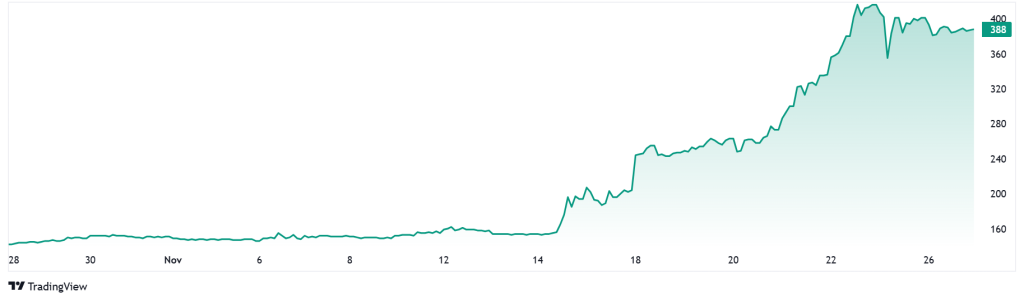

The firm said it was responding to “upward price trends” following the Bitcoin halving event earlier this year. It also wrote:

“We expect more institutional investors to enter the market following the approval of crypto spot ETFs.”

Shareholder Approval

The firm’s shareholders approved the crypto-buying strategy earlier this year, claiming that it would help the company fight the rising risk of yen depreciation.

Euro-yen is getting increased attention as policy divergence between the two regions looks set to offer opportunities in the currency pair. https://t.co/lpOb1MAjlP

— Bloomberg (@business) November 20, 2024

It spoke of the need to diversify and “reduce” its “exposure to yen-denominated assets.”

The company’s documentation shows that Remixpoint’s unrealized gains on its entire crypto portfolio have already reached the $5.3 million mark.

Earlier this year, the company explained that it wanted to use its crypto-buying strategy to offset “the risk of fluctuations in the value of the currencies it holds.”

Japan's aging 'Mrs. Watanabe' could mean turbulent future for yen

— Nikkei Asia (@NikkeiAsia) November 24, 2024

Contrarian retail investors serve as check on volatility in exchange rateshttps://t.co/PmK6iyD4Jl pic.twitter.com/Oah7gwWwMR

The firm was founded in 2004 and floated on the Tokyo Stock Exchange in 2006. It began life as a software firm, but in more recent years has pivoted toward electricity and automobile trading.

- XRP Price Surges as Ripple CEO Takes Role Influencing Crypto Regulation

- Bitcoin Price Prediction: Billion-Dollar Firm Says BTC is Acting Like a Growth Stock – Is That Good or Dangerous for You?

- Elon’s Grok AI Predicts the Price of XRP, Cardano and Bitcoin By the End of 2026

- Crypto Price Prediction Today 16 February – XRP, Ethereum, Cardano

- Google’s Gemini AI Predicts the Price of XRP, Solana and Bitcoin By the End of 2026

About Us

2M+

250+

8

70

Market Overview

- 7d

- 1m

- 1y

- XRP Price Surges as Ripple CEO Takes Role Influencing Crypto Regulation

- Bitcoin Price Prediction: Billion-Dollar Firm Says BTC is Acting Like a Growth Stock – Is That Good or Dangerous for You?

- Elon’s Grok AI Predicts the Price of XRP, Cardano and Bitcoin By the End of 2026

- Crypto Price Prediction Today 16 February – XRP, Ethereum, Cardano

- Google’s Gemini AI Predicts the Price of XRP, Solana and Bitcoin By the End of 2026

More Articles

Get dialed in every Tuesday & Friday with quick updates on the world of crypto