Is $BONK Ready to Rally? 3% Rebound Indicates Strong Key Support

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships. However, this potential compensation never influences our analysis, opinions, or reviews. Our editorial content is created independently of our marketing partnerships, and our ratings are based solely on our established evaluation criteria. Read More

Bonk ($BONK) has bounced back like a spring, recovering 3% after last week’s dip. With major milestones approaching and key support holding, this meme coin might be gearing up for its next move.

The Solana-based token is drawing institutional attention while its ecosystem expands. Now, investors await confirmation that this bounce has legs.

$BONK Nears 1M Holders: Scarcity, Institutional Interest, and Strategic Burns Drive Value

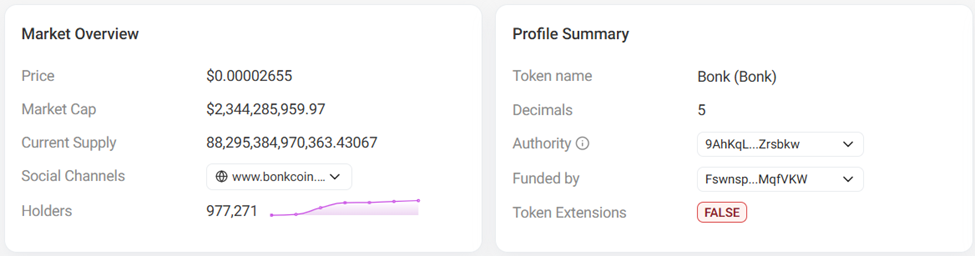

The $BONK token continues to hold its ground as the 46th-largest cryptocurrency by market capitalization at $2.12 billion, despite the recent price swing. This is due to optimism and confidence among its community of enthusiasts.

A major catalyst fueling this optimism is $BONK’s fast-growing user base. With 977,203 holders and counting, the token is edging closer to the anticipated 1 million holder milestone. Once achieved, the project has committed to a massive 1-trillion-token burn, a strategic move to enhance scarcity and strengthen long-term value.

Beyond token burns, $BONK is also attracting strong institutional attention. Its inclusion on the Grayscale Q3 2025 watchlist has given the project a new level of credibility.

Partnership developments are also boosting the token’s narrative. $BONK recently announced a collaboration with Dabba Network, allowing underserved communities to purchase internet hotspots using $BONK, portions of which are burned in the process, merging adoption with deflationary mechanics.

The broad adoption and interoperability of the $BONK token can be attributed to the integration of the Bonk network with more than 400 applications across 13 blockchains. Another important factor in its development is the network’s forward-thinking partnership within the Solana ecosystem, linking up with Magic Eden, Jupiter, and Orca platforms to enhance its exposure and liquidity.

Meanwhile, LetsBonk.fun, $BONK’s official launchpad, dominates the memecoin space on Solana, accounting for about 64% of new meme token launches. It also contributes to BONK’s deflationary cycle, having already burned over 500 billion tokens through fees.

With a rising holder base, deflationary mechanics, institutional interest, and technical support aligning, $BONK appears well-positioned to recover and potentially rally even higher in the near term.

$BONK/$USDT Finds Temporary Support at $0.00002390, but Derivatives Unwind Suggests an Uncertain Rebound

$BONK has bounced off the key 0.618 Fibonacci retracement level at $0.00002390, following a steady decline from the local high at $0.00004087.

The broader trend remains technically intact, but the loss of the ascending support line that guided the move from late June indicates a weakening structure.

The $BONK price is currently hovering around $0.00002660, attempting to stabilize above the 0.5 retracement level at $0.00002714.

However, momentum remains neutral, and there is little evidence of aggressive participation from either side.

The RSI reads 48.17, indicating a neutral zone with no immediate strength or weakness. It has ticked upward slightly from the oversold region but hasn’t shown any bullish divergence or breakout through its midline.

MACD reflects a similar picture, though the MACD line has crossed above the signal line; both remain below zero, showing a shallow attempt at recovery without strong momentum. The histogram has just turned green, but volume remains modest, so the signal lacks confirmation.

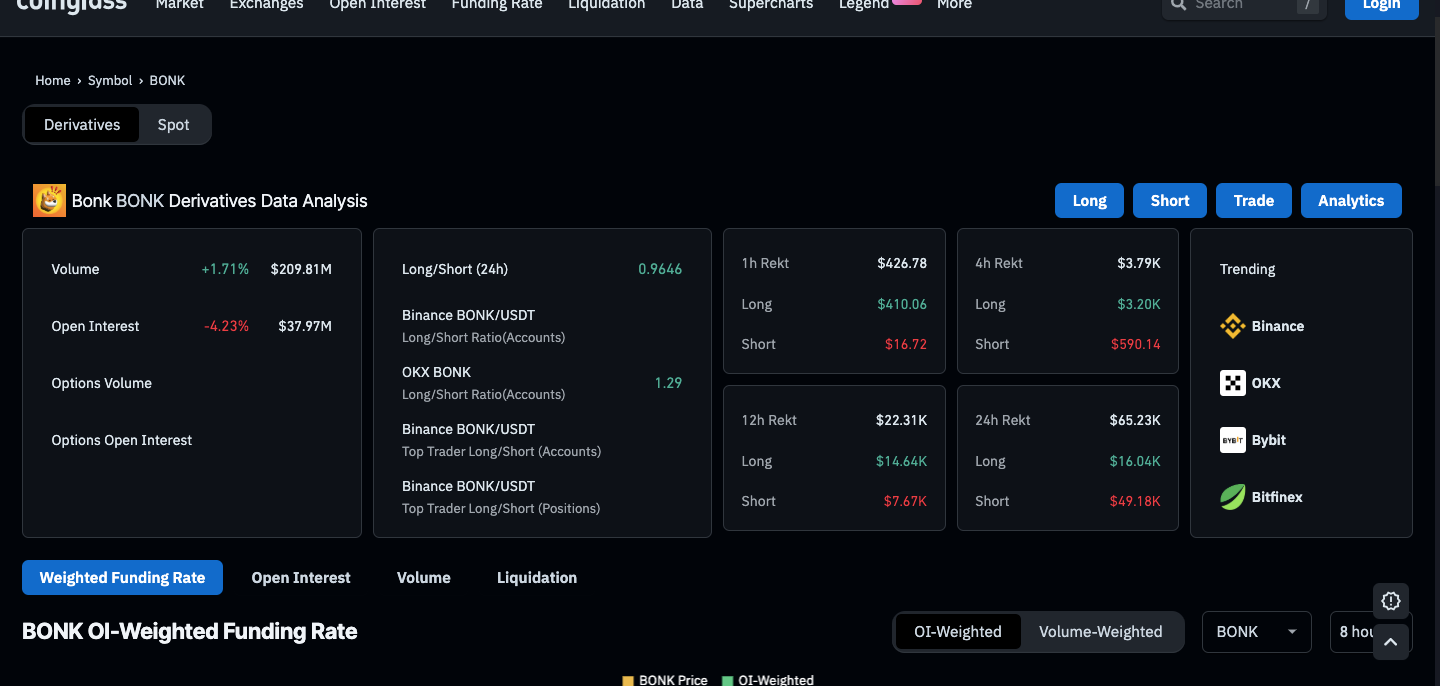

Regarding Bonk’s derivatives data, the unwind in open interest is more telling. Open interest is down 4.23% to $37.97 million, suggesting a pullback in speculative activity.

That drop follows a period of modest price recovery, which implies that the recent bounce is more driven by short covering or passive buying than by new long positioning. The long/short ratio sits just under 1.0, indicating balanced sentiment overall. OKX shows a slightly higher bias toward longs (1.29), but this is not extreme.

Liquidation data shows no major dislocation over the past 24 hours—just $65.23K, with most of that coming from short positions. This aligns with the modest up-move off $0.00002400. Still, without strong long liquidations or spikes in funding, the rally lacks the urgency typically seen in reversal setups.

For this recovery to extend meaningfully, $BONK must reclaim $0.00002714 and hold above it with volume.

That would definitely open the door to a retest of $0.00003038 (the 0.382 level on Fibonnaci), and beyond that, $0.00003439 remains a high-timeframe resistance to monitor. However, if the $BONK price fails to hold strength above $0.00002390, momentum shifts to $0.00001928 and potentially $0.00001711 as deeper retracement zones.

Right now, the bounce looks more corrective than impulsive, and bulls must prove their strength with time and volume.

- [LIVE] Fed Payments Innovation Conference: Real-Time Updates as Federal Reserve Discusses Crypto, Stablecoins, and AI with Industry Leaders

- China’s Alibaba AI Predicts the Price of XRP, Shiba Inu and Bitcoin By the End of 2026

- New ChatGPT Predicts the Price of XRP, PEPE and Ethereum By the End of 2026

- XRP Price Prediction: While the Crypto Market Bleeds, Big Money Is Quietly Flowing Into XRP — What Do They Know?

- Bitcoin Price Prediction: $800M Short Squeeze Resets Market as BTC Holds $95K

- [LIVE] Fed Payments Innovation Conference: Real-Time Updates as Federal Reserve Discusses Crypto, Stablecoins, and AI with Industry Leaders

- China’s Alibaba AI Predicts the Price of XRP, Shiba Inu and Bitcoin By the End of 2026

- New ChatGPT Predicts the Price of XRP, PEPE and Ethereum By the End of 2026

- XRP Price Prediction: While the Crypto Market Bleeds, Big Money Is Quietly Flowing Into XRP — What Do They Know?

- Bitcoin Price Prediction: $800M Short Squeeze Resets Market as BTC Holds $95K