Crypto Product Inflows Hit $224M, Momentum Slows Amid Fed Policy Uncertainty: CoinShares

Tanzeel Akhtar has been reporting on cryptocurrency and blockchain technology since 2015. Her work has appeared in leading publications including The Wall Street Journal, Bloomberg, CoinDesk, Bitcoin...

- Mavryk CEO Alex Davis on Tokenizing Real-World Assets and Building On-chain Yield at Scale

- Xen Baynham-Herd on Building Base: From Experimental L2s to Real On-chain Adoption

- Ethereum Is Emerging as a Global Public Good – and That Changes How It Should Be Valued, Says William Mougayar

- Amplify ETFs Expands Crypto ETF Lineup With Stablecoin and Tokenization Funds

- Bitget Wallet Integrates Hyperliquid to Expand Onchain Perpetual Trading

Digital asset investment products saw US$224 million in inflows last week, extending a strong seven-week streak to US$11 billion, according to the latest data from asset manager CoinShares.

Despite the positive trend, the pace of inflows has decelerated amid investor caution surrounding the U.S. Federal Reserve’s next move on interest rates and inflation.

📈 Digital asset inflows slow amid policy uncertainty, Ethereum leads

— CoinShares (@CoinSharesCo) June 9, 2025

Last week, digital asset investment products saw inflows totalling US$224M. @ethereum led with inflows of US$296.4M, while @Bitcoin saw outflows of US$56.5M. @SuiNetwork saw minor inflows of $1.1M, while $XRP… pic.twitter.com/6j2Aa2RuFl

Ethereum Leads the Pack Amid Market Uncertainty

The standout performer this week was Ethereum (ETH), which saw US$296.4 million in inflows, marking its seventh consecutive week of positive momentum.

These inflows bring Ethereum’s seven-week total to US$1.5 billion, now accounting for 10.5% of total assets under management (AuM)—a level not seen since the U.S. elections in November 2024.

“This represents the strongest run of inflows into Ethereum since last year’s U.S. election, signaling renewed investor confidence in the network’s long-term value,” said James Butterfill, Head of Research at CoinShares.

Bitcoin Sees Second Week of Outflows

While Ethereum gained ground, Bitcoin (BTC) registered its second consecutive week of outflows, totaling US$56.5 million.

Short-Bitcoin investment products also posted a second week of minor outflows, further suggesting that sentiment around Bitcoin remains cautious in the face of macroeconomic uncertainty.

“Policy direction from the Fed continues to create hesitancy,” Butterfill noted. “Many investors are in wait-and-see mode ahead of inflation signals and rate decisions.”

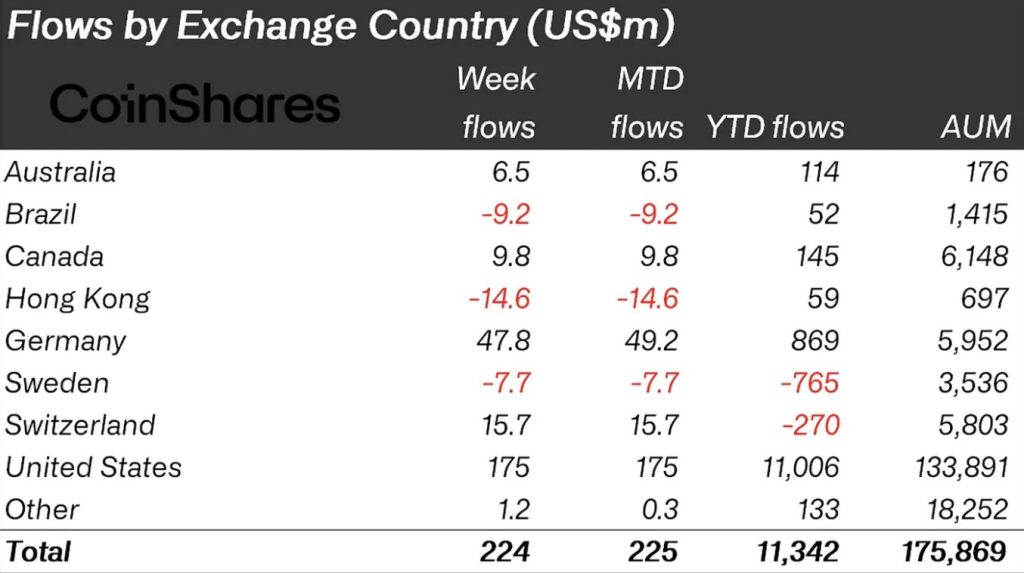

Despite this, the broader regional breakdown shows robust U.S. interest, with US$175 million of the total inflows coming from the U.S. Other regions contributing to the inflows include Germany (US$47.8M), Switzerland (US$15.7M), Canada (US$9.8M), and Australia (US$6.5M).

Altcoins Remain Subdued as Focus Shifts to Majors

Activity in altcoins remained relatively muted. Sui attracted US$1.1 million in minor inflows, while XRP experienced a third consecutive week of outflows, totaling US$6.6 million.

Meanwhile, Hong Kong and Brazil were the only regions to see net outflows, with Hong Kong reversing recent record inflows with US$14.6 million in redemptions.

As markets await more definitive direction from central banks, especially the U.S. Federal Reserve, the digital asset space appears to be consolidating. In the words of Butterfill, “The inflow slowdown reflects a cautious optimism—the capital is there, but conviction hinges on macro clarity.”

- [LIVE] Fed Payments Innovation Conference: Real-Time Updates as Federal Reserve Discusses Crypto, Stablecoins, and AI with Industry Leaders

- Crypto Market Prospect: After the Washout, the Soil Looks Richer

- China’s DeepSeek AI Predicts the Price of XRP, BTC, and SOL By the End of 2025

- Bitcoin Price Prediction: BTC Price Drops Below $88,000, Could Bears Win 2025 Despite New ATH?

- XRP Price Prediction: Franklin Templeton’s Spot ETF Tops 100M XRP in Holdings – Can Institutional Demand Push XRP Above $3?

About Us

2M+

250+

8

70

Market Overview

- 7d

- 1m

- 1y

- [LIVE] Fed Payments Innovation Conference: Real-Time Updates as Federal Reserve Discusses Crypto, Stablecoins, and AI with Industry Leaders

- Crypto Market Prospect: After the Washout, the Soil Looks Richer

- China’s DeepSeek AI Predicts the Price of XRP, BTC, and SOL By the End of 2025

- Bitcoin Price Prediction: BTC Price Drops Below $88,000, Could Bears Win 2025 Despite New ATH?

- XRP Price Prediction: Franklin Templeton’s Spot ETF Tops 100M XRP in Holdings – Can Institutional Demand Push XRP Above $3?

More Articles

Get dialed in every Tuesday & Friday with quick updates on the world of crypto