CoinShares Outlook: Tokenization and Real Revenue Define Crypto’s Next Phase

CoinShares has released its 2026 outlook titled “The Year Utility Wins,” positioning next year as the moment when digital assets transition from speculation to practical adoption.

The report introduces Hybrid Finance as the central framework where traditional financial institutions and blockchain infrastructure converge into a unified system serving real economic purposes.

Bitcoin reached all-time highs in 2025 while becoming more deeply embedded in institutional frameworks.

Stablecoins evolved into genuine settlement infrastructure, tokenization scaled beyond experimental pilots, and blockchain applications began generating consistent revenues.

The report emphasizes that “crypto is entering a value-accrual era” as platforms distribute earnings to token holders through systematic buybacks.

CoinShares Analyst Predicts Bitcoin to $170K

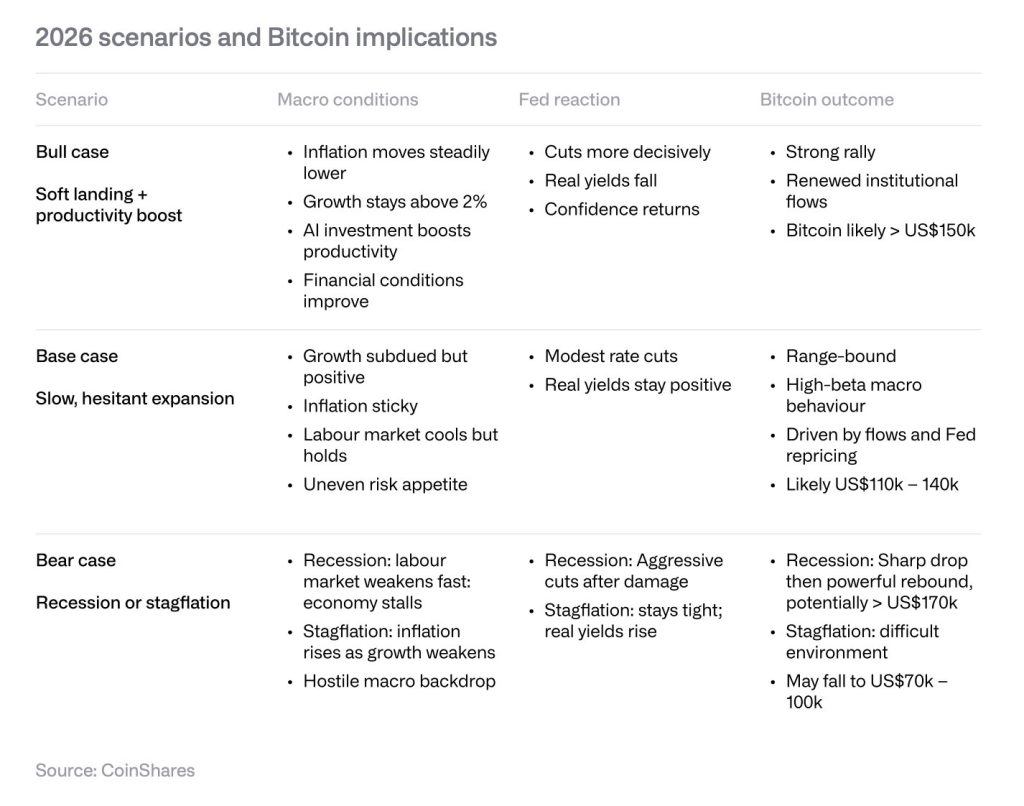

CoinShares projects three distinct scenarios for Bitcoin in 2026. The optimistic case, driven by productivity gains and steady disinflation, could push Bitcoin beyond $150,000.

The base case anticipates a trading range of $110,000 to $140,000, driven by ETF flows and expectations for the Federal Reserve.

The bear case splits between recession, where aggressive monetary easing could support prices above $170,000, and stagflation, which might compress valuations toward $70,000 to $100,000.

The report notes that “the Fed feels fundamentally uncomfortable: wanting to ease, but constantly second-guessing how fragile the disinflation trend really is,” creating an environment demanding fundamental justification for asset appreciation.

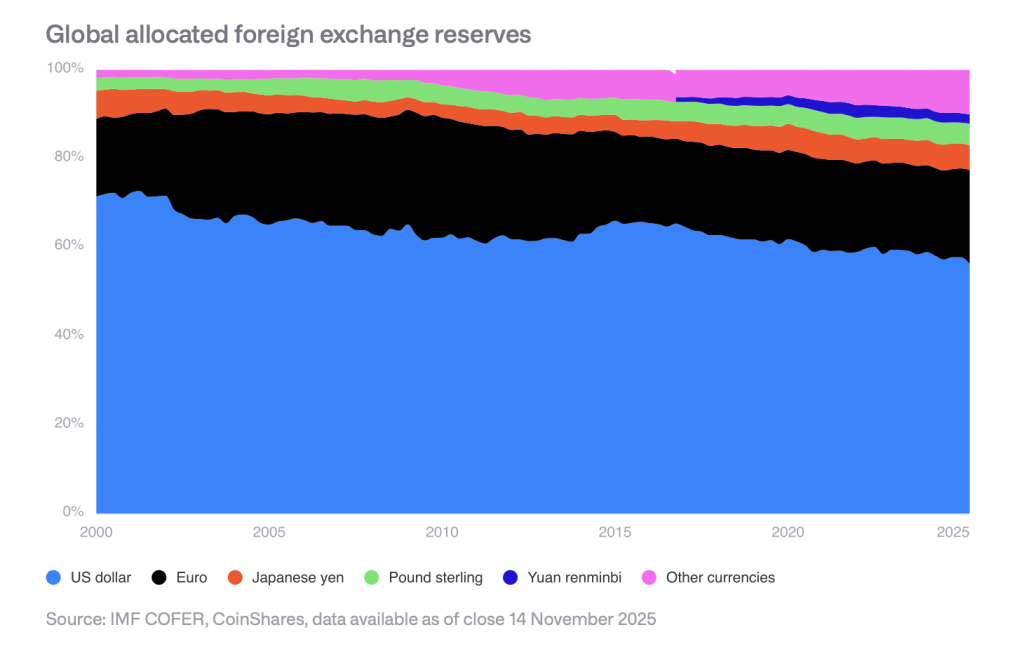

This backdrop reflects the erosion of dollar dominance, with the dollar’s global reserve share at mid-fifties, down from roughly 70% at the start of the millennium.

Corporate Bitcoin Holdings Present Concentration Risks

Corporate Bitcoin holdings have grown substantially, with publicly-listed companies increasing from 44 in January 2024 to 190 by November 2025.

Total holdings nearly quadrupled from 265,709 BTC to 1,048,520 BTC, with total value increasing roughly ninefold from $11.7 billion to $90.7 billion.

Strategy (MSTR) dominates this landscape, accounting for 61% of publicly-listed firms’ Bitcoin holdings after growing its stack from 189,150 BTC to 650,000 BTC.

The company holds approximately $70 billion in assets against $8.2 billion in debt, having secured $13.9 billion through convertible bonds. The top 10 corporate holders control 84% of the supply, while the top 20 hold 91%.

Notably, CoinShares identifies two scenarios that could force Strategy to sell Bitcoin, as both Saylor and the CEO have confirmed they will sell.

The company carries $6.6 billion in perpetual preferred stocks and $3.2 billion in interest-bearing debt, with annual cash flows totaling nearly $680 million.

As the modified net asset value approaches parity, new shares lose appeal, while refinancing risk looms with the nearest debt maturity in September 2028.

The report warns that eroding financing power could trigger a vicious cycle in which plunging prices force Bitcoin sales to cover obligations.

While CoinShares does not expect this to unfold in 2026, hundreds of thousands of coins could eventually flood the market.

Institutional Adoption Advances Through Multiple Channels

Two years after the US spot Bitcoin ETF approval in 2024, these products have attracted more than $90 billion in assets.

CoinShares anticipates the four major US wirehouses will formally enable discretionary Bitcoin ETF allocations in 2026, with at least one major 401(k) provider incorporating cryptocurrency options.

The report projects 13F filers will collectively hold over one-third of spot Bitcoin ETF assets by year-end 2026.

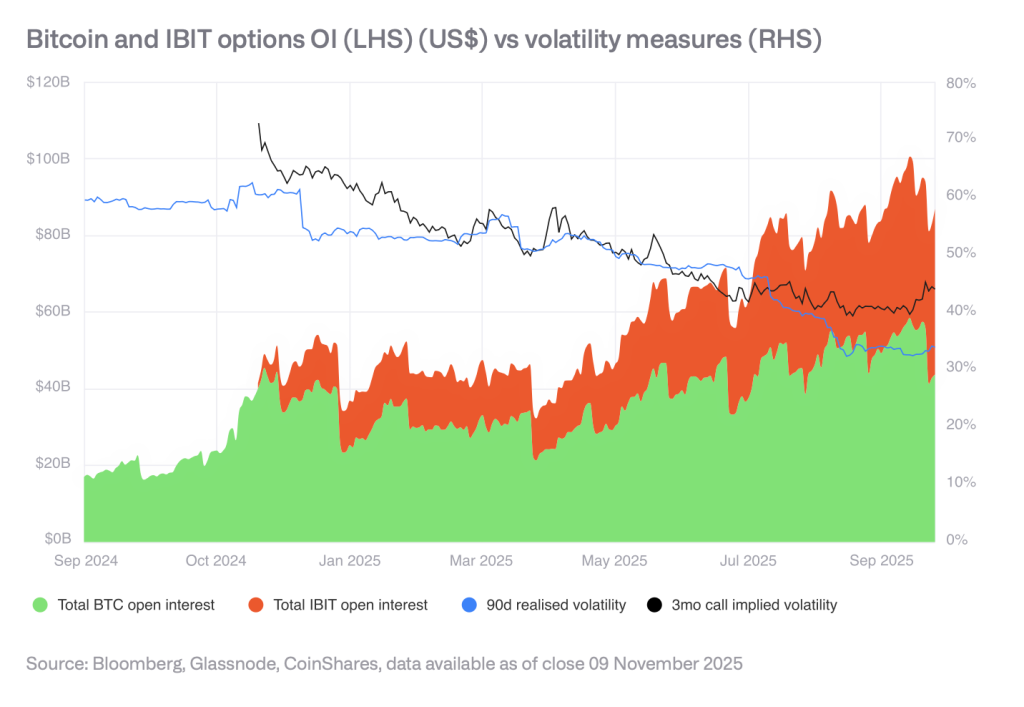

Options market development continues to reduce volatility as open interest expands.

Measurements over 30 days showed instances in 2025 when Bitcoin volatility fell below that of traditional assets, marking a significant shift from historical patterns.

Stablecoin and Tokenization Growth Accelerates

The stablecoin sector has reached $300 billion, with USDT commanding $185 billion and USDC holding $75 billion. Decentralized exchange volumes exceed $600 billion monthly.

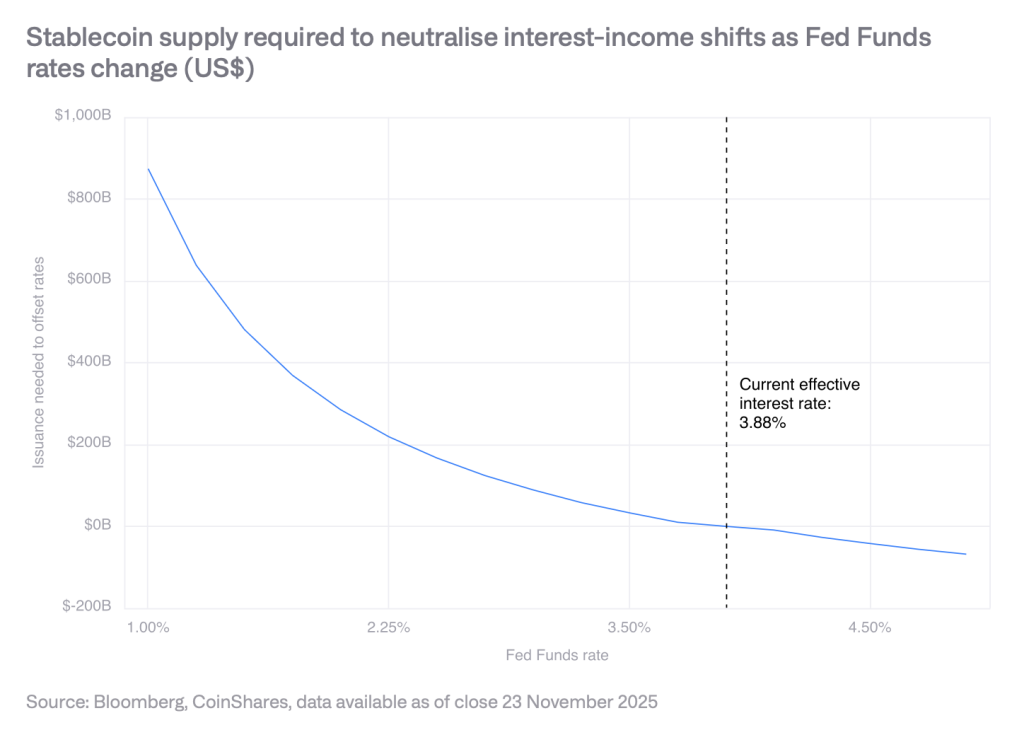

However, CoinShares notes that if rates decline to 3% by year-end 2026, stablecoin supply would need to grow by $88.7 billion to maintain current interest revenue for issuers, though Treasury Secretary Scott Bessent projects market expansion to $3 trillion by 2030.

The tokenized asset market doubled during 2025, expanding from $15 billion to over $35 billion. Private credit grew from $9.85 billion to $18.58 billion, while tokenized Treasuries increased from $3.91 billion to $8.68 billion.

CoinShares highlights institutional deployment through BlackRock’s expansion of its BUIDL fund and JPMorgan’s tokenized deposit launch on Base.

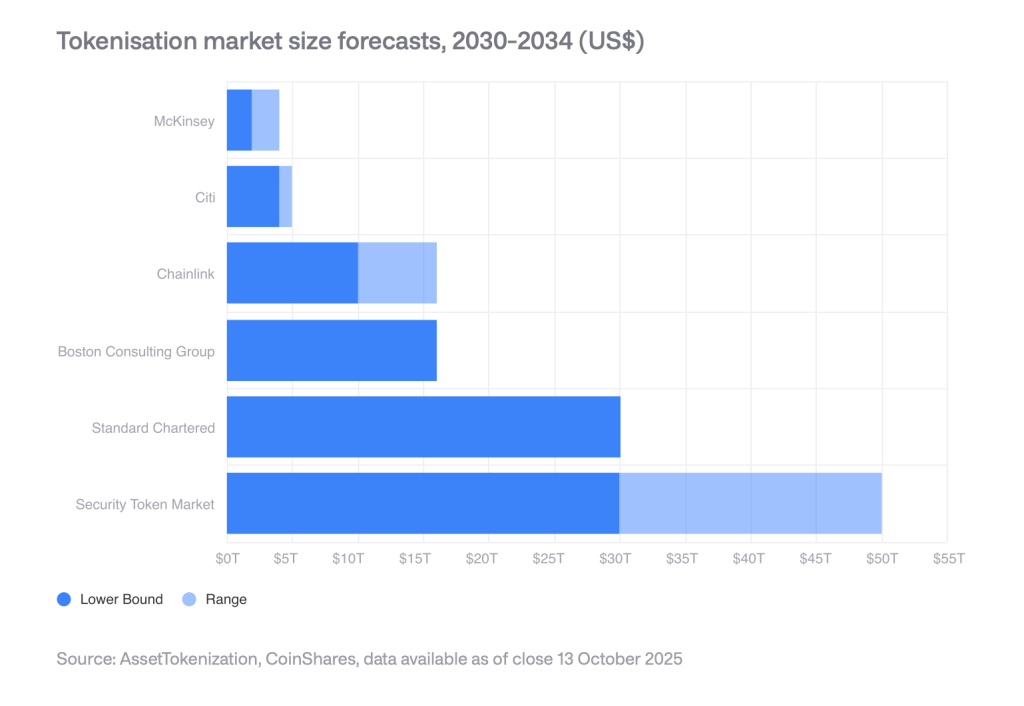

Currently, industry forecasts project the market reaching several trillion dollars by 2030, with estimates approaching 30 trillion through 2034.

CoinShares concludes that “2026 looks like a year where the industry’s centre of gravity moves from narrative to utility, cash flow, and integration.“

- XRP Price Prediction: Ripple’s Executive Criticises Bitcoin’s Technology – Can XRP Overtake BTC?

- Elon’s Grok AI Predicts the Price of XRP, Cardano and Bitcoin By the End of 2026

- XRP Price Could Explode After Tokenization Deal With Fund Manager

- Perplexity AI Predicts the Price of XRP, Cardano and Bitcoin By the End of 2026

- Leading AI Claude Predicts the Price of XRP, Cardano and Ethereum By the End of 2026

- XRP Price Prediction: Ripple’s Executive Criticises Bitcoin’s Technology – Can XRP Overtake BTC?

- Elon’s Grok AI Predicts the Price of XRP, Cardano and Bitcoin By the End of 2026

- XRP Price Could Explode After Tokenization Deal With Fund Manager

- Perplexity AI Predicts the Price of XRP, Cardano and Bitcoin By the End of 2026

- Leading AI Claude Predicts the Price of XRP, Cardano and Ethereum By the End of 2026