China’s Tech-Savvy Youth Drives Global Demand for Blockchain Apps, Despite Restrictions

China’s massive and tech-savvy population still drives global demand for blockchain applications, in spite of strict regulatory restrictions, found the ‘GTM in Asia’ report by Foresight Ventures and Primitive Ventures.

“Western discourse often assumes that “China has completely banned crypto,” leading many to believe its crypto market has vanished,” the report noted. But this, in fact, is a common misunderstanding.

Cryptocurrency in this country is not only alive and kicking, but the users here power the global crypto stage.

China Has 59 Million Crypto Owners

China is the world’s second-largest economy, only behind the US. It has a population of 1.4 billion and a GDP of $17.65 trillion.

But it is also a massive player in the crypto market, the report highlights.

Some 59 million Chinese people owned cryptocurrencies in 2024 – ranking second globally after India.

And though this particular section of the market does face challenges, its vital role and continuous impact on the global crypto market should not be underestimated.

Most notably, the industry has experienced persistent growth even amid significant restrictions over the past several years.

The country has seen a severe crackdown on cryptocurrencies and their mining. As such, the miners’ move from China to other regions has been particularly noticeable.

However, its government still remains a strong supporter of blockchain technology.

And there are a number of other factors going in its favor.

Widespread internet and smartphone use—and a generally tech-savvy population—have significantly contributed to rising digital adoption and digital finance growth.

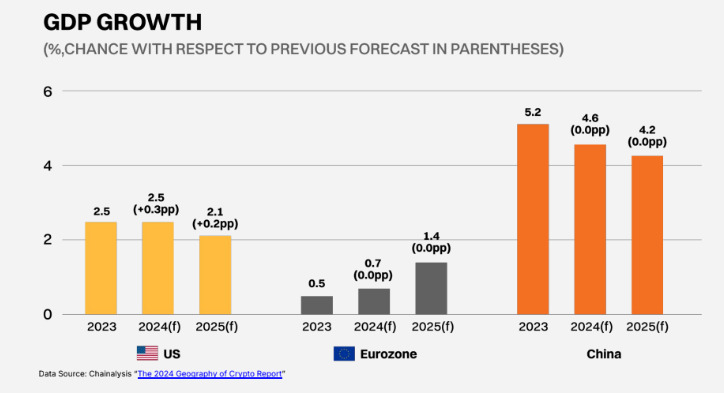

Also, while the country is seeing a slowing economic growth, it’s still outpacing the US and Europe, the report highlighted.

Notably, it has Hong Kong, which has become “the gateway to China’s crypto market.”

With all this, the country has seen thriving OTC markets and increased use of stablecoins, which are now “a flexible tool to aid capital flow.”

High-Risk Appetite and FOMO

The report found that Chinese crypto participants are primarily young retail investors.

However, institutional investors and venture funds also participate in the Chinese market.

Notably, one of the primary group’s main characteristics is their strong adaptability—a key trait in volatile markets—but another is fear of missing out (FOMO).

Overall, they are more willing to take risks.

Furthermore, these young investors have exhibited a “high level of enthusiasm” and a strong understanding of the technology that powers the industry.

Not only is their level of knowledge of blockchain infrastructure high, but they are also willing to explore novel and developing technologies.

These include BTC Ordinals, Layer 2 solutions, and AI Infra, as well as some (somewhat) better-established sectors, such as DeFi and GameFi.

It is perhaps unsurprising then that they show strong demand for DeFi and DEXes, but also that they prefer high-risk assets like meme coins.

Per the report,

“Due to the underdeveloped domestic capital markets and limited investment options, many see cryptocurrency as a shortcut to wealth. Chinese retail investors are high-risk speculators.”

Chinese investors use their funds for speculation, hedging inflation, cross-border payments, and participating in crypto innovation and experiments.

The funds are “relatively evenly distributed” between centralized exchanges and on-chain activities, the report adds.

Many users will choose to convert RMB to stablecoins through over-the-counter (OTC) platforms.

Meanwhile, Chinese crypto users rely heavily on key opinion leaders (KOLs) and influencers for information, leading to “a strong herd effect and significant information asymmetry.”

The primary channels for crypto investors include private groups and secret communities.

However, despite the prevailing opinion that the Chinese population can’t use outside information sources, they commonly do so.

Crypto users utilize and engage with international social platforms and media to gain further information and a “global perspective.”

- [LIVE] Fed Payments Innovation Conference: Real-Time Updates as Federal Reserve Discusses Crypto, Stablecoins, and AI with Industry Leaders

- Crypto Market Prospect: After the Washout, the Soil Looks Richer

- China’s DeepSeek AI Predicts the Price of XRP, Bitcoin and Cardano By the End of 2026

- Bitcoin Price Prediction: Trump vs the Fed Just Escalated – Is BTC About to Explode as Trust in the Dollar Crumbles?

- Ethereum Price Prediction: Banking Giant Standard Chartered Says ETH Will Beat Bitcoin – Can ETH Reach $100,000?

- [LIVE] Fed Payments Innovation Conference: Real-Time Updates as Federal Reserve Discusses Crypto, Stablecoins, and AI with Industry Leaders

- Crypto Market Prospect: After the Washout, the Soil Looks Richer

- China’s DeepSeek AI Predicts the Price of XRP, Bitcoin and Cardano By the End of 2026

- Bitcoin Price Prediction: Trump vs the Fed Just Escalated – Is BTC About to Explode as Trust in the Dollar Crumbles?

- Ethereum Price Prediction: Banking Giant Standard Chartered Says ETH Will Beat Bitcoin – Can ETH Reach $100,000?