Bitcoin Records Highest Weekly Close as Price Nears All-Time High

Jai serves as the Asia Desk Editor for Cryptonews.com, where he leads a diverse team of international reporters. Jai has over five years of experience covering the web3 industry.

- [LIVE] Crypto Market Update: Bank of Japan Raises Rates by 25 bps; Crypto Markets Extend Slide as BTC Breaks Below $86K

- [LIVE] Crypto Market Update: Market Pullback Deepens: ETH Near $2.8K as Sector Indices Flash Steep Declines

- [LIVE] Crypto Market Update: 10x Research Flags Cracks in 2026 Bullish Narrative as Bitcoin Reclaims $87K Amid Extreme Fear

- [LIVE] Crypto News Today: Latest Updates for Dec. 16, 2025 – Bitcoin Drops Under $86,000 as Extreme Fear Deepens Crypto Market Rout

- [LIVE] Crypto News Today: Latest Updates for Dec. 15, 2025 – Crypto Markets Slide as Layer 2 Tokens Lead Losses; Bitcoin Briefly Dips Below $88K

The price of the leading cryptocurrency Bitcoin came close to another all-time high after it briefly traded above $106,000 on Monday during early Asian hours. At the stroke of midnight UTC on May 18, Bitcoin wrapped up its strongest weekly finish to date, settling just shy of $106,500, as per Coingecko data.

Bitcoin has now closed at a weekly gain for the past six consecutive weeks as bulls dominate the market.

Bitcoin posted its previous record weekly gain back in December when the price reached above $104,400. The largest crypto by market cap then notched its all-time high of 108,786 on 20 January.

Bitcoin ETFs and Macro Factors Likely Fueling the Rally

At the time of writing, Bitcoin is trading at $103,500, 10% up in the last 7 days and 21% in the last 30 days. While the previous all-time high rally may have been a result of enthusiasm around Donald Trump’s inauguration and retail speculation, this time Bitcion’s rally has much to do with consistent spot ETF inflows and the impact of macro factors. With uncertainity around inflation, tariff deals, and other major economic factors, investors could be turning to safe assets like Bitcoin and Gold.

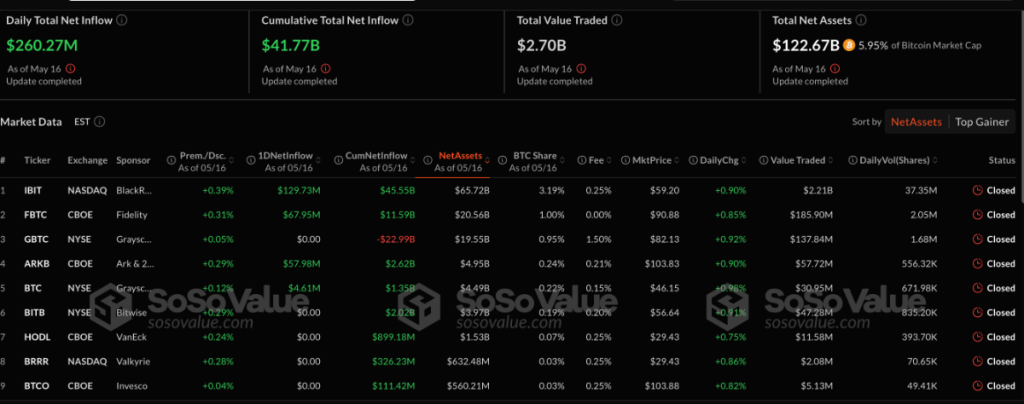

Between May 12 and May 16 (ET), spot Bitcoin ETFs saw a cumulative net inflow of $604 million, extending their streak of positive weekly inflows to five straight weeks. In just the first half of May, US spot Bitcoin ETFs amassed over $2.8 billion in net inflows, as per SoSoValue data.

Global Bond Yields Rise as Moody’s Downgrade US Credit Rating

The credit rating agency Moody’s downgraded the US government from top credit rating AAA to AA1 on Friday, and warned about rising levels of government debt and a widening budget deficit. With inflation tensions and fed chair adamant of not cutting rates, investors might be looking at Bitcoin as the perfect safe haven. So far Bitcoin has reacted positively to the downgrade of the US credit ratings.

Japan’s 40-year bond yield has surged to its highest point in more than two decades. Prime Minister Ishiba described the situation as “worse than Greece.” The global uncertainty and fear of recessions has once again placed Bitcoin as the leading safe haven for investors worldwide.

- [LIVE] Fed Payments Innovation Conference: Real-Time Updates as Federal Reserve Discusses Crypto, Stablecoins, and AI with Industry Leaders

- Crypto Market Prospect: After the Washout, the Soil Looks Richer

- Bitcoin Price Prediction: Saylor Says Quantum Computing Will ‘Harden’ Bitcoin — Is the 2026 Bull Run Locked In?

- Perplexity AI Predicts the Price of Pi, Bitcoin, and Solana By the End of 2025

- China’s Alibaba AI Predicts the Price of XRP, PEPE, Dogecoin by the End of 2025

About Us

2M+

250+

8

70

Market Overview

- 7d

- 1m

- 1y

- [LIVE] Fed Payments Innovation Conference: Real-Time Updates as Federal Reserve Discusses Crypto, Stablecoins, and AI with Industry Leaders

- Crypto Market Prospect: After the Washout, the Soil Looks Richer

- Bitcoin Price Prediction: Saylor Says Quantum Computing Will ‘Harden’ Bitcoin — Is the 2026 Bull Run Locked In?

- Perplexity AI Predicts the Price of Pi, Bitcoin, and Solana By the End of 2025

- China’s Alibaba AI Predicts the Price of XRP, PEPE, Dogecoin by the End of 2025

More Articles

Get dialed in every Tuesday & Friday with quick updates on the world of crypto