Billionaire Michael Saylor Purchases 525 BTC for $60.2M, Lifting Holdings to 638,985 BTC

Tanzeel Akhtar has been reporting on cryptocurrency and blockchain technology since 2015. Her work has appeared in leading publications including The Wall Street Journal, Bloomberg, CoinDesk, Bitcoin...

- Mavryk CEO Alex Davis on Tokenizing Real-World Assets and Building On-chain Yield at Scale

- Xen Baynham-Herd on Building Base: From Experimental L2s to Real On-chain Adoption

- Ethereum Is Emerging as a Global Public Good – and That Changes How It Should Be Valued, Says William Mougayar

- Amplify ETFs Expands Crypto ETF Lineup With Stablecoin and Tokenization Funds

- Bitget Wallet Integrates Hyperliquid to Expand Onchain Perpetual Trading

Billionaire Michael Saylor’s Bitcoin strategy shows no signs of slowing down. Strategy has further cemented its reputation as the world’s largest corporate Bitcoin holder.

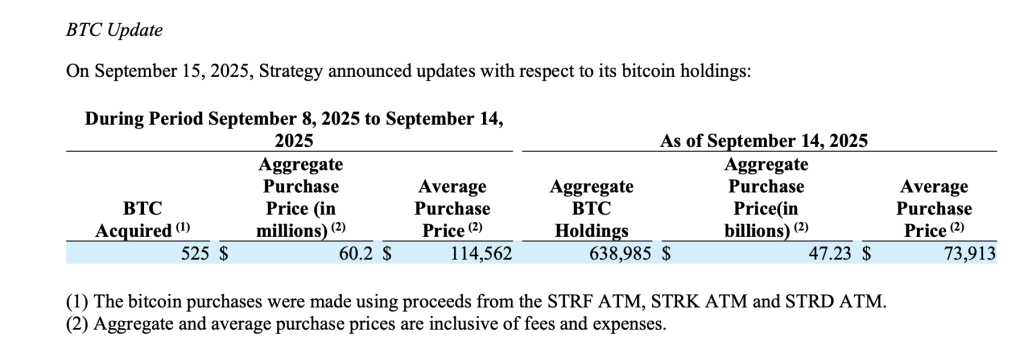

According to a filing on September 15, 2025, the firm acquired an additional 525 BTC during the period of September 8–14, at an aggregate purchase price of $60.2 million.

Strategy has acquired 525 BTC for ~$60.2 million at ~$114,562 per bitcoin and has achieved BTC Yield of 25.9% YTD 2025. As of 9/14/2025, we hodl 638,985 $BTC acquired for ~$47.23 billion at ~$73,913 per bitcoin. $MSTR $STRC $STRK $STRF $STRD https://t.co/hodshO40ma

— Strategy (@Strategy) September 15, 2025

The average price paid per Bitcoin was approximately $114,562. This latest move shows the company’s continued conviction in Bitcoin as its primary treasury reserve asset.

Massive Bitcoin Treasury

With this latest acquisition, Strategy now holds an astonishing 638,985 BTC, purchased at an aggregate cost of $47.23 billion. The company’s average purchase price per Bitcoin stands at $73,913, meaning its holdings remain strong in profit at current market valuations.

This monumental stash, accumulated steadily over several years, shows Saylor’s long-term strategy of treating Bitcoin as digital gold and a hedge against inflation.

Funding Through Share Programs

The purchases were financed through proceeds from the company’s at-the-market (ATM) equity offering programs. Over the same reporting period, Strategy sold hundreds of thousands of preferred shares across different series, raising a total of $68.2 million in net proceeds.

The filing noted sales of STRF, STRK, and STRD shares, all part of the company’s broader strategy to tap equity markets and funnel the funds directly into Bitcoin acquisitions.

This structured financing model has allowed Strategy to consistently accumulate Bitcoin without over-leveraging its balance sheet. By maintaining a steady cadence of share issuance and crypto purchases, the company has managed to expand its digital asset position while retaining operational flexibility.

Strategic Outlook

Michael Saylor remains one of Bitcoin’s most outspoken advocates, frequently describing the asset as superior to traditional stores of value like gold. The company’s growing BTC stockpile represents not only a bold bet on digital assets but also a high-profile example of corporate treasury diversification in the modern era.

As institutional adoption of Bitcoin expands and ETFs drive market inflows, Strategy’s aggressive approach continues to set it apart. With nearly 639,000 BTC under management, the firm’s holdings are larger than the reserves of most countries, placing it in a unique position of influence within the global crypto economy.

Strategy’s unwavering accumulation of Bitcoin indicates that, for Saylor and his company, digital assets are not a speculative play—but a generational hedge and a cornerstone of corporate strategy.

- [LIVE] Fed Payments Innovation Conference: Real-Time Updates as Federal Reserve Discusses Crypto, Stablecoins, and AI with Industry Leaders

- Crypto Market Prospect: After the Washout, the Soil Looks Richer

- China’s DeepSeek AI Predicts the Price of XRP, BTC, and SOL By the End of 2025

- Bitcoin Price Prediction: BTC Price Drops Below $88,000, Could Bears Win 2025 Despite New ATH?

- XRP Price Prediction: Franklin Templeton’s Spot ETF Tops 100M XRP in Holdings – Can Institutional Demand Push XRP Above $3?

About Us

2M+

250+

8

70

Market Overview

- 7d

- 1m

- 1y

- [LIVE] Fed Payments Innovation Conference: Real-Time Updates as Federal Reserve Discusses Crypto, Stablecoins, and AI with Industry Leaders

- Crypto Market Prospect: After the Washout, the Soil Looks Richer

- China’s DeepSeek AI Predicts the Price of XRP, BTC, and SOL By the End of 2025

- Bitcoin Price Prediction: BTC Price Drops Below $88,000, Could Bears Win 2025 Despite New ATH?

- XRP Price Prediction: Franklin Templeton’s Spot ETF Tops 100M XRP in Holdings – Can Institutional Demand Push XRP Above $3?

More Articles

Get dialed in every Tuesday & Friday with quick updates on the world of crypto