While analysts have mainly focused on Bitcoin or individual altcoins, the structure of the total crypto market capitalization is approaching a critical threshold in January.

Signs of weakening liquidity are sending warnings about how fragile this structure has become.

SponsoredCrypto Trading Volume Plunges as Investors Cash Out

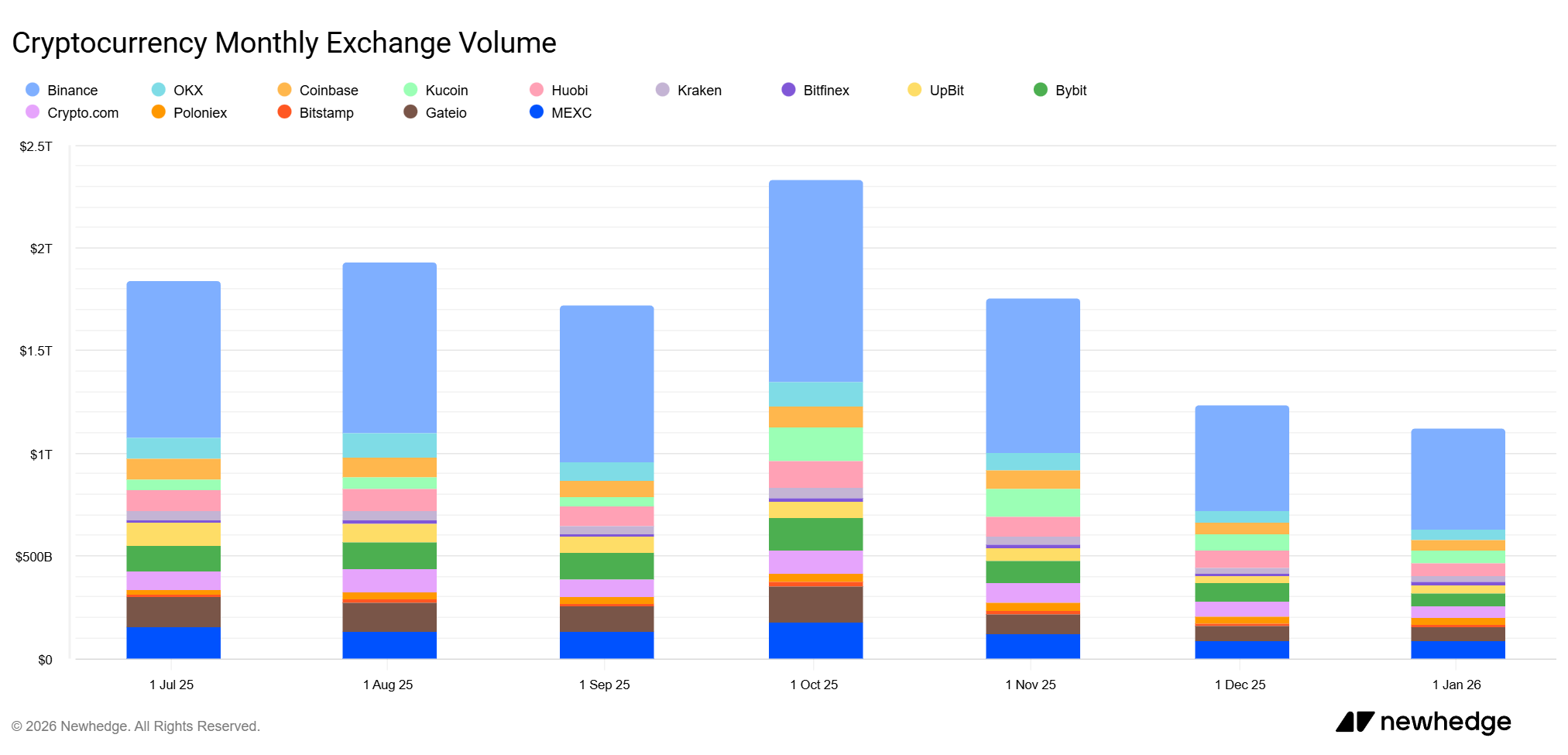

According to data from Newhedge, total trading volume on centralized exchanges reached $1.118 trillion in January. Binance accounted for more than $490 billion of that amount.

What stands out is that unless a significant rebound occurs in the remaining days of January, this figure will mark the lowest level since July last year. The decline in overall market volume provides strong evidence that investors have become increasingly cautious.

This cautious sentiment has made investors hesitant to buy, even though many altcoins remain 70–90% below their peak prices.

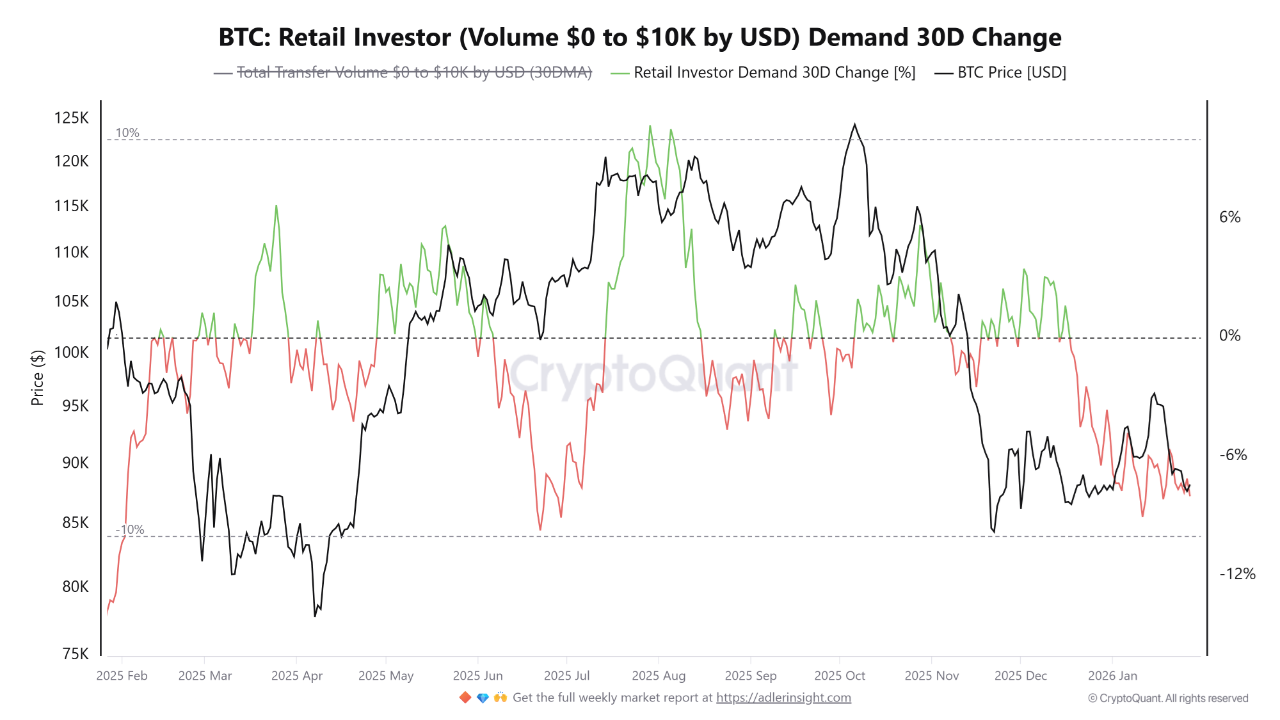

Another dataset from CryptoQuant offers additional clarity. Retail Investor Demand measures small-scale on-chain trading activity (transactions below $10,000). This indicator has dropped sharply since August last year.

Analyst Caueconomy noted that the risk of a potential US government shutdown, combined with concerns surrounding the yen carry trade, has pushed investors into a defensive stance. Trading activity and new investments have been reduced.

Sponsored Sponsored“A solid recovery will require renewed market sentiment and greater retail participation in on-chain volume,” Caueconomy stated.

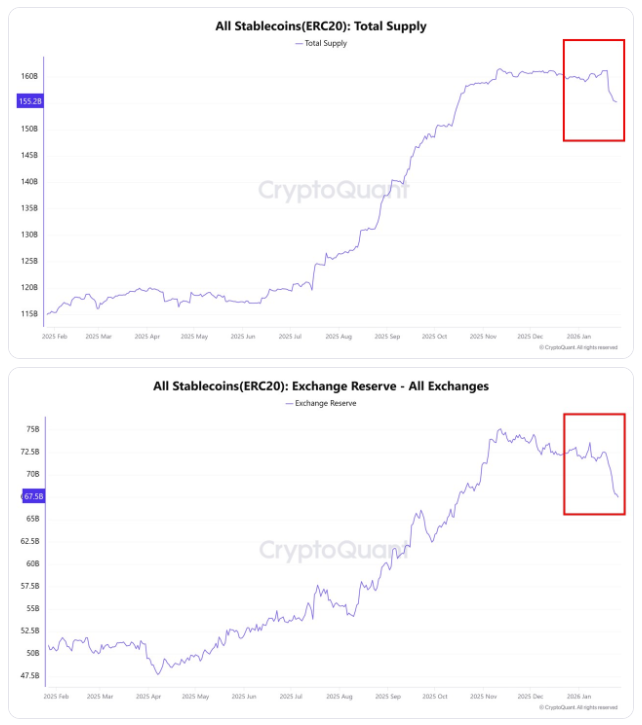

In addition, investors have not only become more cautious with capital allocation, but also appear to be cashing out of the market entirely. Stablecoin data reflects this shift.

CryptoQuant’s ERC-20 stablecoin market cap data shows that stablecoin capitalization declined in January. Stablecoin reserves held on exchanges also dropped significantly.

The total supply of ERC-20 stablecoins and the amount held on exchanges represent capital effectively “waiting” in the crypto market. When both balances decline simultaneously, it signals that funds are leaving the market rather than simply rotating internally.

SponsoredA recent BeInCrypto report suggested that without fresh liquidity, Bitcoin could potentially fall below $70,000.

How is The Market Cap Structure Being Threatened?

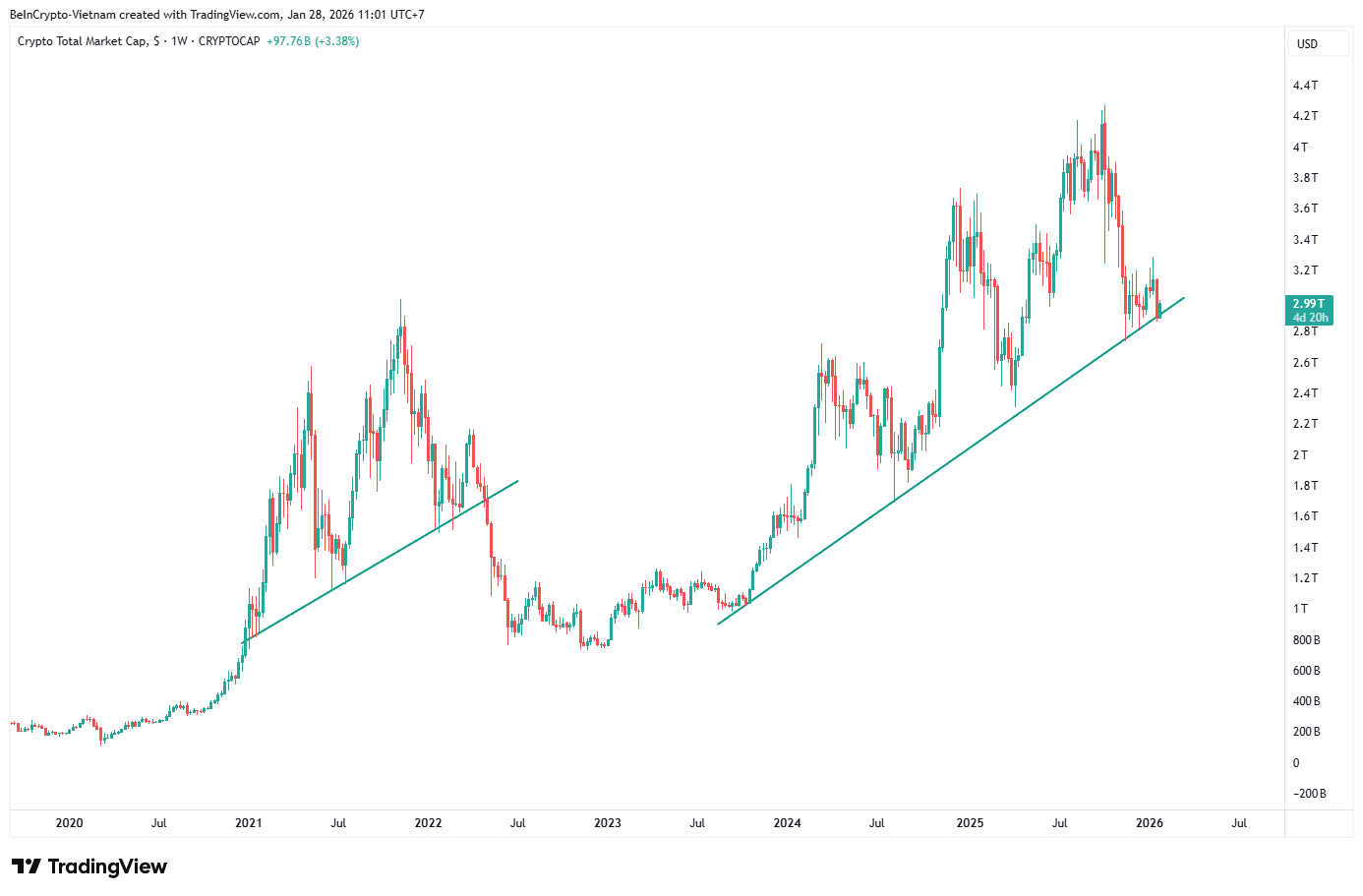

Total crypto market capitalization fell below $3 trillion in January. Several analysts have highlighted the importance of the support level around $2.86 trillion. If this support breaks, market capitalization could decline much further.

TradingView data shows that the market cap is now approaching a trendline that has held since 2024. A breakdown below this trendline could trigger a bear market similar to 2022.

Sponsored Sponsored

As a result, the negative signals from declining trading volume, combined with investor cash-out activity, may increase the likelihood that this trendline will break.

However, the market is also entering a week filled with major macroeconomic events that could shift this trajectory. The US dollar has fallen to its lowest level in four years, largely driven by expectations of Federal Reserve rate cuts and renewed trade policy uncertainty.

Historically, a weaker dollar has supported risk assets like cryptocurrencies by increasing global liquidity and making dollar-denominated assets more attractive to international investors. If this trend continues, it could provide the catalyst needed to reverse the current capital outflow.

Still, the path forward remains uncertain. For a sustained recovery, the market would need to see not just a favorable macro backdrop, but also a return of retail participation and fresh stablecoin inflows—neither of which has materialized yet.

The coming days will be critical. If the $2.86 trillion support level holds and macroeconomic conditions remain favorable, the market may stabilize. But if trading volume continues to decline and investors keep withdrawing funds, a deeper correction could follow.