Crypto news stories are vanishing without a trace. Articles questioning the influence of paid press releases have quietly disappeared from major crypto websites, leaving little evidence they were ever published.

At the same time, thousands of promotional announcements continue to flood the industry, shaping narratives, moving markets, and blurring the line between journalism and advertising.

The Shadow Pipeline That Fuels FOMO

Chainstory analyzed 2,893 press releases distributed between June 16 and November 1, 2025. Using AI-driven sentiment tagging and risk classification, cross-referenced with blacklists like CryptoLegal.uk, Trustpilot, and scam alert feeds, the report found that:

- 62% originated from high-risk (35.6%) or confirmed scam projects (26.9%).

- Low-risk issuers accounted for only 27% of releases.

- In certain niches, such as cloud mining, scam, or high-risk content, dominated ~90% of releases.

The tone of the content was heavily promotional:

- Neutral: 10%

- Overstated: 54%

- Overtly promotional: 19%

Content type breakdown further highlighted the triviality of much coverage:

- Product tweaks or minor feature updates: 49%

- Exchange listing announcements (spam): 24%

- Substantive corporate events (funding, M&A): 2% (58 releases)

Based on this, the researchers concluded that these dynamics create a “manufactured legitimacy loop.” Dubious projects buy guaranteed placements across dozens of outlets, including mainstream financial portals, sidebars, and niche crypto aggregators.

Placement allows these projects to populate “As Seen On” sections, leveraging recognition to drive retail FOMO.

Headlines are deliberately loaded with marketing buzzwords like “AI-Powered Revolution,” “RWA Game-Changer,” terms editorial desks would likely reject if scrutinized.

PR Dollars Speak Louder Than Facts

The ecosystem echoes TradFi abuses. SEC data shows press releases fueled 73% of OTC penny-stock pump-and-dump schemes from 2002–2015.

In crypto, the effect is amplified, with algorithmic trading bots that scrape keywords such as “partnership” or “listing,” automatically triggering buy orders.

The result is a short-term price pump, often followed by unexpected declines once the underlying project fails to meet expectations.

Complicating matters, FTC rules for native advertising require clear disclosure. In practice, many crypto “Press Release” sections appear neutral, erasing the sponsored stigma and conferring the illusion of independent validation.

Retail investors often interpret the placement of content on recognized domains as evidence of legitimacy.

Who Pulls the Strings Behind Crypto Coverage?

Chainstory’s findings initially gained traction across crypto media, with coverage appearing on TradingView, KuCoin, MEXC, and other outlets. Yet, key articles disappeared without explanation on several outlets.

- Investing.com – formerly titled “Crypto press releases dominated by high-risk projects, Chainstory study finds.”

- CryptoPotato, which had described wire services turning placement into a “paid commodity.”

There were no 404 errors or notices. Posts were simply erased from search and archive.

As seen by BeInCrypto via email, sources indicate that an executive from a company implicated in the pay-to-play ecosystem contacted these outlets, citing alleged data faults or bias.

Some editorial teams complied, suggesting a broader vulnerability: advertiser leverage over editorial independence.

It is imperative to note that most crypto outlets rely heavily on PR distribution revenue, particularly during bear markets or when ad budgets are tight.

Therefore, it may be safe to assume that critical reports threatening that revenue stream can prompt quiet removals or editorial self-censorship.

“I’m not involved in the day-to-day of the site/ editorial. I need to ask about this,” a senior executive from CryptoPotato told BeinCrypto.

Responding to questions about editorial standards and the handling of sponsored material, George Georgiev, Editor-in-Chief of CryptoPotato, rejected the notion that commercial pressures influence the outlet’s editorial decisions.

He emphasized that the publication maintains strict disclosure practices and does not remove content at the request of external parties.

“As a crypto OG publication, leading the industry for over 10 years, we insist on proper journalism. We always provide full disclosure of any promoted content or third-party interests, and we never remove articles at the request of external parties,” he stated.

Still, the article link brings a 410 error, an HTTP status code that means the requested resource no longer exists on the server, and the removal is considered permanent.

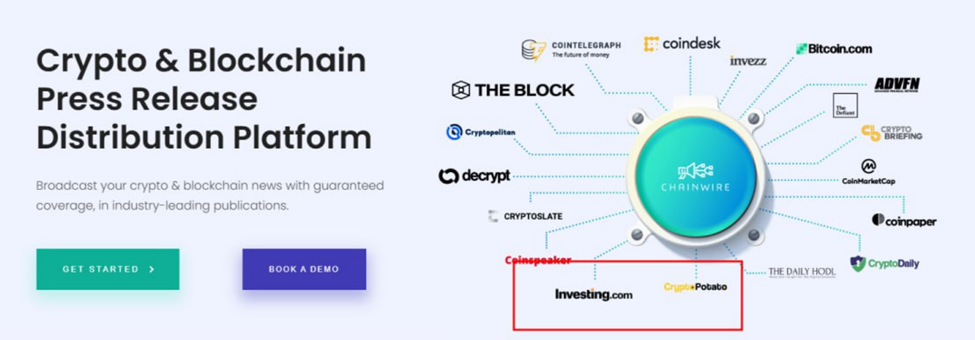

At the core of the paid-PR ecosystem is Chainwire (MediaFuse Ltd.), which markets “guaranteed coverage” across crypto and TradFi sites.

“Broadcast your crypto & blockchain news with guaranteed coverage, in industry-leading publications,” read an excerpt on the Chainwire website.

A source close to the matter told BeInCrypto that Chainwire is the force behind the article takedowns.

Chainwire mirrors the practices highlighted by Chainstory: syndication to dozens of outlets in exchange for visibility, often leveraged to influence retail behavior.

Despite scrutiny, Chainwire remains influential:

- Named “Best PR Wire” at the 2026 CoinGape Awards (February 2, 2026).

- Maintains strong G2 ratings for 2025 campaigns.

Chainwire also faced separate 2025 allegations of exploitative practices, including unpaid “test” campaigns and ghosting publishers.

The Quiet Amplifiers That Shape Crypto Markets

Chainstory’s research exposes a market where credibility can be bought, manipulated, or quietly erased. When critical reports vanish from archives, it reinforces the opacity and manufactured legitimacy that fueled the original concerns.

For retail participants within crypto’s hype-driven environment, skepticism is essential. Verification via on-chain data, independent sources, and awareness of PR revenue dependence is crucial to avoid falling prey to the pay-to-play cycle.

In crypto’s ongoing information wars, the quietest edits—deleted posts, altered archives, and erased analysis—may speak loudest, revealing the subtle levers that shape perception, sentiment, and ultimately, market outcomes.

Chainwire did not immediately respond to BeInCrypto’s request for comment.