BlockFills, a Chicago-based crypto lender and liquidity provider, has temporarily halted client deposits and withdrawals.

The move comes as the crypto market continues to experience notable volatility, with asset prices trending lower.

Crypto Liquidity Provider BlockFills Stops Withdrawals and Deposits During Market Stress

BlockFills operates as a cryptocurrency solutions firm and digital asset liquidity provider. It serves approximately 2,000 institutional clients, including crypto-focused hedge funds and asset managers. In 2025, the firm handled $60 billion in trading volume.

SponsoredThe company said in a statement posted on X that the suspension was implemented last week and remains in effect. According to BlockFills, the decision was made in light of “recent market and financial conditions” and is intended to “protect both clients and the firm.”

Despite the suspension of deposits and withdrawals, clients have continued to trade on the platform. BlockFills said users are still able to open and close positions in spot and derivatives markets, as well as select other circumstances.

The company also said management is working closely with investors and clients to resolve the situation and restore liquidity to the platform.

“The firm has also been in active dialogue with our clients throughout this process, including information sessions and an opportunity to ask questions of senior management. BlockFills is working tirelessly to bring this matter to a conclusion and will continue to regularly update our clients as developments warrant,” the statement read.

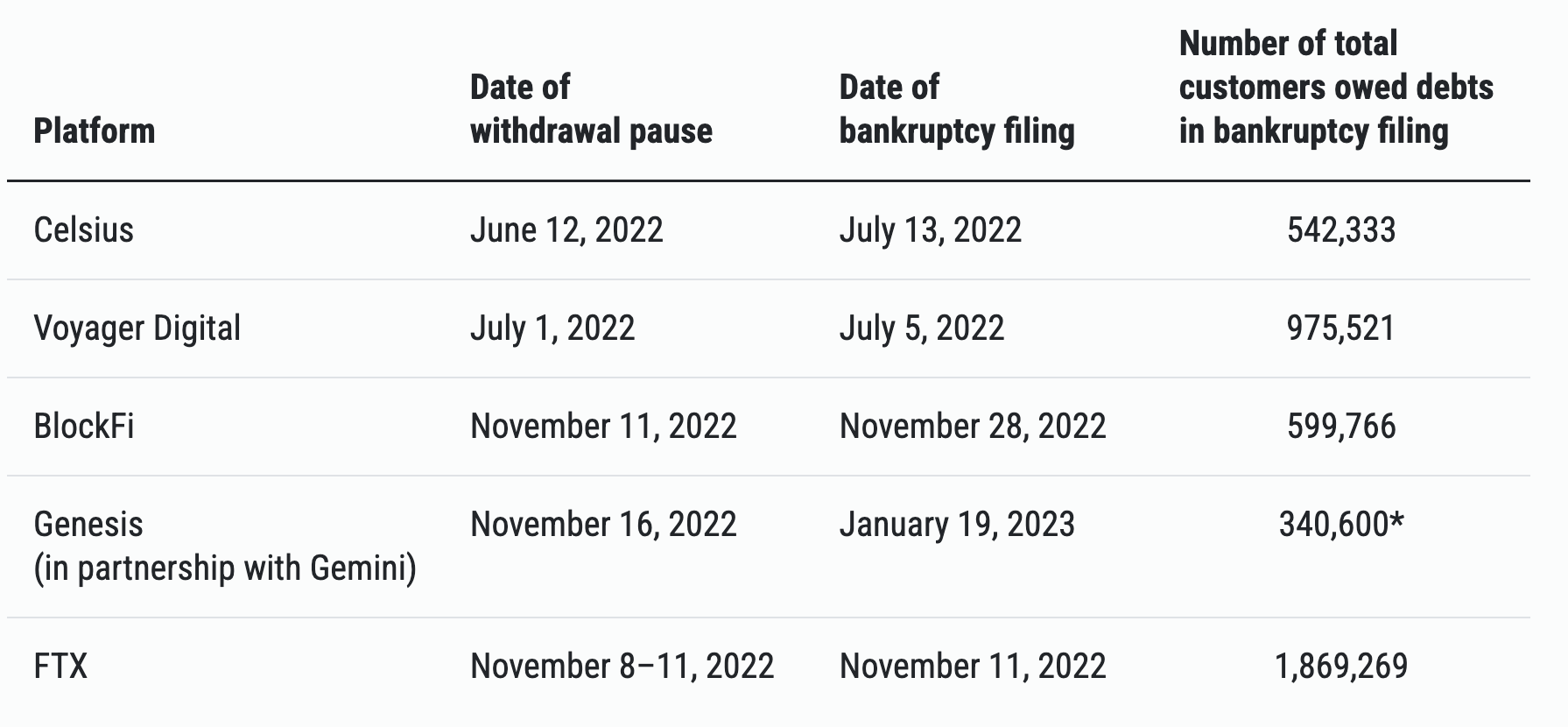

In the crypto industry, withdrawal freezes often trigger concern. The sector’s last severe downturn in 2022 saw several high-profile lenders, including Celsius, BlockFi, Voyager, FTX, and more, halt withdrawals before filing for bankruptcy.

Many of the crypto bankruptcies, such as those of FTX, BlockFi, and Three Arrows Capital, were interconnected, leading to a domino effect in the market. The events led to market destabilization and negatively impacted sentiment.

Nonetheless, it’s worth noting that temporary suspensions can also function as defensive measures during periods of intense market stress. At present, there is no publicly available evidence suggesting that BlockFills is insolvent.

Meanwhile, the suspension comes as some market participants warn of a renewed “crypto winter.” Since the start of the year, the total cryptocurrency market capitalization has declined by more than 22%.

Last Friday, Bitcoin fell to around $60,000, marking its lowest level since October 2024. The asset remains roughly 50% below its all-time high of approximately $126,000, recorded in October.