WEEX Review 2026 - Pros, Cons, and Key Features

- User-friendly interface and dashboard

- Wide range of futures and copy trading options

- There are no KYC requirements for basic use

WEEX has grown quickly as a derivatives-first exchange, with features like high-leverage futures, copy trading, and its own utility token, WXT. But speed of growth doesn’t guarantee reliability, which is why we tested the platform directly, across web and mobile, placing trades, checking fees, and pushing the interface beyond surface-level impressions.

This review covers how WEEX performs in practice, from its trading tools and supported assets to its security, regulation, and real user feedback.

If you’re wondering whether it’s worth using or just another offshore exchange with sharp branding, this WEEX exchange review will give you a clear answer.

WEEX review: Pros and cons

WEEX stands out for its clean interface, strong futures offering, and extras like copy trading and demo mode. Fees are competitive, no KYC is required for basic use, and features like proof of reserves and a protection fund add a layer of trust.

If you’re looking to trade options, though, you won’t find them. Same with fiat withdrawals, they’ve been paused, and there’s no clear timeline for return. Regulation is another blank spot. WEEX operates widely but without licenses in the UK, EU, or other major markets.

Pros

- Easy-to-use interface

- Strong futures and copy trading features

- No KYC for basic use

- Competitive fees

- Transparent reserves and protection fund

Cons

- No options trading

- No fiat withdrawals

What is WEEX?

WEEX is a trading platform that’s been around since 2018. It was originally set up in Singapore and is now based in Dubai. It’s used in over 130 countries and has grown steadily in recent years, especially in the derivatives space.

That said, WEEX isn’t just for experienced traders. One of its more beginner-friendly features is copy trading. You can automatically copy the trades of more experienced investors, which is useful for people who are still learning or prefer a hands-off approach.

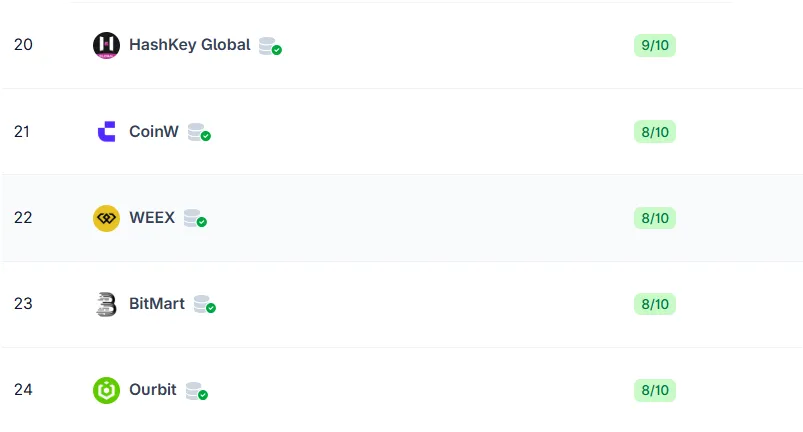

WEEX has grown quickly and now handles large volumes of trades daily. It’s often ranked among the top 25 derivatives exchanges globally.

WEEX exchange overview

WEEX puts most of its weight behind futures trading, but it’s not just for professionals. The platform includes copy trading, demo mode, and a reward system built around its WXT token, among others:

| Exchange Type | CEX |

| Best For | Futures trading, copy trading, low-fee crypto trading |

| Established | 2018 |

| Based In | Dubai, UAE |

| Availability | 160+ countries. Excludes North Korea, Iran, Syria, Cuba, and others |

| Licenses | Not regulated by major financial authorities (e.g., FCA, SEC) |

| KYC Verification | Not needed for crypto |

| Supported Coins | 600 crypto, 1,000 trading pairs |

| Deposit Methods | Crypto only |

| Trading Products | Spot, futures, copy trading, demo trading |

| Fees | Spot: 0.1%; Futures: 0.02% maker / 0.08% taker; discounts with WXT |

| Key Features | Copy trading, demo mode, WXT token, proof of reserves, protection fund |

| Customer Support | 24/7 live chat and email |

Is WEEX safe?

In terms of basic security, WEEX does a decent job. It hasn’t had any major security incidents on record, with no public hacks, leaks, or large-scale failures since it launched in 2018. For a platform that’s been around this long, that counts for something.

Behind the scenes, it uses the standard mix of security tools you’d expect: cold storage for funds, two-factor authentication, and tools to help spot phishing attempts.

WEEX publishes proof of reserves, showing it actually holds user funds rather than running on thin margins. And there’s a 1,000 BTC reserve fund in place, meant to act as a safety net in case of an unexpected event.

That said, the lack of regulation is the sticking point. For some people, that’s a red flag. For others, it’s just the norm when dealing with offshore platforms. Either way, it’s not a small detail. If you’re going to trust a platform with your money, it’s worth knowing exactly who, or what, is keeping it in check.

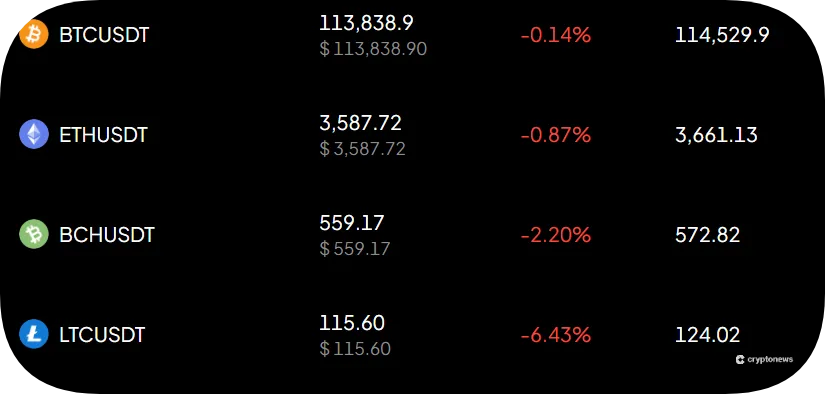

WEEX supported coins and trading pairs

WEEX offers a fairly wide range of trading options. You’ll find all the big names, such as Bitcoin, Ethereum, and Solana, along with a long list of altcoins, meme tokens, and niche projects. Unless you’re chasing something ultra-specific, you’ll probably find what you need.

Where WEEX really builds out its offering is in trading pairs, both derivatives and spot trading. There are well over a thousand pairs available, including both USDT- and USDC-margined contracts. In other words, if you’re trading with stablecoins, you’ve got options, and both major ones are supported.

Most of the action runs through USDT (Tether), which is the main stablecoin used for margin and settlements across the platform. That said, USDC is increasingly supported on futures markets, and a small number of spot pairs use it too.

If you’re a spot trader, the selection is decent, though not as deep as on some larger exchanges. But if you’re focused on futures or high-volume pairs, WEEX offers plenty of coverage, especially if you’re trading in USDT.

WEEX trading features

WEEX isn’t trying to be everything to everyone, but it does pack in a solid range of trading tools for both beginners and more experienced users. You’ll find the usual core features (like spot and futures trading), along with extras like copy trading and a demo mode to help you get comfortable before putting real money on the line.

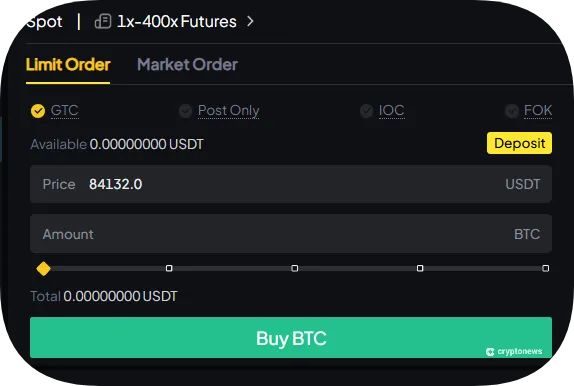

Spot and margin trading

Spot trading on WEEX is pretty simple: you buy and sell actual crypto, and whatever you buy ends up in your account. It’s what most people think of when they first get into crypto. The interface is clean, order types are standard (market, limit, stop), and the selection of coins is decent for mainstream assets.

Margin trading is available too, which means you can trade with borrowed funds (leverage is up to 400x, but check your local regulations).

Futures trading

This is where WEEX puts most of its energy. Futures trading on WEEX is built around perpetual contracts, meaning there’s no expiry date to worry about. You can trade with high leverage, and contracts are settled in USDT.

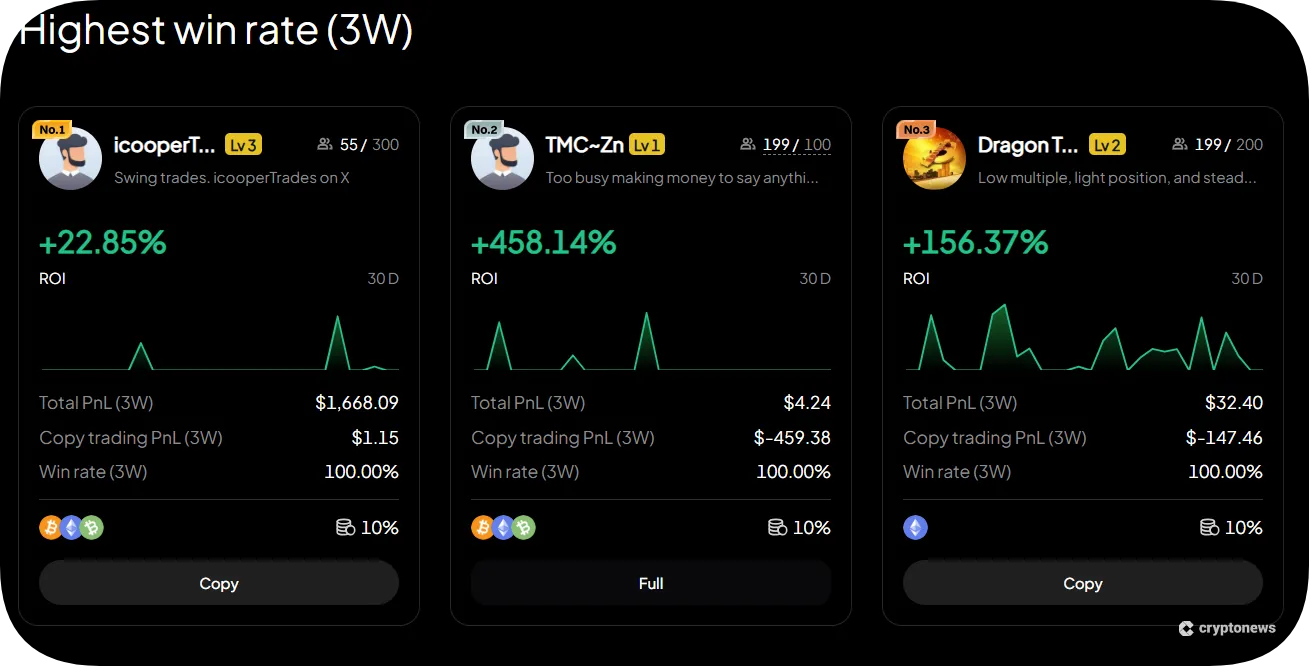

Copy trading

Not everyone wants to make every trade themselves. With copy trading, you can follow someone more experienced and let their moves show up in your account. You’re still in control, but you’re not starting from zero or guessing your way through every decision.

Demo trading

WEEX gives you a full demo environment where you can trade with simulated funds. You’re not trading with real money, but the platform doesn’t treat it any differently. The layout, the tools, and the pace are the same you’d be using with live funds.

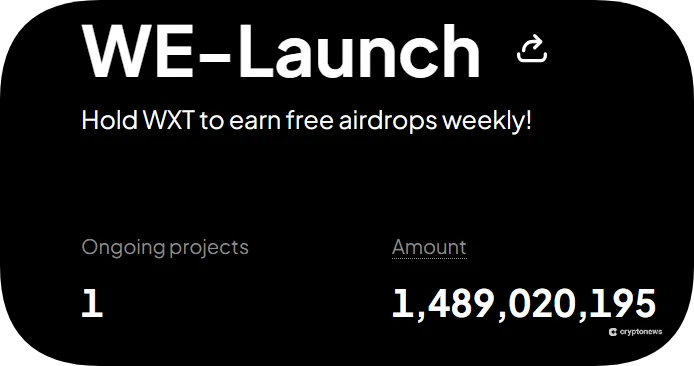

WEEX WE-Launch

WE‑Launch is WEEX’s version of a launchpad to reward users who hold the native token, WXT, with early access to new tokens, airdrops (at least 1,000 WXT), and project launches. If you hold enough WXT, you can take part in exclusive opportunities before those tokens hit the wider market.

Early access is part of a broader set of benefits: holding WXT reduces your trading fees (up to 70% on futures), offers you up to 20% profit share, and also connects you to staking rewards, referral perks, and possibly governance rights as the ecosystem expands.

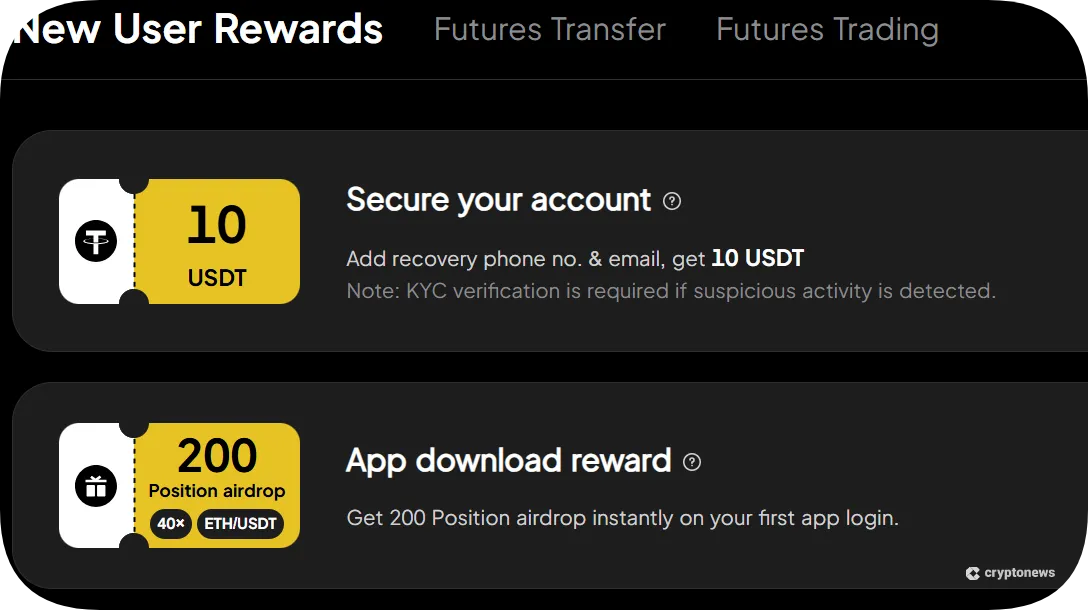

WEEX Rewards Hub

The Rewards Hub pulls all of WEEX’s promos into one place: airdrops, bonus campaigns, seasonal events, and whatever’s currently running. You’ll also see rewards tied to everyday activity: signing in, trading, and copying someone else’s strategy.

The setup is simple: check the hub to see what’s currently live, complete a task (like trading a certain amount or signing in each day), and collect your reward. These come in the form of USDT bonuses, trial funds, discount vouchers, or even token airdrops tied to new launches.

WEEX exchange fees

Here’s a clear overview of what exchange fees you should expect on WEEX:

- Spot trading usually costs you 0.1% whether you’re buying (maker) or selling (taker).

- Futures trading is cheaper: makers pay 0.02%, takers pay 0.08%.

- There’s no fee charged by WEEX for depositing crypto.

- For withdrawals, you only pay the blockchain network or miner fees, depending on the asset.

- If you hold WXT, futures fees can be slashed by up to 70%, depending on your VIP level.

- Spot fee discounts are more limited but still available.

| Feature | Fee Rate | Discount with WXT/VIP |

|---|---|---|

| Spot (maker/taker) | 0.10% / 0.10% | Reduced for high-tier WXT holders |

| Futures (maker/taker) | 0.02% / 0.08% | Up to 70% off via VIP status |

| Deposit | Free | N/A |

| Withdrawal | Network fee only | N/A |

Overall, WEEX is one of the crypto exchanges with the lowest fees.

WEEX deposit methods

On WEEX, the simplest way to add funds is by transferring crypto. If you already hold coins like USDT, BTC, or ETH, you just send them over. The system gives you a deposit address, you make the transfer, and usually, it’s all done in a few minutes.

WEEX doesn’t charge anything for deposits, though the usual blockchain fees still apply. For most tokens, the minimum amount is tiny, around 1 USDT for Tether.

There’s also an option to deposit fiat currency (like USD or EUR) through partners such as AlchemyPay or ChipPay. At the moment, this feature is temporarily paused, so most people just buy crypto on another platform and transfer it in. When fiat deposits are back, you’ll need to verify your identity before using them.

For now, crypto transfers remain the quickest, easiest way to start trading on WEEX.

Is WEEX user-friendly?

Everything on the web platform feels placed with purpose. Markets, trading tools, and balances are exactly where you’d look for them, without distractions or unnecessary layers. You’re not forced to work around a cluttered interface just to get to the basics.

The mobile app doesn’t feel stripped down or overdesigned. You can trade, adjust positions, and check the market without delay, even when things get busy. It’s responsive, direct, and doesn’t take much effort to find what you’re looking for.

Where is WEEX Available?

You can use WEEX in most parts of the world, including the US, UK, Canada, Japan, India, and much of Europe. Access is quick in many regions, and for most users, getting started doesn’t take much more than an email and a crypto wallet.

There are exceptions. Countries under international sanctions, like North Korea, Iran, Syria, and Cuba, are blocked outright. The same goes for certain areas of Russia and Ukraine. Even if someone does try to register from a restricted region, WEEX runs compliance checks that will likely catch it.

As WEEX offers crypto derivatives, make sure to consult local rules before signing up.

WEEX customer support

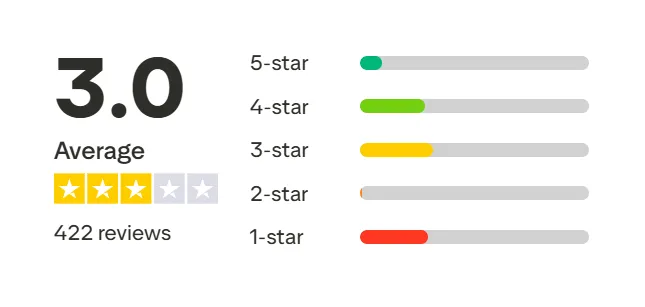

Support is available around the clock, but getting real help can be hit or miss. Live chat handles simple questions fast enough, and the help center covers the basics.

But when the problem is urgent, like a delayed withdrawal or an account restriction, responses slow down, and follow-ups can drag out. Some users report smooth resolutions; the systems are in place, but the consistency isn’t always there.

Where can WEEX exchange improve?

Overall, based on our WEEX exchange review, it does well with derivatives and token access, but there are a couple of areas where it’s noticeably lacking. For starters, the platform doesn’t offer options trading, only spot and perpetual futures. That leaves traders looking for more complex strategies, like calls or puts, out in the cold.

Another downside is the limited fiat support. Currently, there’s no way to deposit or withdraw fiat currencies via bank transfer or credit card; the platform handles only crypto. This can make it awkward when you want to cash out your gains or bring conventional money into the platform. While withdrawal limits are generous, moving funds back into fiat still requires heading to another exchange.

How to create an account and trade with WEEX

Here’s how to set up an account and place your first trade:

1. Sign up

You can register with just an email or phone number; no ID verification is required for basic trading. Once you confirm your code , your account is live.

, your account is live.

2. Deposit funds

Crypto deposits are the only way in, so pick a coin like USDT or BTC, send it from your wallet or another exchange, and it usually lands in your account within a few minutes.

3. Start trading

Go to either the spot or futures section, pick a trading pair, and open an order. You can set your price, choose market or limit orders, and track everything in your positions tab. If you’re unsure, demo trading and copy trading are both available to explore first.

Conclusion: Is WEEX legit?

According to our findings in this WEEX exchange review, this platform is a functioning exchange with real users, real volume, and years of operation behind it.

There’s no obvious red flag in WEEX’s track record. No major breaches, no public disasters, and the platform performs reliably under load, but it’s still operating without regulation in most regions, and some basics like fiat cashouts or options trading aren’t part of the offering.

This won’t matter to everyone, but if what you’re looking for is regulatory cover, you won’t find much of it here.

Visit WEEXOur methodology: How we tested and reviewed WEEX

We spent time directly on WEEX, both on desktop and mobile, to see how the platform actually performs under normal use. This included live futures and spot orders, exploring the rewards hub, testing copy trading, and monitoring speed, responsiveness, and usability across devices.

But platform experience alone wasn’t enough for this WEEX exchange review. We checked feedback from Reddit threads, app reviews, and independent ratings sites to get a clearer view of what happens when things don’t go as planned around support, account restrictions, and delayed withdrawals.

Beyond the user-facing side, we also reviewed WEEX’s documentation and public disclosures. This included proof of reserves, terms of service, and WXT token utility, all checked against publicly available data to make sure nothing important was overlooked.

FAQs

Is WEEX available in the USA?

Does WEEX require KYC?

How to withdraw money from WEEX to a bank account?

How do I claim the WEEX bonus?

References