- In This Article

- In This Article

- Show Full Guide

Launched in 2014, Poloniex is an established crypto exchange that lists over 400 coins and tokens. Key features include spot and futures trading, leverage of up to 100x, and instant crypto purchases with traditional payment methods. This Poloniex review reveals everything to know about the exchange.

To evaluate Poloniex, we opened an account and tested the platform extensively. The process explored core factors from charting tools and trade execution to commission fees and customer support. Read on to explore our review findings and decide whether Poloniex is right for you.

As a global exchange that operates offshore, Poloniex suits traders who want to avoid traditional KYC processes. The platform offers anonymous trading accounts with near-full functionality, and once users activate two-factor authentication, they can withdraw up to $50,000 daily.

Our Poloniex review confirms the exchange is also popular for asset diversification. With over 400 listed cryptocurrencies, users buy and sell a wide range of coins and tokens from one centralized account.

Several drawbacks also emerged. Poloniex is an unregulated exchange, so it doesn’t legally need to provide users with consumer protections. While Poloniex offers futures trading, it limits leverage to 100x and lists just 10 derivative pairs. First-time investors using fiat money to buy cryptocurrencies pay up to 5%, which is much higher than many online exchanges.

Pros

Cons

Backed by Tron (TRX) founder Justin Sun, Poloniex remains a long-standing crypto exchange that launched in 2014. Several million traders use the exchange, and trading volumes average approximately $1 billion.

The platform’s most popular marketplace is spot trading. It lists over 400 cryptocurrencies, including Bitcoin (BTC) and top altcoins like Ethereum (ETH) and Solana (SOL). Exchange users also access leveraged derivatives such as perpetual futures and cross-margin trading.

Besides traditional trading markets, Poloniex supports a wide selection of investor-friendly features. The ecosystem offers automated bots, copy trading, and decentralized finance (DeFi) products with high interest rates.

According to our Poloniex review, beginners also use the exchange to buy cryptocurrencies with convenient deposit types. Simplex and Mercuryo partnerships enable Visa, MasterCard, and bank payments.

As a global exchange located offshore, Poloniex offers trading accounts without know-your-customer (KYC) requirements. Unverified clients withdraw up to $10,000 daily with full functionality, except cross-margin accounts.

The table below outlines key factors about the Poloniex exchange:

| Exchange Type | CEX |

| Best For | Traders seeking access to hundreds of spot and futures markets without completing KYC requirements |

| Established | 2014 |

| Based In | No published headquarters, but the exchange’s terms of service mention the Republic of Panama |

| Availability | All countries except Afghanistan, Burma, China, Crimea, Cuba, Congo, Iran, Iraq, Ivory Coast, Libya, Mali, North Korea, Palestine, Somalia, Sudan, Syria, Yemen, Zimbabwe, and the U.S. |

| KYC Verification | No KYC on withdrawals up to $10,000 (standard) or $50,000 (two-factor authentication) daily |

| Supported Coins | 400+ |

| Deposit Methods | Visa, MasterCard, bank transfers, crypto, and peer-to-peer payments |

| Trading Products | Spot trading, perpetual futures, cross-margin accounts, and instant crypto purchases |

| Fees | Maximum trading commission of 0.2% (spot trading) and 0.05% (futures). Margin accounts pay hourly fees based on the market. Instant purchases cost up to 5% |

| Key Features | Copy trading, automated bots, DeFi tools, 100x leverage |

| Customer Support | 24/7 live chat |

Our Poloniex review identified both positives and negatives in the safety department.

Poloniex stores most client-owned cryptocurrencies in cold storage wallets. A small percentage of holdings are kept in hot wallets for daily withdrawals and liquidity provision. The exchange publishes proof of reserves via the Merkle Root Hash system. The reserves verify that Poloniex covers at least 100% of user deposits, and that clients may withdraw their funds at any time.

Platform users may also activate account security features like two-factor authentication and IP address whitelisting, which require email confirmation when logging in from a new location. Remaining a non-verified user helps avoid data privacy breaches, since users trade without providing personal information or KYC documents.

The key issue to address is the Poloniex hack from 2023. CertiK’s incident report confirms that hackers stole $132 million worth of BTC, ETH, and TRX after compromising the exchange’s private keys. Justin Sun assured the public that customer funds were safe and that no exchange users had lost assets.

While hacks cause a loss of confidence, even the best crypto exchanges like Binance and Coinbase have fallen victim to them. This should remind investors to avoid storing large amounts of cryptocurrencies on centralized exchanges. Instead, use a non-custodial wallet to prevent counterparty risks.

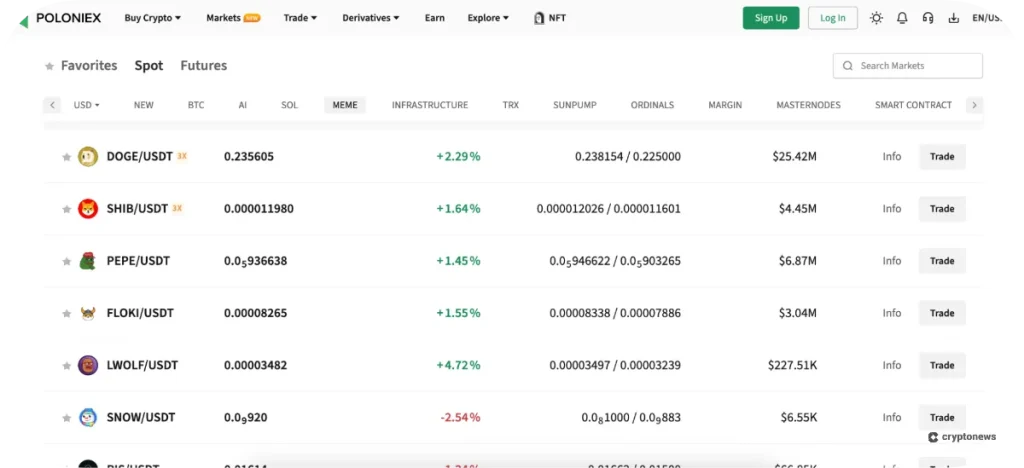

The Poloniex exchange lists over 400 cryptocurrencies, and most pairs are denominated in Tether (USDT). The most popular markets include BTC, ETH, SOL, XRP (XRP), Dogecoin (DOGE), and TRX.

Users may explore Poloniex markets by the crypto narrative. The top meme coins, for instance, cover Shiba Inu (SHIB), Floki (FLOKI), and Pepe (PEPE). The platform also lists Sun Pump tokens. These speculative assets operate on a Tron-backed launchpad and appeal to high-risk traders seeking the next 1000x crypto.

Other listed investment niches include Ordinals, Decentralized Physical Infrastructure Network (DePIN), Real World Asset (RWA), and smart contracts. The exchange also displays markets by the top 24-hour gainers, trending projects, and new listings. These data-driven insights let users discover high-growth tokens before they blow up.

Overall, our Poloniex review confirms that the platform caters to a wide range of risk-reward profiles, including long-term value investors and experienced day traders.

Poloniex provides exposure to the crypto markets in multiple forms.

Traders use the spot exchange to buy and sell crypto pairs, and first-time investors purchase coins with traditional payment methods. More experienced traders prefer the exchange’s derivative platform, which supports perpetual futures with leverage.

Learn more about Poloniex’s most popular trading and investing products.

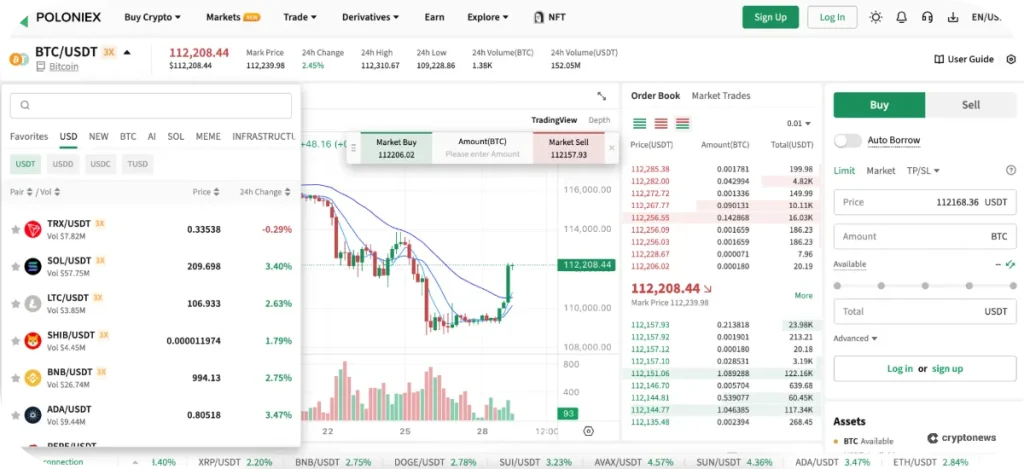

The spot trading exchange lists hundreds of pairs. Most markets allow users to trade cryptocurrencies against USDT, a standard practice with many online exchanges.

Traders place market or limit orders, and once those orders fill, positions execute instantly. The exchange adds the purchased digital asset to the user’s spot balance, which they may withdraw at any time.

Poloniex also lists crypto-cross pairs. Users speculate on price movements against BTC or TRX, and the most traded pairs include DOGE/BTC, ETH/BTC, and XRP/TRX.

In addition to traditional spot trading, Poloniex users access margin facilities. This trading tool enables leverage of up to 3x on BTC and major altcoins. Margin accounts appeal to short-term traders, since Poloniex charges interest hourly. The interest rate varies widely by market. BTC, for instance, incurs 3.65% interest, while Bitcoin Cash (BCH) is significantly higher at 25%.

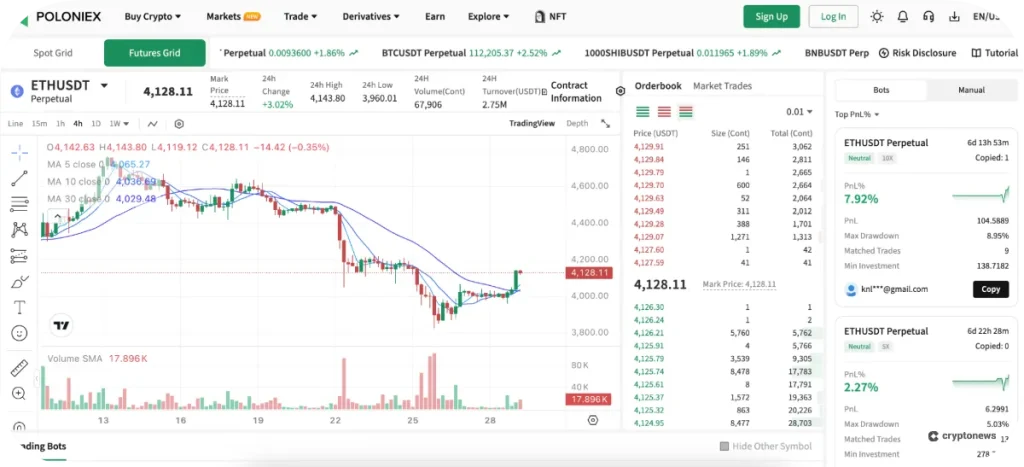

Poloniex offers perpetual futures contracts, which are popular with traders who seek short-selling and leverage tools. Platform users access a maximum leverage limit of 100x, which converts to an initial margin requirement of just 1%. This high-risk feature allows traders to enter positions with substantially more than they can afford.

We compared Poloniex with the best crypto futures trading platforms and found it falls short in several areas. The exchange supports just 10 futures markets, while many platforms typically list hundreds. Since traders must provide margin in USDT, they cannot access inverse contracts that settle in the underlying coin or token.

Trading volumes lag other futures trading platforms, too. The main BTC/USDT perpetual futures market saw just $2.1 million in recent 24-hour trading volume. In contrast, many crypto derivative exchanges handle billions of dollars daily on the same pair.

If you’re looking for the top options trading platforms, Poloniex does not support this derivative market. Instead, options traders typically use Binance, OKX, or Bybit.

While Poloniex lacks in several key areas, its derivative platform offers notable features to enhance the trading experience.

One feature includes the grid trading tool, which lets users automate their futures positions. The pre-built grid trading bot offers various strategies, including a short-selling system on BTC/USDT with 5x leverage. Platform users may also create custom strategies. Trigger points include the grid price range, position size, and whether the bot trades long, short, or neutral.

Copy trading is another derivative feature. Users browse experienced futures traders and choose one based on the strategy, profit and loss, maximum drawdown, and other core metrics. Once users select a trader and input an investment size, they automatically copy their futures positions.

The exchange offers a wide range of staking products, which allow users to earn passive rewards on their account balances. APYs vary by the digital asset and staking term.

Users who stake USDT earn 10% APYs on flexible accounts. These accounts enable withdrawals at any time, so users avoid liquidity risks. Staking USDT on 14 or 30-day terms offers APYs of 3.65% and 3.9% respectively. New exchange users receive a seven-day promotional rate of 100% on their USDT holdings.

Besides stablecoins, users may also earn competitive rewards on BTC, ETH, TRX, DOGE, and other top cryptocurrencies.

Note that Poloniex staking functions as an off-chain initiative. Proof-of-stake blockchains do not hold user assets, which presents counterparty risks.

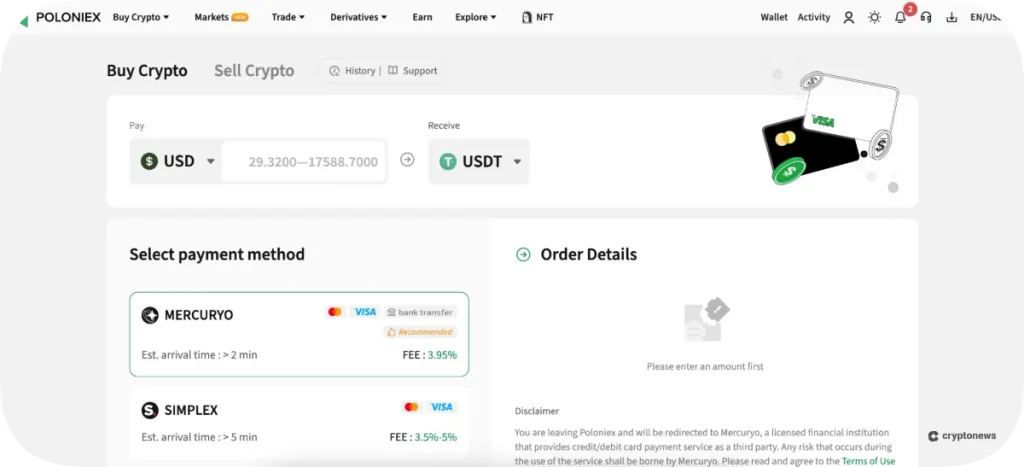

The fastest way to buy cryptocurrencies on Poloniex is with instant payment methods. The platform supports Visa and MasterCard via partnered fiat gateways. The instant buy feature offers just seven crypto assets: BTC, ETH, TRX, XRP, USDT, USDC, and Litecoin (LTC).

Those who want access to other cryptocurrencies may purchase USDT and swap the tokens on the spot exchange.

Minimum purchase requirements of $29 are higher than on other exchanges, and fees of up to 5% apply.

Another way to access the Poloniex exchange with fiat money is the peer-to-peer (P2P) trading tool. Traders buy BTC or USDT with over 100 currencies and payment methods, including local bank transfers and e-wallets.

Buyers purchase cryptocurrencies directly from sellers, and the exchange’s escrow system helps ensure safety. Poloniex does not charge buyers fees on P2P trades, and sellers set exchange rates.

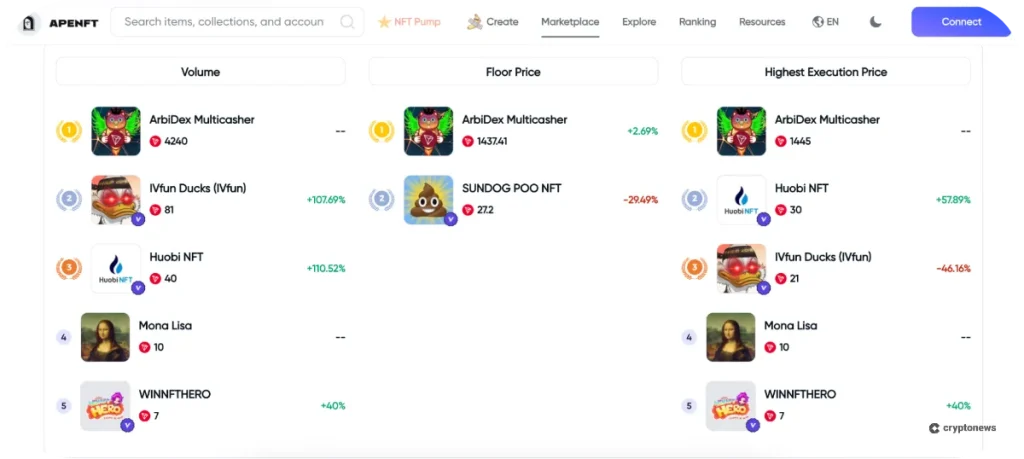

Poloniex integrates the APENFT Marketplace, a blockchain-based platform for NFT trading. APENFT functions as a decentralized initiative, so Poloniex users trade NFTs via non-custodial wallets and smart contracts. Users require the TronLink wallet specifically, which connects directly to the Tron blockchain.

The marketplace supports NFTs on the Tron standard (TRC-721), and popular collections include SUNDOG POO, Tron_szn, and XLGNFT. Users browse NFT collections by various metrics like trading volume, floor prices, and 24-hour trends.

Poloniex has a diverse pricing structure for core markets like spot and margin trading, perpetual futures, and fiat purchases. Fees vary based on the order type and account tier, and whether users hold TRX or HTX (HTX).

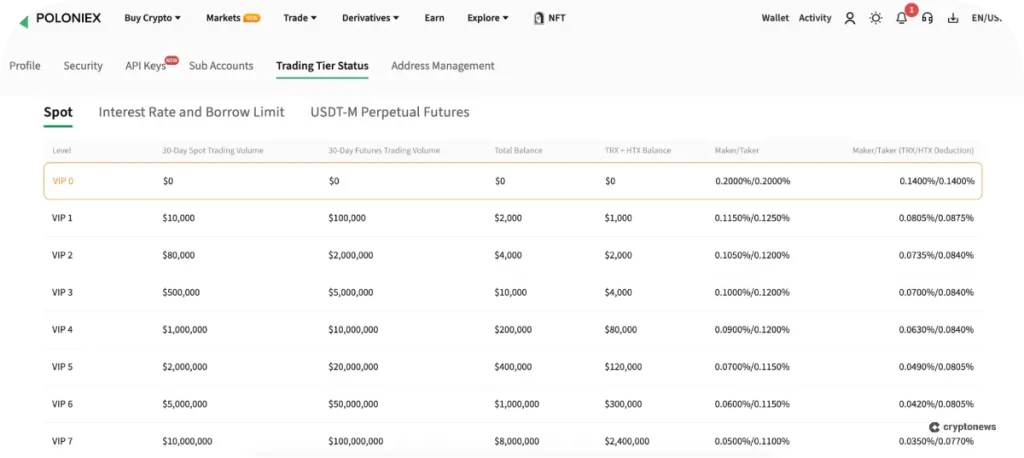

Casual traders pay spot trading commissions of 0.2% per side, regardless of the order type. The platform reduces these commissions to 0.14% when users hold TRX or HTX.

As users increase their 30-day trading volumes, they see lower commission rates. Platform users who trade over $10,000 achieve a VIP 1 status. This framework reduces commissions to 0.115% or 0.125%, depending on whether traders place limit or market orders.

The highest tier, VIP 9, offers a 0.005% rebate for market makers, while takers pay 0.1%. This fee structure makes Poloniex less competitive than many exchanges. Binance and OKX offer 0.1% commissions without requiring minimum trading volumes. Yet on Poloniex, users must trade over $50 million in 30 days to secure the same rate.

Trading cryptocurrencies through margin accounts incurs two separate fees. The first fee is commissions per side, which reflect the spot trading structure. The other fee is interest, which traders pay based on the amount of leverage applied.

Interest rates align with the traded asset. Large-cap markets like BTC and ETH incur annual rates of 3.65%. These rates amplify to 30% when trading SOL and BNB.

Similar to spot trading, the exchange offers more competitive interest rates for VIP members. Accounts with VIP 9 status pay 10.5% on SOL and BNB, which reflects a significant discount compared with standard rates.

Regardless of the market or VIP status, Poloniex applies interest on margin accounts hourly. As such, margin accounts suit short-term strategies only.

Poloniex futures markets rely heavily on liquidity provision, so makers receive considerably better commission rates than takers. The entry-level commission is 0.015% and 0.05% for makers and takers, respectively.

VIP 5 traders who place limit orders avoid commissions entirely, and VIP 6-9 receive a 0.015% rebate.

Our Poloniex review confirms that VIP volume requirements for futures are much lower than spot trading. VIP 1, for example, requires a 30-day futures trading volume of just $100,000. This converts to $1,000 in initial margin when traders apply the maximum 100x leverage.

Futures traders also incur funding fees every eight hours at 04:00 UTC, 12:00 UTC, and 20:00 UTC. The exchange bases funding rates on various metrics, such as the market and liquidity depth.

While instant purchases are the most convenient method to buy cryptocurrencies, Poloniex charges high fees.

If Mercuryo processes the transaction, users pay 3.95% of the total purchase size. Simplex transactions range from 3.5% to 5% depending on the currency and payment method.

Note that using a credit card can trigger cash advance fees with the card issuer. These fees are typically 3-5% and they accrue interest immediately.

Poloniex does not charge deposit fees for crypto transfers, although users are responsible for covering the network fees when making a wallet transfer.

The exchange charges a flat fee on crypto withdrawals, which varies by the digital asset and network. In some cases, withdrawal fees are extortionate. Withdrawing Bitcoin from Poloniex costs 0.001 BTC, which amounts to approximately $111. USDT and other ERC-20 tokens are more competitive, since Poloniex charges just $0.60.

Poloniex users deposit funds with fiat payment methods and cryptocurrencies.

Fiat methods include:

Since transfers go through the SWIFT banking network, they take 3-5 business days to arrive.

A faster alternative is to buy BTC or USDT from P2P sellers in your home country. Sellers accept a huge selection of convenient payment types, from Perfect Money, Neteller, and Alipay to ShopeePay, Revolut, and SEPA Instant. Fees vary widely, since sellers choose their required exchange rate.

Our Poloniex review confirms the exchange’s user interface is a good, friendly experience. It takes seconds to register a new account, as the platform requires an email address or mobile number only. While users must verify their preferred contract method via a verification code, no other information is needed.

The exchange’s menu bar covers core markets like spot trading and perpetual futures, which makes it seamless to navigate different products. Poloniex lets users find suitable cryptocurrencies via a search bar and key market narratives like meme coins, DePIN, and RWA.

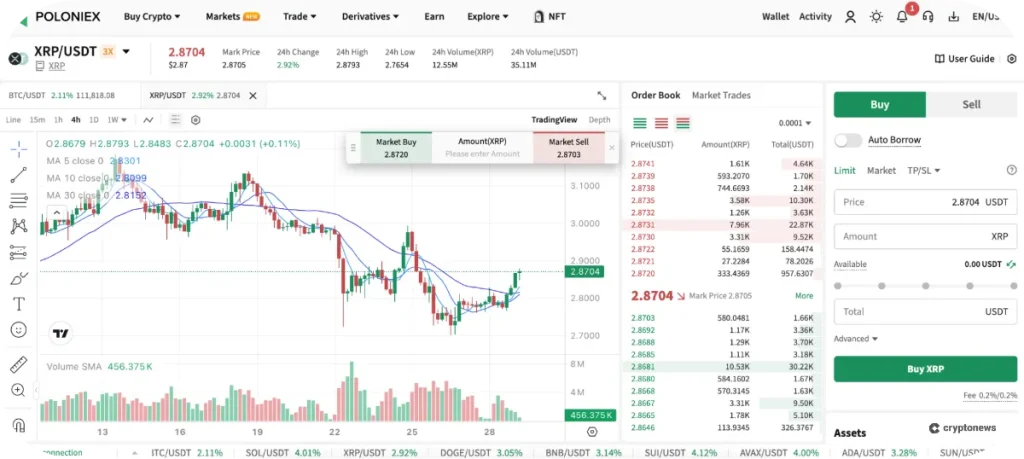

The trading platform has a minimal learning curve. It allocates about 50% of the trading screen to pricing charts, which also support drawing tools and technical indicators. The remaining space shows the real-time order book and order form, where traders easily set up and place limit or market orders.

Most users trade digital assets on the desktop website, yet Poloniex also provides a native mobile app for iOS and Android. Our research shows mobile traders have mixed platform experiences. iOS users rate the app positively, with a 4.4/5 rating. However, the Android app has a 3.2/5 rating across nearly 10,000 individual reviews. Some negative reviews discuss slow trade execution and general lagging.

Poloniex is available in most regions, although the platform’s terms of service prohibit certain countries, including:

The U.S. is the notable exclusion. As per the Securities Exchange Commission’s (SEC) 2019 filing, Poloniex exited the U.S. market in 2019.

While Poloniex allows VPN usage, attempting to use the exchange in a banned country may lead to account closure and a loss of funds.

As one of the best no-KYC crypto exchanges, Poloniex offers anonymous accounts with high withdrawal limits. The platform does not collect personal information when users register, since it only requires an email or mobile number.

Non-verified accounts may withdraw $10,000 daily in any supported digital asset. This limit increases to $50,000 when users set up two-factor authentication. Traders access all platform features other than margin accounts, which require Level 2 verification.

If users provide personal information and government-issued ID, they increase daily withdrawal limits to $500,000, or $1 million if they activate two-factor authentication.

One risk to consider is that non-verified users must wait up to two months if they lose access to the account. The cryptocurrency exchange reduces this timeframe to just four days for verified users. Moreover, while Poloniex does not implement KYC on fiat purchases, partnered gateways may ask for ID depending on the purchase amount.

Poloniex users receive 24/7 customer support via live chat. Some users experience near-instant connection times, and others several hours. While wait times depend on platform demand, we found they reduce significantly over the weekend.

The exchange offers customer service in various languages, including English, Chinese, Japanese, Vietnamese, Thai, and Russian.

Regarding public reviews, Trustpilot users rate Poloniex 1.2/5. Some complaints concern unprocessed withdrawal requests, and others regard unfilled market orders during volatile periods.

The Poloniex subreddit shows similar issues, with multiple users posting about pending withdrawals and unresponsive customer support. Poloniex scores slightly better on G2 with a 3.5/5 rating, yet this remains below the industry average.

In our view, Poloniex could improve in the following areas:

According to our Poloniex broker review, the exchange’s core strengths are supported spot trading markets and its high withdrawal limits on no-KYC accounts. However, Poloniex charges higher spot commissions compared with other exchanges. It also offers lower leverage limits and a much smaller range of derivative markets.

The table below compares Poloniex with other top crypto platforms:

| Poloniex | CoinFutures | MEXC | OKX | |

| Deposit Methods | Debit/credit cards, SWIFT transfers, peer-to-peer, and crypto | Debit/credit cards, Google/Apple Pay, PIX, and crypto | Debit/credit cards, Google/Apple Pay, PIX, SEPA, peer-to-peer, and crypto | Debit/credit cards, Google/Apple Pay, local bank transfers, peer-to-peer, and crypto |

| Trading Fees (Max) | Spot (0.02%), futures (0.05%) | Variable or profit-based | Spot (0.05%), futures (0.04%) | Spot (0.01%), futures (0.05%) |

| Trading Products | Spot trading, margin trading, perpetual futures | Simulated futures | Spot trading, perpetual futures | Spot trading, margin trading, perpetual futures, delivery futures, options |

| Max Leverage | 100x | 1000x | 500x | 125x |

| KYC Require? | No | No | No | Yes |

| U.S. Friendly? | No | Yes | No | Yes |

Follow these steps to open and fund a Poloniex account, and set up and place a crypto trading order.

Poloniex is a no-KYC exchange so that new users can open an account in seconds. Simply visit the Poloniex website, click “Sign Up”, and input an email address or mobile number.

Poloniex sends a verification code to the registered contact method. Enter the code to complete account registration.

Visit PoloniexActivating account security features remains essential for a safe trading experience. Hover over the account profile icon and click “Security”.

We recommend setting up two-factor authentication via mobile passkeys or Google Authentication. Both options require users to enter a verification code whenever they log in or request withdrawals.

Alongside email verifications, consider activating withdrawal whitelisting. This security feature blocks withdrawals to non-whitelisted wallet addresses. While users may add or remove addresses, they must complete the two-factor authentication process.

The next step is to deposit funds into the Poloniex account. The exchange accepts various payment channels, including both digital assets and traditional money.

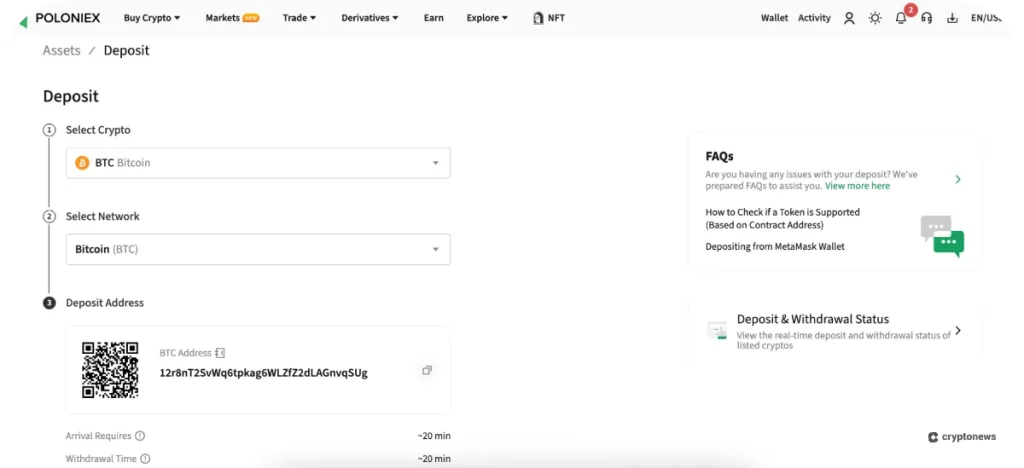

To deposit cryptocurrencies, click “Wallet” followed by “Deposit”. Select the crypto and network, and transfer assets to the provided wallet address. This address links directly to your Poloniex account, which enables you to track the payment via the blockchain transaction ID.

Poloniex waits for two block confirmations before it credits BTC, so expect to wait around 20 minutes for the funds to appear. Most other token standards take less than a minute to arrive.

To use fiat money, choose between the instant purchase method or the P2P dashboard. Fiat methods include Visa and MasterCard, although fees of up to 5% apply. P2P payments are typically cheaper, yet sellers set their own rates, so competitiveness varies.

Note that Poloniex requires users to purchase crypto when they use traditional payment types. This requirement means you cannot add local currency to the account itself.

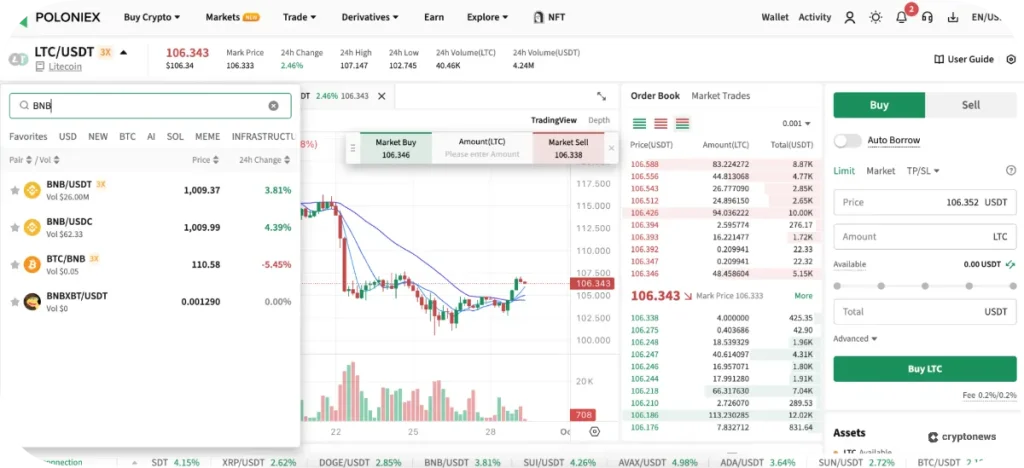

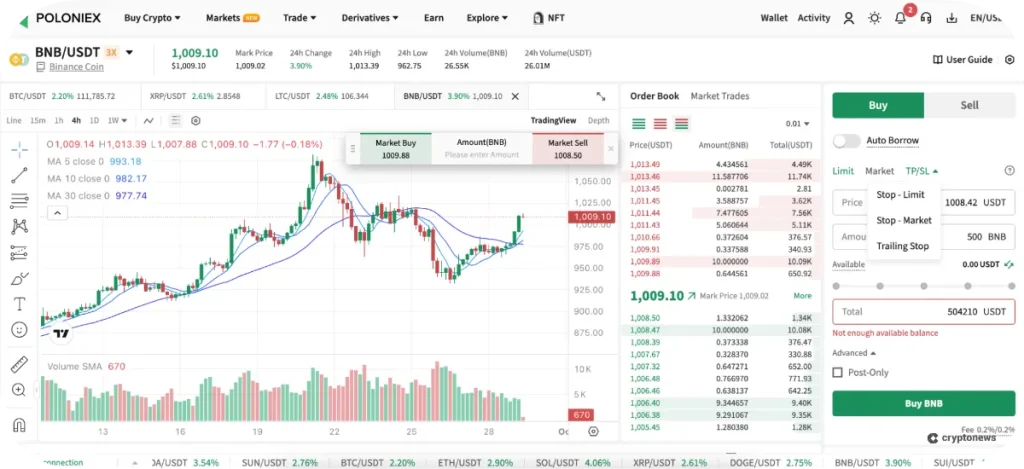

Poloniex offers various crypto trading markets. Beginners prefer the spot exchange, since they buy and sell cryptocurrencies with real asset ownership. The futures platform suits advanced traders who seek leverage and the ability to trade long or short.

Select the preferred market via the top menu bar, then use the search box to find a digital asset pair.

In the above example, the user searches for BNB on the spot exchange. Since Poloniex offers the BNB/USDT pair, traders swap BNB for USDT, or vice versa.

The platform’s order form is located to the right of the live order book. Select a buy or sell order, and choose between a limit or market order. Then enter the position size in USDT, and input the execution price if placing a limit order.

Click “TP/SL” if you want to set stop-loss and take-profit orders. These order types are essential to manage risk.

Finally, confirm the order. Poloniex executes market orders instantly at the next best available price. Limit orders stay pending until other exchange users match the target price.

Poloniex is a popular choice with traders who prioritize anonymity and broad asset diversification. The exchange offers no-KYC accounts with daily withdrawal limits of up to $50,000, and traders have access to over 400 coins and tokens.

While Poloniex also suits experienced traders, the platform supports just 10 futures markets, and it caps leverage at 100x. Despite its 2023 hack, Poloniex implements robust security mechanisms, including IP, device, and wallet whitelisting, as well as cold storage and proof of reserves.

If you’re unsure whether Poloniex is the right option, read our extensive comparison guide on the best crypto exchanges for 2026.

Visit PoloniexWe tested the end-to-end exchange experience to produce this Poloniex review. The research team evaluated account onboarding, crypto and fiat payment methods, processing timeframes, and transaction fees.

We placed limit and market orders on the spot and derivative exchanges to assess execution speeds, average liquidity depth, and trading volume, and the overall user experience on desktop and mobile devices. Our methodology emphasizes safety, which includes business registration, company directors, account security tools, and cold storage solutions.

Researchers compared review findings with other trusted crypto exchanges like CoinFutures, Binance, MEXC, and OKX, and scored each metric accordingly. Since platforms regularly adjust their product offerings, we update this Poloniex exchange review to reflect material changes.