- In This Article

- In This Article

- Show Full Guide

BitMart is a global crypto exchange and derivative platform that was founded in 2017. While it claims over 12 million users worldwide and mid-tier liquidity, crypto traders should read our BitMart review to make an informed decision.

We tested the BitMart exchange on desktop and mobile devices to evaluate the overall user experience, trade execution speeds, and core platform factors like fees, supported markets, and charting tools.

Read on to decide if BitMart is the right exchange for you, or if better alternatives exist in 2026.

BitMart’s biggest strength is its diverse range of markets. Traders can access over 1,700 digital assets on the spot exchange platform, and more than 460 perpetual futures markets with leverage of up to 200x. The instant buy feature helps beginners who prefer investing with debit cards or credit cards, which means BitMart suits all skill sets.

The exchange falls short in other areas, including high fees when users trade low-cap pairs, and reduced leverage on markets with weak liquidity. BitMart also operates without a strong regulatory framework. It has no licenses and has not published Merkle-Tree proof of reserves.

Pros

Cons

BitMart is an established crypto exchange with over 12 million users. Headquartered in the Cayman Islands, BitMart provides a wide range of crypto products and services. Spot trading is the exchange’s most popular offering, with over 1,700 supported markets and average daily volumes of around $3 billion.

The platform also offers derivative trading via linear and inverse contracts, and AI-backed tools for real-time market intelligence. Beginners also turn to BitMart to buy cryptocurrencies instantly with debit/credit cards, e-wallets, and peer-to-peer payments. Research shows that BitMart has a growing decentralized finance (DeFi) ecosystem, too, including crypto loans and savings accounts.

Users may access all BitMart markets and trading tools via a single unified account, either on the desktop website or the native app for iOS and Android.

While BitMart stands out for its wide asset support and broad selection of products, users do not receive the same regulatory protections as on tier-one exchanges. It lacks licensing, which excludes accounts from the U.S., the UK, and other major economies.

BitMart is more than just a cryptocurrency exchange. Its ecosystem offers access to fiat payments, perpetual futures with leverage, and automated services like copy trading and grid bots.

The table below summarizes our BitMart review findings:

| Exchange Type | CEX |

| Best For | Active crypto traders seeking deep market access |

| Established | 2017 |

| Based In | Cayman Islands |

| Availability | A global exchange available in most countries. Key exceptions include the U.S., the UK, Hong Kong, and China |

| KYC Verification | No KYC on withdrawals up to 20,000 USDT daily (excludes margin trading and some nationalities) |

| Supported Coins | 1,700+ |

| Deposit Methods | 300+ fiat payment methods via instant buy, gateways, and peer-to-peer |

| Trading Products | 1,700+ spot markets and 460+ perpetual futures markets |

| Fees | Varies by the product and market. Maximum commission of 0.6% on spot and futures pairs |

| Key Features | DeFi products, 200x leverage, copy trading, automated bots |

| Customer Support | 24/7 live chat |

BitMart runs an established exchange with millions of active platform users. Unlike Coinbase, Gemini, and other tier-one providers, BitMart is an unregulated exchange. Its unlicensed framework enables it to support a global audience and provide products like derivatives and crypto loans without strict compliance.

Although BitMart lacks proof of reserves, the exchange recently announced its plans to implement a Merkle tree system. In the meantime, it provides wallet addresses for Bitcoin, Ethereum, and BNB. However, those addresses cover hot wallet storage, which is a small fraction of BitMart’s overall exchange reserves.

In terms of track record, cybercriminals breached BitMart’s servers in a 2021 hack. The “51% Attack” resulted in the theft of nearly $200 million, although BitMart pledged to reimburse affected accounts.

The exchange has since enhanced its security protocols. Account holders protect their accounts with phone and email confirmation, as well as two-factor authentication via Google Authenticator. Other account controls include device whitelisting and anti-phishing codes.

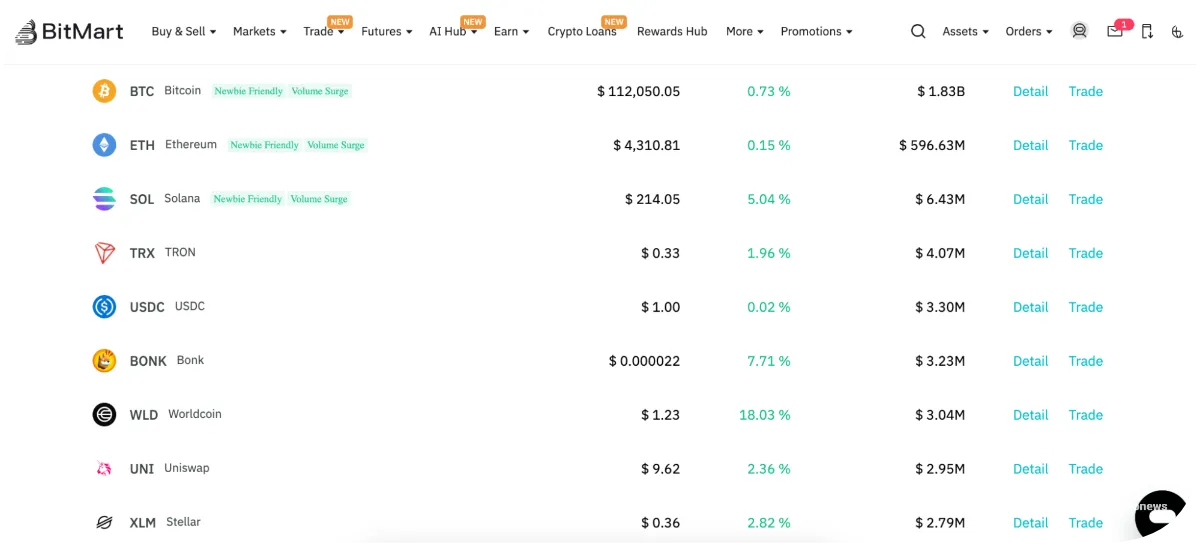

BitMart lists over 1,700 cryptocurrencies. Users trade Bitcoin (BTC) and the best altcoins like Ethereum (ETH), Tron (TRX), Solana (SOL), and Sui (SUI) against USDT. The platform also lists the best meme coins, from Bonk (BONK) and Shiba Inu (SHIB) to Pepe (PEPE) and dogwifhat (WIF).

The spot exchange lets users find markets by investment category, and options include RWA, Layer 1, Layer 2, and DeFi. Another method is to explore trending tokens from specific ecosystems like Ethereum, Base, and BNB Chain.

The sheer number of markets means that BitMart is also popular for discovering new cryptocurrencies. Clicking the “Innovation” button reveals micro-cap cryptocurrencies with strong potential, although some markets have limited trading volumes.

Our BitMart review found that the exchange offers crypto-to-crypto pairs, too, such as SOL/BTC and ETH/BTC. Although users may purchase digital assets with local currency, BitMart doesn’t support fiat-to-crypto pairs like BTC/USD or ETH/EUR.

BitMart users with limited trading experience buy cryptocurrencies with instant payment methods. This is the easiest way to enter the crypto market as a first-time investor.

The instant buy tool supports approximately 20+ cryptocurrencies, and the minimum investment requirement is $11 (or the currency equivalent). Users enter the asset, purchase amount, and deposit method, and input their payment details to confirm the order. BitMart adds those cryptocurrencies to the user’s account immediately, allowing beginners to bypass the order book system.

While the instant buy feature provides a convenient trading experience, the spot exchange offers lower fees and a wider selection of markets.

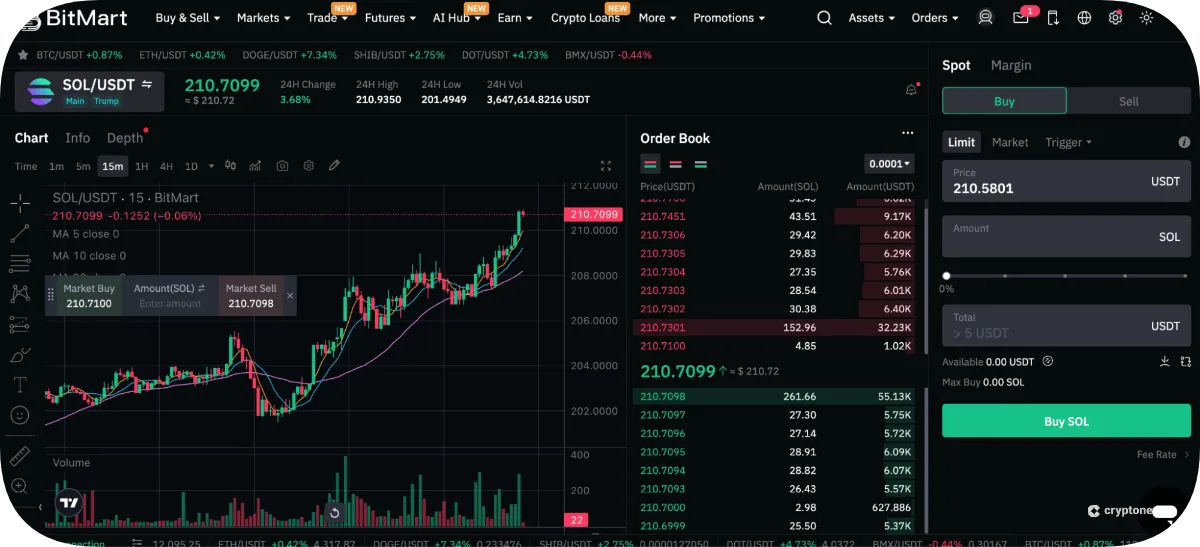

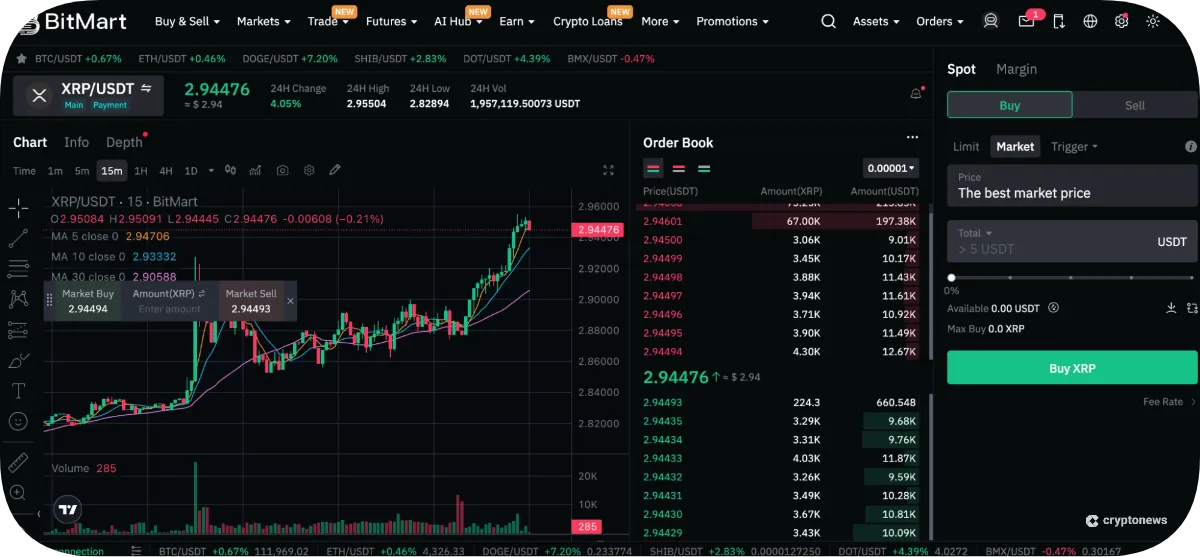

With an average daily trading volume of several billion dollars, BitMart’s spot exchange is ideal for securing tight spreads via limit and market orders. The trading dashboard offers charting indicators and advanced trading tools (including order types), as well as drawing tools like Fib circles and trend lines. The order book is transparent and customizable, which allows traders to evaluate buy and sell trends.

The spot platform also functions as a margin trading facility. This feature enables isolated leverage of up to 5x, and usually 3x on smaller markets. Traders can buy cryptocurrencies with more capital than their BitMart account allows, although just like perpetual futures, they risk liquidation and higher fees.

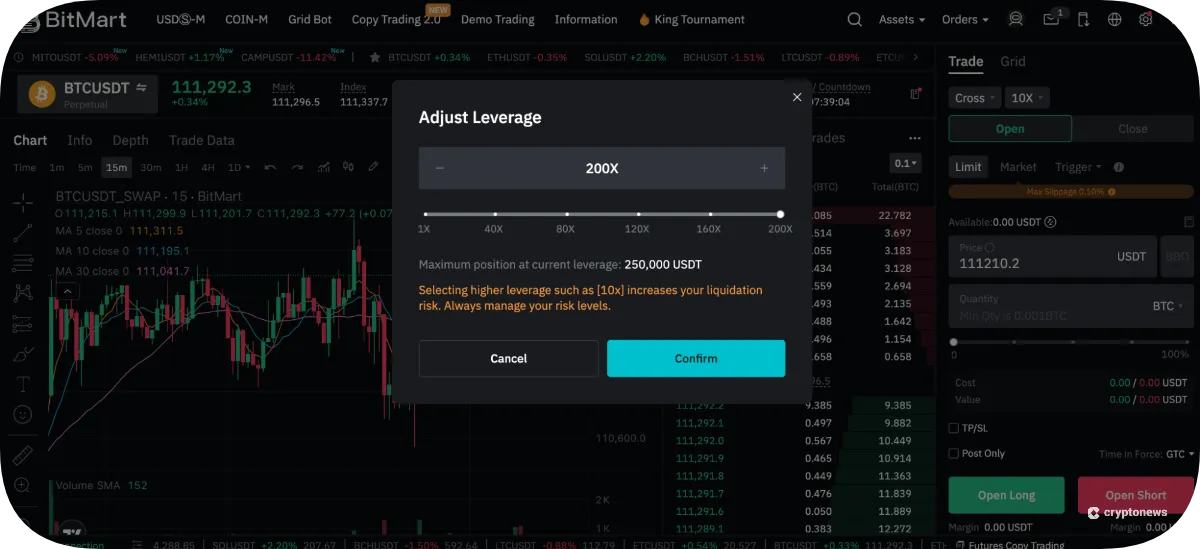

BitMart traders have access to over 460 perpetual futures markets. Two contract types are available: USD-M and Coin-M.

USD-M futures settle in Tether (USDT) or USDC (USDC) for simplicity and risk mitigation. Traders risk the initial margin on the futures position only, and a much wider range of markets is available.

Coin-M futures settle in the underlying asset, although BTC and ETH remain the only two options in that regard.

In compiling this BitMart review, we confirm the maximum leverage is 200x. However, the exchange offers much lower limits on non-major markets. It also reduces leverage on Coin-M futures, with BTC/USDT limited to 50x. To view the leverage limit for your preferred futures market, click the “10x” button toward the top of the order form.

Having reviewed the best crypto futures platforms in 2026, we found that CoinFutures is a better fit for most traders. Maximum leverage limits remain at 1000x for all markets, including volatile pairs like DOGE/USDT. CoinFutures offers transparent proof of reserves, too, which BitMart has yet to publish.

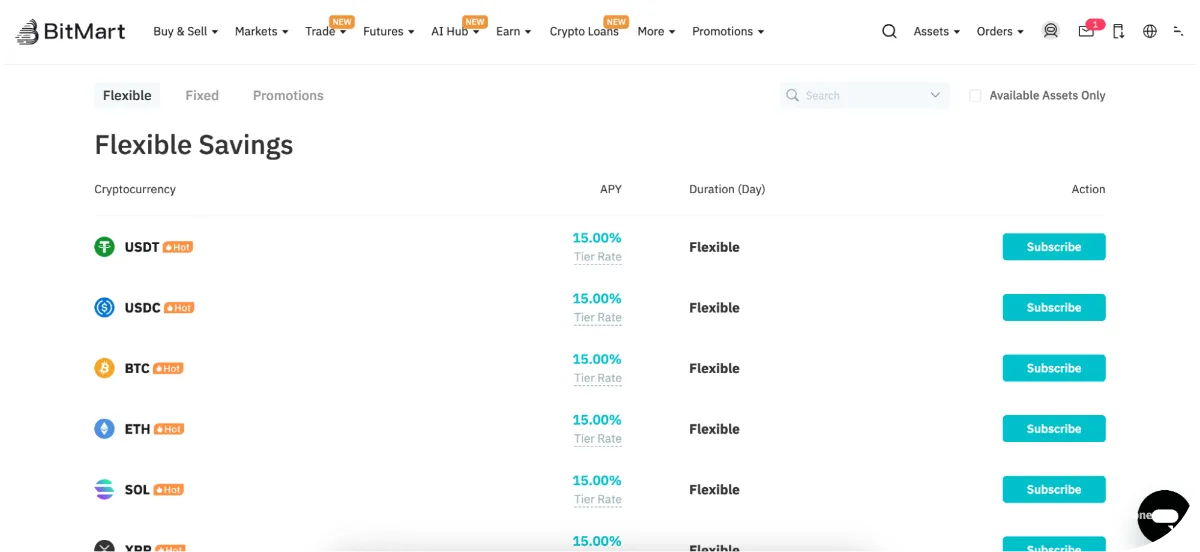

BitMart Earn offers a comprehensive range of DeFi services. No additional account is needed, which lets users allocate funds directly from their BitMart balance.

One notable product is BitMart’s savings accounts, which offer flexible and fixed terms. Flexible accounts provide APYs of 15% on USDT, USDC, BTC, ETH, SOL, and XRP.

The catch is that the 15% rate is available only on the first portion of the total investment. USDT deposits, for instance, drop to 6.25% after the initial 200 USDT. Bitcoin APYs fall to 1% after the first 0.002 BTC. Fixed accounts offer competitive APYs, too, although users cannot withdraw their assets until the term matures.

The exchange also caters to users who prefer the proof-of-stake system. ETH staking yields 4%, while SOL offers 8.25%. BitMart has no minimums, lock-up terms, or fees on staked cryptocurrencies.

BitMart offers welcome packages to first-time customers valued at up to 14,000 USDT. Users unlock various bonuses depending on the required task. The lower-value vouchers are the easiest, since tasks include account verification, making a deposit of 100 USDT or more, and placing a spot trading order.

BitMart runs seasonal promotions for existing traders, including spot and futures prize draws. Winning items include 0.1 BTC, 100 USDT, and an iPhone 16 Pro.

The events centre offers additional opportunities, such as fully-fledged trading competitions on new token listings. Projects gain from increased trading volumes, while users earn free tokens simply for participating.

Following the example of its competitor, Coinbase, BitMart recently launched its own prediction market, allowing users to predict new crypto trends, sports events, and political outcomes using USDC. Each share in the prediction market is priced between $0 and $1.

To participate in the prediction market, you must select an event, choose a prediction outcome (Yes or No), and enter the amount you wish to invest.

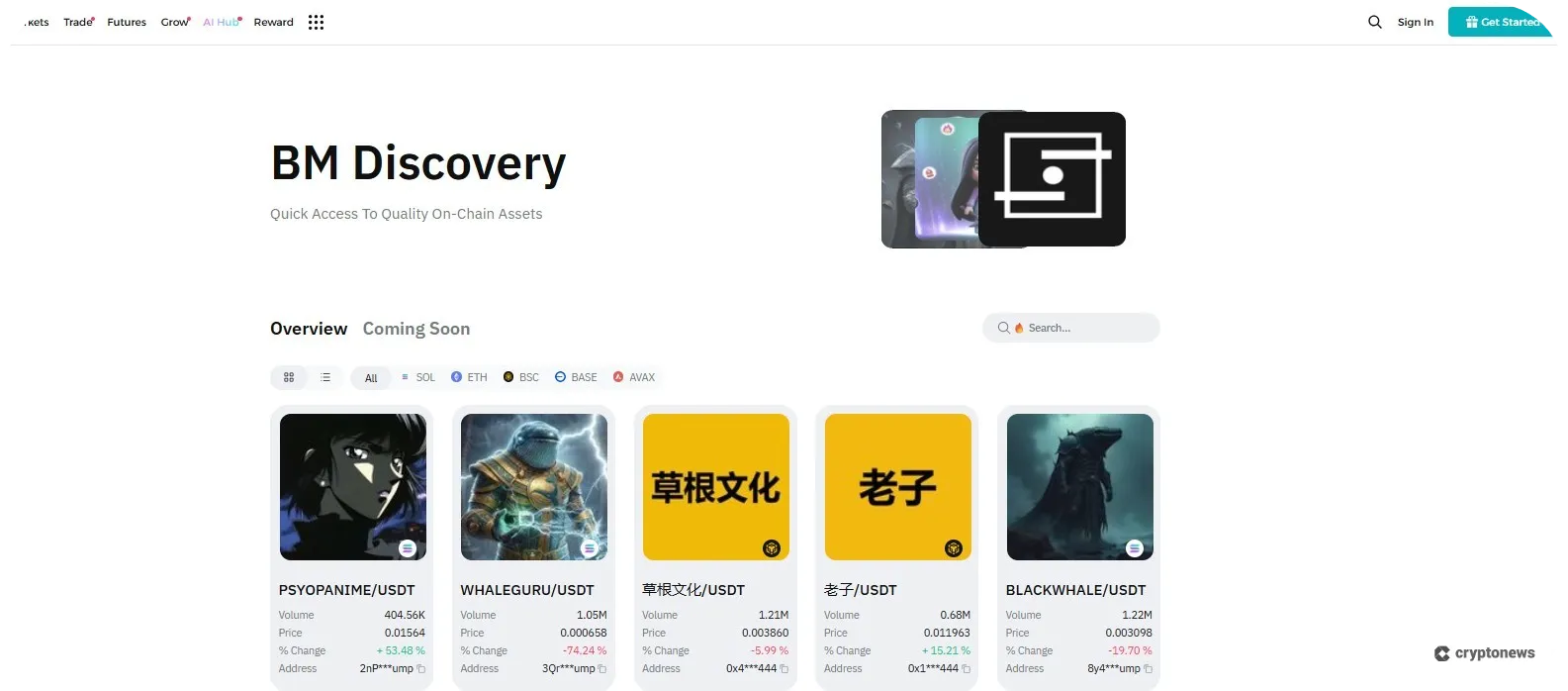

BM Discovery Zone helps you discover new on-chain assets across SOL, ETH, BSC, BASE, and AVAX, such as PSYOPANIME, CREPE, PALU, and JESSE. Most coins listed on the BM Discovery Zone are in their early stages, making them highly volatile. However, BM Discovery Zone also incorporates real-time data to help you identify coins with the highest growth potential.

Pre-Market Trading is BitMart’s staking-to-mint service. You can stake USDT to mint PreTokens and trade them on a dedicated pre-market spot trading platform. Keep in mind that PreTokens are pre-listing vouchers, meaning they cannot be deposited or withdrawn.

To mint PreTokens, you must select the pre-market trading module and create a staking order. You must also pay a 2% unstaking fee.

BitMart Card is a crypto debit card issued by Visa. The card supports 12 cryptocurrencies, including USDT, USDC, BTC, ETH, SOL, ADA, BMX, XRP, LTC, DOGE, TON, and BNB. You can use the card to convert your digital assets into fiat or to make online purchases. You can also earn cashback rewards – up to 4% on online purchases and up to 5.5% on grocery and dining purchases, as well as up to 1000 fee-free ATM withdrawals.

All BitMart users can apply for the card after completing the KYC verification (level 2). There are no annual fees; you only need to cover the transaction and ATM withdrawal fees, which stand at 1.3% and 2%, respectively. The daily withdrawal limit is $2,000, and you can make up to three withdrawals per day.

BitMart uses artificial intelligence (AI) tools to provide real-time analytics. We evaluated each tool and found that use cases are relatively basic. The 24-hour social sentiment feature, for instance, indicates whether posts are bullish, bearish, or neutral; however, the data lacks validity. It analyzes just 7-8,000 posts, which accounts for a small fraction of the overall X activity.

The platform also analyzes market pulse rankings (MPR) and the top key opinion leaders (KOL) in crypto, but these statistics are available on many other data aggregation platforms.

Beacon is the exchange’s ChatGPT-style bot, and it lets users ask market-related questions in a conversational format. The AI tool also helps users with trading strategies and risk management.

BitMart also includes copy trading and grid bots within its AI hub, although these features rely on traditional automation rather than pure AI.

While BitMart is best known for its high-volume spot exchange, it’s also one of the best crypto lending platforms.

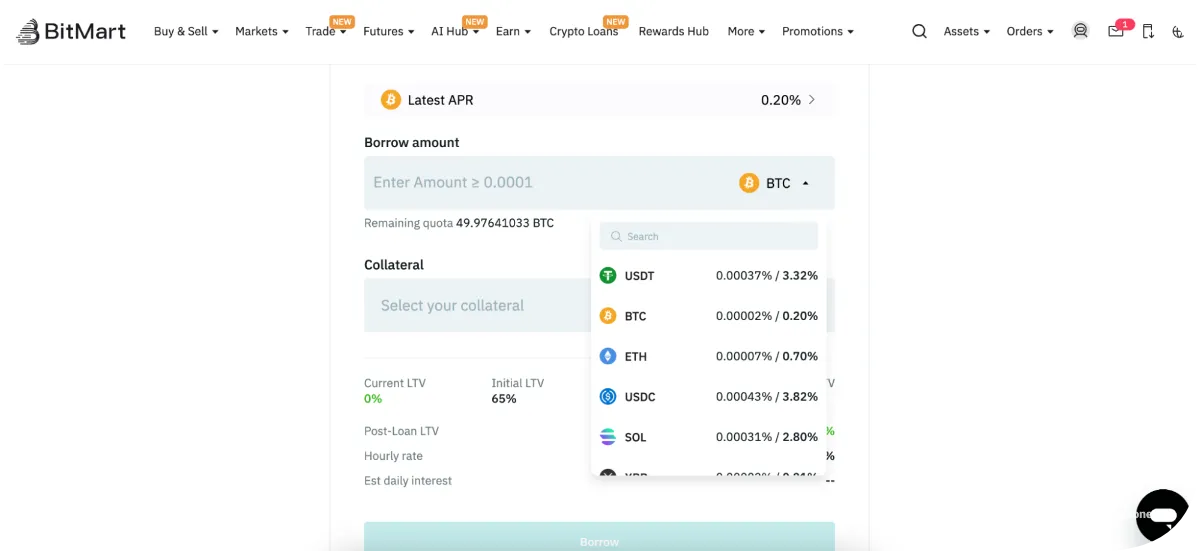

It offers secured loans with a maximum loan-to-value (LTV) of 65%. This framework lets users borrow 650 USDT with a 1,000 USDT collateral deposit. Note that the LTV drops on lower-cap cryptocurrencies to mitigate risk.

Similar to most crypto loans, BitMart requires no credit checks or application processes. Just deposit the collateral and receive the loan funds instantly.

Variable interest rates depend on the coin or token. BTC and ETH APRs are just 0.2% and 0.7%. USDT loans are more expensive at 3.32%, although this rate is still competitive compared with traditional lenders.

If you’re borrowing a non-stablecoin asset, remember to consider the liquidation risks. Liquidation occurs when the original collateral value no longer covers the maintenance margin. The safer option is to borrow stablecoins, since they’re pegged to USD.

Our BitMart exchange review outlines trading and non-trading fees in the following sections.

BitMart has an unusual spot trading commission structure, as it charges fees based on the pair category.

The best cryptocurrencies to buy, like BTC, ETH, and SOL, sit within class-A. This class is the cheapest, as users pay just 0.1% per slide. Commissions in classes B, C, and D increase to 0.25%, 0.4%, and 0.6%. This structure renders low-cap cryptocurrencies expensive to trade, as 0.6% is significantly higher than the market average.

BitMart offers two different ways to reduce spot trading commissions. Account holders with BitMart Token (BMX) get a 25% discount. Those who place limit orders (market makers) also get lower commissions, although they need to meet minimum 30-day trading volumes to qualify.

We’ve ranked the lowest-fee crypto exchanges in our 2026 market report.

Margin fees align with spot trading commissions, although users incur additional charges on the borrowed funds.

BitMart applies initial interest rates when users open orders, and the exact fee depends on the asset. Users pay additional rollover interest rates hourly, making margin positions expensive to hold long-term.

BitMart traders pay 0.06% per side to trade perpetual futures via market orders. Those commissions reduce to 0.02% on limit orders.

No additional discounts are available unless you achieve VIP level 13, which requires institutional-grade volume.

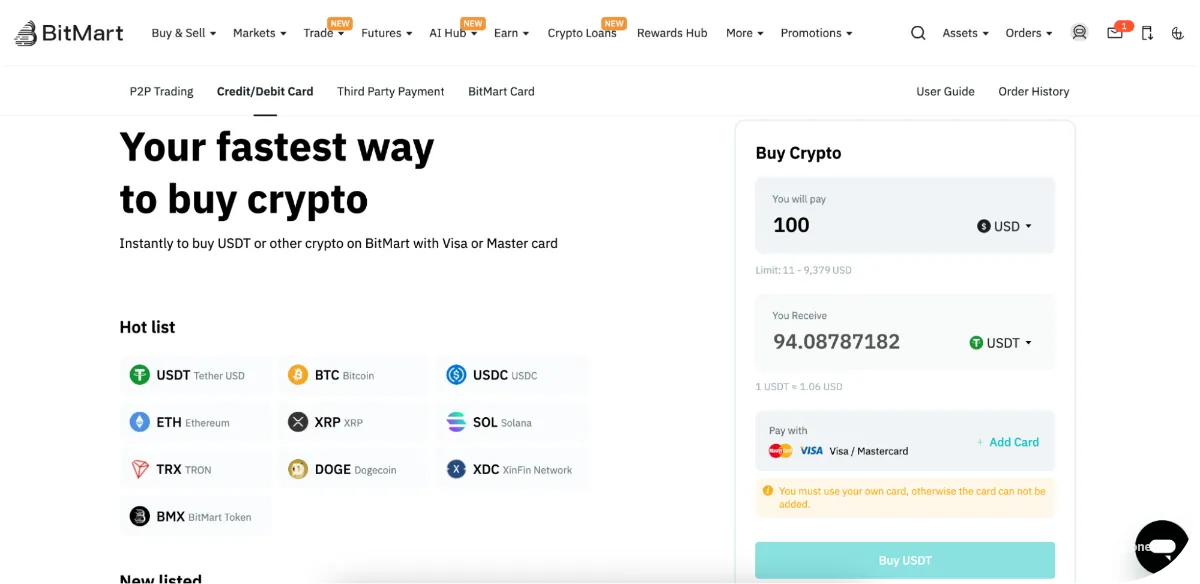

BitMart fees rise significantly when you buy cryptocurrencies instantly with debit/credit cards. It includes those fees in the quoted exchange rate, which lacks transparency and requires users to check them manually. Most other exchanges use the same system, so it’s not necessarily a drawback.

We tested a fiat transaction when compiling this BitMart review. The platform returned a quote of 94.87 USDT on a $100 Visa purchase. This reflects a massive spread of nearly 6% below the spot price.

Depending on your currency, it is often cheaper to buy cryptocurrencies on BitMart’s peer-to-peer dashboard.

BitMart users sometimes pay crypto deposit fees depending on the asset. For example, while major cryptocurrencies like BTC, SOL, and USDT are fee-free, the exchange charges a 2% fee on 10Set Token (10SET) deposits.

Bitmart trading fees are in the native coin or token. Users pay 0.0001 BTC to withdraw Bitcoin, which converts to about $11. Tether withdrawals average 1-2 USDT depending on the network.

Make sure you verify the minimum withdrawal requirement. While USDT withdrawals on BNB Chain have a 2 USDT minimum, using the Solana blockchain increases the minimum to almost 25 USDT.

We found that user-friendliness varies depending on the BitMart product. Beginners buy digital assets with traditional payment methods, which eliminates the learning curve. The order form requires only the crypto, amount, and deposit type, resembling a conventional online purchase.

The spot exchange remains user-friendly, although users should have a basic understanding of market and limit orders. The charting area offers simple navigation, and customization options cover colors, timeframes, and widget locations.

The perpetual futures platform uses the same layout as the spot exchange. Traders must grasp margin specifications and liquidation risks, as futures remain considerably more complex than regular trading.

While the desktop version offers the most effective way to trade, BitMart’s iOS and Android mobile app offers a smooth and hassle-free experience. Our BitMart app review shows it’s ideal for quickly buying or selling cryptocurrencies, and checking portfolio values while on the move.

BitMart operates in most countries, although its nonexistent licensing framework prevents access in certain jurisdictions.

The exchange previously offered limited Bitmart services in the U.S., although it has since exited the market due to increased regulatory pressures. You can check out our list of the best U.S.-based crypto exchanges if you are seeking alternatives. BitMart has also exited the UK market, as per Financial Conduct Authority (FCA) warnings.

We found that the platform also adjusts its product offerings and KYC requirements based on the user’s location. Some users can open an account anonymously and withdraw up to 20,000 USDT daily without needing any ID. However, those in some European nations require KYC documents right away.

Our BitMart review confirms that users receive 24/7 customer support via live chat. We were initially connected to an AI chatbot but promptly transferred to a real agent within seconds. Replies were fast, professional, and satisfactory.

The key issue is BitMart reviews in the public domain. Google Play and App Store users give the app 3.5/5 and 3.7/5 ratings. On Trustpilot, BitMart has a 3.1/5 score across almost 3,000 independent reviews.

We tested and researched the most important aspects of the BitMart exchange. Here are the key areas where the platform could improve:

The table below compares BitMart with the leading crypto exchanges for core factors like trading commissions, supported markets, and maximum leverage limits. Consider these important metrics to make an informed decision.

| BitMart | CoinFutures | MEXC | OKX | |

|---|---|---|---|---|

| Deposit Methods | Debit/credit cards, peer-to-peer, and crypto | Debit/credit cards, Google/Apple Pay, PIX, and crypto | Debit/credit cards, Google/Apple Pay, PIX, SEPA, peer-to-peer, and crypto | Debit/credit cards, Google/Apple Pay, local bank transfers, peer-to-peer, and crypto |

| Trading Fees (Max) | Spot (0.06%), futures (0.06%) | Variable or profit-based | Spot (0.05%), futures (0.04%) | Spot (0.01%), futures (0.05%) |

| Trading Products | Spot trading, perpetual futures | Simulated futures | Spot trading, perpetual futures | Spot trading, perpetual futures, delivery futures, options |

| Max Leverage | 200x | 1000x | 500x | 125x |

| KYC Required? | No (exceptions in some nations) | No | No | Yes |

| U.S. Friendly? | No | Yes | No | Yes |

It takes minutes to open a BitMart account and buy or trade cryptocurrencies. Here is a step-by-step walkthrough to help you get set up.

Visit BitMart to register a new account. Simply provide an email address or phone number, and a password.

Then confirm the email/number via the verification code. That’s all it takes to join BitMart.

Visit BitMartIf you already have crypto, it’s the cheapest way to deposit funds into the BitMart account. If not, skip this step to use fiat money.

Hover over the profile icon and click “Deposit”. Select the coin or token from the drop-down list, followed by the network. BitMart shows the account deposit address via its long format and a QR code. Transfer assets to the address and wait a few minutes for BitMart’s systems to credit the payment.

To buy crypto with a Visa or MasterCard, hover over “Buy & Sell” and click “Credit/Debit Card”. Input the currency (e.g., EUR), crypto (e.g., BTC), and purchase size. BitMart displays the amount of crypto you receive for that amount.

Check the exchange rate to ensure you are happy with the price. To proceed, enter your payment details and confirm the order. BitMart processes the purchase instantly.

BitMart users trade cryptocurrencies with much lower fees on the spot exchange. Select “Spot” under the “Trade” button, and choose your preferred pair.

If you’re a beginner, change the order type to “Market” on the right-hand dashboard. This order ensures your trade executes instantly at the best market rate, so you won’t need to wait for another exchange user to accept your price.

Enter your stake and click the “Buy” button to confirm. The newly purchased coins or tokens appear in your BitMart wallet.

Overall, BitMart is an established crypto exchange with extensive markets, including spot trading, perpetual futures, and instant purchases with debit/credit cards. The platform’s comprehensive ecosystem offers DeFi yields, instant loans, automated bots, and copy trading features.

We found that fees are higher than many other exchanges, especially when trading low-cap markets or buying crypto with Visa/MasterCard. BitMart is an unregulated exchange, too, so account holders have few consumer protections.

BitMart is just one exchange among many. Read our 2026 report on the top crypto exchanges to discover alternative providers.

Visit BitMart

We followed a strict methodology to provide readers with accurate and impartial review findings. Our extensive research process started with the onboarding process. We created an account and funded it, assessing KYC requirements, country eligibility, minimum deposits, and payment fees accordingly.

To assess the trading experience, we placed various markets and limit orders on the spot and futures exchanges, taking care to note average execution speeds, spreads, and slippage. We examined BitMart’s diverse range of markets, pricing structure, and non-trading products like staking and loans, and compared findings with 30+ other crypto exchanges.

We revise this BitMart exchange review regularly to reflect platform changes, although we advise users to conduct independent research to make informed decisions.