Wintermute Reports 400% Surge in OTC Crypto Trading Volumes for 2023

Hongji is a reporter who covers crypto, finance, and tech. He graduated from Northwestern University's Medill School of Journalism with a Bachelor's and a Master's. He has previously interned at HTX,...

- Altcoin Season Shows Flickers As Bitcoin Tests Support Near $90,000

- Why Traders Now Treat Crypto Prediction Markets Like Real-Time Shadow Polls

- Ethereum Rises As Altcoin Season Fear Eases And Select Tokens Join The Move

- The Unbanked Billion: Why AGI Will Choose Bitcoin Over Dollars

- Bitcoin Stalls Near $90K as Select Altcoins Rally, Leaving ‘Altcoin Season’ on Hold

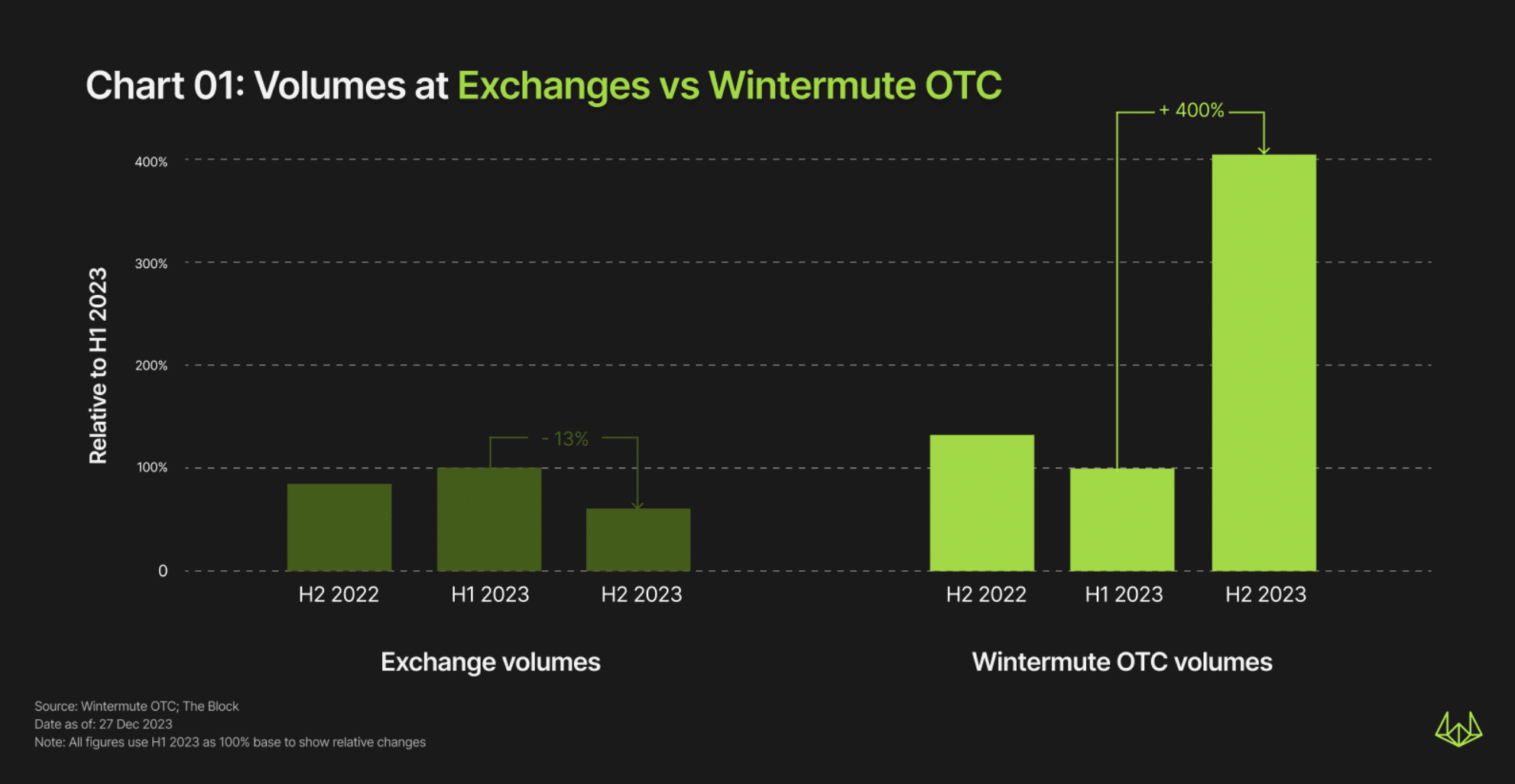

Wintermute has reported a staggering 400% increase in over-the-counter (OTC) trading volumes for the year 2023 in the midst of a challenging year for crypto exchanges.

In the latest report of its OTC performance, the crypto market maker and liquidity provider Wintermute revealed that its OTC trading volume has surged by four times despite the market downturn.

“From the early resurgence, through a volatile mid-year, ending with a renewed optimism largely fueled by expectations for spot ETF approval,” the report wrote so concluding 2023. “Last year, while the markets took a moment to breathe, we focused on building out our OTC business, increasing our capabilities, and adding new product offerings.”

Wintermute Unveils Transition from Traditional Exchanges to OTC

“On Spot, from H1 to H2 2023, while overall volumes on exchange have declined approximately 13%, during the same period, Wintermute OTC volumes have grown >400%,” wrote the report.

In the first half (H1) of 2023, Wintermute’s OTC volumes initially decreased and remained at a lower level, while the second half (H2) has seen a tremendous boost leading to the total amount quadrupled.

“We saw a significant increase in trading activity with the number of trades growing over 6x, making up over 29 million trades,” wrote the report. “We also saw the largest OTC volume week of >$2 billion during this time.”

Meanwhile, the report has demonstrated a shift from trading at traditional exchanges to OTC volumes. From H1 to H2 2023, the exchange volumes lost 13% as indicated in the report.

“We laid the groundwork for what’s next, particularly with the expansion of our OTC business, which saw impressive grolwth in the second half of the year,” said Wintermute CEO Evgeny Gaevoy.

“A key aspect of this growth has been rei fining our derivatives offering and aligning our suite with the increased dem and we’ve observed for these products,” said Gaevoy.

- [LIVE] Fed Payments Innovation Conference: Real-Time Updates as Federal Reserve Discusses Crypto, Stablecoins, and AI with Industry Leaders

- New ChatGPT Predicts the Price of XRP, PEPE and Ethereum By the End of 2026

- XRP Price Prediction: While the Crypto Market Bleeds, Big Money Is Quietly Flowing Into XRP — What Do They Know?

- China’s Alibaba AI Predicts the Price of XRP, Shiba Inu and Bitcoin By the End of 2026

- XRP Price Prediction: Golden Cross at $2.07 Signals Breakout Toward $2.35 Resistance

About Us

2M+

250+

8

70

Market Overview

- 7d

- 1m

- 1y

- [LIVE] Fed Payments Innovation Conference: Real-Time Updates as Federal Reserve Discusses Crypto, Stablecoins, and AI with Industry Leaders

- New ChatGPT Predicts the Price of XRP, PEPE and Ethereum By the End of 2026

- XRP Price Prediction: While the Crypto Market Bleeds, Big Money Is Quietly Flowing Into XRP — What Do They Know?

- China’s Alibaba AI Predicts the Price of XRP, Shiba Inu and Bitcoin By the End of 2026

- XRP Price Prediction: Golden Cross at $2.07 Signals Breakout Toward $2.35 Resistance

More Articles

Get dialed in every Tuesday & Friday with quick updates on the world of crypto