Will Bitcoin Keep Rising After Trump’s Tariff Pause? Here’s What Traders Need to Know

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships. However, this potential compensation never influences our analysis, opinions, or reviews. Our editorial content is created independently of our marketing partnerships, and our ratings are based solely on our established evaluation criteria. Read More

Bitcoin (BTC) is back in rally mode, jumping over 7% to reclaim $81,800 after former President Donald Trump paused tariffs for 90 days on nearly 60 countries. The move temporarily eased pressure on risk assets, sparking a sharp rebound in global equities and crypto markets.

But the rally came with a twist.

While offering relief to some nations, Trump hiked tariffs on Chinese goods to 125%, fueling fresh concerns over an extended U.S.-China trade war. The mixed policy signals have left markets on edge—with Bitcoin caught in the middle of macro optimism and geopolitical risk.

Stocks surged across the board, with the S&P 500 up 9.5% and Dow Jones climbing 7.8%, while BTC bounced from a weekly low of $76,000 to retest $82,000, a key resistance level not seen in days.

What It Means for Bitcoin’s Next Move

So, where does Bitcoin go from here?

BTC is currently consolidating just below a major resistance zone near $83,500. This level aligns with the midpoint of a large descending wedge pattern and is also a high-volume supply zone—making it a crucial battleground for bulls and bears alike.

Technical indicators show some cautious optimism:

- 50 EMA reclaimed at $80,179, a short-term bullish sign

- RSI at 57.5, reflecting neutral-to-bullish momentum

- Resistance: $83,500

- Support: $80,000, with stronger support at $77,813

If Bitcoin breaks cleanly above $83,500, it could open the door for a move toward $86,400. But failure to break out may invite another pullback, especially if macro conditions worsen.

The Bigger Picture: Geopolitics and the Fed

While technicals matter, macro forces remain the main driver of Bitcoin’s current volatility.

Trump’s tariff pause may have calmed markets temporarily, but the steep hike on Chinese goods underscores that geopolitical risk is far from over. Investors are also closely watching the Federal Reserve: if upcoming inflation data shows signs of cooling and Fed officials pivot toward rate cuts, Bitcoin could benefit from lower real yields and a softer U.S. dollar.

In other words, Bitcoin’s recent strength isn’t just about chart patterns—it’s about how global trade dynamics and central bank decisions play out in the weeks ahead.

Final Thoughts

For now, $83,500 is the level to watch. A breakout above it could mark the beginning of Bitcoin’s next leg up. But with ongoing China tariffs and uncertain Fed policy, traders should remain nimble and watch for confirmation before making bold moves.

BTC Bull Presale: Earn Real Bitcoin with Every Price Milestone

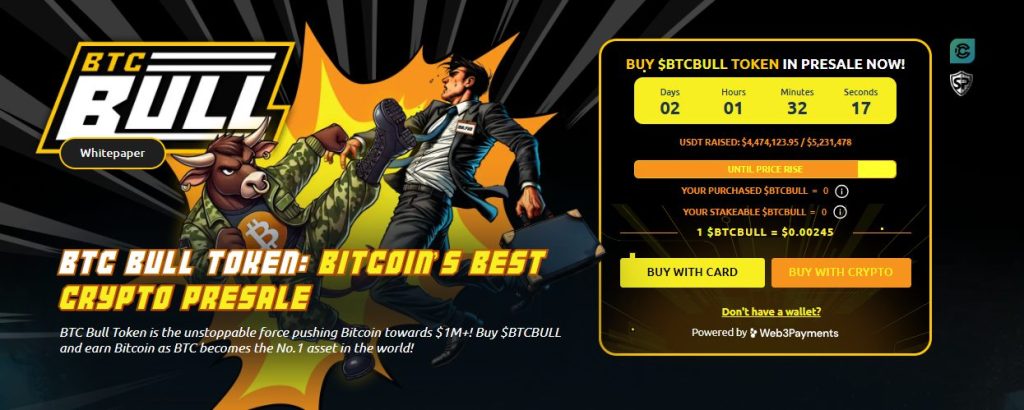

BTC Bull ($BTCBULL) is gaining traction as one of the most exciting presales in crypto, combining meme culture with real utility. Designed for long-term holders, the token automatically rewards investors with real Bitcoin as BTC reaches major price thresholds—aligning community incentives with Bitcoin’s growth.

Staking for Passive Bitcoin Income

BTC Bull offers a lucrative staking program boasting a 119% APY, allowing users to earn passive income while supporting the network. With over 882.5 million BTCBULL tokens already staked, community engagement continues to grow.

Latest Presale Updates:

- Current Token Price: $0.00245 per BTCBULL

- Raised So Far: $4.47M of $5.23M target

With limited time remaining and demand accelerating, this is a key window to secure BTCBULL at presale rates before the next price jump.

- [LIVE] Fed Payments Innovation Conference: Real-Time Updates as Federal Reserve Discusses Crypto, Stablecoins, and AI with Industry Leaders

- Crypto Market Prospect: After the Washout, the Soil Looks Richer

- Bitcoin Price Prediction: Why $88,000 Could Be the Calm Before a $94,000 Push

- XRP Price Prediction: $1.9bn ETF Inflows Put $2.15 Breakout Back in Play

- Bitcoin May Not Have Bottomed Yet as Social Media Fear Remains Low: Analyst

- [LIVE] Fed Payments Innovation Conference: Real-Time Updates as Federal Reserve Discusses Crypto, Stablecoins, and AI with Industry Leaders

- Crypto Market Prospect: After the Washout, the Soil Looks Richer

- Bitcoin Price Prediction: Why $88,000 Could Be the Calm Before a $94,000 Push

- XRP Price Prediction: $1.9bn ETF Inflows Put $2.15 Breakout Back in Play

- Bitcoin May Not Have Bottomed Yet as Social Media Fear Remains Low: Analyst