This Market Could Predict Bitcoin’s Next Move

- SEC's Gag Rule on Settlements Criticized by Commissioner Hester Peirce

- Billionaire Biohacker Bryan Johnson Dives into NFT Realm with Drip Solana Airdrop

- Coinbase Grapples with Regulatory Challenges, Analysts Forecast Volatility Ahead

- Analysts Foresee a Bitcoin ETF Offering by Charles Schwab – Trillions to Enter the Market?

- AI and Crypto Mining to More Than Double Energy Use by 2026, Report Says

There’s a little-known correlation that may provide some clues as to where bitcoin is headed next, according to famous bitcoin bull Tom Lee, who still estimates that bitcoin can surpass USD 20,000 this year.

Lee, who serves as the head of research at Fundstrat Global Advisors, said that the performance of emerging market stocks has correlated closely with the price of bitcoin since the beginning of 2017.

Comparing the two markets, Lee, speaking on CNBC, said that “both really essentially peaked early this year, and they both have been in a downward trend.”

“When emerging markets do well, it’s because we’re in a ‘risk-on’ environment, and when it does poorly it’s because we’re in a ‘risk-off’ environment,” Lee explained, adding that he doesn’t believe bitcoin will rise until traders with a ‘risk-on’ mentality are back.

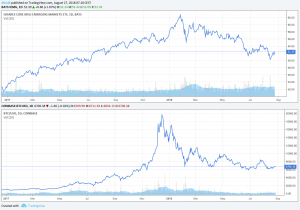

Comparing the two charts below, a correlation can definitely be spotted, with bitcoin (bottom chart) peaking about a month before the MSCI Emerging Markets Index (top chart).

However, it could be argued that emerging market stocks have declined because their currencies have been in decline, such as the situation is with the Turkish lira. And as we have seen in both Turkey, and to an even greater extent in Venezuela, weaker national currencies tend to increase demand for bitcoin.

While Lee agrees with this, he explained that the majority of bitcoin trading is not taking place in emerging markets, but rather in countries like South Korea, Japan, China, the US, and Europe.

However, Lee now sees the markets finally turning to a point where both emerging market equities and bitcoin will be valued higher. Especially if the US dollar weakens going forward, Lee sees “big money and firepower on the sidelines” waiting to move into the crypto space, confirming his bitcoin price target for the end of the year.

Meanwhile, Changpeng Zhao, founder and CEO of Binance, a major exchange, has also reminded the explosive bitcoin price jump in the H2 of 2017. In either case, it doesn’t mean that it will repeat this year, too.

_____

Watch Tom Lee discussing the Bitcoin market:

Fundstrat’s Tom Lee may have found the next leading indicator for bitcoin from CNBC.

- China’s DeepSeek AI Predicts the Price of XRP, PEPE and Shiba Inu By the End of 2026

- New ChatGPT Predicts the Price of XRP, Dogecoin and Solana By the End of 2026

- Bitcoin Price Prediction: Bitcoin Is Stuck Inside a Triangle – And What Happens Next Could Shock the Market

- China’s Alibaba AI Predicts the Price of XRP, Shiba Inu and PEPE By the End of 2026

- XRP Price Prediction: Ripple Has Been Invited to the White House — Is the US Government About to Back XRP?

About Us

2M+

250+

8

70

Market Overview

- 7d

- 1m

- 1y

- China’s DeepSeek AI Predicts the Price of XRP, PEPE and Shiba Inu By the End of 2026

- New ChatGPT Predicts the Price of XRP, Dogecoin and Solana By the End of 2026

- Bitcoin Price Prediction: Bitcoin Is Stuck Inside a Triangle – And What Happens Next Could Shock the Market

- China’s Alibaba AI Predicts the Price of XRP, Shiba Inu and PEPE By the End of 2026

- XRP Price Prediction: Ripple Has Been Invited to the White House — Is the US Government About to Back XRP?

More Articles

Get dialed in every Tuesday & Friday with quick updates on the world of crypto