Telegram Revenue Surges 65% to $870M on Toncoin Boost, Despite $500M Bond Freeze: Report

Telegram’s finances are increasingly being shaped by its deepening ties to crypto, even as legal pressure and geopolitical risks complicate the picture.

A Financial Times report showed an unaudited financial statement that the messaging platform registered a steep increase in operating revenue in the first half of 2025.

Telegram earned revenue of a total of 870 million during the first half of 2025, a 65% increase compared to the previous year’s 525 million.

Almost a third of that sum, approximately $300 million, was obtained by way of so-called exclusivity deals, which are strongly tied to Toncoin, the cryptocurrency of the Telegram ecosystem.

The figures show how revenue tied to TON-related activity is now rivaling more traditional income streams such as advertising and subscriptions.

Toncoin Decline Drags Telegram to Net Loss Despite Revenue Gains

The revenue growth came despite Telegram posting a net loss of roughly $222 million for the period.

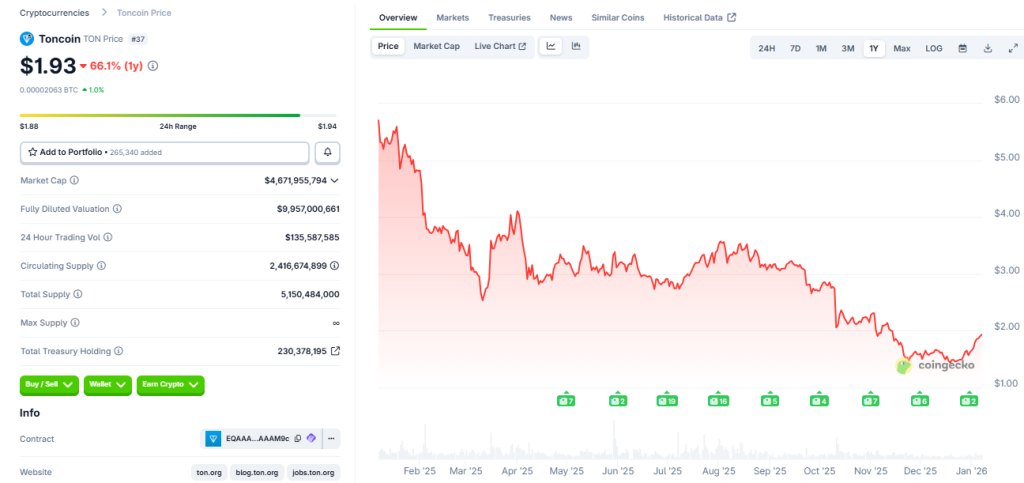

That compares with a net profit of $334 million in the first half of 2024. The swing was largely driven by a write-down in the value of the company’s Toncoin holdings after the token lost about 69% of its value during 2025, data from CoinGecko shows.

Telegram still achieved an operating profit of nearly $400 million, indicating that the underlying business remained profitable before accounting for crypto-related losses.

Toncoin’s role in Telegram’s finances has expanded steadily over the past two years.

Premium subscriptions, which reached $223 million in revenue in the first half of 2025, and various in-app purchases through Telegram’s Fragment marketplace rely heavily on TON for settlement.

Advertising revenue rose more modestly to $125 million over the same period as Telegram told investors that it sold more than $450 million worth of Toncoin during the year to date.

At the time of reporting, that amount represented roughly 10% of TON’s total market capitalization, which stands near $4.6 billion.

At the end of June, the total holdings of digital assets of the company decreased to $787 million against $1.3 billion a year ago, due to the sale volumes and the reduction in token prices.

Toncoin also trades at an approximate of $1.93, which is low compared to its all-time high of $8.25 but is still up over 60% over the last year.

Frozen Bonds Cast Shadow Over Telegram’s Financial Gains

Alongside its improving revenue, Telegram is contending with a separate financial strain tied to its debt.

About $500 million of the company’s bonds have been frozen in Russia’s central securities depository due to Western sanctions imposed after Russia’s invasion of Ukraine.

Telegram has launched multiple bond offerings in recent years, including a $1.7 billion issuance in May, partly to buy back existing debt.

While the company has repurchased most bonds maturing in 2026, the frozen tranche reflects ongoing exposure to Russian capital markets.

Telegram has told bondholders it intends to repay the affected bonds at maturity, leaving it to intermediaries to determine whether payments can reach Russian holders.

The disclosure comes as founder Pavel Durov explores a potential initial public offering, a process that has been slowed by legal proceedings in France.

Durov has been under formal investigation since 2024 over allegations that Telegram failed to adequately address criminal content on the platform.

Bondholders are closely watching the outcome, as Telegram’s recent debt offerings include options to convert bonds into equity at a discount if an IPO goes ahead.

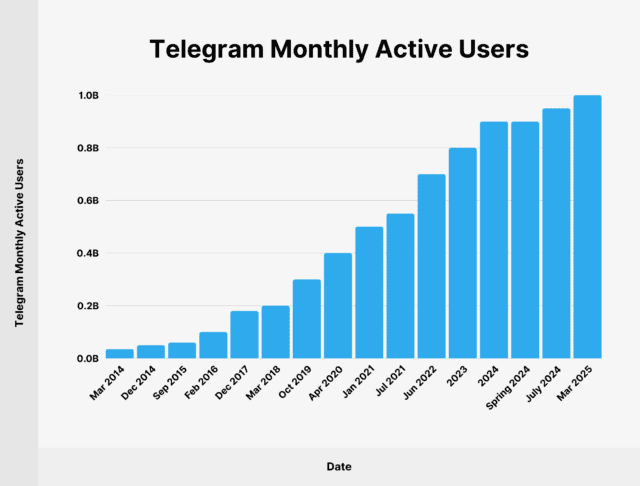

Telegram’s revenue growth is underpinned by scale, as the platform has surpassed 1 billion monthly users, around 500 million daily, while paid subscriptions rose to 15 million from 4 million in late 2023.

- Crypto Market Prospect: After the Washout, the Soil Looks Richer

- [LIVE] Fed Payments Innovation Conference: Real-Time Updates as Federal Reserve Discusses Crypto, Stablecoins, and AI with Industry Leaders

- XRP Price Prediction: Years of Waiting Might Finally Pay Off – Is This the Breakout Everyone’s Been Hoping For?

- China’s Alibaba AI Predicts the Price of XRP, Bitcoin and Solana By the End of 2026

- Leading AI Claude Predicts the Price of XRP, Shiba Inu and Solana By the End of 2026

- Crypto Market Prospect: After the Washout, the Soil Looks Richer

- [LIVE] Fed Payments Innovation Conference: Real-Time Updates as Federal Reserve Discusses Crypto, Stablecoins, and AI with Industry Leaders

- XRP Price Prediction: Years of Waiting Might Finally Pay Off – Is This the Breakout Everyone’s Been Hoping For?

- China’s Alibaba AI Predicts the Price of XRP, Bitcoin and Solana By the End of 2026

- Leading AI Claude Predicts the Price of XRP, Shiba Inu and Solana By the End of 2026