Stablecoin Adoption in U.S. is Low: Chainalysis Reports

Jimmy has nearly 10 years of experience as a journalist and writer in the blockchain industry. He has worked with well-known publications such as Bitcoin Magazine, CCN, and Blockonomi, covering news...

- Bitget Burns 60M $BGB, Price Up 3% - $6 Next?

- Quant ($QNT) Climbs 1.4% as Fusion Devnet and Sibos 2025 Boost Adoption Outlook

- $HYPE Nears All-Time High on Rising Volume and Deep Liquidity

- Will $OKB Hold $184 After Token Burn and X Layer Upgrade Despite Regulatory Challenges?

- $OKB Jumps Over 6% After 65M Token Burn and ‘X Layer’ Launch

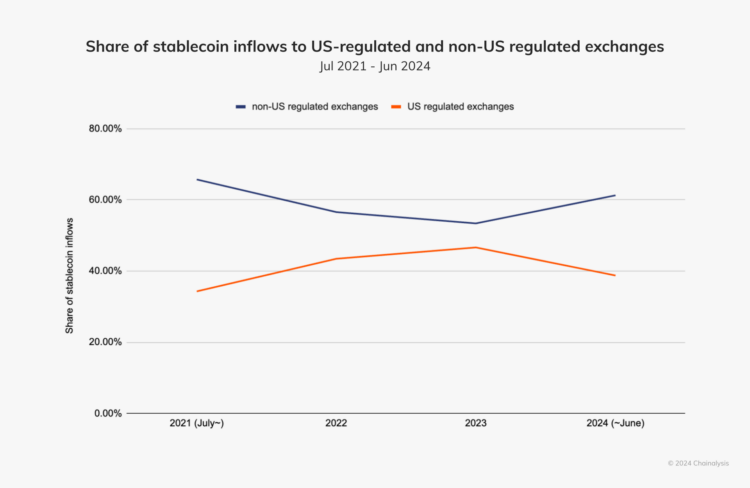

Stablecoin adoption in the U.S. has slowed in 2024 compared to global markets, according to an October 17 report by blockchain analysis firm Chainalysis.

The report highlights that while stablecoin use has surged internationally, U.S. markets have seen a decline in their share of stablecoin transactions, dropping from roughly 50% in 2023 to below 40% in 2024.

Global Stablecoin Adoption Outpaces the U.S.

As per the report, this slowdown in adopting stablecoin in the U.S. is largely attributed to the lack of regulatory clarity.

Chainalysis noted that, in contrast to other regions, the U.S. has failed to make significant regulatory progress in the digital assets space, particularly stablecoins, contributing to a stagnation in adoption.

While the U.S. stablecoin market is experiencing a relative decline, global markets have witnessed increased adoption.

Stablecoin growth over the past month shows two particularly interesting things:

— David Alexander II (@Mega_Fund) October 16, 2024

(1) USDC ($960M) circulating supply outpaced Tether ($793M) and

(2) PYUSD circulating supply on Solana is down 36% as users are reverting back to baseline behaviors since incentives for using it… pic.twitter.com/3GZUvQz6A5

More transactions are now taking place on non-U.S.-regulated exchanges, reflecting a growing demand for stablecoins in emerging markets.

This surge is driven by stablecoins’ ability to offer a stable store of value in regions with volatile currencies and limited access to U.S. dollars.

Populations in these areas use stablecoins to access U.S. dollar stability without needing traditional banking systems.

U.S. Regulatory Uncertainty and Global Competition

Chainalysis also emphasized that regulatory uncertainty in the U.S. contributes substantially to the country’s slowdown in stablecoin adoption.

Unlike regions such as the European Union, United Arab Emirates, Singapore, and Hong Kong, which have enacted clear regulatory frameworks encouraging digital asset growth, the U.S. struggles to regulate stablecoins.

Additionally, the European Union’s Markets in Crypto-Assets Regulation (MiCA), implemented in June 2024, has provided much-needed clarity for stablecoins in Europe, attracting projects and fostering adoption.

Meanwhile, Circle warns that without clear guidance, the U.S. could forfeit its influence in the stablecoin market and lose its leadership in dollar-based on-chain commerce.

While the U.S. lags in regulatory progress, there have been steps toward developing a stablecoin framework.

In July 2023, the House Financial Services Committee advanced a stablecoin bill aimed at providing regulatory clarity.

Circle remains optimistic, hoping that Congress will pass the bill to establish clear anti-money laundering (AML) and sanctions obligations for stablecoin issuers, ensuring the U.S. retains its role in the global stablecoin market.

- [LIVE] Fed Payments Innovation Conference: Real-Time Updates as Federal Reserve Discusses Crypto, Stablecoins, and AI with Industry Leaders

- Crypto Market Prospect: After the Washout, the Soil Looks Richer

- China’s DeepSeek AI Predicts the Price of XRP, BTC, and DOGE By the End of 2025

- [LIVE] Crypto Market Update: Bank of Japan Raises Rates by 25 bps; Crypto Markets Extend Slide as BTC Breaks Below $86K

- Why Is Crypto Up Today? – December 19, 2025

About Us

2M+

250+

8

70

Market Overview

- 7d

- 1m

- 1y

- [LIVE] Fed Payments Innovation Conference: Real-Time Updates as Federal Reserve Discusses Crypto, Stablecoins, and AI with Industry Leaders

- Crypto Market Prospect: After the Washout, the Soil Looks Richer

- China’s DeepSeek AI Predicts the Price of XRP, BTC, and DOGE By the End of 2025

- [LIVE] Crypto Market Update: Bank of Japan Raises Rates by 25 bps; Crypto Markets Extend Slide as BTC Breaks Below $86K

- Why Is Crypto Up Today? – December 19, 2025

More Articles

Get dialed in every Tuesday & Friday with quick updates on the world of crypto